The State of Productivity and Job Satisfaction in B2B Companies

The productivity and performance indicators in B2B companies are strongly related to the level of satisfaction and comfort employees get. In other words, the more the company invests in employee satisfaction - the more productive the employee will be.

Having this statement as a starting point, we decided to explore this theory in our latest survey that we conducted between September 12-27, 2023.

The survey participants are 1332 professionals coming from 157 B2B companies across 43 countries & territories.

Survey respondents’ profile

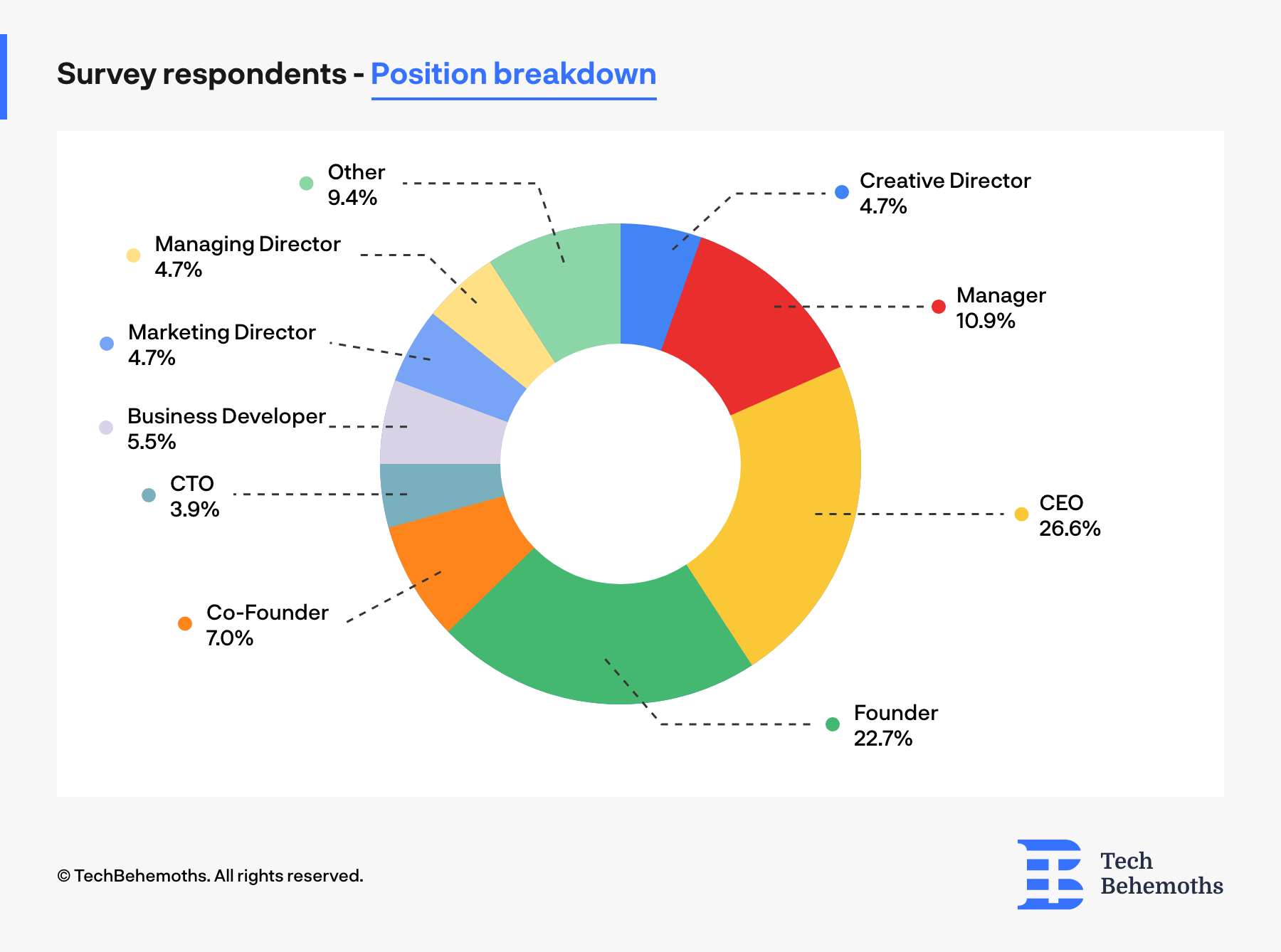

Apart from the demographic dimension, the respondents who voluntarily offered their answers to the present survey hold different positions in the companies they represent. On this note, we highlight that highest percentage of respondents (26.6%) are Chief executives officers in their companies and other 22.7% are company founders.

The other half of the respondents hold different positions - managers, creative directors, marketing officers, business developers and more. Considering that, we can state that the survey has a balanced audience which allows us to discover both positions - entrepreneurial and employee.

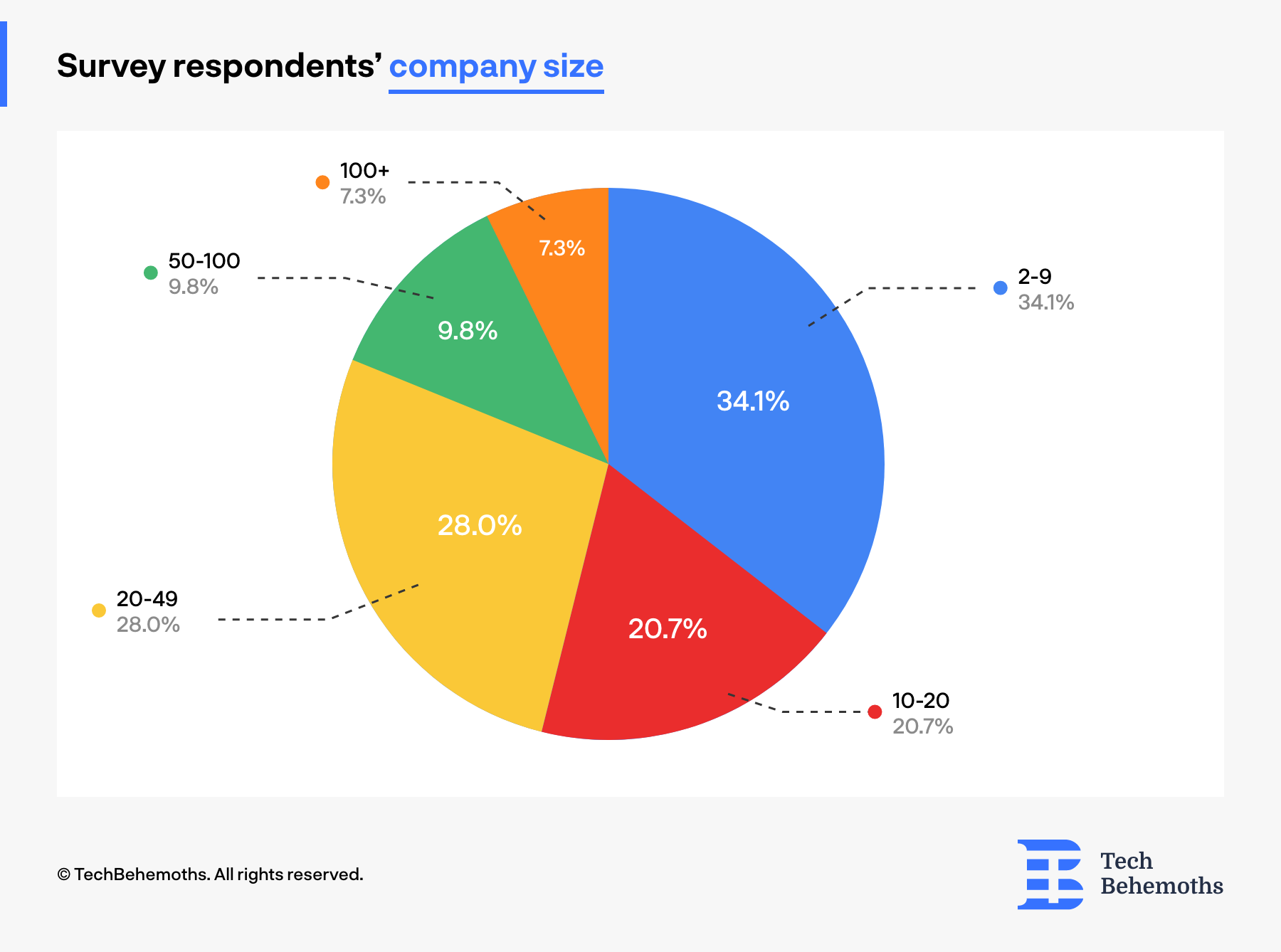

Regarding the respondent’s company size we can note that ⅓ represents professionals working in small B2B companies, and other 28% of respondents come from companies with 20-49 employees. The smallest portion of respondents - 7.3% come from companies with more than 100 employees.

Are B2B companies Hiring or Laying off in 2023?

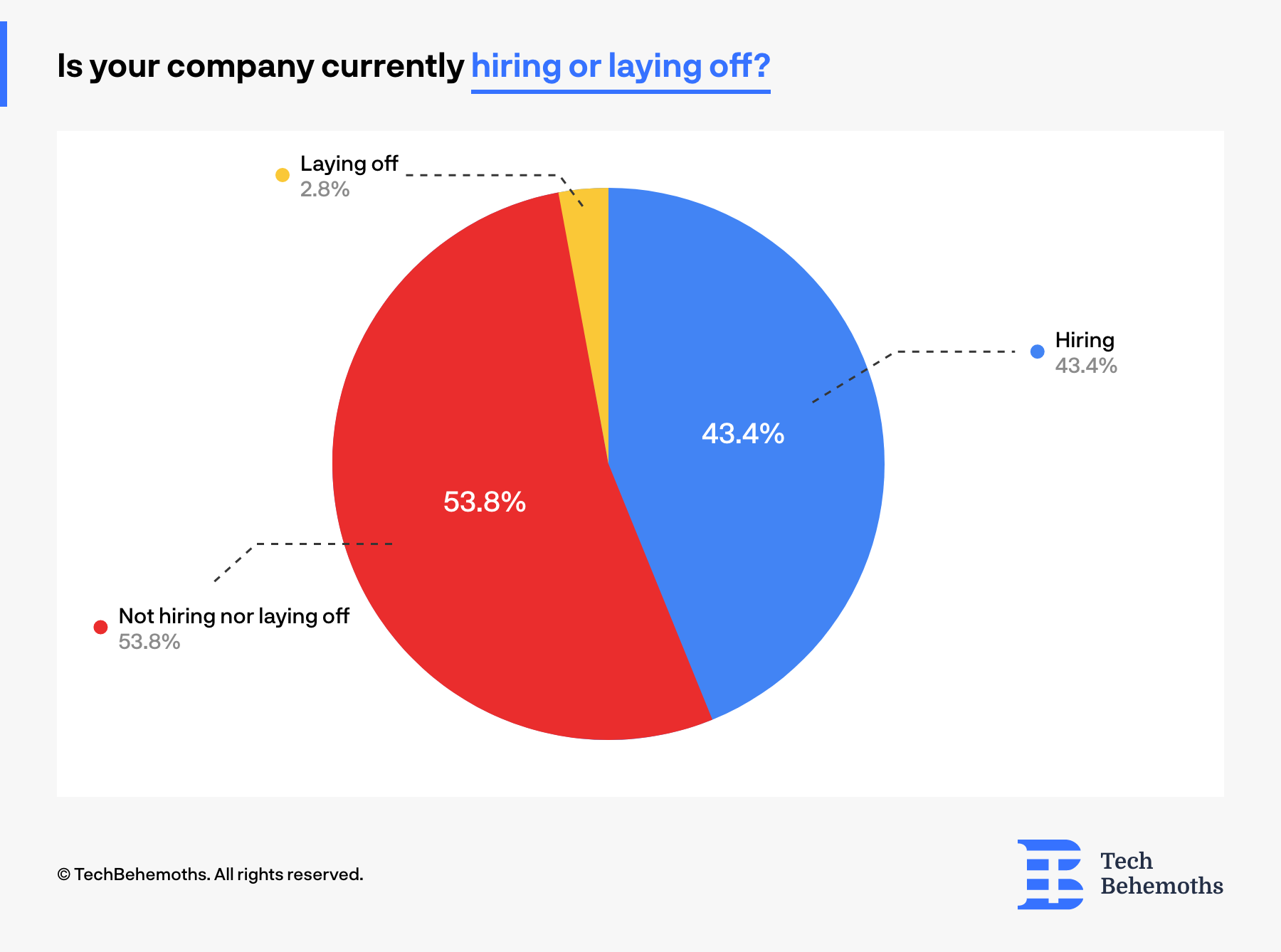

Now that we have the data about survey respondents’ characteristics and profile, let’s dive deeper into their overall human resources directions this year. The first question addressed within the survey was if the companies where respondents work at is currently hiring or laying off employees. And here are the results:

The results show that a significant portion of companies (43.4%) indicated that they are currently in a hiring phase. This suggests that a substantial number of organizations are actively seeking to expand their workforce, which can be indicative of growth and positive economic conditions.

Conversely, a relatively small percentage of companies (2.8%) reported that they are in a laying-off phase. While this number is relatively low, it still highlights that some organizations are facing challenges or downsizing, which could be due to various factors such as economic downturns or strategic shifts.

Another 53.8% of respondents mentioned that their companies are neither hiring nor laying off employees at the moment. This could indicate stability or a holding pattern in these organizations, where there may be no immediate plans for significant workforce changes.

All in all, the data reveals a predominant trend of companies actively hiring, but it also acknowledges a smaller segment that is laying off employees. The presence of organizations in a holding pattern suggests a mix of employment dynamics within the surveyed companies.

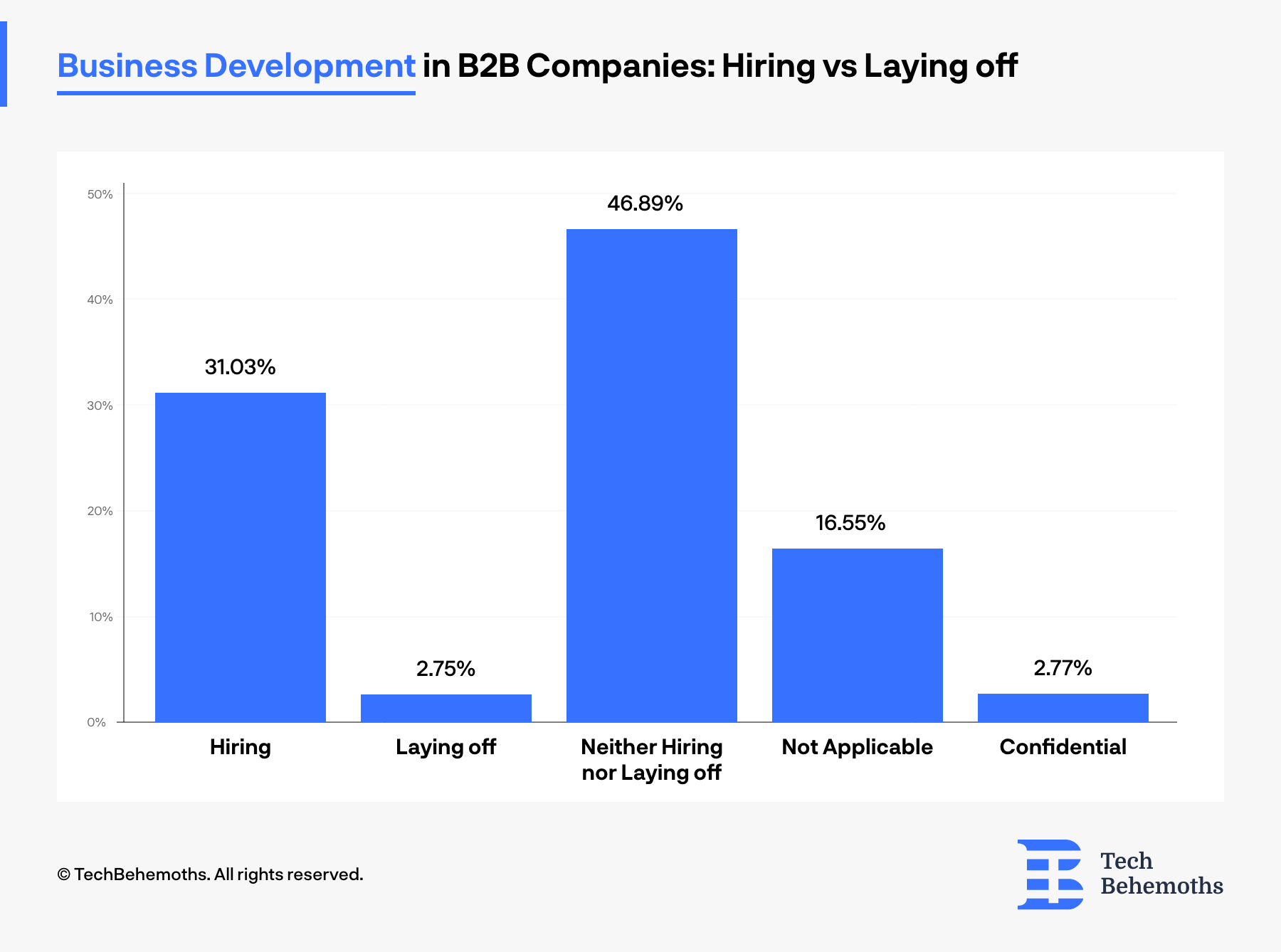

Business Development in B2B Companies: Hiring vs Laying off

When asked about the Business Development department and professionals, the pattern shows that Approximately 31.03% of B2B companies are actively looking to hire in the Business Development department.

This signals a positive outlook for growth and expansion within these organizations. It suggests that they see opportunities for business development and are investing in acquiring new talent to pursue those opportunities.

On the other hand, a relatively small percentage, 2.75%, of B2B companies are laying off employees in the Business Development department. While this percentage is low, it still signifies that some organizations are facing challenges or may be restructuring their business development teams for strategic reasons.

A substantial proportion, 46.89%, of B2B companies reported that they are neither hiring nor laying off in the Business Development department. This suggests a level of stability or a status quo approach, where these companies are maintaining their current business development teams without significant changes.

Additionally, the "Not Applicable" category, at 16.55%, indicates that a notable portion of respondents either did not have a Business Development department or chose not to disclose their hiring or layoff activities in this specific area. The "Confidential" category, at 2.77%, further underscores the sensitivity of this information for certain organizations.

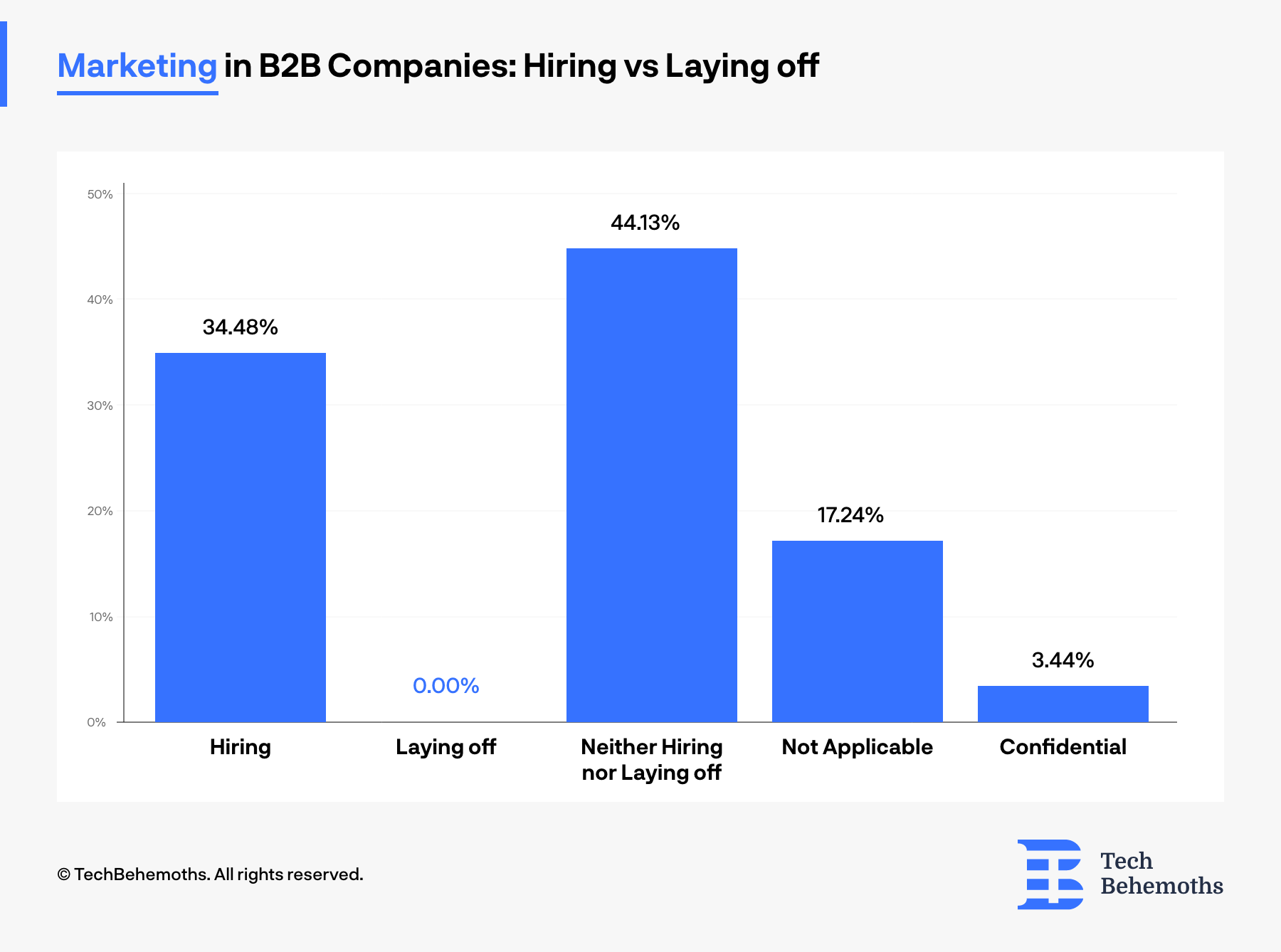

Are B2B Companies Hiring Marketing Specialists or Laying Off?

The data concerning the hiring and layoffs of marketing specialists within B2B companies reveals the following insights:

-

Hiring Activity: About 34.48% of B2B companies are actively in the process of hiring marketing specialists. This indicates a positive demand for marketing expertise, suggesting that these companies are looking to strengthen their marketing teams, likely to support growth or adapt to changing market conditions.

-

Zero Layoffs: Notably, there is no reported laying off of marketing specialists among the surveyed B2B companies. This signifies stability in the marketing departments, with no companies opting to reduce their marketing workforce during the survey period.

-

Maintaining Status Quo: A significant portion, approximately 44.13%, of companies mentioned that they are neither hiring nor laying off marketing specialists. This suggests a state of equilibrium in these organizations, where they are maintaining their current marketing teams without significant changes.

-

Not Applicable and Confidential Responses: The "Not Applicable" category (17.24%) and the "Confidential" category (3.44%) highlight that some respondents either do not have marketing specialists in their organizations or chose not to disclose their hiring or layoff activities in this specific department. These responses underline the diversity of organizational structures and information sensitivity.

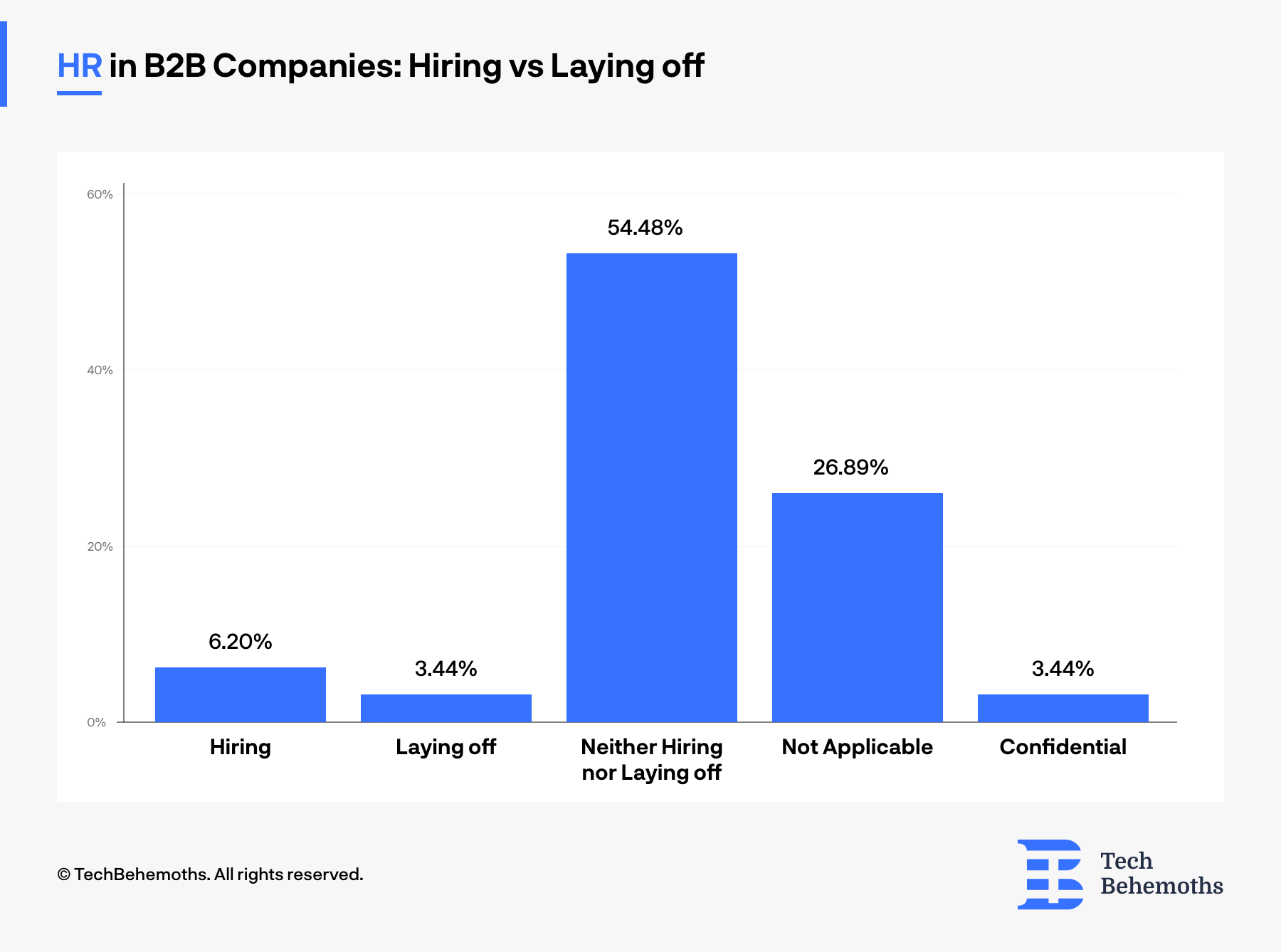

The State of HR in B2B Companies - Hiring vs Laying Off

When asked about hiring vs laying off HR professionals, representatives of B2B companies revealed the following trends:

Firstly, a substantial majority of B2B companies, accounting for approximately 54.48% of respondents, have indicated that they are neither hiring nor laying off HR professionals. This suggests a state of stability within HR departments, where organizations are maintaining their existing HR teams without making significant changes. This stability may reflect the ongoing recognition of the importance of HR functions in managing personnel and company culture.

Secondly, the data reveals that a relatively small percentage of companies, approximately 6.2%, are currently in the process of hiring HR professionals. In contrast, 3.44% of companies reported that they are laying off HR staff. These percentages are notably lower compared to other departments, such as marketing or business development. This suggests that the HR job market may be relatively steady, with modest hiring and limited layoffs, indicating that organizations continue to recognize the value of HR expertise.

Lastly, the data includes responses categorized as "Not Applicable" (26.89%) and "Confidential" (3.44%). These responses indicate that a significant portion of respondents either do not have HR professionals in their organizations or chose not to disclose their hiring or layoff activities in the HR department. These variations in responses underscore the diversity of organizational structures and the sensitivity of information related to HR workforce strategies.

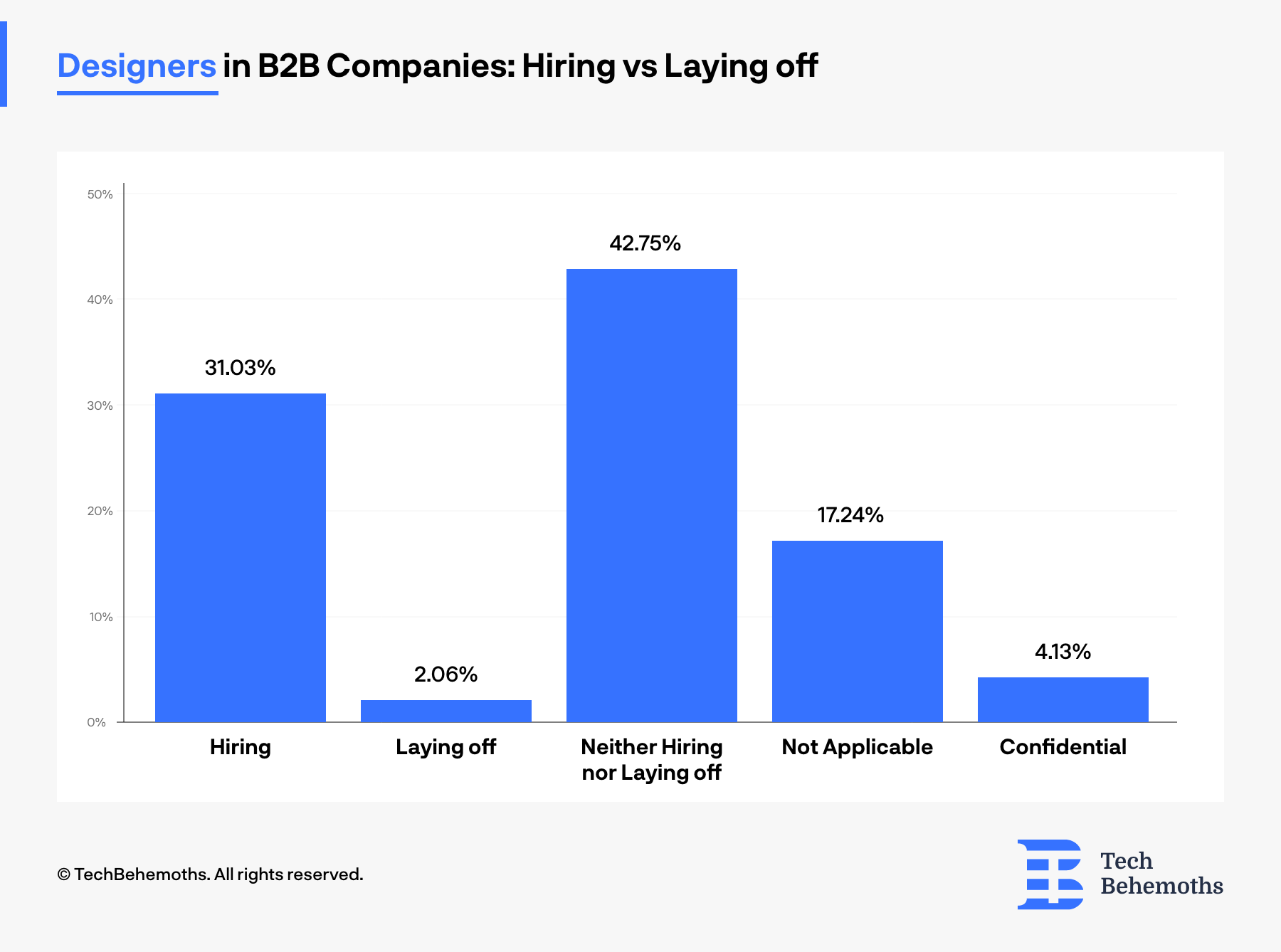

Designers in B2B Companies: Hiring vs Laying Off

The data regarding the hiring and layoffs of designers within B2B companies provides the following key insights:

-

Stability in Design Departments: A significant portion of B2B companies, approximately 42.75%, reported that they are neither hiring nor laying off designers. This indicates a state of stability in design departments, with organizations maintaining their current design teams without significant changes. This stability may reflect a continuous need for design expertise.

-

Hiring Intent: About 31.03% of companies are actively hiring designers. This signals a positive demand for design talent, suggesting that these companies recognize the importance of design in their business strategies and are investing in expanding their design teams.

-

Limited Layoffs: A relatively small percentage (2.06%) of companies reported laying off designers. This low percentage indicates that layoffs in the design field are infrequent among the surveyed B2B companies, signifying a generally steady job market for designers.

-

Not Applicable and Confidential Responses: The "Not Applicable" category (17.24%) and the "Confidential" category (4.13%) reveal that a notable portion of respondents either do not have designers in their organizations or chose not to disclose their hiring or layoff activities in the design department. These responses underline the diversity of organizational structures and the sensitivity of workforce-related information.

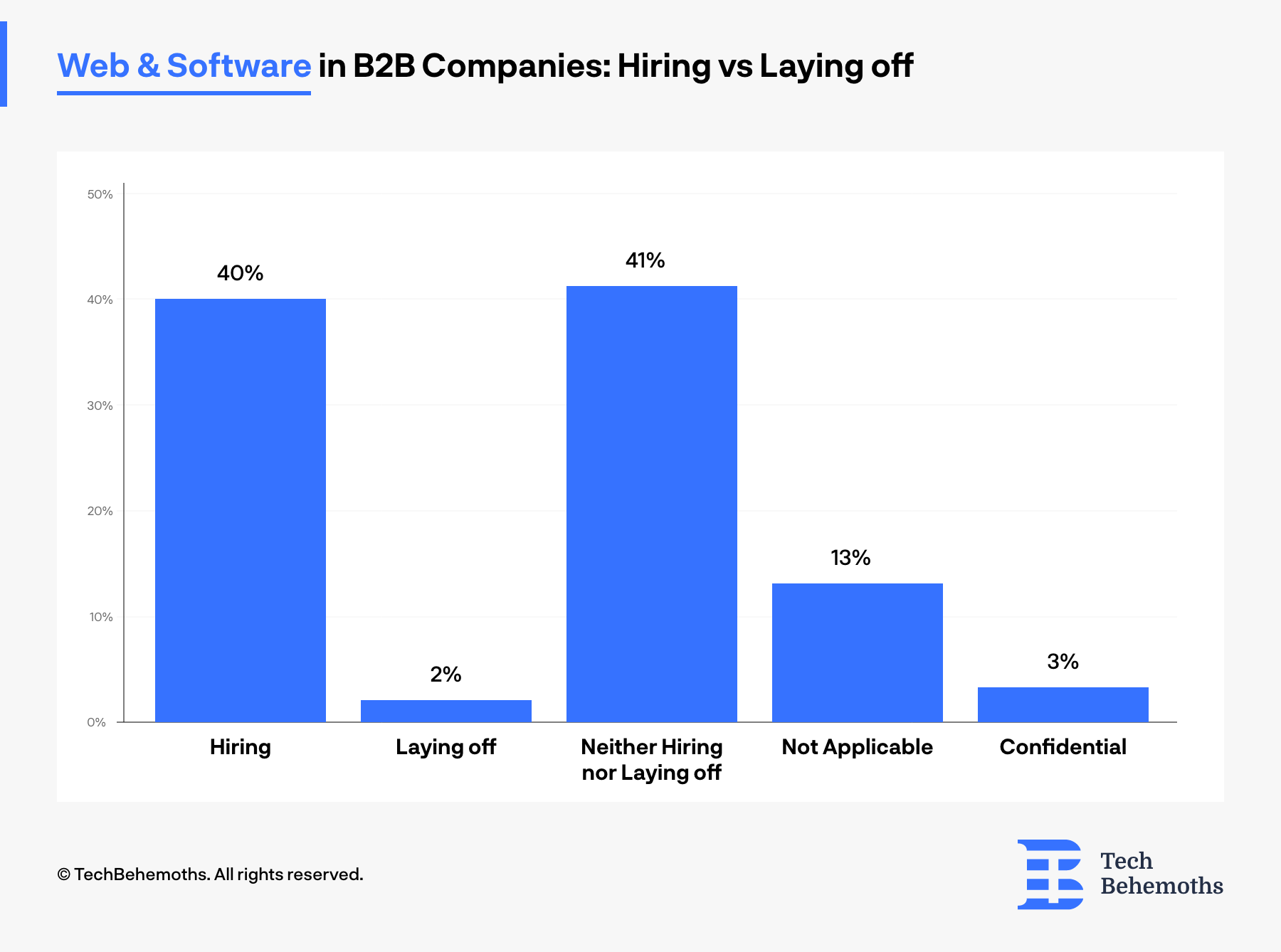

Are B2B Companies Hiring or Laying Off Software Developers?

When it comes to Web and software developers in B2B Companies, here’s how the trends go:

Firstly, a substantial portion of companies, approximately 40.68%, reported that they need to hire or lay off Web and software Developers. This signifies a state of stability within this domain, where organizations are maintaining their existing teams without significant changes. This stability reflects the ongoing demand for technology expertise, which is essential for the development and maintenance of digital products and services.

Secondly, the data indicates a strong demand for Web and Software Developers, with 40% of companies actively looking to hire in this category. This hiring intent suggests a recognition of the pivotal role played by developers in technology-driven industries. The need to expand developer teams is likely driven by growth opportunities and the continuous evolution of digital technologies.

Thirdly, the percentage of companies laying off Web and Software Developers is relatively low at 2.06%. This low percentage indicates that layoffs in this field are infrequent among the surveyed B2B companies, indicating a stable developer job market.

Lastly, the "Not Applicable" category (13.10%) and the "Confidential" category (3.44%) reveal that a notable portion of respondents either do not have Web and Software Developers in their organizations or chose not to disclose their hiring or layoff activities in this specific department. These responses highlight the diversity of organizational structures and the sensitivity of workforce-related information in the technology sector.

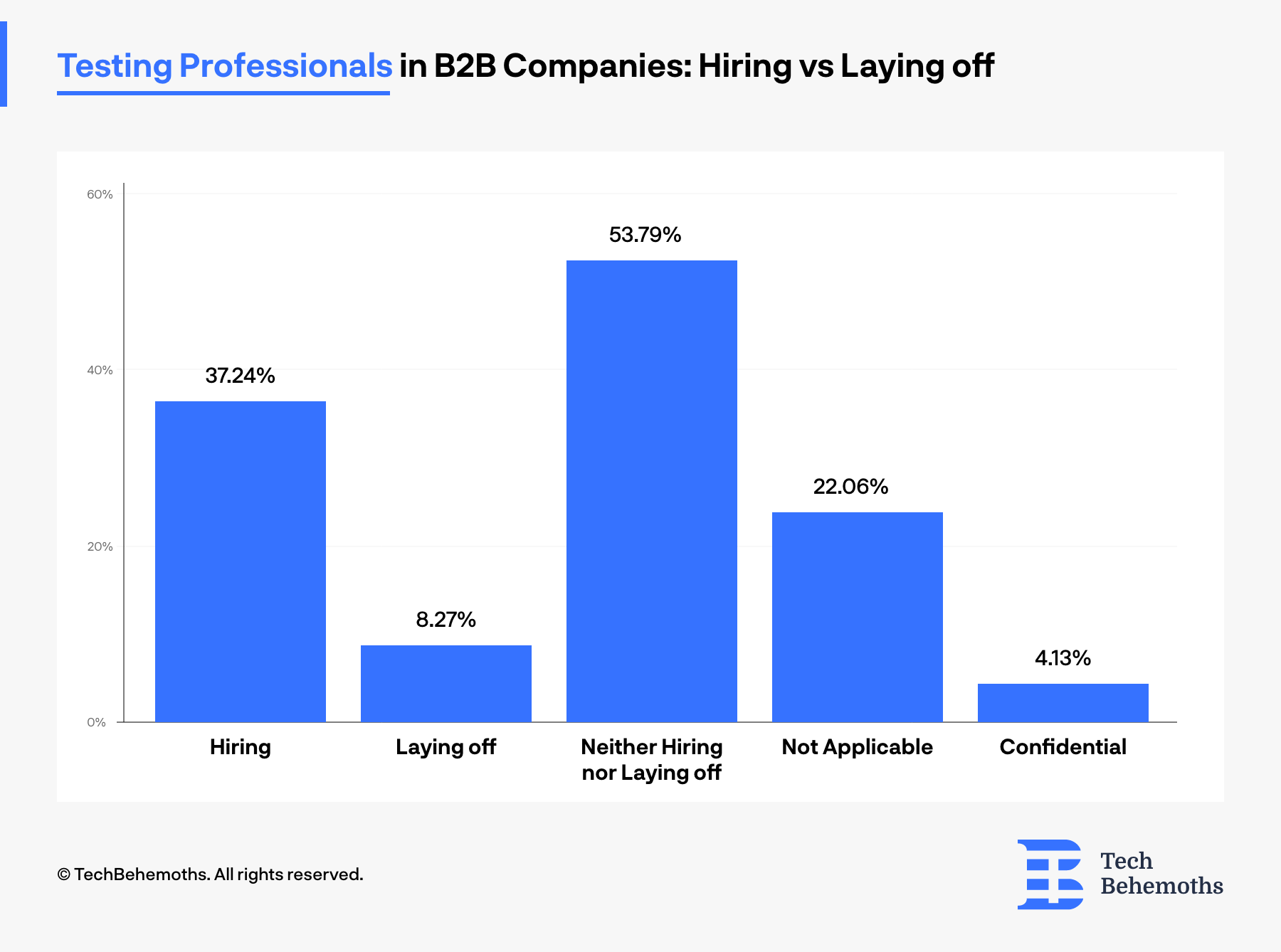

The State of Testing Professionals in B2B Companies

From a human resources perspective, the data concerning hiring and layoffs of Testing professionals within B2B companies revealed interesting trends and dynamics. Here are the survey results that cover this dimension:

It is important to note that the majority of companies, around 53.79%, reported that they are not currently hiring or laying off any Testing professionals. This indicates that the Testing department is in a state of stability, with companies maintaining their current testing teams without making significant changes. This stability suggests that companies recognize the importance of consistent quality assurance in their product development processes.

However, the data reveals that there is still a relatively strong demand for Testing professionals, with 37.24% of companies actively seeking to hire in this field. This hiring intent highlights the continuous need for quality assurance and testing expertise in technology-driven industries. The growth of digital products and services is likely driving the demand for skilled testers.

It is worth noting that the percentage of companies laying off Testing professionals is noteworthy at 8.27%. Though this is higher than in some other departments, it still suggests that layoffs in the Testing field are not as common as hiring. Layoffs in this area could be related to project completion, reorganizations, or shifts in testing methodologies.

Finally, the "Not Applicable" category (22.06%) and the "Confidential" category (4.13%) indicate that a significant portion of respondents either do not have Testing professionals in their organizations or chose not to disclose their hiring or layoff activities in this specific department. These responses emphasize the diversity of organizational structures and the sensitivity of workforce-related information, particularly in areas like testing, where quality control is critical.

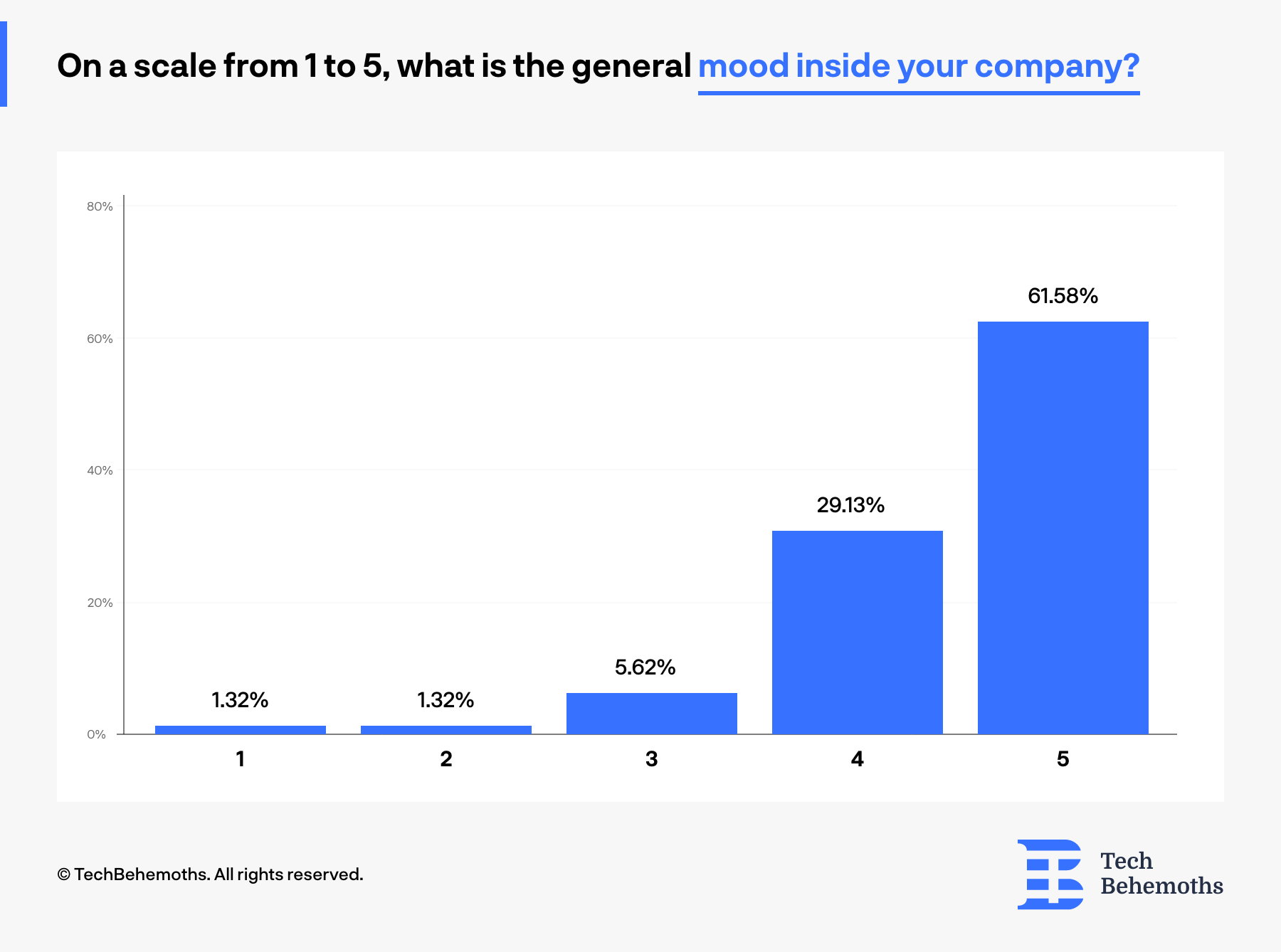

The State of Happiness in B2B Companies

Considering the trends mentioned in the above sections, it’s time to look at this from another perspective, and specifically on how satisfied are the employees with their current position, perks, and other benefits.

To start with, we asked professionals to rate the overall mood that persists within their companies, and here’s what the survey shows:

-

Positive Overall Mood: The majority of respondents, accounting for a significant 61.58%, rated the overall mood within their companies as a 5 on a scale of 1 to 5. This high percentage of positive ratings suggests that a substantial portion of employees within B2B companies perceive a generally positive and favorable working atmosphere. A positive work environment can contribute to higher morale, motivation, and job satisfaction.

-

Moderate Satisfaction: A notable portion, 29.13%, rated the mood as a 4, indicating a moderately positive outlook. This suggests that while the majority of employees perceive their work environment positively, there is still room for improvement or that some may have mixed feelings about certain aspects of their workplace. It's an important signal for HR to explore areas for enhancement.

-

Minor Dissatisfaction: A smaller percentage, 6.62%, rated the mood as a 3, suggesting a somewhat neutral or lukewarm sentiment. This group may represent employees who have a more neutral view of their workplace or those who feel that certain aspects could be improved. HR should consider seeking feedback from this group to identify areas for enhancement.

-

Low Dissatisfaction: A very small percentage, 1.32%, rated the mood as either 1 or 2, indicating a low level of satisfaction or a negative perception of the overall mood. While this percentage is minimal, HR should pay attention to this minority, as addressing their concerns is crucial to prevent potential issues from escalating.

Overall, the data portrays a predominantly positive mood within B2B companies, with the majority of employees expressing high satisfaction levels. However, it's essential for professionals to remain attentive to the smaller percentages of employees who have expressed neutral or negative sentiments to ensure that their concerns are addressed and the positive working atmosphere is maintained and enhanced where possible.

Factors of Risk and Concern in B2B Companies

Another question within the survey is about the concerning factors within their companies. The respondents were asked to rate how much do specific aspects could raise concerns. In the 21 century, work-life balance, remuneration, and career perspectives are among the most appreciated perks by professionals.

Here’s how professionals answered in regard to each of these aspects:

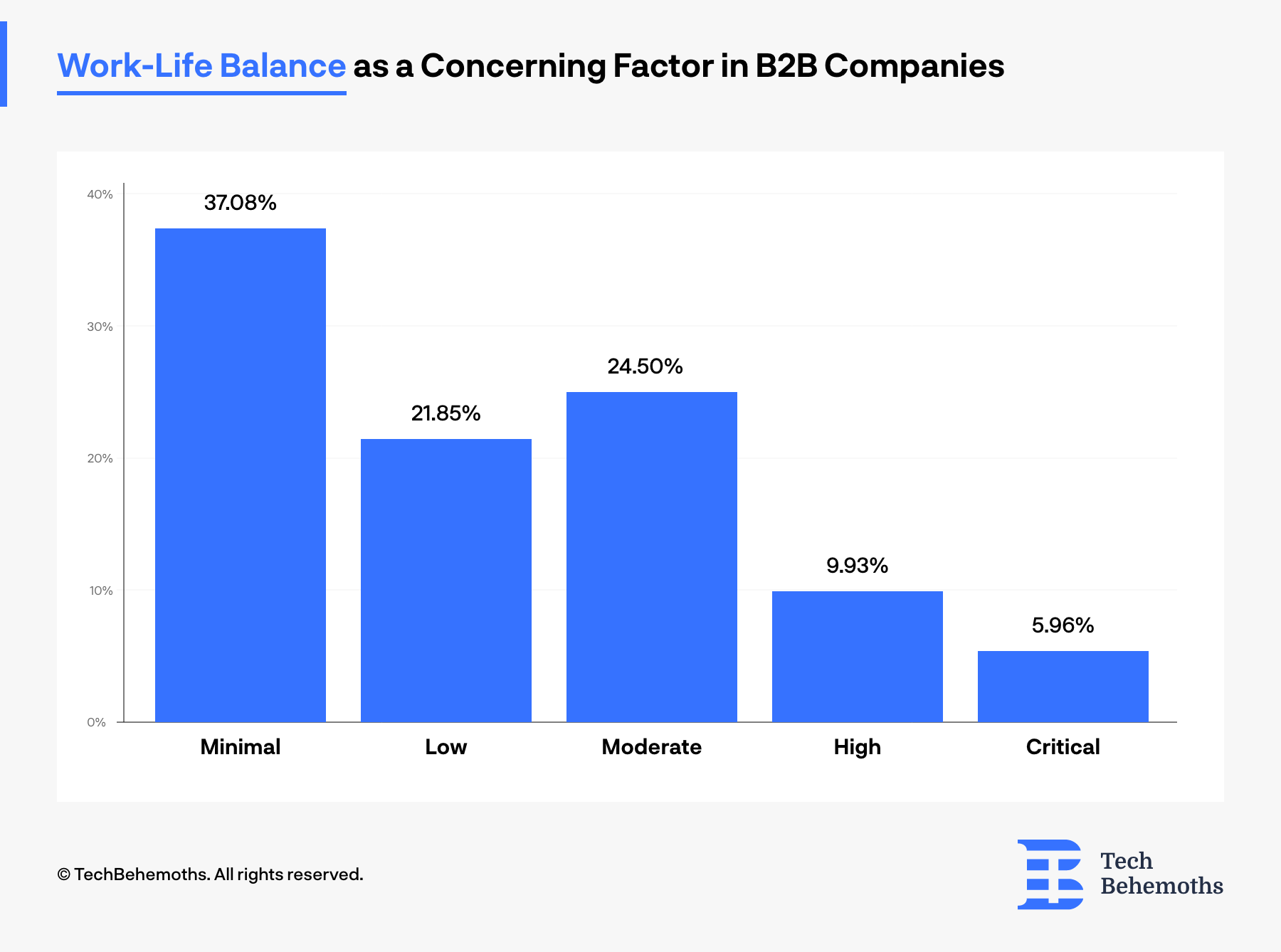

Work-Life Balance as a Factor of Concern in B2B Companies

The responses regarding the level of concern about Work-Life Balance in their companies provide valuable insights into employee perceptions and concerns:

Minimal Concern (37.08%): A significant portion of respondents consider Work-Life Balance to be a minimal concern in their companies. This suggests that for these employees, the organization's policies and practices likely support a healthy balance between work and personal life. It can also indicate that the company culture places value on employees' well-being.

Low Concern (21.85%): While still a substantial percentage, a lower proportion of respondents perceive Work-Life Balance as a low-level concern. This group may include individuals who feel that the company is generally supportive of work-life balance but may have occasional challenges or areas for improvement.

Moderate Concern (24.50%): Approximately a quarter of respondents view Work-Life Balance as a moderate concern in their organizations. This suggests that a notable portion of employees may be experiencing some difficulties in balancing their work and personal lives. HR departments should consider this group's feedback seriously and explore potential interventions to address their concerns.

High Concern (9.93%): A smaller but notable percentage of respondents consider Work-Life Balance a high-level concern. This group likely faces more significant challenges in balancing their professional and personal commitments. HR should investigate the underlying causes and consider implementing policies or programs to support these employees better.

Critical Concern (5.96%): The smallest percentage of respondents, but still significant, rate Work-Life Balance as a critical concern in their companies. For these employees, work-life balance may be severely compromised, impacting their well-being and job satisfaction. HR should prioritize addressing the issues faced by this group to prevent burnout and turnover.

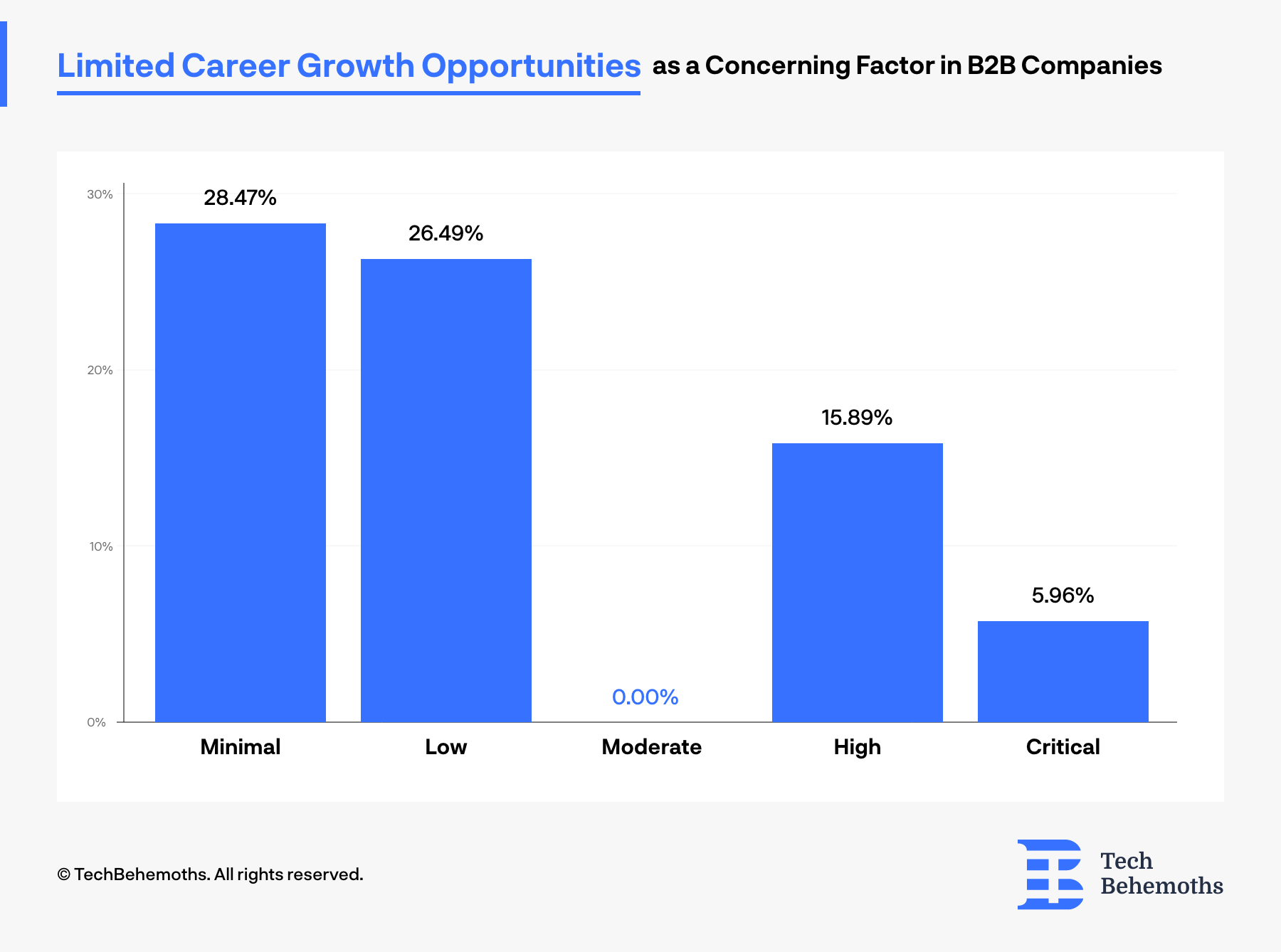

Limited Career Growth as a Factor of Concern in B2B Companies

The responses to the question about the concern of Limited Career Growth Opportunities in their companies revealed the following results:

: A significant portion of respondents, nearly 30%, indicated that they have minimal concerns about limited career growth opportunities within their organizations. This suggests that for these employees, they believe the company provides ample room for career advancement and development. It also implies that they may perceive a positive outlook for their professional growth within the organization.

Roughly a quarter of the respondents (26.49%) expressed a low level of concern regarding limited career growth opportunities. This group may acknowledge that there is room for improvement in career development practices but overall feel reasonably content with their current career trajectories within the company.

It's noteworthy that none of the respondents selected the "Moderate Concern" option, indicating that no one falls into this category. This suggests that employees either perceive their companies as offering clear career advancement paths or view the issue with more extreme perspectives (high or critical concern).

Around 16% of respondents view limited career growth opportunities as a high concern in their companies. This group may feel that the organization's career development paths are limited or competitive, which can potentially lead to frustration and dissatisfaction. HR should investigate the factors contributing to this perception and work on improving career development programs.

A smaller but still significant percentage, approximately 5%, consider limited career growth opportunities as a critical concern. This suggests that a subset of employees may be seriously dissatisfied with the lack of career advancement prospects in their companies, potentially leading to retention challenges and disengagement.

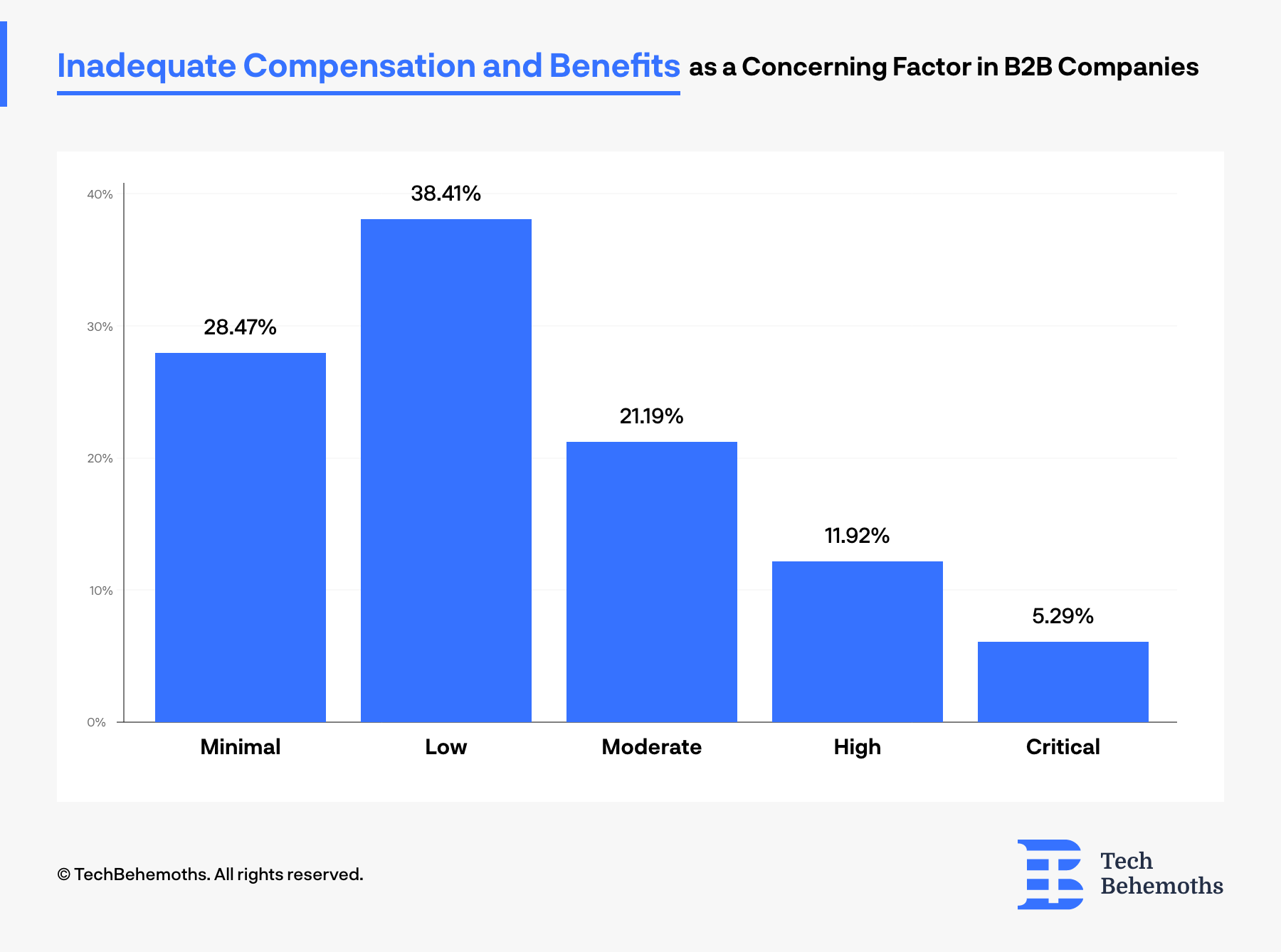

Low Compensation and Benefits as a Concerning Factor in B2B Companies

Low compensation is also considered a factor of concern in B2B companies, and could trigger sooner rather than later some employee reactions in companies. According to Harvard Business Review, 62% of workers mentioned that getting a raise or a promotion would motivate them to stay with the company they are currently employed at.

In the current survey, we measured on how the wage or compensation is seen as a concerning factor for employees in B2B companies, and the results showed that a noteworthy 28.47% of respondents indicated that they have minimal concerns regarding inadequate compensation and benefits. For these employees, their compensation packages appear to align with their expectations, thus reducing their concern in this particular area.

The largest group of respondents, comprising approximately 38.41%, expressed a low level of concern about inadequate compensation and benefits. This suggests that many employees feel generally content with their current compensation packages but may still see room for improvement. They likely view their compensation as competitive and fair but recognize areas where enhancements could be made.

Around 21.19% of respondents expressed a moderate level of concern, indicating that there are certain aspects of their compensation packages that warrant attention. They may perceive gaps between their expectations and the current compensation structure, leading to this moderate level of concern.

A smaller yet notable percentage, about 11.92%, views inadequate compensation and benefits as a high concern within their companies. This group likely believes that their compensation does not meet their expectations, potentially leading to dissatisfaction and affecting retention and motivation levels.

Lastly, approximately 5.29% of respondents consider inadequate compensation and benefits a critical concern. This subset of employees may be deeply dissatisfied with their compensation packages, raising concerns about morale, employee turnover, and overall organizational performance.

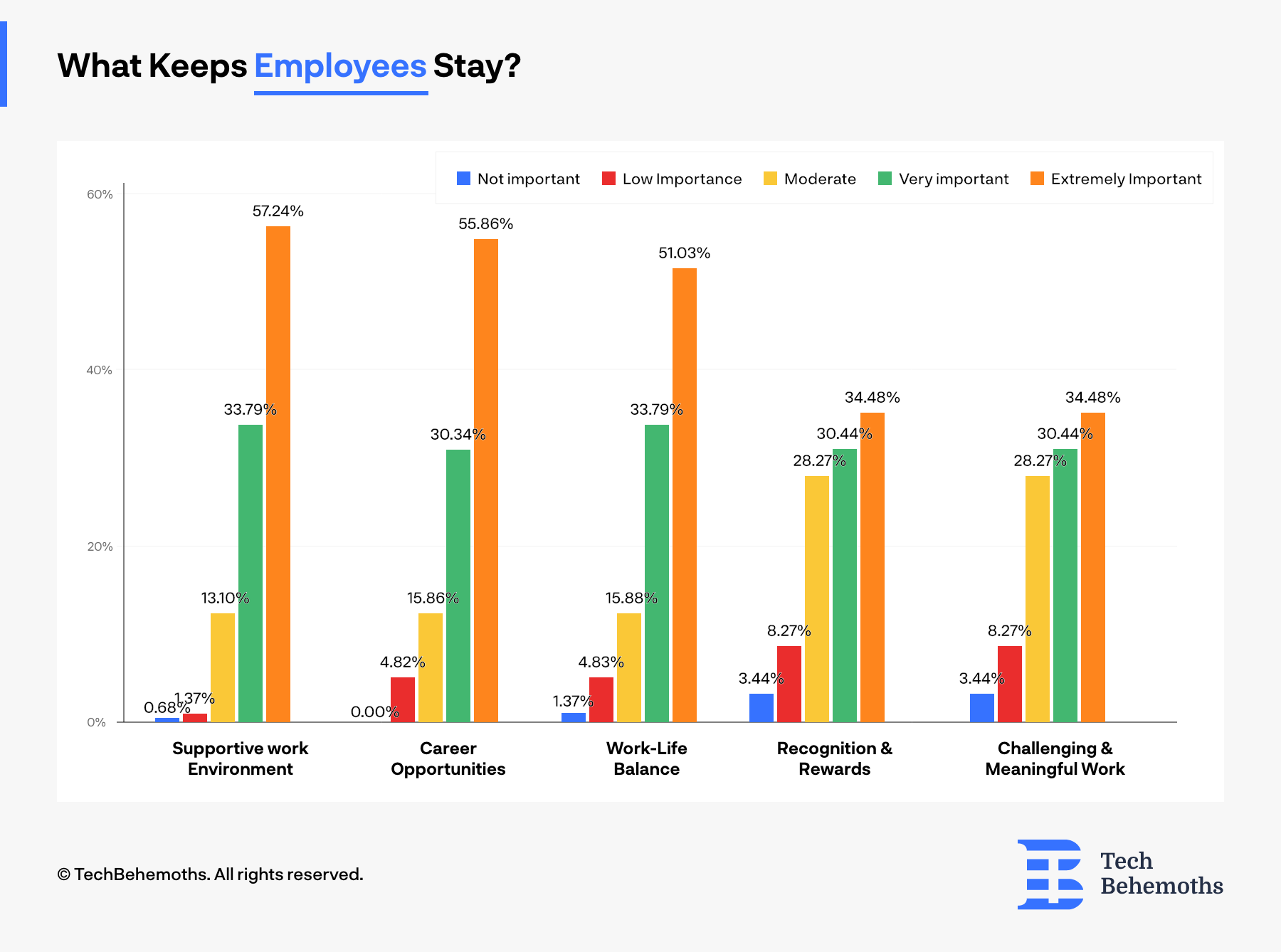

What Keeps Employees Stay At Their Current Company

Whether it’s the right work-life balance, supportive work environment, or promising career opportunities, people do stay at the company where they are currently employed for a reason. It’s not always about money or rewards. In a blog on Better Up, career growth was explained as one of the most important factors that employees choose to stay at their current job, and this factor was also confirmed in our survey.

In 2023 career opportunities and a supportive work environment are the most important factors that keep employees at their current jobs. The survey revealed that 57.24% of employees consider their work environment very important, and 55.86% of employees think that career opportunities are the most important thing that keeps them motivated to stay with their current company.

Surprisingly, only 34.48% of employees consider recognition and rewards as a “very important” factor to stay and 44.13% of respondents consider meaningful work as their main reason to stay.

At the same time, the survey results show that for 51% of respondents, Work-life balance is the most important thing that keeps them from leaving their companies.

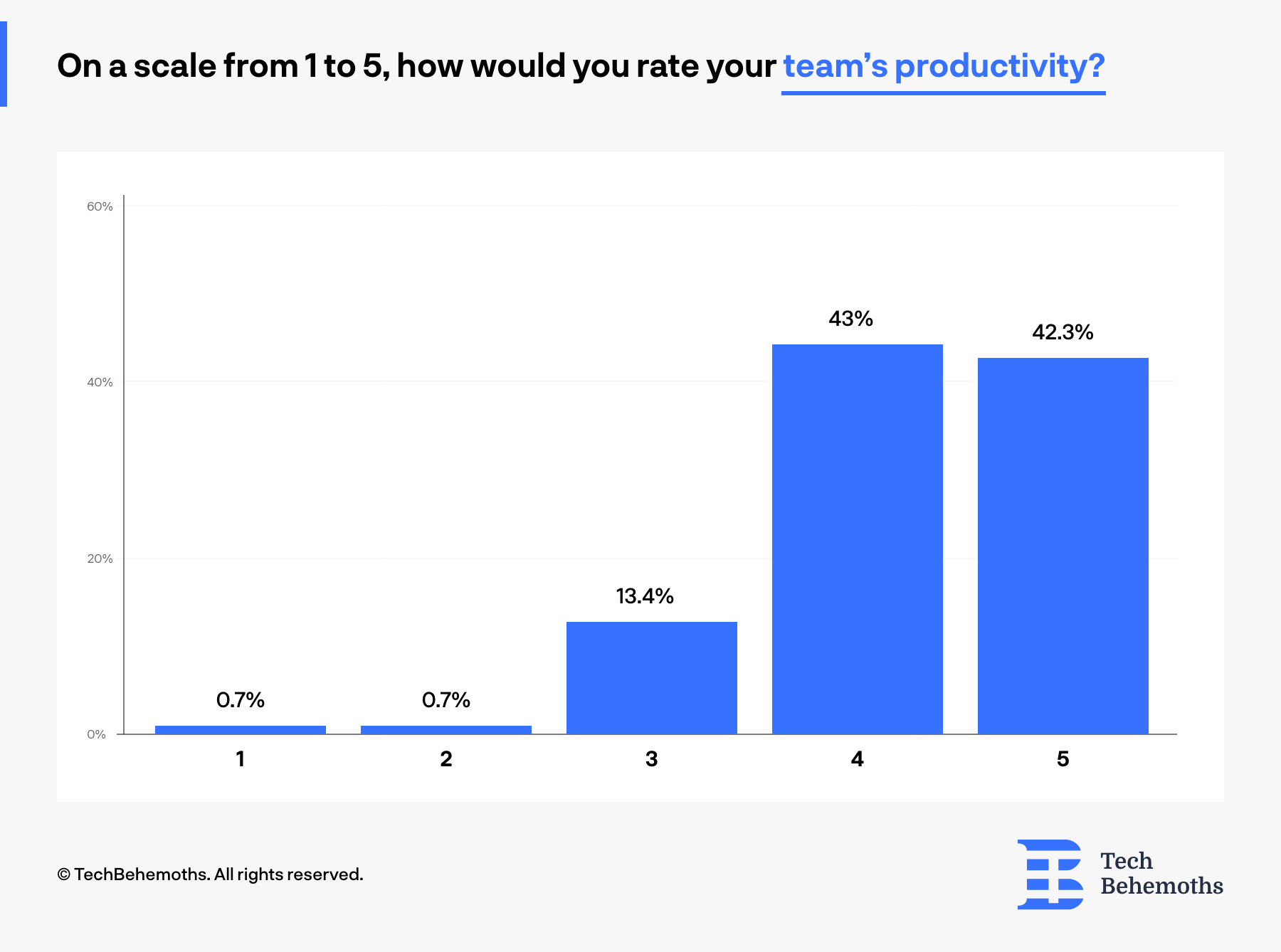

How Employees Rate Their Teams’ Productivity

Of course, employees consider themselves and their teams productive or very productive, which means that there’s almost no doubt that they lack self-appreciation. When asked to rate their teams’ productivity only 1.4% in total consider that they are not productive at all, or partially.

At the same time, 13.4% of employees consider themselves and their teams as average productive, and a total of 85.3% of employees rated their teams’ productivity as Great and Excellent.

The positive self-rating trend could be explained by the fact that a large portion of employees have a favorable perception of their teams' performance. This could be attributed to optimism, pride in their work, or a culture of positivity within the organization. Employees may feel motivated and believe in the quality of their output.

At the same time, those who rated themselves as average, have a more realistic perception of their work. They acknowledge that while their teams are performing adequately, there may still be areas where improvement is possible. This group may have a balanced view of their team's strengths and weaknesses.

The small percentage of employees who view their teams as "not productive at all" or "partially productive" may be signaling specific challenges or dissatisfaction. Possible reasons could include mismanagement, lack of resources, communication issues, or personal frustrations.

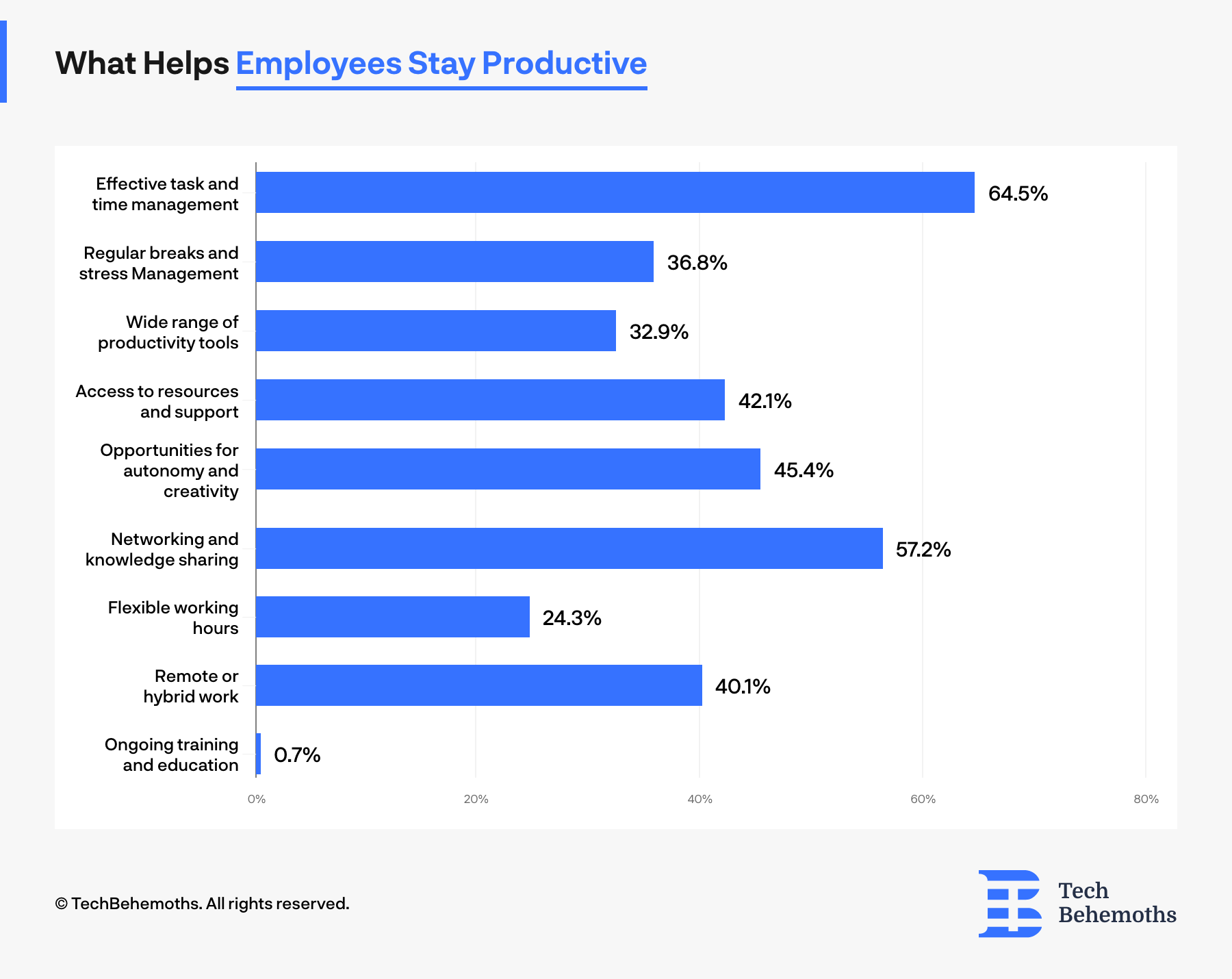

What Keeps Employees Productive?

In order to rate their productivity, employees should have some productivity practices, so if initially they were asked to rate their team’s productivity, the next question they were asked was to share what helps them be productive.

Back in 2021, the Ottawa University wrote a short explanatory list about what could increase employee productivity. We took that list beyond and expanded with some other practices that are common in B2B field, and here are the survey results:

The #1 factor that over 64% of employees consider that helps them stay productive is effective time and task management, followed by Networking and knowledge sharing practices with 57.2% of respondents voting in favor if it.

Flexible working hours and remote or hybrid work schedule are not so popular among professionals working in B2B environments and companies. Only 24.3% of respondents consider that flexible working hours help them stay productive, and 40.1% of professionals consider that remote or hybrid work could impact their work effectiveness.

At the same time, around ⅓ of B2B employees use productivity tools and find them useful. Of course, breaks and stress management are also considered by 36.8% of employees among the best practices to increase productivity.

Top Rated B2B Productivity Tools

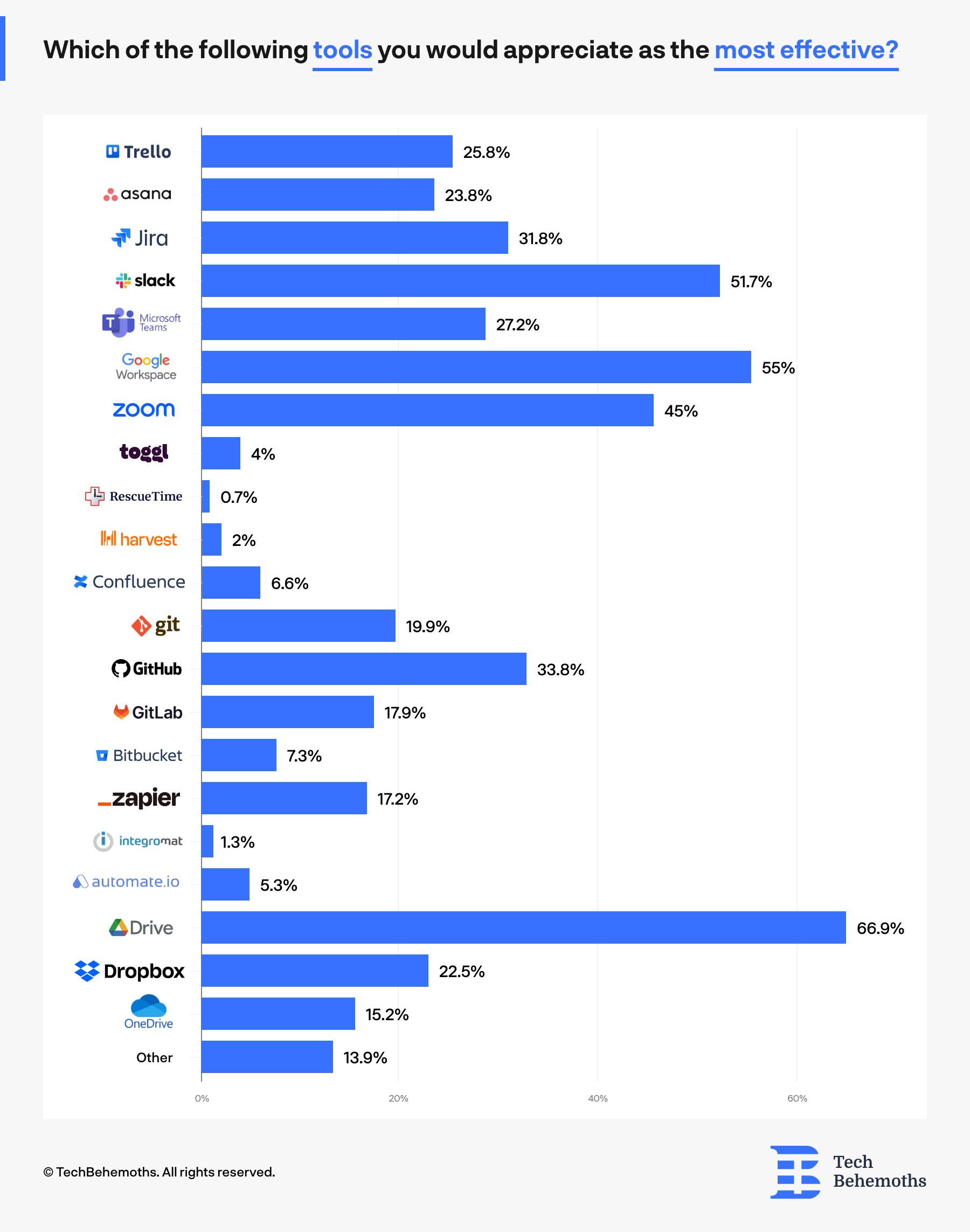

Earlier we touched a bit the topic of productivity tools and how they help employees actually stay productive or increase their productivity. According to the survey results, Google Drive, Google Workspace, and Slack are the top 3 productivity tools for employees in 2023. They were rated as top B2B productivity tools by 66.9%, 55%, and 51.7% of surveyed employees.

At the same time, RescueTime, Harvest, and Integromat got the lowest results and were voted as good productivity tools by less than 3% of surveyed employees. Of course, they got these results not necessarily because they are bad productivity tools, but rather because they are less-known tools.

Conclusion

Considering the current trends of productivity and job satisfaction shown by the survey results we can conclude that employees put more price on career growth rather than wages, which compared to 2013 - is totally the opposite. At the same time, employees in B2B companies are likely to seek for jobs that have a work-life balance which include shorter working hours or, a 4-day work week. In terms of productivity, it's clear that Google-developed tools are the most reliable and help employees save time or do more tasks. At the same time, communication tools such as Slack or Teams by Microsoft help employees keep an active and operational environment. We can't neglect here the important role that Jira,

Asana and Trello play in task and time management as these tools are top 3 most rated among survey respondents when it comes to assignments and projects.

Partner companies

The survey was not limited to any geographical region or country and its main target was the global community of IT companies and web agencies. As such, survey respondents totalize the number 1332 specialists from 157 companies, located in 43 countries across the globe. On this occasion, TechBehemoths is proudly announcing and crediting the list of partner companies that helped spread the word and gather answers for this survey.

-

Mobiteam, Germany

-

Ringostat, Ukraine

-

Communication Crafts, India

-

Filez, Argentina

-

Pace Social Media, USA

-

CerconeBrown, USA

-

Ikonerx, Nigeria

-

Aiosphere / Afocus, Singapore

-

Socialmeds Digital Limited, Kenya

-

Loopex Digital, Armenia

-

H&S Reliancegroup.com, Kenya

-

Wild Creek Web Studio, India

-

Ruby Search Solutions Pty Ltd T/A Ruby Digital, South Africa

-

Aqaba Digital, USA

-

SYZYGY 1 Media, USA

-

The Business Theory, USA

-

David Martin Design, USA

-

Five Dog Solutions, USA

-

PixoLabo, Japan

-

DigiSmiths, India

-

Alto Servicios Comunicación, Spain

-

Sydney Digital Marketing Agency, Australia

-

Valmax Digital, Ukraine

-

LiftConversions, USA

-

NERDZ LAB, Ukraine

-

Agencia Divulgar Meu Negocio, Brazil

-

The Digital Marketing People, Canada

-

SEO Rocket, USA

-

Editoteka, Mexico

-

Bacon Marketing, United Kingdom

-

XB Software, Poland

-

TeaCode.io, Poland

-

Betlace, Ukraine

-

Dikonia, India

-

Aleannlab, Ukraine

-

BeeWeb LLC, Armenia

-

Techgropse Pvt. Ltd., USA

-

Altoros, USA

-

A2 Design, Canada

-

Fively, Poland

-

OptiSol Business Solutions, India

-

IT Brick, Russia

-

Altimi Sp. z o.o. S.K, Poland

-

App Gurus, Australia

-

Glowbal Digital, Kenya

-

Tecalis, Spain

-

Business Config, Portugal

-

HUSPI, Poland

-

Exquisite Software, USA

-

Jash Entertainment, India

-

Watermark Design, USA

-

Art+Logic, USA

-

Nick France Design, USA

-

Kollective, Greece

-

Nokto Studios SRL, Romania

-

Fanan Limited, Kenya

-

Saint Rollox Digital, Australia

-

Mars Consultation, Egypt

-

Ezeeanything, Nigeria

-

Tech Business News - Australia, Australia

-

The Generalissimo Media, Nigeria

-

NNPARTNERS, Poland

-

Point Jupiter, Croatia

-

g&co design studio, poland

-

Leoceros, Lebanon

-

5w155 SA, Switzerland

-

Maniflex Ltd, Uganda

-

Bac Ha Software Co., Ltd., Vietnam

-

Frontspace, The Netherlands

-

Hamdan IT Solutions, Pakistan

-

Cosmico Studios, USA

-

Elites, Lebanon

-

Hydralab, Armenia

-

Kemetova Digital, Egypt

-

Wireless Computer Services, Nigeria

-

Jeff Social Marketing, Canada

-

JohnCube, Poland

-

Techdroid Inc., Canada

-

Solveita, Malta

-

Solid Metrics: Crypto Marketing Agency, Singapore

-

Brandzee, United Arab Emirates

-

Primal Ape Consulting, Lebanon

-

Digital Dividend, Sweden

- Bespoke Web Dev, Australia

- Adzglobe, India

- PanX Project, Egypt

- Altlier, United Kingdom

- Appwapp, Canada

- Leeway IM, Lebanon

- Digital rise solutions ltd, Tunisia

- TOG Africa, Nigeria

- The Natives, Melbourne

- VeecoTech Solutions, Malaysia

- Manao Software, Thailand

- The Art of Business, Canada

- Primal Ape Consulting, Lebanon

- SilverPeople, India

- VebItSolutions,, UAE

- Digital Marketing Agency, India

- Naturality Digital, China

- Breadnbeyond, Indonesia

- Zendev AB, Sweden

- Default Value, Ukraine

- Benarda ICT Solutions & Software Design, Ethiopia

- Siddhatech Software Solutions Pvt Ltd, India

- Silk Data, Poland

- Catalyic Security Pvt Ltd, USA

- Appomart, Serbia

- Loovatech, Estonia

- WePixel, Romania

- SunHouse Marketing, Israel

- Silicon Valley Infomedia Pvt. Ltd., India

- Quema, Tallin

- CodeRiders, Armenia

- NIX, USA

- Mythology Labs SRL, Uruguay

- Agencia SEO & Marketing Digital René Rodríguez, Spain

- Chumachenko Consulting, Ukraine

- Vertical Motion, Canada

- Mamudi, North Macedonia

- Authorselvi

- Instinctools, Germany

- ScanFlow Pvt Ltd, India

- OmniStreak, Serbia

- Redbee Software, Romania

- Rocket Systems, Armenia

- FatCat Coders, Serbia

- SECLINQ, Netherlands

- We Are The Robots Inc, Mexico

- NERDZ LAB, Ukraine

- zeropoint7 Studio, USA

- Barvy Digital Eye, Moldova

- Eagle Alliance Technology Pvt. Ltd, Pakistan

- Red Search, Australia

- Zurafin technologies international, Nigeria

- Niche Marketing Management, United Arab Emirates

- Silk Data, Poland

- Aimprosoft, Ukraine

- Rhodium Digital, Canada

- SEO Enforcer, New Zealand

- Beach Chair Marketing, Canada

- FinThink Inc., USA

- CCS Interactive, USA

- Mifort, UK

- Founder, Bangladesh

- ShotCoder Tech, Nepal