An overview of Lithuania's startup ecosystem

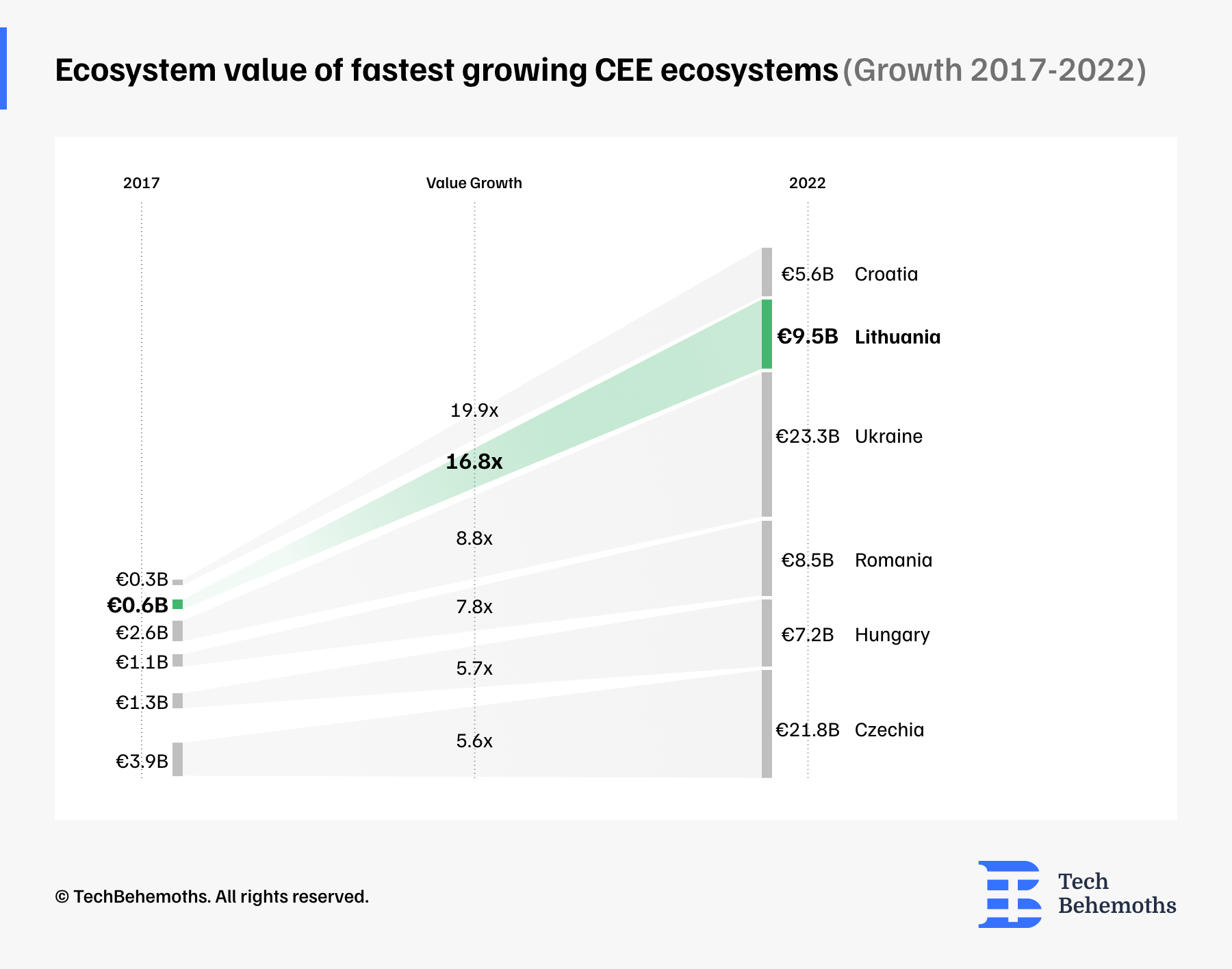

The startup and venture capital ecosystems in Central and Eastern Europe have shown impressive growth and resilience in recent years. From 2017 to 2022, the CEE ecosystem has expanded almost fivefold in terms of deal value, indicating progress and growth.

However, in 2023, the region faced a sobering reality check, revealing its dependence on global markets. According to a recent report, global funding in the first quarter of 2023 experienced a massive decline, dropping by 53% compared to the same period in the previous year. Moreover, this decline was evident across all funding stages. In CEE countries, VC investments, which had reached €1.1 billion in Q4 2022, significantly contracted to €600 million in Q1 2023.

Lithuania’s Macroeconomic Indicators:

-

Currency: Euro

-

GDP in 2022: 66,791 million USD

-

GDP per capita in 2022: 25,036 USD

-

GDP growth in 2022: 1.9% with an expected 0.5% for 2023

-

Population: 2.75 million

-

Area: 65,300 square kilometers

-

Lithuania is ranked 39th among the 132 economies featured in the Global Innovation Index 2022.

Startup ecosystem stats & facts:

The Lithuanian startup ecosystem has shown significant growth, with over 800 startups contributing to a combined ecosystem value of €8 billion. Notable among these are two unicorns, Vinted and NORD Security, and several soonicorns including TransferGo, Kevin., GetJar, yPlan, Cast AI, Interactio, PVcase, and Ovoko. In 2021, the sector saw around €450 million in investments, while approximately €259 million was invested in 2022. Vinted's Series F funding round in 2021 was a standout, raising €250 million, the largest round ever in the region. This round was supported by investors such as EQT Growth, Accel, Burda Principal Investments, Insight Partners, Lightspeed Venture Partners, and Sprints Capital.

In 2023, some of the top funding rounds included Cast AI's €18.8 million from Creandum, Oxipit's €4.4 million from Taiwania Capital, Atrandi Biosciences/Droplet Genomics' €4.5 million from Vsquared Ventures, Practica Capital, and Metaplanet, PVCase's €95 million from Highland Europe and Elephant Energize Capital, and Ibanera's €17.4 million from Emerchantpay. The previous year, 2022, also saw significant investments with Nord Security raising €91.8 million from Novator, Burda Principal Investment, General Catalyst, BaltCap, and angels, Kevin.'s €61.6 million from Accel, Eurazeo, OTB Venture, Speedinvest, OpenOcean, Global Paytech Ventures and angels; Zenith Chain's €35 million from GEM Digital, and Argyle's €52 million from Bain Capital Ventures, Checkr, SignalFire, Bedrock.

Top Lithuanian venture capital investors include Iron Wolf Capital, Practica Capital, Open Circle Capital, Contrarian Ventures, Coinvest Capital, 70V, Katalista Ventures, Firstpick, and GamedevFund, demonstrating a robust and dynamic investment landscape in the country.

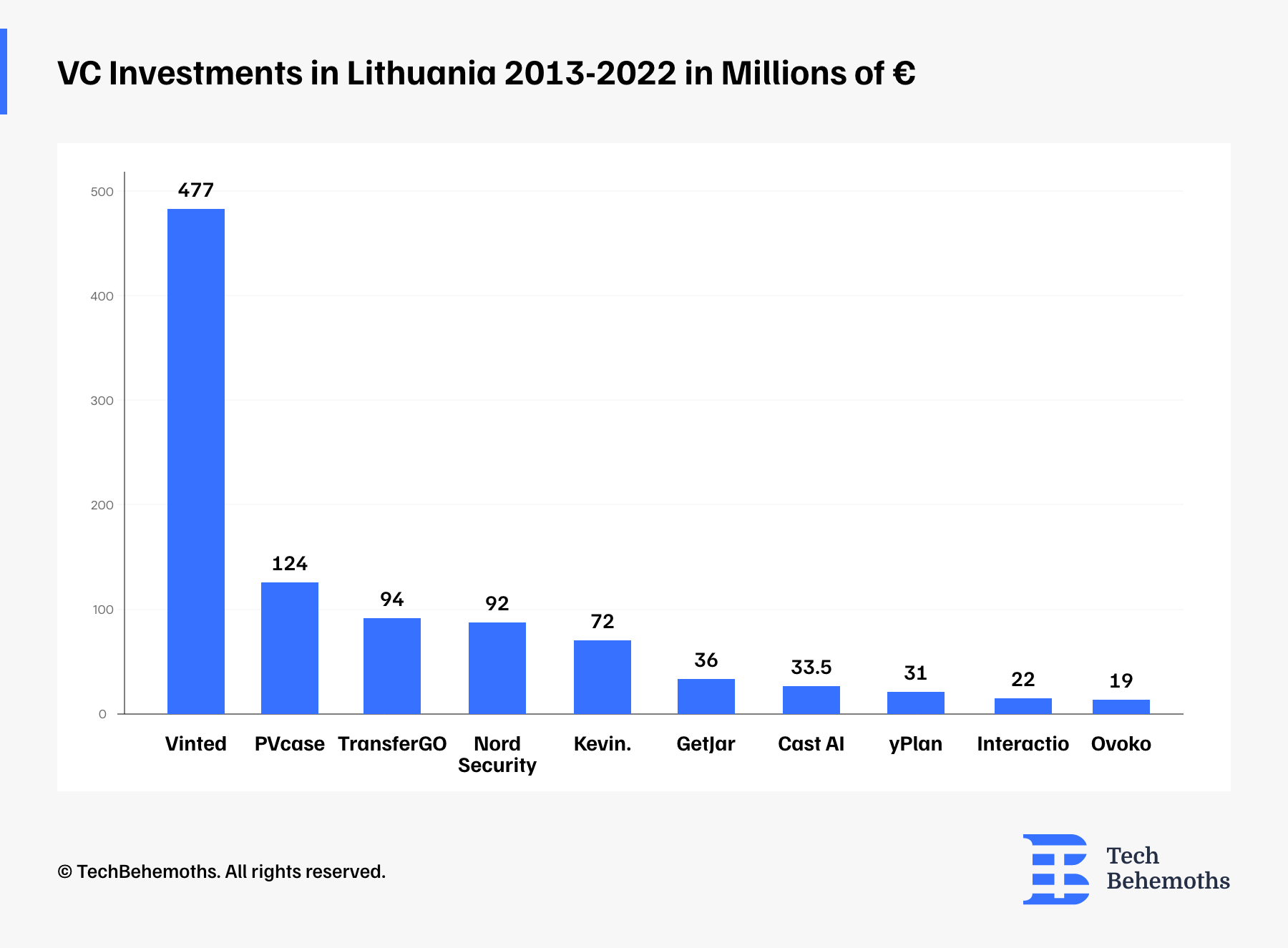

VC Investments in Lithuania 2013-2022

The Lithuanian startup ecosystem has witnessed significant funding between 2013 and 2022. During this period, various startups received noteworthy funding. Since its inception, several Lithuanian startups have stood out based on the total value of their financing rounds. Vinted leads the pack with an impressive €477 million in funding, followed by Nord Security with €92 million, and TransferGo close behind with €94 million. Kevin. has secured €72 million in funding, while GetJar and yPlan have also made significant strides, raising €36 million and €31 million, respectively. Other notable startups include Cast AI with €33.5 million, Interactio with €22 million, PVcase with a substantial €124 million, and Ovoko with €19 million. These figures highlight the dynamic and flourishing nature of the Lithuanian startup ecosystem.

Biggest funding rounds in 2023:

-

Cast AI - Venture - Series Unknown - €18,8M - Investors: Creandum, Scale Asia Ventures, Web Summit Ventures

-

PVCase - Early VC - €95M - Investors: Highland Europe, Elephant, Energize Capital

-

Ibanera - Late VC - €17,4M - Investor: Emerchantpay

Biggest funding rounds in 2022:

-

Nord Security - Series A - €91,8M - Investors: Novator, Burda Principal Investment, General Catalyst, BaltCap, angels

-

Kevin. - Series A - €61,6M - Investors: Accel, Eurazeo, OTB Venture, Speedinvest, OpenOcean, Global Paytech Ventures and angels

-

Argyle - Series B - €52M - Investors: Bain Capital Ventures, Checkr, SignalFire, Bedrock

-

Zenith Chain - Seed - €35M - Investor: GEM Digital

-

Ovoko - Venture round - €14M - Investors: Piton Capital, Practica, Mantas Mikuckas

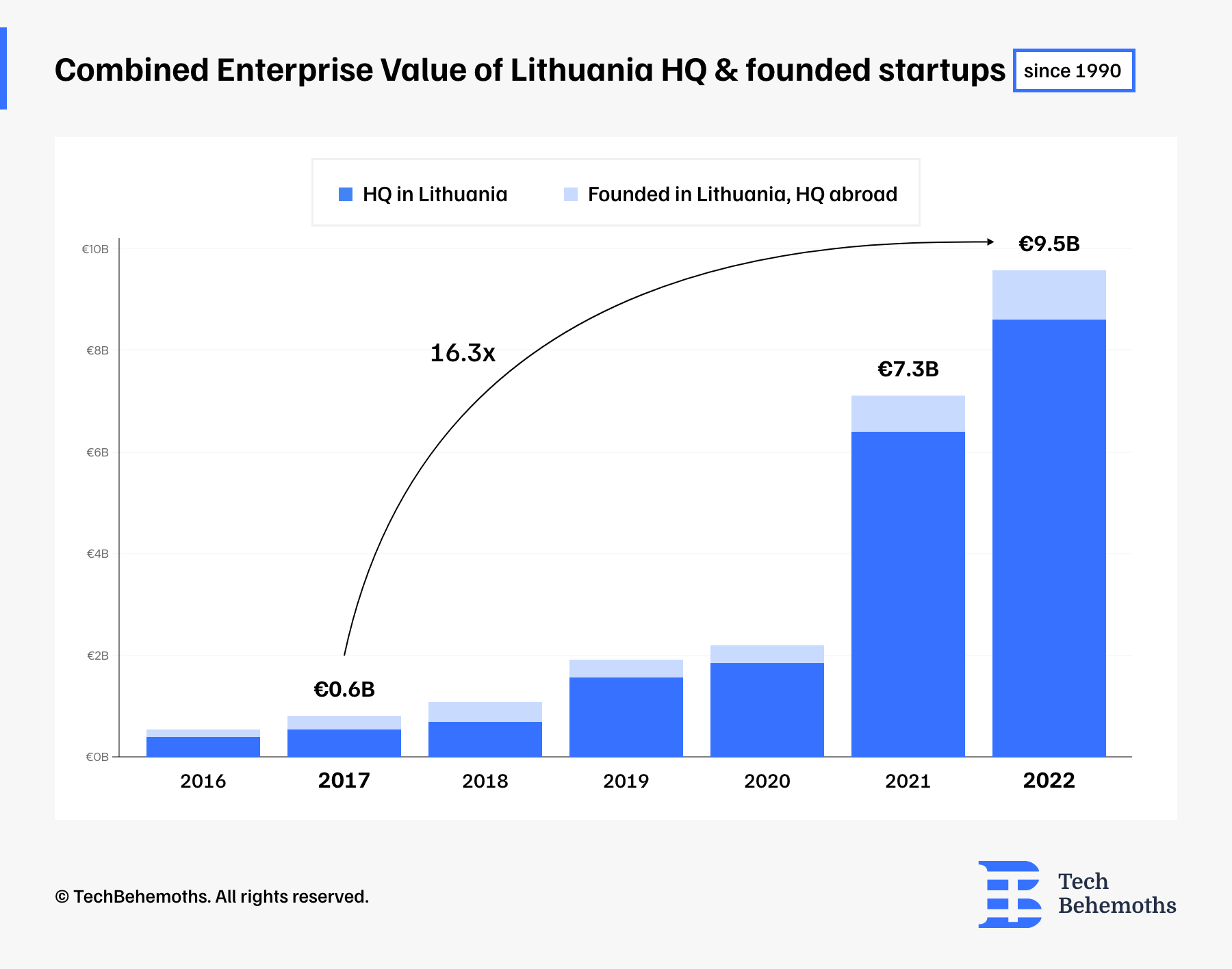

The Lithuanian startup ecosystem is rapidly growing and becoming a promising landscape for entrepreneurs and investors in the CEE region. According to a report by Dealroom, the combined enterprise value of startups founded and headquartered in Lithuania has grown 16.8 times between 2017 and 2022, with regional startups now worth €9.5 billion.

This growth is facilitated by various factors, including favorable government regulations, open data policy, and a friendly business environment. For instance, Lithuania's Startup Visa and Startup Employee Visa programs attract skilled entrepreneurs from other countries by providing them with a temporary residence permit for up to a year, thus enabling a more dynamic flow of inward FDI's.

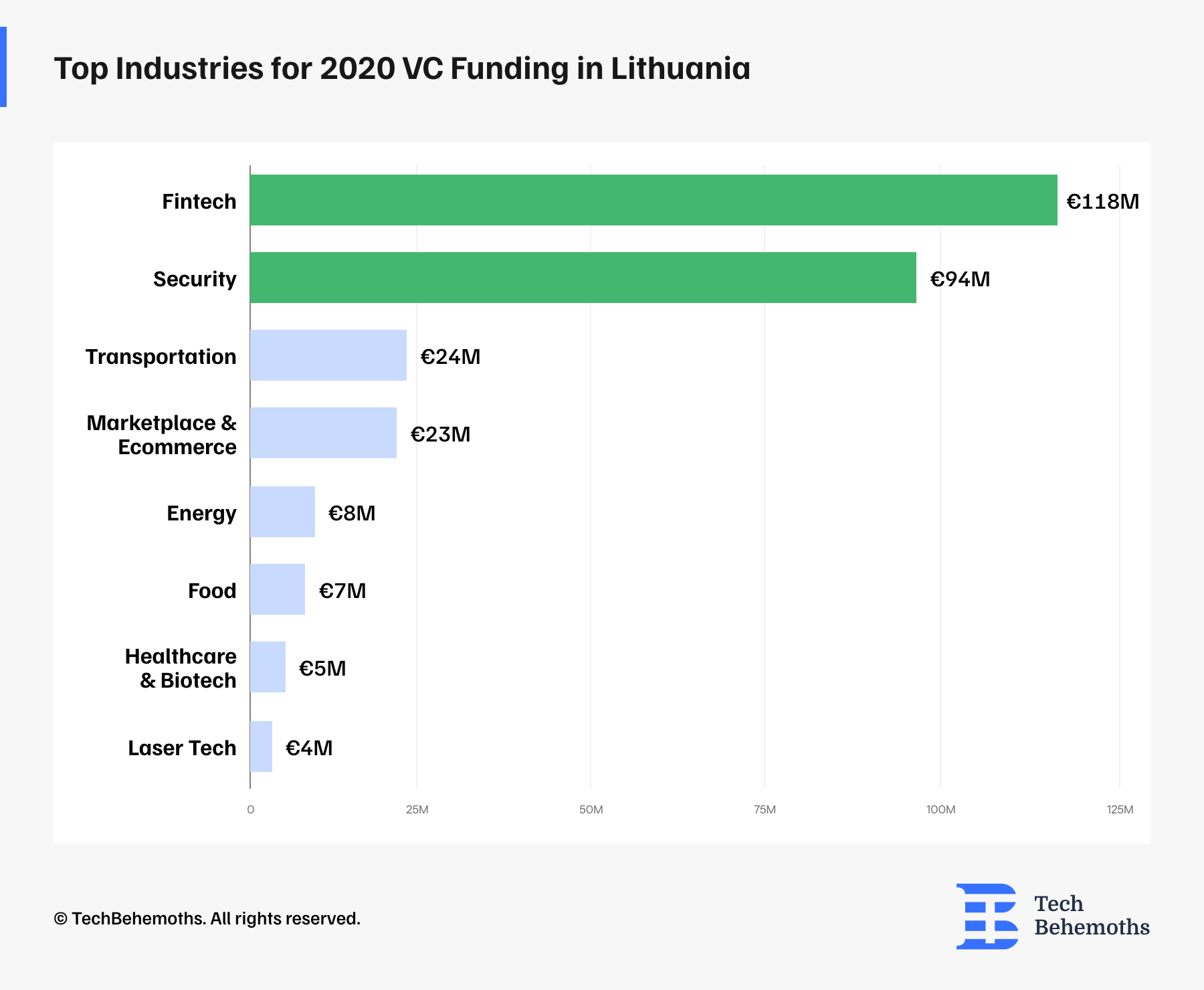

Furthermore, Lithuania has a large pool of skilled software developers, which has resulted in the dynamic growth of hi-tech industries. The fintech sector is leading the national industry, with Vilnius being the largest fintech hub in the EU in terms of licensed companies. Other sectors that have been gaining traction in recent years include ICT and game development, security, life sciences, AI, software, transportation, data science, and more.

Overall, Lithuania's startup ecosystem is growing rapidly, and with its favorable regulations, skilled workforce, and dynamic industries, the country is well-positioned to continue attracting entrepreneurs and investors from around the world.

Lithuanian Venture Capital scene - funding data

Lithuania hasn’t been immune to recent market fluctuations and a general economic downturn observed on the continent. Nevertheless, according to the 2022 yearly report created by Dealroom and Startup Lithuania, the size of the country's startup ecosystem has been growing very dynamically, especially in the years 2019-2022 (with a dip in 2020). According to Dealroom, Lithuania ranks 6th amongst all CEE countries for 2022 Venture Capital investment, and 3rd for VC investment per capita. 2021 was a record-breaking year for the country, in terms of all funding secured by startups, however, the expansion was halted by 2022’s political and economic decline and as a result, Lithuanian startups raised 36% less capital. And we don’t have much data for 2023 yet but it’s visible that there has been an even more significant freeze in VC investment activities this year.

It is also worth noting that the ecosystem has been continuously characterized by good availability of funding. In 2021 Lithuanian startups raised over 450M (however, more than half of this sum - €250M - was actually raised by a single startup, Vinted, in its Series F), and €259M in 2022. Additionally, as Dealroom reports, at the beginning of 2023, Lithuania was a home of 740+ startups, with a total of more than €8B in combined ecosystem value.

As Startup Lithuania reports, 2022 was a year of significant milestones for the Lithuanian ecosystem. The country saw the emergence of its second unicorn NORD Security and the biggest exit in its history - a successful sale of MailerLite for €84M. What is more, angel investing was more rampant than ever, growing by 40% in 2022 and amounting to €14,5M. It is however to be determined how the global slowdown of 2023 will affect angel investing in the upcoming quarters.

Lithuanian Business Angels

Besides venture capital funds, Lithuania owns an active Business Angel community, significantly influencing the overall ecosystem. The Lithuanian Business Angel Network (LitBAN) comprises 300 members who collectively invested €14.5 million across 21 startups in 2022. Furthermore, LitBAN highlighted a record number of funding rounds involving Angel investors for startups like Vilimed, Hassle, Moremins, MarkID, No-CV, and others in 2022. LitBAN's influence extends beyond Lithuania's borders, and in 2022, the European Business Angel Network acknowledged it as its top-performing member.

It's also important to mention that, as per LitBAN, Lithuanian business angels are particularly inclined to invest in startups' initial funding stages, frequently collaborating with or alongside other venture capital funds. For instance, in 2023, they contributed €1.1 million to the seed round of Perfction42, in partnership with venture capital firms like CoInvest Capital and Open Circle Capital.

Startup Community

The Lithuanian startup ecosystem is helped by a dynamic community comprising various stakeholders including public entities, accelerators, and incubators, all contributing to the nation's innovative landscape.

Startup Lithuania stands as a pivotal government-backed initiative under the Ministry of the Economy and Innovation, serving as a linchpin for the national startup ecosystem. This entity orchestrates an internationally acknowledged startup-conducive environment, linking burgeoning businesses, venture capital entities, accelerators, startup-centric corporations, and governmental bodies. Its array of services encompasses disseminating startup ecosystem updates, managing a startup database, facilitating a job marketplace, and disseminating a weekly newsletter. Additionally, Startup Lithuania orchestrates influential startup gatherings, offers consultation and advisory expertise, and plays a crucial role in educating the ecosystem and aspiring entrepreneurs, thereby catalyzing collaboration, expansion, and innovation within Lithuania's vibrant startup sphere.

Vilnius TechFusion operates as a catalyst for the genesis of innovative enterprises in Vilnius, consolidating the city's distinctive and dynamic tech ecosystem to spur cross-sector collaborations and positioning Lithuania’s capital as a vanguard in technological advancements. Its primary focus lies on sectors like ICT and Fintech, as well as Life Sciences and Lasers.

Unicorns Lithuania is an energetic entity dedicated to the enhancement and prosperity of Lithuanian startups. With an objective to galvanize both startups and the public sector, their vision encompasses transforming Lithuania into a hub for high-value-added economic activity and a destination for unicorns. By 2025, their ambition is to triple the size of the startup ecosystem, positioning startups as key drivers of economic progression. Unicorns Lithuania amalgamates over 85 tech companies, significantly contributing to the sector's employment, and concentrates on community engagement, knowledge exchange, ecosystem advocacy, and fostering entrepreneurial spirit.

The Lithuanian Private Equity and Venture Capital Association (LT VCA) is a significant consortium in Lithuania, uniting principal players in the private equity and venture capital arena. From 2018-2022, their members injected over EUR 300 million into Lithuanian companies, bolstering economic development, entrepreneurship, and support for SMEs. LT VCA is instrumental in scrutinizing and improving the regulatory and business climate essential for the efficacious functioning of the private capital market. As a pivotal platform, it represents and advocates for the Lithuanian private equity and venture capital sector to institutional investors, policymakers, and the broader audience, both domestically and internationally. It also stands as a primary resource for research and statistics on the market, offering critical insights into trends and performance.

Sunrise Tech Park, established in 2003, is a non-profit entity with a legacy in nurturing entrepreneurship and fostering synergy between the business sector and academia. As a premier science and technology park in Lithuania, it provides extensive support services and cutting-edge infrastructure to emerging innovative enterprises and other knowledge-based businesses. The park creates an optimal setting for tech ventures, academicians, and R&D initiatives to convert their expertise into commercially viable projects and propel innovation. Focused on delivering top-tier services to knowledge-based businesses, Sunrise Tech Park is dedicated to becoming the leading science and technology hub in the Baltics, drawing and empowering businesses with its dynamic ecosystem. It provides comprehensive assistance, ranging from consultancy for innovative startups to numerous incubation and acceleration programs, including:

-

Hackathon “Hack4Vilnius”, promoting city-centric innovations

-

Pre-accelerator “Futurepreneurs”, a sustainability program for evolving an idea into an investor-ready solution

-

Cleantech Cluster Lithuania, amalgamating clean tech companies and educational institutions for sectoral development

-

Sunrise Valley Digital Innovation Hub, aiding in digitizing traditional industry sectors

Tech Park Kaunas assembles a community of innovators and technologists, offering guidance to startups and existing tech companies on business growth, enhancing international competitiveness, and innovation support services. The park is home to over 100 entities in sectors like information technology, engineering, health medicine, social innovation, future energy, and sustainable chemistry.