Top 6 Startups to Follow in Australia in 2025

Australia is one of the top nations worldwide for new startups. The Australian startup environment was rated favorably due to its physical infrastructure, internal market dynamics, and commercial and legal framework.

The Australian government provides a range of support to startups, from small grants to the Startup Year Program, which aims to create a new wave of student entrepreneurs and innovative businesses. This program is currently in public debate.

Over 130 VC firms invest in Australia, and there are more than 200 incubators and accelerators that offer early-stage startups the support they need. The Australian government is very supportive of startups, providing a range of government-backed grants to help them get off the ground, as well as the recent Startup Year Program.

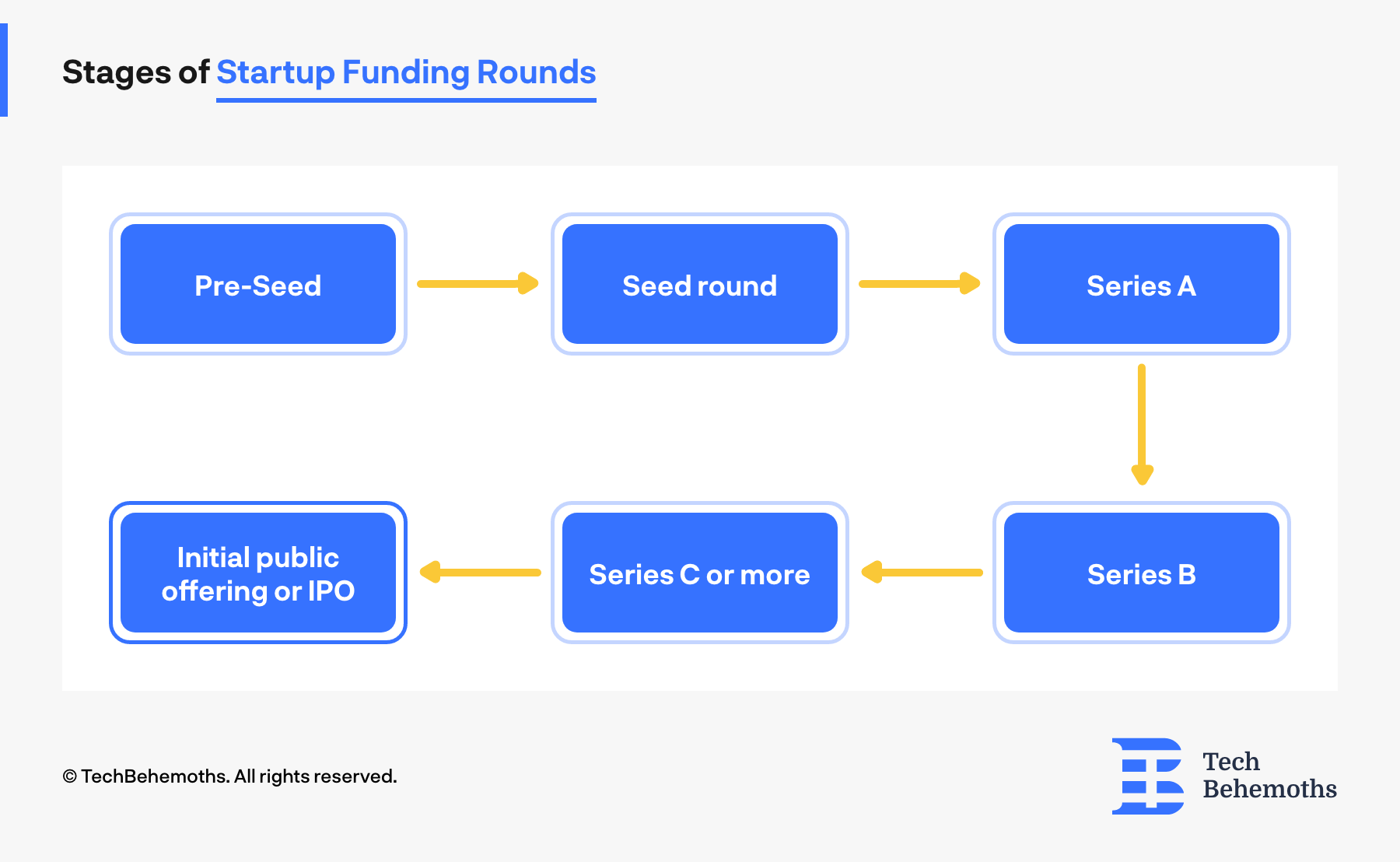

Moreover, companies often go through multiple fundraising rounds prior to going public via an IPO (Initial Public Offering). These rounds offer investors the opportunity to invest funds in a growing company, in exchange for ownership/equity. The first investment, known as seed funding, is followed by several rounds, named Series A, B, and C. At each round, a fresh valuation is conducted to determine the potential, market size, management, and current revenues of the company.

In this article, we will discover the top 6 startups to follow in Australia in 2025. Find out how they became successful and had the necessary support.

1. Cauldron

Location: Orange, New South Wales, Australia

Founded: 2023

Employees: 11-50

Last Funding Type: Seed

Type of product and market: The biotechnology industry

Cauldron is a start-up located in Orange, New South Wales, that aims to provide scientists with the tools they need to produce the basic materials for new foods and materials.

The firm, which was established in 2023 by Michele Stansfied and supported by a seed fund, has already attracted a group of 11 to 50 talented people who are enthusiastic about creating cutting-edge solutions to enhance the quality of life.

Cauldron Ferm has received $708 897.00M (A$10,500,00M) in investment in a single round. On March 28, 2023, a Seed round was raised and was supported by two investors. Cauldron's oversubscribed investment round is one of Australia's largest seed rounds in a female-founded business, headed by Main Sequence, the CSIRO-founded deep tech venture capital firm, and Horizons Ventures.

According to Ms Stansfield, Australia has a rare chance to lead the area in precise fermentation and set the way for future innovations in the fields of science, technology, and medicine. Together with places like Mackay, we will be able to expand the potential for the production of food, fiber, and feed for the globe while generating new employment.

With 1,871 monthly visits, Cauldron Ferm is rated 5,281,552 among all websites in the world.

2. Paypa Plane

Location: Asia-Pacific (APAC), Australasia

Founded: August 2018

Employees: 1-10

Last Funding Type: Series A

Type of product and market: B2C, and B2B space in the FinTech market segments.

Paypa Plane is a payment system with an eye on the future that offers benefits to banks, businesses, and payers. Paypa Plane is prepared to advance the payment ecosystem by elevating historical structures using current methods. Providing services in the B2C and B2B FinTech industry categories.

Founded in 2018 by Simone Joyce and Jonathan Grant and now situated in Asia-Pacific (APAC), Australasia, Paypa Plane enables financial institutions to add the plug-in solution from fintech to their current payment product lineup. A digital payments service provider that offers a bank-grade platform for both traditional scheduled payments and payment initiation through the New Payments Platform (NPP) and PayTo.

Paypa Plane has raised $10 million in two stages, the most recent of which being a Series A financing on March 27, 2023. They hope to nearly increase their personnel to about 100 employees.

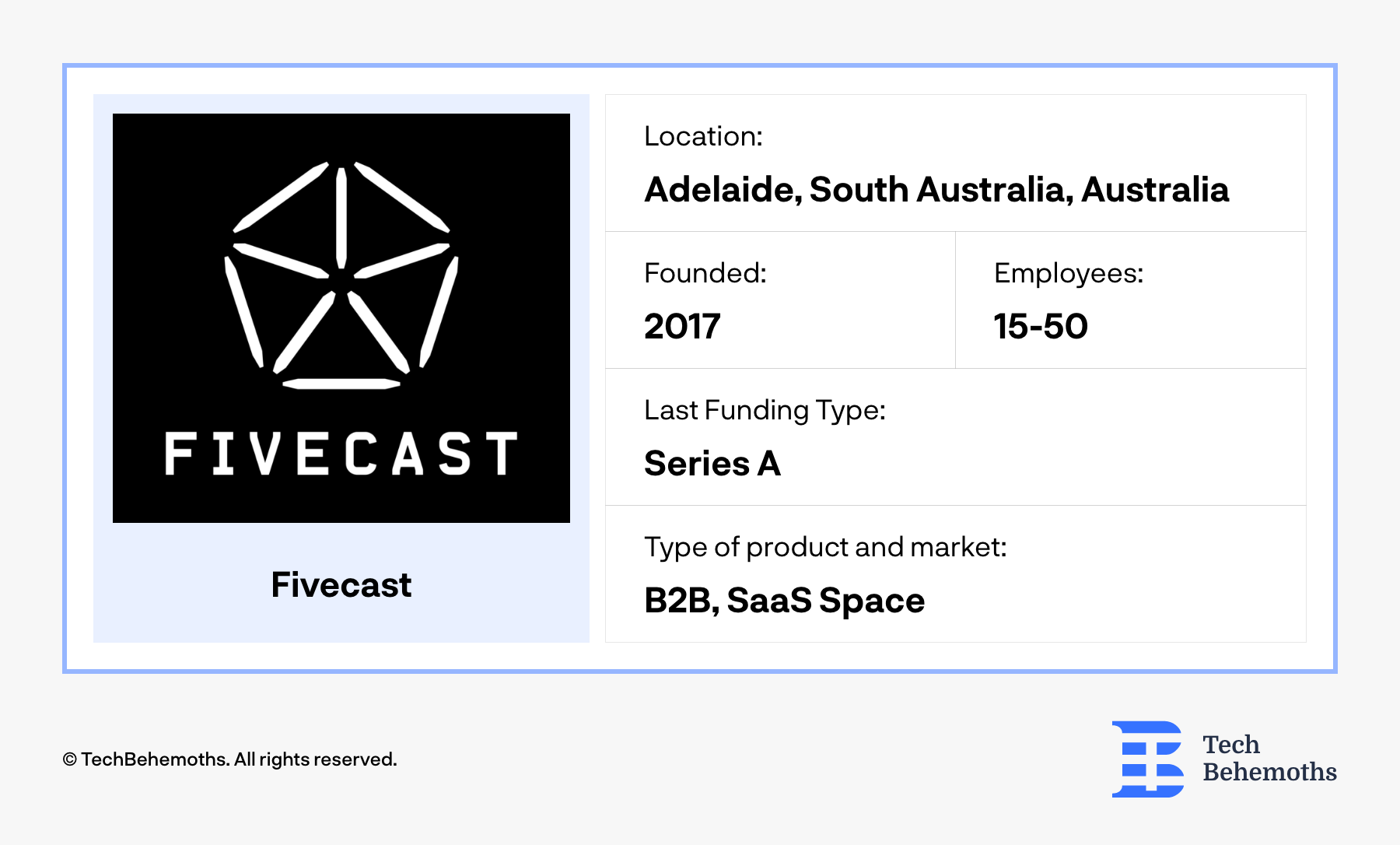

3. Fivecast

Location: Adelaide, South Australia, Australia

Founded: 2017

Employees: 15 to 50

Last Funding Type: Series A

Type of product and market: B2B, SaaS Space

Fivecast, an Australian tech startup founded in 2017, has created AI-powered software capable of exploring the public and dark web for potential dangers to companies and governments. Its capabilities include automatic change detection and alerts, threat visualization, threat assessments across bulk data, and threat detections across pictures, text, and video.

The company received $20 million (A$29.8 million) in funding from a US cyber-specialist venture capital fund. During the investment process, former Prime Minister Malcolm Turnbull gave counsel. Former Prime Minister Malcolm Turnbull provided advice during the investment process.

Currently based in Adelaide, South Australia the company is expanding in both the UK and the US, benefiting from expanded intelligence-sharing cooperation among the Five Eyes countries, as well as the recently joined AUKUS security partnership. Four investors have contributed to the funding of Fivecast. The most recent investors include the CSIRO and the South Australian Venture Capital Fund. Fivecast has raised a total of $24 million in two rounds of investment. Their most recent funding came from a Series A round on April 11, 2023.

Fivecast has grown from 15 to 50 employees in the past 18 months, with the expectation of employing 20 more people by the end of the year. The startup is rated 1,830,665 worldwide among websites, with 11,847 monthly web visits.

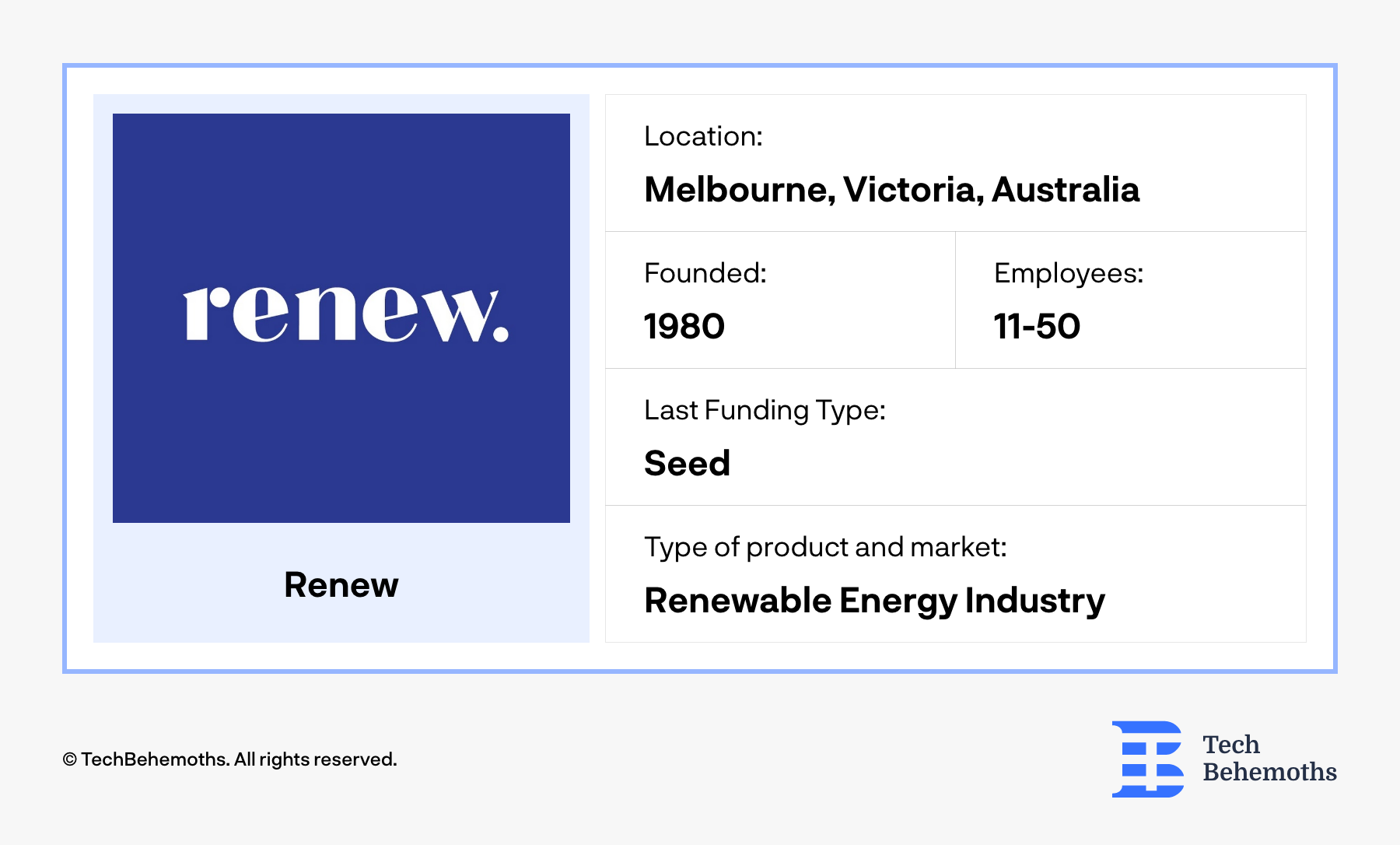

4. Renew

Location: Melbourne, Victoria, Australia

Founded: 1980

Employees: 11-50

Last Funding Type: Seed

Type of product and market: Renewable Energy Industry

Renew is a non-profit organization located in Melbourne, Victoria, Australia. A startup dedicated to empowering, representing, and motivating people to live more sustainably in their homes and communities. The ATA, founded in 1980, provides professional, objective advice on sustainable housing solutions to homes, government, industry, and corporate clients.

Renew is supported by five investors. The most recent investors are Allen & Company and Walkabout Ventures. Renew has received $8 million in investment in one round, on April 11, 2023, a Seed round was raised.

The Renew has 6650 members across Australia, providing information on energy efficiency, solar power, rainwater tanks, materials reuse and waste helping them to save money and minimize their environmental impact. They have 14 branches across Australia that meet regularly, hold seminars and workshops, sustainable house tours and attend fairs and events.

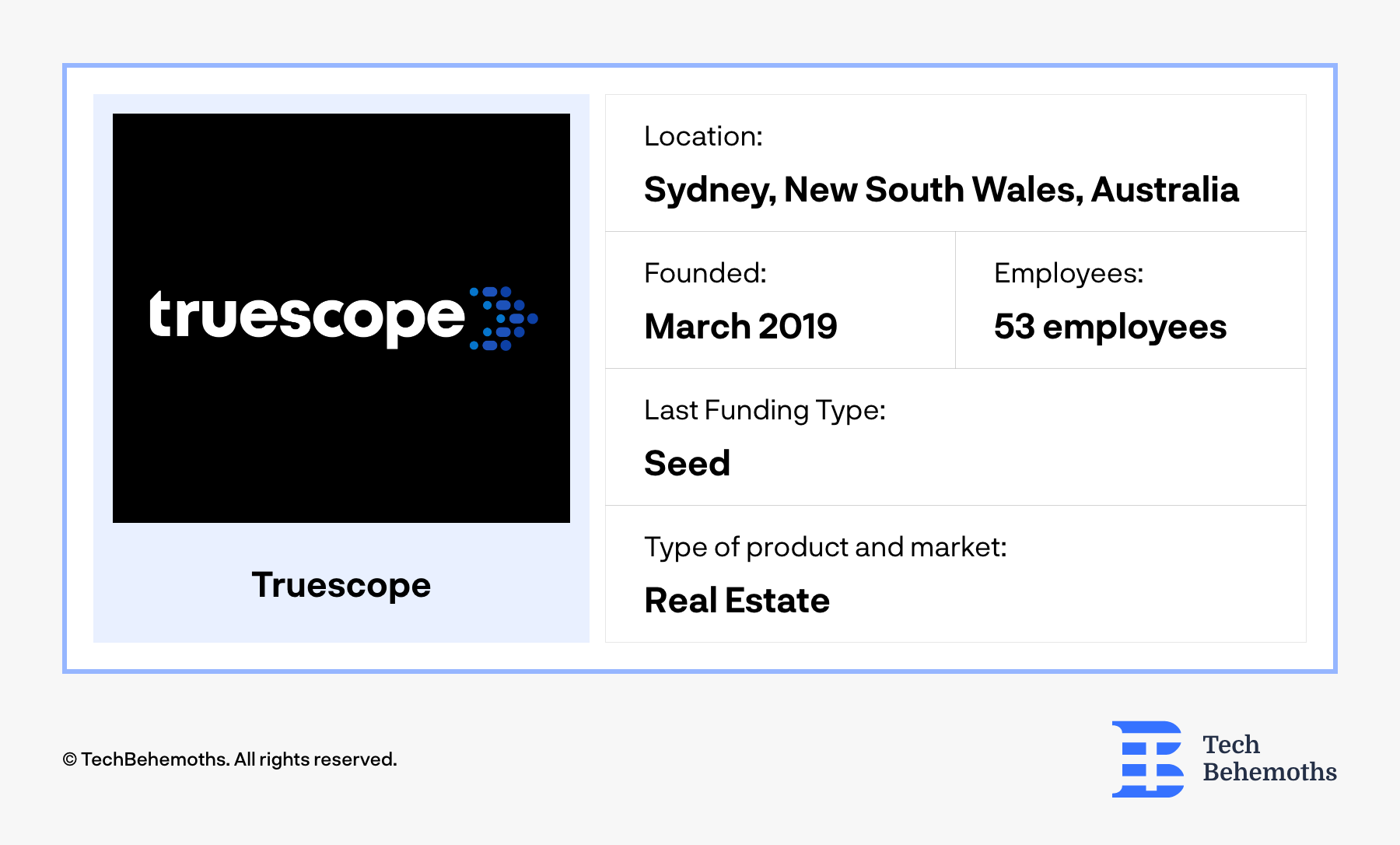

5. Truescope

Location: Sydney, New South Wales, Australia

Founded: March 2019

Employees: 53 employees

Type of product and market: Real estate

Last Funding Type: Seed

Truescope, an Australian startup currently located in Sydney, was established in 2019 and had 53 employees. They aim to provide businesses with up-to-the-minute information on various topics by gathering and consolidating media posts. This enables companies to make better strategic decisions based on the most current data available.

Truescope, under the guidance of tech and media veterans John Croll and Michael Bade, is striving to establish itself as the premier smart media intelligence platform that guarantees real-time and precise information.

The company has already made significant strides in the worldwide industry and has acquired over 250 corporate and government clients spanning Singapore and New Zealand. Truescope plans to maintain its focus on expanding these markets while simultaneously hiring a team of commercial experts in the US.

Since its inception, this business has received multiple rounds of startup funding. The most recent funding was a $6.2 million seed round in February 2022. At this point, it is uncertain whether the business will seek additional funding in the near future.

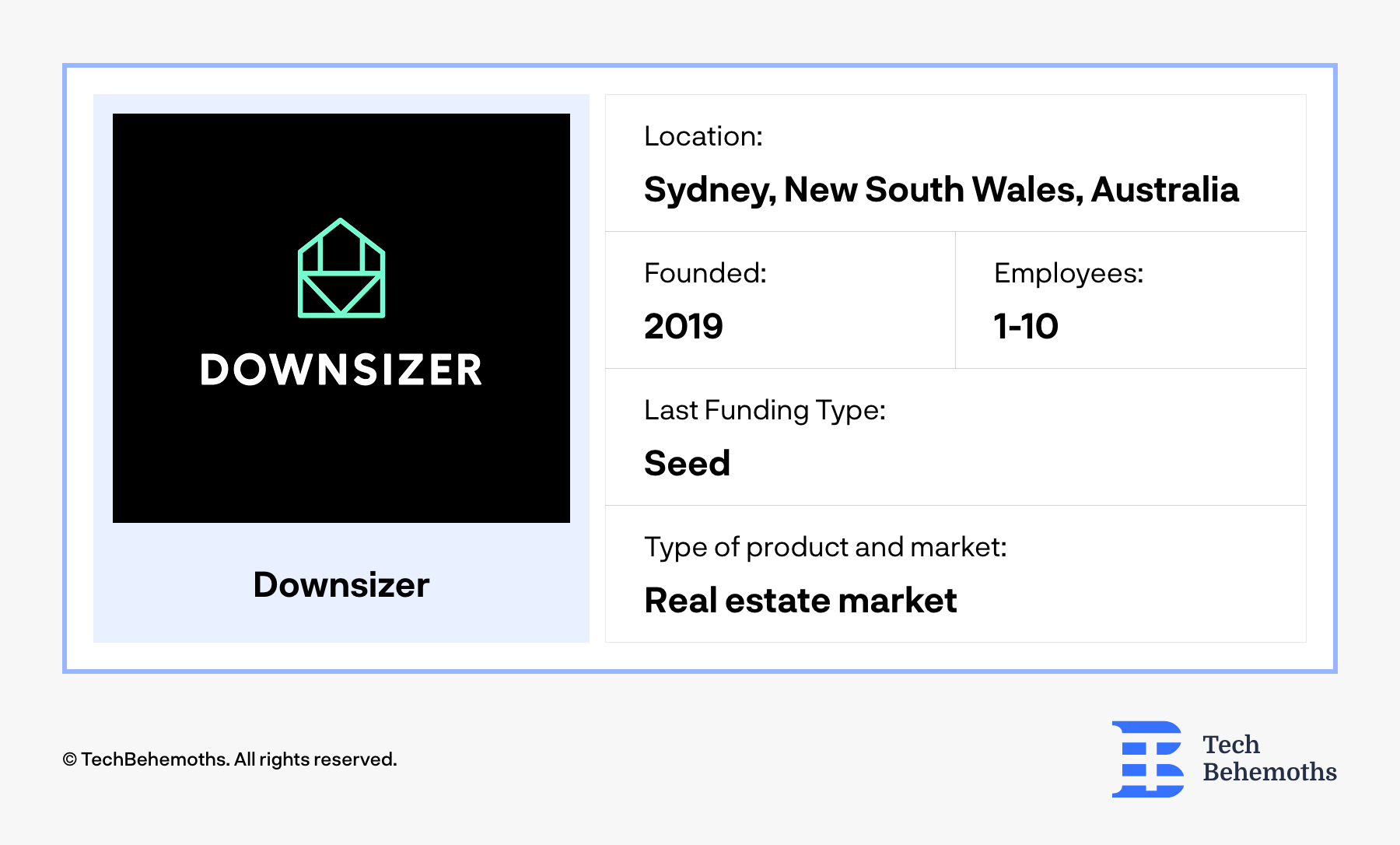

6. Downsizer

Location: Sydney, New South Wales, Australia

Founded: 2019

Employees: 1-10

Last Funding Type: Seed

Type of product and market: Real estate market

Last Funding Type: Seed

Downsizer, a startup that has received recognition for its innovative services, offers digital solutions to the finance, property, and insurance sectors, catering to people who are seeking to move to a new residence while at the same time raising their financial and lifestyle prospects. The Sydney-based company has successfully secured $2.53M (A$3.75M) in seed funding to facilitate the growth of its SaaS platform, which operates at the links of fintech, proptech, and insurtech.

Correlation Australia Holdings (CAH) played a crucial role in leading the investment round, contributing a substantial strategic investment, with participation from current shareholders such as family offices and high-net-worth individuals.

Downsizer has been an incredible asset for property development companies, real estate agents, financial advisors, mortgage brokers and lenders, and insurance brokers and underwriters to connect with individuals over the age of 50, belonging to the Baby Boomer or Gen X generation.

With the platform's cutting-edge technology, it provides digital content and market insights that aid in lead generation. Furthermore, Downsizer offers a national property marketplace where developers can list off-the-plan properties and access authentic sales data in real time. This recent investment round has catapulted Downsizer's total funding raised to an impressive $6.1 million.

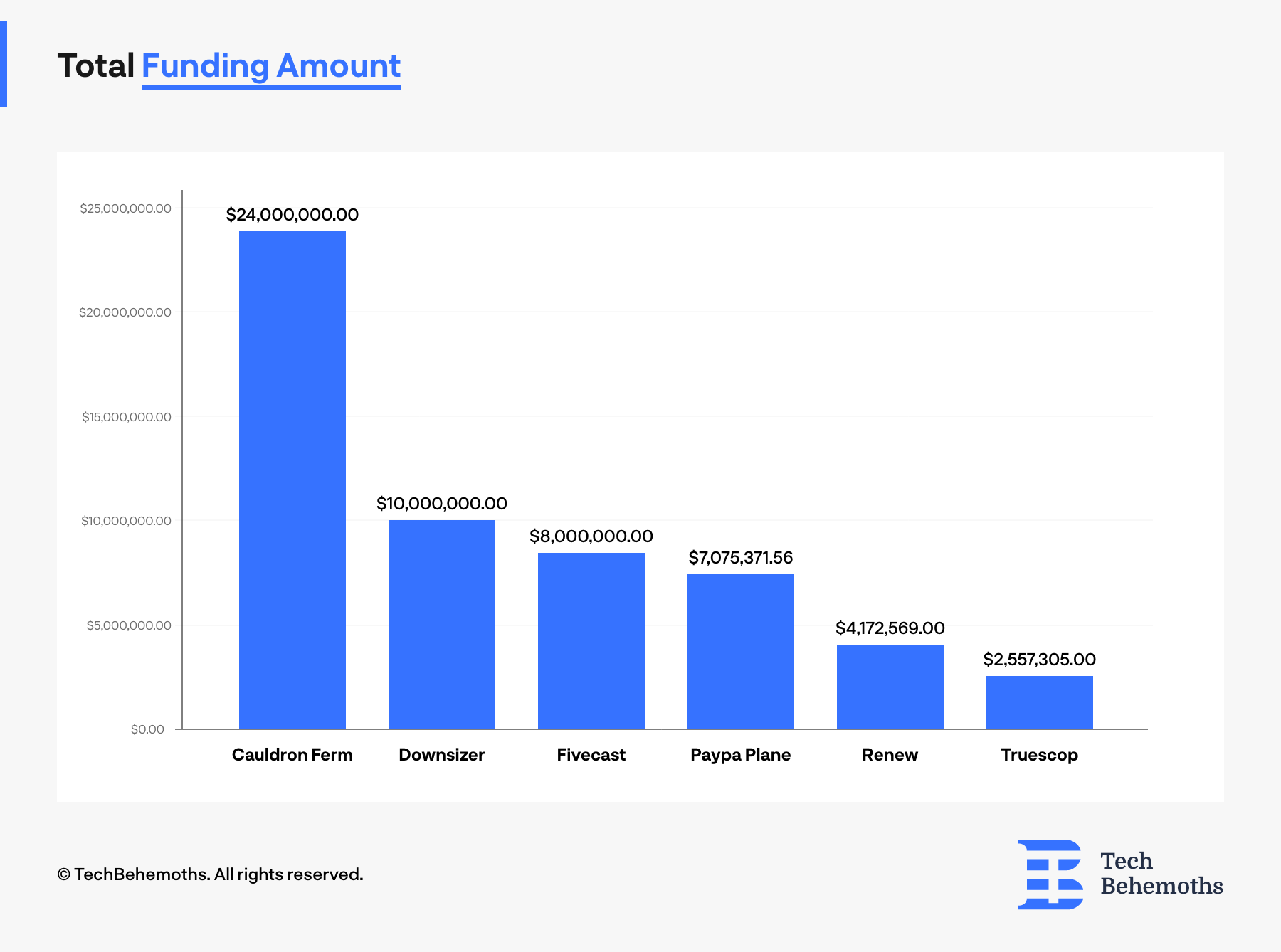

Total amount raised across all funding rounds:

CB Rank (Organization). Algorithmic rank assigned to the top 100,000 most active Organizations by highest 30-day trend score:

|

CB Rank |

Organization |

|---|---|

|

1 |

|

|

|

|

272 |

Fivecast |

|

|

|

4,542 |

Paypa Plane |

|

|

|

6,172 |

Renew |

|

|

|

13,050 |

Cauldron Ferm |

|

|

|

26,081 |

Downsizer |

|

|

|

34,621 |

Truescop |

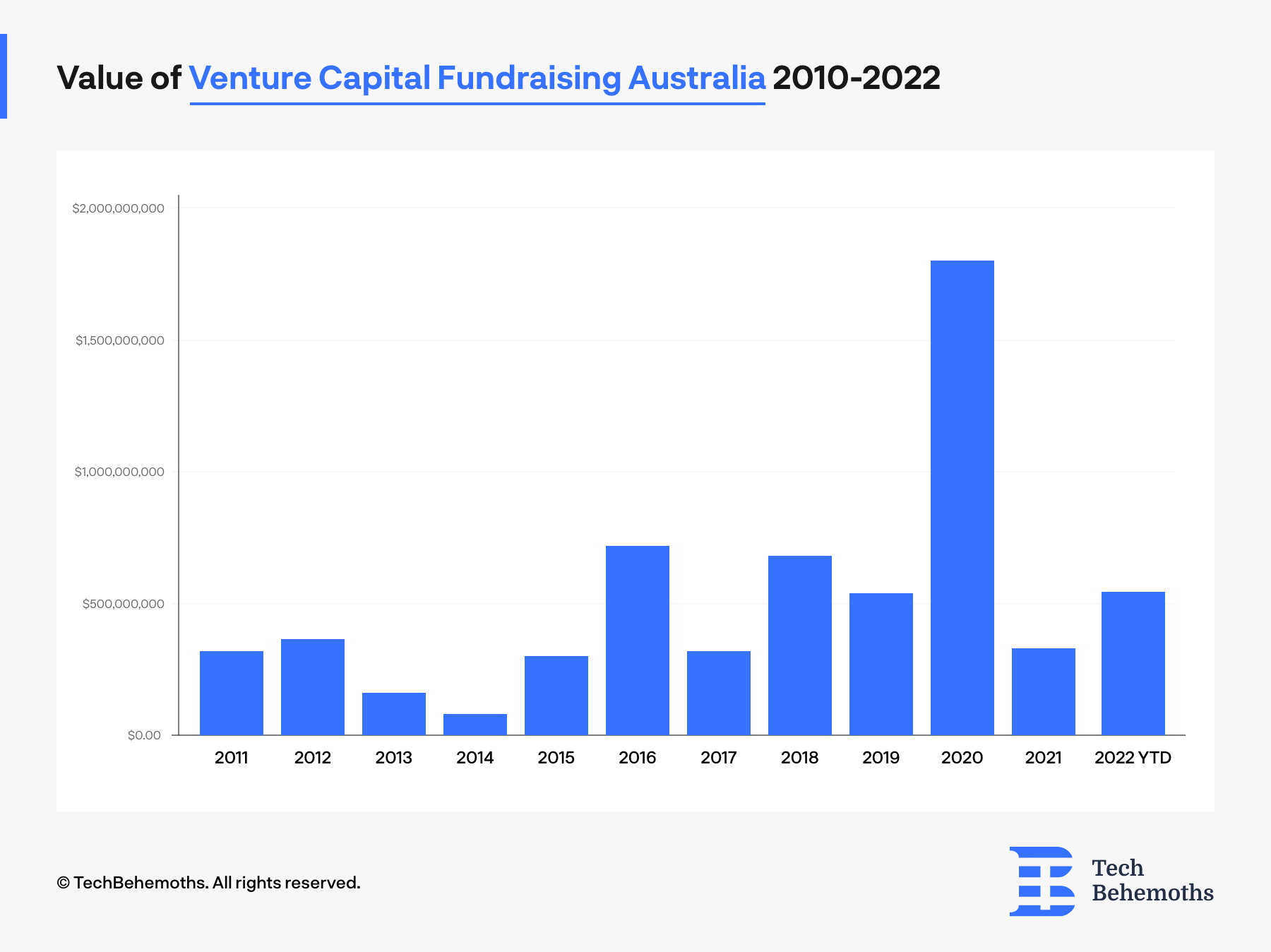

Australian-based venture capital funds had a value of $539.34 million in 2022 and $331.73 million in 2021. Startups have gained global market reach with their Unicorn status, worth more than a billion US dollars.

To Sum Up

All in all, governments are supporting startups in any field including those listed above with sustainable initiatives, the real estate market, renewable energy industry, B2B, SaaS, and B2C, setting up policies to drive climate and economic changes, and providing a foundation for capital raising and stability during financial volatility at the current time. This support gives major results in the startup market, and Australia is a worthy example to follow in this niche.