How did Poland become an Emerging Tech Hub in Europe?

Poland is one of the largest tech hubs in Europe, and that’s a fact. In 2022, the number of ICT sector enterprises increased by 7.2% compared to the previous year, and the number of people employed in the ICT sector in Poland increased from 500,000 in 2021 to 555,000 in 2022.

But the Polish tech growth didn’t start in 2022 and its size is not a recent occurrence. According to Wikipedia, the history of Polish computing (informatics) began during the Second World War with breaking the Enigma machine code by Polish mathematicians. After World War II, work on Polish computers began. Poles made a significant contribution to both the theory and technique of world computing.

Of course, from a computing machine to a tech hub the path seems long, but we can’t deny its significance in the Polish tech scene. Following the World War II, Poland was one of the largest beneficiaries of the reconstruction plan that helped the country to retain skilled workforce, and rebuild its infrastructure from scratch. The connection between the reconstruction plan, and nowadays Polish tech capacities is simple - consistent investments in education, technology, and business sector.

Moving forward to 2004, when Poland joined the EU, the country and business community consequently, benefited from more funds, that helped the country reach 2018 achievements such as the launch of the first Polish satellite - PW-Sat, and employ over 430,000 people in the IT sector according to Emerging Europe.

The access to EU funds, the capabilities to retain and invest in the workforce, combined with Poland’s geographical location, helped the country become one of the largest tech hubs in Europe. Now, the country serves as a bridge between Eastern Europe and Western Europe including in the tech field.

This also attracted the attention of tech behemoths, and as of 2022, Google, Samsung, Facebook, Amazon, and Intel have established offices in Polish cities, while Microsoft also announced plans to invest one billion euros into a data center outside Warsaw, including access to local cloud services.

Polish talent pool is also one of the most appreciated in the world. According to HackerRank, Poland was appreciated as having the #3 world’s best developers, falling behind only to Russia and China. But, this also impacts Poland’s capability to deliver its tech services outside the country. The most recent report from the Polish Statistical Bureau mentioned that Poland exports IT services and products in Western Europe and the US, becoming the largest ICT exporter in Central and Eastern European Region.

Poland Tech Expansion

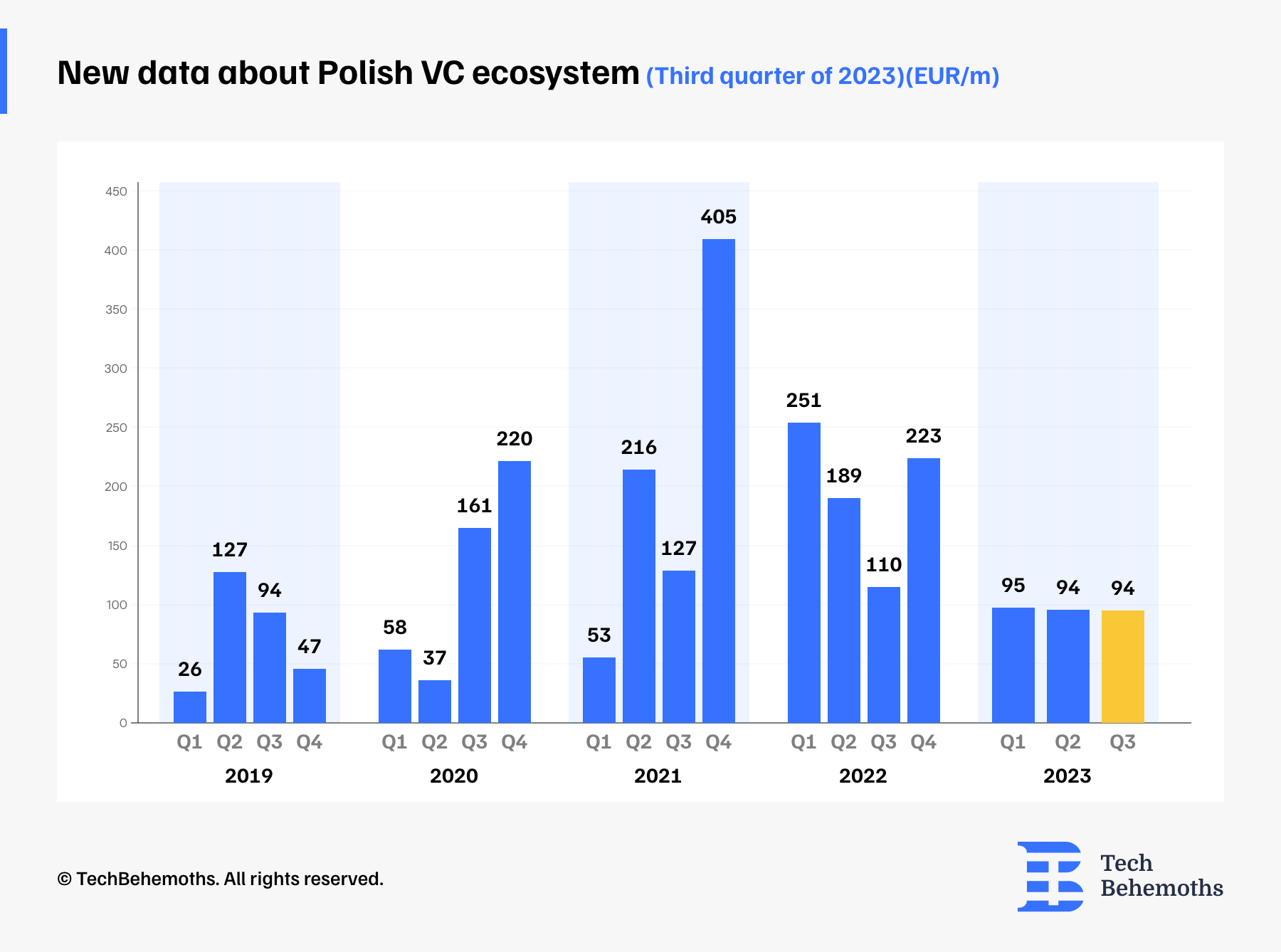

Starting in 2018 the Polish tech scene has become more visible on the international market, and also attracted more investments. In 2018, venture capital funds invested €178M in Polish startups (0.033% of GDP). According to Startup Poland, as of March 2019, total assets managed by VC companies operating in Poland are estimated at €2.6B. The total value of investments in the Polish VC market is worth €209.2M. However, the first international VC funds in Poland appeared back in the ’90 that aimed to develop the Polish private sector. Some examples include the Polish-American Entrepreneurship fund with a capital of $240M, or Invesco, which was a private fund.

Since 2017, the National Centre for Research and Development, has signed contracts under the subsidy and investment instrument Bridge Alfa with 33 firms that conduct venture transactions, and in 2018 another state agency, the Polish Development Fund signed additional 26.

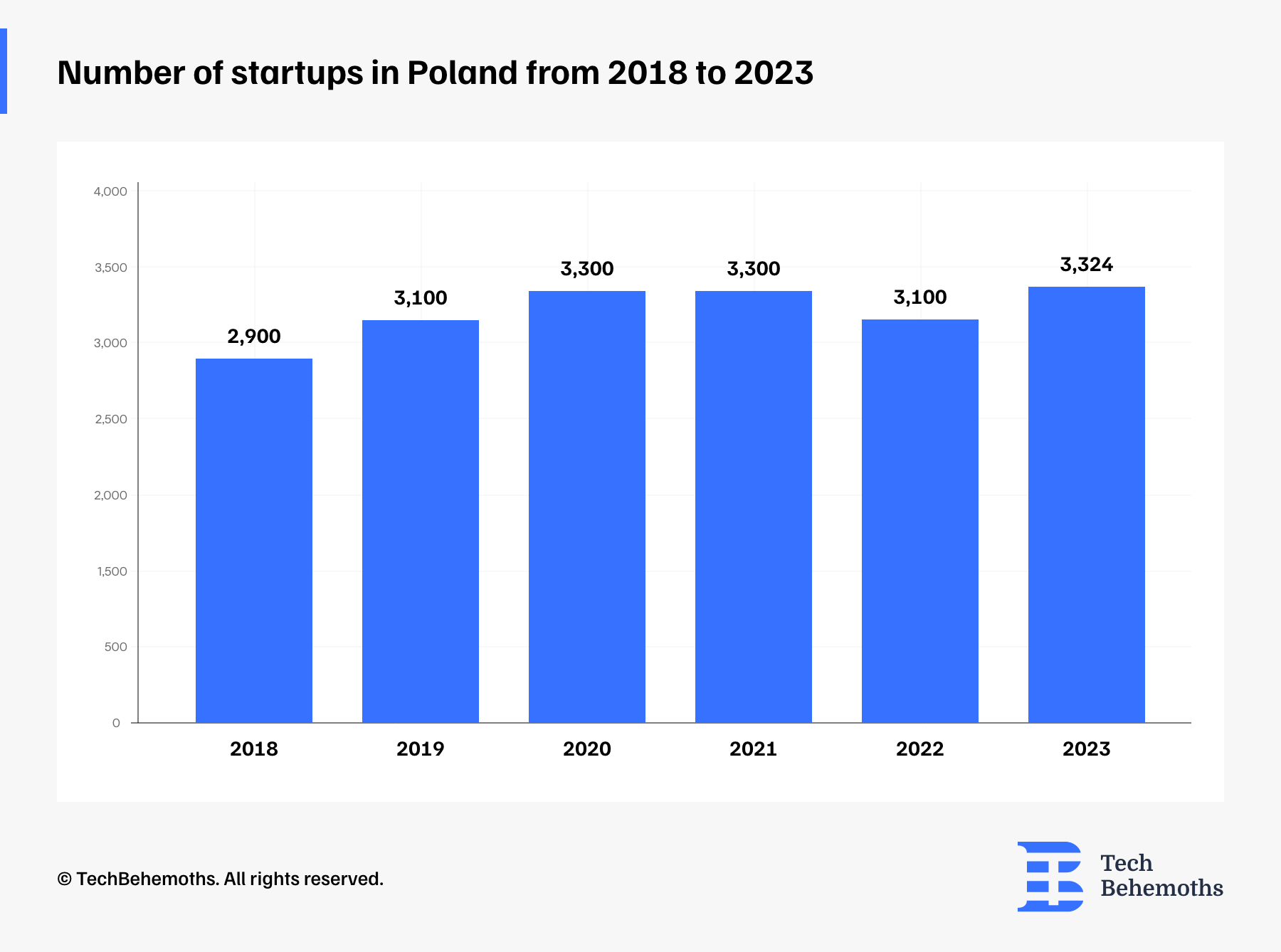

Also, between 2018-2023, a total number of 12,024 startups have emerged in Poland, the highest peak being registered in 2023, with 3324 startups registered. This could have been facilitated by several factors such as Russia’s war in Ukraine, where Ukrainian companies choose to start over or relocate their business in Poland. However, Poland’s Recovery and Resilience Plan that granted access to EU funds worth €59.8B could have played a more significant role in boosting the number of startups, surpassing the 2020-2021 peak of 3300 yearly startups.

Nonetheless, as of Q3 2023, Poland managed to attract only €94M as a quarterly result, which is almost equal to previous quarters of 2023 showing a stable line in these terms. The largest quarterly amount of money Poland managed to attract from VC’s was in Q4 2021 - €405M.

Return on sales in the Polish Tech sector

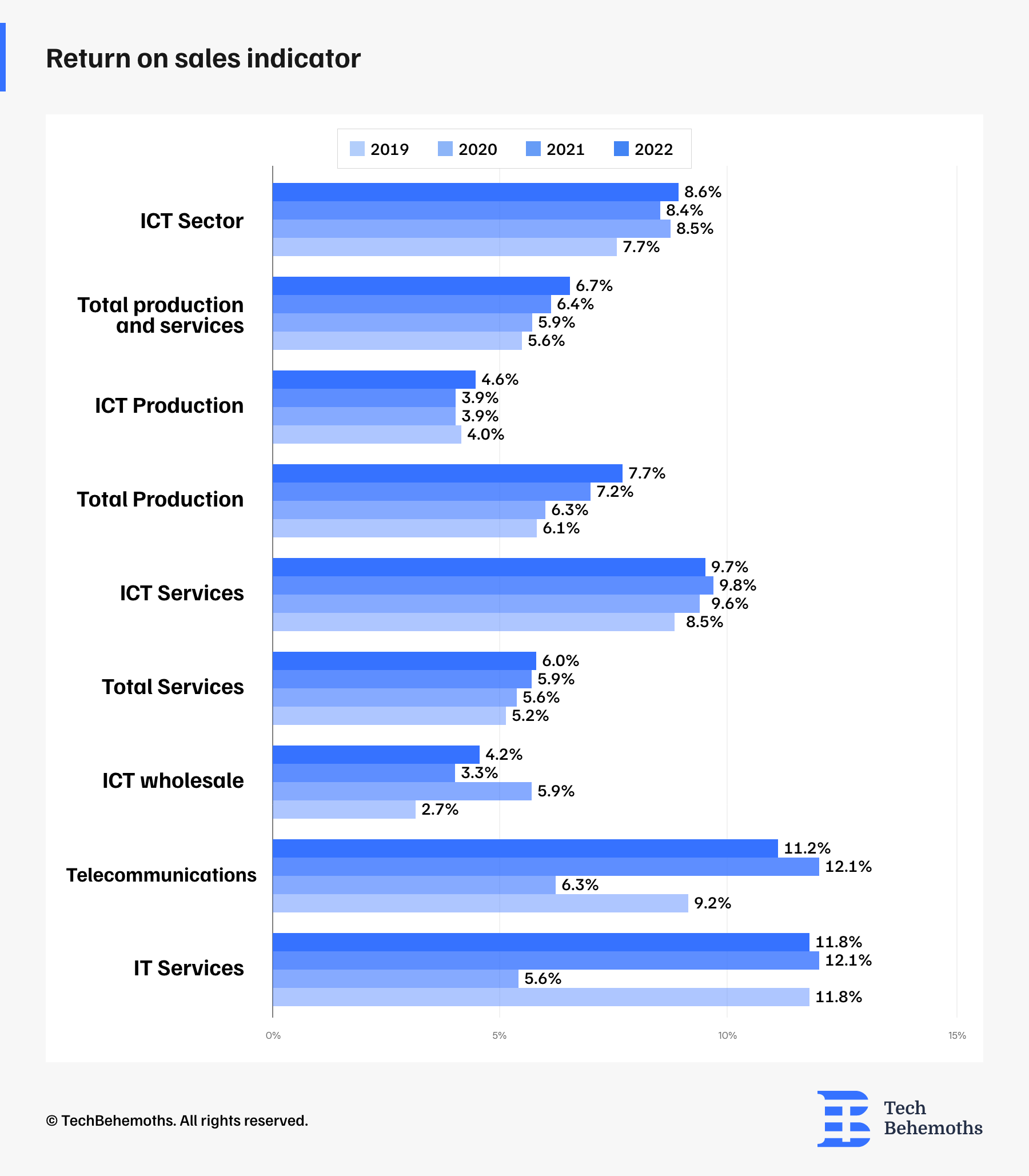

In 2022, the profitability indicator of ICT sector enterprises increased by 0.2 percentage points year-on-year to 8.6%. The profitability of the ICT sector was almost 2.0 percentage points higher than the profitability measured for all industrial and service companies. Compared to 2021, the profitability indicator increased both in the entire production sector and among companies producing ICT products (by 0.5 percentage points and 0.7 percentage points, respectively). Among companies providing ICT services, the indicator decreased by 0.1 percentage points, but it was still higher than for all service companies in Poland (by 3.7 percentage points). The highest value of the indicator among ICT sector enterprises was recorded by companies providing IT services and telecommunications services (11.8% and 11.2%, respectively).

Product and business process innovations in the Polish ICT sector

Product Innovation is defined as the introduction of a new or improved product or service to the market. This includes significant advancements in technical specifications, components and materials, embedded software, ease of use, and other functional features.

Business Process Innovation, on the other hand, refers to the implementation of new or improved processes within a company, across one or more business functions, that significantly change the way things are done.

Between 2020 and 2022, nearly every third enterprise in Poland (32.2%) introduced product innovations or business process innovations. Among entities classified as part of the ICT sector, it was almost every second enterprise. Both in the production of ICT products and in ICT services, business process innovations were more often introduced.

According to GUS, in 2022, in ICT sector enterprises, revenues from sales of new or improved products accounted for 14.3% of total sales revenues, i.e. 2.7 percentage points less than a year earlier. This indicator for all enterprises was 5.0%, i.e. 1.2 percentage points less than a year earlier.

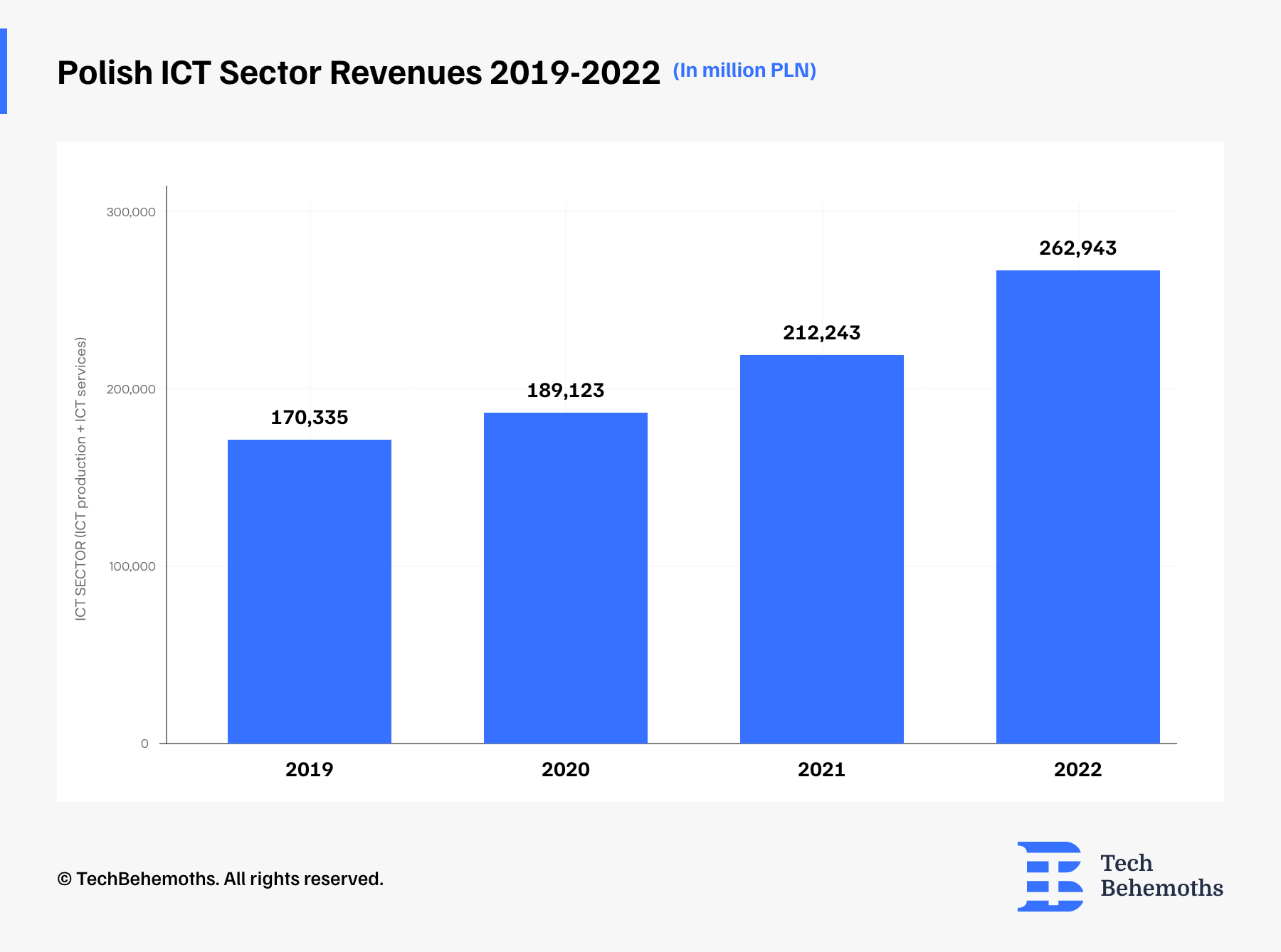

Polish ICT Industry: Revenues

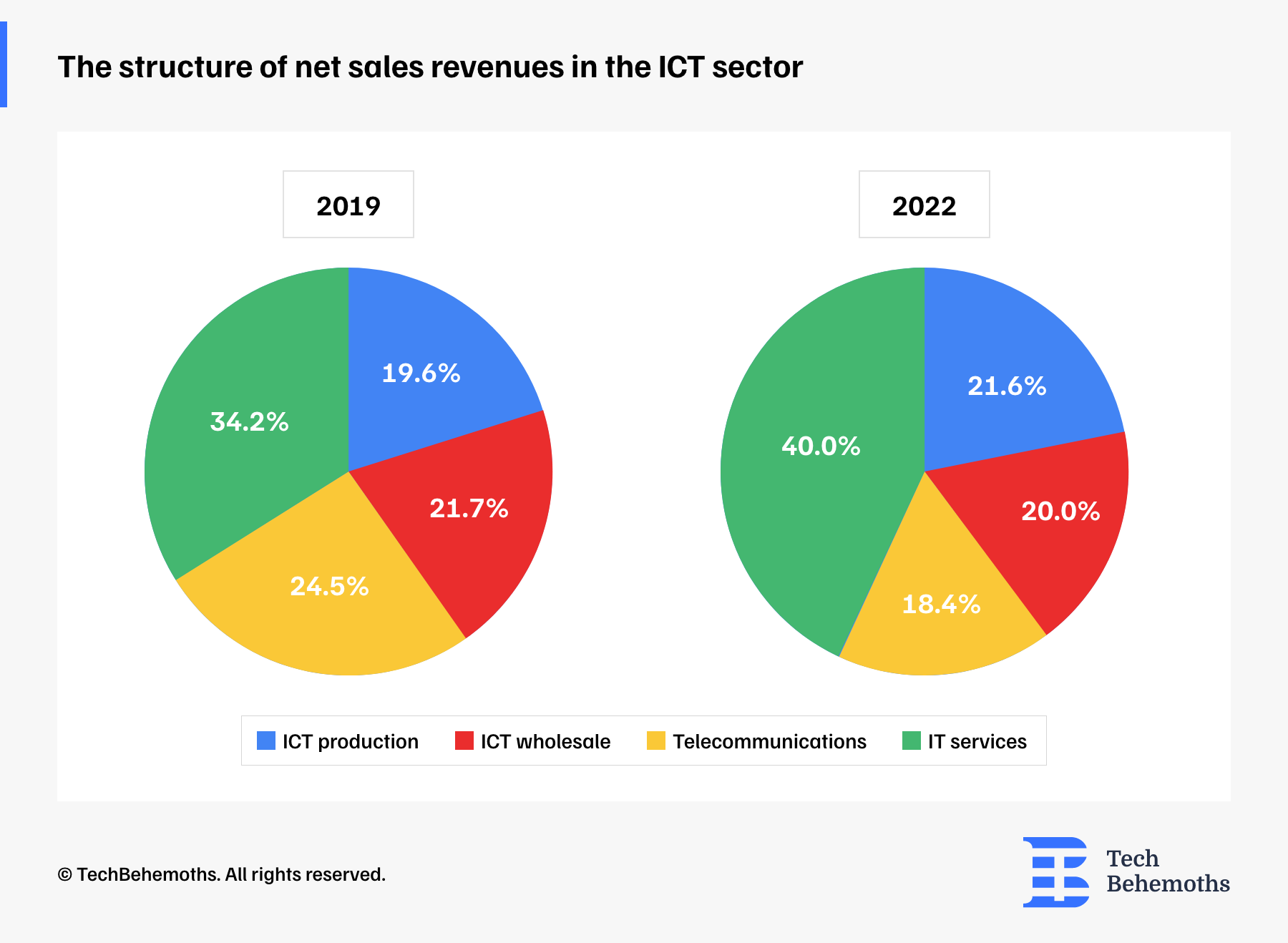

In 2022, net sales revenue of ICT sector enterprises amounted to PLN 262.9 billion and increased by 23.9% compared to the previous year. In manufacturing enterprises, there was an increase of 13.5%, while in service enterprises - 27.0%. In 2022, sales revenue of ICT service providers accounted for 78.8% of ICT sector revenue. Over one third was generated by IT services companies (40.1%).

In 2022, the revenue of ICT sector enterprises accounted for 5.2% of the revenue generated by manufacturing and service companies in Poland, i.e. by 0.1 percentage points less than a year earlier. The revenue of entities providing ICT services accounted for 7.1% of the revenue of all service entities in Poland, i.e. by 0.2 percentage points more than a year earlier. The revenue of companies producing ICT products accounted for 2.6% of the revenue of entities engaged in manufacturing in Poland, i.e. by 0.4 percentage points less than a year earlier.

In 2022, IT services companies generated over one third of the revenue in the ICT sector (40.0%, i.e. 3.1 percentage points more than a year earlier). In second place were companies producing ICT products with a result of 21.6% (1.5 percentage points less than a year earlier).

In 2022, net sales revenue from exports generated by entities classified as part of the ICT sector amounted to PLN 93.7 billion and increased by 23.5% year-on-year. In manufacturing companies, there was an increase of 11.7%, and in service companies - 31.6%. Export revenues generated by service companies accounted for almost two-thirds of the revenues of the entire ICT sector (63.2%). The revenues of the ICT sector constituted 7.2% of the value of the entire export - by 0.3 percentage points less than a year earlier.

Poland’s Unicorn Stage

The rule mentions that to become an unicorn, the company must meet $1B valuation. And Poland has so far 5 confirmed unicorns.

Allegro

The largest Polish e-commerce company, Allegro has an estimated market capitalization as of March 2024 of $8.28B and an enterprise value of $9.79B according to Yahoo Finance.

Starting October 30 since the company was publicly traded and by March 2024, Allegro had a 64.26% growth in stock value, with an all time high of $50.84/share on July 28, 2023, and an all time low of $18.30/share on October 30, 2020.

InPost Group

InPost Group is the second-largest Polish Unicorn as of 2024, with a market capitalization of EUR 7.24B as of March 2024 according to Google Finance. InPost is a Polish public logistics limited company with courier, package delivery and express mail service. It is based in Kraków, Poland, and it is owned by Integer.pl corporate group. The company specializes in parcel locker service operated in Poland, Italy, United Kingdom,France, Benelux, Spain, and Portugal.

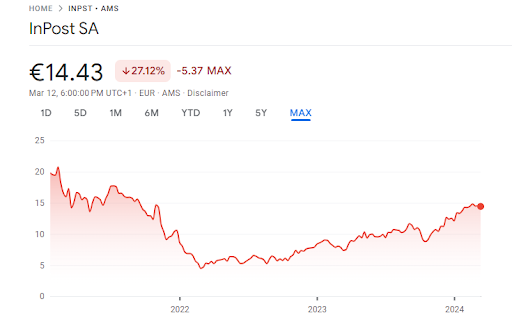

Compared to an all-time-high, InPost Group stocks value 27.12% less - EUR14.43 as of Mar 12, 2024. InPost SA went public in January 2021 on the Amsterdam Stock Exchange after its shareholders raised 2.8 billion euros as an online shopping boom, largely caused by pandemic lockdowns, increased demand for its automated parcel lockers

CD Project Red

The Witcher 3 or Cyberpunk 2077 definitely sound familiar to you even if you are not a gamer. Well, find out that Poland’s largest studio of video games and consoles is the country’s top 3 unicorn.

The company’s market cap is valuated at $2.98B as of March 2024, and has a whopping 1671% growth in cost per share all time, now estimated at over $29. The company was founded in May 1994 by Marcin Iwiński and Michał Kiciński. Iwiński and Kiciński were video game retailers before they founded the company, which initially acted as a distributor of foreign video games for the domestic market. In March 2018, the company joined WIG20, an index of the 20 largest companies on the Warsaw Stock Exchange.

The rest of 2 other Polish unicorns are Parcuj Group and Techland with valuations close to $1B.