There are 4 Companies in Lahore

that provide Finance & Accounting Outsourcing (FAO) Services!

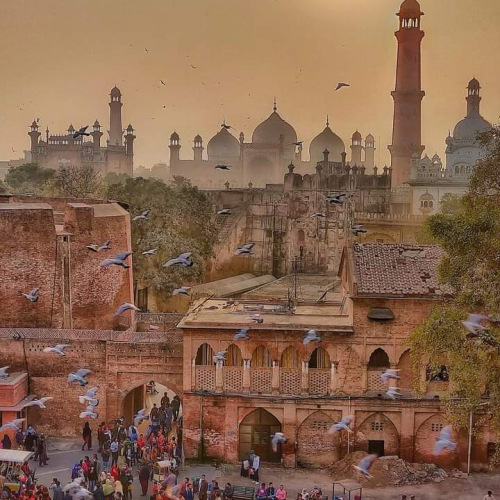

Lahore is Pakistan's 2nd biggest city after Karachi and is known for its multiple parks, rich cultural legacy, and vibrant atmosphere. It recently emerged as a busy tech city attracting multiple startups and IT companies.

Discover Top IT Companies in Lahore specialized in Finance & Accounting Outsourcing (FAO) including bookkeeping, credit control, accounting, financial consulting and more.

Finance & Accounting Outsourcing services involve partnering with specialized IT companies to delegate financial and accounting functions, allowing businesses to focus on their core competencies. These services encompass a range of offerings such as bookkeeping, payroll processing, tax preparation, and financial accounting providing comprehensive support for commercial development.

According to Grandview research, the global finance and accounting business process outsourcing market was valued at USD 56.42 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030.

Handpicked companies • No obligation to hire • 100% risk-free

Explore Top Finance & Accounting Outsourcing (FAO) Companies in Lahore

Business Line is a SAP Gold Partner in Iraq, specializing in ERP solutions and digital transformation for businesses.

Axiom World has evolved into a multinational group of companies with offices in 4 countries and a team of over 200 people across the globe.

Services:

We simplify finances for complex businesses with accounting, innovation, and automation.

TalentHue is a Top Rated Recruitment Agency in Pakistan specializing in Tech Recruitment, and HR Consulting.

Filter Finance & Accounting Outsourcing (FAO) Companies in Cities near Lahore

Find the right tech company near you or from a specific city. Some of the best companies might be located in smaller cities.

Find more Finance & Accounting Outsourcing (FAO) companies around the world

TechBehemoths is the world's most advanced and user-friendly platform to match IT Companies with real clients without hustle.

The ICT in Lahore: Performance and Profile

Lahore is Pakistan's 2nd biggest city after Karachi and is known for its multiple parks, rich cultural legacy, and vibrant atmosphere. It recently emerged as a busy tech city attracting multiple startups and IT companies.

It created a dynamic environment for tech companies and professionals to prosper by investing in the infrastructure, universities like Lahore University of Management Sciences, coworking spaces, and getting some government support for the IT sector.

According to StartupBlink’s startup ecosystem ranking, Lahore is ranked 2nd in Pakistan, 12th in South Asia, and 209th worldwide (with an increase of 8 places, compared to last year).

Over the past decade, the city attracted $ millions of venture capital, representing about 40% of the whole startup venture funding of the country.

Lahore is home to some promising startups like GrocerApp, Finja, Tajir, Zameen, Dawaai, and many more. Additionally, some established companies like Afiniti, Ibex, 10Pearls, Arpatech, and more are successfully operating in the city.

While the tech industry in Pakistan has some challenges, its growing digital economy and tech-savvy population represent a good opportunity for the tech industry to grow in the long term.

There are over 390 IT companies from Lahore registered on TechBehemoths. They offer a wide range of services and have various areas of expertise.

If you need to hire an IT service provider to execute your projects, use the advanced filters on our website to shortlist the companies based on your project requirements. Alternatively, submit your project and get a list of handpicked and trusted IT companies from us.

You’re not required to hire a company if it doesn’t meet your needs, and the platform is free of charge for end users.

What is Finance & Accounting Outsourcing (FAO) and what are its benefits for your projects?

Finance & Accounting Outsourcing services involve partnering with specialized IT companies to delegate financial and accounting functions, allowing businesses to focus on their core competencies. These services encompass a range of offerings such as bookkeeping, payroll processing, tax preparation, and financial accounting providing comprehensive support for commercial development.

According to Grandview research, the global finance and accounting business process outsourcing market was valued at USD 56.42 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030.

If you decide to team up with a specialized IT company for their Finance & Accounting Outsourcing needs, here’s a list of benefits you might be interested in:

- Cost Savings: Outsourcing financial functions eliminates the need for hiring and training in-house staff, reducing overhead costs and achieving operational efficiency.

- Expertise and Knowledge: Specialized IT companies provide access to a team of skilled professionals with extensive experience in financial management and accounting practices.

- Compliance and Accuracy: Outsourcing financial tasks ensures compliance with regulatory requirements and accounting standards, minimizing the risk of errors and penalties.

- Scalability and Flexibility: Finance & Accounting Outsourcing services can easily scale up or down based on business needs, adapting to changing requirements.

- Focus on Core Competencies: By delegating financial functions, businesses can allocate their time and resources to strategic initiatives, innovation, and business growth.

At the same time, it’s important to choose the right service provider for your needs and requirements. That’s why when choosing a Finance & Accounting Outsourcing provider for a project, we recommend you to consider the following criteria:

- Industry Expertise: Look for providers with experience in serving businesses in your industry, as they will better understand your specific financial needs and regulatory requirements, taking a look at the year when the company was founded, or, the number of real customers can be a good starting point to track their expertise.

- Service Offerings: Assess the range of services offered by the provider to ensure they align with your organization's financial requirements, such as bookkeeping, tax preparation, financial analysis, or payroll processing.

- Security and Confidentiality: Verify that the provider has robust security measures in place to safeguard your financial data and ensure confidentiality.

- Technology and Infrastructure: Evaluate the provider's technological capabilities, such as accounting software proficiency and infrastructure, to ensure efficient and accurate financial management.

- Client References: Seek references and review feedback from past or current clients to gauge the provider's reliability, responsiveness, and quality of services.

TechBehemoths can assist in choosing the best Finance & Accounting Outsourcing companies for your projects. With a comprehensive directory of over 160 companies offering Finance & Accounting Outsourcing services, TechBehemoths.com simplifies the selection process. At the same time, you should keep in mind that this is an outsourcing service, which means that by contracting a company providing this service, it is possible to lose the location comfort in exchange for a lower price offer.