The State of Digital Marketing Channels and Tools: Survey Results

Digital marketing tools have always helped IT companies analyze, plan, and implement their strategies across various channels. Yet companies’ preferences regarding tools are not equally distributed between these tools, which results that some tools being more helpful than others.

In 2023 specifically, the occurrence of a high number of AI tools, and the implementation of AI technologies in some of the existing digital marketing tools lead to a more dynamic market and even shake the position of the most favorite tools in the market.

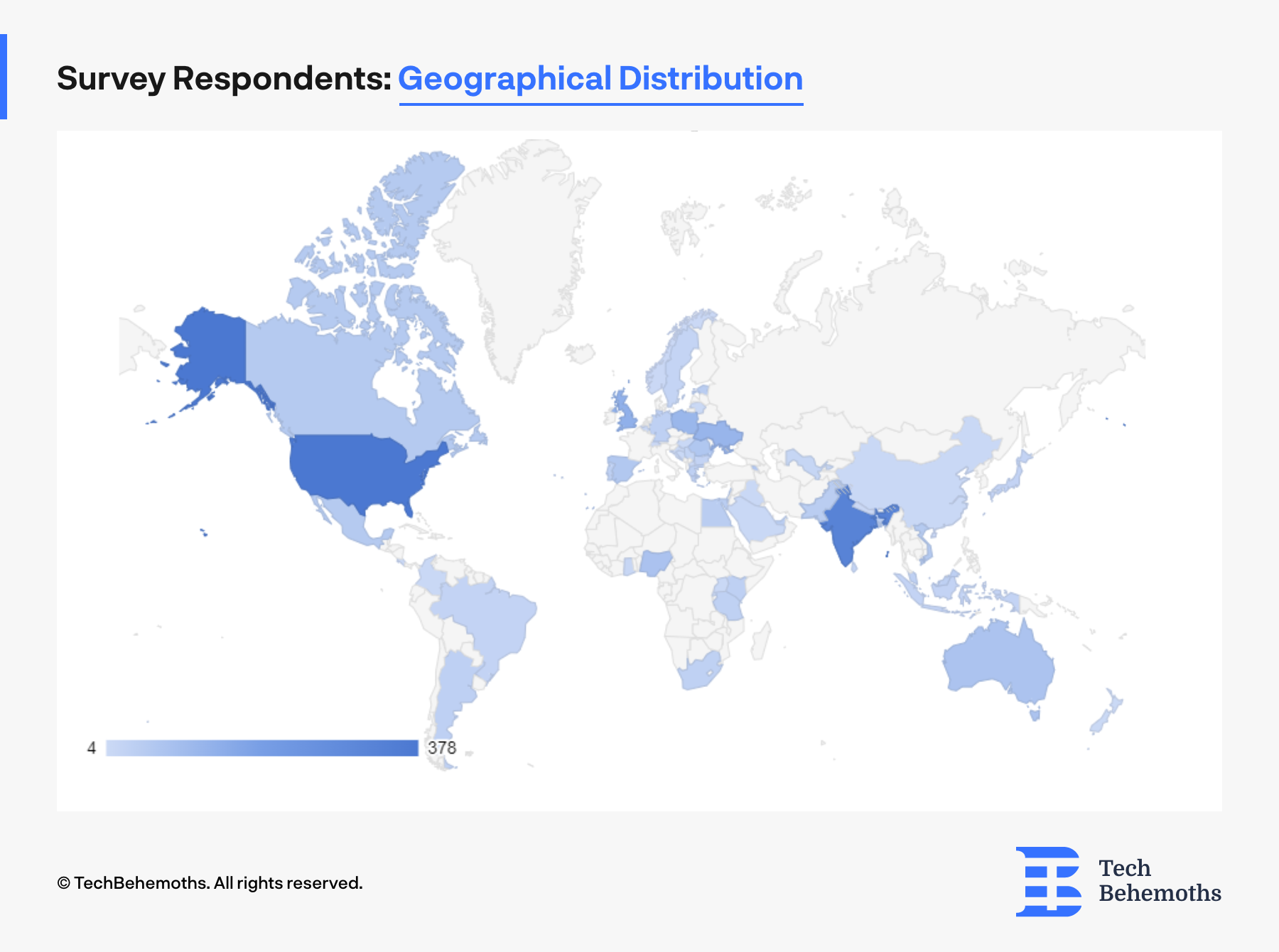

To identify which digital marketing tools are most popular and effective, TechBehemoths conducted a survey between May 15-25, 2023, across 2,542 IT companies located in 57 countries and territories.

Survey Respondents’ Profile

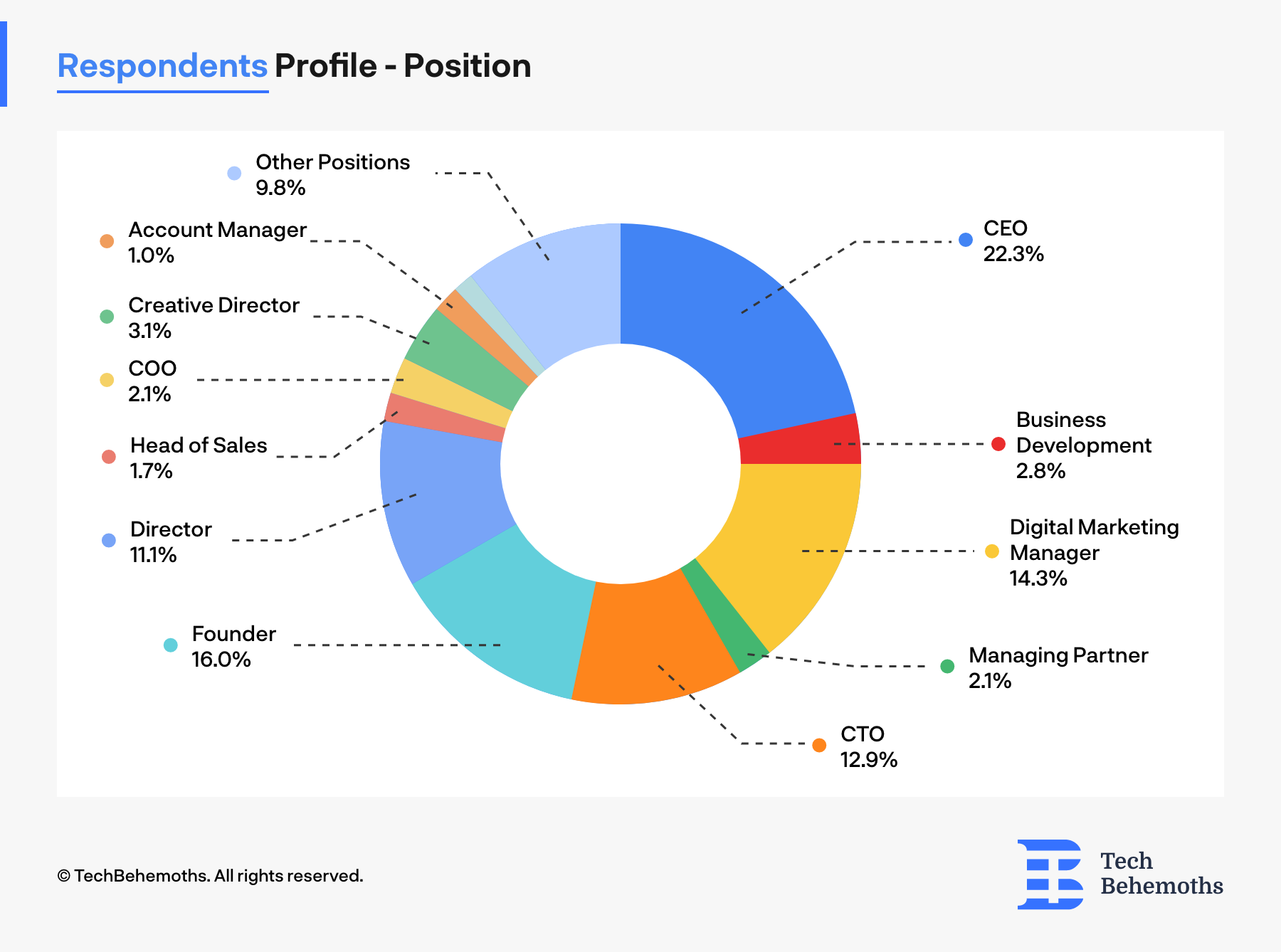

Apart from demographics, survey respondents representing IT companies are also divisible by position held in their company and number of employees. According to survey results, 22.3% of respondents are CEOs and 16% of respondents are Founders of IT companies and digital agencies.

At the same time, 14,3% of respondents mentioned that their position is related to digital marketing and other 12.9% are CTOs.

Among these positions, other respondents identified themselves a operational managers, sales, account managers, directors and business development managers.

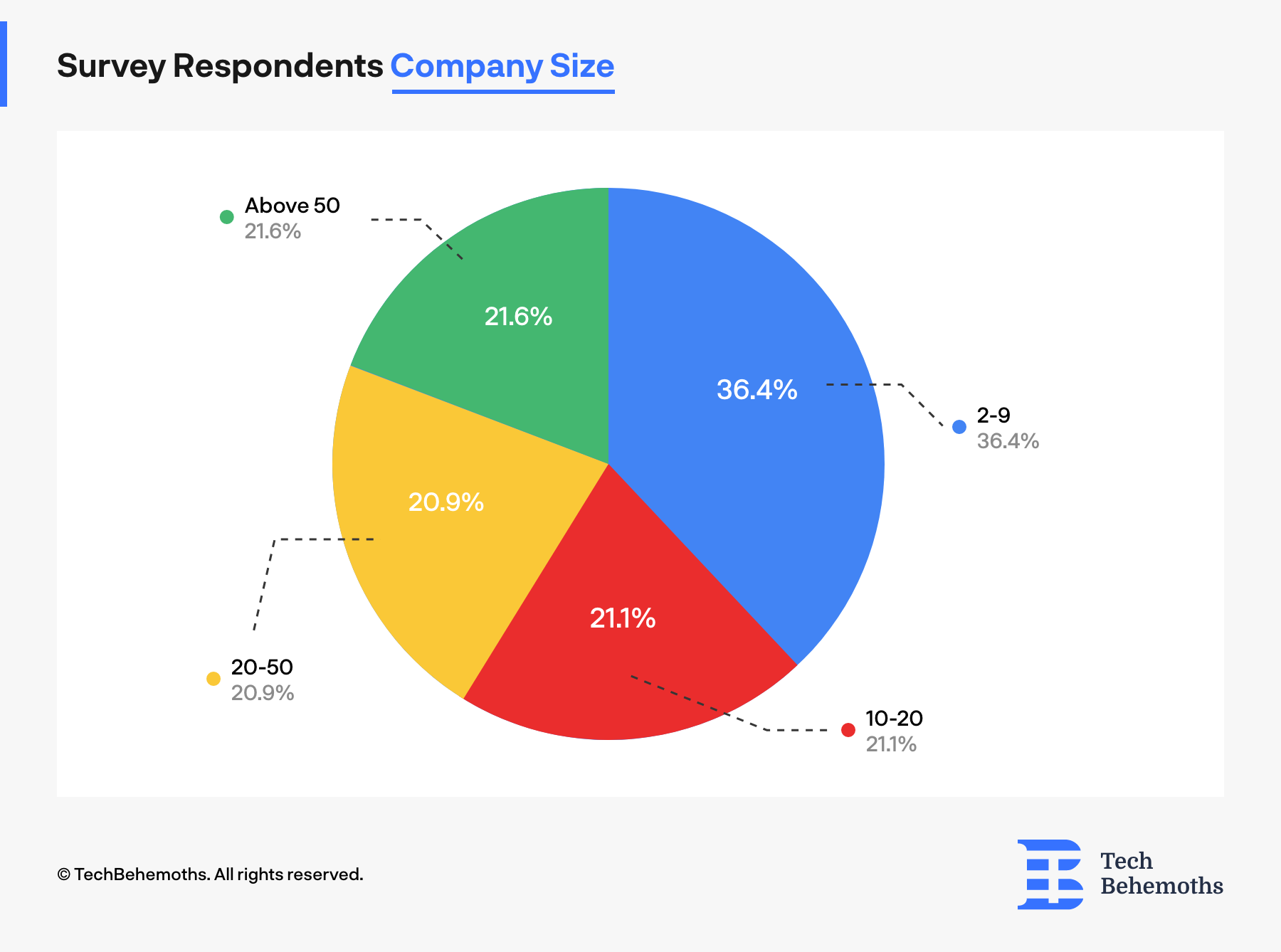

As for survey respondents company size, the distribution of responses was as follows:

-

SMEs with 2-9 team members - 35.7%

-

Companies with 10-20 employees - 21.1%

-

Companies and agencies with 20-50 employees - 20.9%

-

Companies with more than 50 employees - 21.6%

The survey measured how IT companies and digital agencies use digital marketing tools, and used 32 topics separated into main topics and subcategories for a more in-depth analysis of how they view tools or digital marketing branches and directions. On this note, we invite you to discover what they had to say about multiple topics, individually.

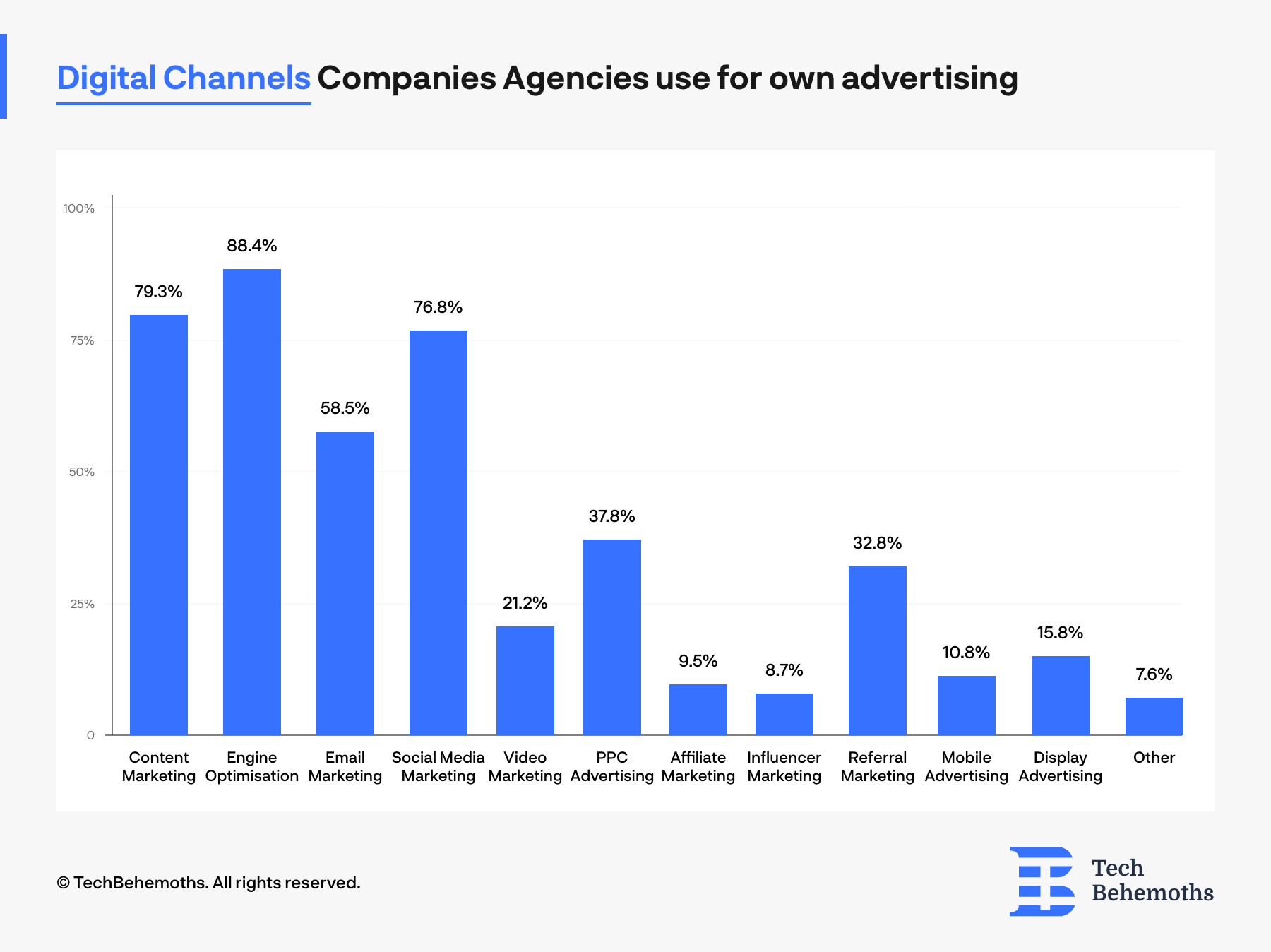

Most popular Digital Channels Companies and Agencies Use for Self Promotion

The first survey question aims to identify what digital channels IT companies use to advertise their own products and services. When asked, respondents were allowed to choose multiple answers, as a company may use more than one digital marketing channel to pursue its advertising goals.

The results showed that the most popular way on how IT companies choose to advertise is via search engine optimization, the option gathered 88.4% of all responses. On a 10% distance, SEO is followed by Content Marketing and Social Media Marketing, both options being chosen by 79,3% and 76,8% respectively.

At the same time it turns out that IT companies and digital agencies use affiliate marketing and influencer marketing the least, with a rate of under 10% of responses.

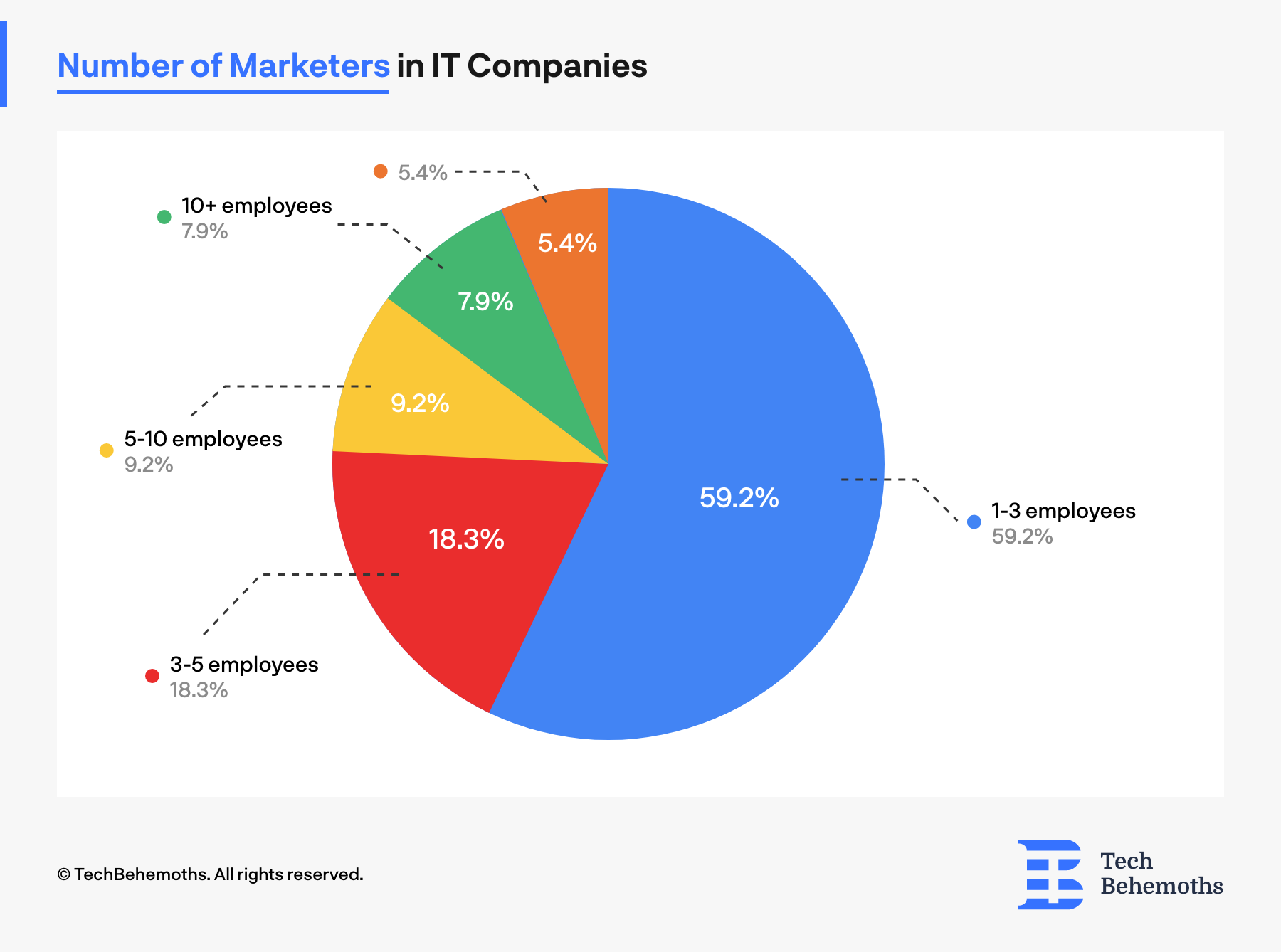

Almost 60% of IT Companies Have Between 1-3 Marketers in Their Team

Another interesting finding that the survey revealed is that the majority of IT companies have between 1-3 marketers, while only 18.3% of the participating companies declared that they hired between 3-5 marketers.

At the other end of the spectrum, only 5.4% of companies have more than 10 marketing specialists in their teams.

By analyzing the results on this specific aspect, we can conclude that either smaller IT companies and digital agencies don’t need more professionals in handling their marketing activities, or the companies are not so focused on this particular aspect.

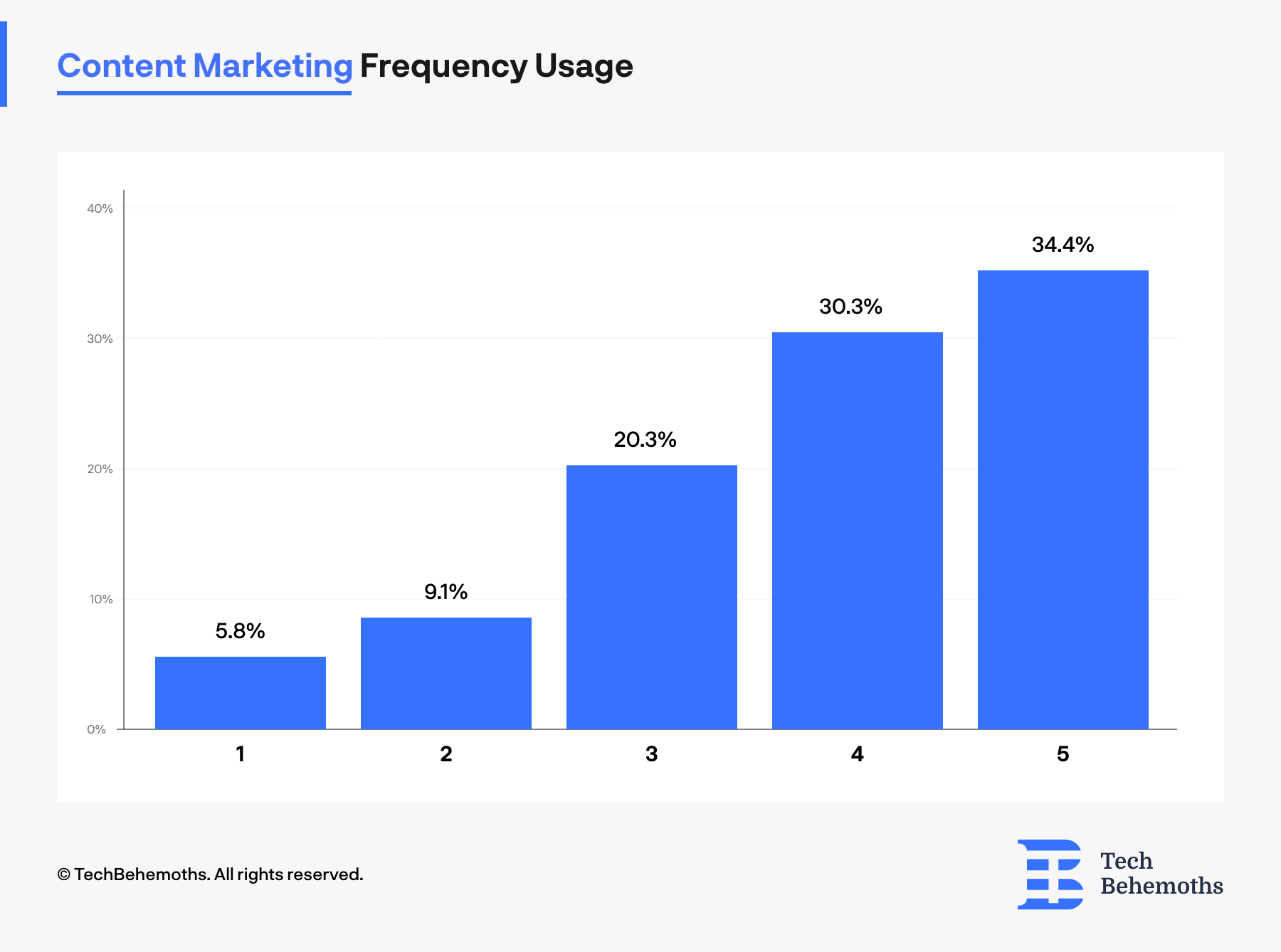

More Than 34% Of IT Companies And Digital Agencies Frequently Use Content Marketing

When it comes to content marketing, the survey results show that more than ⅓ of respondents use content marketing in their activities. Participants were asked to rate on a scale of 1 to 5 the frequency of using content marketing, and here are the results:

Out of all company representatives, 5.8% of the respondents declared that they don’t use at all content marketing in their activities. At the same time, 9.1% of companies and agencies participating at this survey declared that they rarely use content marketing.

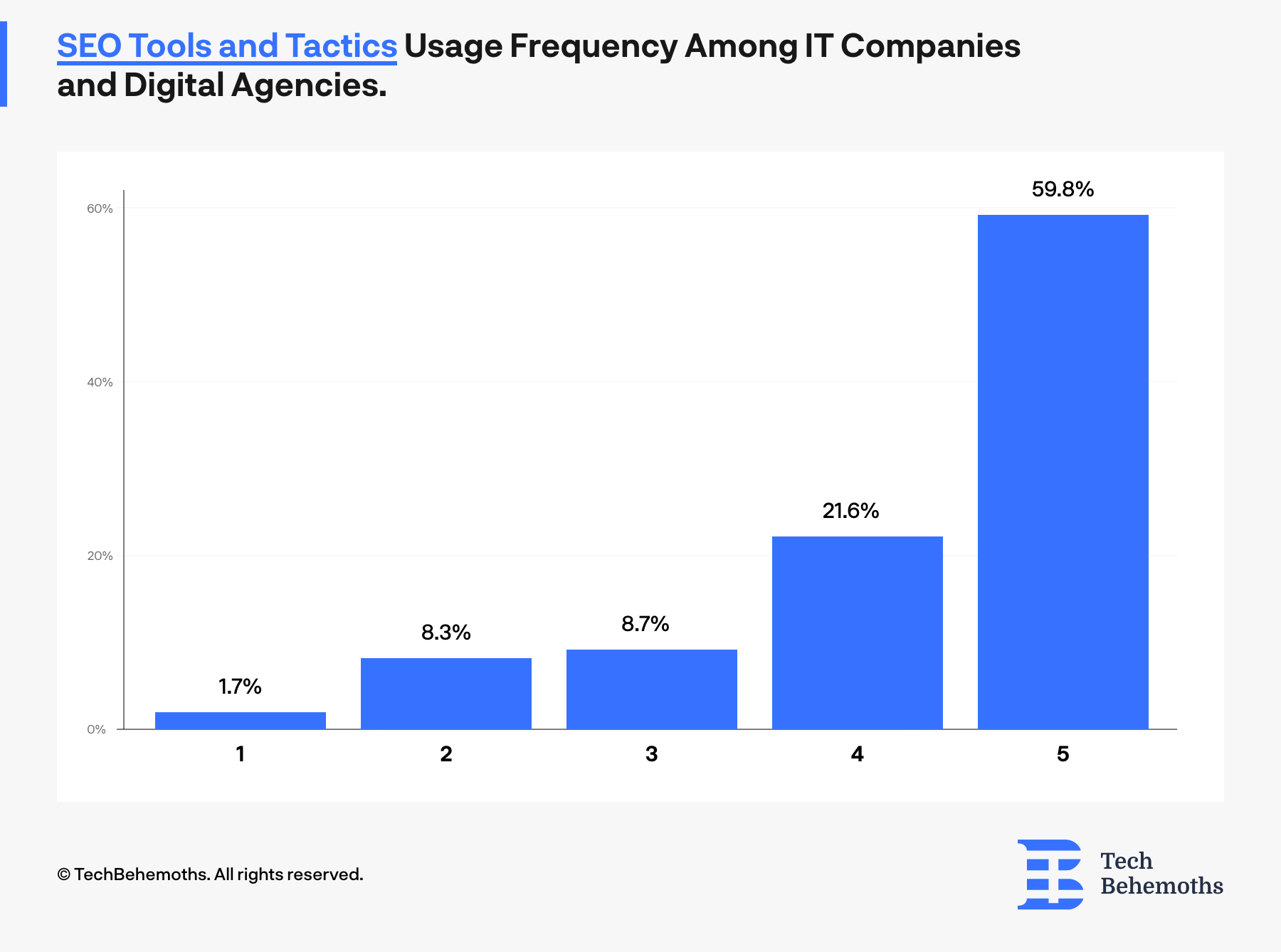

Almost 60% of IT Companies and Digital Agencies Frequently Use SEO Tactics and Tools In Their Activity

As for SEO frequency usage, it appears that a significant majority of the IT companies and digital agencies surveyed place a high level of focus on Search Engine Optimization (SEO).

The highest percentage of respondents, 59.8%, chose the highest rating of 5 on the scale, indicating that their company places a strong emphasis on SEO. This suggests that SEO is considered a vital aspect of their digital marketing strategy, and they likely allocate a considerable amount of resources towards optimizing their online presence for search engines.

Following the highest rating, the next highest percentage of respondents, 21.6%, chose a rating of 4. This indicates that a significant portion of companies still prioritize SEO to a considerable extent, although perhaps not as intensely as those who chose a rating of 5.

The responses for the lower ratings (1, 2, and 3) indicate that a smaller percentage of companies have a relatively lower focus on SEO. However, even the lowest rating of 1 received 1.7% of the responses, suggesting that there are still a few companies that allocate some attention to SEO, albeit to a lesser extent compared to others.

Overall, the results indicate that the majority of IT companies and digital agencies surveyed recognize the importance of SEO as a digital marketing tool. It is likely considered an integral part of their overall marketing strategy, aimed at improving their online visibility, attracting organic traffic, and enhancing their website's performance in search engine results pages.

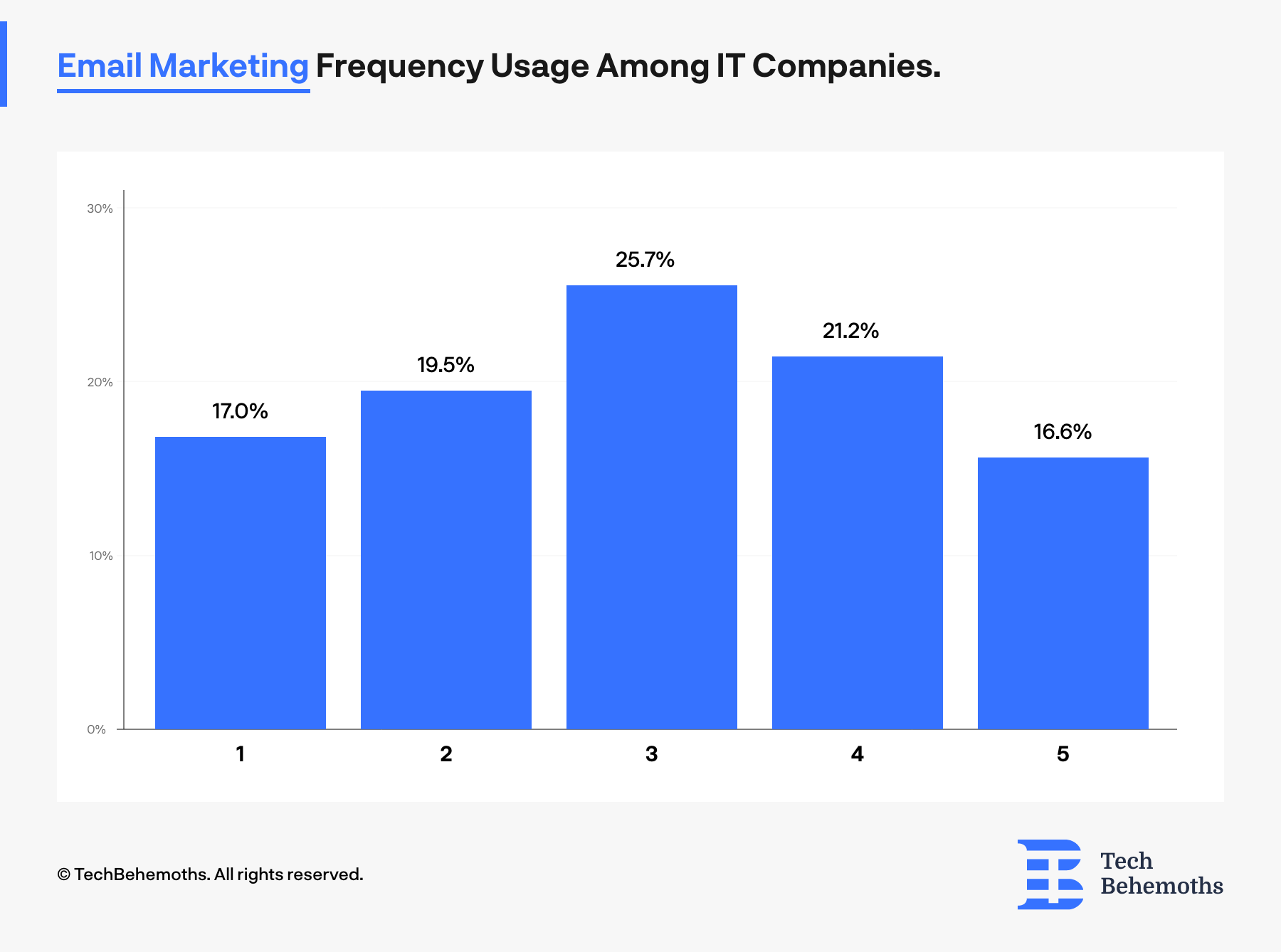

Email Marketing Among IT Companies Reveals A Balanced Distribution

There is a relatively balanced distribution of focus on email marketing among the IT companies and digital agencies surveyed.

The highest percentage of respondents, 25.7%, chose a rating of 3 on the scale, indicating a moderate level of focus on email marketing. This suggests that a significant portion of companies consider email marketing to be an important tool in their digital marketing strategies, but it may not be their primary focus.

Following the moderate rating, the next highest percentage of respondents, 21.2%, chose a rating of 4. This indicates that a considerable number of companies prioritize email marketing to a significant extent. They likely allocate resources and efforts towards building and nurturing their email lists, creating engaging email campaigns, and leveraging email as a means of communication and customer engagement.

The ratings of 1 and 2 received 17% and 19.5% of the responses, respectively. These lower ratings suggest that a notable portion of companies have a relatively lower emphasis on email marketing. However, it's worth noting that even with these lower ratings, email marketing still receives attention from a considerable percentage of respondents.

The lowest rating of 5 received 16.6% of the responses, indicating that a smaller portion of companies place the least amount of focus on email marketing. This suggests that email marketing might not be a primary channel or strategy for these companies, and they may allocate fewer resources to it compared to other digital marketing tools and strategies.

Overall, the results indicate that email marketing holds varying degrees of importance among the IT companies and digital agencies surveyed. While a significant portion of respondents allocate a moderate level of focus to email marketing, there is a relatively even distribution across the different ratings, indicating a diversity of approaches to this particular digital marketing tool.

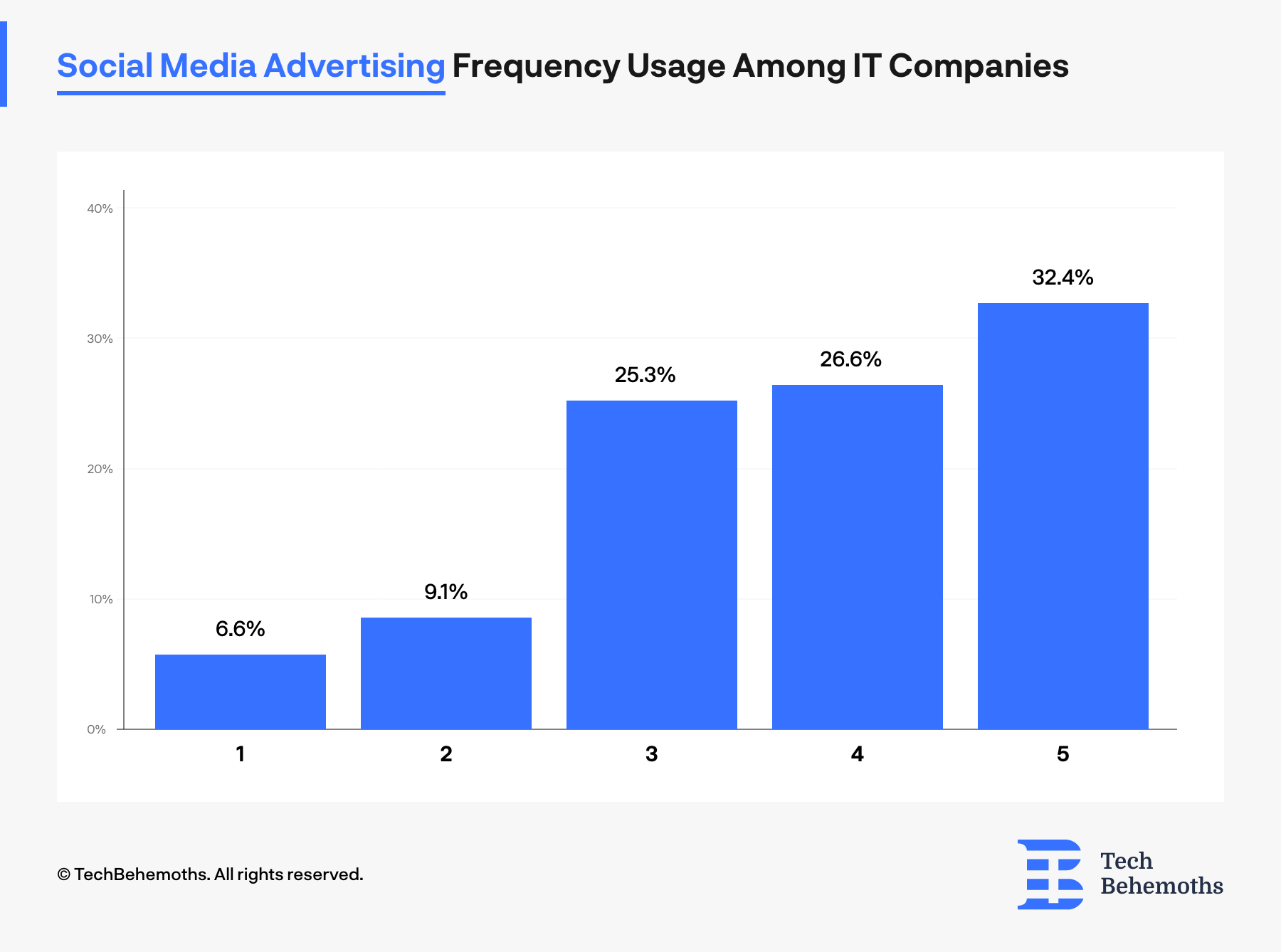

Social Media Marketing Frequency Usage Among IT

The survey results suggest that social media marketing is a significant focus for a considerable number of IT companies and digital agencies.

The highest percentage of respondents, 32.4%, rated their company's focus on social media marketing as a 5 on the scale. This indicates that a significant portion of the surveyed companies place a strong emphasis on leveraging social media platforms as a core component of their digital marketing strategies. They likely allocate substantial resources and efforts towards creating engaging social media content, building a strong social media presence, and utilizing social media channels to connect with their target audience.

Following the highest rating, the next highest percentage of respondents, 26.6%, chose a rating of 4. This suggests that a sizable number of companies prioritize social media marketing to a considerable extent. They recognize the importance of leveraging social media platforms to promote their brand, reach a wider audience, and engage with customers and prospects.

The responses for ratings 3 and 2 indicate that a significant portion of companies maintains a moderate focus on social media marketing. This means that they allocate resources and efforts toward utilizing social media platforms as part of their digital marketing strategies, but it may not be their primary area of focus.

The lowest ratings, 1 and 2, received 6.6% and 9.1% of the responses, respectively. These lower ratings suggest that a smaller percentage of companies have a relatively lower emphasis on social media marketing. However, even with these lower ratings, it is apparent that social media marketing still receives attention from a notable portion of respondents.

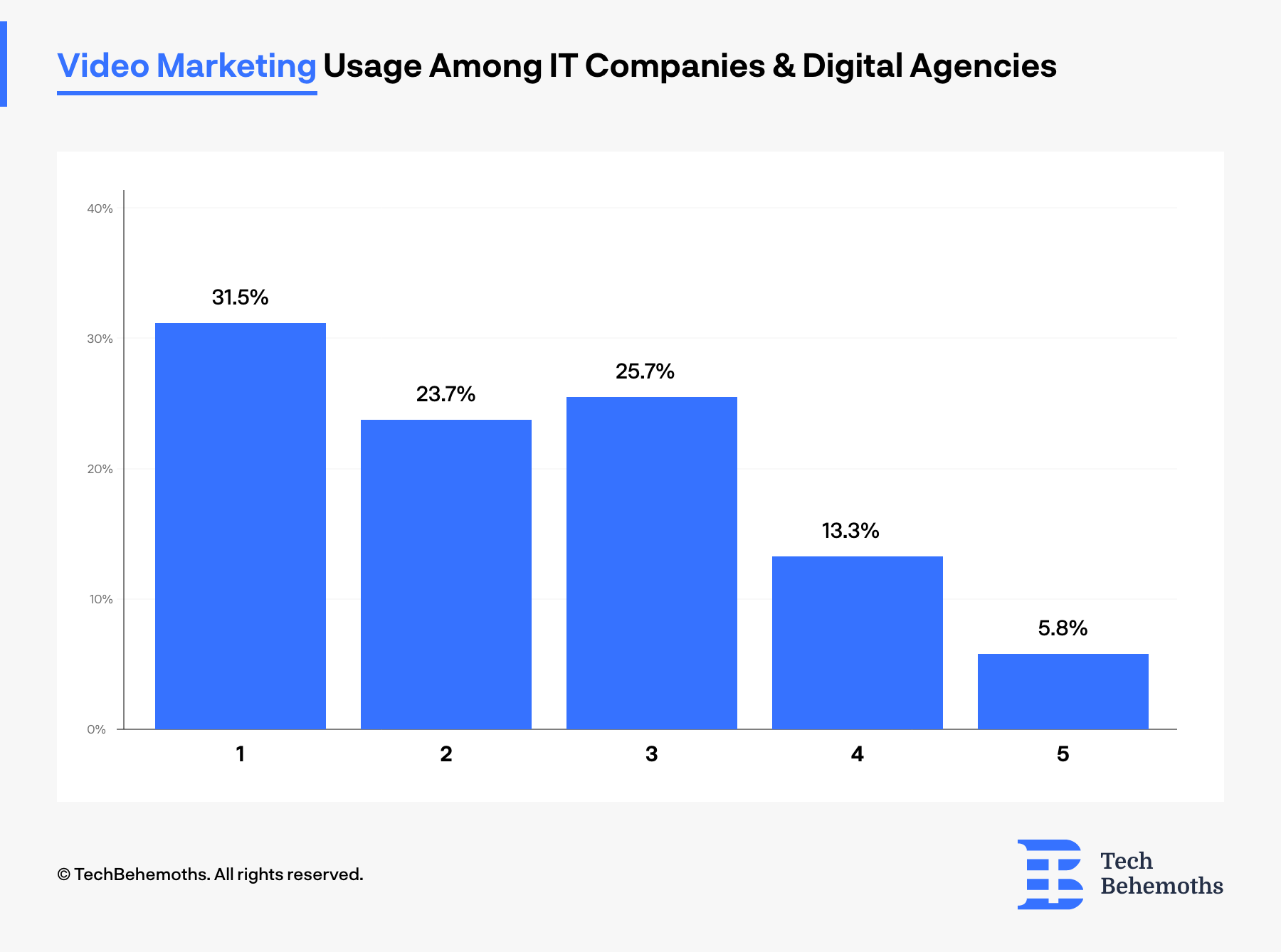

Most of IT Companies and Digital Agencies Don’t Use Video Marketing For Self-Advertising

The highest percentage of respondents, 31.5%, rated their company's focus on video marketing as a 1 on the scale. This suggests that a significant portion of the surveyed companies place a relatively lower emphasis on video marketing. It is likely that they allocate fewer resources and efforts towards utilizing video content as a digital marketing tool.

Following the lowest rating, the next highest percentage of respondents, 23.7%, chose a rating of 2. This indicates that a sizable number of companies have a slightly higher level of focus on video marketing compared to those who chose a rating of 1. However, it still suggests that video marketing might not be a primary focus for these companies.

The responses for ratings 3 and 4 demonstrate that a considerable portion of companies maintain a moderate level of focus on video marketing. This suggests that they recognize the value and potential of utilizing video content in their digital marketing strategies, but it may not be a central or primary component of their overall approach.

The highest rating, 5, received the lowest percentage of responses at 5.8%. This suggests that a smaller proportion of companies place the highest level of focus on video marketing. However, it also indicates that there are still some companies that prioritize video marketing and allocate significant resources and efforts towards creating and promoting video content.

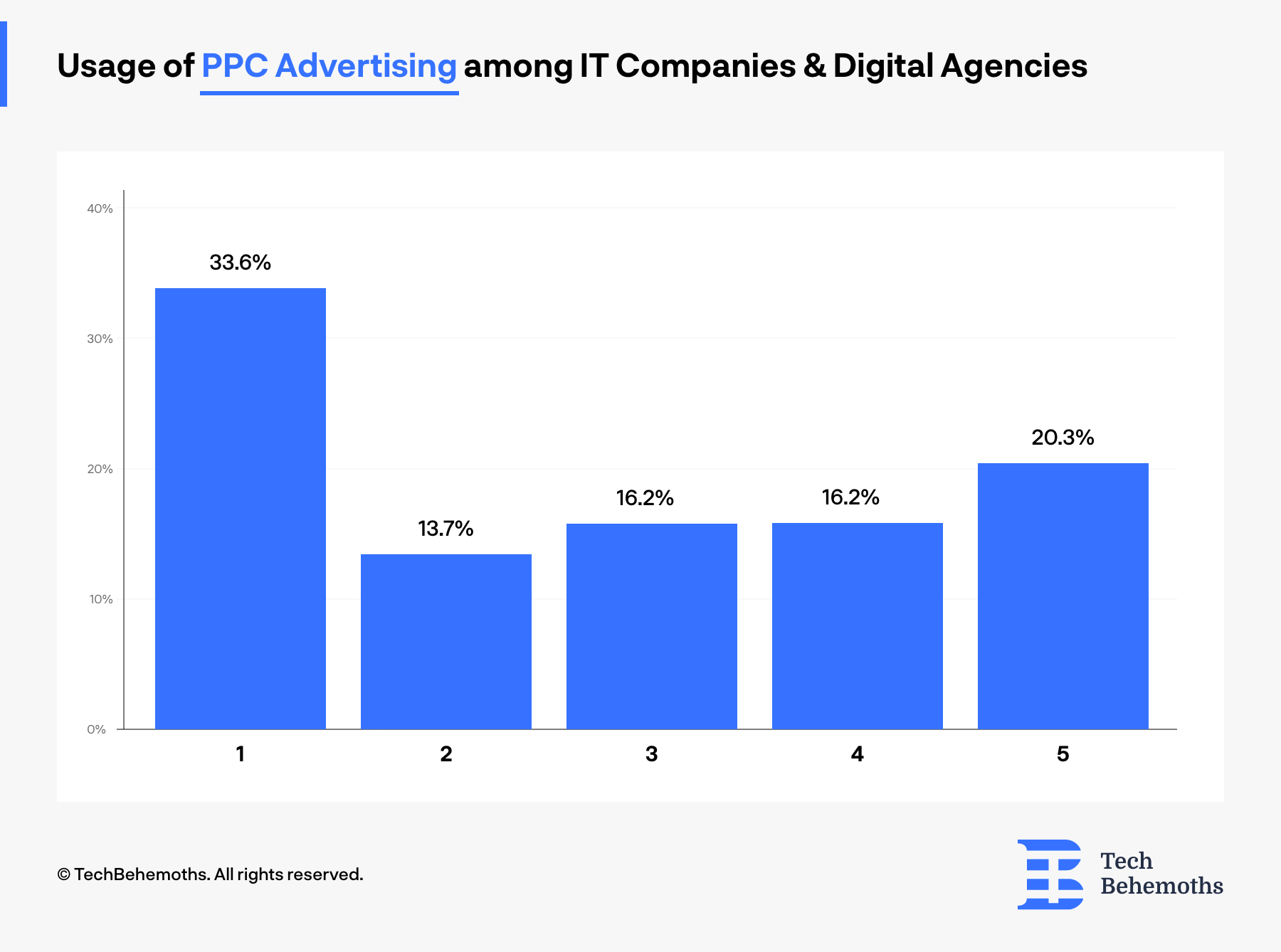

⅓ Of Surveyed IT Companies Don’t Use PPC for Self Advertising

The survey results indicate that there is a diverse range of focus on PPC (Pay-Per-Click) advertising among IT companies and digital agencies.

The highest percentage of respondents, 33.6%, rated their company's focus on PPC advertising as a 1 on the scale. This suggests that a significant portion of the surveyed companies place a relatively lower emphasis on PPC advertising. They may allocate fewer resources and efforts towards running PPC campaigns or may prefer to focus on other digital marketing strategies.

Following the lowest rating, the next highest percentages of respondents, 20.3% and 16.2%, chose a rating of 5 and 4, respectively. This indicates that a notable number of companies prioritize PPC advertising to a significant extent. They recognize the value of PPC campaigns in driving targeted traffic, generating leads, and achieving their digital marketing goals. These companies are likely willing to invest resources and efforts into optimizing and managing PPC campaigns.

The responses for ratings 2 and 3 suggest that a smaller portion of companies maintain a moderate level of focus on PPC advertising. They allocate some attention and resources to PPC campaigns, but it may not be their primary digital marketing strategy.

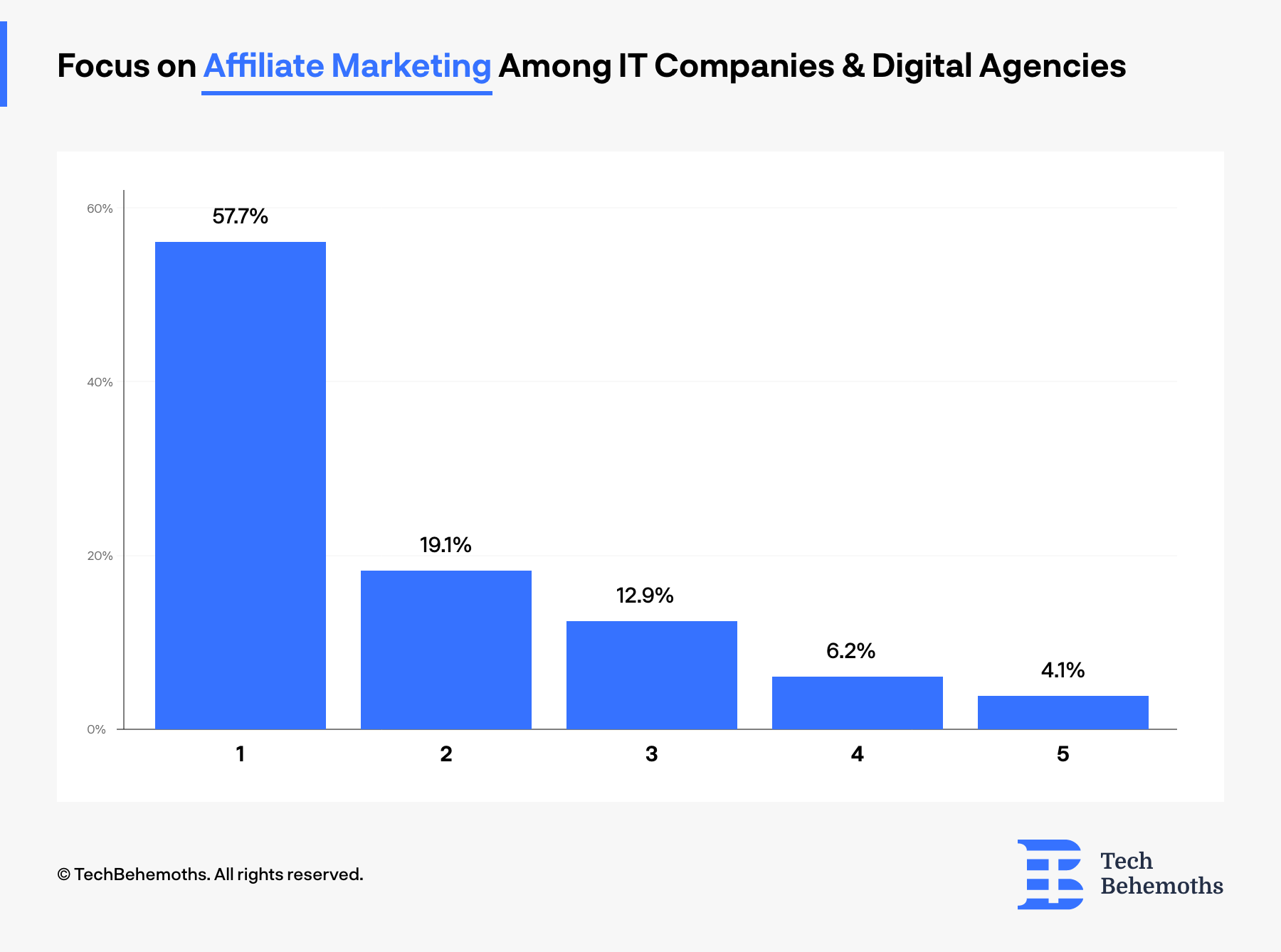

Majority of IT Companies and Digital Agencies Show Limited Focus on Affiliate Marketing

The survey results indicate that a majority of IT companies and digital agencies surveyed have a relatively low focus on affiliate marketing.

The highest percentage of respondents, 57.7%, rated their company's focus on affiliate marketing as a 1 on the scale. This suggests that a significant portion of the surveyed companies allocate minimal attention and resources to affiliate marketing. Affiliate marketing may not be a primary strategy for them in terms of driving customer acquisition or generating revenue.

Following the lowest rating, the next highest percentage of respondents, 19.1%, chose a rating of 2. This indicates that a smaller but notable number of companies have a slightly higher level of focus on affiliate marketing compared to those who chose a rating of 1. However, even with this rating, affiliate marketing may still not be a central component of their overall digital marketing strategy.

The responses for ratings 3, 4, and 5 collectively received relatively lower percentages. This suggests that a smaller portion of companies place a moderate to high level of focus on affiliate marketing. These companies recognize the potential of affiliate marketing as a strategy to leverage third-party partnerships and drive revenue through commissions or referrals, but they may not be as prevalent compared to those with lower ratings.

Overall, the survey results indicate that affiliate marketing is not a primary focus for the majority of IT companies and digital agencies surveyed. While there may be a smaller percentage of companies with a moderate to high focus on affiliate marketing, the majority allocate limited attention and resources to this particular strategy.

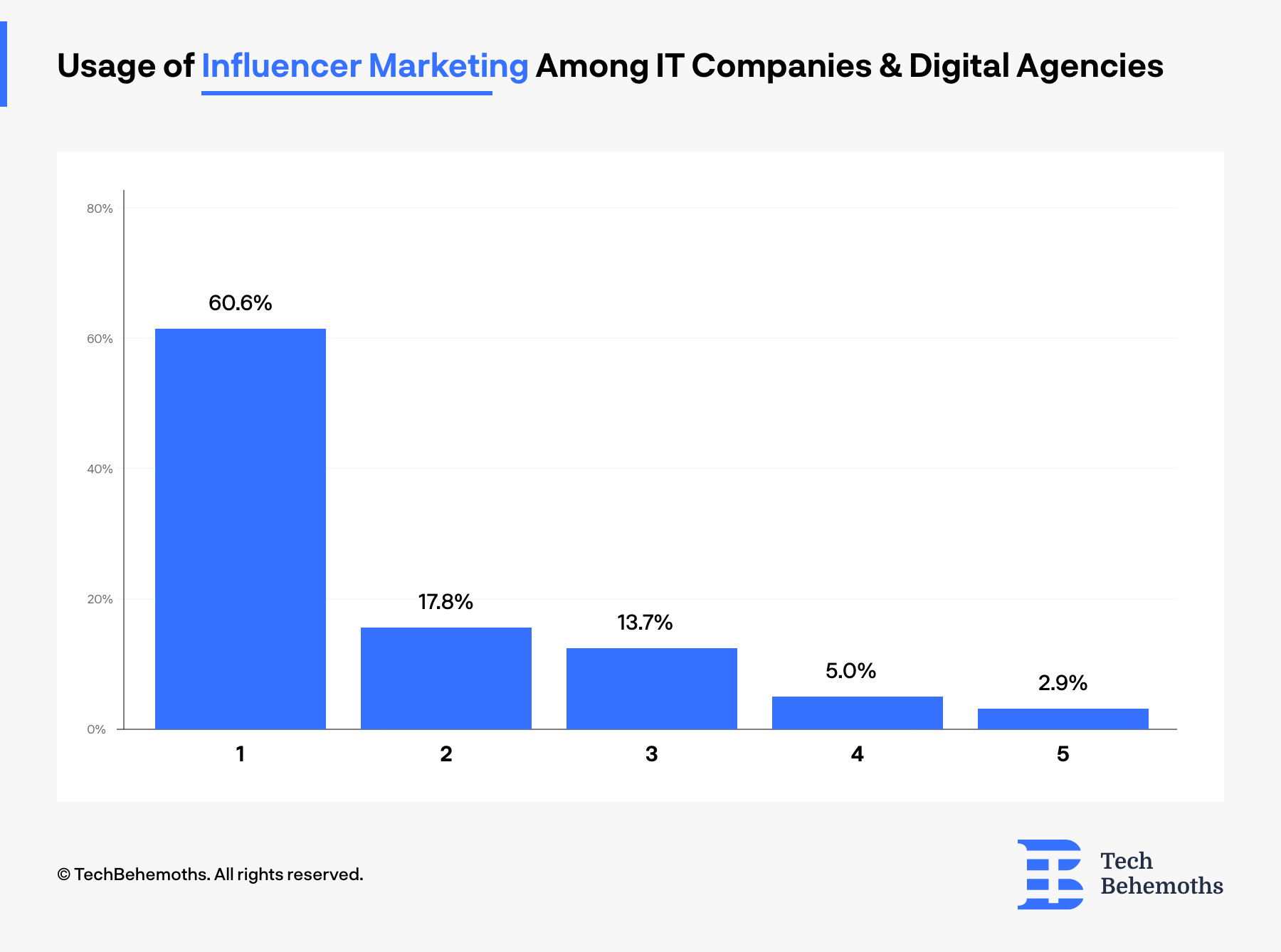

Only 2.9% Of IT Companies and Digital Agencies Use Influencer Marketing For Self Advertising

The survey results highlight a minimal focus on influencer marketing among the IT companies and digital agencies surveyed.

The highest percentage of respondents, 60.6%, rated their company's focus on influencer marketing as a 1 on the scale. This indicates that a significant majority of the surveyed companies allocate minimal attention and resources to influencer marketing. Influencer collaborations may not be a prominent strategy for them in terms of leveraging the reach and influence of social media influencers.

Following the lowest rating, the next highest percentage of respondents, 17.8%, chose a rating of 2. This suggests that a smaller but notable portion of companies have a slightly higher level of focus on influencer marketing compared to those who chose a rating of 1. However, even with this rating, influencer marketing does not emerge as a central component of their overall digital marketing approach.

The responses for ratings 3, 4, and 5 collectively received relatively lower percentages. This indicates that a smaller proportion of companies place a moderate to high level of emphasis on influencer marketing. These companies recognize the potential of collaborating with influencers to enhance brand awareness, reach a wider audience, and drive engagement, but they may not be as prevalent compared to those with lower ratings.

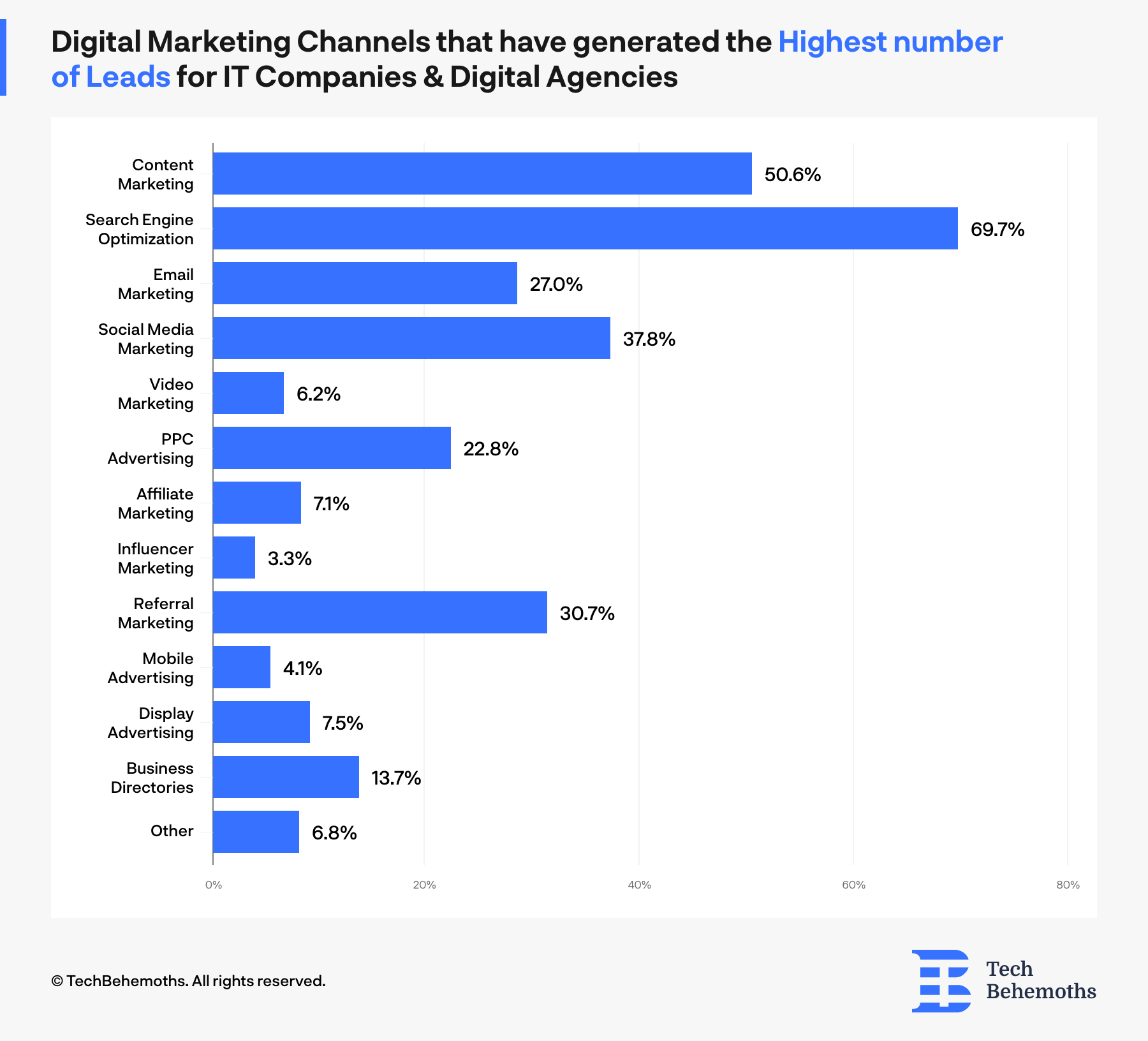

Effectiveness of Digital Marketing Channels in Lead Generation

The survey results provide insights into the effectiveness of various digital marketing channels in generating leads for IT companies and digital agencies.

Search Engine Optimization (SEO) emerged as the top-performing digital marketing channel, with 69.70% of respondents indicating that it generated the highest number of leads for their businesses in the past year. This highlights the importance of optimizing websites and content to improve organic search visibility and attract relevant traffic from search engines.

Content Marketing also proved to be a significant lead generator, with 50.60% of respondents attributing their highest number of leads to this strategy. This indicates the value of creating and distributing relevant, valuable, and engaging content to attract and engage target audiences.

Social Media Marketing demonstrated its effectiveness, with 37.80% of respondents reporting it as a channel that generated their highest number of leads. Leveraging social media platforms to engage with audiences, promote content, and drive conversions proved beneficial for these companies.

Email Marketing, Referral Marketing, and PPC Advertising were also identified by a notable percentage of respondents (27%, 30.70%, and 22.80%, respectively) as channels that generated a significant number of leads. These channels highlight the effectiveness of targeted email campaigns, customer referrals, and paid advertising campaigns in driving lead-generation efforts.

While Video Marketing, Influencer Marketing, Mobile Advertising, Display Advertising, Business Directories, and Other channels received lower percentages in terms of lead generation, they still contributed to the overall marketing efforts of some companies.

The results suggest that a combination of digital marketing channels can be effective in generating leads. SEO, Content Marketing, Social Media Marketing, Email Marketing, and Referral Marketing emerged as the primary channels that have proven successful for lead generation in the past year. IT companies and digital agencies should consider investing in these channels to maximize their lead generation potential and overall business growth.

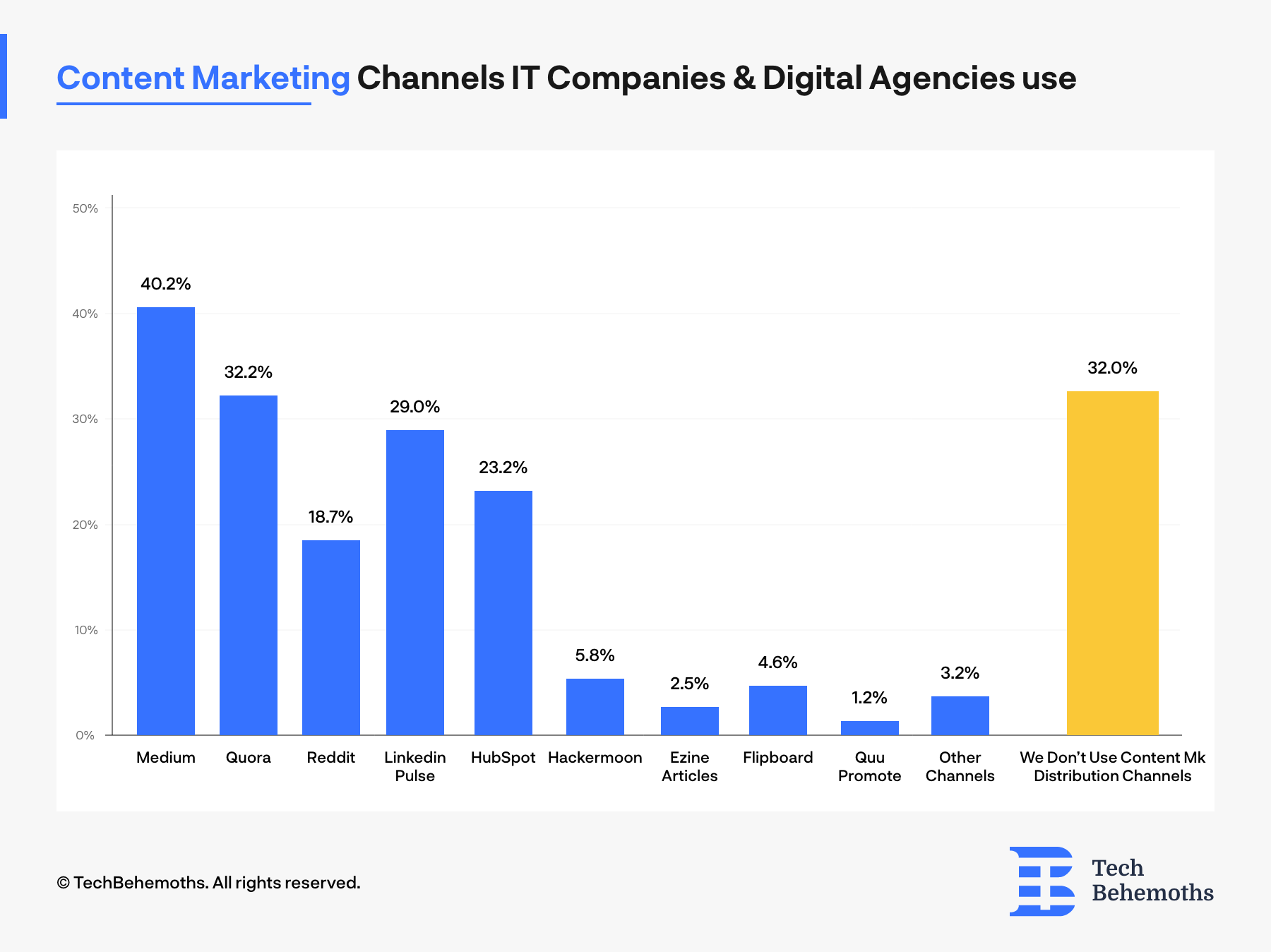

Survey Results: Content Marketing Distribution Channels Companies and Agencies Use Most

The survey results shed light on the content marketing distribution channels commonly utilized by IT companies and digital agencies.

Medium emerged as the most popular content marketing distribution website, with 40.20% of respondents indicating its usage. Medium provides a platform for publishing and sharing articles, making it a favored choice for companies to distribute their content and reach a wider audience.

Quora and LinkedIn Pulse were also popular choices, with 32% and 29% of respondents utilizing these platforms, respectively. Quora offers a question-and-answer format, allowing companies to share their expertise and knowledge, while LinkedIn Pulse provides a professional platform for publishing articles and industry insights.

Reddit and HubSpot were selected by a notable percentage of respondents (18.70% and 23.20% respectively). Reddit serves as an online community with various discussion forums, providing an opportunity for companies to engage with a diverse audience. HubSpot, on the other hand, offers a comprehensive platform that includes content creation, marketing automation, and distribution features.

Other content marketing distribution channels such as Hackernoon, EzineArticles, Flipboard, Quu Promote, and various other channels collectively received lower percentages of usage. However, they still serve as additional outlets for distributing content and reaching specific audiences.

It is worth noting that 32% of respondents indicated that their company/agency does not use content marketing distribution channels. This suggests that a significant portion of the surveyed IT companies and digital agencies may not be actively leveraging content distribution websites as part of their content marketing strategy.

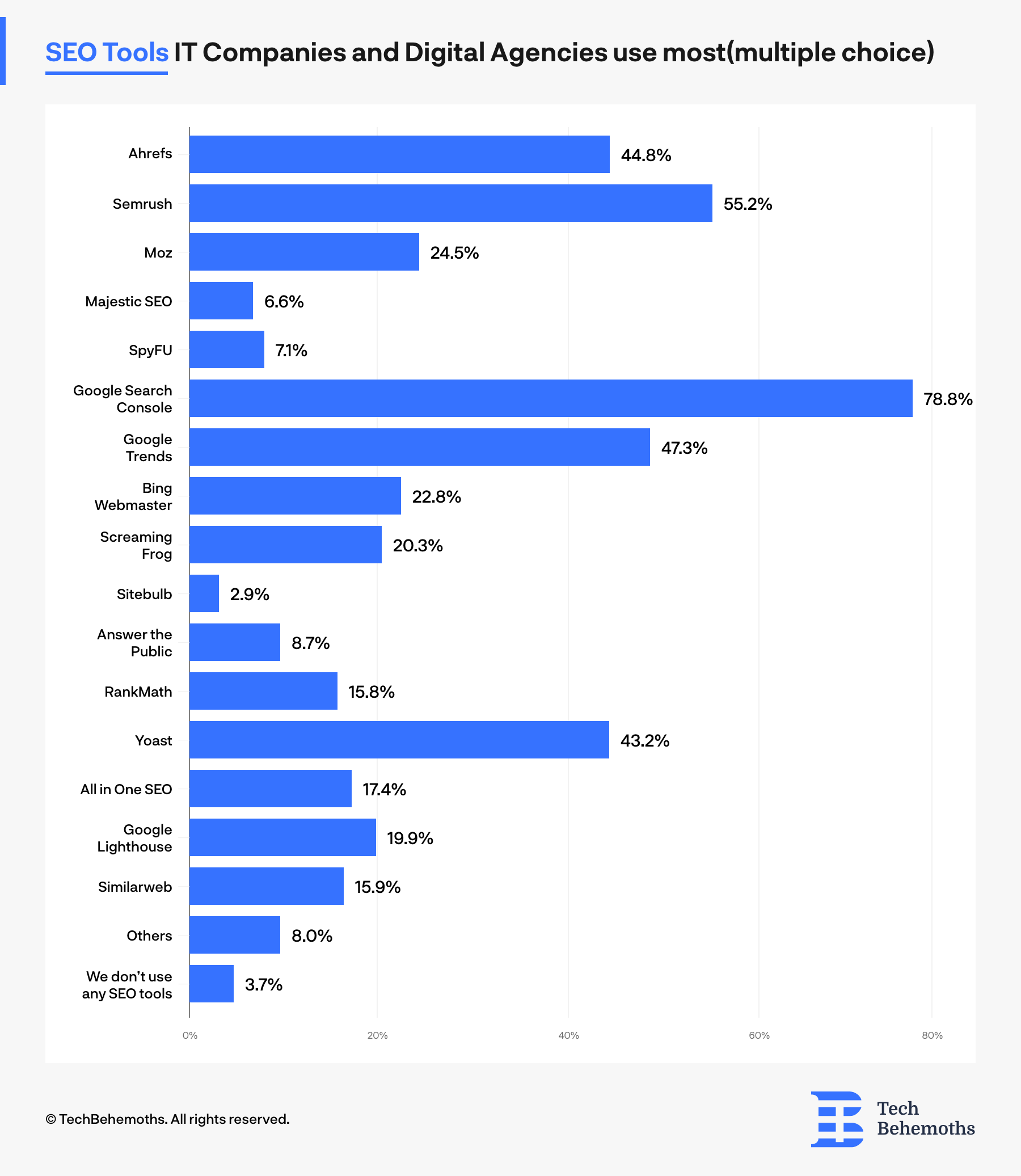

Analysis of SEO Tool Usage Among IT Companies and Digital Agencies

The survey results provide insights into the SEO tools commonly utilized by IT companies and digital agencies to enhance their search engine optimization efforts.

The top three most used SEO tools are Semrush, Ahrefs, and Google Search Console. Semrush holds the highest usage percentage at 55.20%, followed closely by Ahrefs at 44.80%. Both tools offer comprehensive SEO functionalities, including keyword research, competitor analysis, backlink analysis, and site auditing.

Google Search Console, a free tool provided by Google, proves to be widely adopted, with 78.80% of respondents utilizing it. This tool allows website owners to monitor their website's performance in Google search results, identify indexing issues, submit sitemaps, and track keyword rankings.

Other notable SEO tools in the survey results include Google Trends (47.30%), Yoast (43.20%), Moz (24.50%), Bing Webmaster (22.80%), and Google Lighthouse (19.90%). These tools offer various features such as keyword research, content optimization, technical SEO analysis, and performance monitoring

It is interesting to note that 3.70% of respondents indicated that their company or agency does not use any SEO tools, suggesting that a small portion may rely on manual SEO practices or outsource SEO tasks to specialized professionals.

Additional SEO tools like Majestic SEO, SpyFU, Screaming Frog, Sitebulb, Answer the Public, RankMath, All in One SEO, Similarweb, and others received varying levels of usage percentages, highlighting the diverse range of tools available in the market to cater to specific SEO needs.

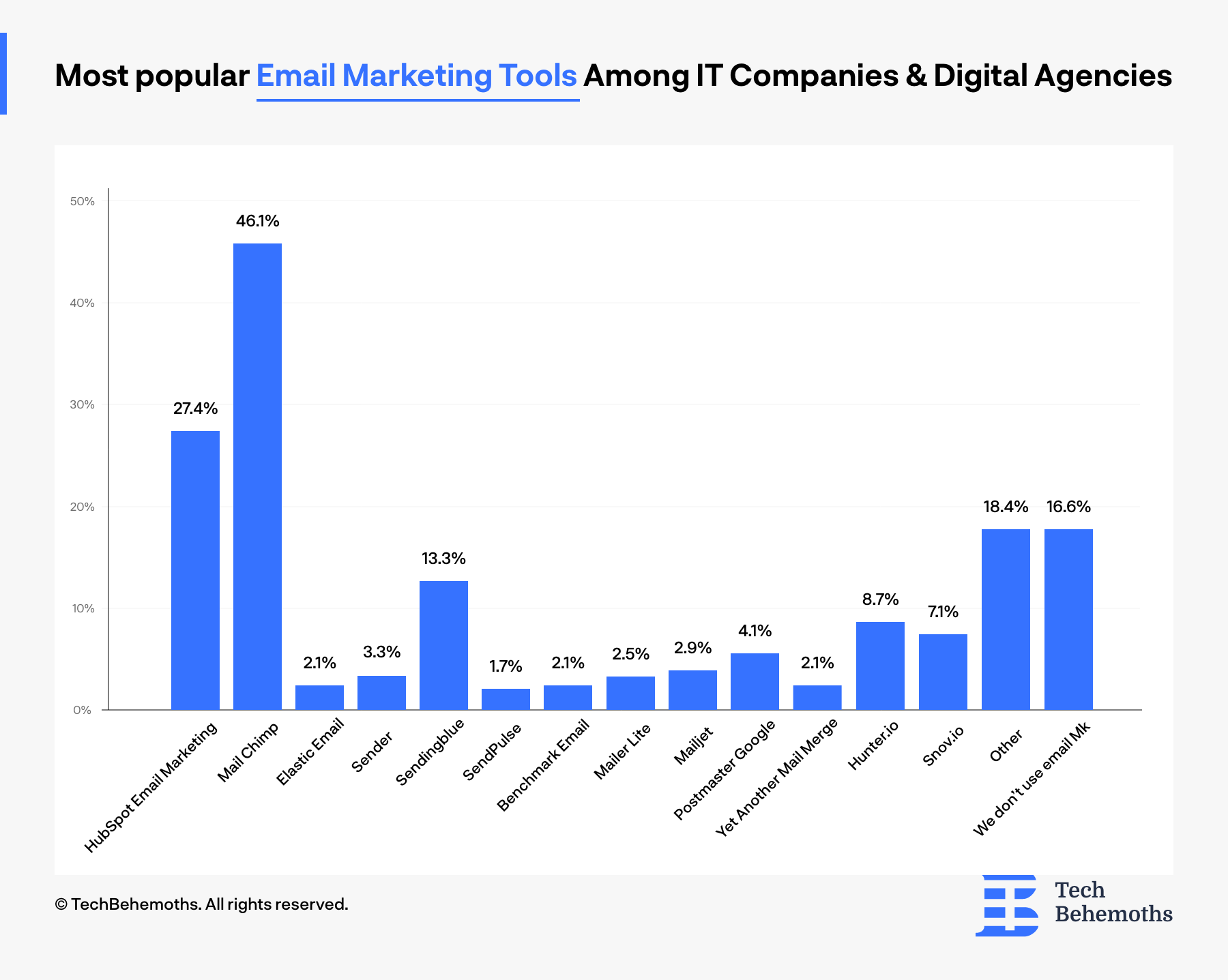

Most popular Email Marketing Tools Among IT Companies & Digital Agencies

The survey results shed light on the email marketing tools commonly utilized by IT companies and digital agencies to manage their email marketing campaigns.

Mail Chimp emerges as the most widely used tool, with 46.10% of respondents utilizing its features. Mail Chimp offers a comprehensive email marketing platform that enables businesses to create, send, and track email campaigns efficiently.

HubSpot Email Marketing follows closely behind, with 27.40% of respondents utilizing its email marketing capabilities. HubSpot provides a robust marketing automation platform that includes email marketing functionality along with other marketing tools.

Other notable email marketing tools in the survey results include Sendinblue (13.30%), Hunter.io (8.70%), Snov.io (7.10%), and Postmaster Google (4.10%). These tools offer various features such as email campaign management, contact list management, automation, and tracking.

It is worth noting that 16.60% of respondents indicated that their company or agency does not use email marketing, suggesting that a significant portion may not prioritize email marketing or may rely on alternative communication channels for their marketing efforts.

Additional email marketing tools such as Elastic Email, Sender, SendPulse, Benchmark Email, Mailer Lite, Mailjet, Yet Another Mail Merge (YAMM), and others received varying levels of usage percentages, showcasing the diverse range of tools available to cater to specific email marketing needs.

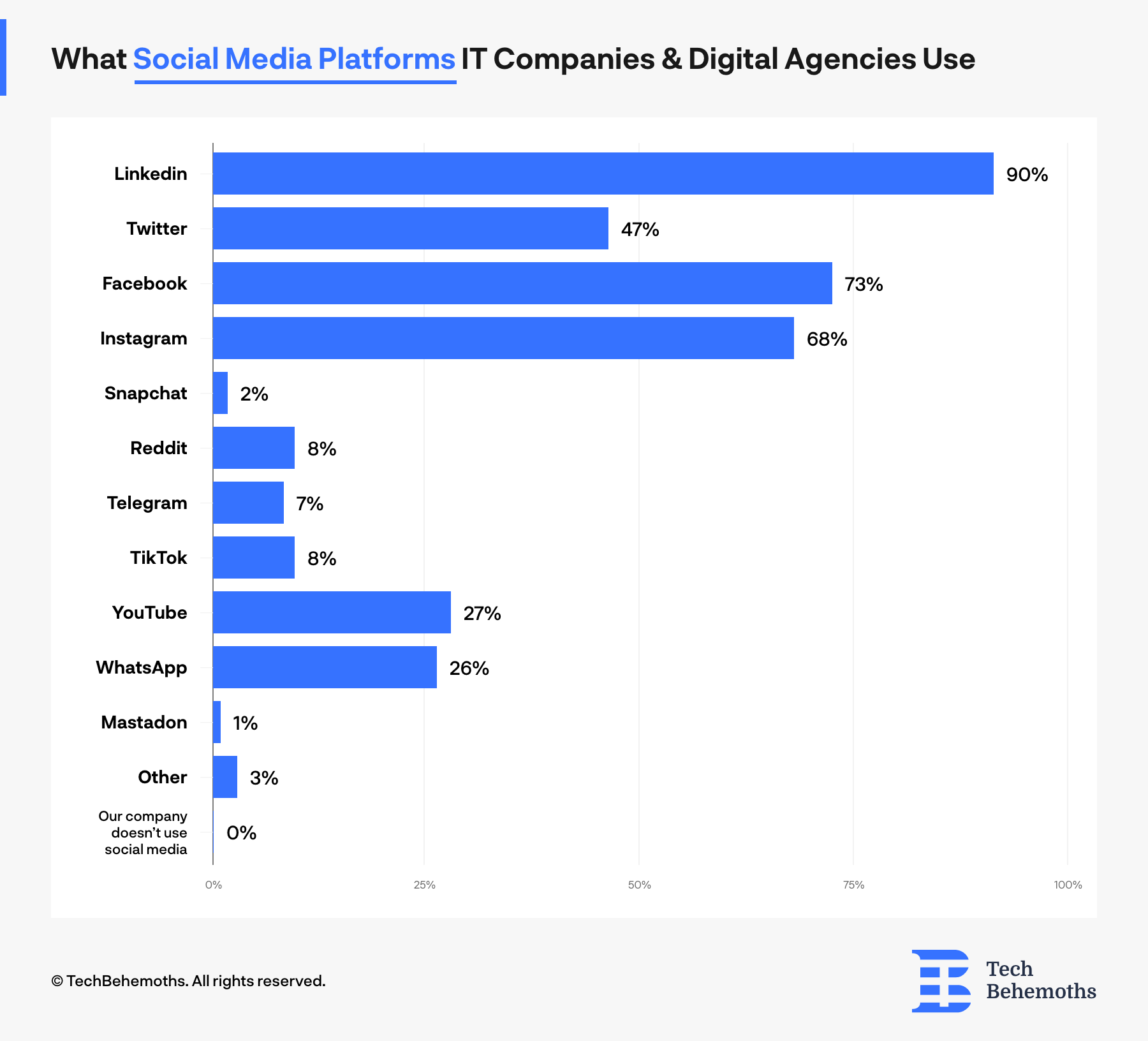

The Use of Social Media Platforms By IT Companies and Digital Agencies

The survey results provide insights into the social media platforms where IT companies and digital agencies maintain a strong presence for their online marketing efforts.

LinkedIn emerged as the most prevalent social media platform, with a significant majority of 90% of respondents indicating their company's presence on this professional networking site. LinkedIn offers a valuable platform for B2B networking, industry connections, and sharing business-related content.

Facebook and Instagram also showed high levels of adoption, with 73% and 68% of respondents respectively. Facebook remains a popular choice for businesses to engage with a diverse audience and build brand communities, while Instagram provides a visually appealing platform for sharing images and videos to connect with a younger demographic.

Twitter (46.90%), YouTube (27.40%), and WhatsApp (25.70%) were also commonly utilized social media platforms. Twitter enables real-time communication and content sharing, while YouTube offers opportunities for video marketing and reaching a vast audience. WhatsApp serves as a messaging app for businesses to engage with customers and provide personalized communication.

Other social media platforms such as Snapchat, Reddit, Telegram, TikTok, and Mastodon received lower usage percentages, indicating a more selective presence among IT companies and digital agencies based on their target audience and marketing objectives.

It is interesting to note that a small percentage of respondents (0.40%) indicated that their company or agency does not utilize social media platforms for their marketing efforts, suggesting a minority approach or focus on alternative marketing channels.

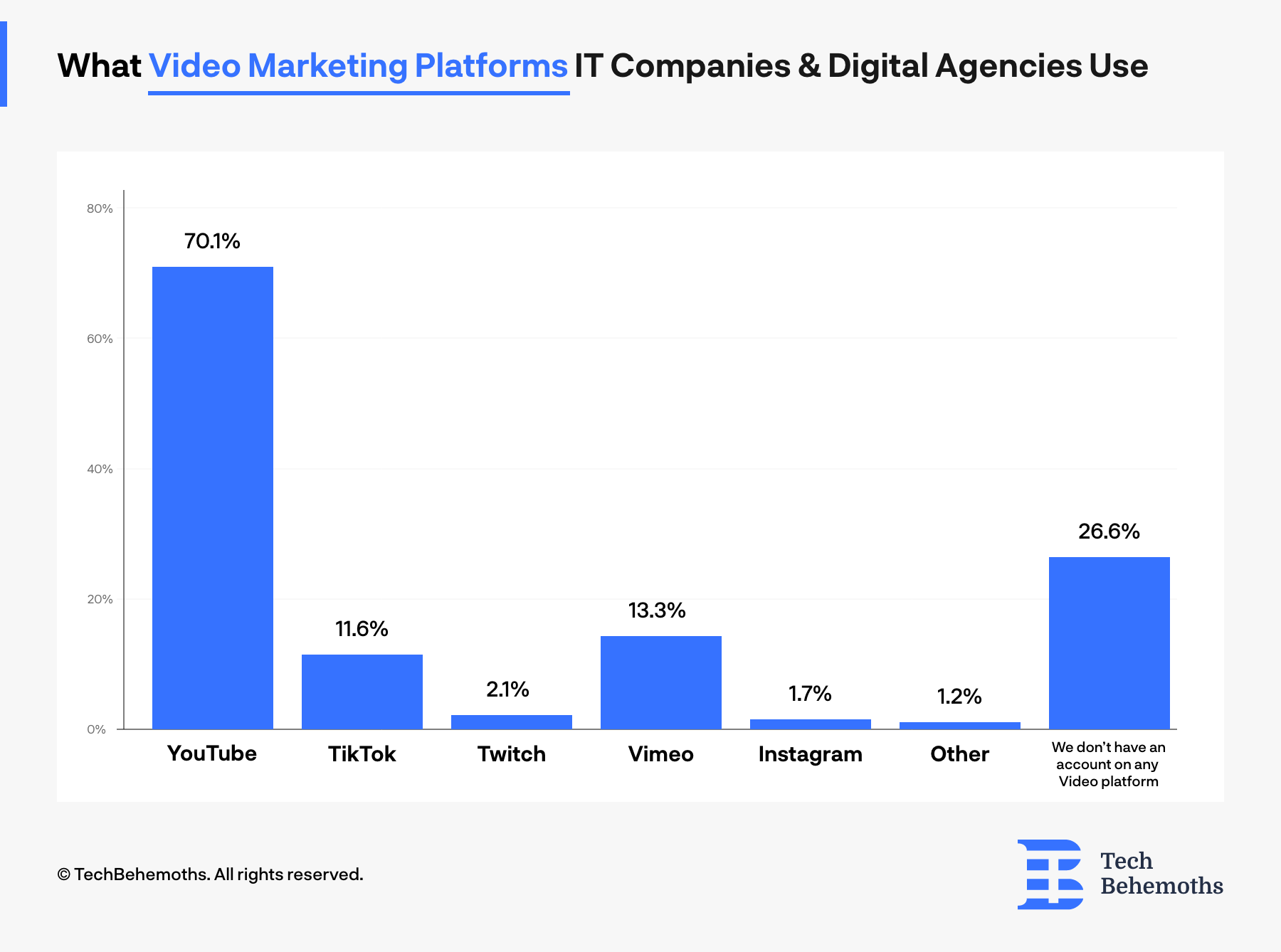

How IT Companies & Digital Agencies Use Video Marketing

The survey results provide insights into the video sharing platforms most commonly utilized by IT companies and digital agencies for their marketing efforts.

YouTube emerges as the dominant video sharing platform, with 70.10% of respondents indicating its usage. YouTube's popularity stems from its wide reach, user-friendly interface, and robust video hosting capabilities, making it an ideal platform for businesses to share video content and engage with their target audience.

Vimeo, with 13.30% usage, is another notable video sharing platform chosen by IT companies and digital agencies. Vimeo offers a more professional and creative-oriented platform, known for its high-quality video playback and customization options.

TikTok, with 11.60% usage, has gained significant popularity among businesses, especially those targeting younger demographics. TikTok's short-form video format and viral potential provide unique opportunities for engaging with a diverse and active user base.

Other video sharing platforms, including Twitch, Instagram, and others, received lower usage percentages, indicating a more selective adoption among IT companies and digital agencies based on their specific video marketing strategies and target audience preferences.

It is worth noting that 26.60% of respondents indicated that their company or agency does not have an account on any video platforms. This suggests that a significant portion of businesses may not prioritize video marketing or may focus on alternative content formats for their marketing efforts.

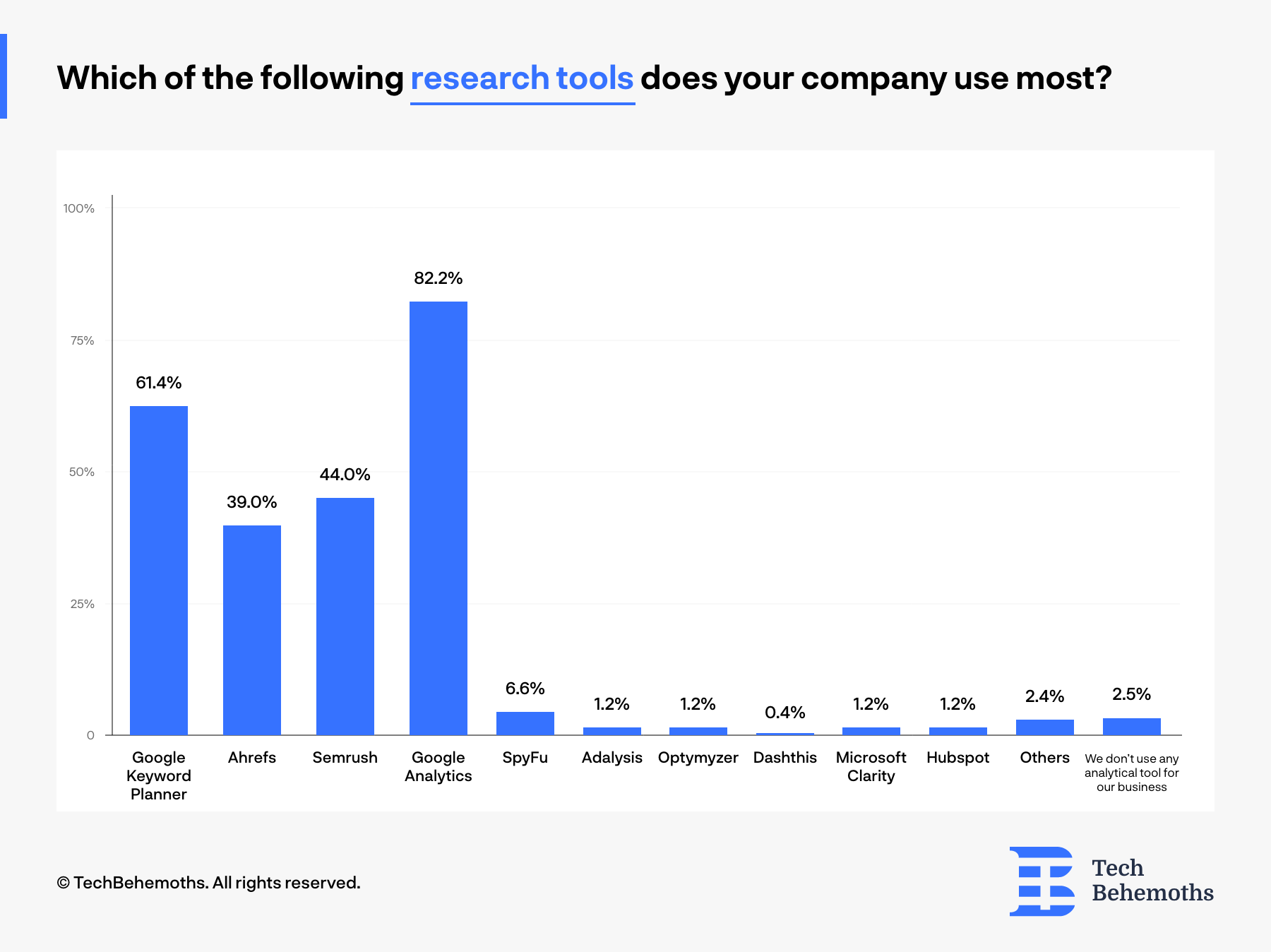

Analysis of Research/Analytics Tool Usage Among IT Companies and Digital Agencies

The survey results provide insights into the research and analytics tools most commonly used by IT companies and digital agencies to gather data and gain valuable insights for their digital marketing strategies.

Google Analytics stands out as the most widely utilized tool, with an impressive 82.20% of respondents indicating its usage. Google Analytics offers comprehensive website analytics and tracking capabilities, enabling businesses to monitor website performance, user behavior, traffic sources, and conversion metrics.

Google Keyword Planner is another widely adopted tool, with 61.40% of respondents utilizing its features. This tool assists businesses in conducting keyword research and understanding search volume trends, helping them optimize their content for better search engine visibility.

Semrush (44%) and Ahrefs (39%) are also popular choices for research and analytics. These tools offer a range of functionalities, including competitor analysis, backlink analysis, keyword tracking, and content optimization.

Other notable research/analytics tools mentioned in the survey results include SpyFu, Adalysis, Optimyzr, Microsoft Clarity, HubSpot, and others, each with smaller usage percentages.

It is worth mentioning that a small percentage of respondents (2.50%) indicated that their company or agency does not use any analytical tool for their business, suggesting potential missed opportunities for data-driven decision-making.

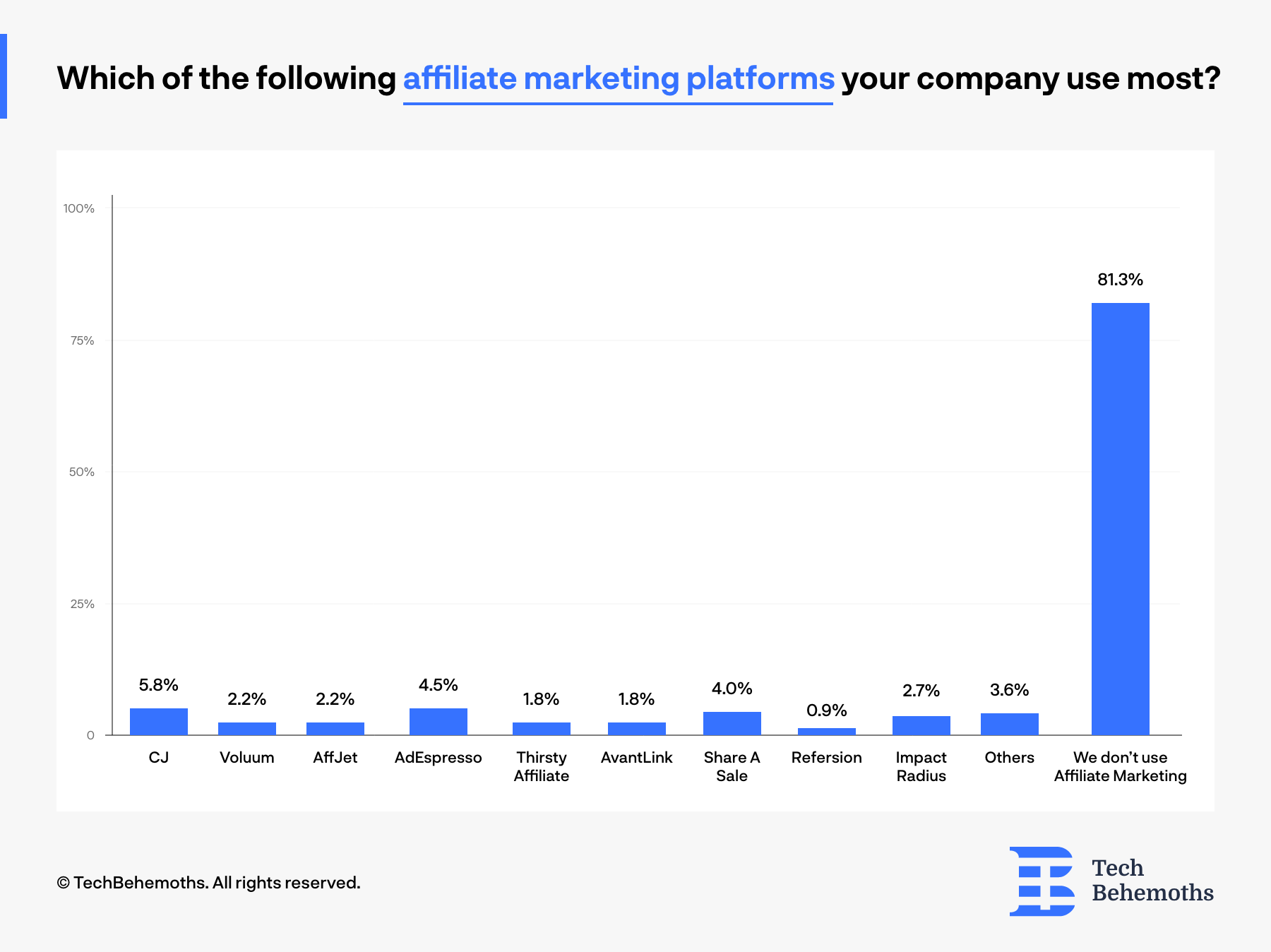

How IT Companies & Digital Agencies Use Affiliate Marketing

The survey results provide insights into the affiliate marketing platforms most commonly used by IT companies and digital agencies to manage their affiliate programs and partnerships.

Among the respondents who use affiliate marketing platforms, CJ (Commission Junction) emerged as the most popular choice, with 5.80% of respondents utilizing its services. CJ is a well-known and widely used affiliate marketing platform that connects advertisers with publishers, offering a range of features such as tracking, reporting, and commission management.

Share A Sale also garnered significant usage, with 4.00% of respondents indicating its usage. Share A Sale is recognized for its extensive network of merchants and affiliates, facilitating partnerships and affiliate program management.

Other notable affiliate marketing platforms mentioned in the survey results include AdEspresso (4.50%), Impact Radius (2.70%), Voluum (2.20%), AffJet (2.20%), AvantLink (1.80%), Thirsty Affiliate (1.80%), and Refersion (0.90%). These platforms provide businesses with tools to track affiliate referrals, manage commissions, and optimize affiliate marketing campaigns.

Additionally, a small percentage of respondents (3.60%) mentioned using other affiliate marketing platforms not specifically listed in the survey options, indicating the presence of a diverse range of tools in the market.

It's important to note that the survey revealed a significant proportion of IT companies and digital agencies (81.30%) do not currently engage in affiliate marketing, suggesting that this marketing strategy may not be a primary focus for these businesses.

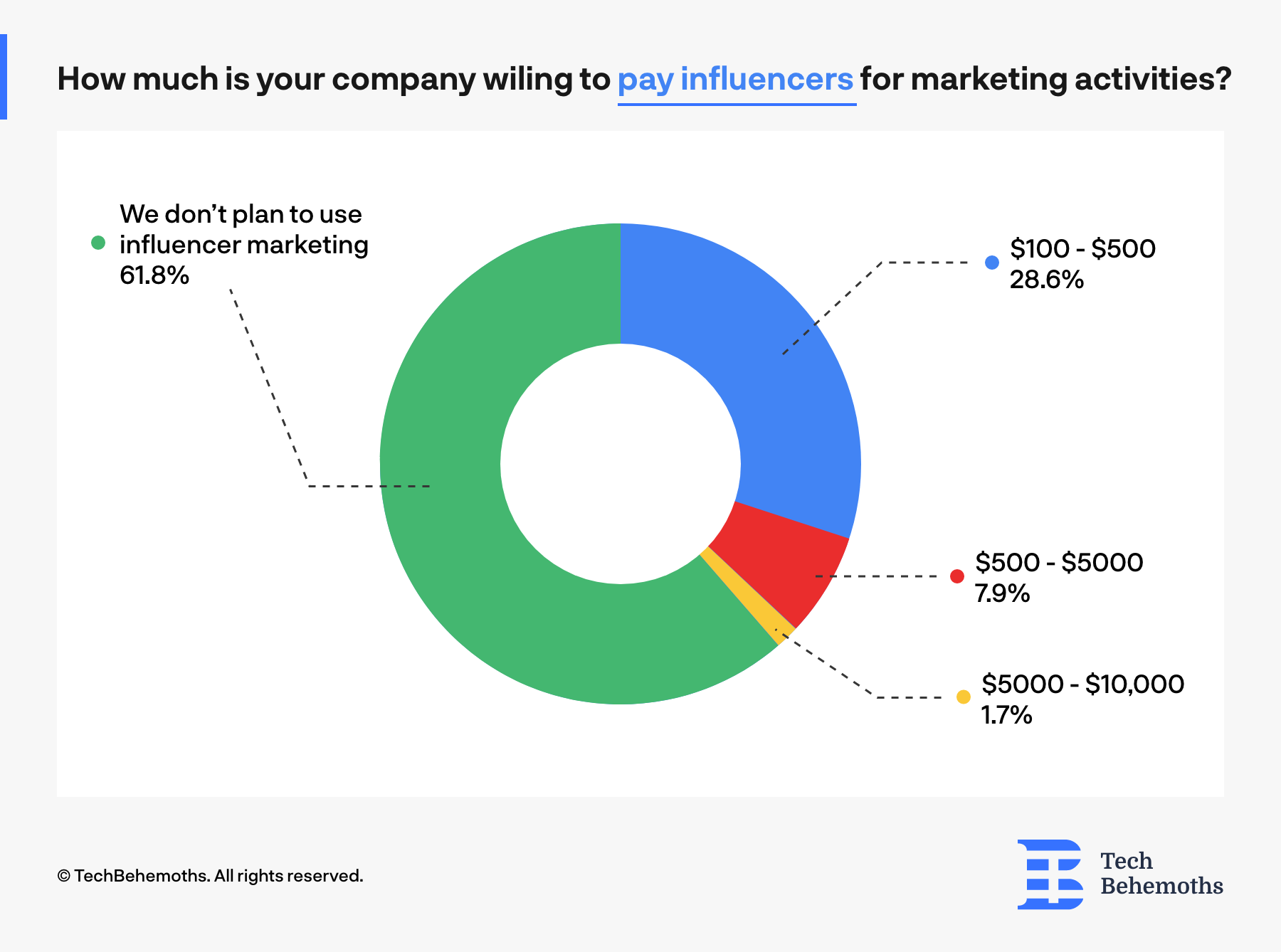

Almost 2/3 of IT Companies and Digital Agencies do not intend to use Influencer Marketing

The survey results reveal insights into the budget allocation that IT companies and digital agencies are willing to allocate for influencer marketing activities.

The majority of respondents, accounting for 61.80%, indicated that their company or agency does not plan to utilize influencer marketing for their promotional efforts. This suggests that influencer marketing may not be a primary focus or strategy for these businesses, potentially due to other marketing priorities, budget constraints, or different target demographics.

Among the respondents who do plan to engage in influencer marketing, the budget allocation varies. The highest percentage of respondents (28.60%) indicated a willingness to pay influencers between $100 and $500 for their marketing activities. This budget range is commonly associated with micro-influencers or influencers with a smaller following but high engagement rates, offering a cost-effective option for businesses to collaborate with influencers within their niche.

A smaller percentage of respondents (7.90%) expressed a willingness to allocate a higher budget in the range of $500 to $5000 for influencer marketing. This budget range may enable businesses to engage with influencers with a larger following and potentially reach a broader audience.

A very small percentage of respondents (1.70%) indicated a willingness to allocate a budget of $5000 to $10,000 for influencer marketing activities. This budget range may allow businesses to collaborate with more prominent influencers or execute larger-scale influencer campaigns.

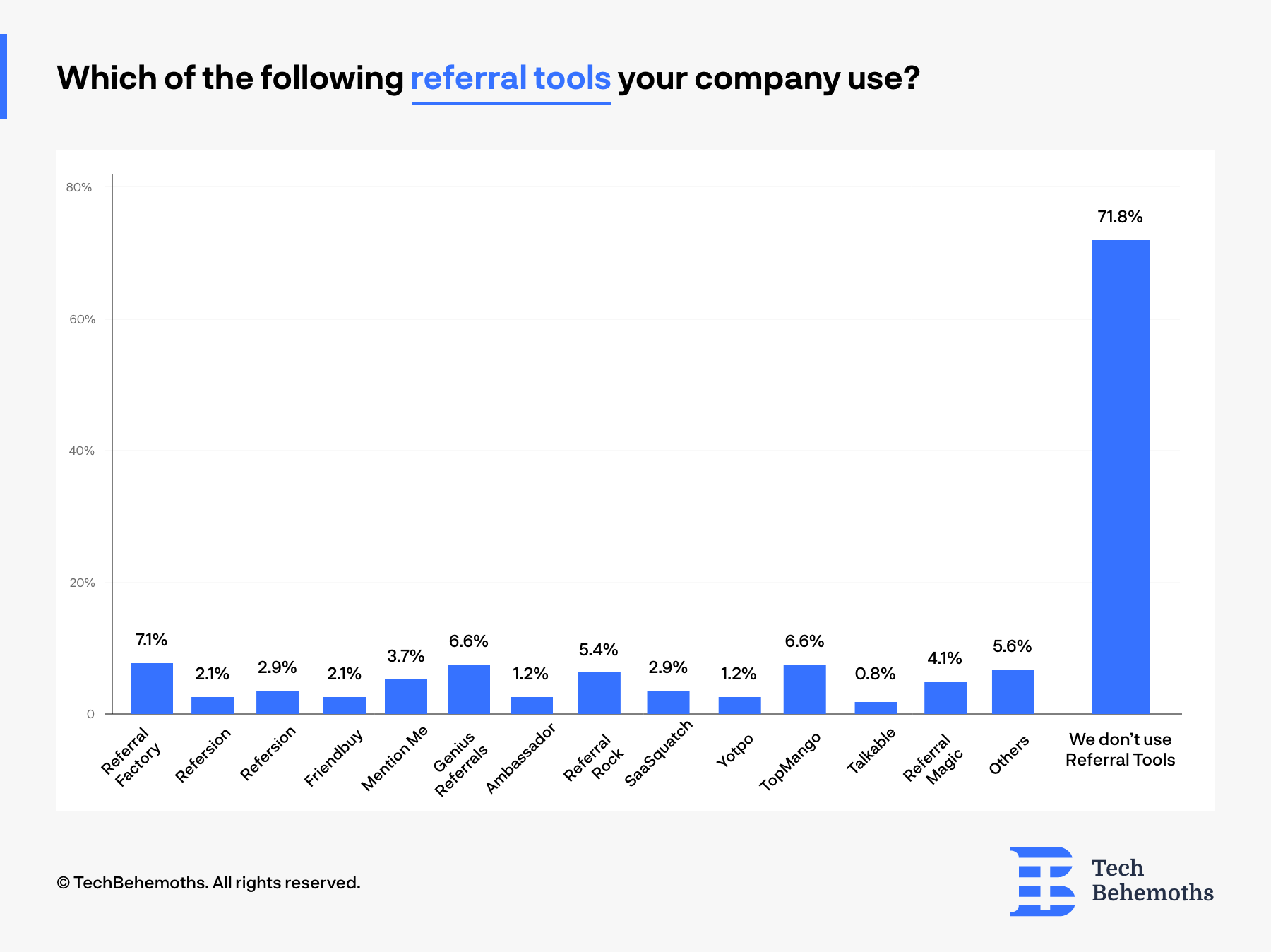

How IT Companies & Digital Agencies Use Referral Marketing Tools

The results shed light on the adoption of various referral tools and the prevalence of companies not utilizing such tools.

A significant majority of respondents, accounting for 71.80%, stated that their company or agency does not use any referral tools. This indicates that referral marketing may not be a common practice or a priority for these businesses, potentially due to different marketing strategies or a lack of focus on customer referrals.

Among the respondents who do employ referral tools, there is a diverse distribution across different platforms. Referral Factory received the highest response rate, with 7.10% of companies utilizing this tool for their referral marketing efforts. This suggests that Referral Factory has gained some traction in the industry and is being utilized by a notable portion of the surveyed companies.

Other notable referral tools used by the respondents include Genius Referrals (6.60%), TapMango (6.60%), Referral Rock (5.40%), and Referral Magic (4.10%). These tools showcase a variety of options available for companies interested in implementing referral marketing strategies.

Several other referral tools were mentioned, collectively representing 5.60% of the responses. These tools may have a smaller user base or may be specific to certain industries or niches.

It is worth noting that a range of popular referral tools did not receive a significant mention in the survey results, indicating that they may not be widely adopted or known within the surveyed IT companies and digital agencies. However, it is possible that some companies may be utilizing referral systems or in-house solutions not included in the provided options.

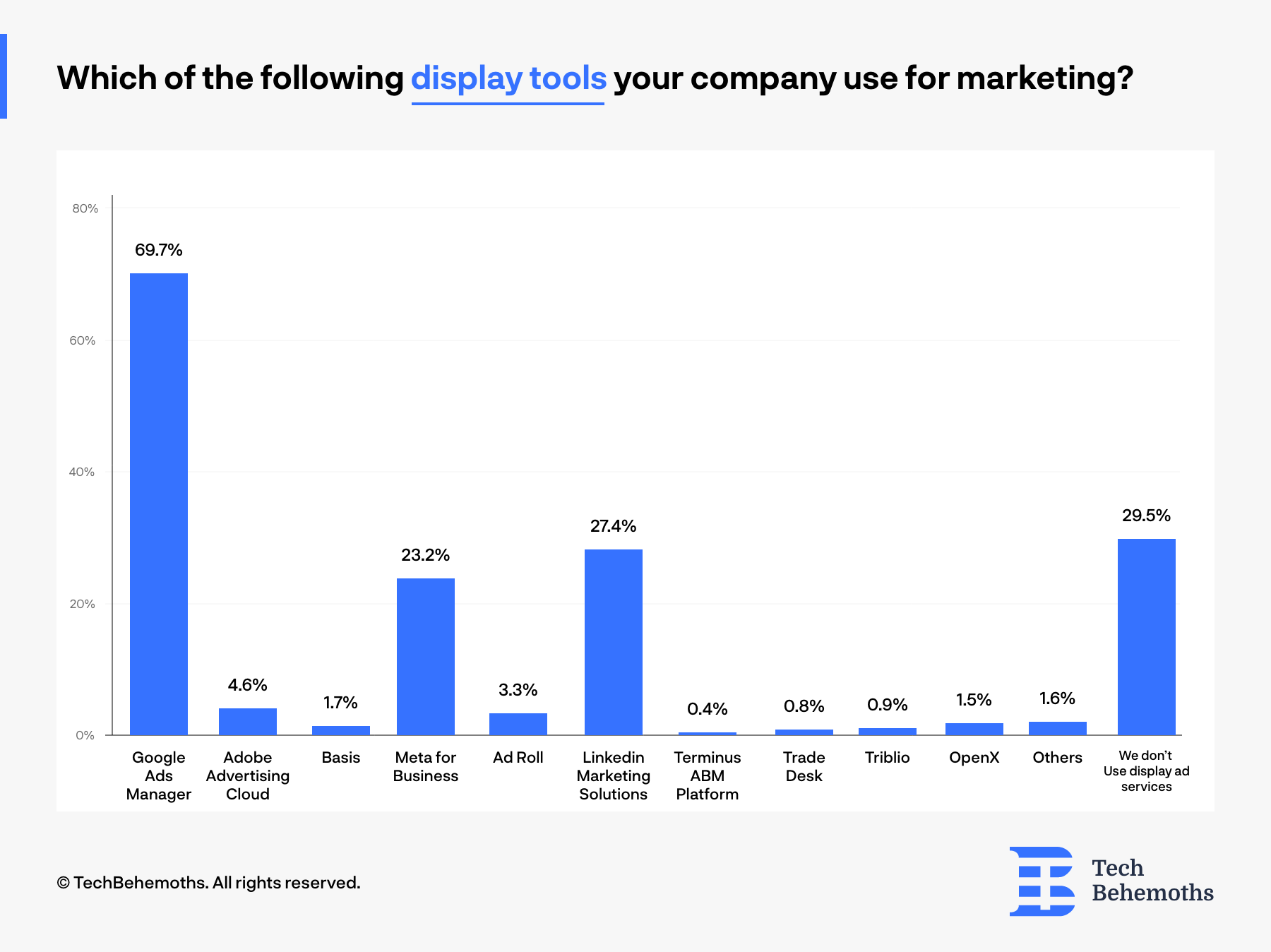

Display Advertising Services and Platforms Usage Among IT Companies and Agencies

The survey aimed to explore the utilization of display advertising tools by IT companies and digital agencies for their marketing purposes. The results reveal the prevalence of various display advertising tools and the proportion of companies that do not employ such tools.

A notable finding from the survey is that 29.50% of the respondents reported not using any display ad services or platforms. This suggests that display advertising may not be a primary focus or a commonly utilized strategy for these businesses, potentially due to other marketing priorities or different advertising approaches.

Among the respondents who do use display advertising tools, Google Ads Manager emerged as the most popular choice, with 69.70% of companies utilizing this platform. Google Ads Manager's dominance in the market demonstrates its widespread adoption and recognition as a leading display advertising tool.

LinkedIn Marketing Solutions also garnered significant usage, with 27.40% of the respondents employing this platform for their display advertising needs. This indicates that LinkedIn is a favored channel for targeted B2B advertising within the surveyed IT companies and digital agencies.

Other display advertising tools that received notable mentions include Meta for Business (23.20%), Adobe Advertising Cloud (4.60%), AdRoll (3.30%), and others (1.60%). These tools provide additional options for companies seeking diverse avenues to run their display ad campaigns.

Several tools, such as Basis, Terminus ABM Platform, Trade Desk, Triblio, and OpenX, had relatively lower usage rates among the respondents. This suggests that these platforms may have more specialized or niche applications within the IT and digital agency landscape.

It is worth noting that the survey did not capture all possible display advertising tools, and the "Others" category accounted for 1.60% of responses. This indicates the presence of alternative tools or in-house solutions that were not listed as options in the survey.

Overall, the results indicate a mix of widely adopted and niche display advertising tools among IT companies and digital agencies. While a significant portion of respondents reported not utilizing display ad services or platforms, those who do utilize these tools have found value in platforms like Google Ads Manager and LinkedIn Marketing Solutions.

Do Press Releases Work for IT Companies & Digital Agencies?

This section aimed to assess the utilization of press release services as a marketing strategy by IT companies and digital agencies. The results provide insights into the prevalence and perceived usefulness of press release services among the respondents.

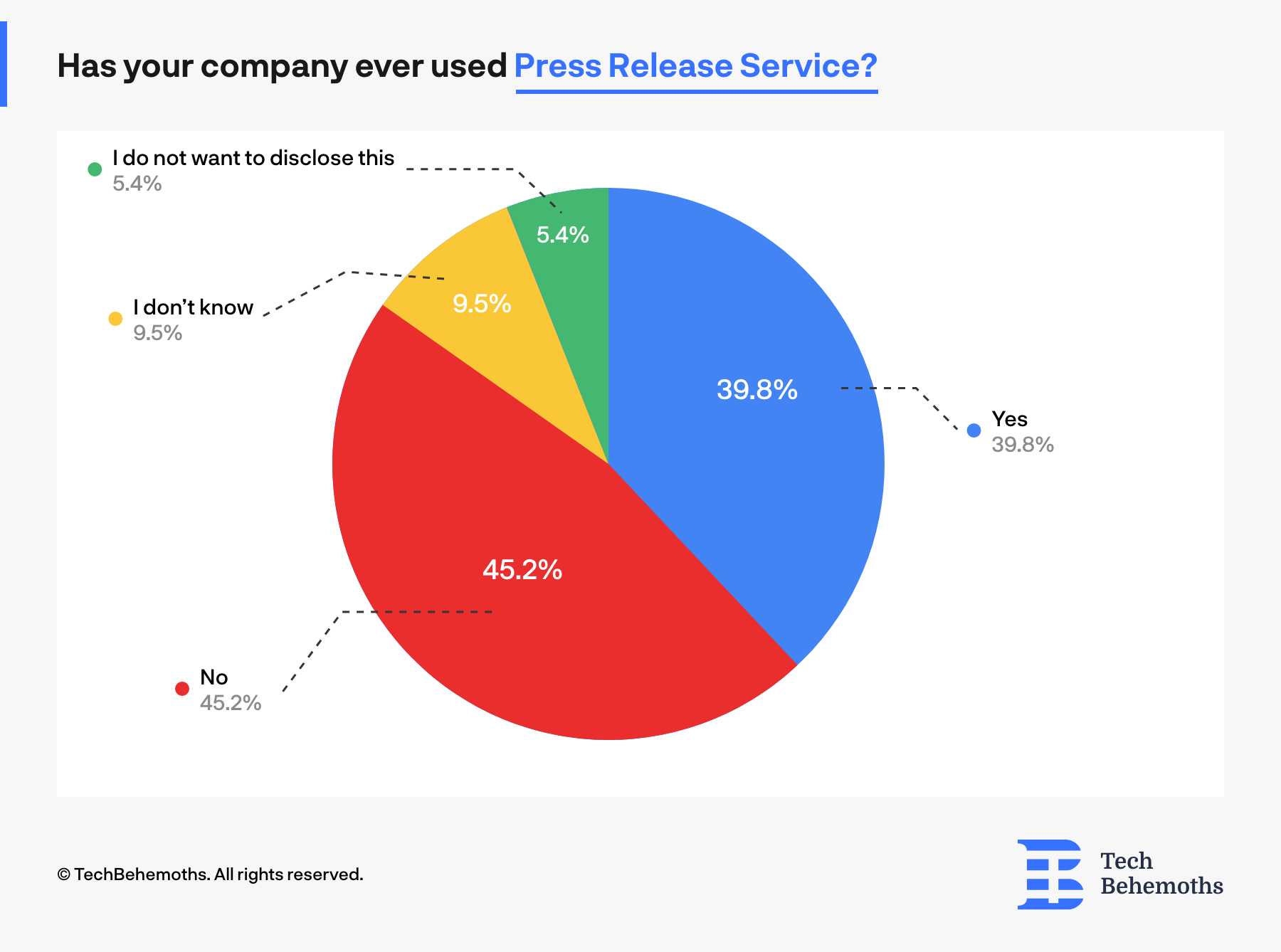

Among the surveyed companies and agencies, 39.80% reported having used press release services. This indicates that a significant proportion of IT companies and digital agencies recognize the potential value and benefits that press releases can offer as part of their marketing efforts.

On the other hand, 45.20% of the respondents indicated that they have not used press release services. This suggests that a substantial portion of companies either do not consider press releases as an effective marketing strategy or have chosen to allocate their resources towards other marketing channels and tactics.

Interestingly, 9.50% of the respondents were uncertain about whether their company or agency had used press release services. This could imply a lack of clarity or awareness regarding the specific marketing activities undertaken by their organization.

A small percentage (5.40%) of respondents chose not to disclose whether their company or agency had utilized press release services. This might be due to confidentiality reasons or personal preferences.

From the perspective of press-release usefulness for IT companies and digital agencies as a marketing strategy, it is worth noting that press releases can serve several purposes. They can help generate media coverage, increase brand visibility, and create opportunities for companies to share important announcements, product updates, or thought leadership content with their target audience.

Press Release Effectiveness for IT Companies and Digital Agencies

The survey sought to assess the perceived effectiveness of press releases in helping IT companies and digital agencies reach their marketing goals. The results provide insights into how these organizations perceive the impact of press releases on their overall marketing efforts.

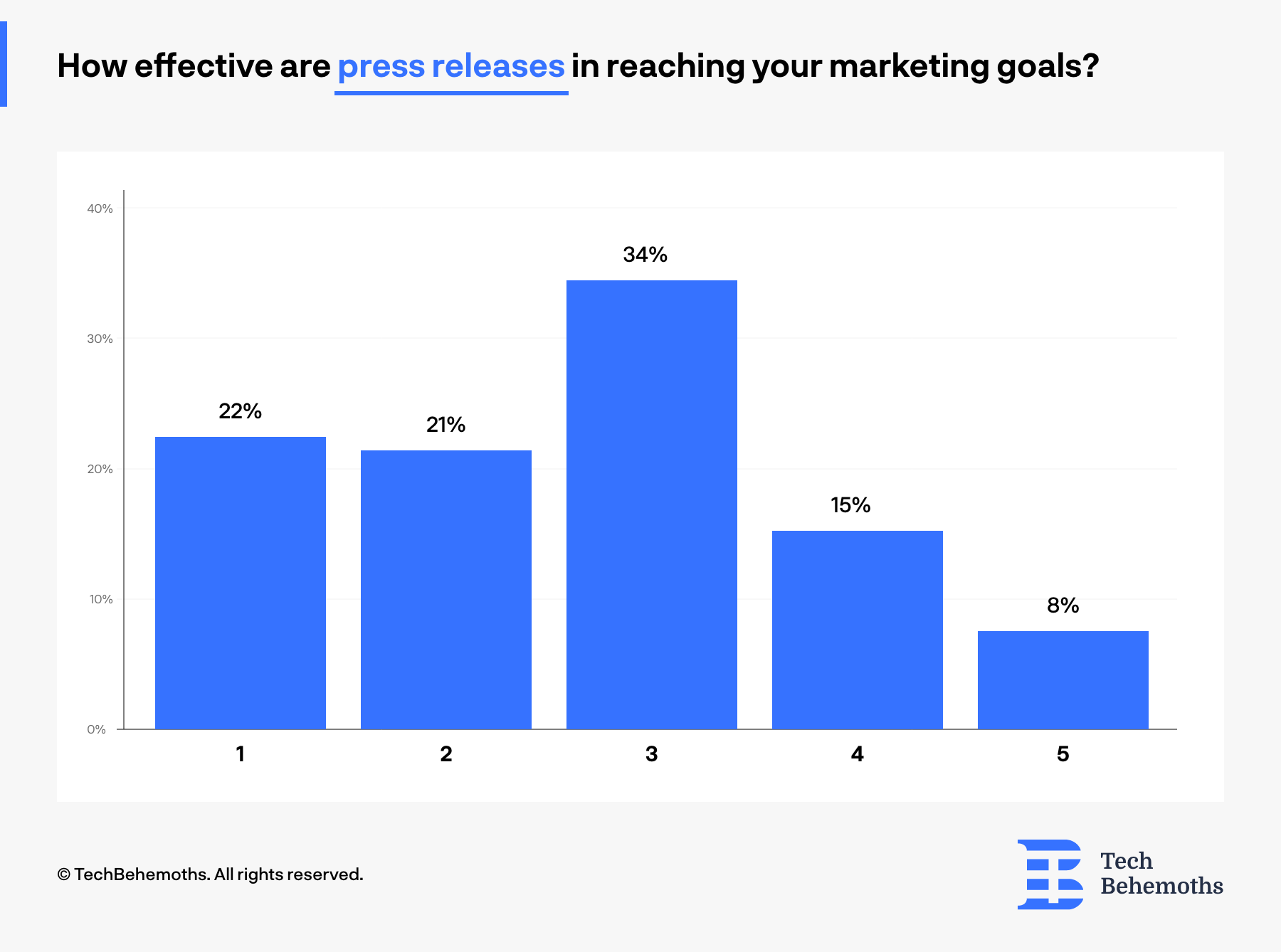

Among the respondents, 22% rated press releases with a score of 1, indicating a low level of effectiveness in reaching their marketing goals. Similarly, 20.70% of the participants rated press releases with a score of 2, suggesting a limited impact on their marketing objectives.

On the other hand, 34.40% of the respondents rated press releases with a score of 3, reflecting a moderate level of effectiveness. This suggests that for a significant portion of IT companies and digital agencies, press releases have the potential to contribute to their marketing goals to some extent.

A smaller percentage of participants (14.90%) rated press releases with a score of 4, indicating a relatively high level of effectiveness. Additionally, 7.90% of respondents rated press releases with a score of 5, suggesting the highest level of effectiveness in reaching their marketing goals.

How IT Companies and Digital Agencies Rate PR Service Providers

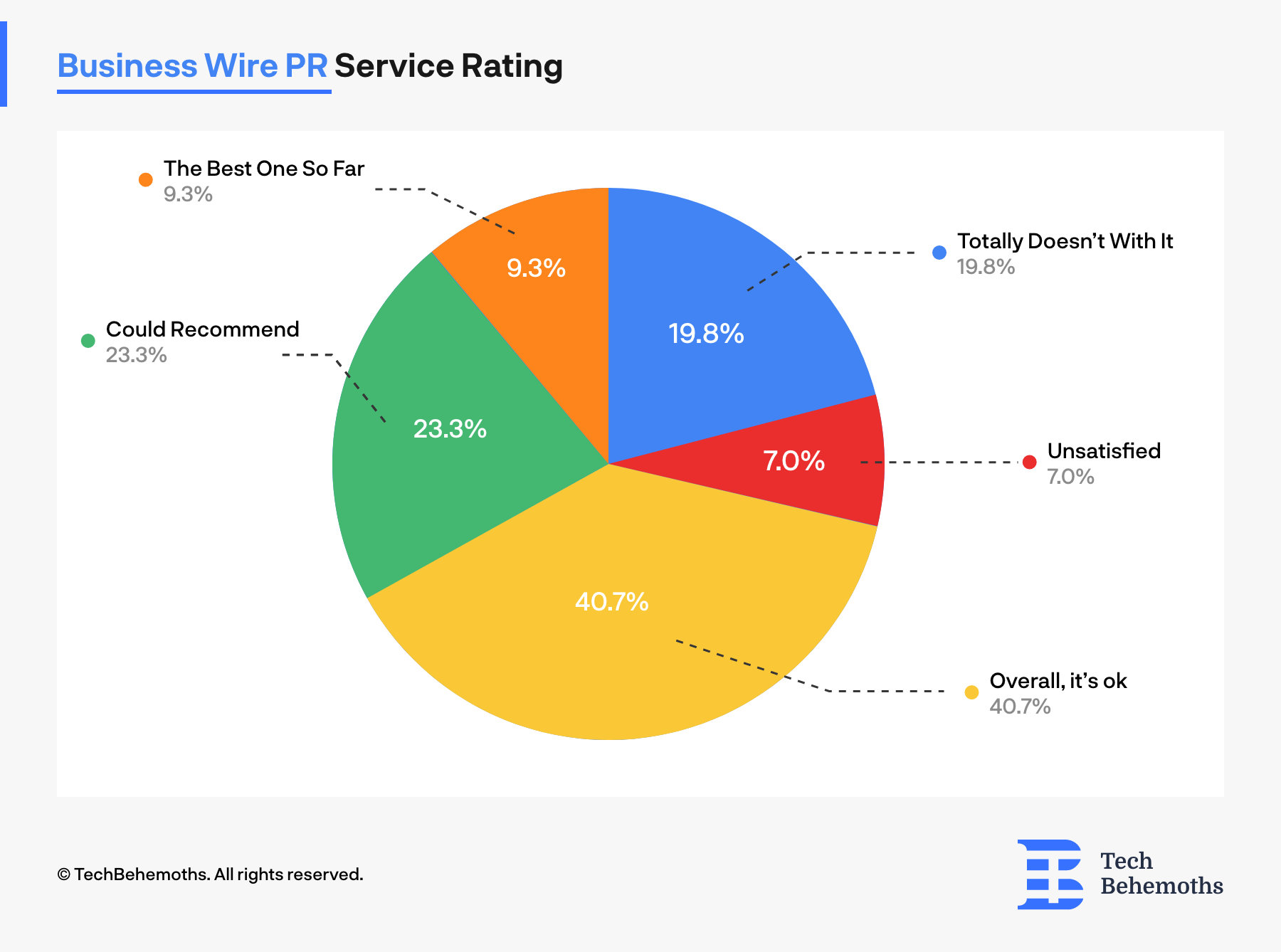

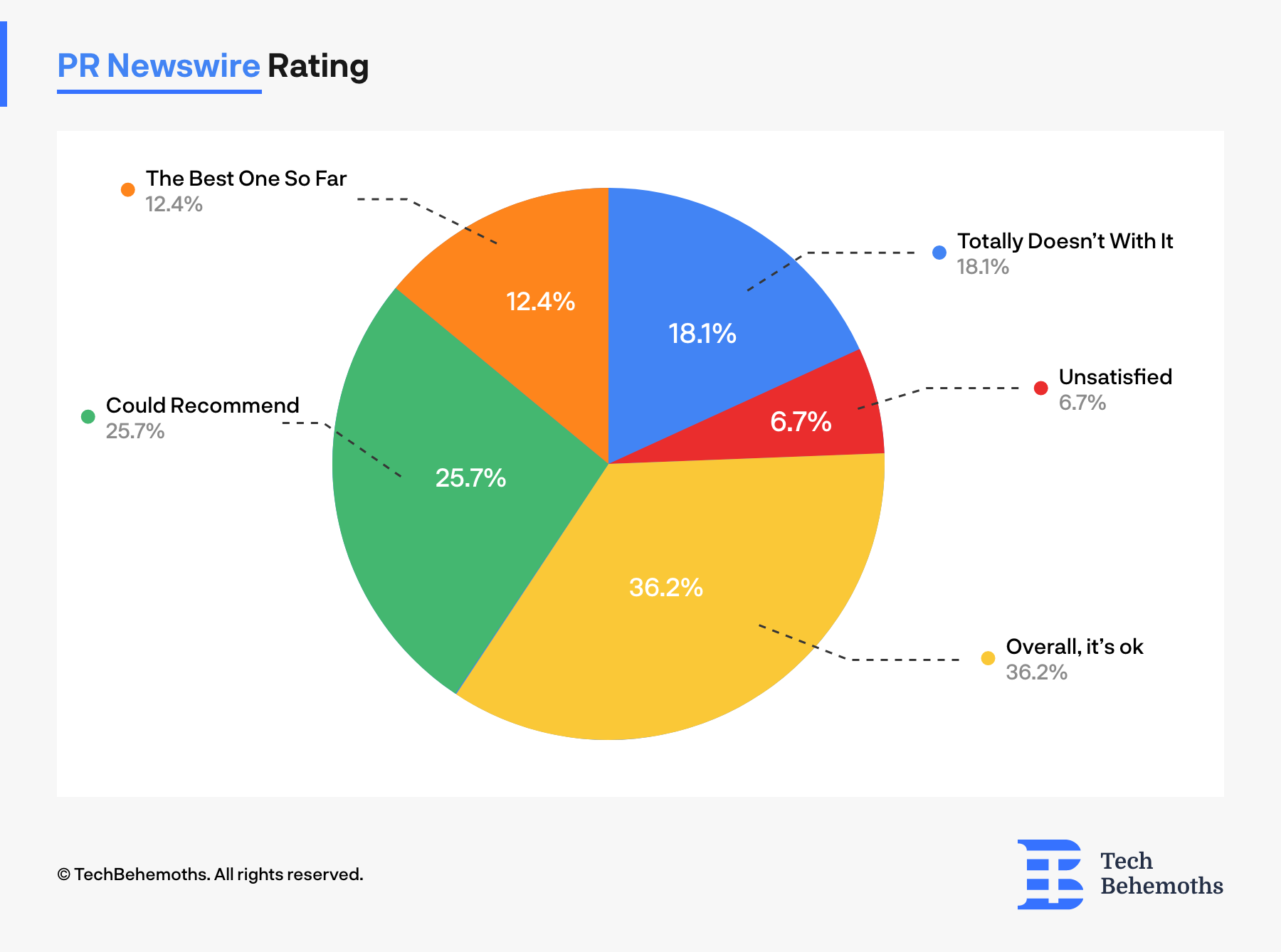

Among the PR services evaluated, PR Newswire and Business Wire emerged as the top contenders, as indicated by the survey participants. Both services received positive feedback, with a notable percentage of respondents stating they could recommend these services. PR Newswire stood out with a higher percentage of respondents considering it as the best PR service so far. This suggests that these platforms are regarded as reliable and effective options for IT companies and digital agencies seeking PR distribution.

Newswire and PR Web also received favorable ratings from the respondents. While they didn't rank as highly as PR Newswire and Business Wire, a significant number of participants expressed satisfaction with these services and stated that they could recommend them. This implies that these platforms are considered satisfactory choices for PR distribution, albeit not at the same level as the top contenders.

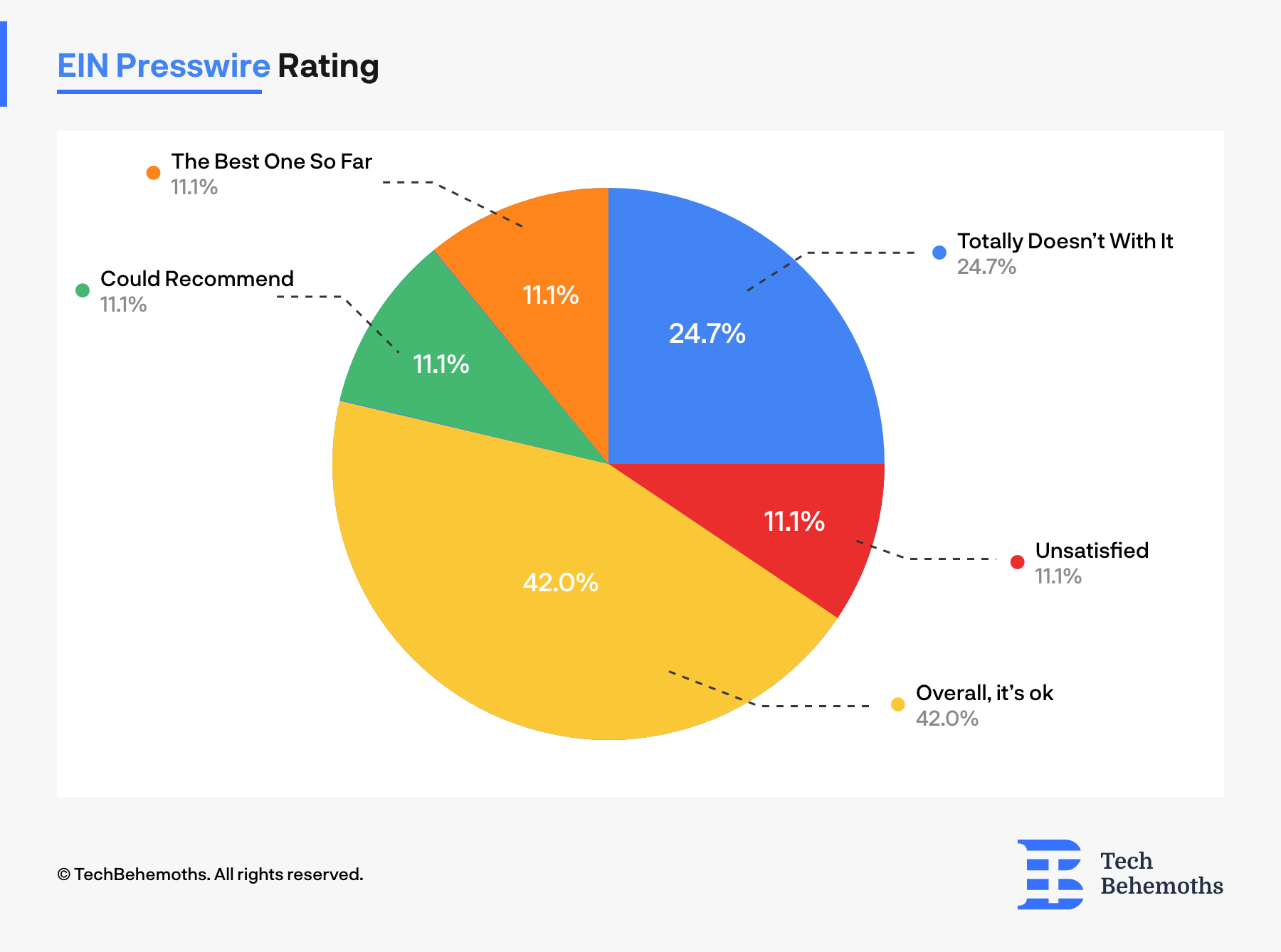

EIN Presswire falls into the average category, with respondents reporting an overall positive experience. Although it didn't receive as many recommendations as the top services, it received a noteworthy percentage of respondents considering it the best PR service so far. This suggests that EIN Presswire is a viable option worth considering for PR activities.

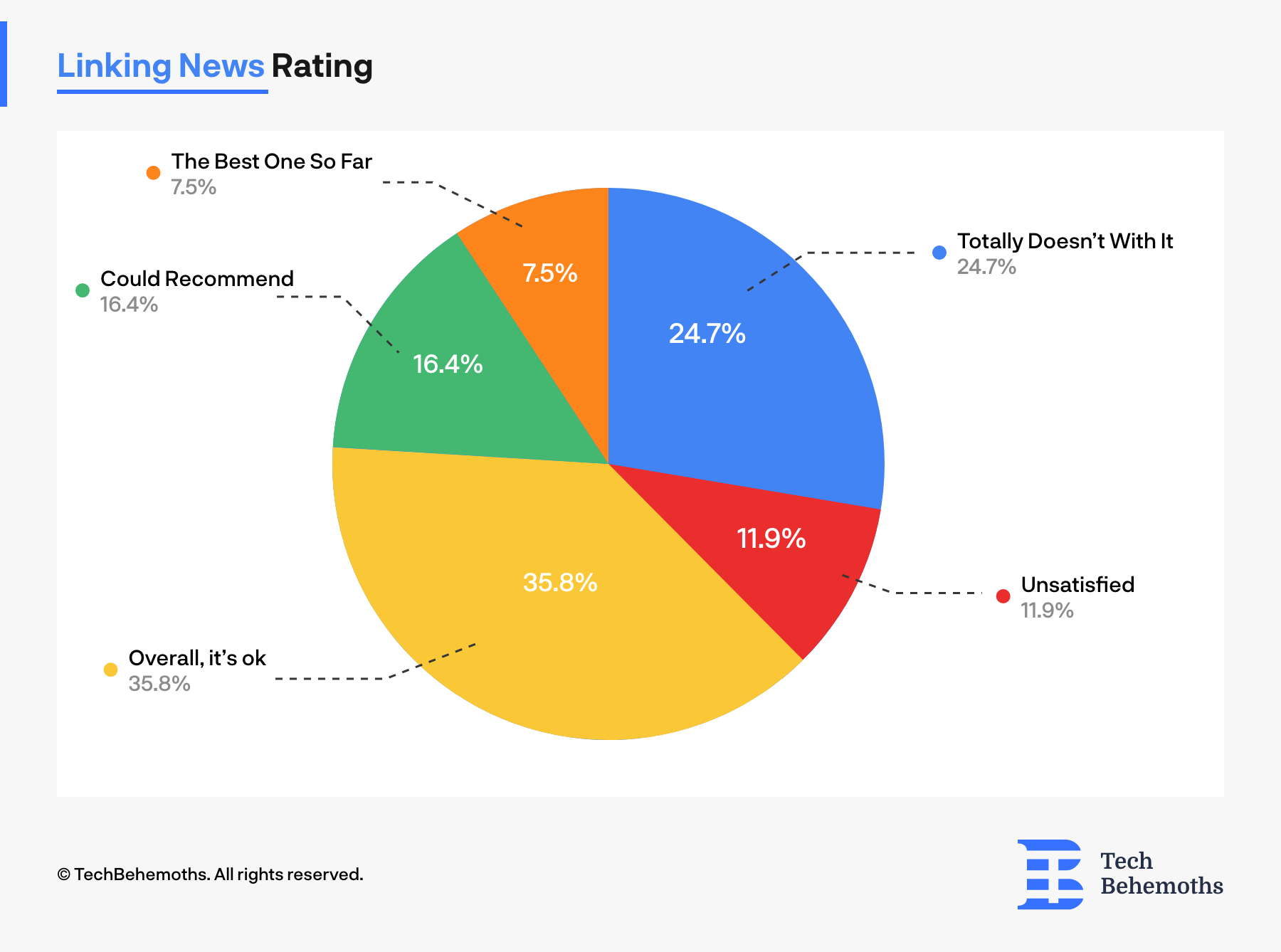

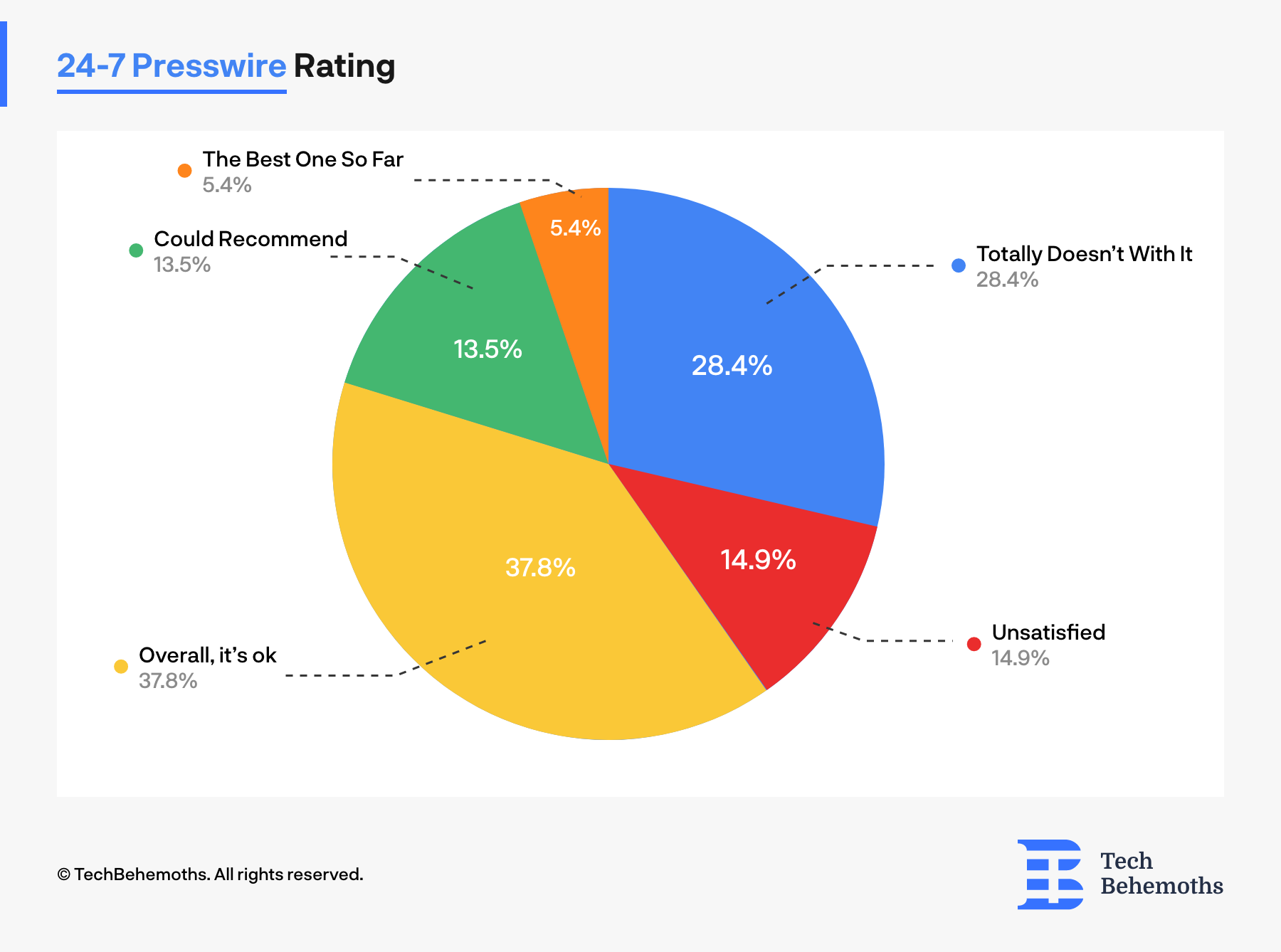

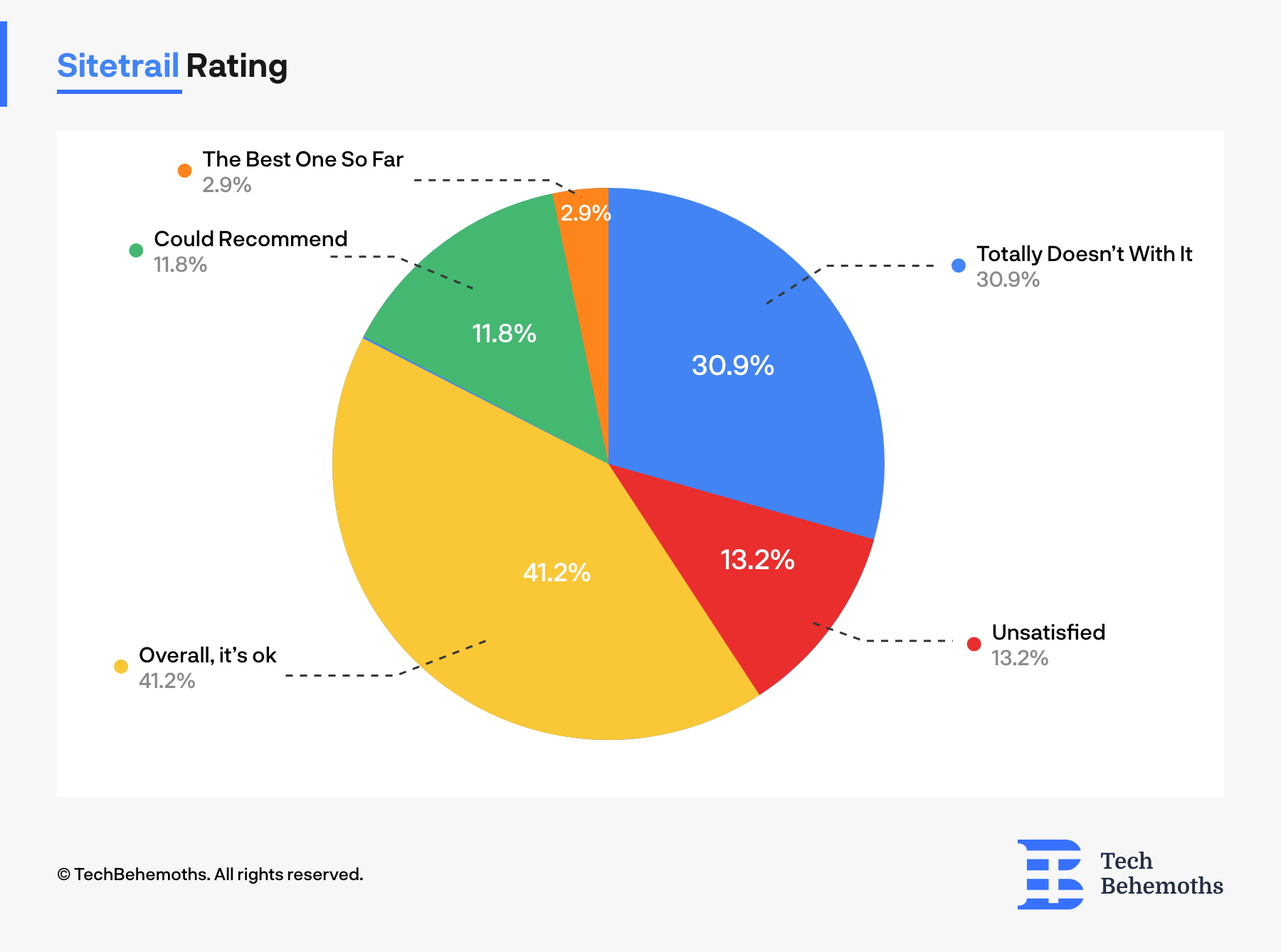

Several PR services, including Linking News, 24-7 Presswire, and Sitetrail, were classified as average. While these platforms didn't receive as high recommendations or best ratings as the top contenders, they still garnered an overall positive response from the participants. They can be seen as reliable options for PR distribution, although not necessarily standing out as the most outstanding choices.

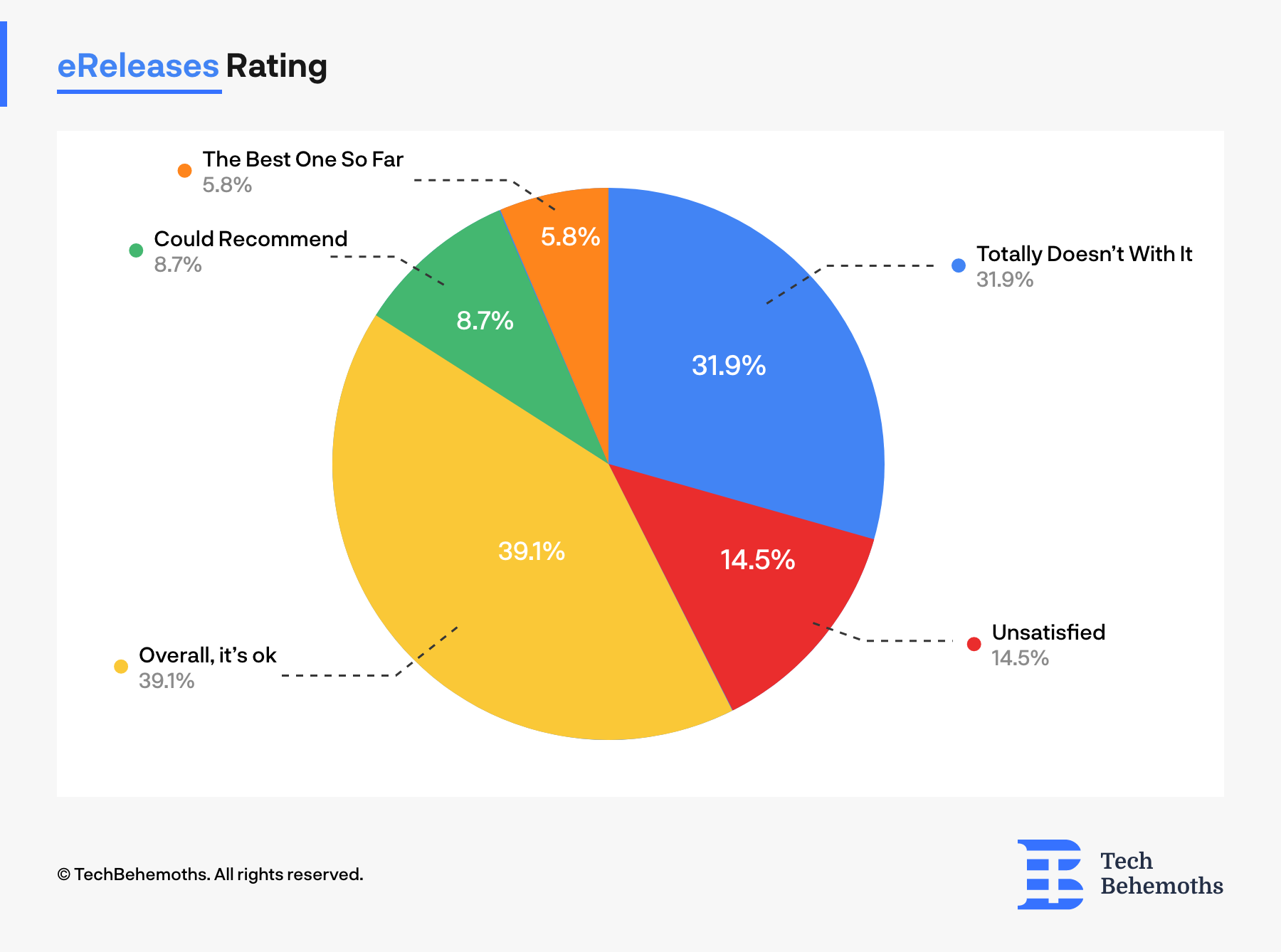

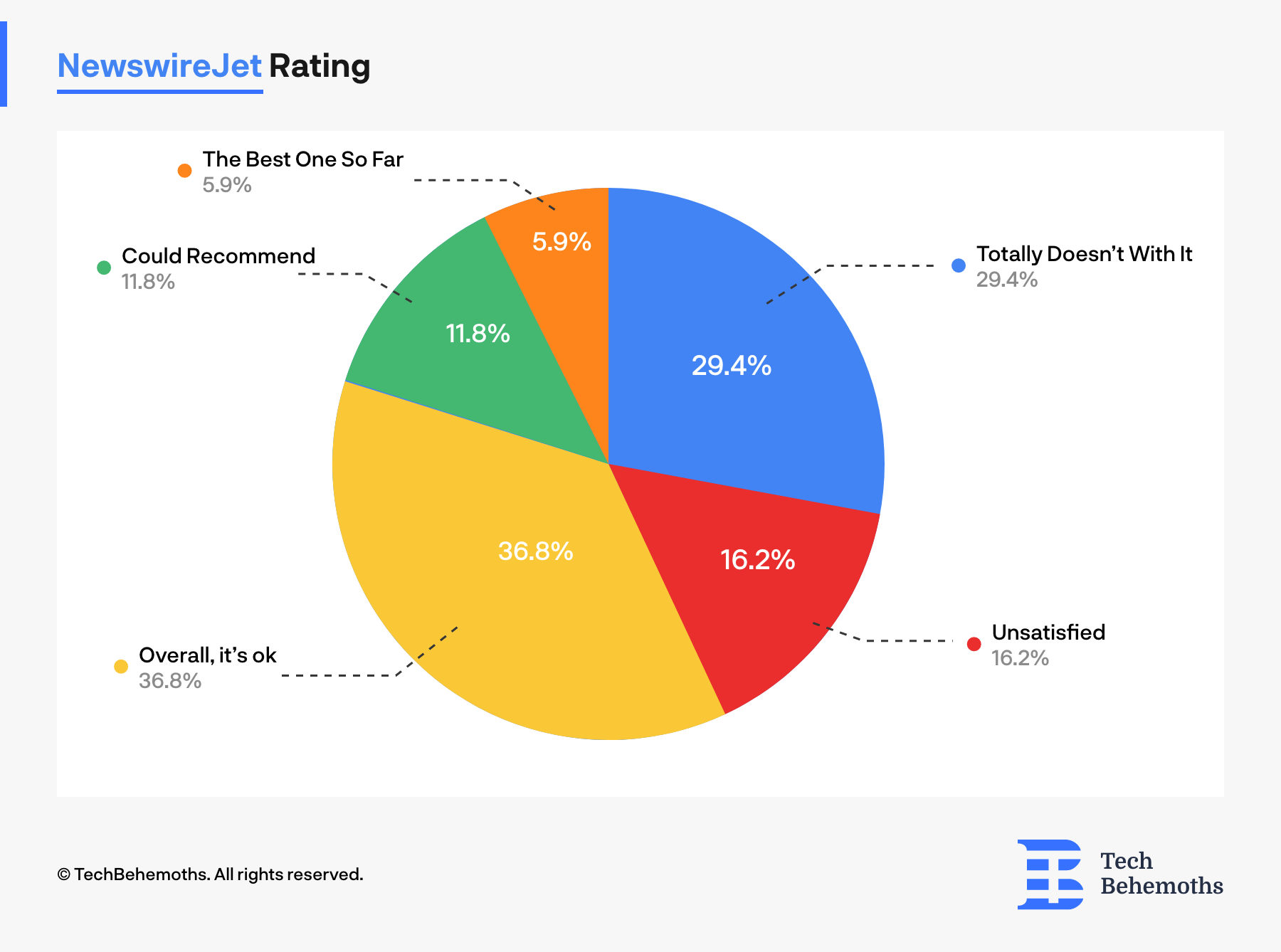

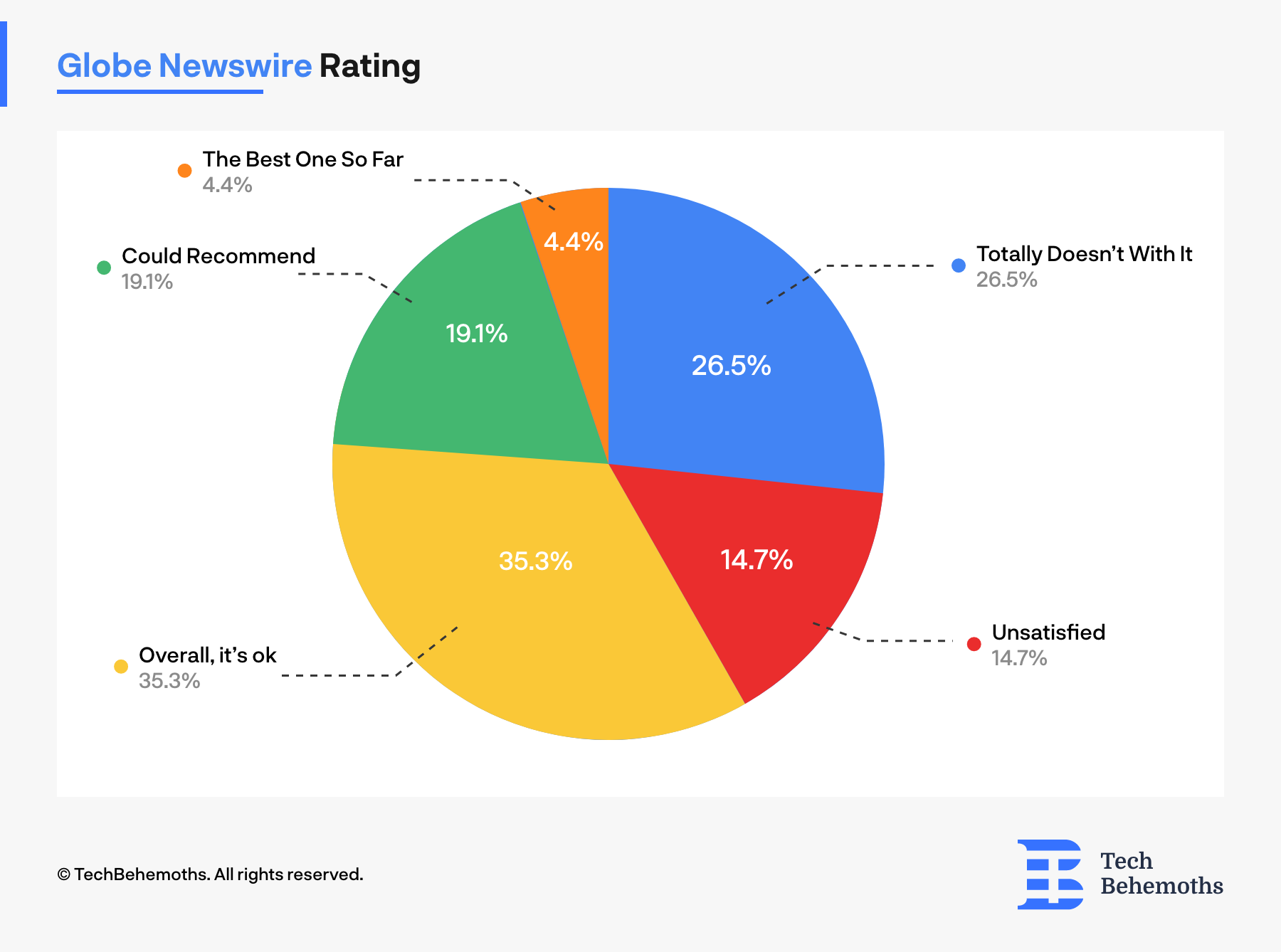

On the other hand, there were some PR services that received lower satisfaction ratings. Newswire Jet, Globe Newswire, and eReleases fell into this category, with a significant proportion of respondents expressing dissatisfaction or considering them not worth the investment. These findings suggest that these services may not meet the expectations or needs of the surveyed IT companies and digital agencies.

It's important to note that the classification of the PR services is based on the responses provided by the survey participants. Individual experiences and preferences may vary, and additional research and consideration of specific requirements are advisable when choosing a PR service. IT companies and digital agencies should thoroughly evaluate the features, pricing, and reputation of PR services before making a decision to ensure they align with their marketing goals and objectives.

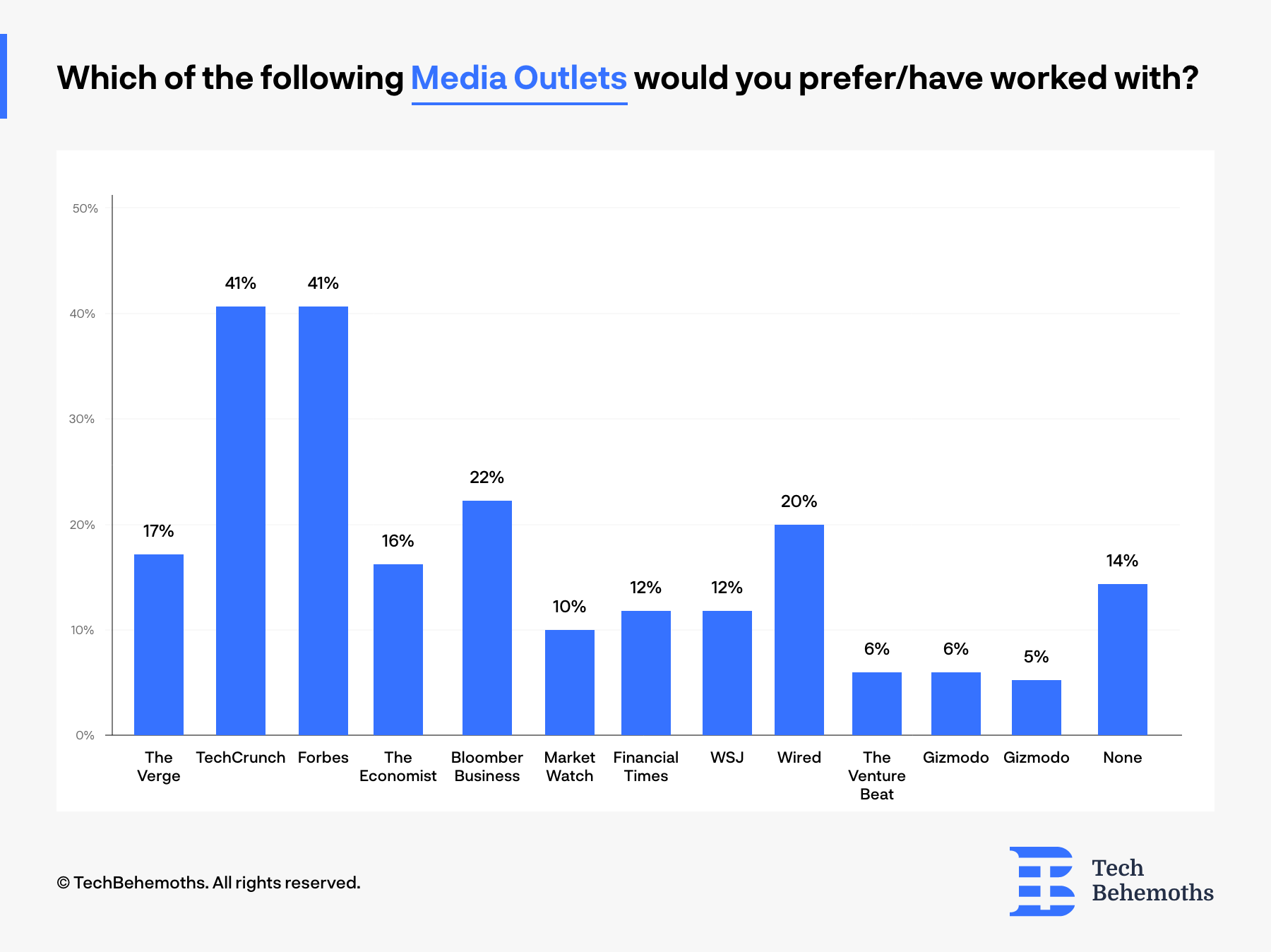

How IT Companies & Digital Agencies Refer To Media Outlets

The survey respondents were asked about their preferred or past media outlets they have worked with for their IT companies and digital agencies. The results provide insights into the outlets that are popular or desirable among the participants:

TechCrunch and Forbes emerged as the top choices, with an equal percentage of respondents preferring or having worked with these outlets. This indicates that both TechCrunch and Forbes are highly regarded platforms for IT companies and digital agencies, likely due to their strong influence and credibility in the technology and business sectors.

Following closely behind TechCrunch and Forbes, The Verge and Bloomberg Business received a significant percentage of respondents who preferred or had worked with these outlets. These media outlets are recognized for their coverage of technology, business, and related topics, making them attractive options for IT companies and digital agencies to showcase their products, services, or achievements.

Other notable outlets with a substantial percentage of respondents expressing preference or previous collaborations include Wired, Financial Times, and WSJ (The Wall Street Journal). These outlets are known for their comprehensive coverage of technology, finance, and business news, making them appealing choices for companies in the IT and digital sectors.

It's worth mentioning that MarketWatch, The Economist, Gizmodo, and The Venture Beat received a moderate level of preference or past collaborations from the respondents. While not as dominant as the top choices, they still hold value as media outlets that cater to specific interests or have niche audiences that may align with the goals and target audience of IT companies and digital agencies

Among the respondents, a notable percentage expressed a preference for or having worked with other media outlets not specified in the options provided. This suggests that there are diverse media preferences among IT companies and digital agencies, emphasizing the importance of considering a range of outlets to reach their target audience effectively.

A portion of the participants indicated that they have not worked with any of the listed media outlets, highlighting a potential opportunity for them to explore partnerships or collaborations with relevant outlets to enhance their visibility and reputation.

Final Words

In the end, the survey on IT companies and digital agencies' use of digital marketing tools and strategies provided valuable insights into their preferences and practices. The results highlighted the varying degrees of focus and effectiveness across different tools and channels. While certain strategies like SEO and email marketing received substantial attention, others such as affiliate marketing and influencer marketing were less emphasized. The findings underscore the importance for companies to carefully assess their specific marketing goals and target audience to determine the most effective tools and strategies to drive their digital marketing success.

Partner Companies

The survey was not limited to any geographical region or country and its main target was the global community of IT companies and web agencies that specialized in web development services. As such, survey respondents come from 2500 different companies located in 57 countries across the globe. On this occasion, TechBehemoths is proudly announcing and crediting the list of 242 partner companies that helped spreading the word and gathering answers for this survey.