Lithuanian Unicorns - An Overview of Vinted and Nord Security

As we discussed previously in our article about Lithuania’s startup ecosystem, the Baltic country is one of the fastest-growing in terms of startups in the CEE reion but also in Europe. Counting more than 800 startups in 2022 only, Lithuania has a huge potential in delivering to the world some of the most promising unicorns as well.

But, by 2024 local and international specialized publications say that Lithuania has only 2 unicorns, as most of the local startups are aiming to grow relying on sole profit and not VC investments. That’s their right, and thus some of the names such as the portal Skelbimai that was circulating as potential unicorn have been kicked off the list of unicorns. The reason - the group is listed on the London Stock Exchange from 2021, and such companies are not considered unicorns.

Therefore, we will be analyzing the two Lithuanian-based unicorns - NordSecurity and Vinted

Nord Security - Unicorn Profile

NordSecurity is a major player in internet privacy and security solutions, was founded in 2012 by Tom Okman and Eimantas Sabaliauskas. The company, headquartered in Lithuania, started on its journey with a vision to create advanced security tools, contributing to a safer online future. Over the years, NordSecurity has developed a suite of security products, including NordVPN, NordPass, NordLocker, and NordLayer, catering to both consumer and enterprise needs.

The company's financial trajectory saw a significant milestone in 2022 when it raised $100 million in its first external investment round. This funding round was led by Novator Ventures, with participation from Burda Principal Investments and General Catalyst. Notably, this investment round marked a pivotal moment for NordSecurity, valuing the company at $1.6 billion and earning it the status of a tech unicorn, the second in Lithuania's history. This achievement underscored NordSecurity's robust position in the cybersecurity domain and its commitment to innovation and excellence in internet security.

Further increasing its financial and market position, NordSecurity secured an additional $100 million in funding in a subsequent round led by Warburg Pincus. This round increased the company's valuation to an impressive $3 billion. This capital infusion was crucial for expanding the company’s product lineup and facilitating growth through mergers and acquisitions.

Throughout its journey, NordSecurity has maintained a focus on developing cutting-edge security and privacy tools. The company's rise to unicorn status and its subsequent growth in valuation reflect its strong market presence, commitment to innovation, and the trust it has garnered from its investors and users worldwide.

Nord VPN - most popular VPN service as of 2023

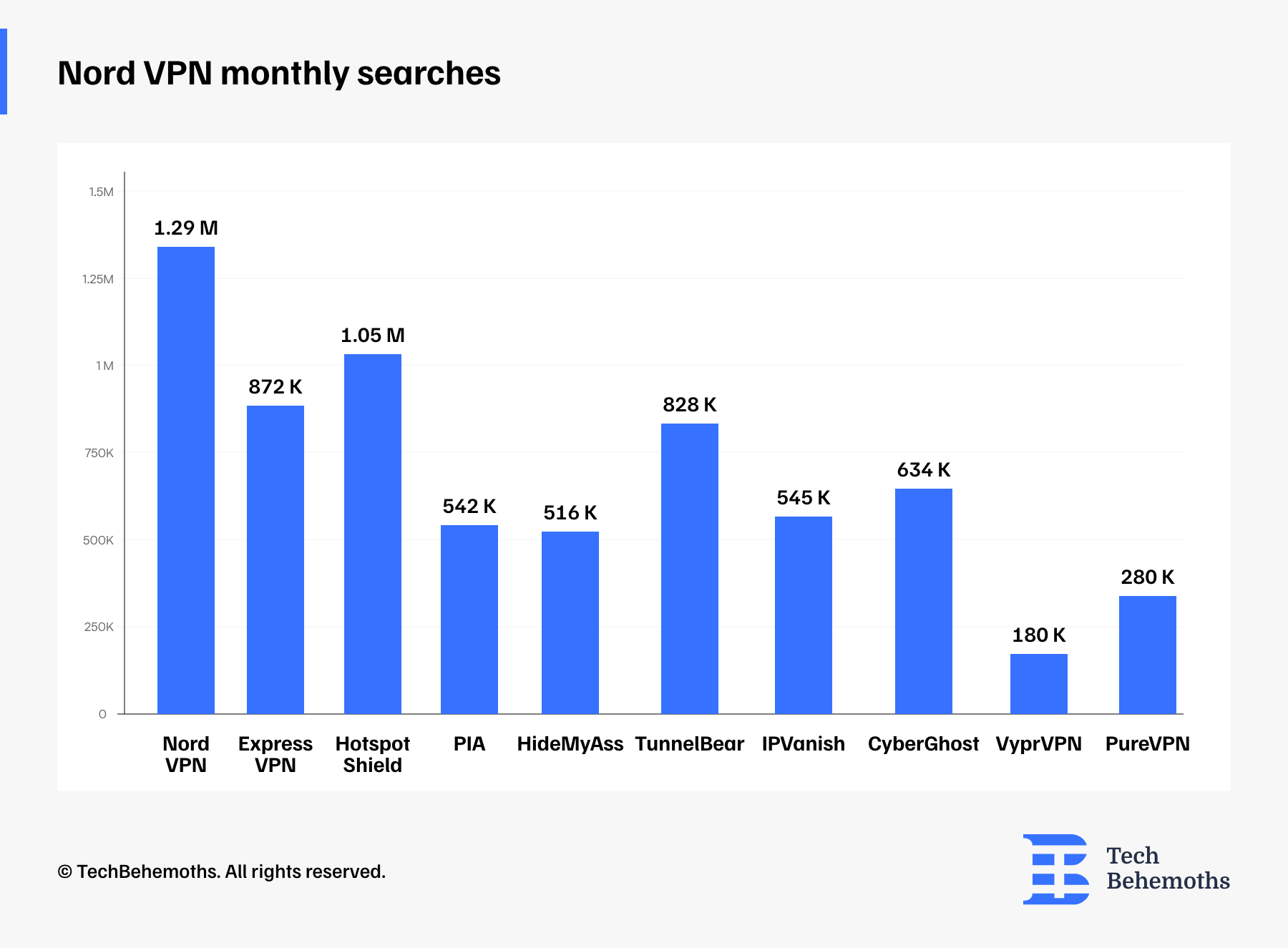

According to PCMagazine, NordVPN has the highest search rates on the web, with 1.29M searches per month.

NordVPN is one of the NordSecurity products, but it was founded back in 2012

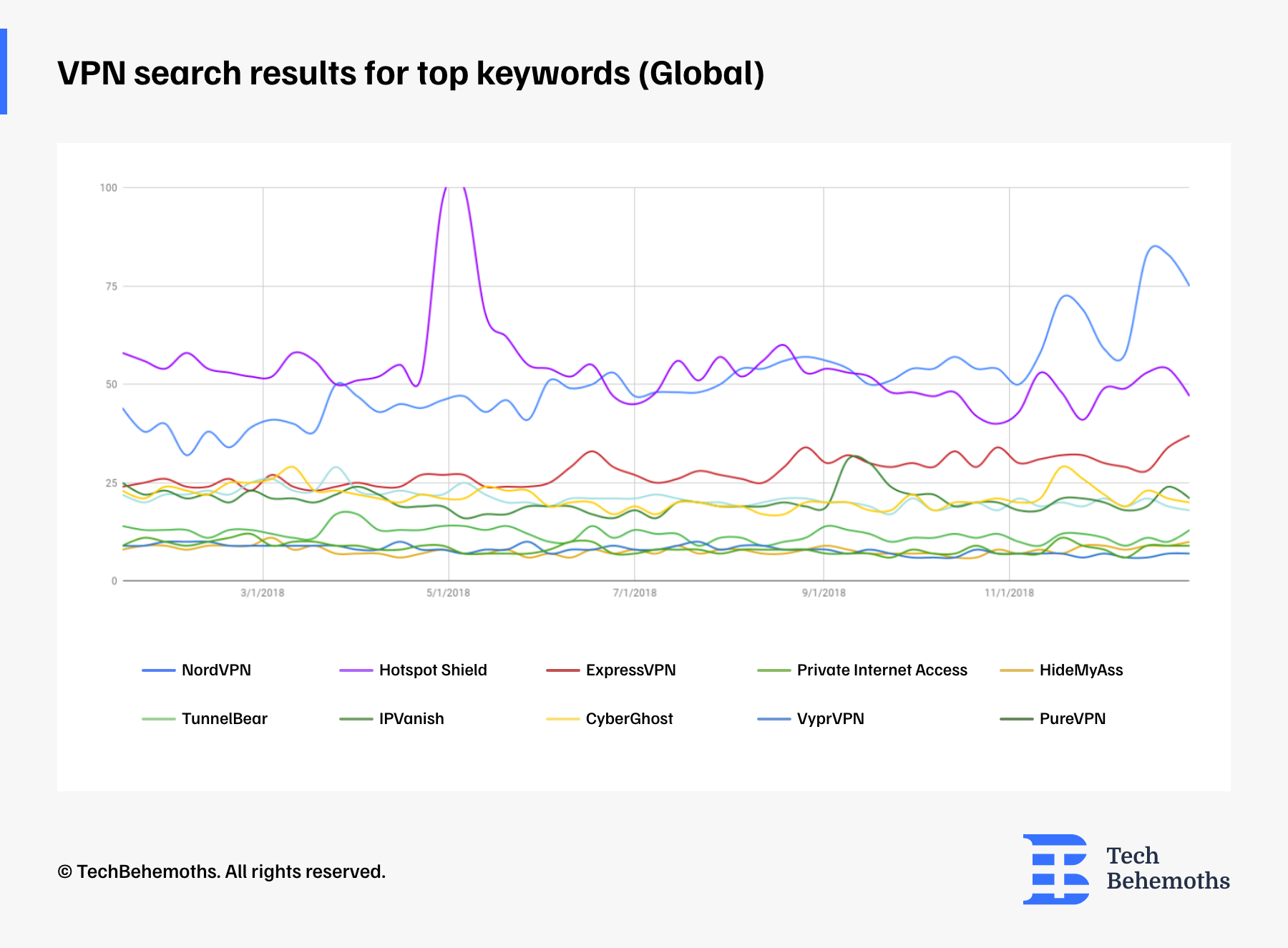

At the same time, NordSecurity invested in NordVPN online visibility and reputation, as it comes out most often the first result on search engines for keywords like “the best VPN” and “free VPN”.

Vinted - Unicorn Profile & Data

Vinted is another Lithuanian unicorn, that works as an online marketplace for secondhand clothing and accessories, was founded in 2008 by Milda Mitkute and Justas Janauskas in Vilnius, Lithuania. Initially, it was a platform for Lithuanian women to trade clothes, but it soon expanded to other markets, including Germany under the brand Kleiderkreisel. A significant milestone in the company's history was the launch of its mobile app in 2012, developed in partnership with Lemon Labs, which led to a substantial increase in its traffic.

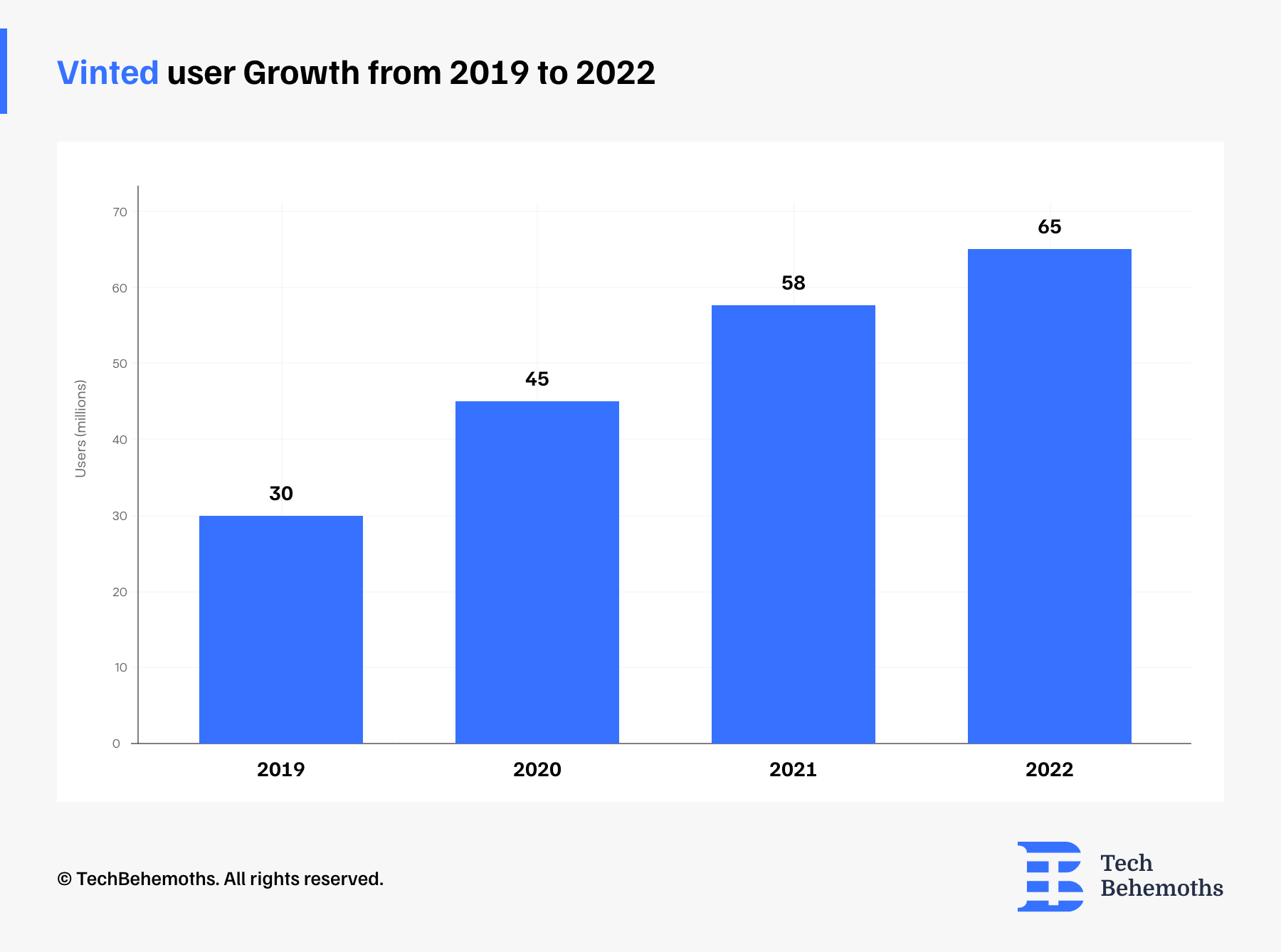

The company achieved unicorn status in 2019, becoming Lithuania's first tech unicorn, after raising €128 million in a funding round that valued it at €1 billion. This round was led by Lightspeed Venture Partners. In October 2020, Vinted acquired United Wardrobe, a Dutch competitor, further expanding its market presence. As of December 2023, Vinted operates in twenty-one countries and has over 65 million registered users.

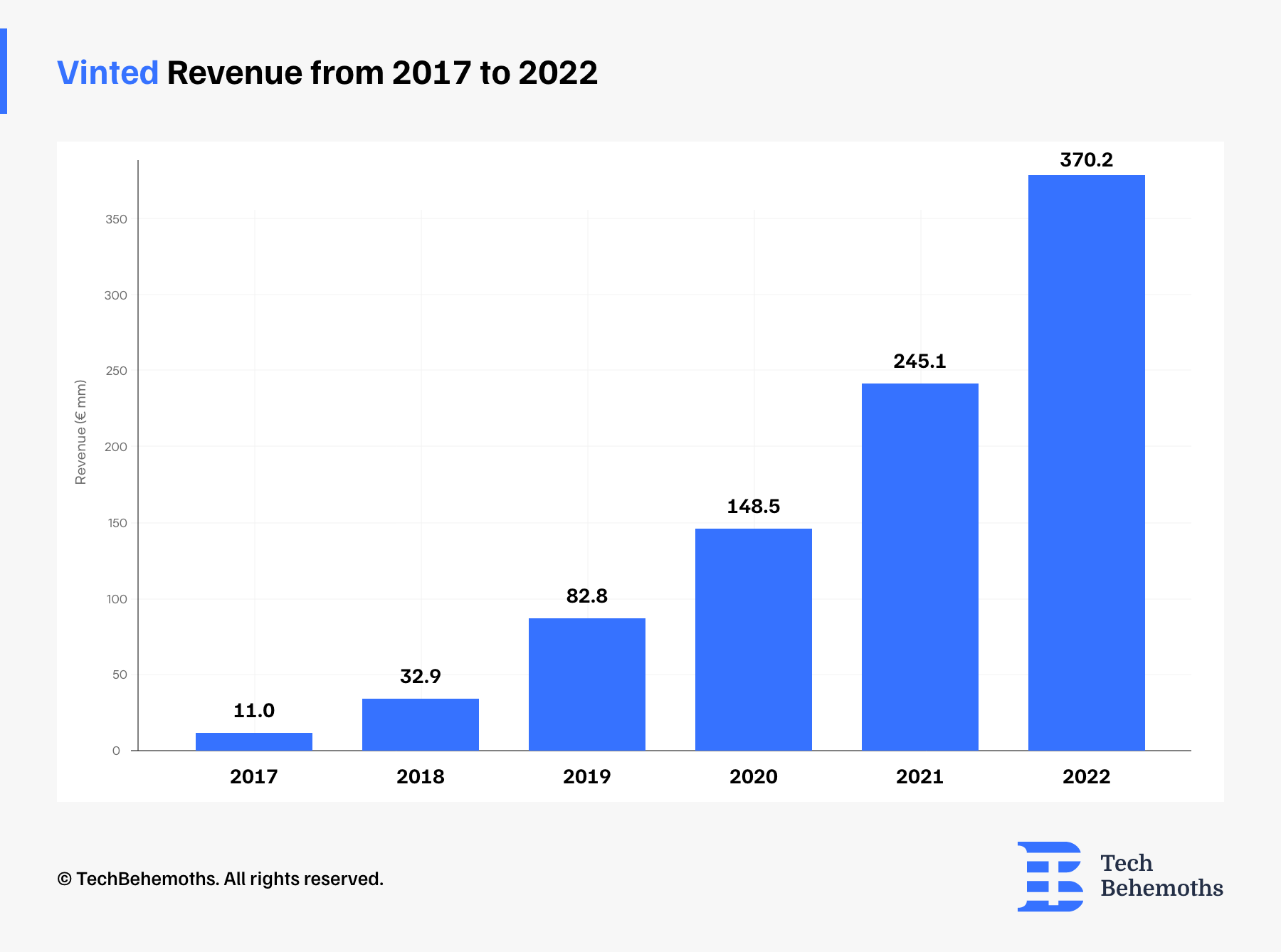

The business model of Vinted includes charging buyers a service fee on each purchase and allowing sellers to pay for additional features like bumping listings or spotlighting their wardrobes. This revenue generation strategy, coupled with its significant market expansion, underscores Vinted's growth in the competitive online marketplace for secondhand goods.

As of 2021, it was reported that Vinted held a nearly 40% share of the resale market in Europe. This impressive market presence is underscored by its gross merchandise volume (GMV) of approximately €2.75 billion. By 2030, it's anticipated that the resale market will be twice the size of the fast fashion market, a testament to the rising consumer interest in sustainable and second-hand fashion options, and Vinted has all the chances to keep the market share and its position.

Vinted's leadership in this market segment is further highlighted by its top ranking among the 'Top 100 Cross-Border Sustainable Marketplaces operating in Europe', a study that evaluates marketplaces based on various sustainability criteria and business practices.

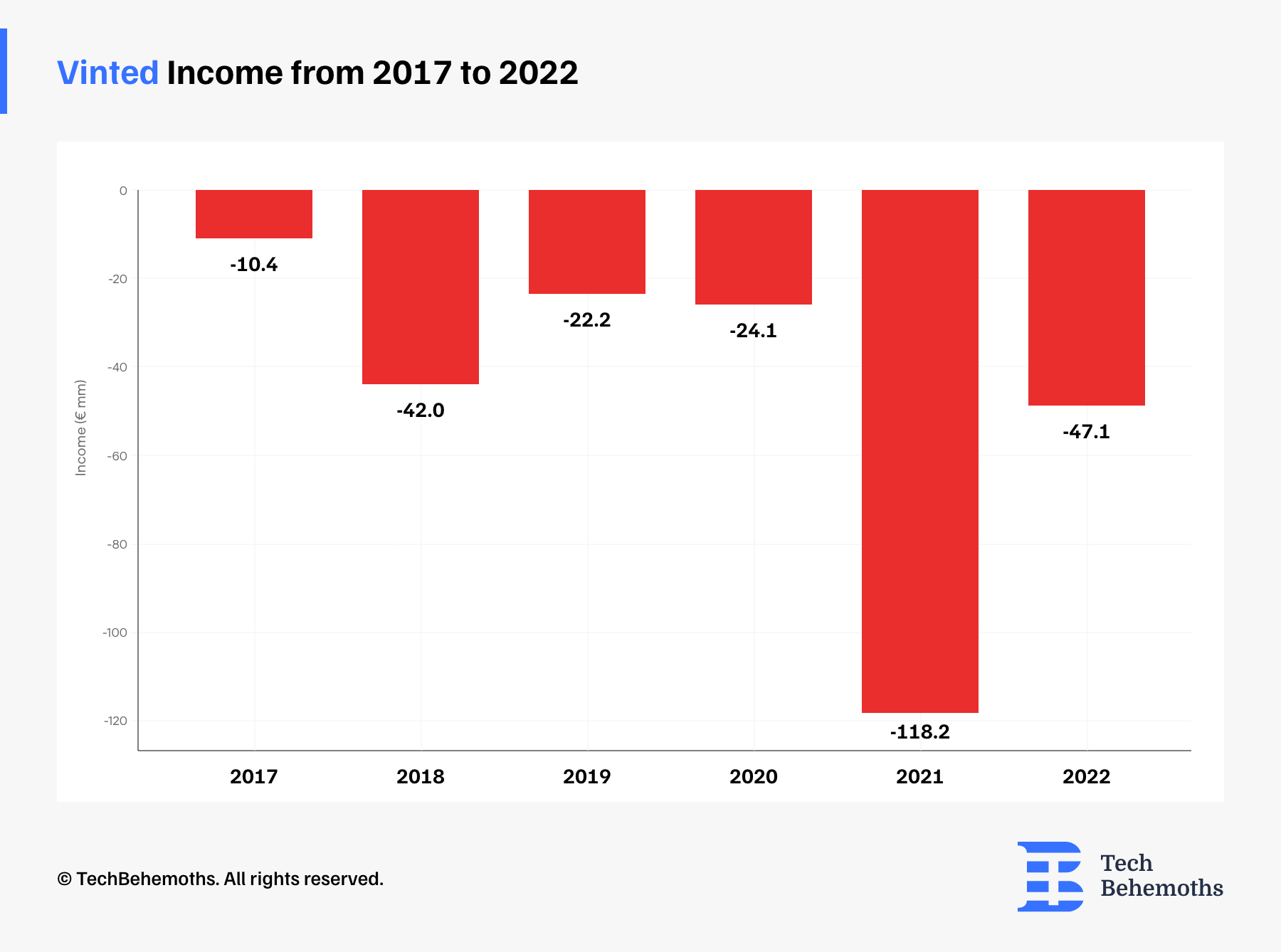

According to the company’s financial report, Vinted experienced losses each year during this period. The least negative income was in 2017 at -€10.4 million, suggesting a relatively smaller loss compared to other years. However, there was a significant drop in 2018, with losses increasing to -€42 million. In 2019 and 2020, losses were somewhat reduced to -€22.2 million and -€24.1 million, respectively.

The year 2021 stands out with the most substantial loss at -€118.2 million, indicating a notable increase in expenses or a decrease in revenue, or possibly both. Following that, in 2022, the losses were reduced again to -€47.1 million, which is still substantial but indicates an improvement over the previous year.

Overall, while Vinted has been growing its revenue, it has also been incurring losses. The reasons behind these financial outcomes could include investments in growth, expansion into new markets, increased operational costs, or competitive market dynamics, among others.

As for the number of Vinted users, the trend shows that while year-over-year growth is positive, the rate of growth is decelerating. The initial large jump from 2019 to 2020 could be due to a variety of factors, including the increasing popularity of second-hand marketplaces, greater environmental awareness among consumers, or the global pandemic's influence on online shopping behaviors. The deceleration in growth rate might suggest a maturing market or increased competition. Despite the slowing growth rate, the consistent increase in users each year highlights Vinted's expanding market presence.

All in all, Lithuania is the home to other unicorns-to-be in 2024, if the things turn right for these businesses. However, it’s too early to give names and predictions as there are many cards to play and a lot of money in the game. Nonetheless, if you are an investor looking for promising Lithuanian unicorns, don’t miss our previous article about Lithuanian startups where you can learn more about the entire ecosystem.