Strategies for Acquiring and Retaining B2B Clients: A Survey-Based Analysis

Whether you are an experienced professional or just starting, knowing how to attract and retain clients is essential for your success.

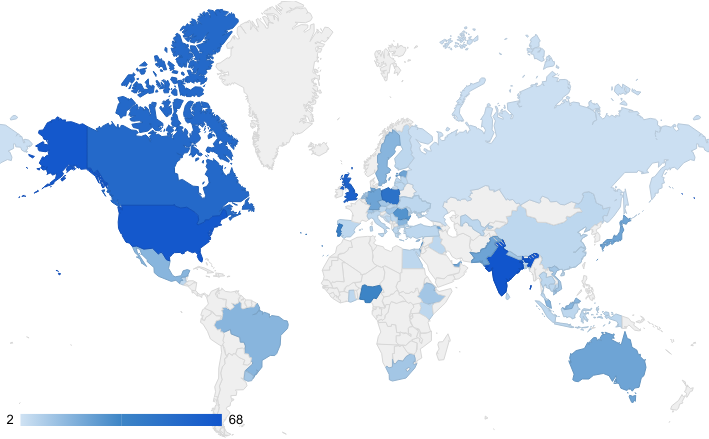

TechBehemoths surveyed 1,020 IT companies in 60 countries from February 20-28 to uncover the strategies behind successful customer relationships, the challenges they face, and real experiences.

The findings and insights from the survey will equip companies with the knowledge and tools to succeed in today's competitive marketplace, as customer acquisition and retention are decisive to sustainable growth.

Survey Respondents’ Profile

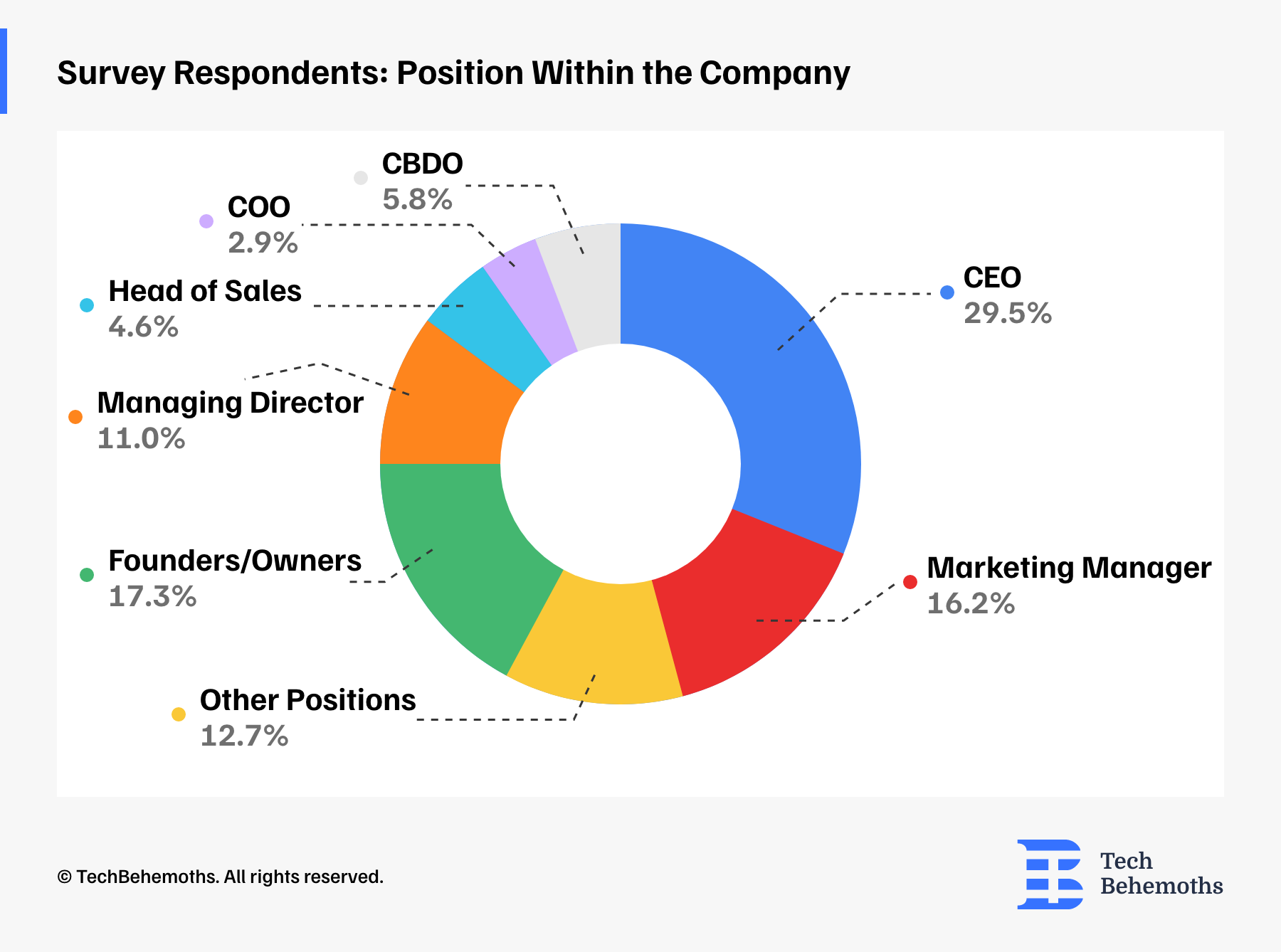

In addition to demographic diversity, survey respondents hold different positions within their companies: CEOs (29.5%), Marketing Managers (16.2%), Founders/ Owners (17.3%), Managing Directors (11%) and Business Development Managers (5.8%).

Other survey respondents' positions included Sales Executives, PR Managers, and Operations Specialists.

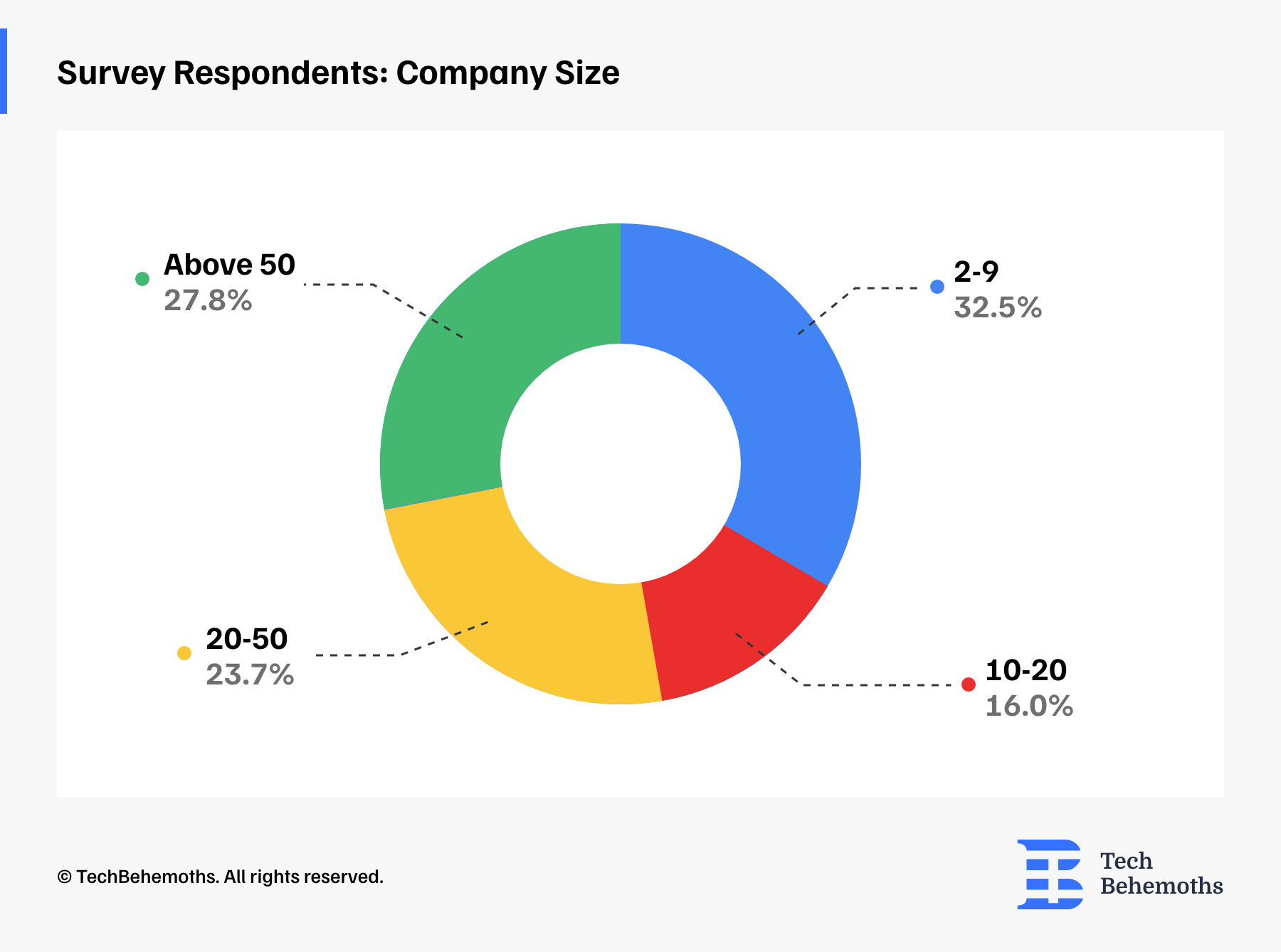

When looking at company size, the distribution of responses varied. The largest share (32.5%) of respondents came from companies with 2-9 team members, on the one hand, and companies with more than 50 employees (27.8%), on the other.

This indicates a notable presence of both small and large agencies in the survey pool. Companies with 10-20 employees and 20-50 employees made up 16.0% and 23.7% of the responses, respectively. This suggests a moderate presence of medium-sized companies in the survey.

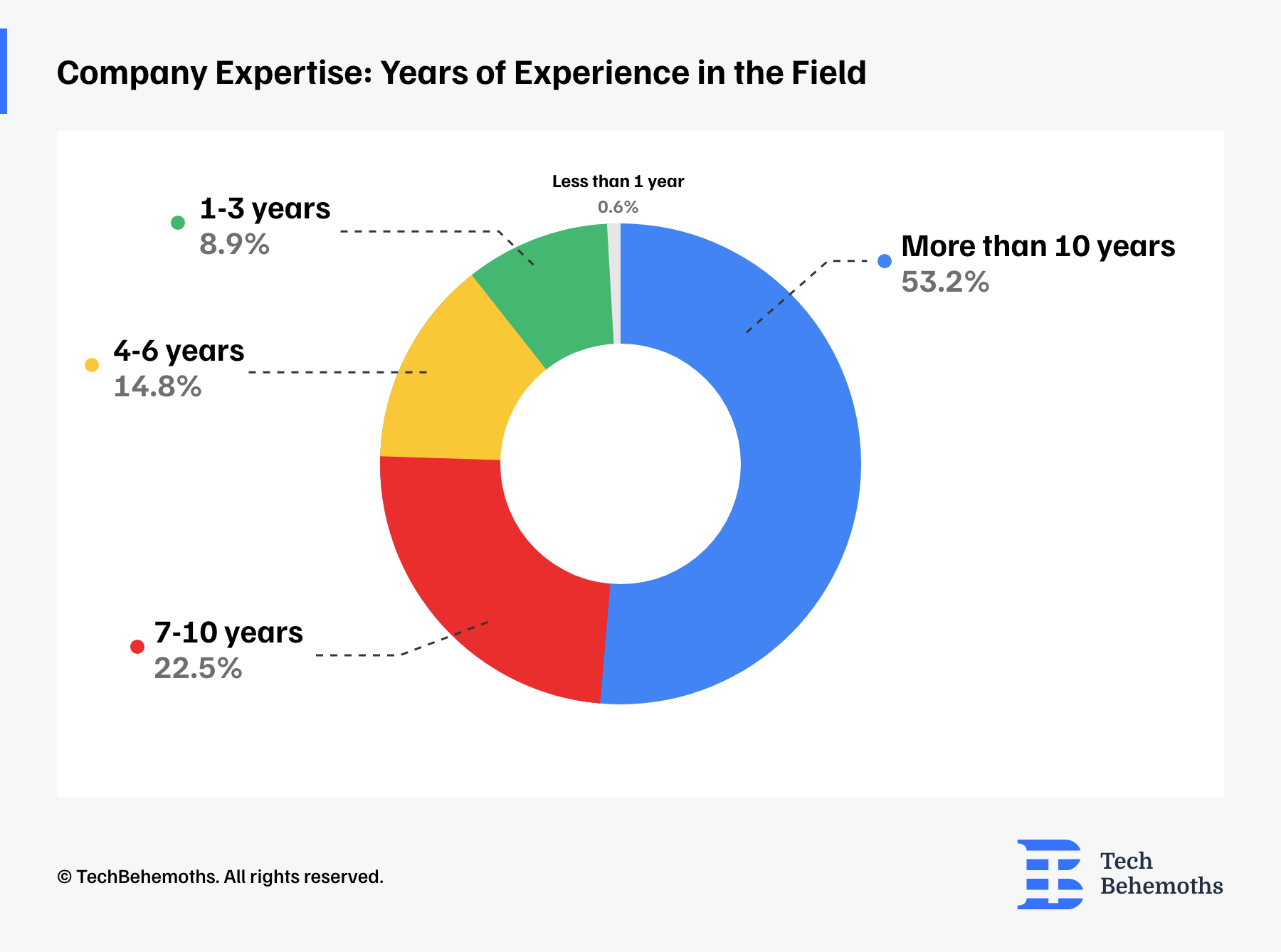

It is worth noting that 53.30% of the companies that responded to the survey have more than 10 years of experience, while 22.50% have 7-10 years of experience. The 4-6 years category comprises 14.80%, while those with 1-3 years of experience constitute 8.90% of the total. The smallest group has less than 1 year of experience, making up only 0.60% of the total.

This clearly is that many companies involved in the survey have wide experience in their industry, or have a workforce that has been working for more than a decade, and only a very small portion are newcomers to the field. This way the data collected is based on the experience, which includes interaction with clients, making it all the more valuable.

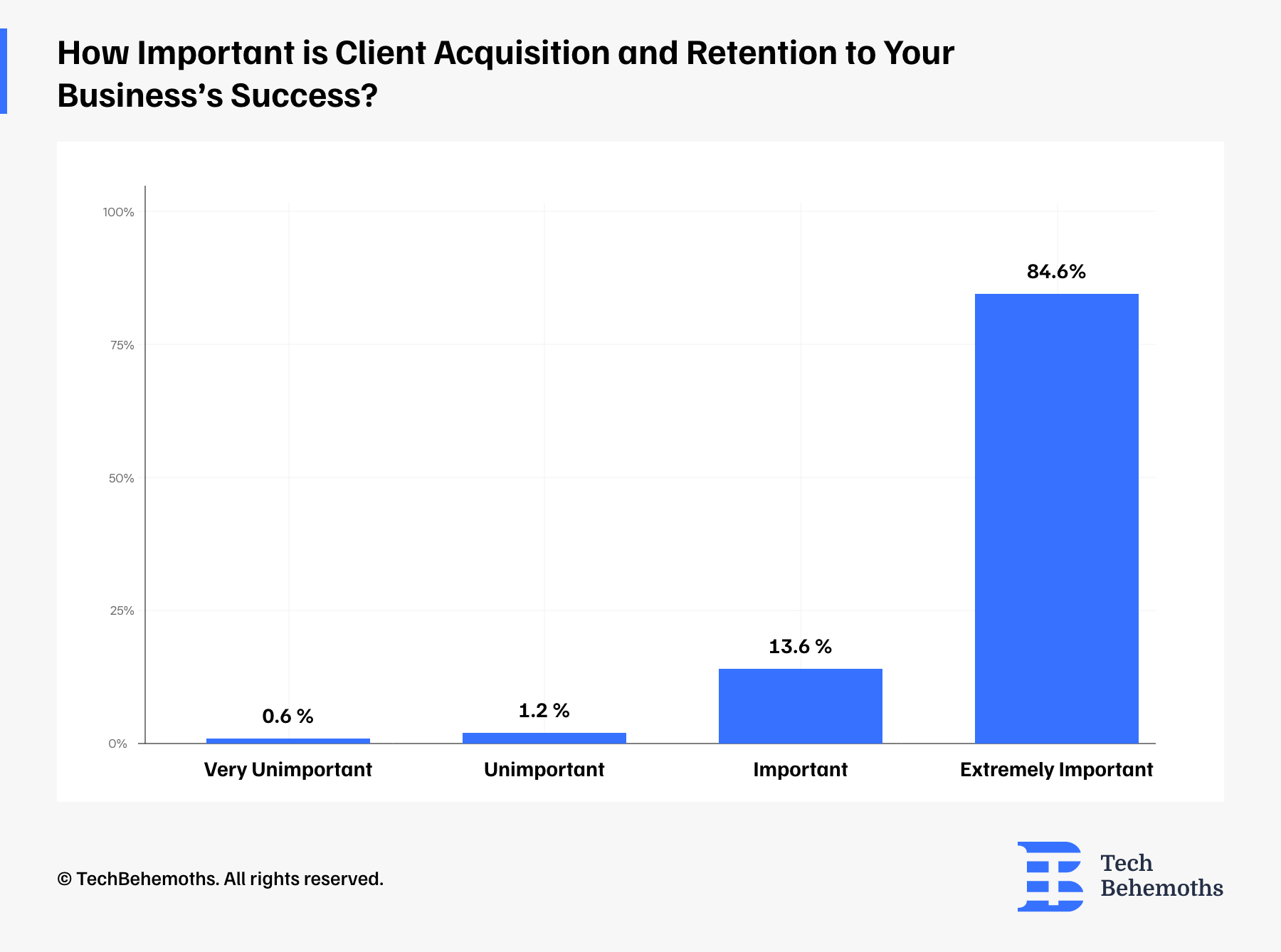

More than 84.6% of Companies Consider that Acquiring and Retaining Clients is Extremely Important

The data shows that the majority, 84.6%, of respondents consider that both acquiring new clients and keeping existing ones happy are very important for business's success. 13.6% consider these factors important, but not extremely important.

Only a tiny percentage of respondents believe client acquisition and retention are unimportant (1.2%) or very unimportant (0.6%) to success.

Top Client Acquisition Channels

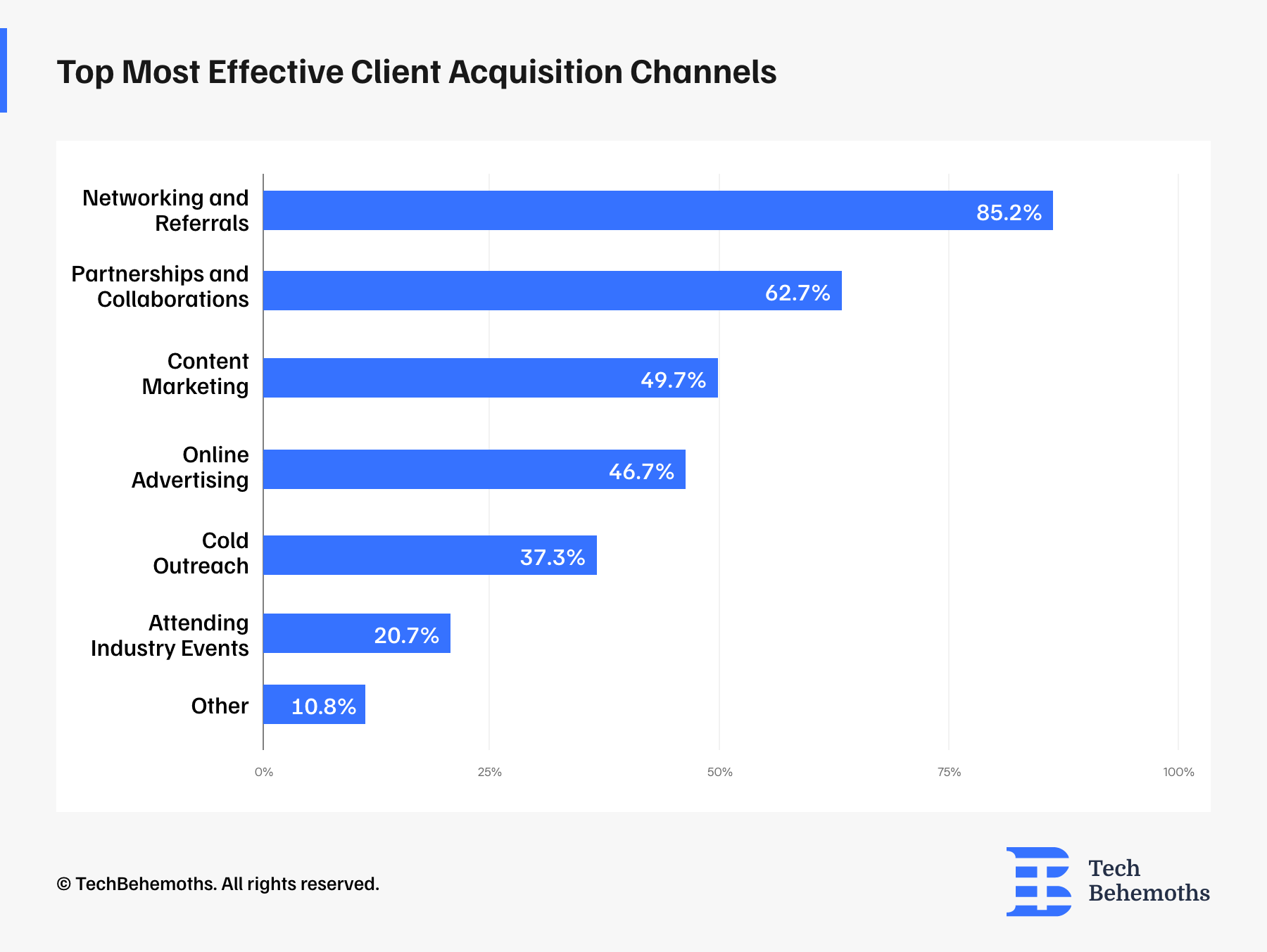

When asked what are the most effective channels to attract new customers, we found that:

-

Networks and Referrals (85.20%) are at the top of the list, suggesting that people are more likely to trust a business recommended by someone they know. This channel shows the power of personal connections and recommendations.

-

Partnership and Collaboration (62.70%) follow next, as by partnering with other companies it is possible to expand to their audience and involve co-marketing initiatives or joint product offerings.

-

Content Marketing (49.70%) third on the list, aims to create valuable and informative content that engages potential customers establishing the brand as a thought leader and building trust.

-

Online Advertising (46.70%) includes paid search engine ads and social media that are also effective in targeting specific demographics and generating leads.

-

Cold Outreach (37.30%) - reaching out to potential clients directly by mail, or phone can be effective, but requires a well-crafted message and personalization.

Other channels, including attending industry events, have a lower impact based on our survey data.

Client Acquisition: Key Metrics to Track Success

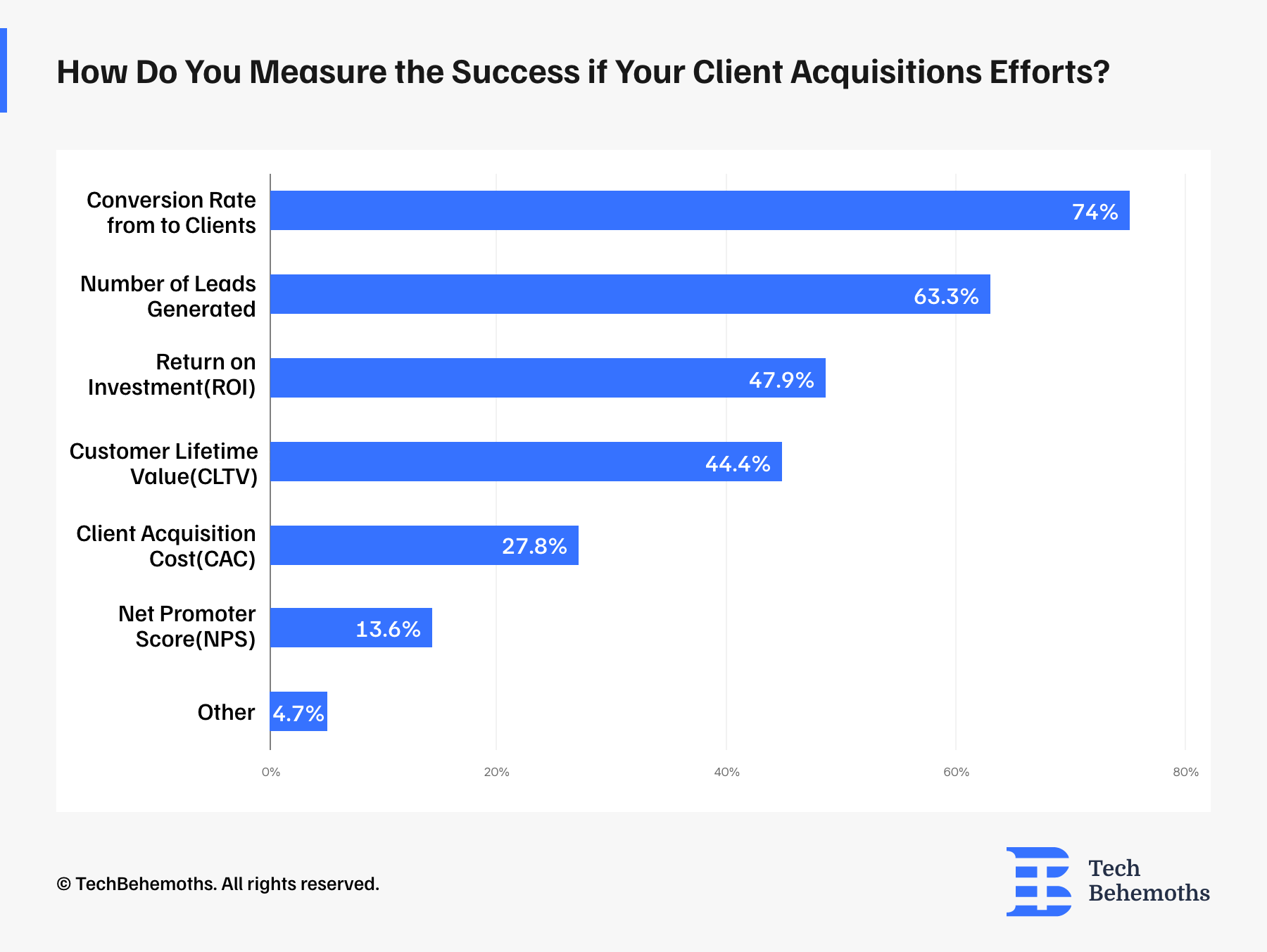

Measuring the effectiveness of acquiring customers is important in any business.

According to survey data, the top three metrics used by IT companies to evaluate their success are the conversion rate from leads to clients (74%), the number of leads generated (63.3%), and return on investment (48%). These metrics provide valuable insights into how effectively IT companies can attract, convert, and profit from customer acquisition efforts.

Another crucial metric is the customer lifetime value (44.4%), as it evaluates the long-term profitability of customer acquisition. IT companies also use less common metrics such as client acquisition cost (27.8%) and low net promoter score (NPS) (13.6%) to measure their client acquisition success.

For this question, survey respondents had multiple options to choose from.

The Biggest Challenges in Attracting New Clients

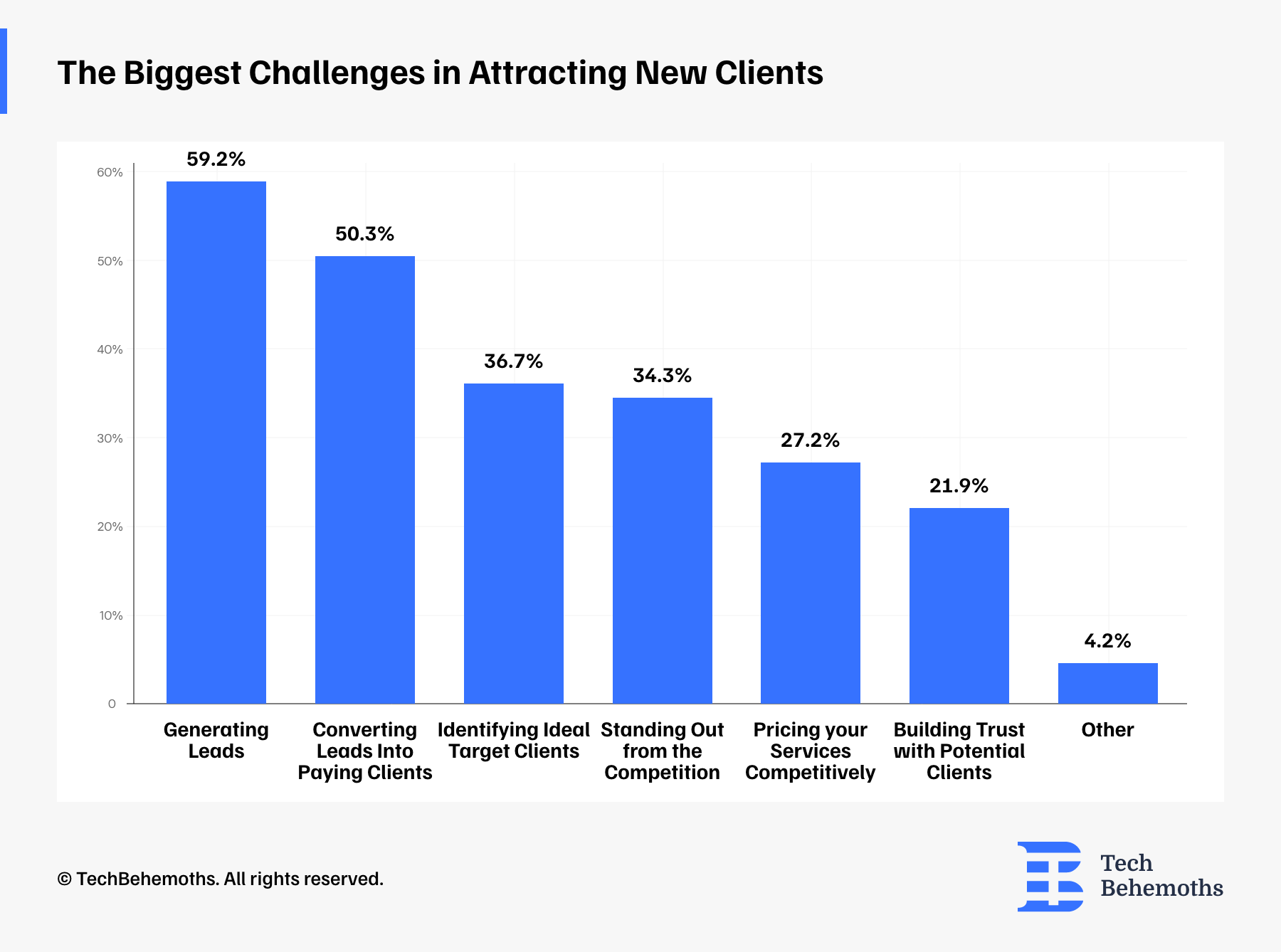

When it comes to the challenges IT companies face in attracting new customers, survey respondents agreed that lead generation is the most difficult at nearly 60%. Converting leads into paying clients is the next most difficult task, with 50.3% of respondents declaring it as a challenge. Identifying ideal target clients and standing out from the competition share the 3rd and 4th positions in terms of the biggest challenges, both with more than 30% of the votes.

Setting the right prices for your services is one of the most important elements in attracting customers while maintaining profitability. However, this remains a challenge for 27.2% of businesses. Building trust with potential customers is also difficult, but less compared to pricing. It requires time and effort to prove that companies are worthy of their investment. This is a challenge for 21.90% of businesses.

To address the major difficulties in attracting new customers a good recommendation would be to to focus on targeted marketing, implement lead generation strategies, develop compelling sales pitches, provide demos/proofs, leverage testimonials/case studies/certifications, and prioritize exceptional customer service.

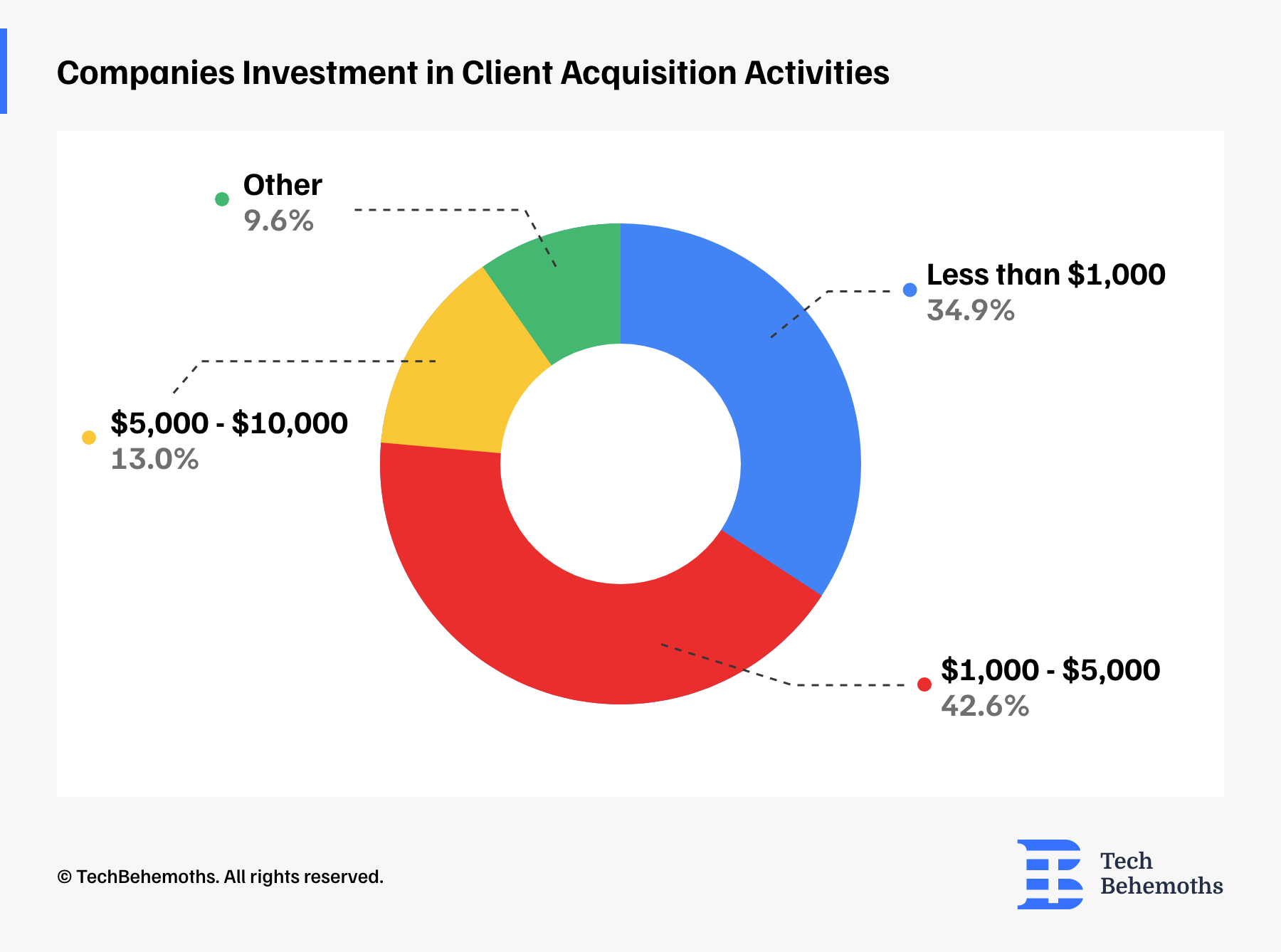

Almost 78% of Companies Invest Less Than €5000 in Their Client's Acquisition Activities

When asked about costs, the largest percentage (42.6%) of companies surveyed fall within the $1,000 - $5,000 range, indicating that this may be the most common investment range for customer acquisition activities, which may include a combination of different strategies, such as social media, advertising, as well as targeted outreach.

Around one-third of companies keep their spending modest by spending less than $1,000, and rely on referrals or a basic online presence to attract customers. Although a major percentage of companies spend less than $5,000, 13% of IT companies spend between $5,000 and $10,000. There is also a small group that falls into the "Other" (9.6%) category, representing companies that spend even more.

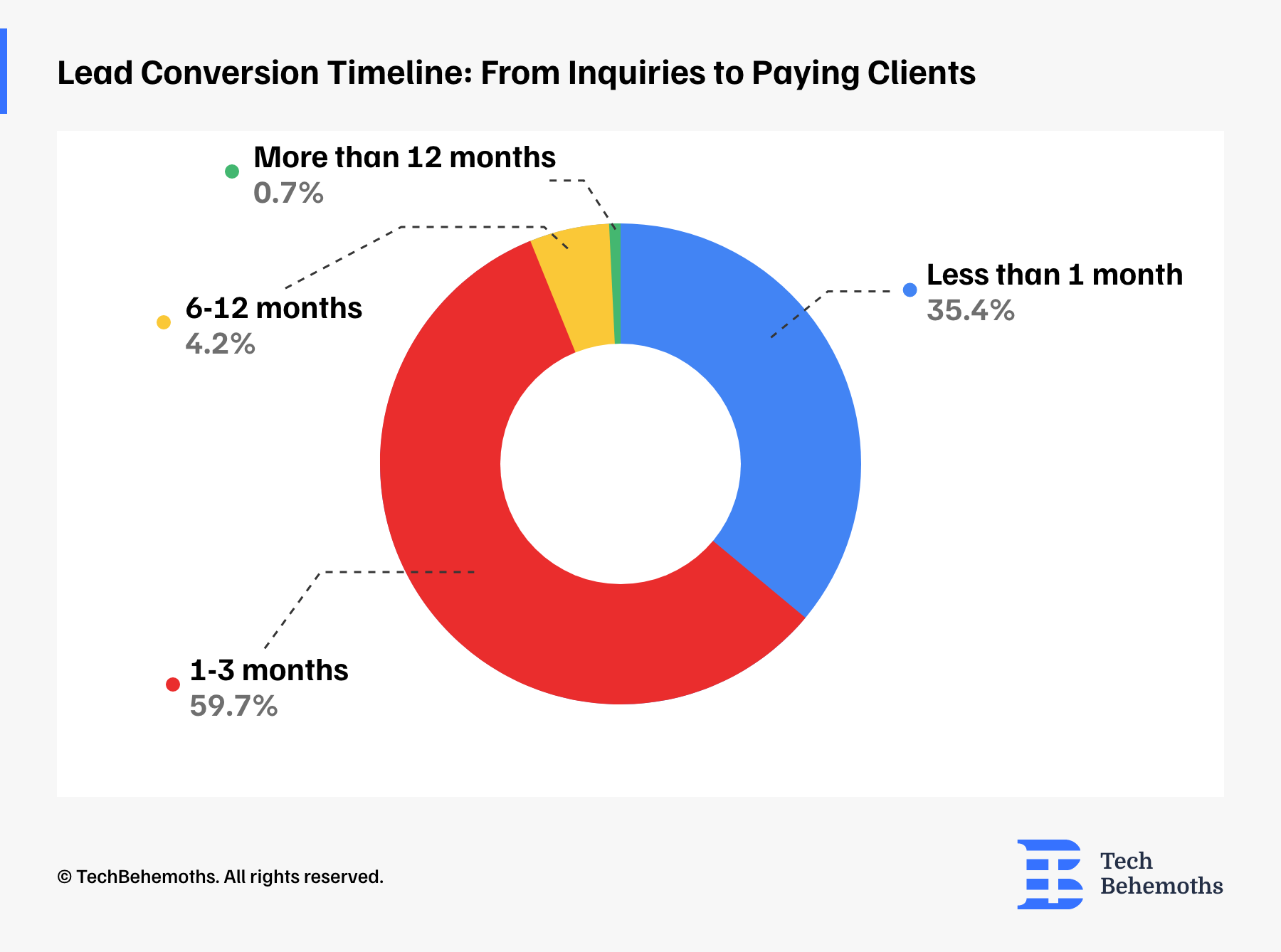

59.7% of Companies Convert Leads into Paying Clients within 1-3 Months

Converting leads into paying customers is the culmination of efforts to attract and engage potential customers, resulting in revenue generation and business success, which is why it is such an important point. But how long does it typically take for companies to turn a lead into a paying customer?

- Less than 1 month - 35.4%

- 1-3 months - 59.7%

- 6-12 months - 4.20%

- More than 12 months - 0.70%

According to the survey results, the majority of conversions, which is about 59.7%, happened within 1 to 3 months. About 35.4% of the time, when someone expresses interest in a product or service become paying customers in less than a month. Only a very small percentage of leads, around 4.2%, take 6 to 12 months to convert into paying customers. Additionally, about 0.70% of leads convert into paying customers after more than 12 months. Therefore, it is evident that the majority of conversions occur within the first three months, which indicates the importance of timely follow-up and implementing strategies to accelerate the conversion process.

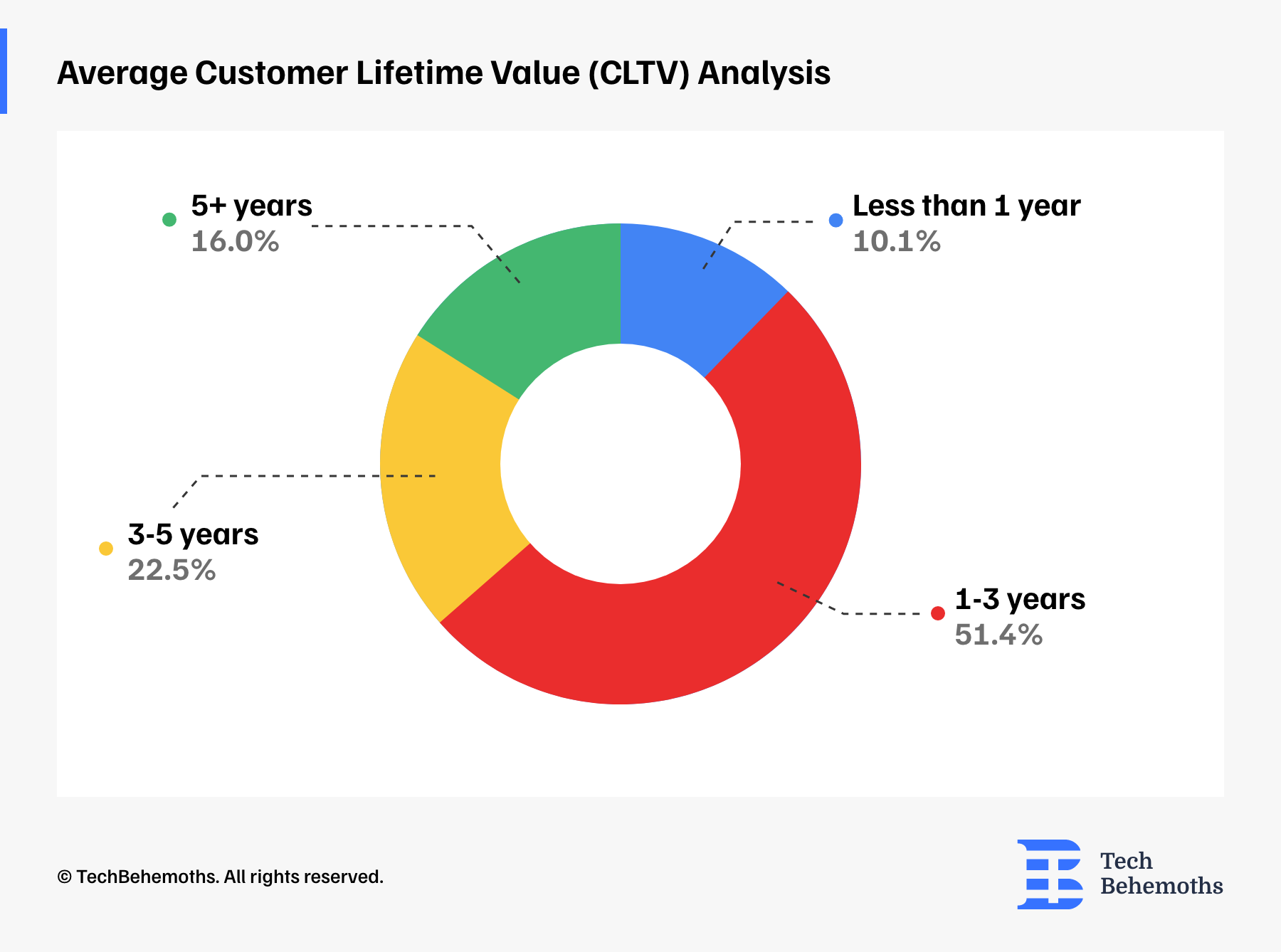

Average Customer Lifetime Value (CLTV) Analysis

Based on the survey results the majority of customers (51.4%) stay with IT companies for a period of one to three years. This suggests that these companies manage to retain a significant portion of their customer base for a moderate period of time.

The percentage of customers who stay longer decreases as the time frame increases (22.5% for 3-5 years and 16% for 5+ years). 10.1% of customers leave the company in the first year. This indicates a relatively high dropout rate in the initial period.

In general, while IT companies are successful in retaining customers for a reasonable amount of time, there may be opportunities to improve long-term retention and address churn in the early stages of customer engagement.

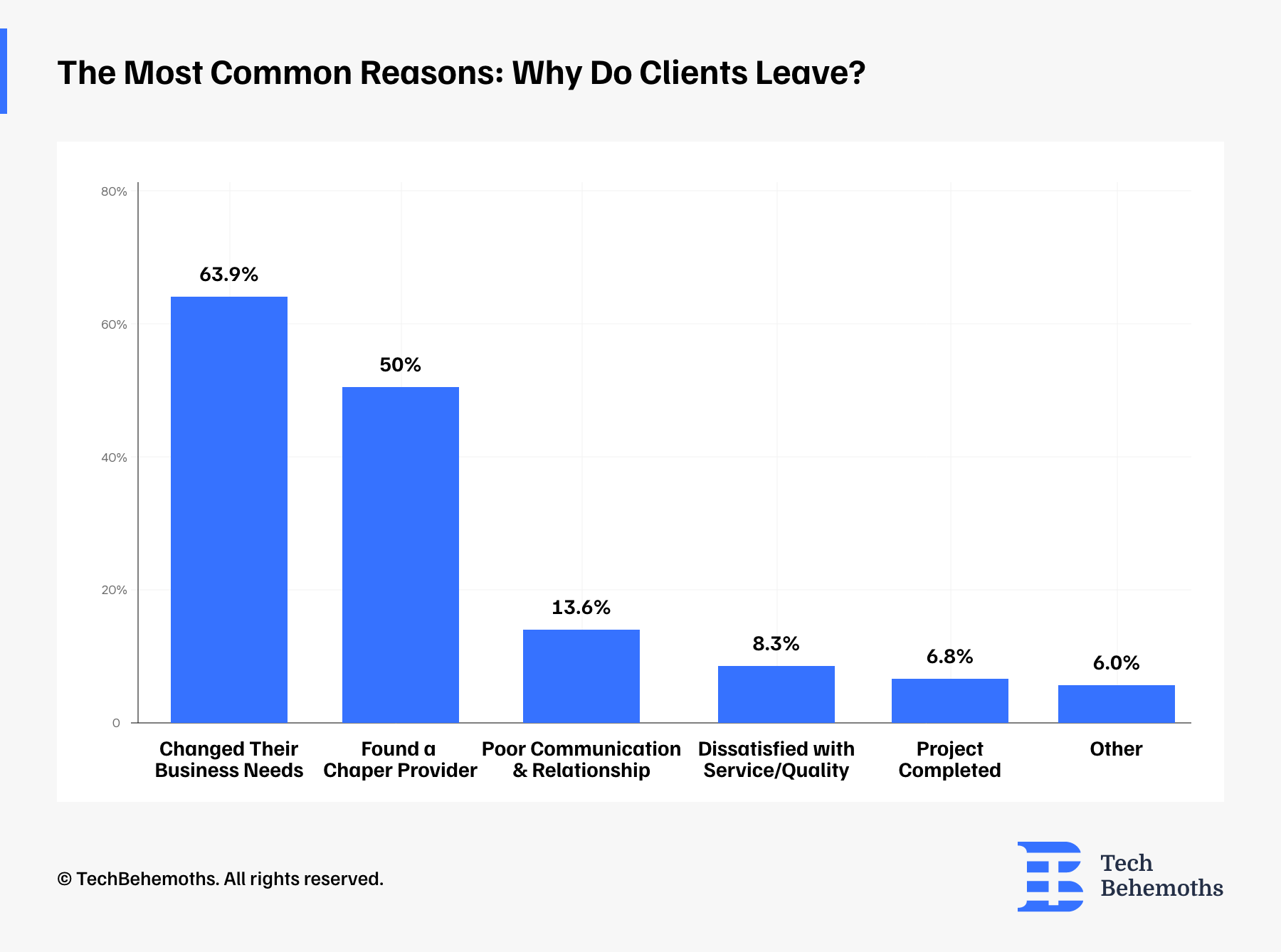

Why Clients Leave: the Most Common Reasons

Understanding why customers leave is just as important as what makes them stay.

The most common factors that influence customers' decision to leave, according to our survey are:

- Changed Their Business Needs - 63.90%

- Found a Cheaper Provider - 50.00%

- Poor Communication/Relationship - 13.60%

- Dissatisfied with Service/Quality - 8.30%

- Project Completed - 6.8%

Many customers leave a company because their business needs change and the services provided no longer match their requirements. This accounts for 63.9% of customers who leave. The second most common reason is because they found a cheaper provider, which is true for 50% of customers who leave. Despite being satisfied with their current service, customers may still choose to switch to a cheaper alternative.

Poor communication or a weak relationship is another reason why customers may leave 13.6% of the time. It demonstrates once again the importance of good communication. 8.3% of clients leave if they are dissatisfied with service quality. While not as common as cost or changing needs, clients may still seek alternatives if they are unhappy with the service they receive. Finally, 6.8% of clients leave after the project is completed, it is natural, especially for project-based work.

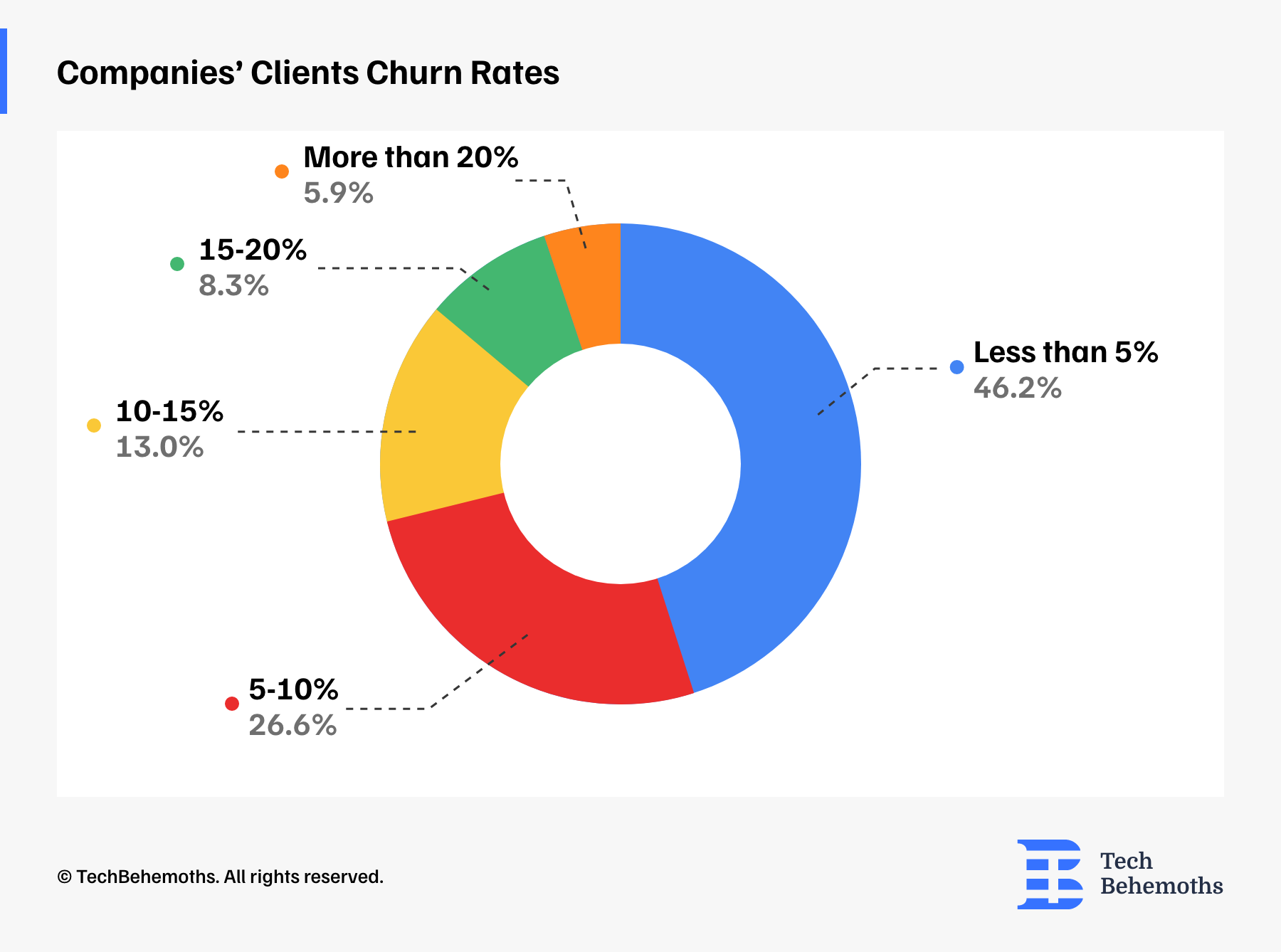

Strong Retention! 72% of Companies Experience Low Churn

The churn rate represents the percentage of customers leaving.

According to survey data, it can be observed that 72.8% of customers belong to the "less than 5%" and "5-10%" churn rate categories, which is a good sign for IT companies as it points to a decent customer retention rate for a big part of their customer base.

However, it is important to note that 27.2% of companies’ customers are experiencing a greater loss, falling into the categories of "10-15%" (13%), "15-20%" (8.30%), and "More than 20%" (5.90%). These clients are at risk of leaving and therefore require extra care and attention to keep them on board.

While it is great to see that a large proportion of clients expose strong loyalty with low churn rates, we cannot pay attention to the smaller portion of customers who are at risk of leaving. Addressing their concerns and providing them with personalized support can help retain their loyalty and prevent them from leaving.

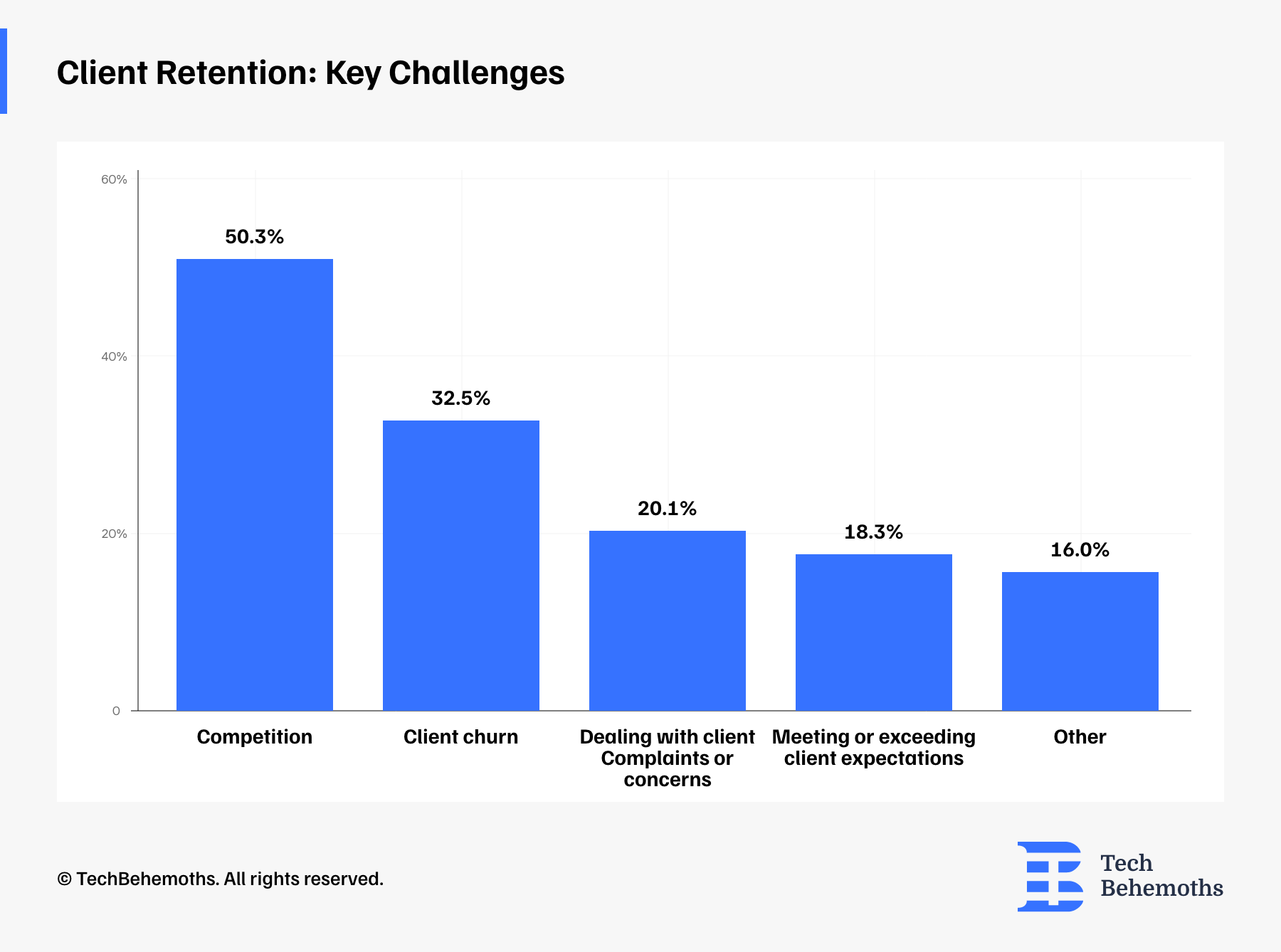

Client Retention Challenges

When companies were asked what the biggest challenge they face in retaining customers, their responses were distributed as follows.

Competition (50.3%) is the biggest obstacle, with over half of respondents citing it as a major factor in customer retention. The IT industry, in particular, is known for rapid innovation and a multitude of options for customers, which makes it challenging to differentiate and offer unique propositions. Client churn (32.5 %) is another substantial challenge and can significantly impact revenue and profitability.

Difficulties dealing with client complaints or concerns (20, 1%) is also an important challenge, with 20.1% of respondents citing it as a difficulty. It is complicated to ensure every time effective measures to address client issues promptly and professionally. 18.30% of customers expect high-quality products or services and superior customer service. Failure to meet these expectations can lead to customer dissatisfaction and ultimately churn. There are various other reasons why customers might leave, including a lack of communication, pricing issues, or security issues. It is important to collect customer feedback and address it effectively.

For this question, survey respondents had multiple options to choose from.

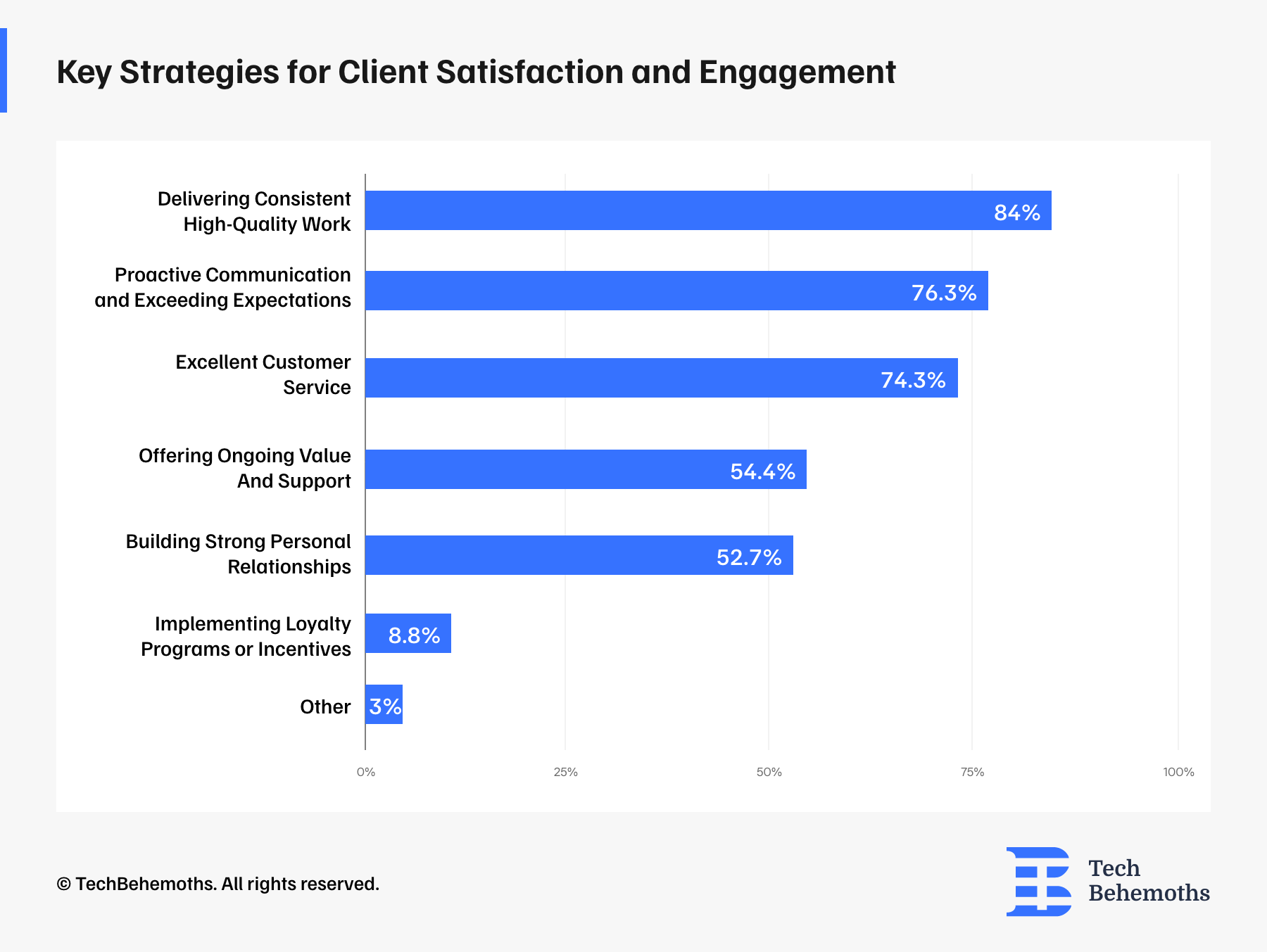

Key Strategies for Keeping Clients Happy and Engaged

Converting leads into customers is very important, but keeping them is just as important. The companies surveyed highlight the following top strategies as the top things they do to keep their customers engaged and happy.

The most important factor for client satisfaction is providing consistent, high-quality work (84%). Next highly valued by clients is proactive communication and exceeding expectations (76.30%). Everyone likes clear communication and when delivered, work meets or exceeds their expectations. Excellent customer service (74.3%) remains a core aspect, as customers expect helpful, friendly, and efficient interactions.

54.40% of the respondents consider long-term partnerships and ongoing value and support to be important, but not among their top three priorities. Building strong personal relationships with customers is considered important by 52.70% of the respondents. Implementing loyalty programs or initiatives is the least important customer satisfaction strategy, with only 8.80% of the votes. Although some businesses have loyalty programs or incentives, they are not considered to be a significant factor in customer satisfaction.

Survey Conclusions

This survey serves as a road map, for what is working and what challenges face IT companies globally to attract and retain customers, at the same time it provides a complete understanding of the strategies to use to succeed.

Some important points to take away from this analysis are:

-

Networking, referrals, partnerships, content marketing, online ads, and cold outreach are key acquisition channels

-

Conversion rates, leads, ROI, and customer lifetime value are primary metrics

-

Lead generation, converting leads, and targeting ideal clients are competition-challenging factors

-

Proactive communication and delivering high-quality work are essential strategies for achieving client satisfaction and retention.

Strategies Unveiled,

Challenges Addressed,

Success Assured!

Partner Companies

The survey was conducted on a global scale and targeted IT companies and web agencies around the world. It was not limited to any specific geographical region or country, which resulted in responses from 1020 companies located in 60 different countries. TechBehemoths is pleased to announce the list of partner companies who assisted in spreading the word and gathering responses for this survey.

- Acid Labs, USA

- Acropolium, Czech Republic

- AFIVE Digital Agency, United Kingdom

- Ahy Consulting, India

- Alluxi, Mexico

- Altlier, United Kingdom

- Antagosoft, Ukraine

- Aptagon Technologies, United Kingdom

- Asiakas Group Oy, Finland

- Asterdio Inc., Nepal

- Astoe Company, Pakistan

- Atlantic IT Solutions, Ethiopia

- Azikus, Croatia

- Barvy Digital Eye SRL, Moldova

- Bespoke Web Dev, Australia

- Bionic Egg, USA

- Brand Envoy Africa, Nigeria

- SocialSellinator, USA

- BRND WGN, Malta

- BugRaptors, USA

- Bulcode 2016 Ltd., Bulgaria

- Burlamaqui Marketing & Strategy, Brazil

- Business Config, Portugal

- Butcher, Israel

- ChatPlus, Japan

- Chimp&z Inc, India

- Codefia, Poland

- Codewave, India

- Codezela Technologies, Sri Lanka

- Codment, USA

- Cosmico Studios, USA

- Crystal Translation and Content Creation, Lebanon

- ctrlweb, Canada

- Cubet Techno Labs, India

- Custom Media, Japan

- Darksky Digital, South Africa

- datarockets, Canada

- dev.family, Portugal

- Dexoc Solutions, India

- Digital Sail, Armenia

- Direlli, Armenia

- Doomel, Brazil

- Dot IT, Egypt

- Double Coconut, USA

- DTC Infotech, India

- Duaal Studio, Netherlands

- Editoteka, Mexico

- Effectus Software, Uruguay

- Elites, Lebanon

- EloQ Communications, Vietnam

- Evonicsoft FZE LLC, United Arab Emirates

- F(x) Data Labs Pvt Ltd, India

- FCS Web Development, Portugal

- FilmspbTV, Russia

- Firmao CRM, Poland

- Flowmatters, Romania

- Fusion Tech, USA

- Future Forward, Netherlands

- Game Art & Development, Cyprus

- GCC, United Arab Emirates

- Gooder Marketing, Canada

- GPRINTS Nigeria (Genii-Prints Limited), Nigeria

- Grio, USA

- Growzilla Agency, South Africa

- Hotel SEO Agency, Greece

- HUSPI, Poland

- iCONEXT Co., Ltd., Thailand

- Ideo Sp. z o.o., Poland

- ILB Metrics, Guatemala

- Inbound.BG, Bulgaria

- Infinkey Solutions, Pakistan

- Influence IT Consulting Pty Ltd, Australia

- Innoventix solutions, USA

- Intcore, United Arab of Emirates

- IT, Cambodia

- IT brick, Uzbekistan

- IT Consultis, China

- ITCTRLS Digisol LLP, India

- ITD-GBS Tokyo, Japan

- Jeff Social Marketing, Canada

- Kernelics, United Kingdom

- Ledger Labs Inc., USA

- Leobit, Ukraine

- Leoceros, Lebanon

- Litslink, USA

- Loopstudio, Uruguay

- Loovatech, Estonia

- Magnetic Point, Poland

- Marketing Departmnet, Pakistan

- Ministry of Programming, Bosnia and Herzegovina

- MobileCoderz Technologies, India

- Monkeys at Work, Canada

- Muse Marketing Group, Canada

- MWIMMERDESIGN, Germany

- My Biz Consulting, USA

- Navus, Lithuania

- NERDZ LAB, Ukraine

- NKOM IO, Germany

- Ongadi Studios, Kenya

- ORBIS Production, Italy

- Percepto, Israel

- Phaedra Solutions, Pakistan

- Pixelmatters, Portugal

- PixoLabo, Japan

- Presentation.STUDIO, Switzerland

- Presitely, Bulgaria

- PRO Media 66, United Kingdom

- Profinit, Czechia

- Qarbon IT, Poland

- Qualysoft, Austria

- Real Wisconsin Website Design, USA

- RECHPUNTO SARL, Lebanon

- Reenbit, Ukraine

- RexterTech, India

- Risivonne Investments, Kenya

- Rocket House Pictures, USA

- Rohallion, United Kingdom

- Ronik, Croatia

- Safnah IT Services, Iraq

- Saint Rollox Digital, Australia

- Selfish, Mexico

- SEO Expert Gold Coast, Australia

- Sherlock Communications, Brazil

- shift - shift asia, Vietnam

- ShotCoder Tech, Nepal

- Snappymob, Malaysia

- Snotor, Latvia

- Software Development Services, India

- Solar Digital, United Kingdom

- Subsgin, Romania

- Synergo Group, Canada

- Tecalis, Spain

- TechDoodles, India

- The Art of Business, Canada

- The Digital Marketing People, Canada

- The Generalissimo Media, Nigeria

- The Gnar Company, USA

- The SEO Works, United Kingdom

- thecon srl, Romania

- Timspark, United Kingdom

- TOG Africa, Nigeria

- Tresify Lab, Bangladesh

- Tribal House Studios, Ghana

- Tribe Business Services Sdn Bhd, Malaysia

- Trust Deep Branding, USA

- Unstuck Labs, USA

- Upcasted, Romania

- Upstack Studio, Malaysia

- Velvetech LLC, USA

- VM Project, Russia

- WDIPL, India

- WebOrigo Magyarország Zrt., Hungary

- WebSailors, United Kingdom

- Wild Creek Web Studio, India

- Williams Web Solutions, USA

- Wireless Computer Service, Nigeria

- X-TECH, Armenia

- ZalaTech, Ethiopia

- Zendev AB, Sweden

- zeropoint7 Studio, USA