Irish Fintech Sector Overview

Financial technology (Fintech) refers to the use of technology to provide people with financial services and products, such as banking, insurance, investments, and digital payments.

For example, you can open a bank account online without going to a physical bank. You can connect this account to your smartphone to track your transactions. You can also use your phone as a “digital wallet” to pay for things directly from your account. Maybe one day you’ll get automated financial advice using “robo-advice” without having to talk to a person.

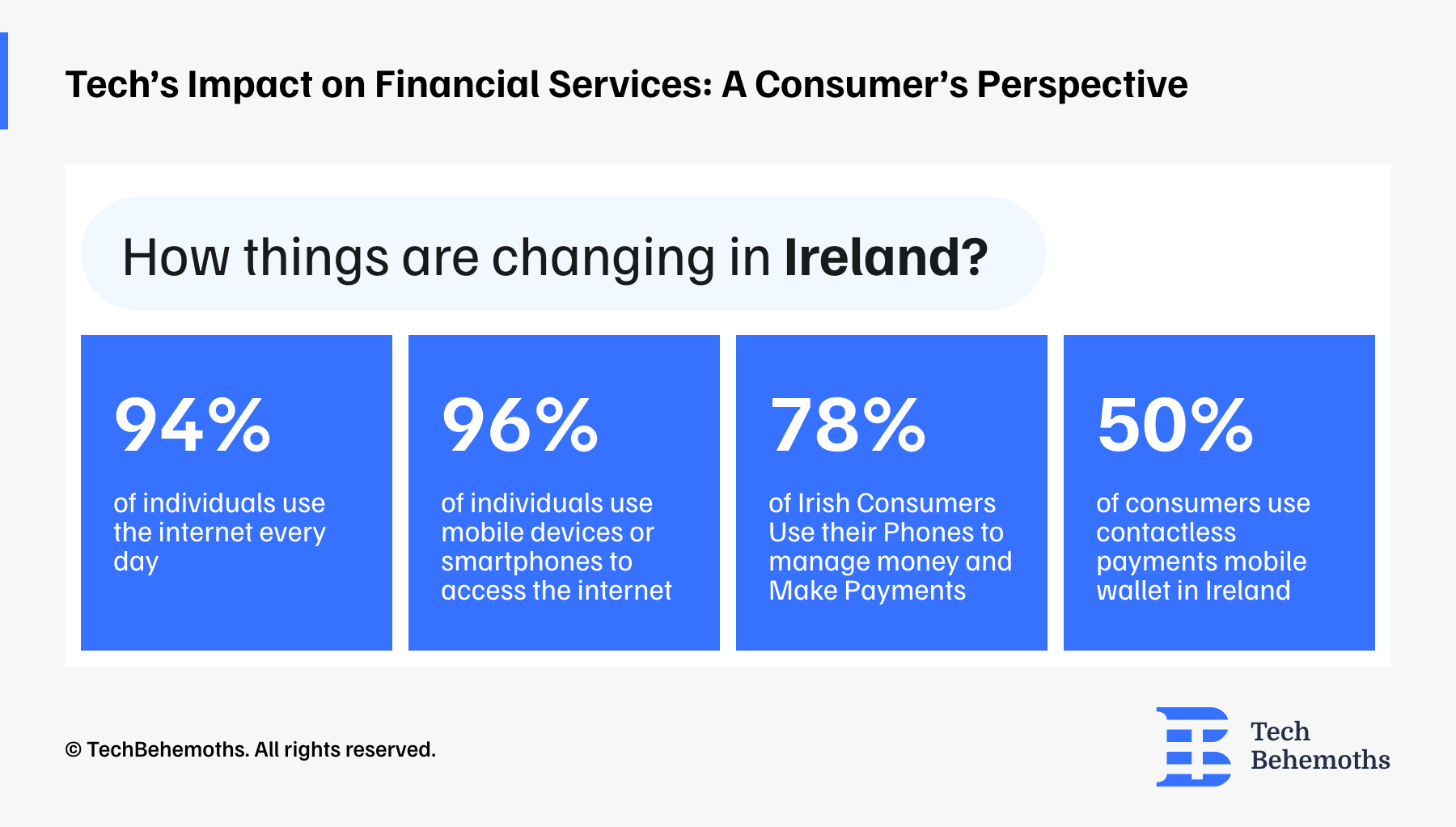

Fintech is transforming how consumers interact with finance and the internet and the rise of smartphones and tablets has sped up this change in recent years. How are things changing in Ireland?

Ireland Fintech Stats and Facts for 2024

- 94% of Irish use the internet every day.

- 96% of Irish access the internet via mobile devices or smartphones.

- 78% of Irish consumers use their phones to manage money and make payments.

- 50% of Irish consumers use contactless payment mobile wallets in Ireland.

How Ireland Built Its Fintech Success

The term "Fintech" first appeared in the early 1990s and became more popular in the 20th century, especially in the 2010s when it gained global attention. It was also then that Ireland began to focus on becoming a center for technology and financial services.

Skilled Workforce Strengthens Fintech

Ireland has a highly educated English-speaking workforce, especially in technology and finance. According to Ireland's Competitiveness Scorecard, it leads the EU in the number of STEM graduates aged 20 to 29, with 40 graduates for every 1,000 people. Ireland also has a large workforce, with the second-highest percentage of working-age people with university degrees in the OECD, just behind Japan.

Big Companies Choose Ireland

Many leading tech and finance companies such as the Collison brothers and Stripe, and global tech giants such as Google and Facebook moved to Ireland, being attracted by Ireland’s business-friendly environment and skilled workforce. According to Fintech Ireland, there are more than 280 local fintech companies and over 130 international fintech companies operating in and from Ireland.

Government Supports Innovation

The Irish government supports the growth of the financial services sector, including fintech. The government’s strategy - Ireland for Finance aims to strengthen Ireland’s international financial services by 2026. This plan includes actions to promote fintech and blockchain technologies, increase the participation and representation of women in finance through initiatives such as the Women in Finance Charter in Ireland, and develop sustainable finance with the establishment of a center of excellence.

“Sustainable finance remains key to the future of our financial services industry. Of particular importance is the financing of renewable energy infrastructure and this needs to be a key priority across all of government.”

Dr Jennifer Carroll MacNeill TD Minister of State with responsibility for Financial Services, Credit Unions, and Insurance

Dublin’s Research and Development Investments

Dublin is a key location for research and development in Ireland. Major companies like BNY Mellon and Fidelity Investments are working on new technologies in AI, blockchain, and digital assets. Last year, BNY Mellon made a significant investment of €8 million with support from IDA Ireland to promote innovation and increase its patent applications. Fidelity Investments is also growing in Ireland's fintech sector. The company is expanding its tech operations, working with universities to support new ideas, and using government help to improve areas like cloud computing, cybersecurity, and digital assets.

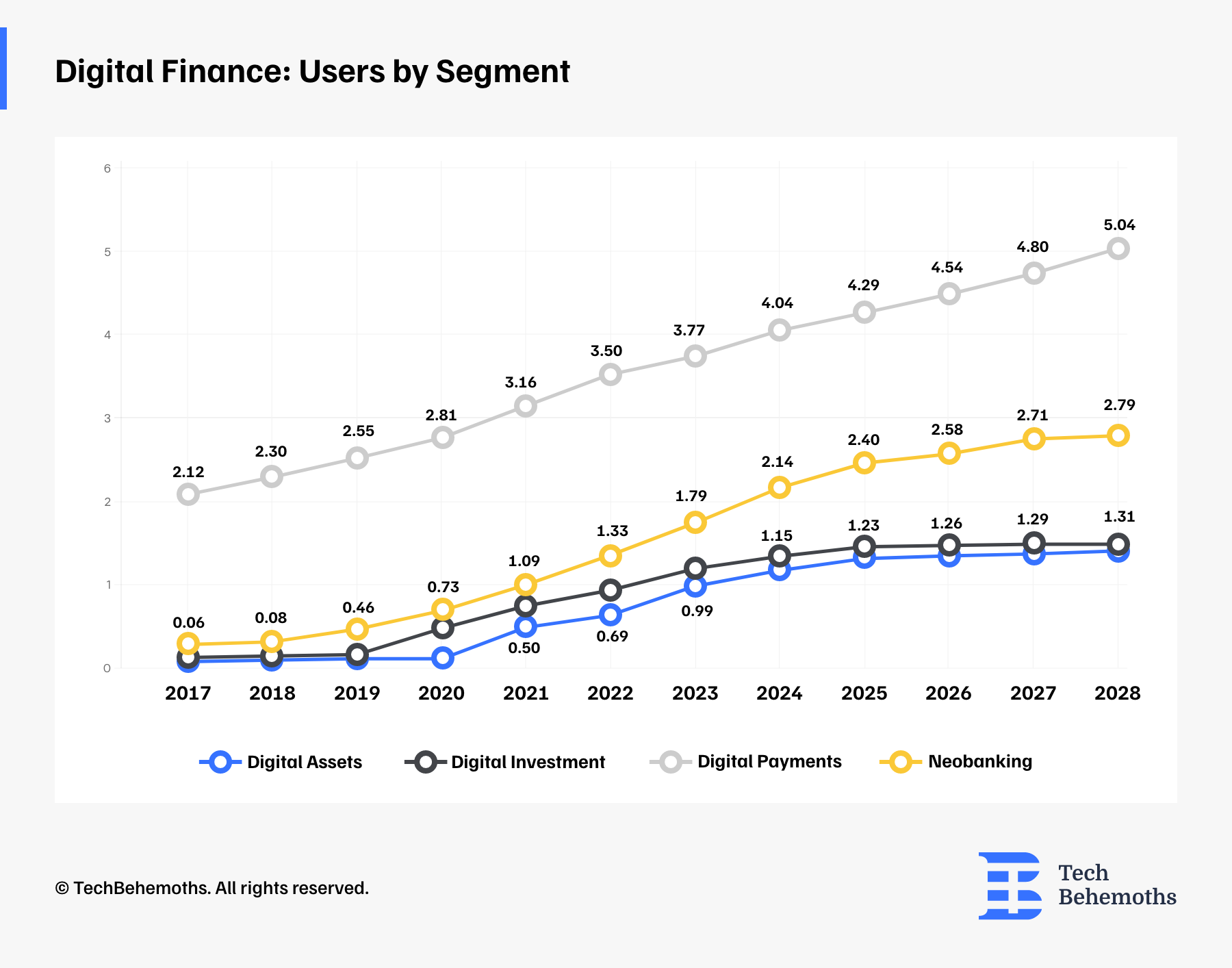

Digital Finance: Payments, Neobanking

In digital finance, digital payments will continue to lead in user numbers through 2028, according to Statista. Neobanking started with a small number of users in 2017 and is also growing quickly. By 2028, it is expected to become the second-largest segment. Digital assets and digital investments are growing more slowly, which may mean they appeal to fewer users or face challenges in attracting users compared to digital payments and neobanking.

The Role of the Central Bank in Irish Fintech

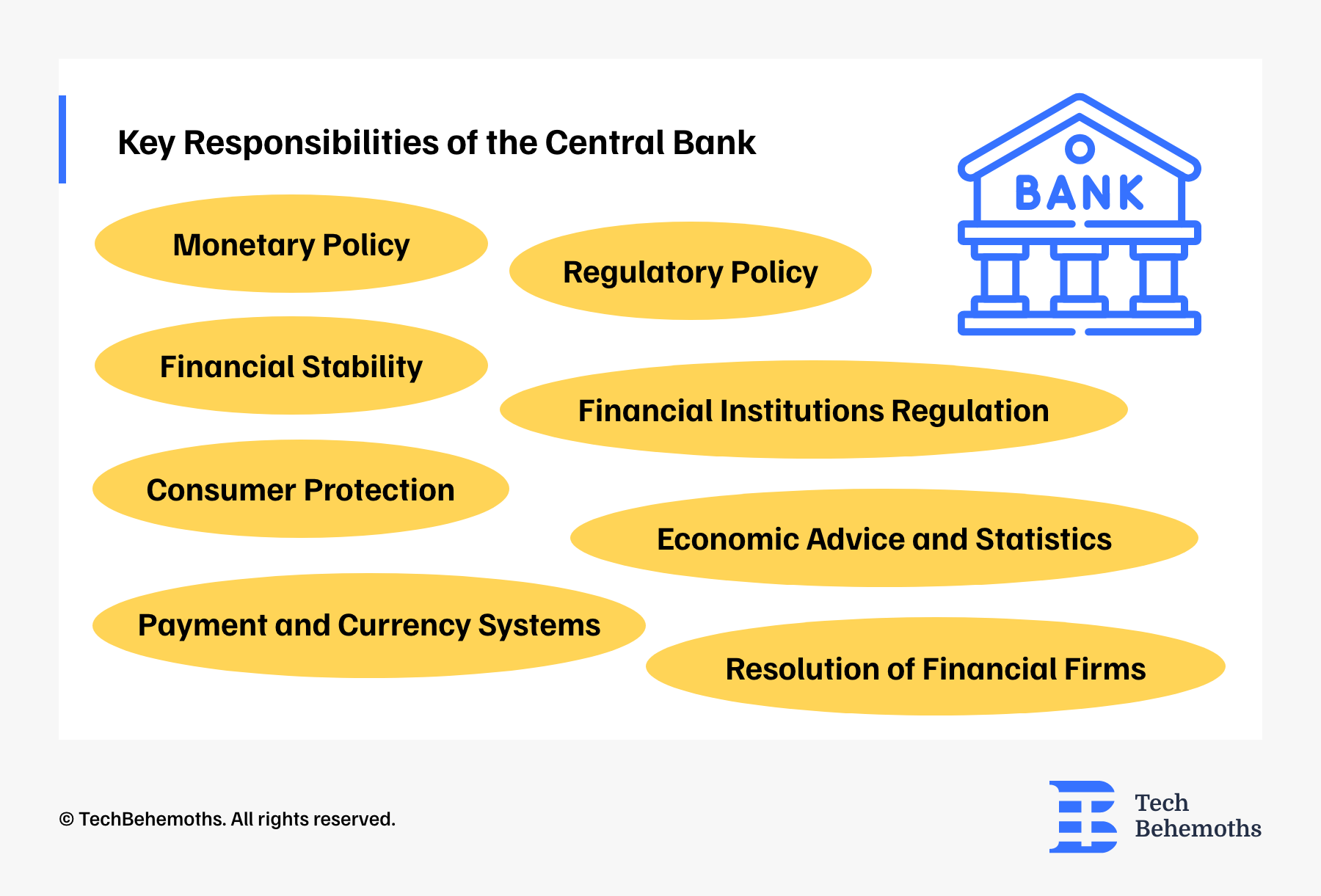

The Central Bank's Role in Irish Tech is important. By law, it is defined to ensure the stability of Ireland’s financial system and to protect consumers.

The Bank supports the Eurosystem’s monetary policy, with a focus on achieving price stability and keeping inflation near the 2% mark. To maintain a stable financial system, it actively estimates risks and takes various tools to address emerging threats.

The Bank ensures that financial service providers prioritize consumers' interests by reviewing and enforcing relevant rules. It closely monitors the safety and management of financial institutions through risk-based supervision, taking necessary actions when required.

Additionally, the Bank contributes to shaping financial legislation in Europe, tailoring it to meet Ireland's specific needs. It also guarantees that payment systems and currency services are secure, and efficient, making it easy for the public to access banknotes and coins.

The bank offers independent economic advice and provides statistics to inform policy decisions. It also devises strategies for managing troubled financial institutions, helping them resolve issues smoothly without causing significant disruptions.

To be more specific the key responsibilities of the Central Bank are:

- Monetary Policy

- Financial Stability

- Consumer Protection

- Financial Institutions Regulation

- Regulatory Policy

- Payment and Currency Systems

- Economic Advice and Statistics

- Resolution of Financial Firms

Together, these efforts work to promote a financial environment that is stable, fair, and efficient.

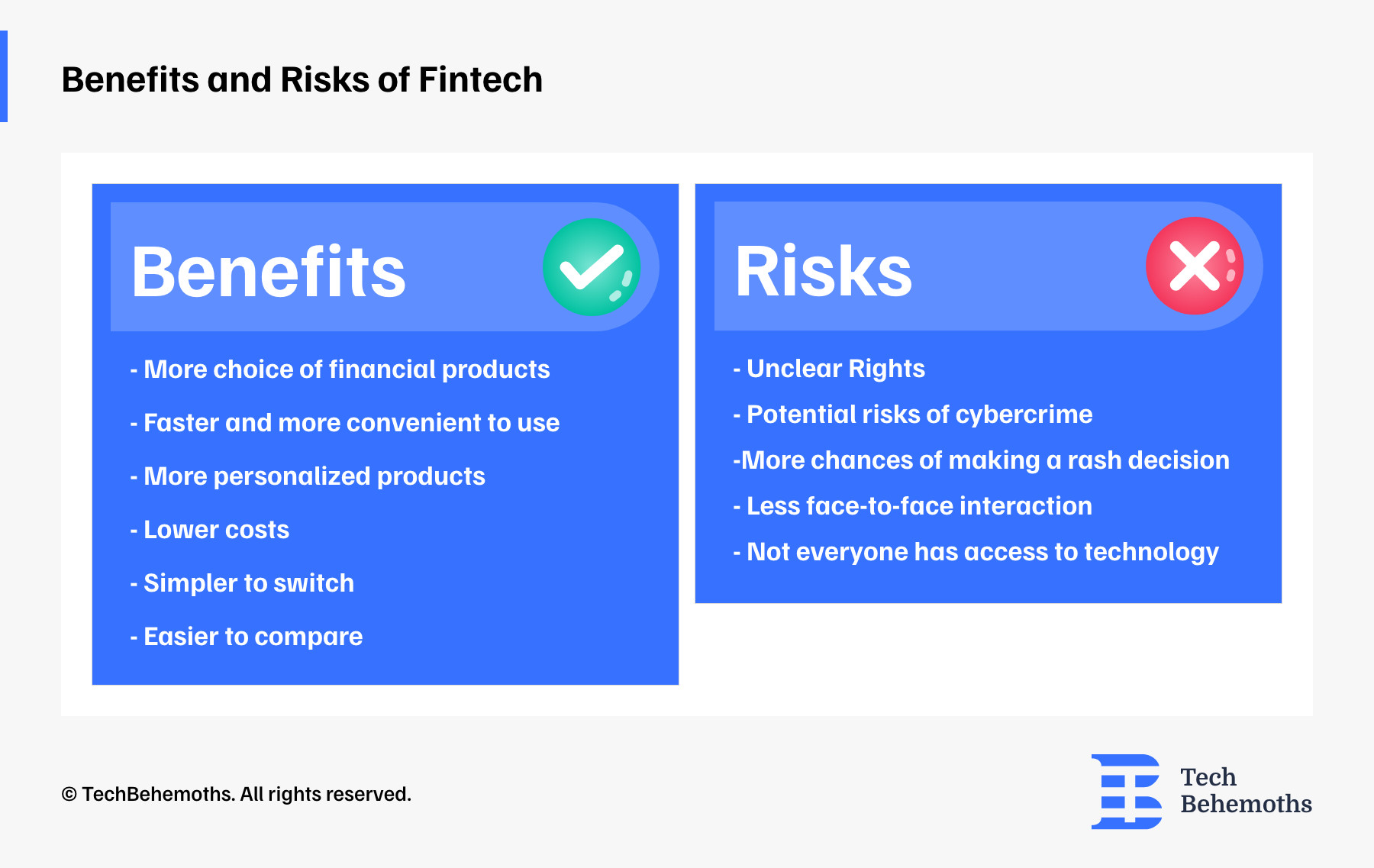

Benefits and Risks of Fintech

As in any industry, there are risks and benefits, fintech is no exception. Let's see what these could be.

Potential Benefits of Fintech

-

Accessible and easy to use

Fintech products are accessible online, making them faster and easier to use.

-

Bigger choice of products and services

You have access to a wider range of products and services since you can purchase them from anywhere.

-

Lower Costs

Fintech companies often have lower operating costs compared to traditional banks, allowing them to offer more affordable options.

-

More Personalized Products

Fintech companies can collect and analyze additional customer information, enabling them to provide personalized products and services.

Potential risks

-

Unclear rights

Some fintech companies are new and might use different business models. This can make it difficult to understand which companies are regulated and what your rights are if issues arise.

-

The probability of making a rash decision

Buying financial products online without meeting anyone can lead to quick and uninformed choices.

-

Technology-based risks

Online financial products can expose you to risks such as data misuse or cybercrime.

-

Not everyone has access to technology

While technology can provide more choice for many, it may exclude those who struggle to use the internet or devices like computers and smartphones.

That being said, we can benefit from fintech services and products, but we must also be aware of the associated risks to protect ourselves and take appropriate measures.

Conclusion

In the end, we can conclude that Ireland’s fintech sector is growing quickly. It has a skilled workforce, strong government support, and big investments in technology and research. All this helped create the strong fintech sector we see in Ireland today.

The country leads in sustainable finance and promotes gender diversity. Cities like Dublin have strong research centers, making it a hub for local and global fintech companies. Right now, 78% of Irish consumers manage their finances with their mobile phones, and 50% use mobile wallets. However, fintech also brings challenges that need careful attention.

If you are curious how Ireland is leading the way in finance, check out fintech companies in Ireland on TechBehemoths to find their innovative solutions!