How important is the ICT sector for Malaysia?

The ICT sector is one of the most productive industries for the Malaysian economy, contributing about 13.8% to GDP while also driving digital transformation. It creates highly skilled jobs, attracts global investment in technology, and supports innovation in the country’s other prominent industries. ICT also helps bridge the gap between rural and urban areas, positioning itself as a dominant force in the Southeast Asian region.

This article presents the importance of the ICT sector for Malaysia, reflected through a numerical and descriptive analysis of the main trends, market players, weaknesses, and opportunities in the development of the digital economy.

What will the ICT market size be in Malaysia by 2025?

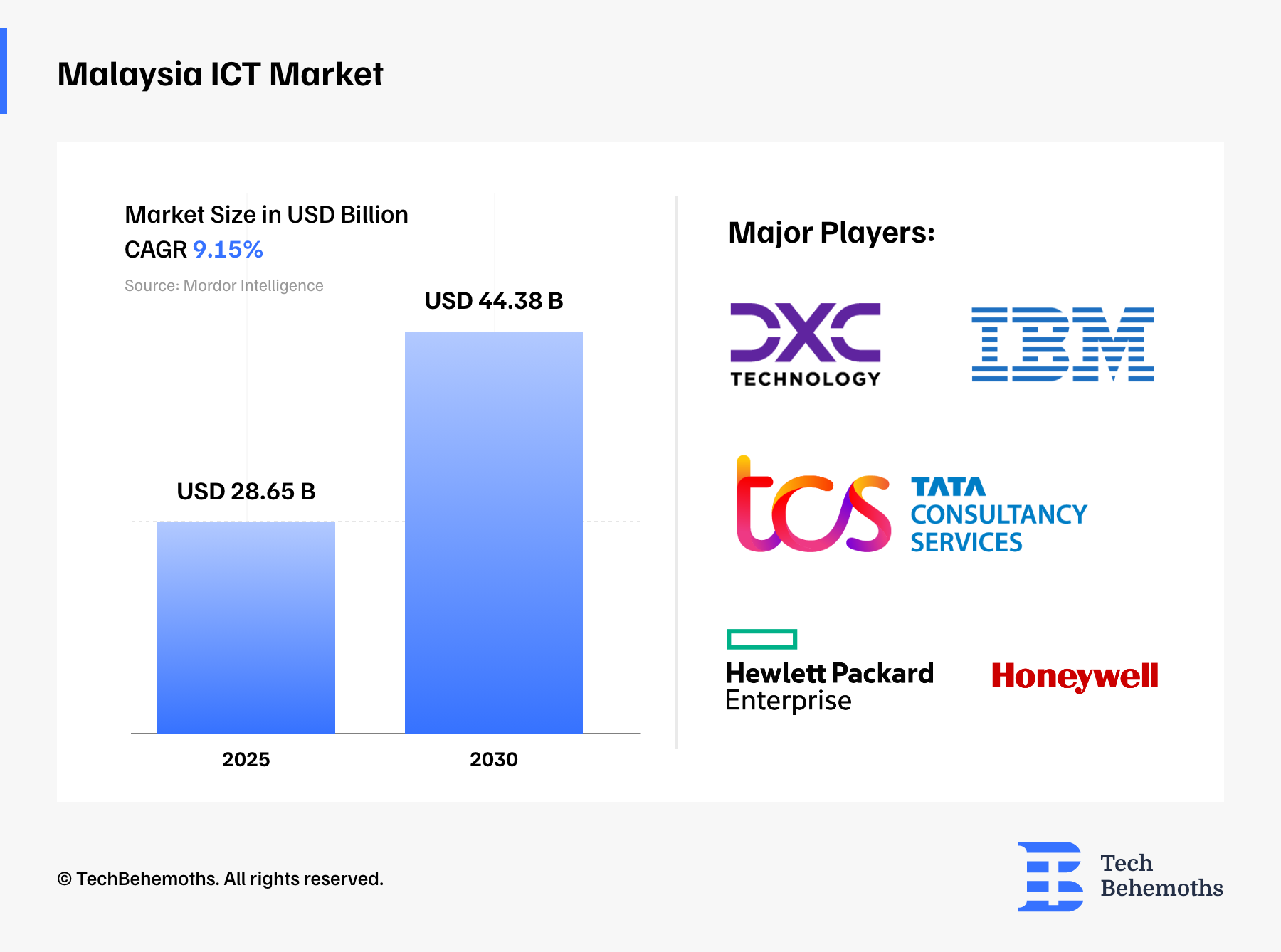

The Malaysian ICT Market size is estimated at USD 28.65 billion in 2025 and is expected to reach USD 44.38 billion by 2030, at a CAGR of 9.15% during the forecast period.

Malaysia’s ICT landscape covers various sectors, including hardware, software, services, and telecommunications, providing solutions across different industries.

Who are the Major Players in Malaysia’s ICT Sector?

The growth of the ICT sector and digital economy in Malaysia is largely due to several global ICT giants with expertise in cloud, artificial intelligence, cybersecurity, and enterprise solutions. These companies play a significant role in the digital transformation in both the public and private sectors.

Let’s see which companies have had the biggest impact on this sector:

-

Tata Consultancy Services (TCS)

-

Main Activities: All Other Information Services

-

Full name: Tata Consultancy Services Malaysia Sdn. Bhd.

-

Incorporation date: August 18, 2003

TCS is headquartered in Kuala Lumpur, Malaysia. It provides solutions for software development, cloud computing, AI, and enterprise digital transformation. It supports businesses in Malaysia through IT outsourcing and supports digital solutions for all industries. Tata Consultancy Services Malaysia Sdn. Bhd. reported a net sales revenue increase of 13.09% in 2024, while its total assets grew by 2.59% over the same period.

-

IBM Corporation

-

Main Activities: Computer Systems Design Services

-

Full name: IBM Malaysia Sdn. Bhd.

-

Incorporation date: December 07, 1999

IBM is a multinational tech company based in the U.S. offering hardware and software. It also provides IT services. In Malaysia, it offers enterprise cloud platforms as well as AI-powered analytics plus cybersecurity. Solutions for hybrid clouds are also provided.

-

Hewlett Packard Enterprise (HPE)

-

Main Activities: Computer and Computer Peripheral Equipment and Software Merchant Wholesalers; Other Computer Related Services

-

Full name: Hewlett-Packard (M) Sdn Bhd

-

Incorporation date: October 20, 1978

HPE has a focus on networking technologies, storage, and edge-to-cloud solutions. It helps Malaysian enterprises modernize infrastructure also innovate with data.

-

DXC Technology Company

-

Main Activities: All Other Information Services

-

Full name: Dxc Technology Malaysia Sdn. Bhd.

-

Incorporation date: November 06, 1975

DXC is an American IT services firm that delivers IT outsourcing, cloud services, and enterprise applications. It partners with the private and public sectors in Malaysia for digital transformation and infrastructure management. In 2023, the company reported a net sales revenue increase of 63.94% and its total assets recorded a growth of 51.49%, while net profit margin increased by 4.86%.

-

Honeywell International

-

Main Activities: Machinery, Equipment, and Supplies Merchant Wholesalers; Other Services (except Public Administration)

-

Full name: Honeywell International Sdn. Bhd.

-

Incorporation date: October 30, 2015

Honeywell is a U.S. conglomerate in aerospace, building technologies, and industrial automation. In Malaysia, IoT and automation platforms contribute to smart city solutions and industrial digitalization.

These firms are major contributors to the growth and digital transformation of the Malaysian ICT market, as noted in Mordor Intelligence's report.

What is the Contribution of ICT to GDP and Employment in Malaysia?

The Information and Communication Technology (ICT) sector continues to be a key driver because it has a strong influence on GDP as well as employment toward Malaysia’s economic growth. The ICT sector (including e-commerce) generated RM427.7 billion, approximately 89.8 billion USD, in 2023, accounting for 23.5% of the national GDP, according to the Department of Statistics Malaysia (DOSM). This shows a GDP rise from RM411.6 billion (86.4 billion USD), which was 22.9% in 2022. This is a highlight of the role that the sector is expanding into in the national economy.

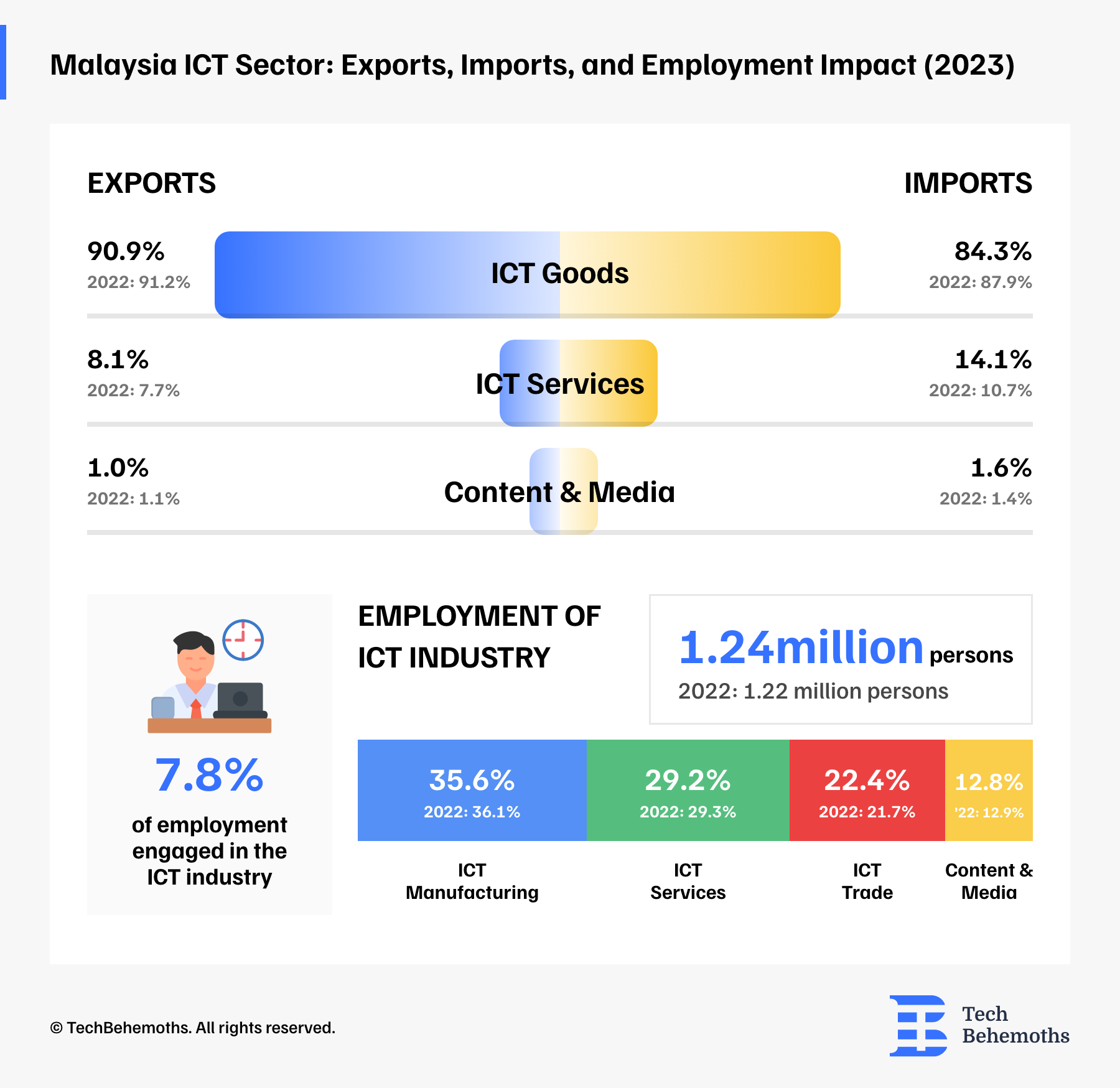

Exports of ICT products contributed 34.5% to Malaysia's exports, valued at RM430.7 billion (90.4 billion USD) in 2023, dominated by ICT goods with a share of 90.9%. As for imports, ICT products recorded a contribution of 23.4% to national imports with a value of RM270.7 billion (56.8 billion USD), contributed by ICT goods with a share of 84.3%.

ICT industry employment increased by 1.6% to 1.24 million persons in 2023, with a contribution of 7.8% to the overall employment in Malaysia. It was dominated by ICT manufacturing at 35.6%, followed by ICT services and ICT trade with a share of 29.2% and 22.4% respectively.

Beyond its financial contribution, the ICT industry also supports job creation and workforce development across a range of fields, from software development and cybersecurity to digital marketing and logistics. As Malaysia continues to invest in digital infrastructure and innovation, the sector’s potential to drive inclusive economic participation and long-term productivity remains strong. Its growing influence underscores the importance of addressing existing challenges to ensure sustainable growth and global competitiveness.

What are the Emerging Trends in Malaysia’s ICT Sector by 2025?

As Malaysia’s ICT sector evolves, rapid technological advancement, increased digital integration, and evolving user needs are expected to bring transformative changes by 2025. The following represent a few major new patterns. These trends shape all of the digital landscape.

AI, big data, and machine learning adoption

Business operations, public services, as well as industry innovation are each becoming central to artificial intelligence, big data analytics, and machine learning. Firms use these technologies to make better choices plus optimize processes. These technologies improve customer experiences for companies. Government initiatives also support AI adoption in key industries like medical care, finance, and agriculture, and this aligns with national goals under the MyDIGITAL Blueprint.

5G rollout and infrastructure development

Deploying 5G across the nation marks a major milestone because coverage enables connectivity, IoT growth, and cities' smart technology. The continued rollout supports high-speed data transmission for autonomous vehicles, remote surgeries, and advanced manufacturing. This infrastructure upgrade must lessen digital gaps within cities and the countryside.

“All economic sectors were expected to benefit from 5G which also created a new ecosystem in delivering the 4th Industrial Revolution (IR4.0), digital transformation, cloud services, Internet of Things (IoT) data and Artificial Intelligence.”

- Dato Sri Ismail Sabri bin Yaakob, Prime Minister of Malaysia

“The 5G network's seamless integration with each MNO's existing core platforms will further enable the accelerated adoption of 5G services in Malaysia and narrow the digital divide.”

- Tan Sri Datuk Seri Panglima Haji Annuar bin Musa, Minister of Communications and Multimedia

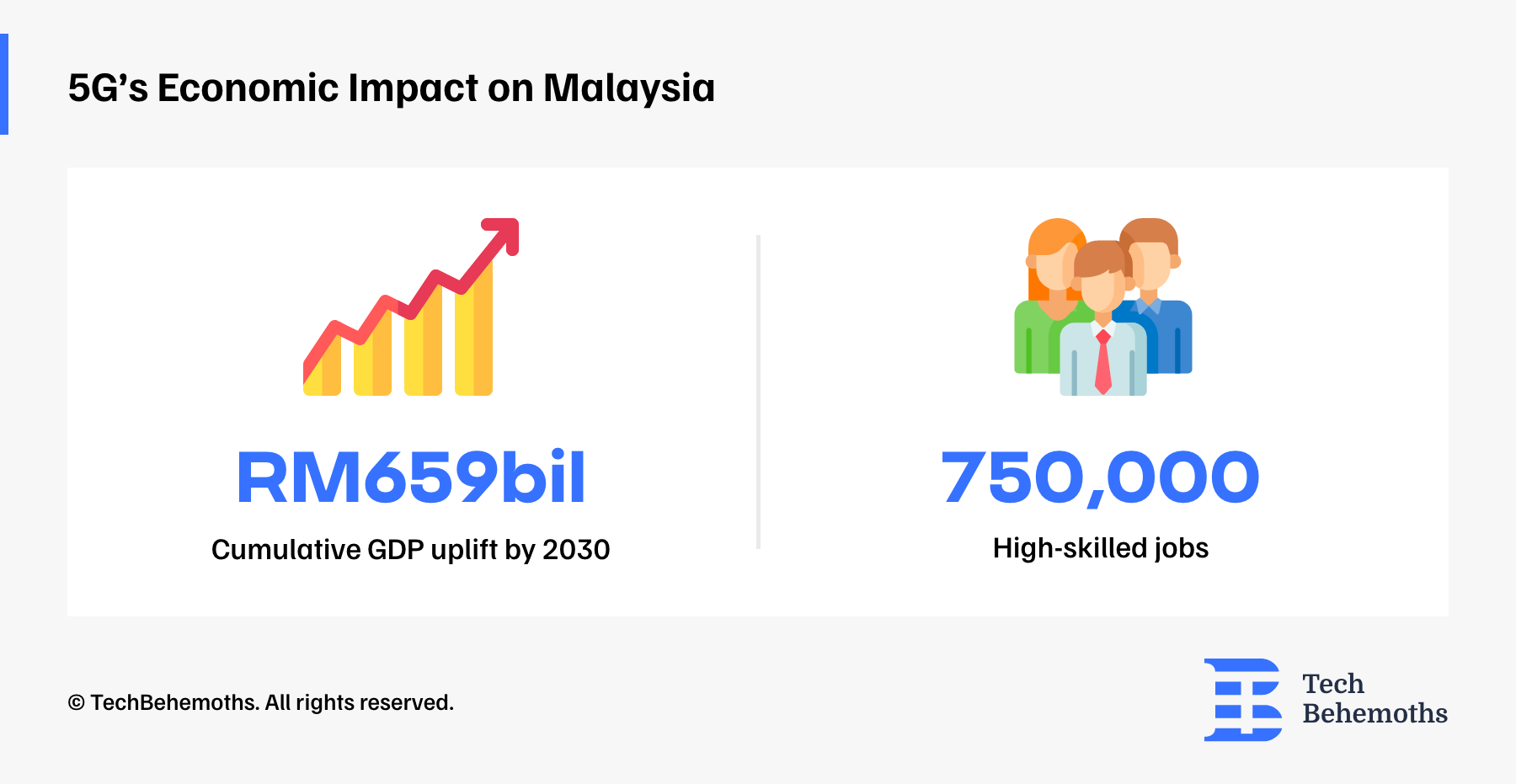

TRP says that the sooner Malaysia achieves nationwide 5G coverage, the sooner it can reap substantial economic benefits. This is supported by the results of a recent EY study on the potential economic impact of 5G, which shows a cumulative GDP growth of RM650 billion over the next 10 years, with RM150 billion in 2031 alone.

This means that an estimated 750,000 new highly skilled jobs will be created by 2030, giving Malaysia a significant advantage over its neighbors.

How Is Malaysia’s ICT Sector Responding to Cybersecurity Demands and Emerging Innovations?

Digitalization is making cybersecurity an increasingly important priority. This is driving demand for advanced security solutions, such as blockchain-based authentication, zero-trust architecture, and AI-powered threat detection. To maintain user trust and protect national digital assets, both the public and private sectors are investing in stronger cybersecurity frameworks.

One of the biggest challenges facing the ICT sector in Malaysia is cyber threats and data privacy. In 2024, Malaysia saw a major rise in cyber incidents, reaching 5,664 cases, according to official data from Cybersecurity Malaysia.

“The law needs to understand the context of the country and the needs of the ecosystem. Overall, the government agrees that the cybersecurity laws in Malaysia need to be updated. I believe in the next several months or year, it will be a busy time for Malaysia as it looks to make amendments to the regulation and legislation with regards to cybersecurity and data protection in the country”

- Dato Amirudin, CEO of CyberSecurity Malaysia

A third of Malaysian organizations saw a 50% or more increase in incidents, with malware (64%), ransomware attacks (64%), and password attacks (47%) being the most concerning types of attacks. As a result, Malaysian companies, realizing the need to protect their data and reputation, have now increased their budget allocation for cybersecurity.

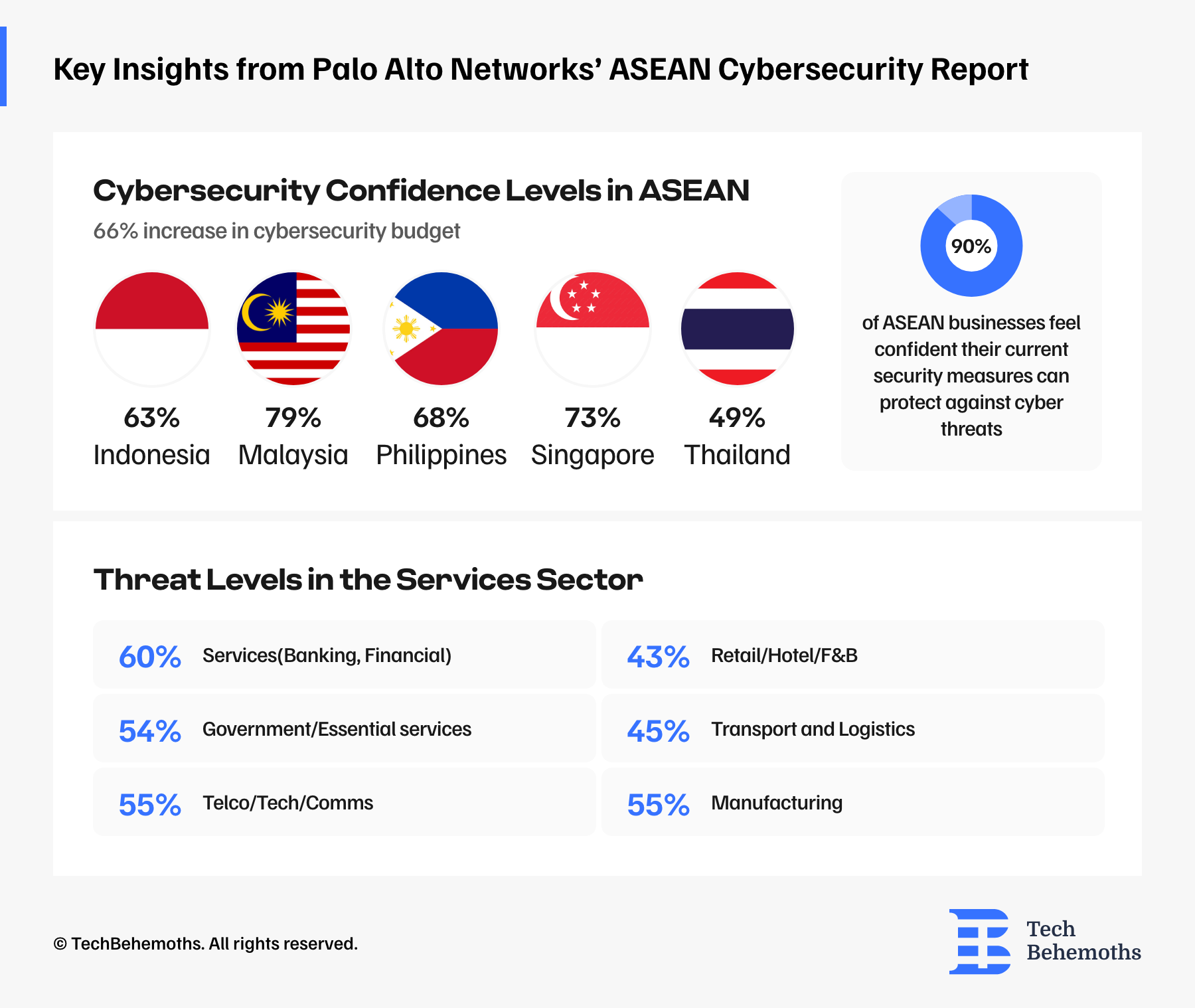

Palo Alto Networks’ 2023 ASEAN Cybersecurity State Report showed that 79% of organizations surveyed said they would increase their cybersecurity budget allocation in 2023. This increase in spending gives Malaysia the highest percentage in the ASEAN region.

Compared to 2022, this is a very positive trend as more and more organizations are building their resilience against cyber threats, where 33% of all Malaysian organizations reported a budget increase of over 50% for 2023. It is also admirable that the majority of Malaysian company board members have ongoing discussions about cybersecurity, either monthly or quarterly.

As reported, cybersecurity in ASEAN is seeing positive developments, reflected in a 66% increase in budgets and over 80% of companies discussing these issues at the board level. Confidence levels are high in countries such as Malaysia (79%), Singapore (73%), and the Philippines (68%), while Thailand lags at just 49%.

Notably, 90% of businesses, including 81% of SMEs, believe they are prepared to deal with cyber threats. However, critical sectors such as financial services (60%), manufacturing (55%), and telecommunications (55%) report the highest levels of risk, demonstrating the need for continued investment and tailored strategies for effective protection.

Both the Malaysian government and private entities are now actively involved with massive contributions and investments in artificial intelligence and cybersecurity.

CFO Tech Asia reports that Malaysia is now reaping the rewards of the government's RM20 billion investment, under the 2024 budget, in a national artificial intelligence framework, which aims to boost research, development, and commercialization in artificial intelligence.

In addition, according to the Malaysia Digital Economy Corporation (MDEC), Malaysia’s commitment to artificial intelligence (AI) and cybersecurity is set to accelerate its digital economy, which is projected to contribute 25.5% to the country’s GDP by 2025.

Also, MDEC has recorded a significant increase in digital investments, reaching RM163.6 billion in 2024, representing a 250% increase from the previous year. These investments have generated over 48.000 jobs, SME competitiveness, and developed digital skills to meet future demands, accentuating the positive impact of the focus on AI and cybersecurity on the national economy.

Green ICT and sustainable tech

Malaysia is already in its tenth year of implementing the Sustainable Development Goals (SDGs) and has committed to intensifying efforts to achieve the 17 SDGs so as to become a sustainable nation by 2030.

The Malaysian Ministry of Economy has dedicated a separate official section to the Sustainable Development Goals (SDGs), where it provides citizens, researchers, investors and international partners interested in Malaysia's commitment to sustainable development with information on how it integrates the 17 SDGs established by the United Nations into its economic, social and environmental policies.

Sustainability has become a key part of Malaysia’s digital development. As for green ICT practices, these involve energy-efficient data centers along with low-emission technology solutions. Sustainable e-waste management is also among the green ICT practices that are gaining traction. The focus on environmentally responsible innovations reinforces Malaysia’s broader climate commitments and makes its economy resilient in the long term.

Forecast: What’s Next for Malaysia’s ICT Sector?

Growth projections for 2026 and beyond

The Malaysian ICT Market size is expected to grow by approximately USD 2.21 billion by 2025 compared to last year. So, from USD 24.40 billion in 2024, the Malaysian ICT Market will reach USD 26.61 billion, representing a compound annual growth rate (CAGR) of 8.31% for the period between 2025 and 2030.

Another good thing to mention is that the Total Consumption of ICT Goods in Malaysia also demonstrates a constant increase in consumer and business demand for ICT products and services, thus predicting an increase of up to 593.67 billion by the end of 2025.

These flourishing figures are due to technological progress and the digitization of more and more sectors, but also to government initiatives, which are quite focused on supporting the ICT sector, which is really pleasing.

Also, to support the prosperity of ICT, projects such as the Digital Free Trade Zone (DFTZ) and the Digital Center in Malaysia have been developed. These are just a few of the initiatives aimed at attracting foreign investment and supporting local technology startups.

Regarding the digital economy plan, the MyDIGITAL program also encourages the development of this area by aiming to transform Malaysia into a high-income nation by 2030 through digitalization. The Cloud First initiative within MyDIGITAL also strategically positions Malaysia as a crucial data center in the region.

What is Malaysia’s Role in the ASEAN Digital Economy?

The Association of Southeast Asian Nations (ASEAN) was established on 8 August 1967 in Bangkok, Thailand, with the signing of the ASEAN Declaration (Bangkok Declaration) by the Founding Fathers of ASEAN: Indonesia, Malaysia, the Philippines, Singapore and Thailand. Brunei Darussalam joined ASEAN on 7 January 1984, followed by Vietnam on 28 July 1995, Laos and Myanmar on 23 July 1997 and Cambodia on 30 April 1999, forming what are now the ten member states of ASEAN.

The Digital ASEAN Initiative comprises a portfolio of four work streams focused on the following areas of interest:

-

Pan-ASEAN Data Policy - defines common regional data policies

-

ASEAN Digital Skills - aims to build a shared commitment to digital skills training for the ASEAN workforce

-

ASEAN e-Payments - enables the building of a common ASEAN framework for e-payments

-

ASEAN Cybersecurity - aims to foster cooperation and capacity building in the field of ASEAN cybersecurity

One key fact to be aware of is that the ASEAN Digital sector was formerly known as the ASEAN Information and Communications Technology (ICT) sector. It covers cooperation of ICT infrastructure, telecommunications regulation, ICT development policies, information and network security, ICT skills, and other areas under the purview of ASEAN ministries of ICT.

According to The World Economic Forum, ASEAN's digital economy will grow significantly over the next decade, adding an estimated $1 trillion to the regional GDP. Therefore, Malaysia plays an important role in shaping this indicator.

ASEAN's digital economy benefits from Malaysia's digital policies, advanced infrastructure, and planned location. Malaysia, as an early regional adopter in terms of digital transformation frameworks, has positioned itself as more of a hub for innovation, digital trade, and tech talent. The country is fostering cross-border collaboration along with harmonizing digital standards. It is enabling smooth data flows through initiatives like Malaysia Digital with its active participation in ASEAN digital integration efforts. This proactive stance does tie regional economies together in a much stronger way and makes Malaysia competitive in the broader Asia-Pacific digital landscape.

Conclusion

The ICT sector in Malaysia is the foundation of the national economy since it gave RM427.7 billion, approximately 89.8 billion USD, or 23.5% to the GDP in 2023. The sector's central role in the country's development reflects its rapid growth fueled by e-commerce and digital services, together with strong government backing.

Although the financial results for the 2023 GDP were generally satisfactory, Malaysia still recorded some decreasing values in the export and import of ICT products, for the year 2023, compared to 2022. The difference was not catastrophic, but it does not represent an admirable increase. Precisely because of this, we are waiting for updates from the competent institutions to have current data at hand to make a detailed, up-to-date analysis of the Malaysian ICT sector.

To sum up, the ICT industry is expected to remain a key driver for economic progress, job creation, and regional influence, as Malaysia continues with investments in infrastructure, digital literacy, and also within innovation. The numbers point toward a clear message - Malaysia's future has the digital economy as a core engine, not just a supporting pillar.