How Netflix Makes Money and How Much

Netflix is the largest streaming service in the world with more than 233 million users that watch 4000+ movies and 1800+ TV shows of all genres. Present in 190 countries and territories, the streaming giant managed to earn billions of dollars in revenue ever since it was launched due to its two main segments:

-

DVD rental services

-

Streaming services

Netflix hasn’t always been a streaming service, and its main activity was DVD rental services in the US. Of course, back in 1997 when Netflix was launched there were no streaming services at all, and DVD rentals were the big trend. It took the company 10 years to start streaming movies, and another 10 years until it reached the top of the market.

Now that we explored Netflix's history, and general data, let’s take a closer look at how Netflix makes money, and how its revenues evolved in the past 3 years

How Does Netflix Make Money?

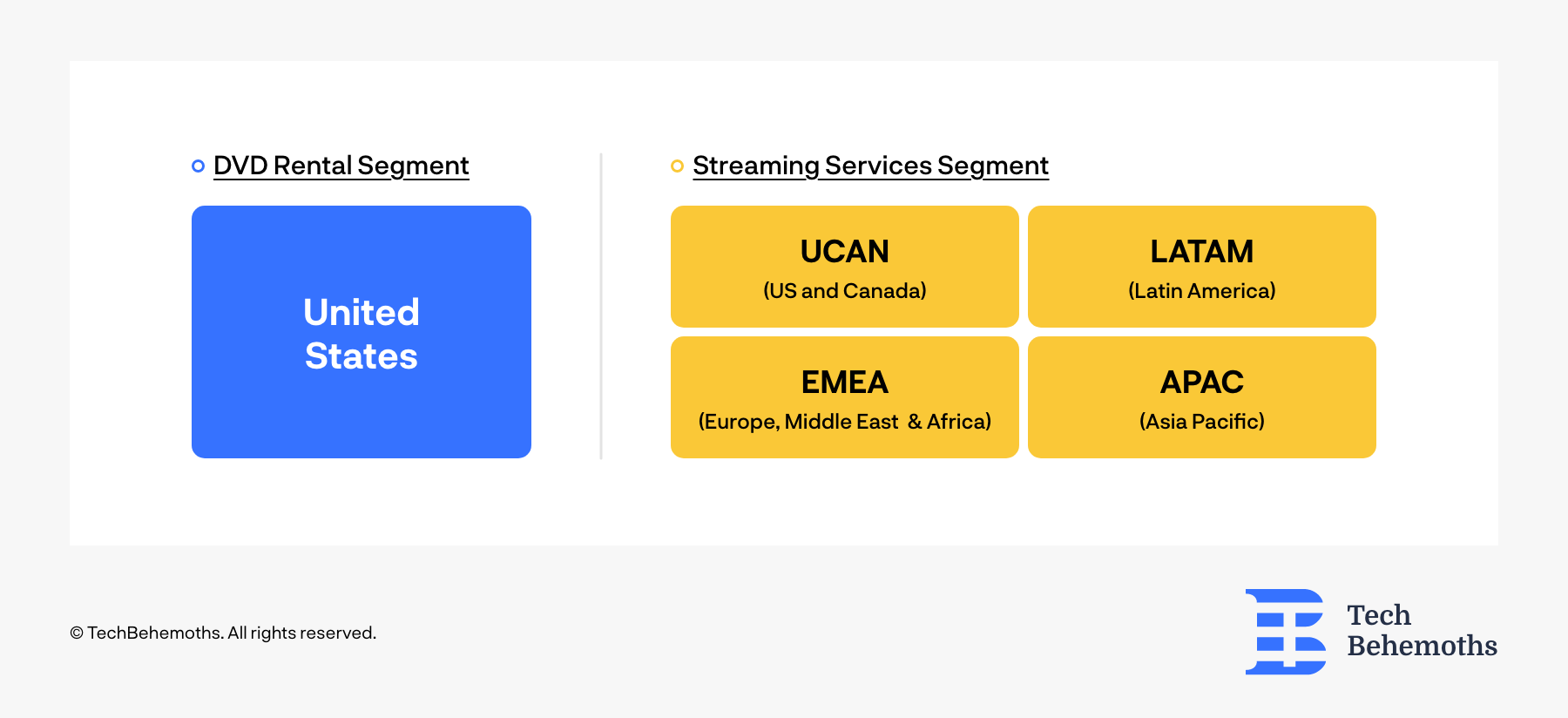

As we mentioned in the introduction, Netflix has two revenue streams - DVD rental services and Streaming services. While Netflix DVD rental services are available only in the US and they assume DVD rentals with included delivery, the other segment - streaming services is the main revenue source for Netflix in 2022.

In its turn, the streaming service segment is divided into 4 geographical locations. These are as follows:

-

UCAN - United States and Canada

-

EMEA - Europe, Middle East, and Africa

-

LATAM - Latin America

-

APAC - Asia Pacific

How Netflix Makes Money from DVD rentals

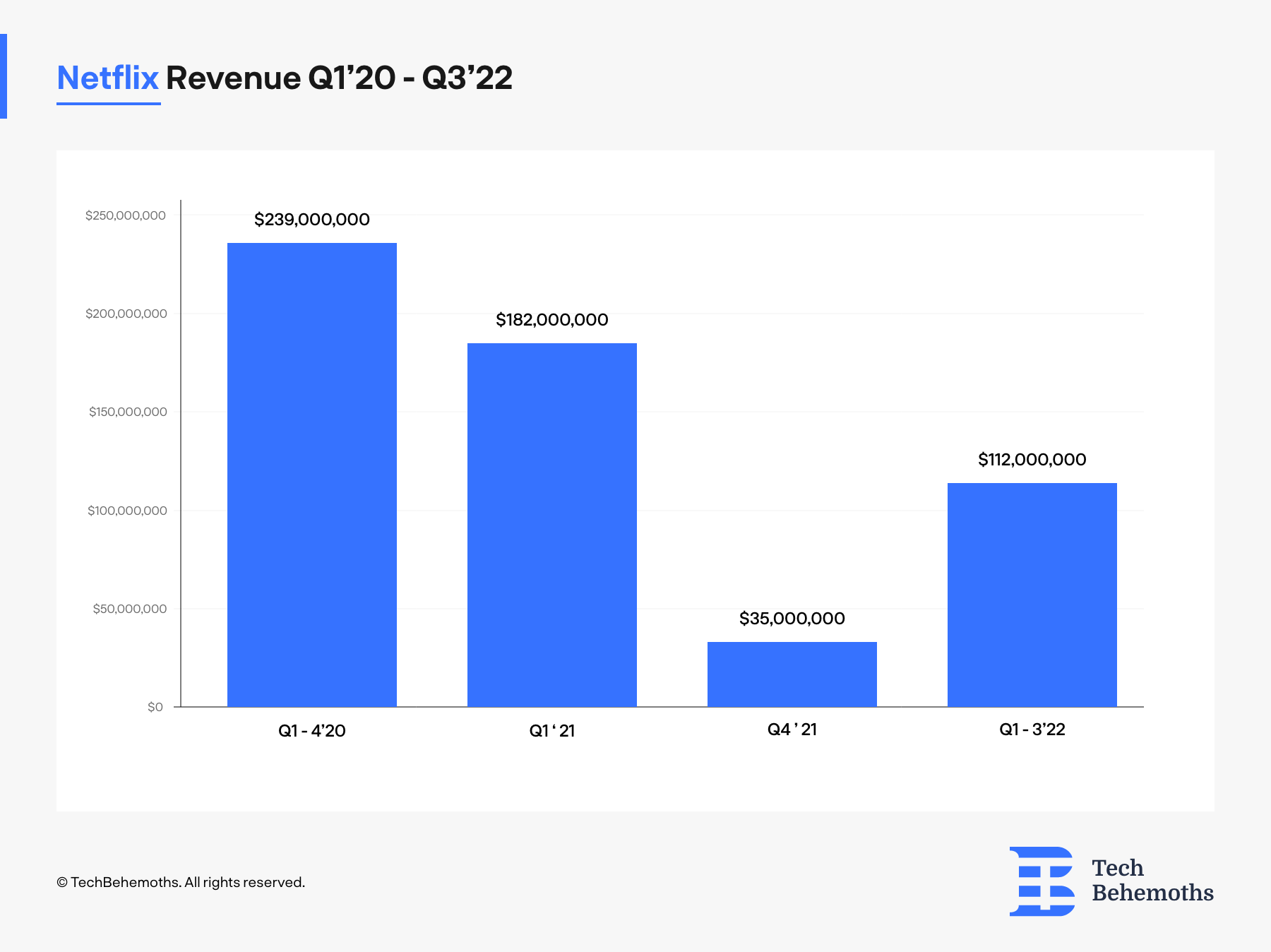

The DVD rental service in the US has the smallest share in terms of revenue, but also by the number of subscribers. Between January 2020 - September 2022, the segment had strong fluctuations in terms of revenue - $568M in revenue in total declared Netflix. This is significantly low compared to any sub categories from the streaming service segment.

If we break down the revenue quarterly, we can notice that in US, Q1- Q4 2020 was the best period for DVD rentals with $239M in revenue. In Q1 2021, Netflix earned $182M from DVD rentals, and in Q4 2021 ended up with $35M in revenue. Also, between Q1-Q3’22 Netflix earned from DVD rentals $112M

However, Netflix plans to slowly take down the DVD rental service. According to Business Insider, by 2018 Netflix had only 17 rental centers out of 50 - the maximum in its peak period. Also, Netflix DVD rentals counted back in 2010-2011 around 20M rentals/week, but now, it doesn’t even state the number of DVD service subscribers in their reports. Based on some estimations from Paste Magazine, the number could be close to under 2M subscribers.

How Netflix Makes Money from Streaming Services

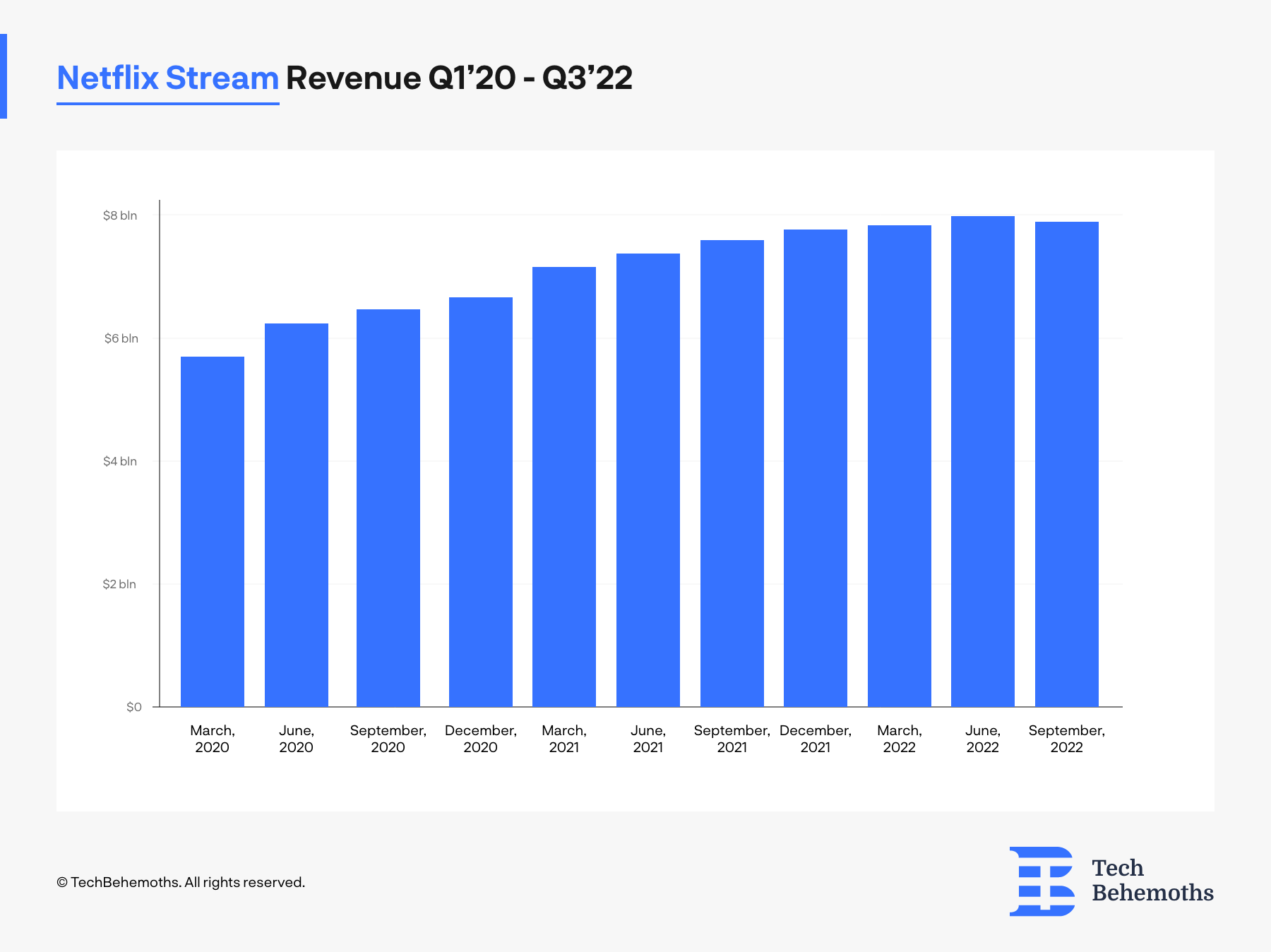

The main revenue source for Netflix is the Streaming Service. The Streaming Service Segment is geographically divided into 4 subcategories to control and report easier the performance and market demand for Netflix products. In Netflix’s latest financial report, some regions outperformed others in terms of revenue, subscribers, and spending as well. Overall, Netflix declared revenue for Q3’22 equal to $7.92B which marks the first drop in its quarterly revenue report since Q1 2020. Compared to Q1’22 when Netflix declared $7.97B revenue from all streaming segments, the revenue in Q3’22 dropped by $50M.

It is still yet to find out how Netflix will close in 2022, as the streaming service lost almost 1 million subscribers in 2022. But until then, let’s go through each segment Netflix has, and find out how much revenue each segment provides

How Much Money Does Netflix Earn in the US and Canada

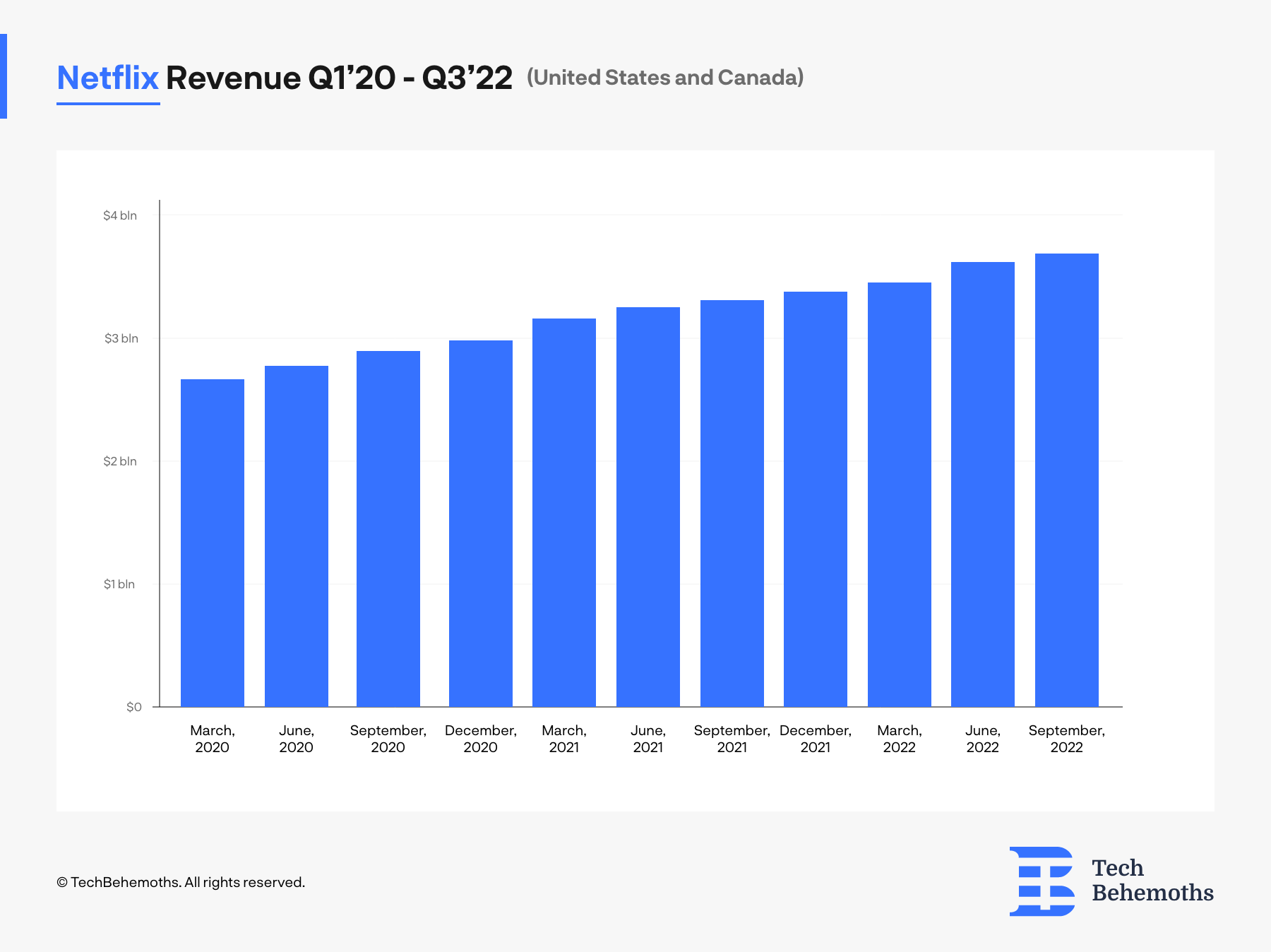

The UCAN segment is the most profitable for the streaming service giant. Since Q1’20 until Q3’22 Netflix had a constant revenue growth rate that was not hit by the high unsubscribe rate. As you can see in the table below, in Q3’22 Netflix declared $3.60Billion in revenue, $64M more compared to Q1’22.

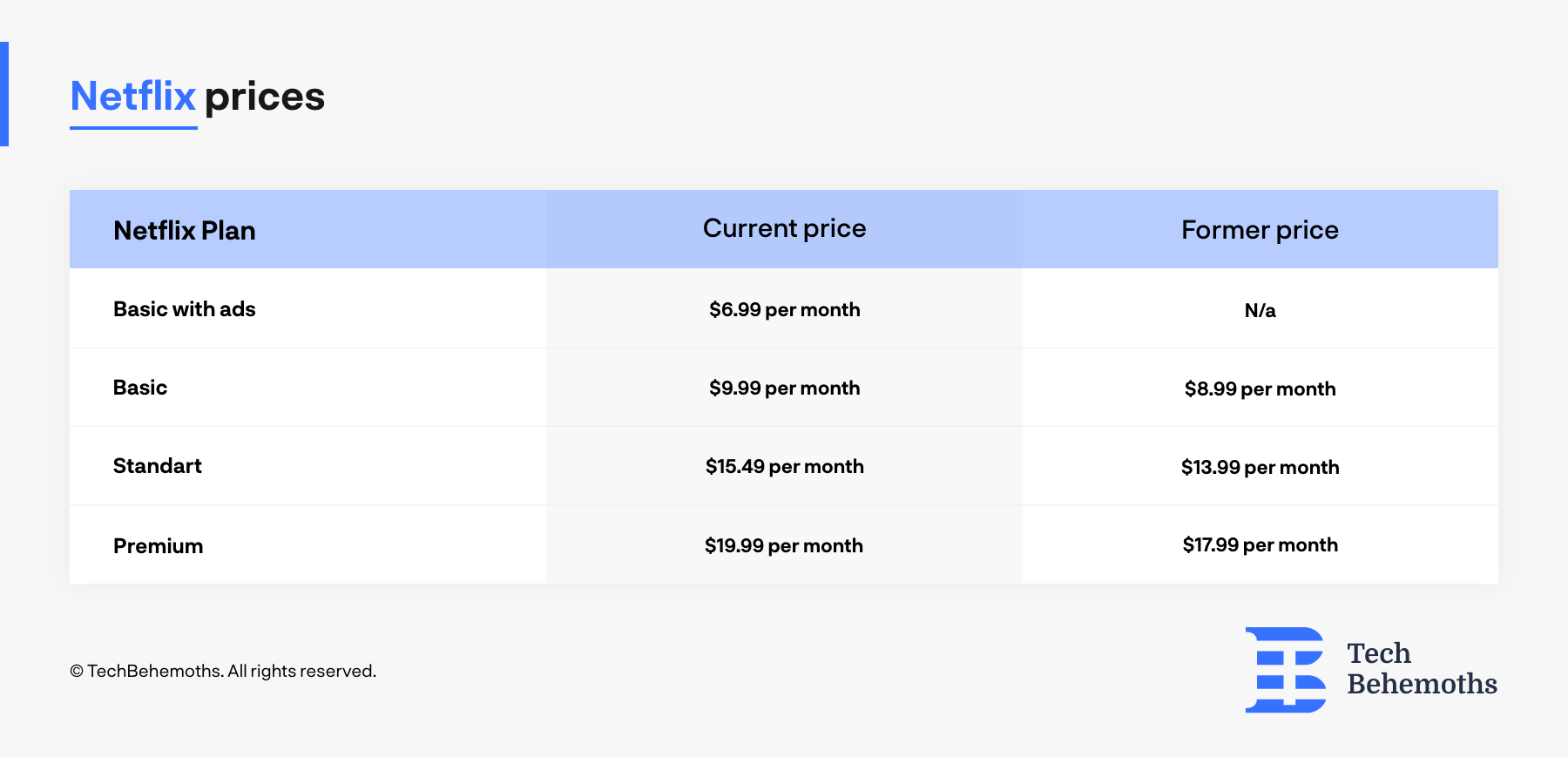

Even though Netflix lost customers in all its business segments and geographical areas, the revenue growth in the UCAN segment was due to higher prices for their subscriptions. According to Tom’s Guide, Netflix subscription prices started to grow for all categories in the UCAN segment on October 13, 2022.

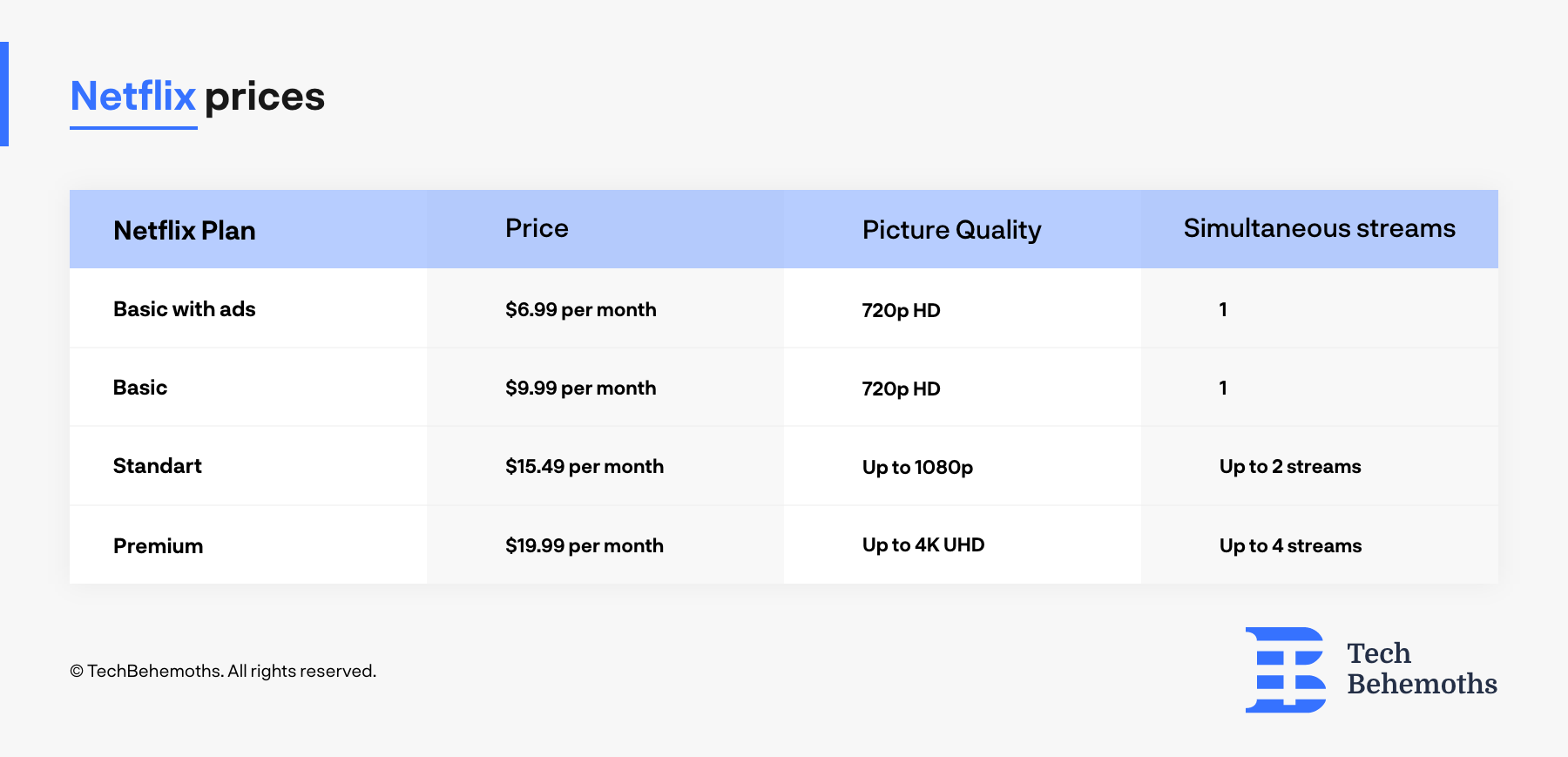

The prices also changed on the quality + # of devices tier with $3-6 increases for each of these plans. The most popular plan is the Standard tier which is $15,49/mo in exchange for 1080p, adless streams on two devices simultaneously.

How Much Money Does Netflix Make in Europe, the Middle East, and Africa?

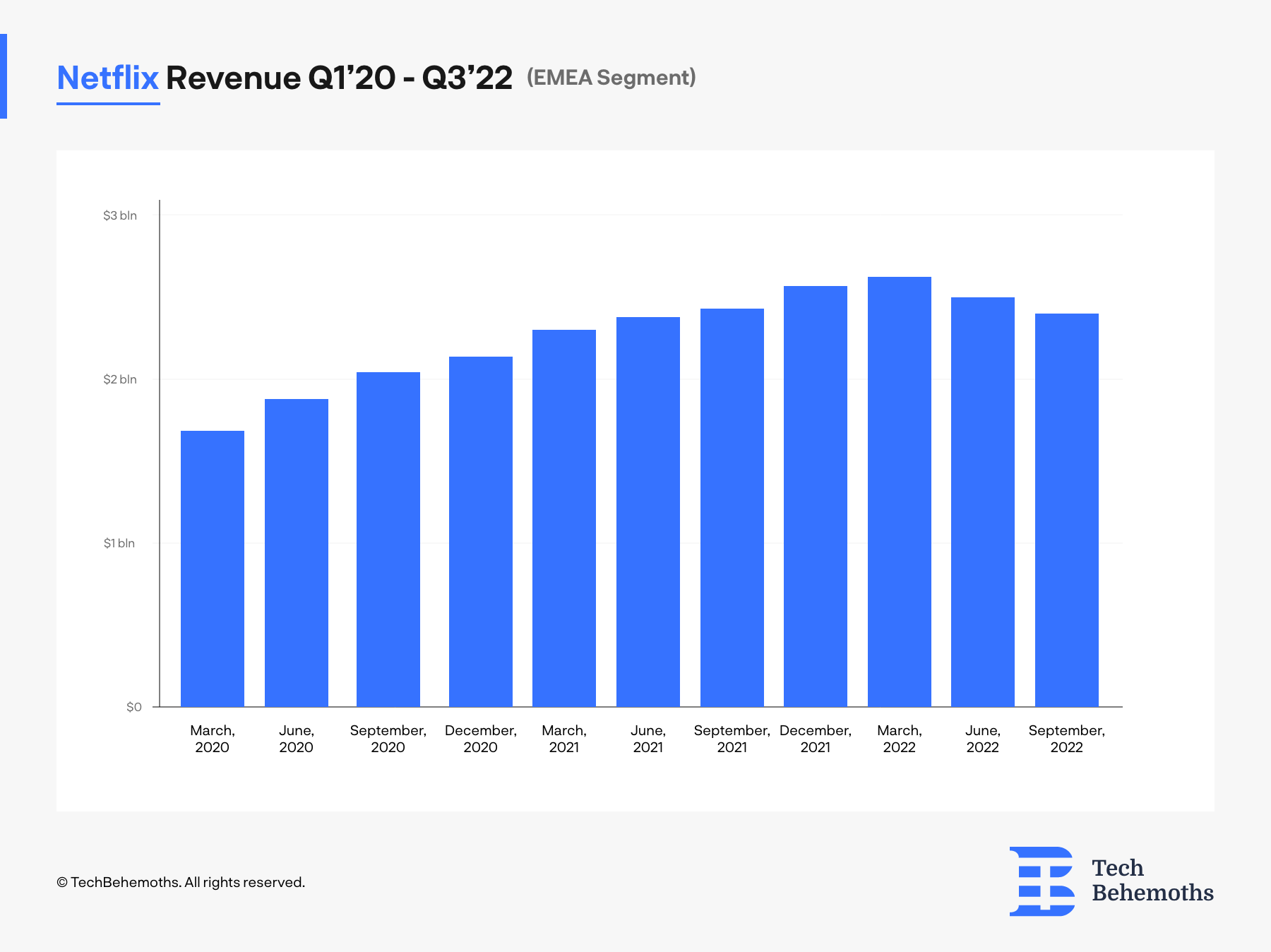

The EMEA segment doesn’t bring so much money to the streaming service giant, but it also has fewer subscribers. On top of that, the subscription prices in the EMEA region are lower compared to the ones from the UCAN segment, so this may also be a reason behind the in-segment lower profits.

Referring to the Q3’22 Netflix financial report, the streaming platform declared $2,37B in revenue in Q3’22 for the EMEA segment. That’s $8M less than in Q2’22 and $9M less compared to Q1’22.

At the same time, Netflix's revenue significantly increased in 2021 compared to 2020 as the reports show that for 2021 Netflix earned $1,94B more than in 2020.

Considering the recent developments that touch the number of subscribers and the price hike, Netflix could streak 4 quarters in a row with less revenue in the EMEA segment.

How Much Money Does Netflix Make in Asia?

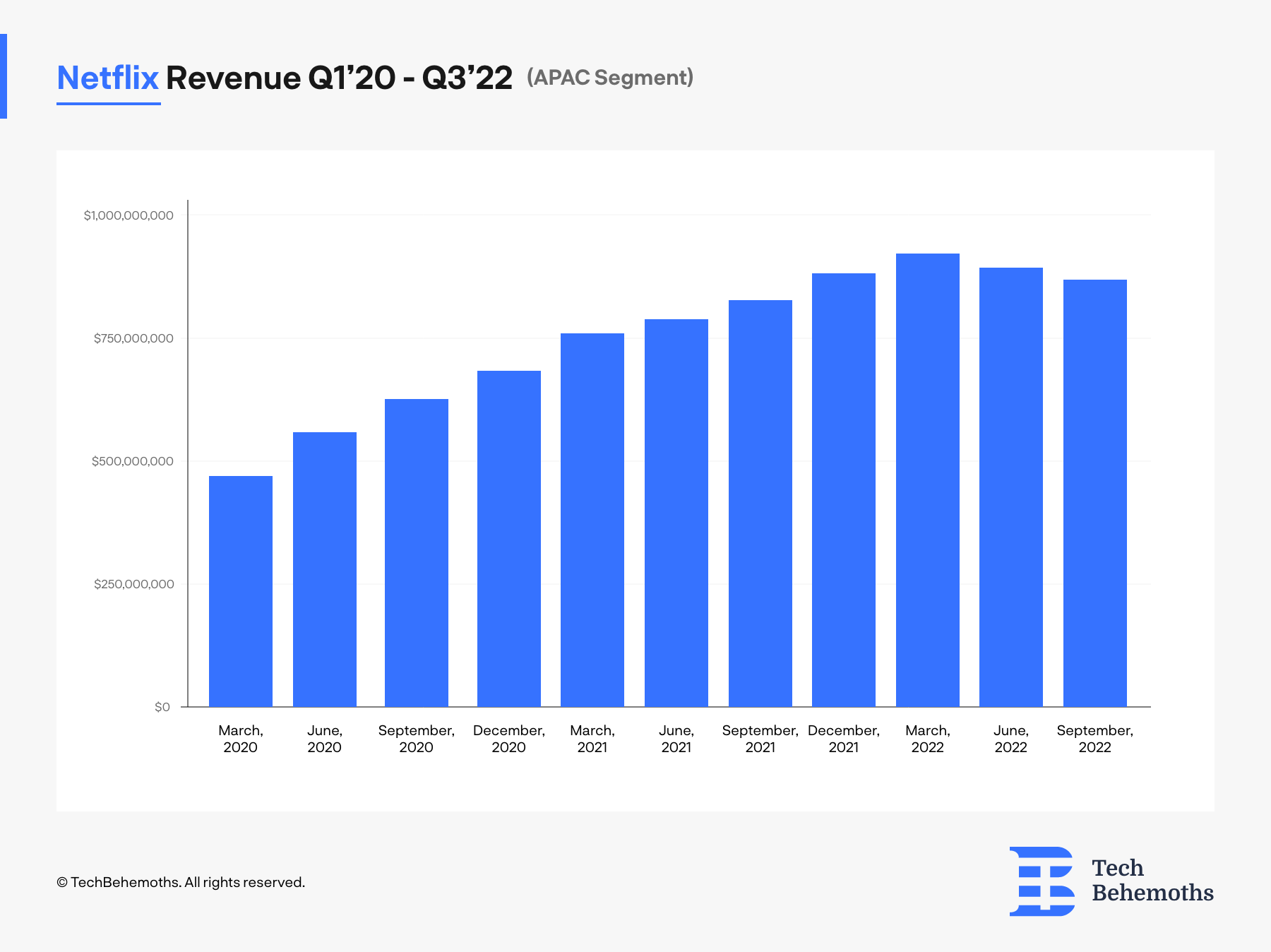

The next region we invite you to explore is the Asia Pacific segment or shortly the APAC. The Asia Pacific region brings the least revenue to Netflix but it also had consistent growth until Q1’22 when the platform announced the new prices.

As of Q3’22 Netflix reported $889M in revenue from the APAC segment, which is $19M less compared to Q2’22. Similar to the drop in the EMEA segment, Netflix Q3’22 was the second quarterly drop in a row for the APAC segment.

As it was mentioned previously, the number of subscribers didn’t hit a specific region/segment and affected the global audience. In addition, Netflix is competing in Asia with multiple regional streaming platforms such as Hotstar TV, ALTBalaji, Airtel Movies, or Viu that probably provide alternative TV shows and movies to their local audience. Something that definitely Netflix isn’t able to stream is local TV shows that are produced exclusively by a series of local filmmakers.

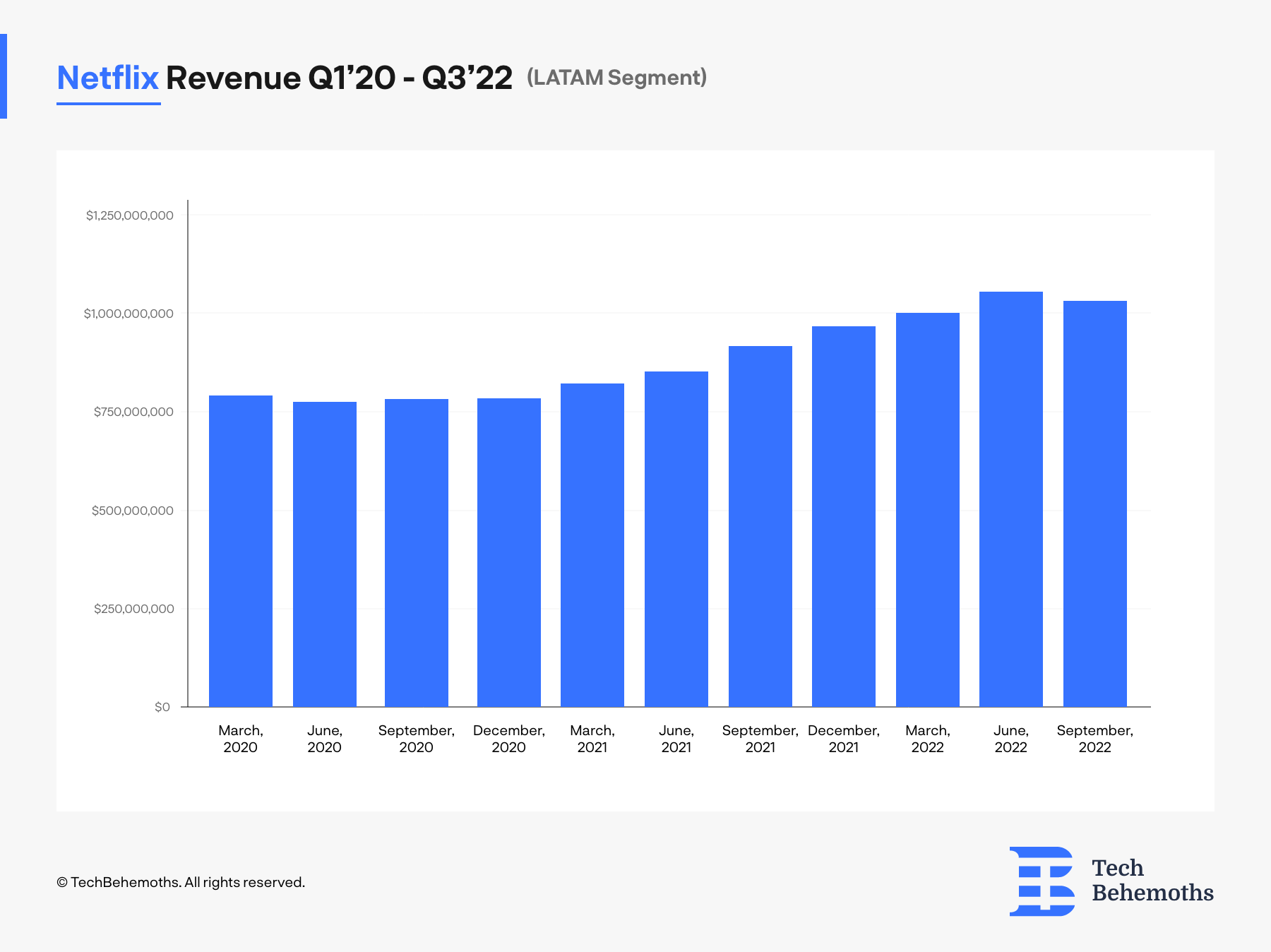

How Much Money Does Netflix Earn in Latin America?

The 4th and last segment is the Latin American market where Netflix earns $2.3 - 3.2B/year. According to its financial statement, Netflix earned in the 3rd quarter of 2022 $1,02B from the LATAM segment, which is $7M less than in Q2’22.

So, Netflix earns more in Latin America than in APAC even if subscriptions on average are more expensive in the APAC segment. On the other hand, the number of subscriptions in Latin America is ~3M users more than in the APAC segment, and this could explain the difference.

At the same time, in Latin America, Netflix didn’t have such consistent growth compared to other regions, and it started to consolidate its market position starting with Q3’21 when it marked its first solid revenue growth - $915M compared to $860M in the previous quarter.

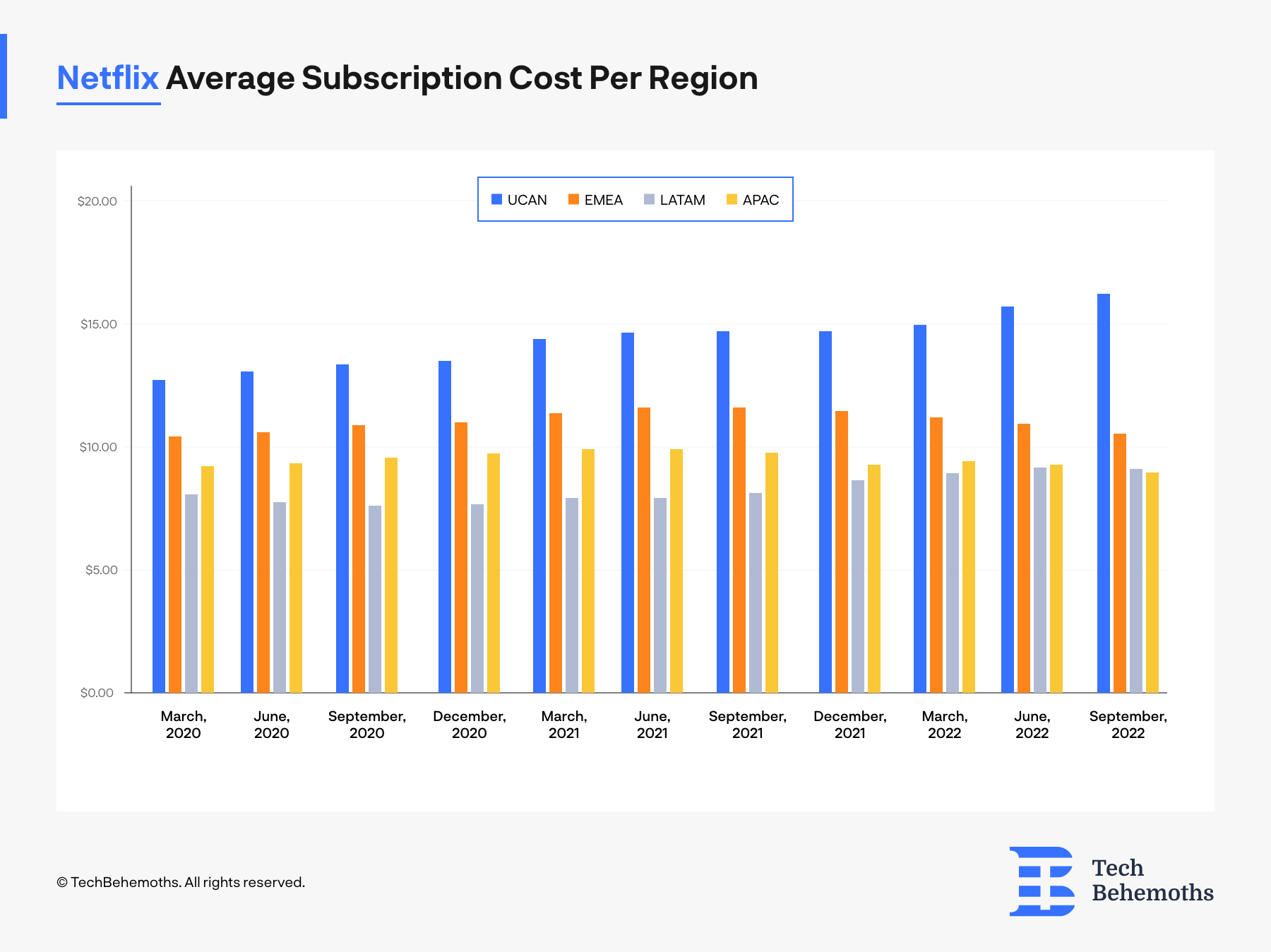

Average Netflix Subscription Cost

It’s no secret that Netflix charges differently in every country, and once in a while, they update their pricing across the regions. That’s why we decided to dive deeper into the subject and see how the average subscription cost evolved over the past 2 years and 9 months across each segment.

In the last 3 years Netflix shared that in some regions, like US and Canada the average cost has increased, while in other regions, it dropped, which is the case of the LATAM Segment.

The average subscription cost is calculated based on the average revenue per membership from each country included in every region. For example, the UCAN region includes the United States and Canada. In the past 3 years the price/membership both in the US and Canada increased, and so did the average revenue from this region. But so did the number of subscribers that chose a higher-cost subscription plan - which is a secondary factor that contributed to the average membership cost. This rule equally applies to the rest of the regions.

Just like the chart above shows, the average subscription cost on Netflix by region is as follows:

Netflix Average Membership Cost in the UCAN Region (US and Canada)

In the United States and Canada, the average membership cost increased since Q1’20 from $13,09 to $16.,37/mo in Q3’22. The price increased by $3,26 which makes it on average $1 year-over-year price growth. As it was mentioned previously, this was determined by the monthly subscription cost growth, but also due to the growing number of subscribers that choose a more expensive subscription over the past three years.

Netflix Average Membership Cost in the EMEA region (Europe, the Middle East, and Africa)

In Europe, the Middle East, and Africa the average membership cost started from $10,41 in Q1’20 and hiked up to $11,66 in Q2’21. After that, the average membership cost settled near its initial value, and in Q3’22 marked $10,81 which is only ¢40higher than 3 years back.

Netflix Average Membership Cost in the APAC Region (Asia-Pacific)

The average Netflix membership cost in the Asia-Pacific region started from $8,94 in Q1’20 and increased to a maximum of $9,74 in Q2’21. Later the average cost of membership started to drop, reaching lower than initial values in Q3’22 which is $8,34. This means that as of September 2022 the average cost of a monthly subscription on Netflix in the Asia Pacific region is ¢60 lower than in January 2020. It is also the lowest average subscription cost across all Netflix segments.

Netflix Average Membership Cost in the LATAM Region (Latin American Countries)

The average monthly membership cost in Latin American countries has also increased in the past three years. In its financial statement, Netflix mentions that in Q1’20 the average membership cost in countries such as Brasil or Argentina among others was $8,05/mo. Later on, the prices started to drop down to $7.12/membership in Q4’20. However, starting Q1’21 the average membership cost started to grow again, and as of Q3’22 reached its maximum level in three years - $8,58. Once, the cheapest region in terms of membership cost, LATAM countries have gave in their position to the APAC countries.

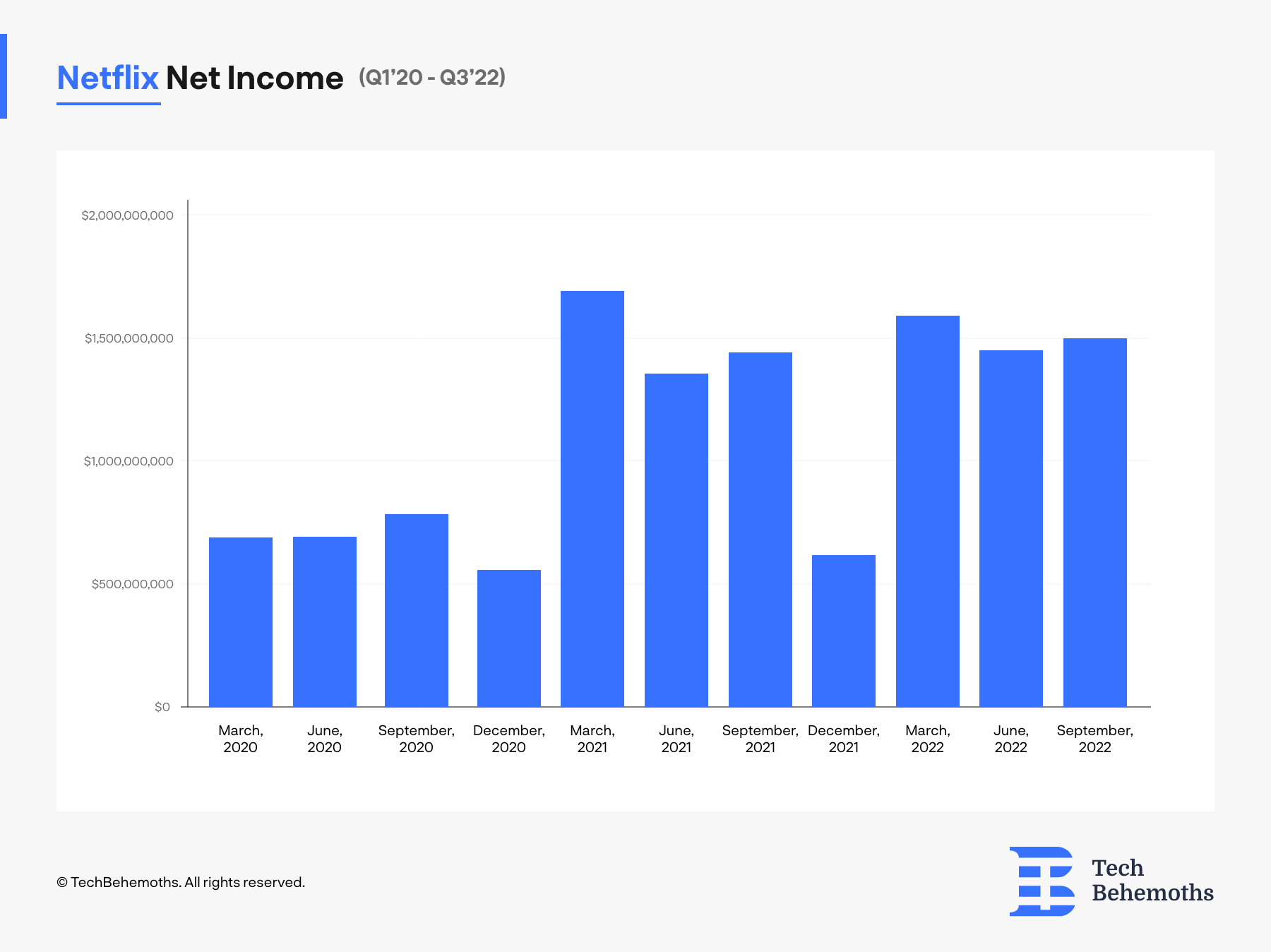

Netflix Net Income Q1’20 - Q3’22

As it’s known to everyone, the revenue is by far not equal to the net income, as companies invest to earn, and the investments and spending mark the difference between revenue and profit. Based on this, Netflix’s earnings are by far not those mentioned in the revenue statement, and rather they refer to the net income chart that we share below

Netflix's investments in Q1-Q3’20 paid off later in Q1-Q3’21, which is one year later. So even if the revenue declared is close to $8B in Q3’22 the net income is closer to $1.5B. This means that Netflix invests at least $6B in a quarter to make a profit.

Netflix spending and investments include among other things marketing campaigns, technology investments and administrative investments. Acquiring new productions and producing their own TV shows and movies are also costly, and the risks are also high considering the wide variety and competition on the movie and TV show market worldwide.