How an IT Company Can Raise Money and Get Funds?

Money and funds are essential for the growth and prosperity of any business and IT companies are no exception. We all know that access to sufficient funds can make the difference between success and failure for an IT company.

When an IT company lacks adequate funds it may experience adverse outcomes such as stunted growth, inability to hire skilled professionals or invest in new technologies, reduced competitiveness, and ultimately, failure to survive in a highly dynamic and competitive industry.

But how can an IT company raise money and get the funds they need to succeed?

In this article, we'll explore some of the most common methods that IT companies can use to get funds.

So, let’s start!

Strategies for Raising Funds and Financing for IT Companies

There exist various methods through which IT companies can obtain funds.

But, what is a fund? - A fund is an entity that pools other people’s money together into a single entity and invests in companies.

If you want to enhance your fundraising results, you need to implement specific strategies, which include:

- diversifying your fundraising channels incorporating various channels such as online campaigns, social media, peer-to-peer fundraising, events

- segmenting your donors based on their giving patterns, interests, and demographics

- leveraging technology, use donor management software, online donation platforms, and social media tools to maximize your fundraising efforts

- developing strategic partnerships, partnering with other nonprofits, businesses, or corporations to expand your reach and fundraising potential

- showing appreciation and recognition to your donors by sending thank-you notes, providing updates, and inviting them to events

- continuously evaluating and adjusting your strategies, based on feedback and fundraising results to improve and maximize your fundraising potential.

By implementing these strategies, you can expand your reach and maximize your fundraising potential. To have a better idea of where to focus your efforts when it comes to fundraising, we also invite you to take a closer look at how software companies make money.

Given this, we aim:

- to discuss and analyze the different funding methods available for IT companies

- to provide in-depth definitions and examples

- to underline which funding methods are best suited for small IT companies and those that are suitable for larger, established organizations.

Venture Capital Funds

One of the most popular ways for startups to raise funds is through venture capital (VC) funding. Venture capital (VC) funding is a type of private equity financing where investors provide funds to early-stage companies with high growth potential. In return for their investment, they receive equity in the company.

Venture capital investors are usually interested in companies that have a strong founding team, a clear market opportunity, and a differentiated product or service. VC investors play an active role in the companies they invest in, more than just capital to the table. They also provide guidance and advice on everything from strategy to hiring and give access to a network of contacts that can help the company grow. On the other hand, it's important to bear in mind that by obtaining a substantial equity stake in the company, VC investors have a high degree of control over the company, which is a key requirement.

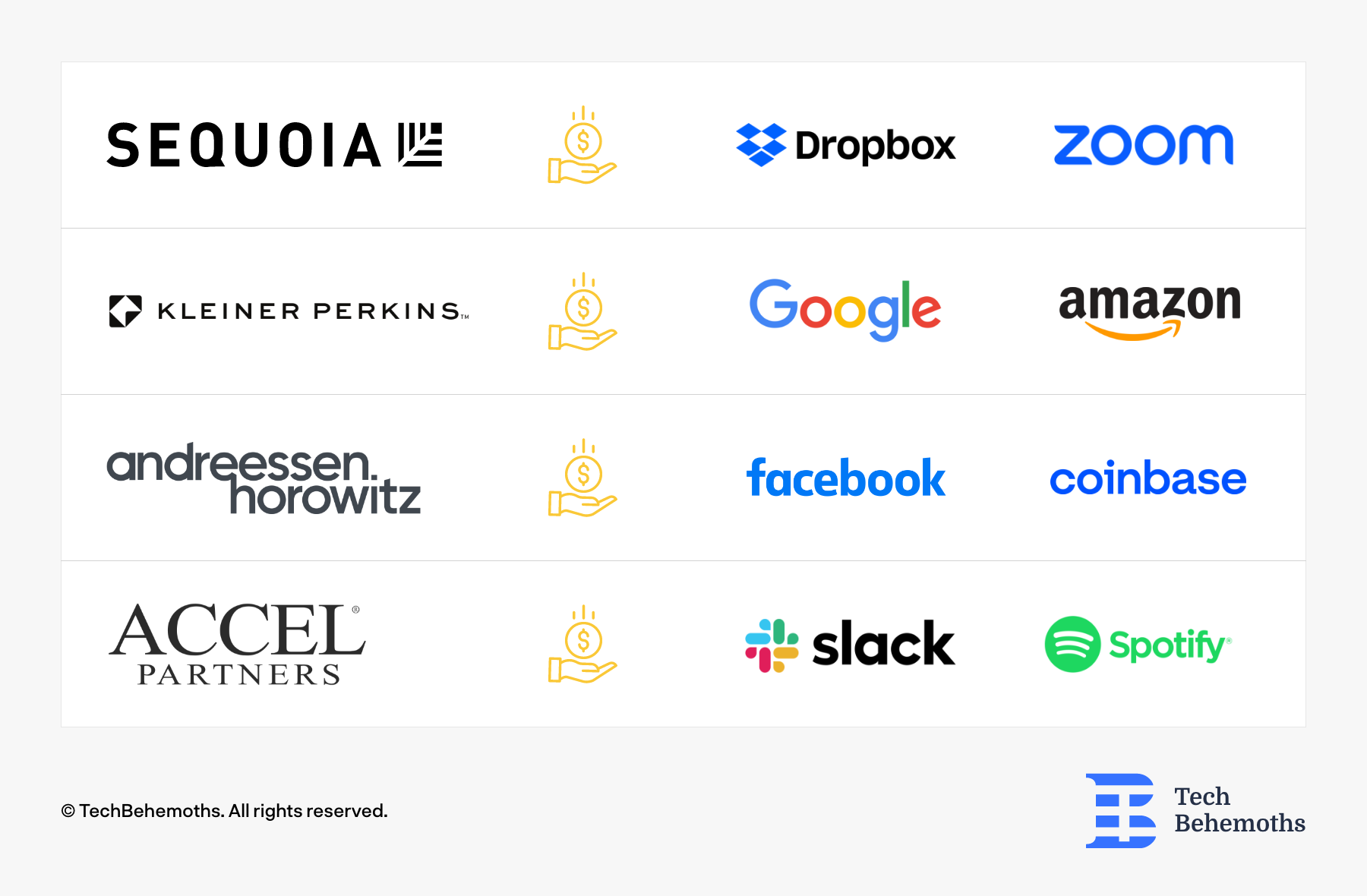

Some of the most well-known VC firms in the world are:

- Sequoia Capital investing in successful companies like Dropbox and Zoom

- Kleiner Perkins has invested in companies like Google and Amazon

- Andreessen Horowitz has invested in companies like Facebook and Coinbase

- Accel Partners invested in companies like Slack and Spotify

and more.

Important to mention that Venture Capital will typically take between 25 and 50% of a new company's ownership. However, the amount that a VC fund invests in IT companies can vary widely, depending on the company's stage of development, growth potential, and the dynamics between the investors and founders. But, we can definitely say that Venture capital investment is an important tool to raise funds unlocking the potential of new and exciting business ideas.

Angel Investments

Angel investors are rich persons who invest their own money in startups that require not a big amount of capital.

The term "angel" investor comes from the idea that these individuals provide financial support and guidance to entrepreneurs who are just starting out and sometimes are the only ones who believe in their vision. At the same time, they may request a significant equity stake in the company and have a high degree of control over the company's operations.

Angel investors provide capital in exchange for a percentage of ownership in the business, typically between 10% and 50%. On average, Angel Groups invested a total of $5.3 million per group, up 15% from 2020 according to Angel Funders Report 2022.

Here are some notable angel investors and their cases:

Peter Thiel, provided a $500,000 investment to Facebook in 2004 when the company was still in its infancy. Thiel's investment gave him a 10.2% stake in the company, which is now worth billions of dollars.

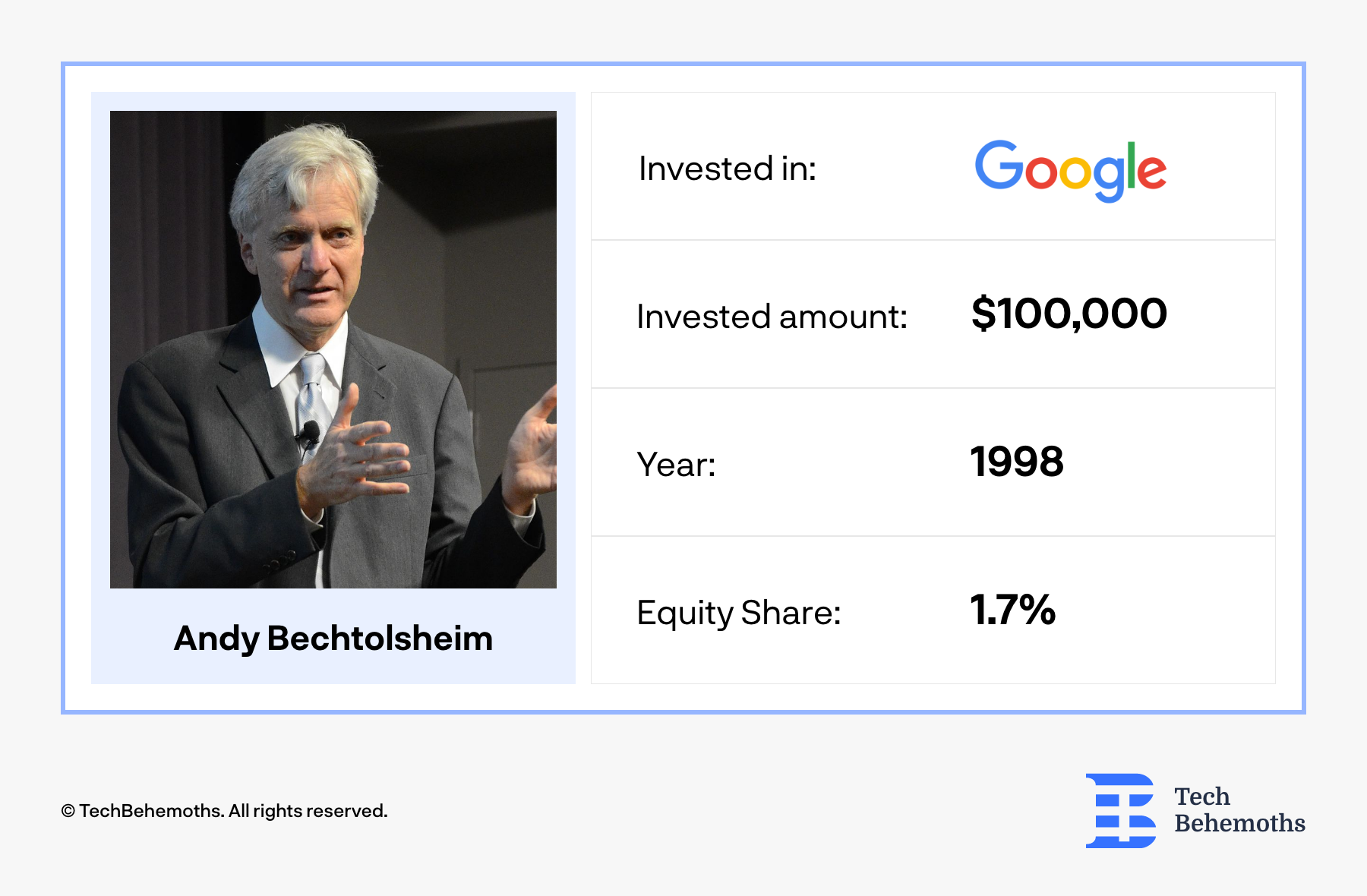

Google received an angel investment of $100,000 from Andy Bechtolsheim in 1998, in exchange for 1,7% of the company, which is now also worth billions of dollars.

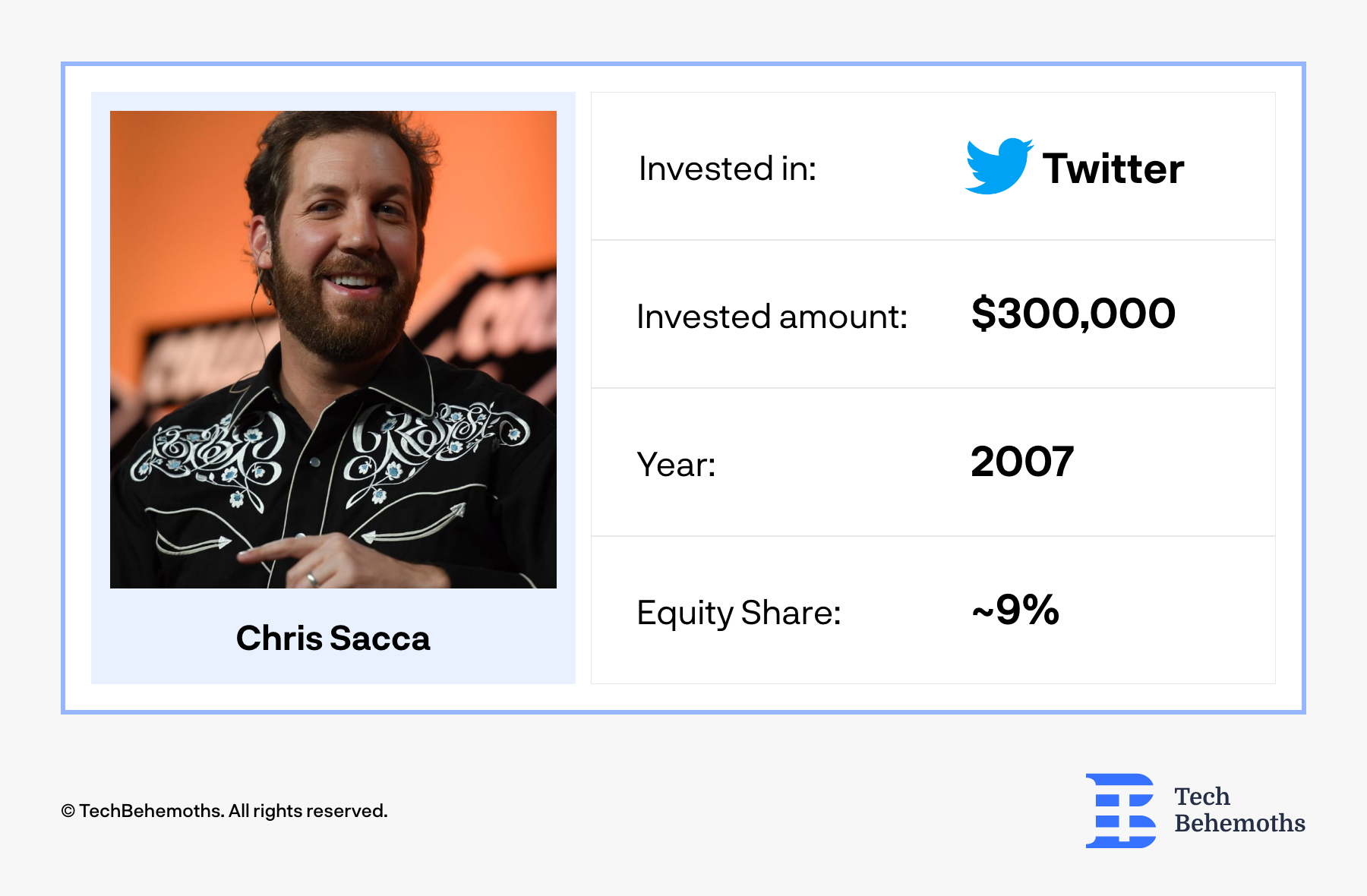

In 2007, angel investor Chris Sacca invested $300,000 in Twitter. Today, Twitter is a publicly traded company with a market cap of over $50 billion, granting it an ownership interest of around 9 %.

That being said, it's also good to know angels prefer to invest in ventures they are familiar with and trust. Hence, developing personal connections with angel investors can be beneficial in order to establish a relationship with them.

Crowdfunding

Crowdfunding is a method of financing a project by raising small amounts of money from a large number of people through an online platform.

This method of funding is suitable for early-stage IT companies that develop a unique product or service that resonates with the public and need to raise a relatively small amount of capital.

There are a few types of crowdfunding:

- equity-based funding that involves selling equity in the company to investors

- reward-based funding which involves offering rewards, such as early access to the product in exchange for funding

- donation-based funding, which consists in giving money without receiving anything in return

- debt-based funding, which involves repayment of the money by a certain deadline

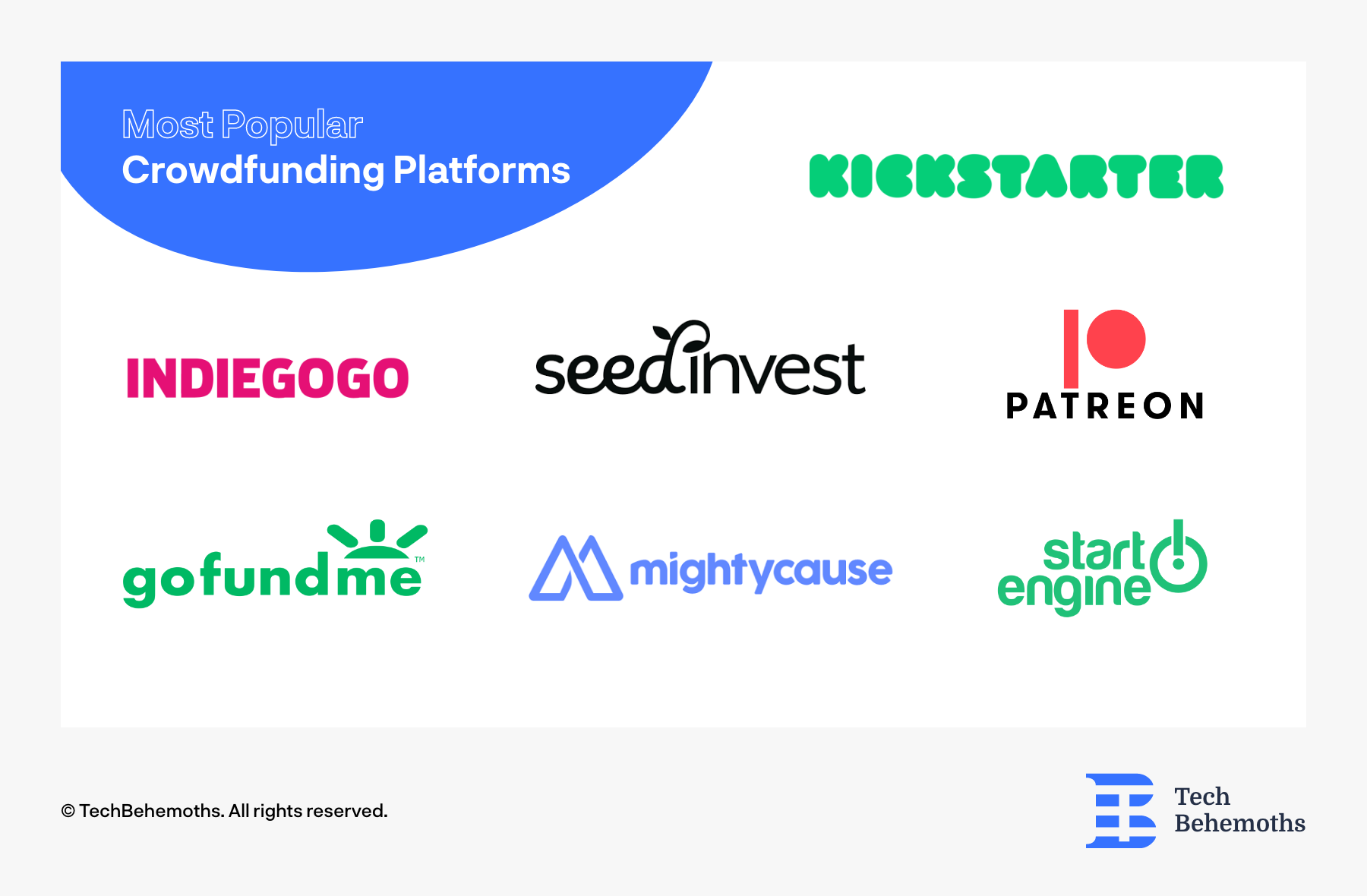

Among the most popular crowdfunding platforms we can count on the following

Some examples that obtained funding through these platforms are:

- Indiegogo helps Jibo: an intelligent companion robot to raise money from a crowdfunding campaign.

- Oculus raised over $2.4 million through a Kickstarter campaign to develop its virtual reality headset.

- Tap System Inc has used Start Engine as a platform to raise funds for their innovative products, such as their Tap Strap wearable keyboard and mouse.

According to Statista, the global crowdfunding market is expected to reach $28.8 billion by 2025.

So, if you are an entrepreneur who wants to launch a new product but doesn't have enough capital you can create a crowdfunding campaign on a platform like a platform mentioned above, provide information about the product, set a fundraising goal, and ask people to donate money in exchange for rewards, such as early access to the product or exclusive merchandise.

In change, crowdfunding will provide to your start-up investors that can generate buzz around your product or service. However, is important to know that it can be challenging because this method of funding can be unpredictable, and there is no guarantee that the company will reach its funding goal.

Incubators and accelerators

Incubators and accelerators are increasingly popular among IT startups. These programs provide resources and support to startups, helping them to grow and develop their businesses.

According to Climate Technology (CTCN), there are estimated to be around 2,000 incubators and 150 accelerators worldwide.

To begin let's define these terms: incubator and accelerator.

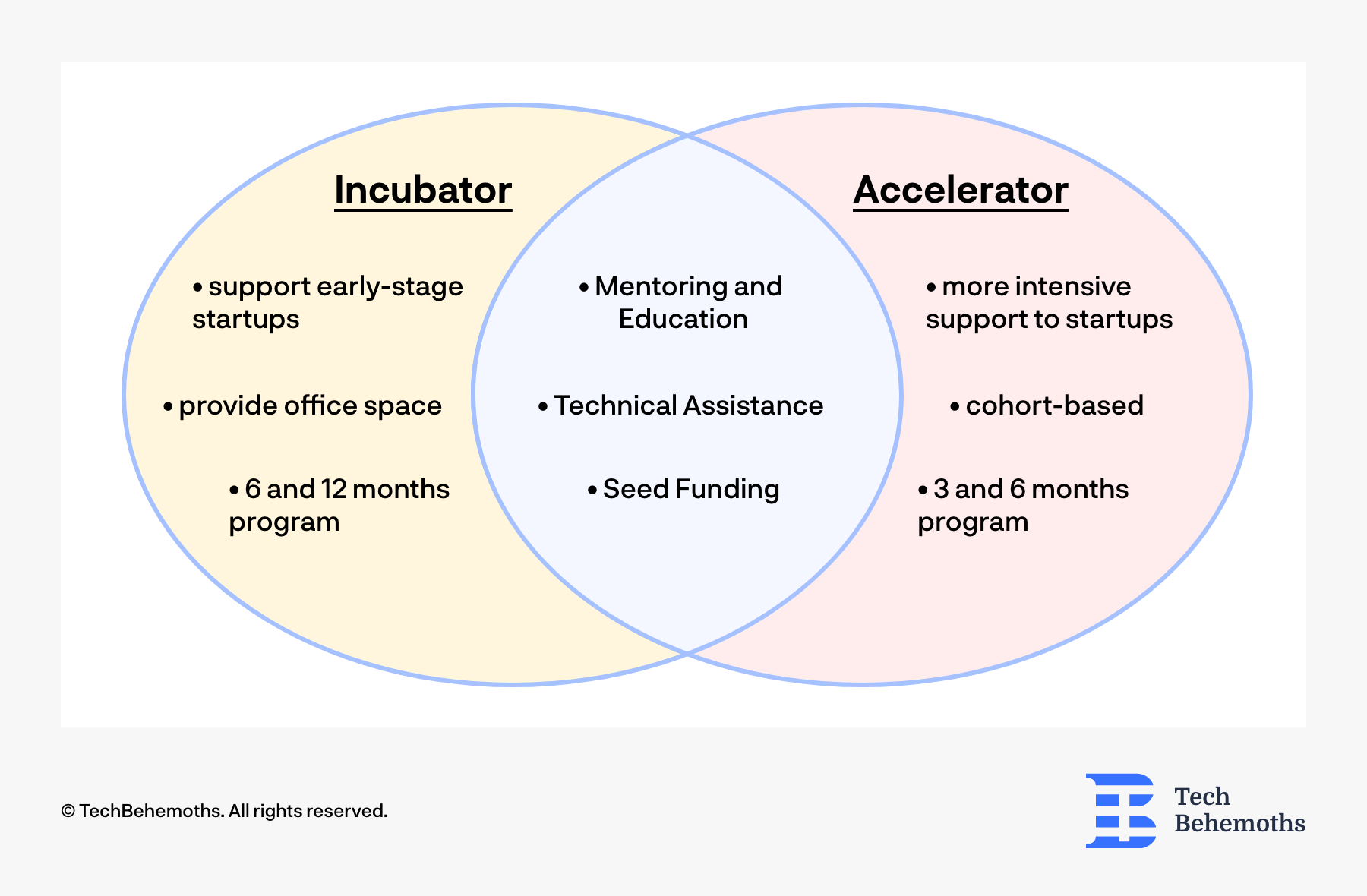

An incubator is a program designed to support early-stage startups by providing resources such as office space, mentorship, and funding. These programs usually last between 6 and 12 months, during which time the startup is given access to a variety of resources and support services to help them develop their products and services.

Accelerators, on the other hand, are programs that provide more intensive support to startups, in the form of mentorship, networking opportunities, and funding. These programs are often shorter than incubators, lasting between 3 and 6 months, and are designed to help startups quickly grow their businesses.

One example of an incubator program is Y Combinator, one of the most well-known incubator programs in the world, which has helped to launch a number of successful IT companies such as Dropbox, Airbnb, and Stripe.

Another example of an accelerator program is Techstars, a global network of startup accelerators that has helped to launch companies such as SendGrid and DigitalOcean.

Considering that, incubators and accelerators help startups to benefit from funding, valuable mentorship, and support, however, startups should meet certain criteria, for example, to have a minimum viable product or a certain level of revenue, in order to be considered for an incubator program. This can be challenging for startups that are still in the early stages of development. However, if you are a well-established IT company with an innovative product worthy to be known - these accelerator programs and incubators are worth trying.

Grants

Grants are a type of funding that does not require repayment, suitable for IT companies that are developing new technologies or solutions that have a positive impact on society.

Grants are provided by governments, foundations, or other organizations in form of financial assistance to help the company to achieve its goals and objectives. At the same time, grants can be an excellent way to gain exposure and recognition for the company and its projects.

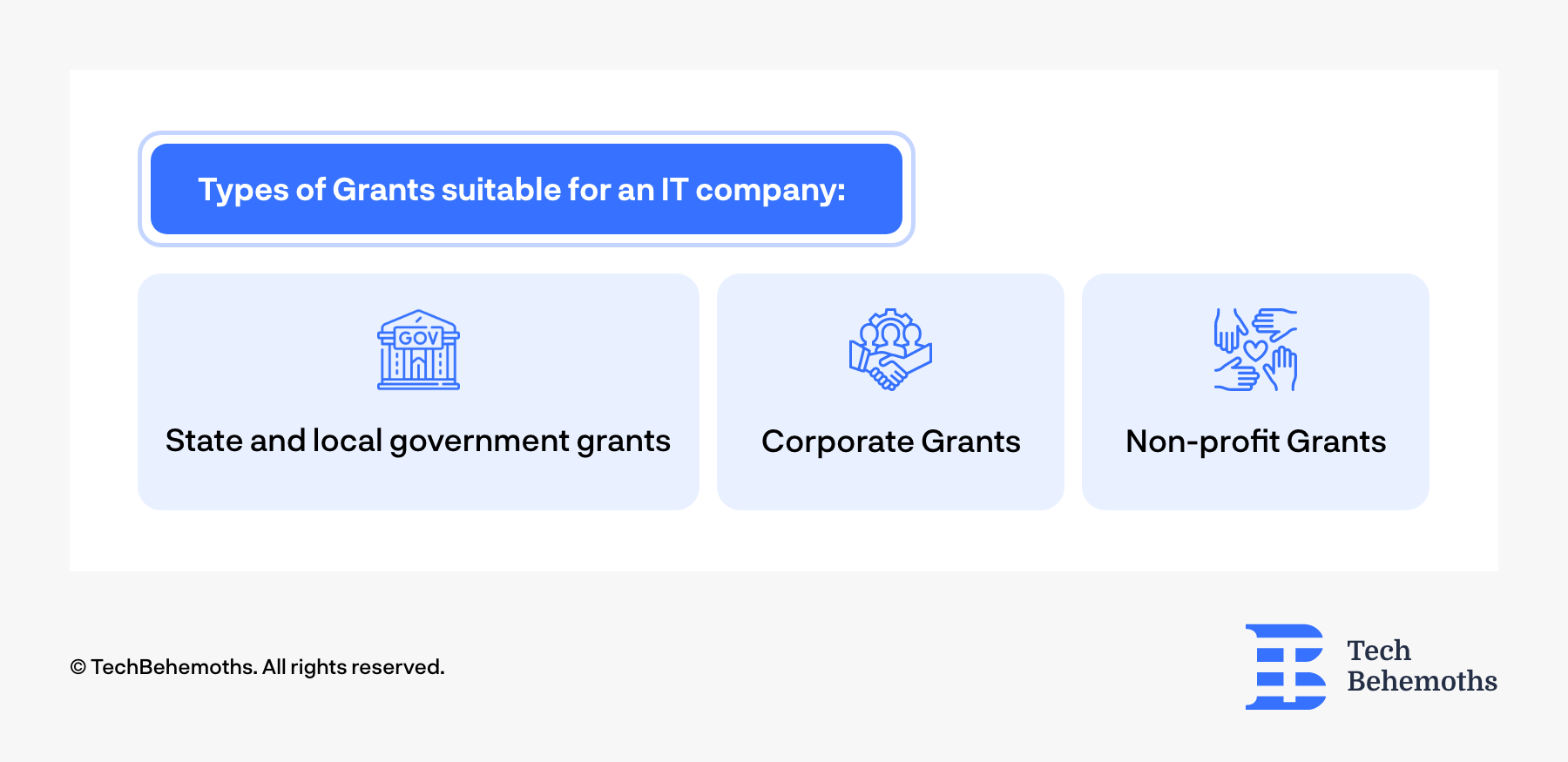

Here are several types of grants that may be suitable for an IT company, good to consider

- State and local government grants - State and local governments often offer grants and funding opportunities. IT companies can explore these options to see if they qualify for any relevant grants or funding programs.

For example, Small Business Innovation Research (SBIR) grants can be considered a form of a government grant, specifically a federal government grant. These grants are offered by the US government. IT companies can apply for SBIR grants to fund their research and development efforts. One example of an IT company that has benefited from SBIR funding is Cybernet Systems Corporation, a system software company that develops innovative technologies.

- Corporate Grants - Many corporations offer grants or funding opportunities for IT companies that align with their goals and values. For example, a company that is focused on environmental sustainability may offer grants to IT companies that are developing innovative solutions for reducing carbon emissions.

For example, Google offers grants to support open-source projects and initiatives that promote access to information Selected startups receive mentorship, resources, and funding to help them grow.

- Non-Profit Grants - Non-profit organizations, such as foundations and charities, offer grants to support a wide range of initiatives, including technology and innovation.

For example, The Mozilla Foundation is a non-profit organization that supports an open and accessible internet. This includes supporting projects that are working to build secure and decentralized infrastructure. In 2020, the MOSS program awarded a grant to Matrix.org, an open-source project that is developing a decentralized, secure communication platform.

The amount of grant funding available can vary widely depending on the program, the government agency, and the specific project or activity being funded. Some grants may be as small as a few thousand dollars, while others can be millions of dollars or more.

It is important to take into account that the application process can be time-consuming and competitive. Grant funding may not be consistent or reliable, which can make it difficult to plan the budget for the future and also may come with some restrictions on how the funds can be used, which can limit the company's flexibility.

Bank Loans

An IT company can also raise funds through bank loans.

Bank loans are a traditional form of financing that involves borrowing money from a bank and paying it back over time with interest.

This method is suitable for IT companies that have a proven track record of generating revenue and a strong credit history. Bank loans can provide IT companies with the capital they need to fund their operations, invest in new technology, or expand their business. Bank Loans can be relatively easy and fast to obtain compared to other forms of financing, but at the same time, the application process can be lengthy and cumbersome, requiring extensive documentation, financial statements, and business plans. This option may be more difficult for startups without an established credit history.

JPMorgan Chase, Bank of America, and Wells Fargo are all examples of major banks that offer lending services to businesses, including IT companies.

Here are two examples of companies that have used loans to fund their operations:

- Apple Inc. - In 2020, Apple borrowed $8.5 billion through a bond issuance to fund its stock buyback program and dividend payments.

- Alphabet Inc. (Google) - In 2021, Alphabet issued $5.75 billion in bonds to fund various corporate purposes, including stock repurchases and capital expenditures. The bonds were issued in six tranches with maturities ranging from 5 to 40 years.

So we see that bank loans can be an effective method for an IT company to raise money. It is important carefully to consider the terms and conditions of the loan and to ensure that you have a solid plan for using the funds to grow and expand your business.

Wrapping up

In conclusion, IT companies have several options available to them when it comes to raising money and getting funds.

Each method has its own benefits and drawbacks, and the choice of funding method will depend on the company's specific requirements and objectives.

There is no one-size-fits-all answer to which funding methods are the best for IT companies.

It is important to evaluate the pros and cons of each funding method and choose the one that best suits the business's needs and goals.