What Is the Average Price of Software Development in Ukraine?

The price of software development is roughly the duration of a project multiplied by the developers’ hourly or monthly rates. While timelines depend on each unique product’s feature set, complexity, and other variables, evaluating Ukrainian developer rates is relatively easy.

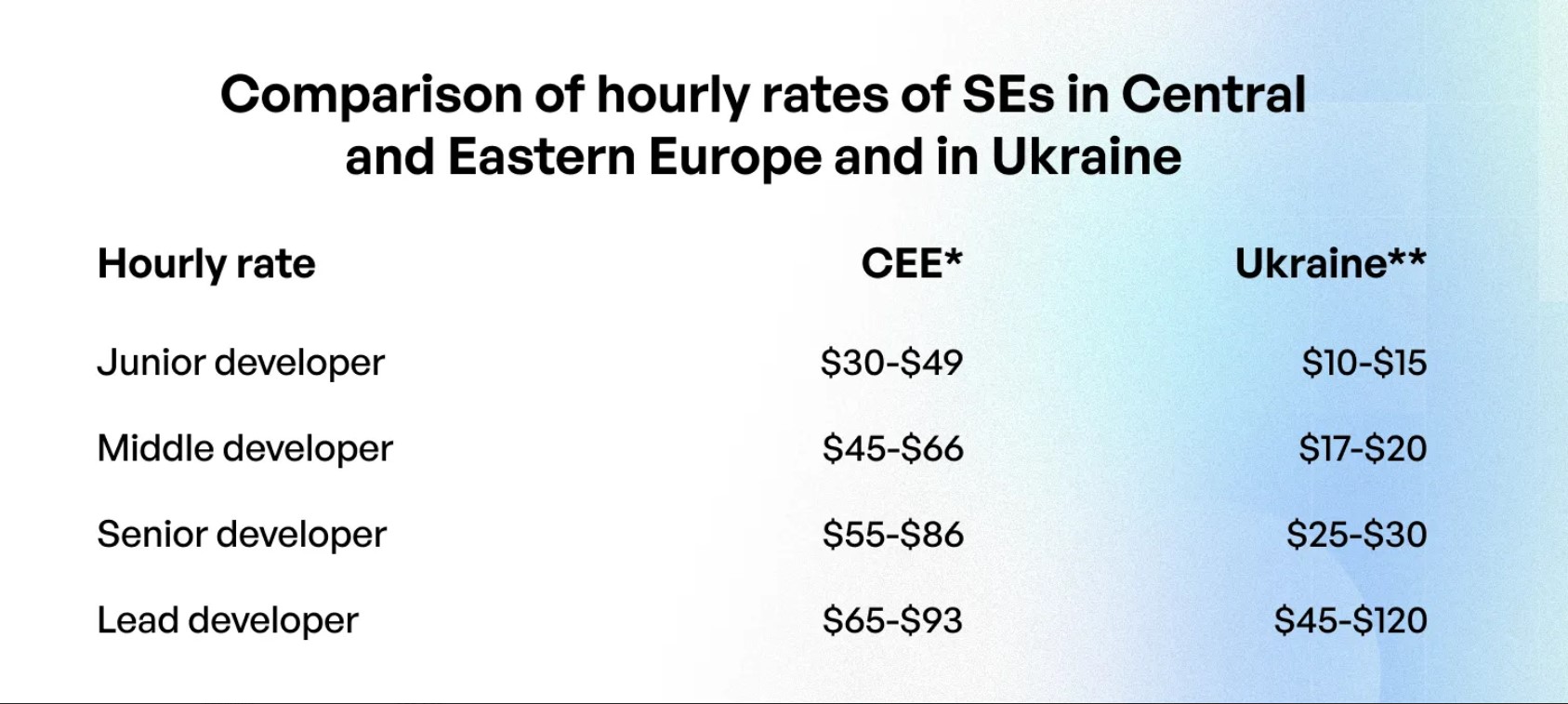

The current software engineer’s hourly rate of $10-$120 enables significant cost-saving without compromising quality.

However, Ukraine has much more to offer. Firstly, a vast pool of IT talent proficient in diverse technologies and domains. SEs’ levels of expertise, English, and professionalism are consistently high due to extensive international collaboration experience. Ukraine’s business conditions, compliance with international standards, and location in the Eastern European Time zone (GMT+2) are convenient for European and American clients.

Still, first things first.

Factors Determining Software Development Prices in Ukraine

As of June 2024, DOU.ua estimated the median monthly salary of a Middle software engineer at $2,500. This is barely $15 per hour, while an average software engineer in the USA makes $60.6 per hour.

Of course, these “average” and “median” rates are mere statistics. The actual numbers vary even from firm to firm. For instance, Onix’s developers’ rates range between $35 and $45 per hour and are negotiable.

Here are several factors that may determine the price of your software development in Ukraine.

1. Specialty and type of technology required for your project

Data scientists and ML engineers receive the highest salaries among all IT specialties in Ukraine. Back-end and mobile developers working with Java or Python and Swift/Kotlin, respectively, are the most expensive SEs.

2. The required skill level of the specialists

Your budget should also account for the level of technical expertise your project requires.

The difference in salaries between a Junior and a Senior developer working with the same technology can be more significant than between different programming languages.

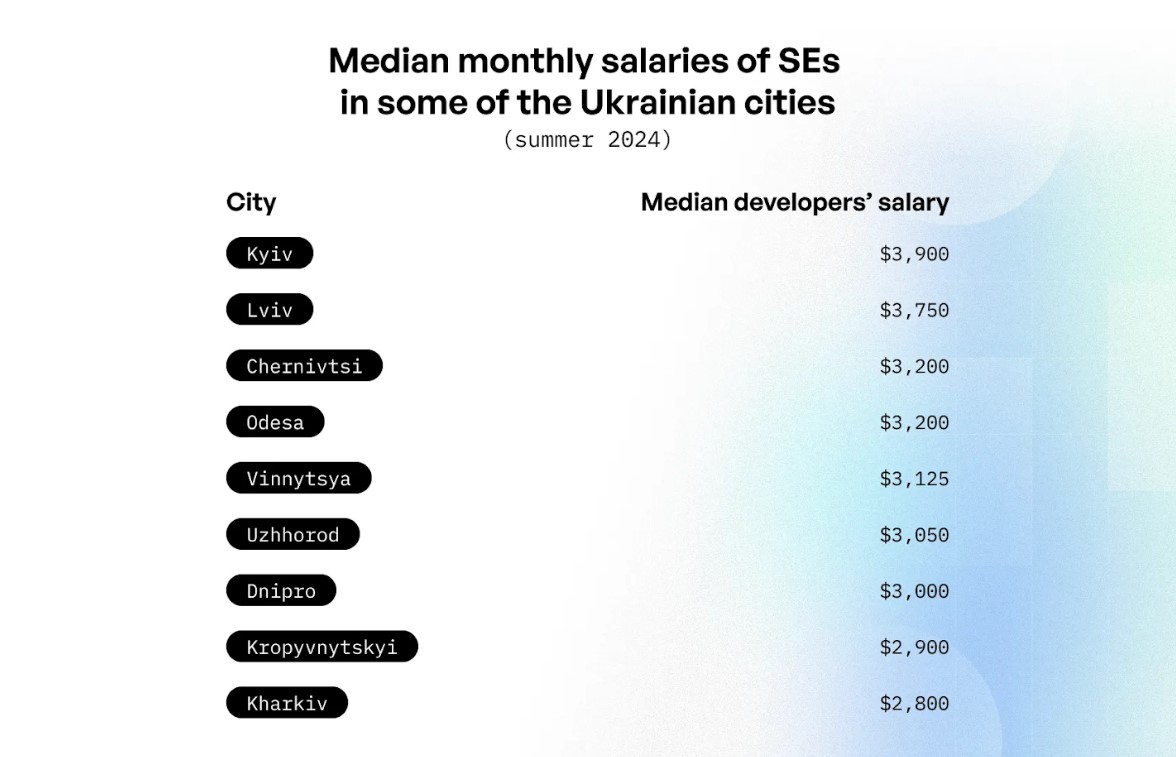

3. City/region where the IT specialists or company are located

Most IT companies and talent are concentrated in Ukraine’s largest cities. Below are the largest IT hubs according to the Lviv IT Cluster’s “IT Research Ukraine 2023: Adaptability and Resilience Amidst War.”

|

Tech hub |

Number of companies |

Number of tech specialists |

|

Kyiv |

~85,000* |

|

|

Lviv |

~600 |

~51,000 |

|

Kharkiv |

~20,000 |

|

|

Dnipro |

~18,000 |

|

|

Odesa |

~130 |

~15,000 |

* Most of the numbers in this table are quoted from the above source, except for data where different sources are indicated.

Companies outsourcing software development to Ukraine may save money by recruiting teams and specialists outside its major IT hubs. SE’s salaries are generally lower in smaller towns like Onix’s headquarters Kropyvnytskyi than in the capital and other big cities.

4. Preferred outsourcing pricing model

The following cooperation models are popular:

Hiring freelancers. On platforms like Upwork or Freelancer, hourly rates may depend on a freelancer’s specialization, skill level, and location. Still, they are often higher than a fixed salary for a project or per month, and there’s also the platform’s commission.

Fixed-price contract. Clients often contract offshore companies and teams to realize smaller, well-defined projects. The estimated number of hours required to complete the project is multiplied by the project team members’ hourly rates. Some extra hours are added to account for uncertainty and risks, usually plus 20% to the initial budget.

Time-and-material, a.k.a. hourly rate contract. Each specialist has a fixed daily or hourly rate and is paid for the time they’ve worked for the client. This flexibility suits startups and businesses that must quickly respond to changes. However, the SE’s rates are still higher than dedicated developers’ monthly rates.

Dedicated team. The vendor assembles a full-time team to the client’s requirements regarding the specialists’ expertise, project specifics, and timeline. Clients can negotiate each worker’s monthly salary. Even with the vendor’s fixed monthly service fee, they can save up to 20-30% of software development costs compared with other pricing models.

Now, let us address the elephant in the room: despite the Russian aggression, Ukraine retains its appeal to startups and established companies. Here is why...

Why Ukraine Remains a Top Destination for Tech Outsourcing

1. Ukraine is the second-largest tech talent pool in Central and Eastern Europe.

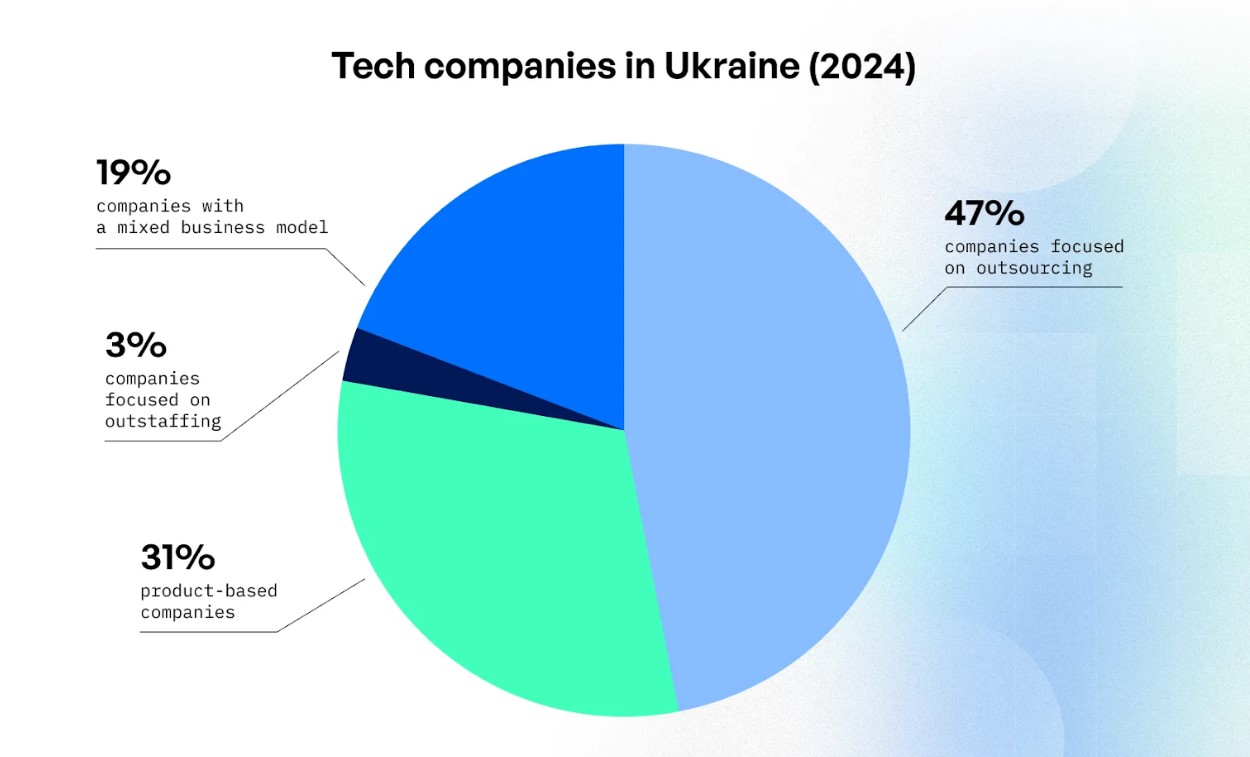

As of November 2024, there are 2,118 verified tech companies in Ukraine.

302,000 IT professionals make Ukraine the second-largest IT talent pool in CEE. The country also ranks 2nd by the number of AI businesses with 243 companies, some 5,200 AI/ML specialists, and a higher concentration of marketing, gaming, and business software AI startups.

Hundreds of educational institutions, often in collaboration with IT companies, train some 20,000 more techies every year. For example, 106 educational programs are dedicated to AI alone.

These numbers mean two things for those outsourcing software development to Ukraine. Firstly, the choice of IT talent is really wide. Secondly, Ukrainian companies and software engineers are compelled to provide high-quality services at highly competitive prices.

2. Ukraine offers an optimal software development price/quality ratio.

The outsourcing rates in CEE are generally comparable to those of LATAM and higher than in South and Southeast Asia.

However, the median hourly rate of a Ukrainian developer is more competitive than that of a developer in neighboring Poland, Romania, or the Czech Republic.

Sources: *2025 Global Software Outsourcing Rates and Trends Guide **Qubit Labs

3. Ukrainian world-level tech talent is diverse, experienced, dedicated, and flexible.

Over decades, Ukrainians have built an excellent reputation as hard-working, ingenious software developers. It’s as easy to see global tech leaders’ R&D centers in Kyiv as to come across Ukrainians in Silicon Valley.

82% of the Ukrainian tech talent have Middle, Senior, or Lead qualification levels. 43% have more than 6 years of experience, including 9% with 15+ years.

Another undeniable advantage is a long track record of creating successful companies. Since 2019, two Ukrainian AI startups have become unicorns: Grammarly and People.ai. Together with Preply, they are valued at over $14.5 billion. Ukraine’s startup scene also saw an increase in 2024.

89% of Ukrainian IT professionals have an intermediate or higher level of English proficiency. All leading SEs, project managers, and sales and client relationship officers speak English fluently and are often based in the USA, European Union, and Australia.

Ukrainian IT pros also stand out for their willingness to go the “extra mile” for clients’ sake. You’ll see dedicated teams working 10-12 hours daily to meet tight deadlines, skipping holidays, and staying in the office overnight to cover for an overseas team.

The traditional Ukrainian focus on establishing long-term relationships and remarkably high employee retention rate, up to 94%, also has practical meaning for long-lasting project outsourcing: clients can get great remote dedicated teams and save thousands of dollars they’d spend or lose due to in-house product developers turnover.

Ukrainian SEs are now keener than ever to keep their jobs and clients. At the same time, agencies are refocusing on new markets and new types of partnerships.

4. Ukraine’s IT professionals are resilient and reliable outsourcing partners.

Even during the Russian invasion, Ukraine managed to increase IT exports by 28% in the first quarter of 2022; the industry generated a record $2 billion in revenue. In the year after the invasion, Ukraine’s IT sector expanded and doubled its earnings from 2021.

The USA had previously accounted for 40% of Ukraine’s IT services exports and the UK for 10%. As of Q1 2024, the largest recipients were still the U.S. (36%) and the UK (9%), followed by Malta (8%), Cyprus (6%), and Israel (5%).

Most Ukrainian IT companies claimed that the number of clients and projects they worked on also remained the same. 4 out of 5 companies have continued to operate in Ukraine since the invasion. Moreover, 51% of existing tech companies plan to expand; more than ⅓ of them are going to establish branches abroad.

For example, of 511 companies operating in Kharkiv in early 2022, 500 are still in business despite the hub’s proximity to the frontline.

Of nearly 2,000 companies with German capital, “[...] almost no companies have completely ceased operations in Ukraine. They keep their foot in the door because they know it’s worth it," said Svenja Schulze, Germany's Minister for Economic Cooperation and Development. Production can be run in most of the country, and Ukraine’s prospect of EU membership is a "long-term" advantage for companies.

Even Ukraine’s problems can benefit outsourcing clients, especially startups and small- and medium-sized businesses. Highly skilled professionals and digital agencies have become more receptive to job opportunities, wages, and contracts they wouldn’t have considered previously.

The government has taken measures to secure reasonable IT rates, e.g., by preventing double taxation in outsourcing. A special legal and tax regime fosters conditions and tools for companies to build transparent corporate structures, attract international investment, and protect intangible assets. Since 2022, this has helped attract 800+ companies, including Lyft, Revolut, and Samsung.

The urgent need for health tech, cybersecurity, drones, and logistics solutions accelerates the development, testing, and delivery of these products. For example, the Ukrainian military uses dozens of indigenous systems supplemented by AI for drones, whose production has increased dozens of times since 2023.

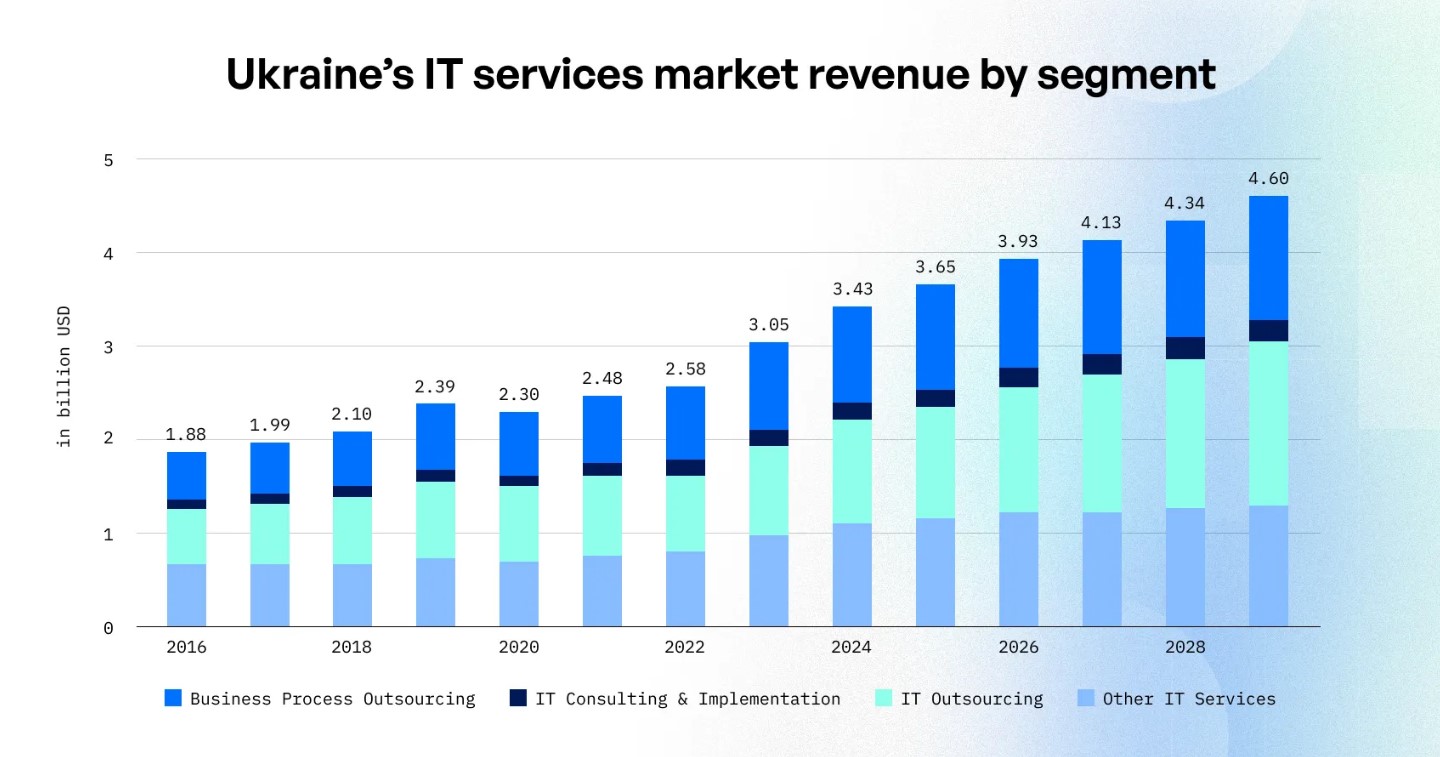

The revenue in Ukraine’s IT services market is projected to reach $3.42 billion in 2024 and grow at a CAGR of 6.11% from 2024 to 2029.

Wrapping Up

Two main reasons for the continuing interest in Ukraine as an outsourcing destination are highly competitive software engineer rates and the specialists themselves. The cost of employing one SE in the USA may equal hiring two to four Ukrainian SEs with equal skills but higher retention rates and lower overhead.

Businesses outsourcing their needs offshore can benefit from the Ukrainian SEs’ decreasing hourly rates and a growing pool of keen candidates. For the best deals, it is recommended to explore the variations within the country.