An Overview of Polish Information & Technology Sector

Recent technological developments in Central and Eastern Europe have brought into the ICT spotlight several countries that stand out in this sector from different perspectives. Be it the number of startups, or unicorns, the amount of skilled professionals in this industry, or the number of companies that provide services both on the local and international market.

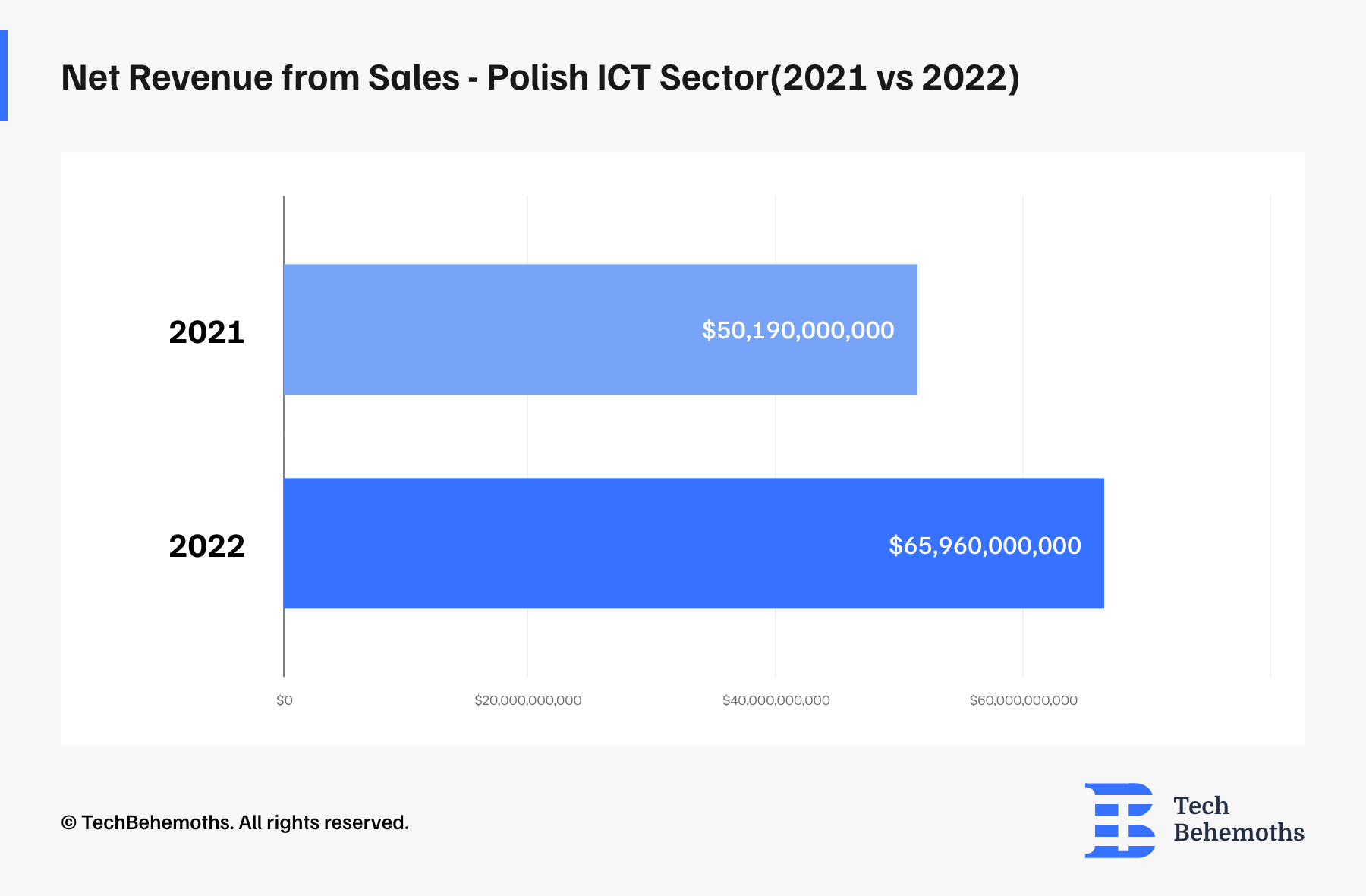

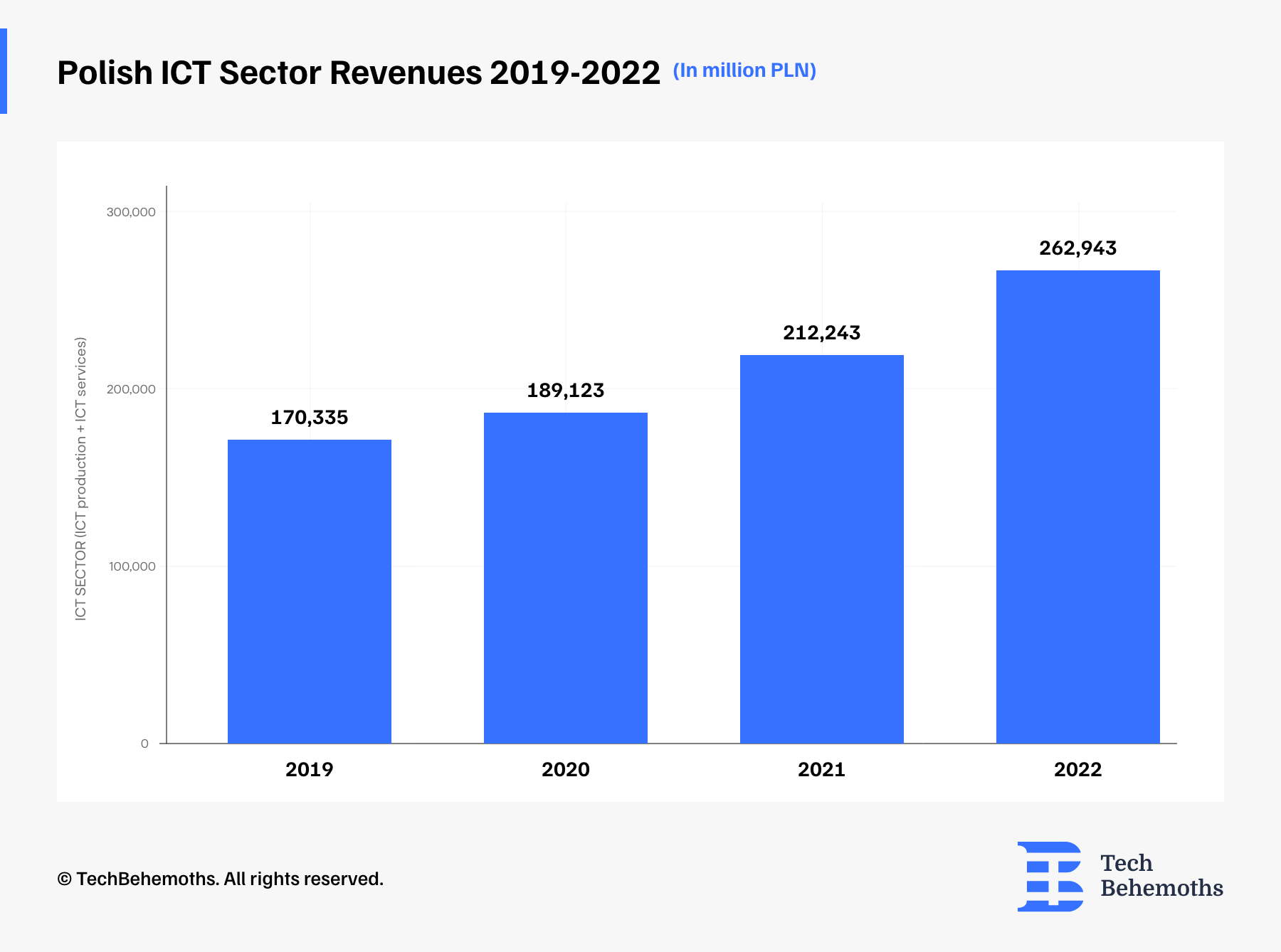

Poland is one of these countries, that seems to have taken the lead in the CEE region. According to the Polish Statistical Bureau, the number of local IT companies with 10 or more employees has grown to 2712 in 2022. According to the same source, more than ¾ of ICT entrepreneurs in Poland provided IT services. Also in 2022, the revenue for Polish ICT companies was PLN 262.9 billion, or its equivalent of USD 65. 96 billion. The Polish Statistical Bureau states that this is an increase of 23.9% compared to 2021.

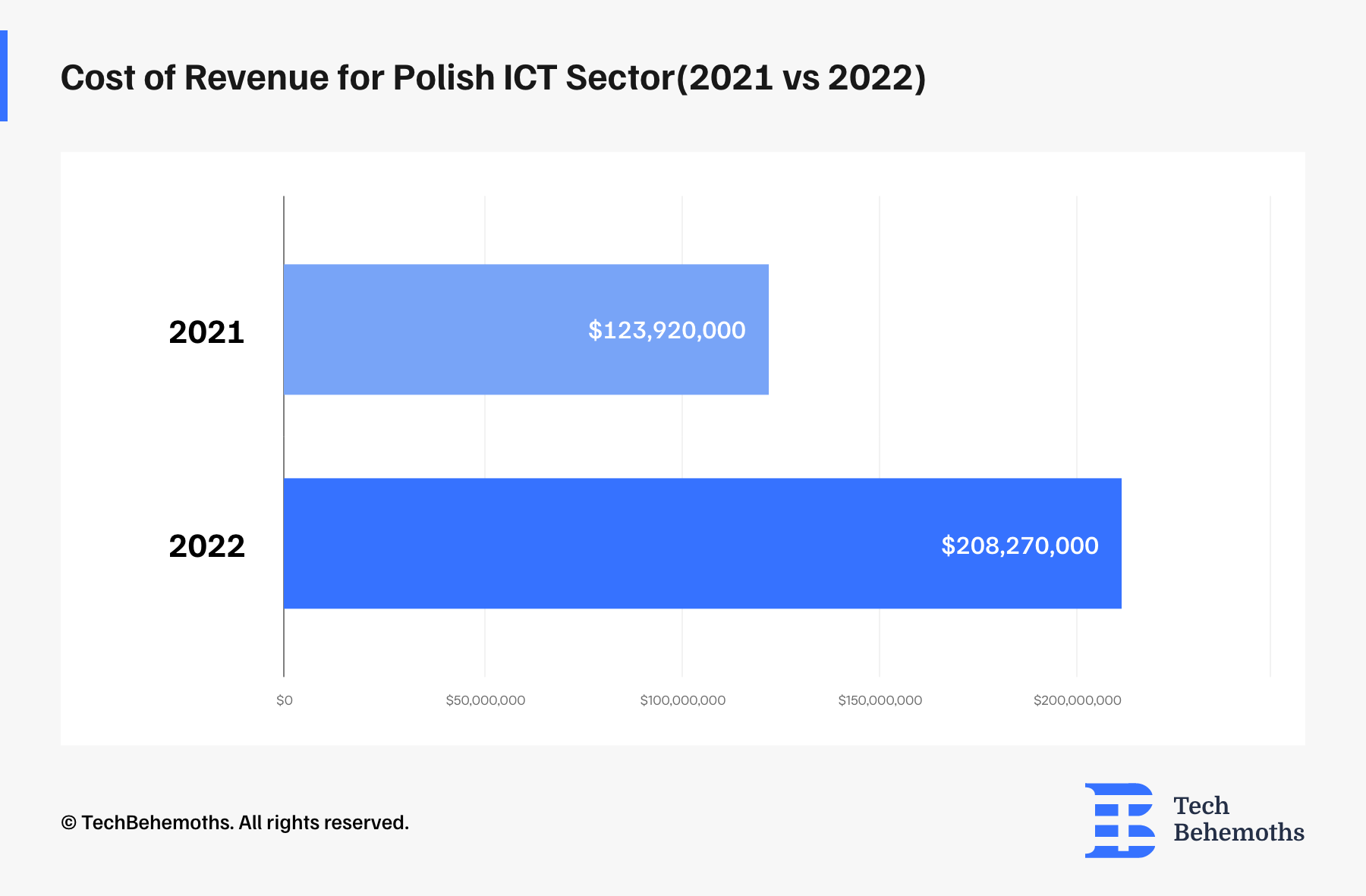

But the net revenue sales growth in 2022 also came with a cost, and that cost consists of $208,27 million, which is 40.5% higher than in 2021. The Polish Statistical Bureau mentioned that 91.8% of this cost in the ICT sector was investments in the R&D that companies made to reach this outbreak.

In other words, the cost of revenue for the Polish ICT sector in 2021 was $123.92 million and reached in the next year $208,27 million.

Polish ICT Usage In Public Administration

Public administrations in Poland are also large consumers of ICT products from the local market. Electronic voting, accessibility, mobile responsiveness, orthophotomaps and building records were among the most important services used by the Polish public administrations by contracting services from local ICT companies.

In 2022, 95.9% of public administration units provided remote access to resources for employees, while 29.9% of workers were equipped with mobile devices with internet access. In the same year, 95.5% of public administration units had a website adapted to be used by mobile devices, and 37.7% showed that the website

was harmonized for foreigners.

According to a recent survey, 27.1% of public administration units have provided online facilities to the citizens for participating in voting and public consultations. Further, as many as 84.1% of public administration units have made spatial data available electronically. In most cases, this data pertains to land and building records (74.9%) and orthophotomaps (63.1%). Additionally, 43.2% of the surveyed units supported the development of digital skills among citizens by providing instructions and advice on using e-government services.

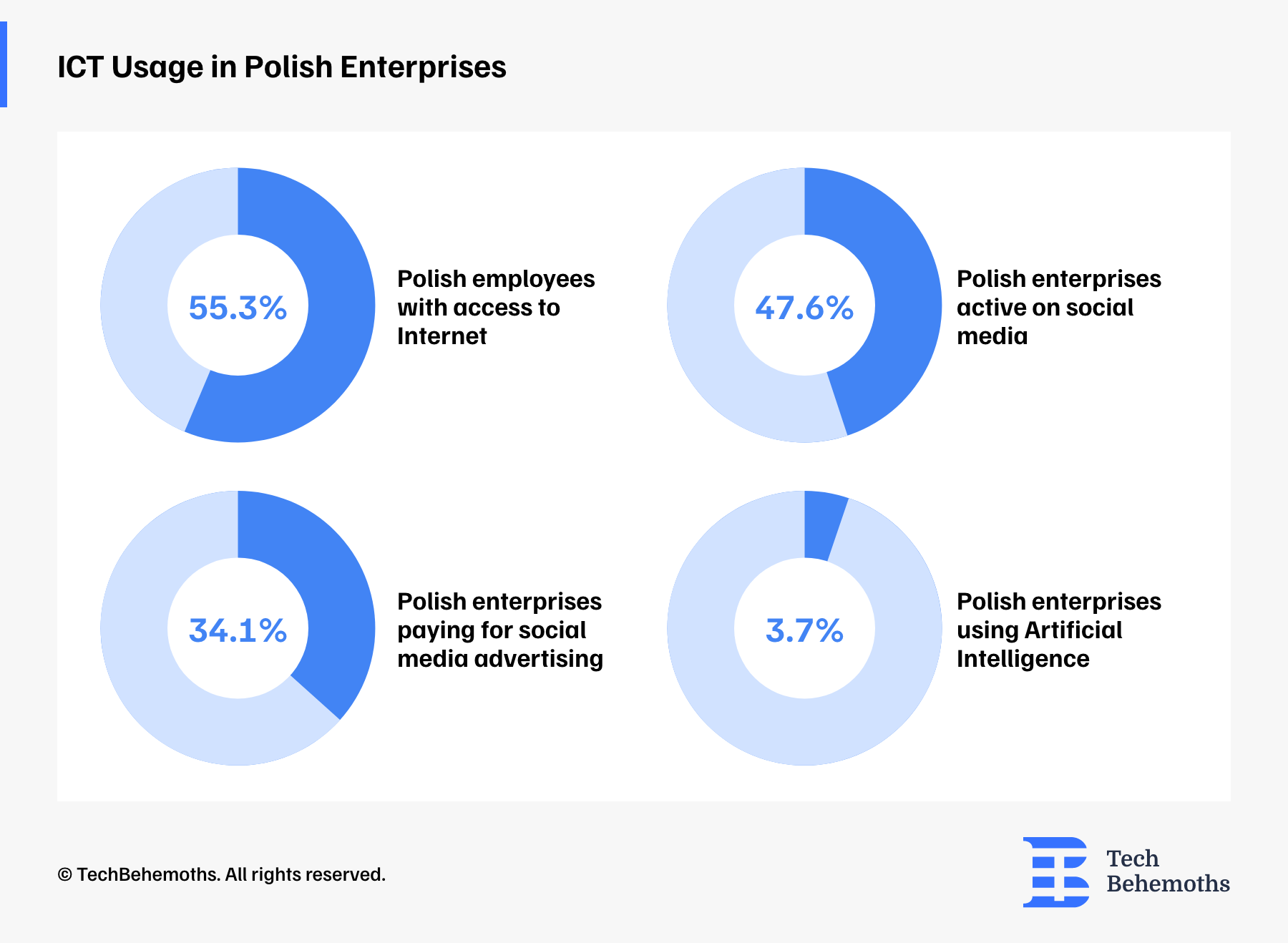

ICT Usage in Polish Enterprises

In 2023, the percentage of entities with broadband access to the Internet amounted to almost 99%, with the highest level was recorded in Opolskie and Lubuskie Voivodships (respectively 99.6% and 99.5%) and the lowest in Warmińsko-Mazurskie (97.8%). The most frequently declared Internet connection speed was: at least 100 but less than 500 Mbit/s (29.7%).

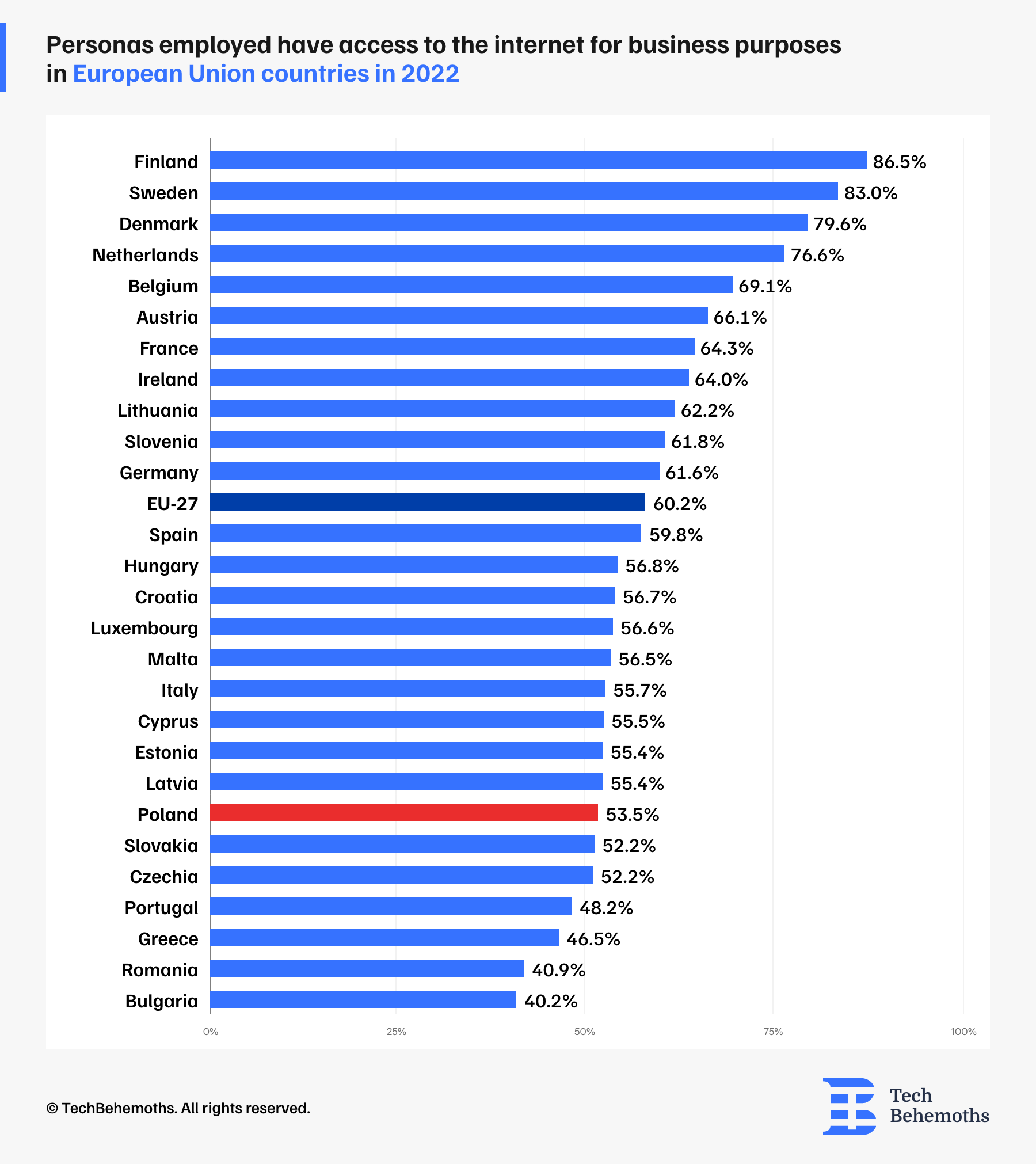

The percentage of employees with access to the Internet amounted 55.3%. More than two-thirds of enterprises had a website (67.3%), which was primarily used to present products, goods and services (62.0%). Almost half of the enterprises were active in social media (47.6%). The main purpose for which they were used was to create the image of the firm or to market products (43.8%). Social networking sites gained

the most popularity among them (46.7%). In 2023, every fifth enterprise paid for advertising on the Internet, most often large entities (34.1%). Large companies also dominated among entities using artificial intelligence technologies (3.7% in the country overall). Almost a quarter of them used this type of solutions (24.4%). In 2022 18.0% of companies conducted e-commerce sales

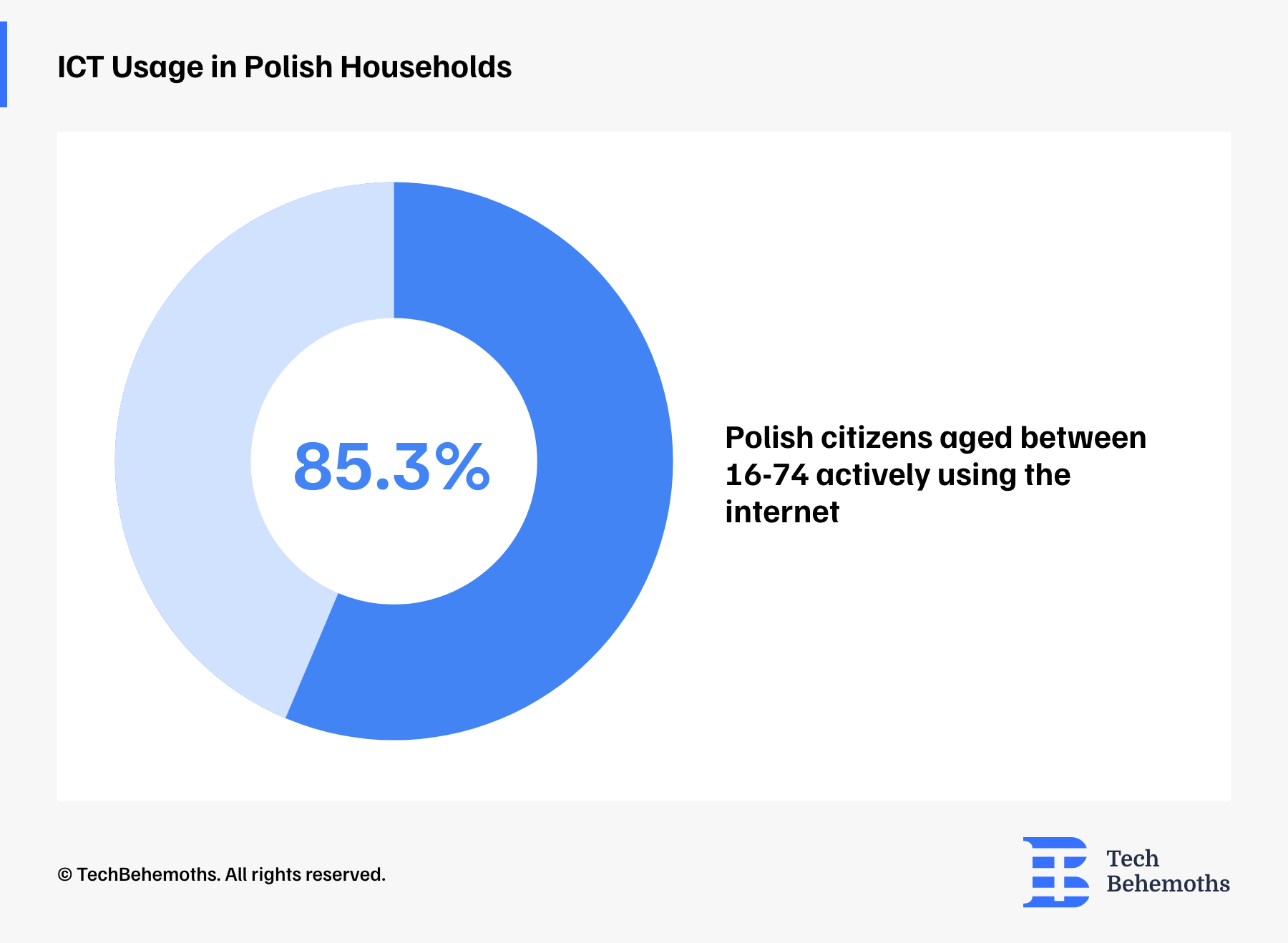

ICT Usage in Polish Households

In 2023, 93.3% of households had access to the Internet at home, that is, the same as in the previous year. The percentage varied depending on the type of household, degree of urbanization, place of residence, and region. Households with children had access to the Internet more frequently than the ones without them. The percentage was also slightly higher in large cities than in smaller cities and rural areas, as well as in Central Poland compared to Western and Eastern regions of the country. In the year 2023, almost 93% of households in Poland had broadband access to the Internet at home, that is, by 0.2 percentage points more than in the previous year.

According to the data, in the year 2023, around 85.3% of individuals aged between 16 to 74 years regularly used the internet. However, it was observed that there were differences in the usage rate based on factors such as age, employment status, education level, and place of residence. The highest percentage of regular internet users were found in the age group of 16-24 years (98.9%), among pupils and students (99.8%), individuals with tertiary education (98.4%), and people living in large cities (91.7%). The residents of Central Poland had a higher percentage of regular internet users compared to those in other regions.

In 2023, 64.3% of people aged 16-74 in Poland purchased goods or services online within the past year. The region with the highest percentage of people buying goods or services for personal use was Małopolskie Voivodship, with 70.7%. Additionally, 58.5% of people used e-government services, with obtaining information from public authority websites being the most popular way of using these services. The region with the highest percentage of people using e-government services was Śląskie Voivodship, with 68.5%.

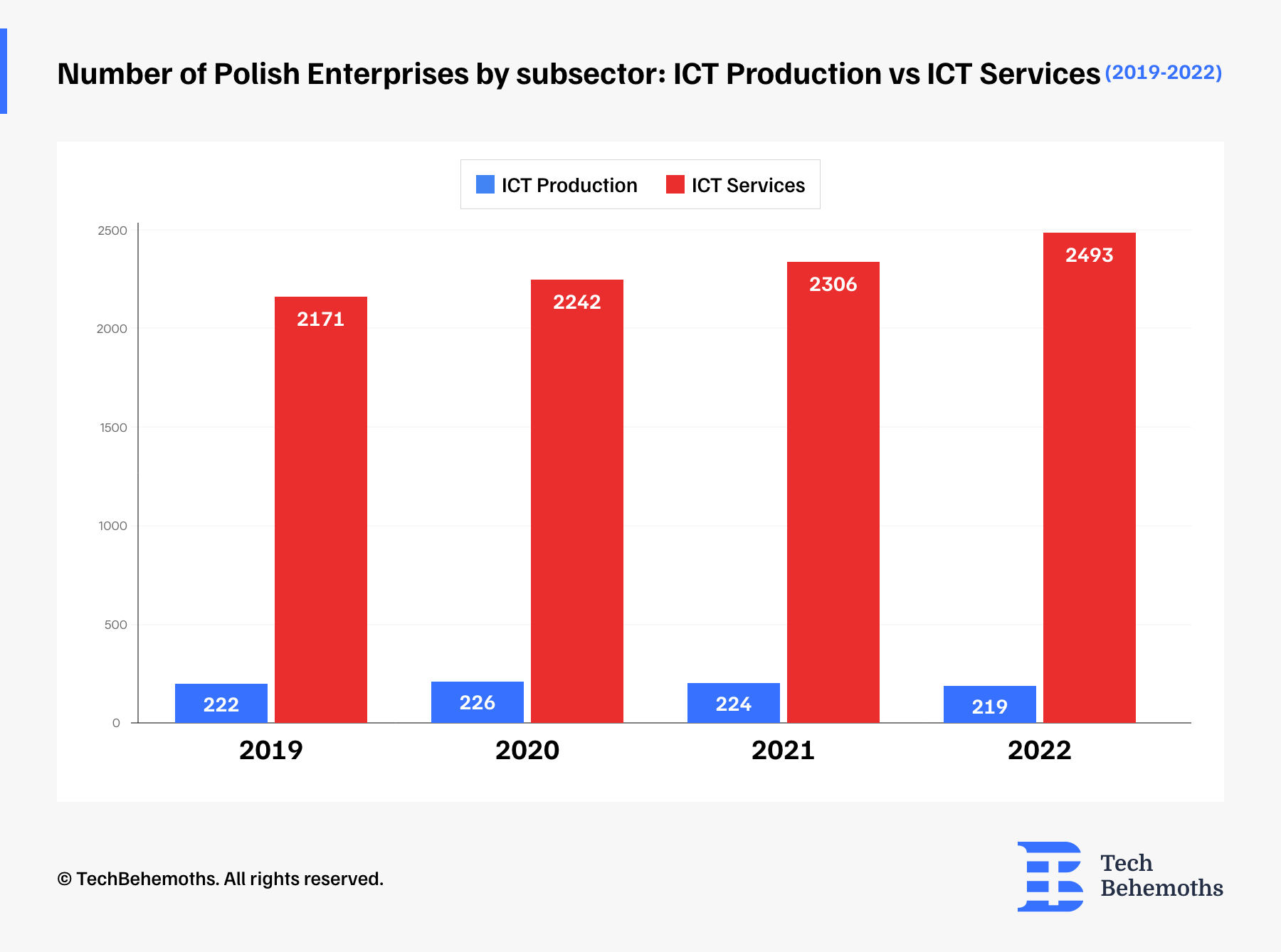

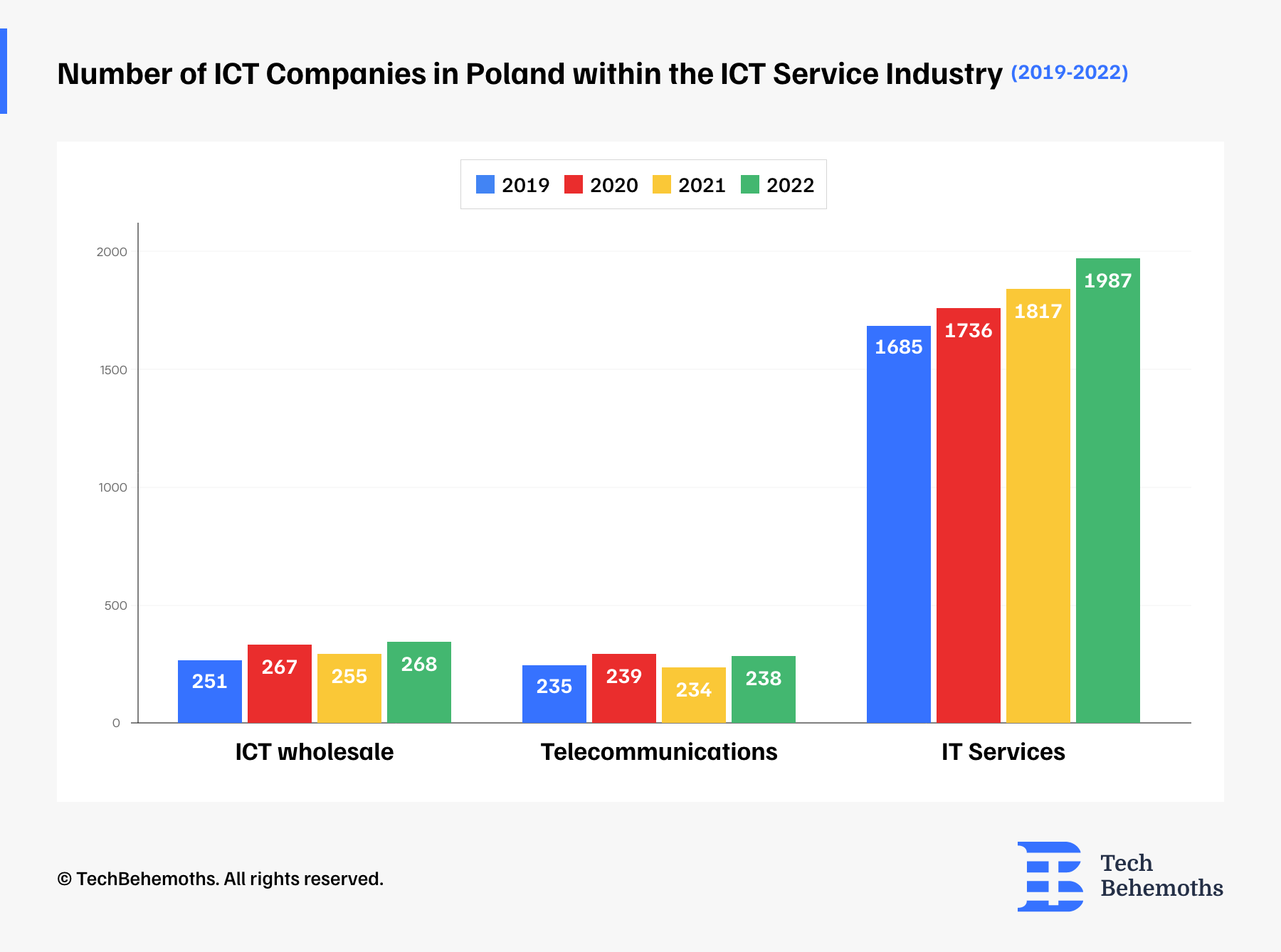

The Structure of the Polish ICT Sector

In 2022, the number of ICT sector enterprises increased by 7.2% compared to the previous year. The overall increase was driven by ICT service providers, whose number was 8.1% higher than a year earlier. The number of manufacturing enterprises, on the other hand, decreased by 2.3%.

Service enterprises accounted for 91.9% of ICT sector enterprises, and the majority of them (79.7%) specialized in IT services. The number of people employed in the ICT sector increased by 11.2% year-on-year. The increase in employment in the ICT services sector was even higher, at 12.2%. Compared to 2021, the largest increase in the number of employees in service enterprises was observed among entities providing IT services (15.1%). People employed in services accounted for 87.7% of the workforce of the entire ICT sector.

In addition the following statistics relate about the structure of the Polish ICT:

-

The number of ICT enterprises in Poland increased from 142,000 in 2021 to 151,000 in 2022.

-

The number of people employed in the ICT sector in Poland increased from 500,000 in 2021 to 555,000 in 2022.

-

The ICT sector accounted for 7.2% of GDP in Poland in 2022.

Polish ICT Industry: Revenues

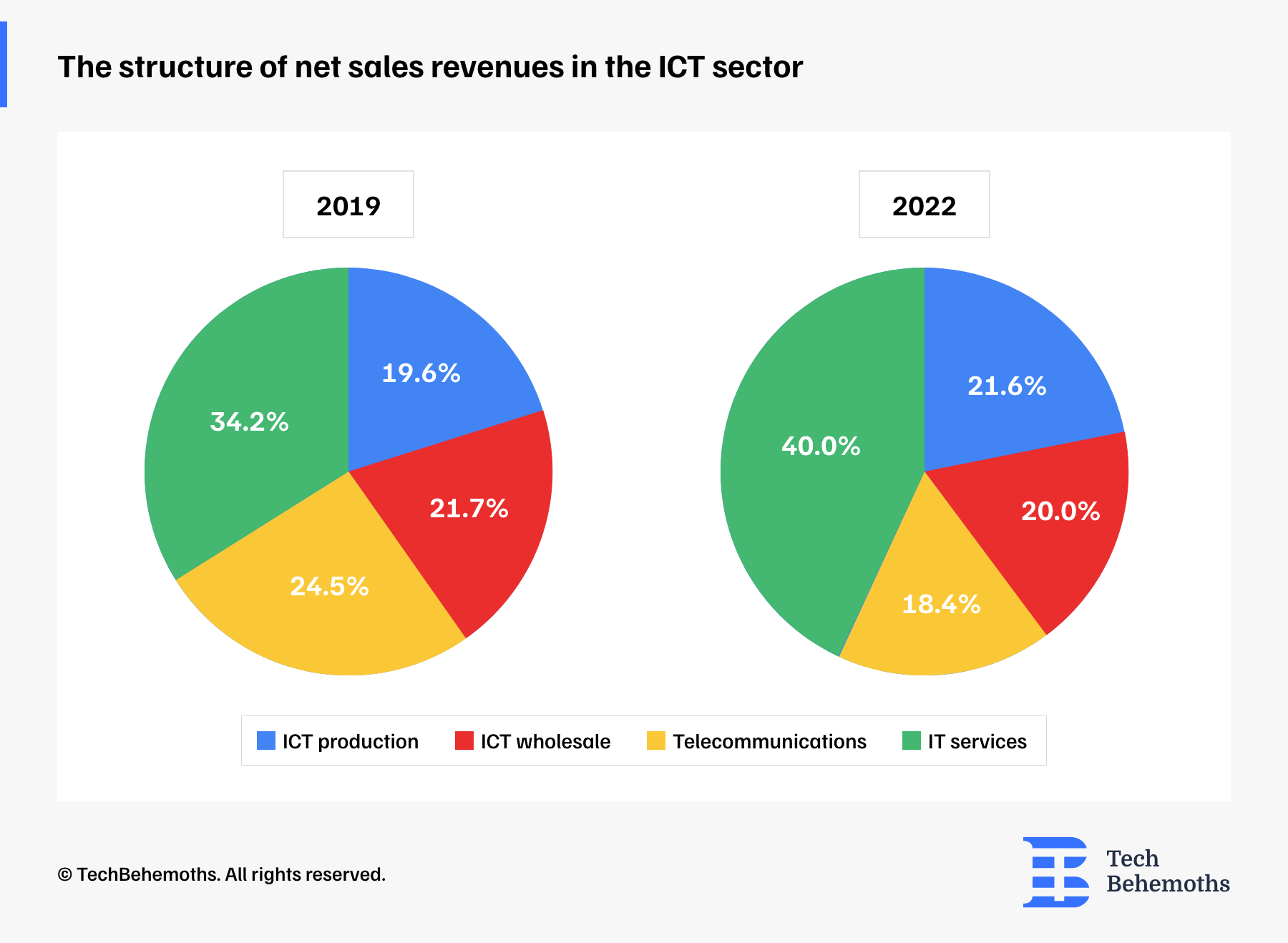

In 2022, net sales revenue of ICT sector enterprises amounted to PLN 262.9 billion and increased by 23.9% compared to the previous year. In manufacturing enterprises, there was an increase of 13.5%, while in service enterprises - 27.0%. In 2022, sales revenue of ICT service providers accounted for 78.8% of ICT sector revenue. Over one third was generated by IT services companies (40.1%).

In 2022, the revenue of ICT sector enterprises accounted for 5.2% of the revenue generated by manufacturing and service companies in Poland, i.e. by 0.1 percentage points less than a year earlier. The revenue of entities providing ICT services accounted for 7.1% of the revenue of all service entities in Poland, i.e. by 0.2 percentage points more than a year earlier. The revenue of companies producing ICT products accounted for 2.6% of the revenue of entities engaged in manufacturing in Poland, i.e. by 0.4 percentage points less than a year earlier.

In 2022, IT services companies generated over one third of the revenue in the ICT sector (40.0%, i.e. 3.1 percentage points more than a year earlier). In second place were companies producing ICT products with a result of 21.6% (1.5 percentage points less than a year earlier).

In 2022, net sales revenue from exports generated by entities classified as part of the ICT sector amounted to PLN 93.7 billion and increased by 23.5% year-on-year. In manufacturing companies, there was an increase of 11.7%, and in service companies - 31.6%. Export revenues generated by service companies accounted for almost two-thirds of the revenues of the entire ICT sector (63.2%). The revenues of the ICT sector constituted 7.2% of the value of the entire export - by 0.3 percentage points less than a year earlier.

Operating costs in the ICT sector enterprises

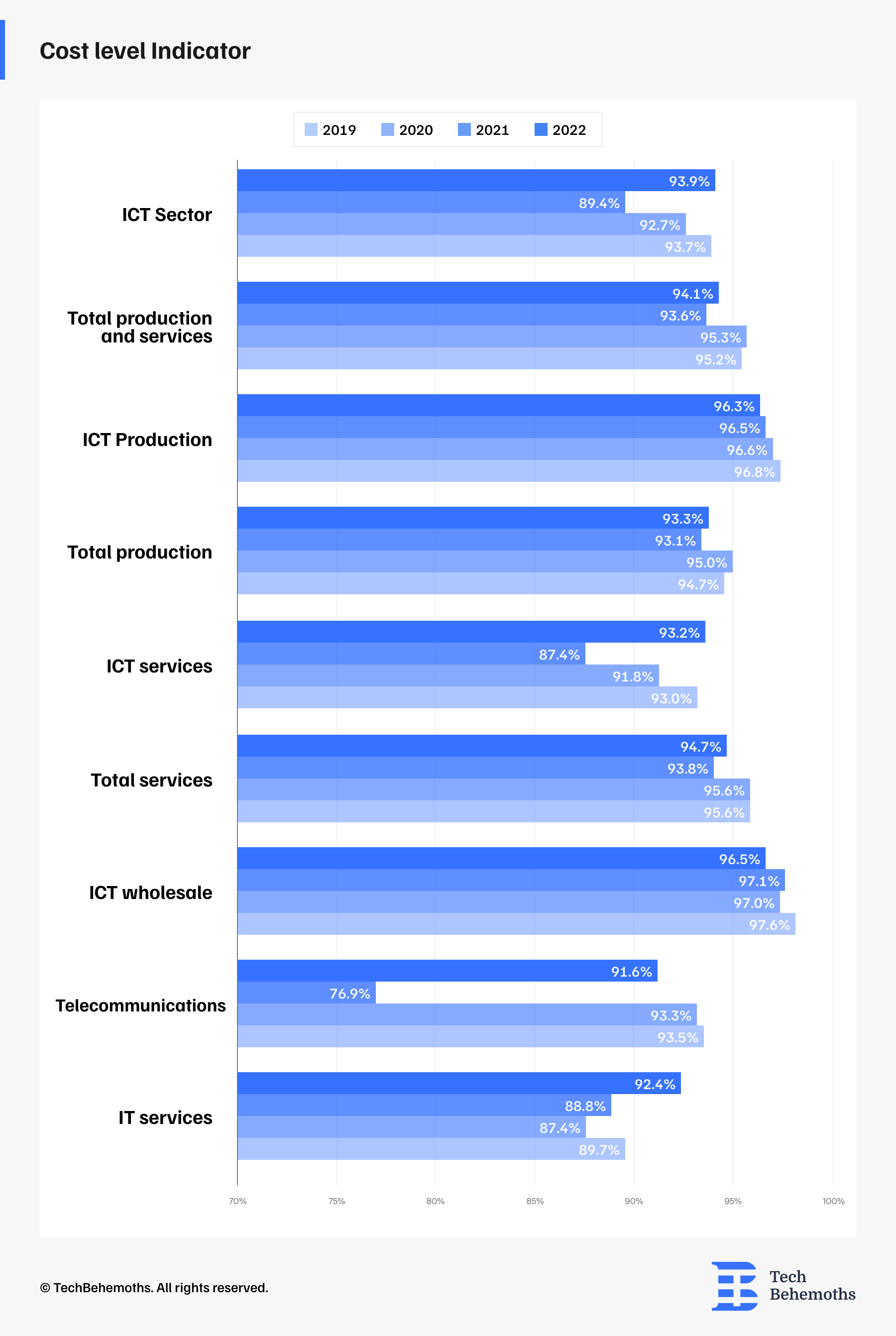

In 2022, the cost level indicator for the ICT sector was 93.9%, i.e. 4.5 percentage points higher than a year earlier. In entities providing ICT services, it increased by 5.8 percentage points, while among companies producing ICT products it decreased by 0.2 percentage points. The largest increase year-on-year was recorded in telecommunications companies - by 14.7 percentage points. In 2022, ICT service providers were characterized by a lower level of the indicator compared to all service entities in Poland. Among companies producing ICT products, the cost level indicator was higher than for all manufacturing companies in Poland.

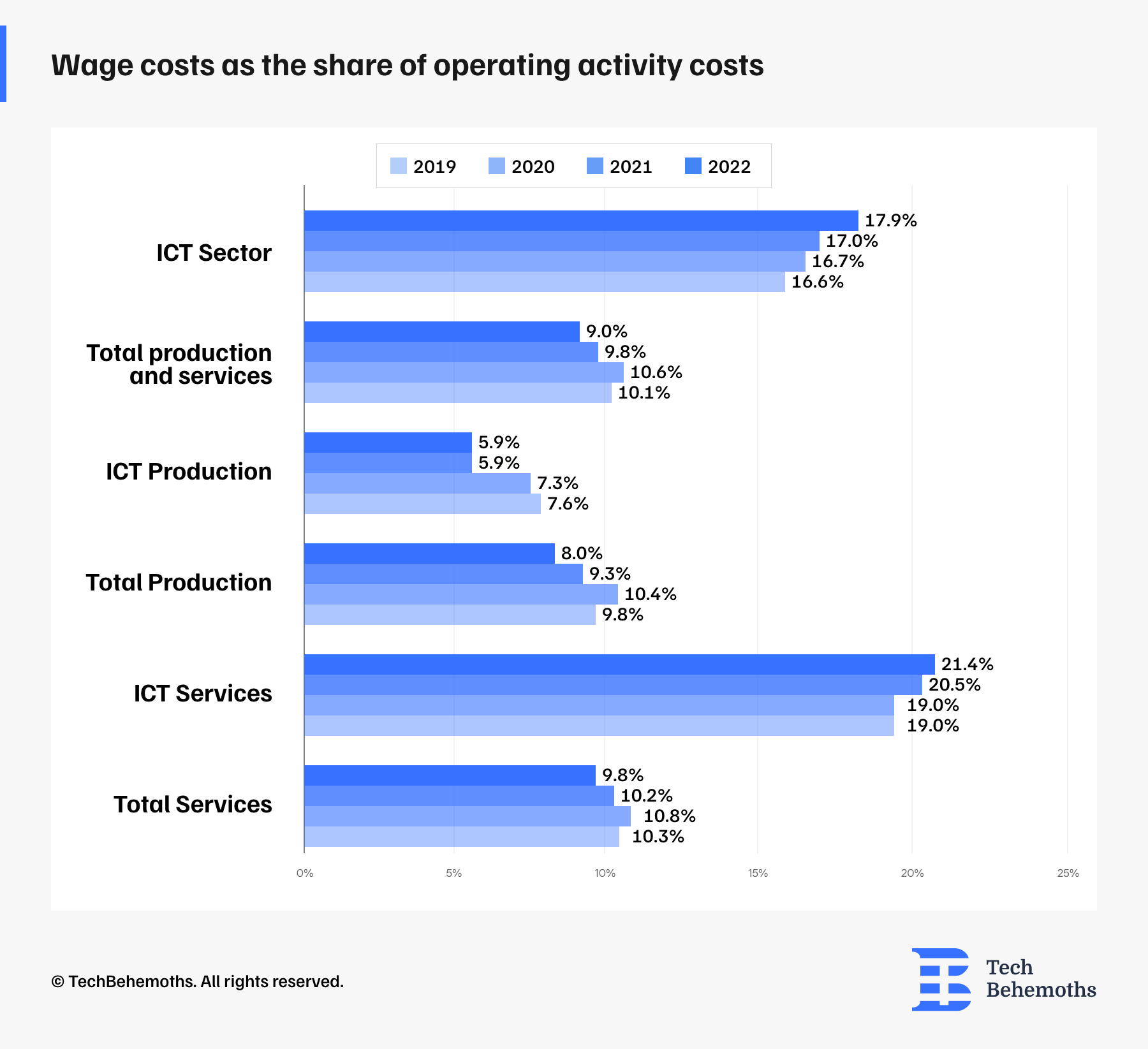

In 2022, the share of wage costs in operating costs in the ICT sector increased by 0.9 percentage points year-on-year to 17.9% and was almost twice as high as the indicator measured for all manufacturing and service companies. A similar relationship occurred between the group of companies providing only ICT services and the group of service companies. The share of wage costs in operating costs among companies providing ICT services increased by 0.9 percentage points year-on-year and amounted to 21.4%. Among companies producing ICT products, the level of the indicator remained unchanged and amounted to 5.9%.

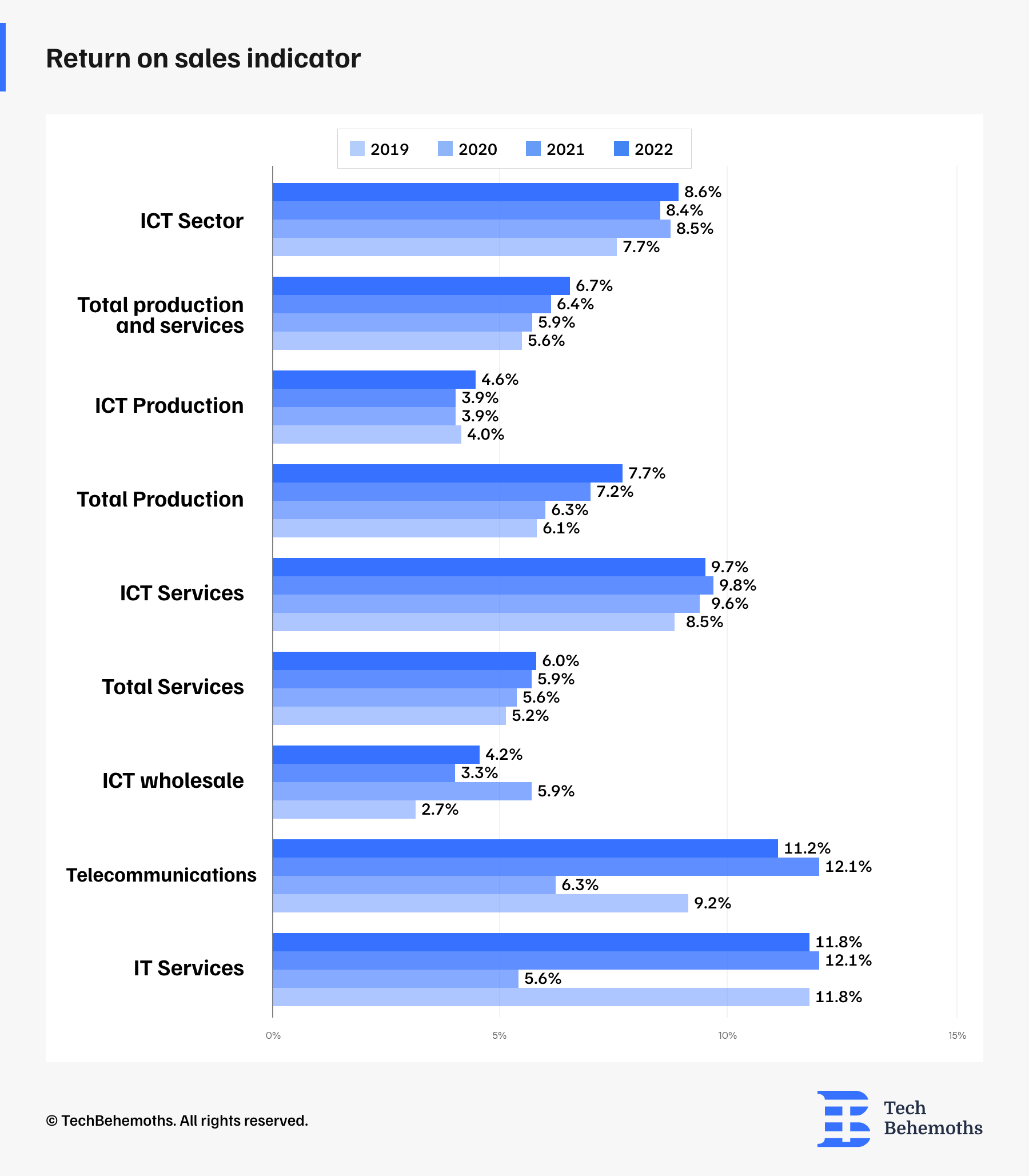

Return on sales in the Polish ICT sector

In 2022, the profitability indicator of ICT sector enterprises increased by 0.2 percentage points year-on-year to 8.6%. The profitability of the ICT sector was almost 2.0 percentage points higher than the profitability measured for all industrial and service companies. Compared to 2021, the profitability indicator increased both in the entire production sector and among companies producing ICT products (by 0.5 percentage points and 0.7 percentage points, respectively). Among companies providing ICT services, the indicator decreased by 0.1 percentage points, but it was still higher than for all service companies in Poland (by 3.7 percentage points). The highest value of the indicator among ICT sector enterprises was recorded by companies providing IT services and telecommunications services (11.8% and 11.2%, respectively).

Product and business process innovations in the Polish ICT sector

Product Innovation is defined as the introduction of a new or improved product or service to the market. This includes significant advancements in technical specifications, components and materials, embedded software, ease of use, and other functional features.

Business Process Innovation, on the other hand, refers to the implementation of new or improved processes within a company, across one or more business functions, that significantly change the way things are done.

Between 2020 and 2022, nearly every third enterprise in Poland (32.2%) introduced product innovations or business process innovations. Among entities classified as part of the ICT sector, it was almost every second enterprise. Both in the production of ICT products and in ICT services, business process innovations were more often introduced.

According to GUS, in 2022, in ICT sector enterprises, revenues from sales of new or improved products accounted for 14.3% of total sales revenues, i.e. 2.7 percentage points less than a year earlier. This indicator for all enterprises was 5.0%, i.e. 1.2 percentage points less than a year earlier.

Polish ICT products

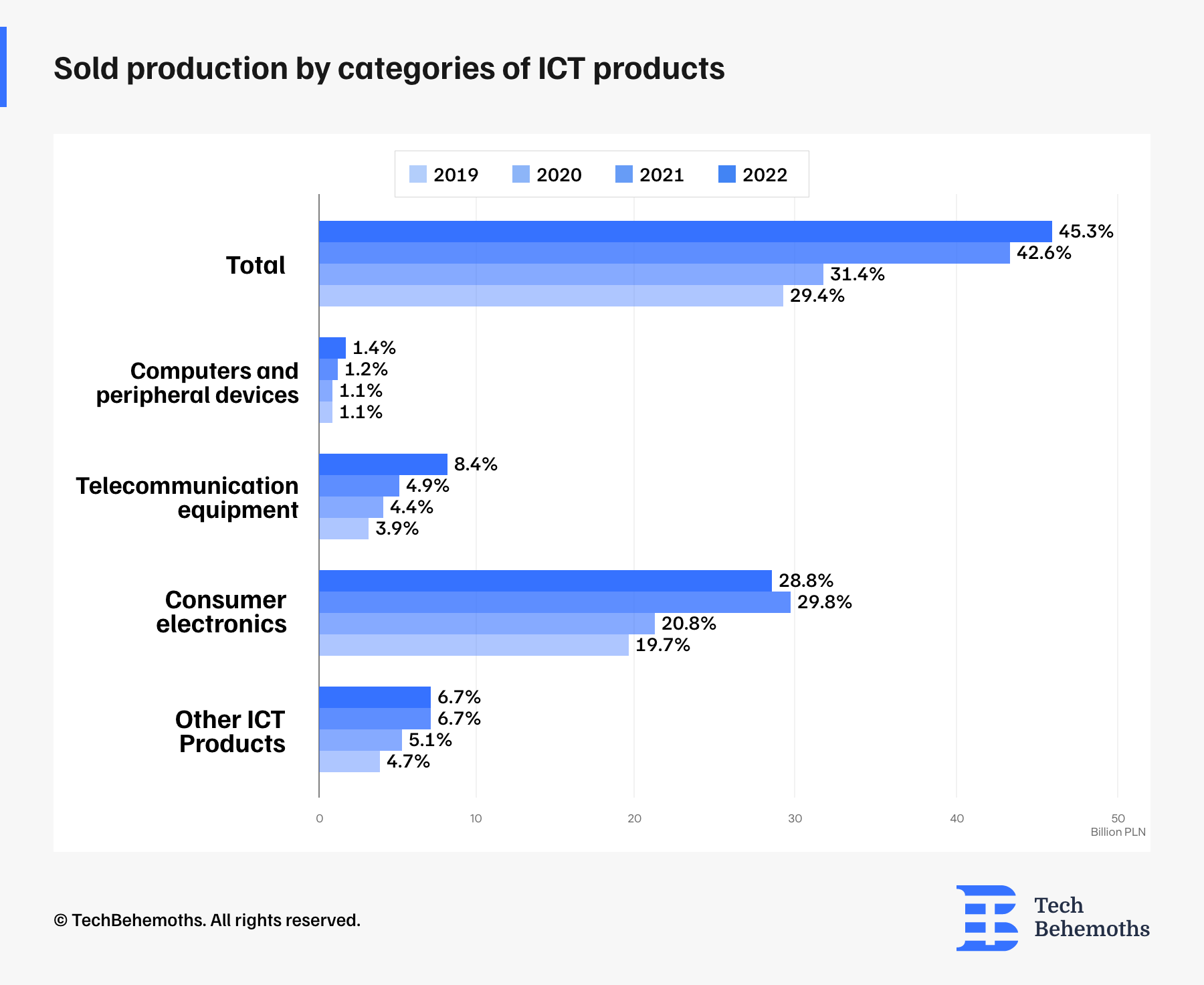

Sold Production is the value of revenue obtained from finished products sold during the year, coming from own production and production commissioned to be carried out in another enterprise, regardless of the time of production. The value of sold production is shown in basic prices, i.e. without the value added tax (VAT) and excise duty, and together with the value of subsidies for products and services. The development of new technologies affects changes in demand for some ICT products, which necessitates the adaptation of the offer of enterprises producing these products to the current market needs.

In 2022, the total value of sold ICT products amounted to PLN 45.3 billion and increased by 6.3% compared to 2021. The largest increase was recorded in the category of telecommunications equipment - by 71.4%. The only decrease was in the category of electronic consumer goods - by 3.4%

Access to the Internet in Polish enterprises

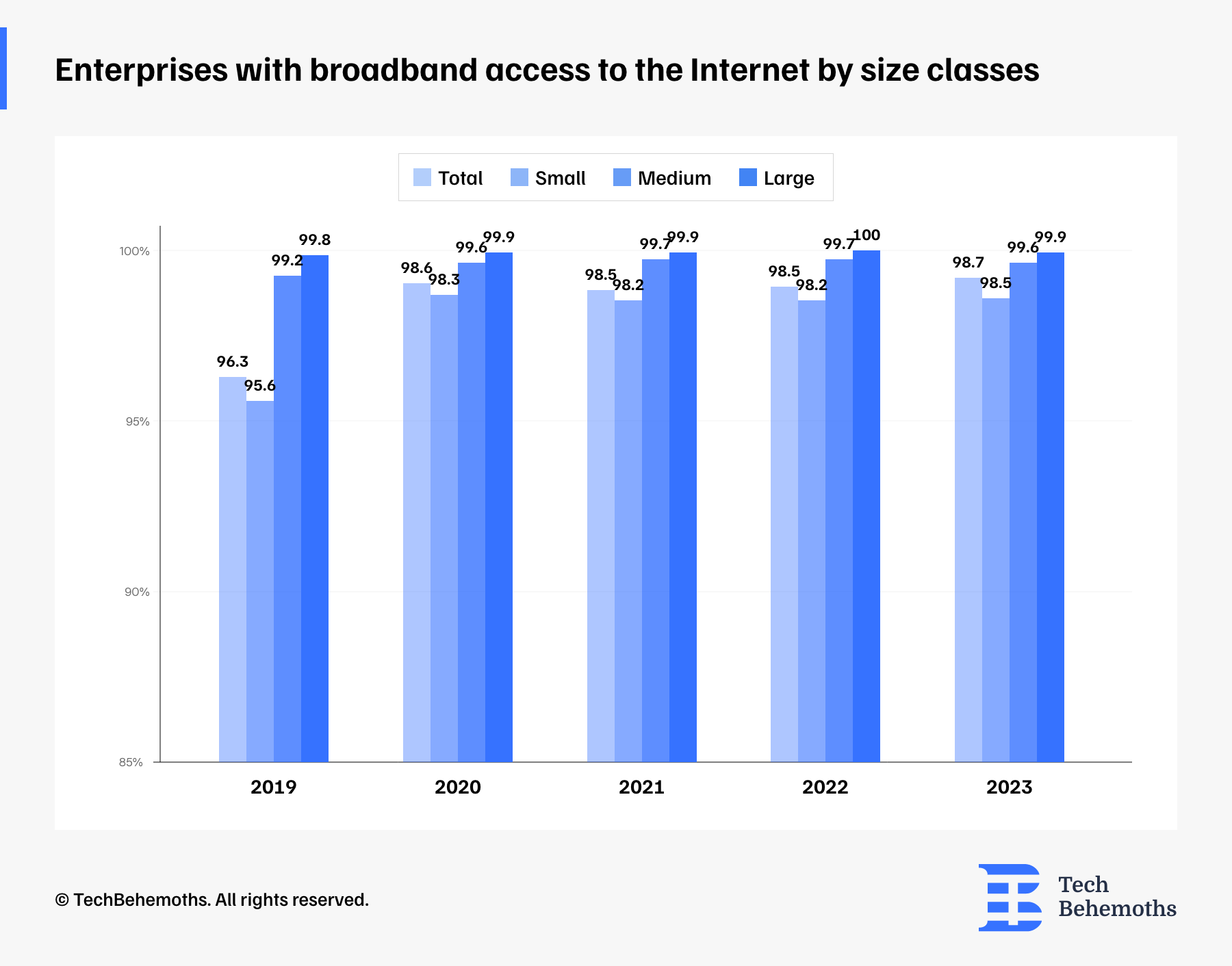

Between 2020 and 2023, the percentage of enterprises with broadband internet access nationwide exceeded 98%. The high level of the indicator indicates an unabated interest in the benefits of connecting to the global network. Among large enterprises, this value oscillated around 100%.

The highest percentage of enterprises with broadband internet access was in the Opole voivodeship (99.6%), the lowest - in the Warmian-Masurian voivodeship (97.8%).