Poland vs Germany - A Comparative Analysis of the ICT Sector

The technology industry in Europe is a dynamic arena, with countries like Poland and Germany playing significant roles in shaping its future. As the world increasingly relies on digital innovation, it becomes crucial to understand the contributions and challenges of these nations. Poland has emerged as a significant player in the region with its burgeoning tech hubs and entrepreneurial spirit, while Germany continues to be a powerhouse in the tech industry, known for its engineering prowess and robust economy.

This article aims to examine the nuances of the tech sectors in both countries, comparing and contrasting their strengths, weaknesses, and potential for future growth. By analyzing key factors such as economic impact, innovation, and regulatory environments, we provide a comprehensive overview of Poland and Germany's roles in the European tech landscape. Through this analysis, we hope to offer insights into the opportunities and challenges that lie ahead for these nations as they navigate the ever-evolving world of technology.

Historical Context of Tech Industry in Poland and Germany

Poland's tech industry has seen remarkable growth over the past two decades, becoming an attractive hub for both domestic and international businesses. The country's strategic location in Central Europe, coupled with its economic potential and wealth of tech talent, has made it an emerging tech epicenter. Since joining the EU in 2004, Poland has experienced economic stability and growth, which has bolstered its tech sector. The industry currently accounts for about 8% of the GDP and employs over 430,000 people. Notable milestones include the launch of the first Polish satellite, PW-Sat, in 2012, and the first artificial heart implant in the country in 2018. Major tech companies like Google, Samsung, Facebook, Amazon, and Intel have established bases in Poland, further solidifying its position as a leading tech hub in the region

Germany's tech industry on the other hand has a long-standing tradition of innovation and excellence, with a strong focus on engineering and manufacturing. The country has been at the forefront of technological advancements in various sectors, including automotive, engineering, and information technology. Germany is known for its highly skilled workforce, robust infrastructure, and supportive government policies, which have fostered a conducive environment for tech growth. The country has also been a leader in embracing Industry 4.0, integrating advanced technologies like IoT, AI, and robotics into its manufacturing processes. Berlin, Munich, and Frankfurt are among the key tech hubs in Germany, hosting a vibrant startup ecosystem and attracting significant investments in tech.

Now, in 2024, both countries have achieved specific milestones in Europe that makes them leading tech hubs. The establishment of 60,000 technology companies and ten unicorns, significant investments from major tech companies, and the development of tech hubs like Warsaw and Krakow for Poland and pioneering Industry 4.0, leading in automotive and engineering technologies, and the growth of tech hubs such as Berlin, Munich, and Frankfurt with a strong focus on startups and innovation in Germany.

Germany and Poland - Current state of Tech Industry

The current state of the tech industry in Poland is characterized by robust growth and innovation, with the sector contributing significantly to the country's economy. In 2023, total information technology (IT) expenditures in Poland are estimated to grow by 12.4 percent in local currency, reaching a value of $29.4 billion. The IT industry is responsible for generating 8-9% of the Polish GDP, with the value of the market estimated to be around PLN 70-85 billion. The software and IT services sector alone accounts for approximately two-thirds of the entire market, with this share currently rising towards 70%. Poland is home to around 50,000 software companies, making it the country with the highest number of domestic IT companies in Europe.

Poland's tech industry has been buoyed by major investments from international tech giants. In 2021, Google, Amazon, Microsoft, and several other international and local market players made significant investments in local data centers in Poland. Additionally, in 2023, Intel announced a major investment plan of a semiconductor integration and testing facility in Poland with an estimated value of $4.6 billion. These investments are part of efforts to create a more resilient semiconductor supply chain in Europe and further establish Poland as a leading tech hub in the region.

The Polish IT market is highly competitive, with most global and international technology players having a direct presence in the country. The market is characterized by a vast majority of local IT companies that are small and often merge or form alliances when working on larger projects. Services, including cloud computing services, software-as-a-service, and infrastructure and platform services, are driving sales growth and are key trends in the enterprise market.

Despite the positive outlook, the Polish IT sector faces challenges such as rising labor costs, talent draining, and low awareness of the benefits resulting from IT investments in the SME sector. The COVID-19 pandemic has accelerated the global digitalization process, leading to a shift in plans for the future, with many traditional businesses being forced to think about digital transformation or new digital channels.

The tech industry in Germany is currently experiencing a significant talent gap, with 700,000 open tech positions in 2023, expected to rise to 780,000 by 2026. Despite this, there's optimism due to recent fluidity in the tech talent market. To address the tech gap, German companies need to rethink their approach to talent management, focusing on skills rather than roles, valuing potential for future learning over past experience, and adopting more flexible working models. The demand for specific tech skills has shifted dramatically in recent years, highlighting the importance of adaptability and continuous learning in potential hires. Soft skills, such as adaptability and problem-solving, are becoming increasingly important, yet many companies still prioritize experience and hard skills.

German companies are lagging behind in learning and development, offering only 22 hours of training per employee annually, compared to 75 hours in more effective learning organizations. This underinvestment in skill development could hinder their competitive edge. Inclusivity is also a challenge, with many companies seeking tech talent with German-language skills, limiting their talent pool. DAX companies have a lower share of women in their workforce compared to their Dow Jones counterparts, except at the executive level.

To attract and retain tech talent, German companies need to embrace a skill-based approach to talent management, invest in learning and development, and create a more inclusive and flexible work environment. This will require a fundamental shift in mindset and culture for most companies.

Social media platforms like Facebook, YouTube, and Instagram have a significant presence in Germany, with millions of users on each platform. TikTok, in particular, has seen a notable increase in its user base, with a 21.5% growth between the start of 2022 and early 2023.

Poland vs Germany’s Tech Industry - Comparative Analysis

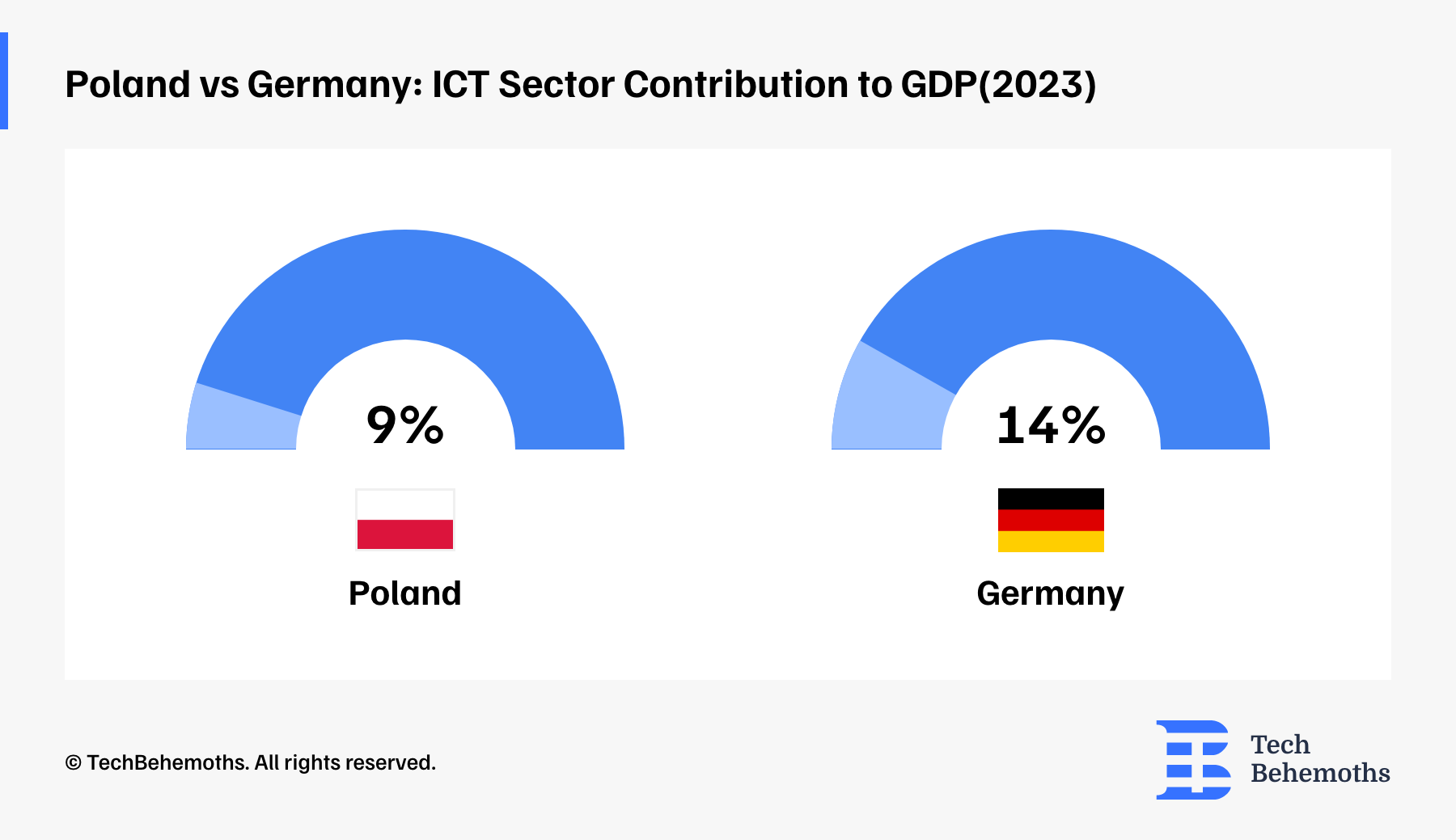

In Poland, the IT sector contributes 8-9% to the GDP, with the market value estimated to be around PLN 70-85 billion. In comparison, Germany's tech industry is more mature, with a higher contribution to the GDP which is 13-14% or or EUR 40.1B

Poland's tech industry employs over 430,000 people, while Germany has 1,26 million employees in the ICT according to Statista. However, Germany has a significant tech talent gap with 700,000 open tech positions in 2023, expected to rise to 780,000 by 2026.

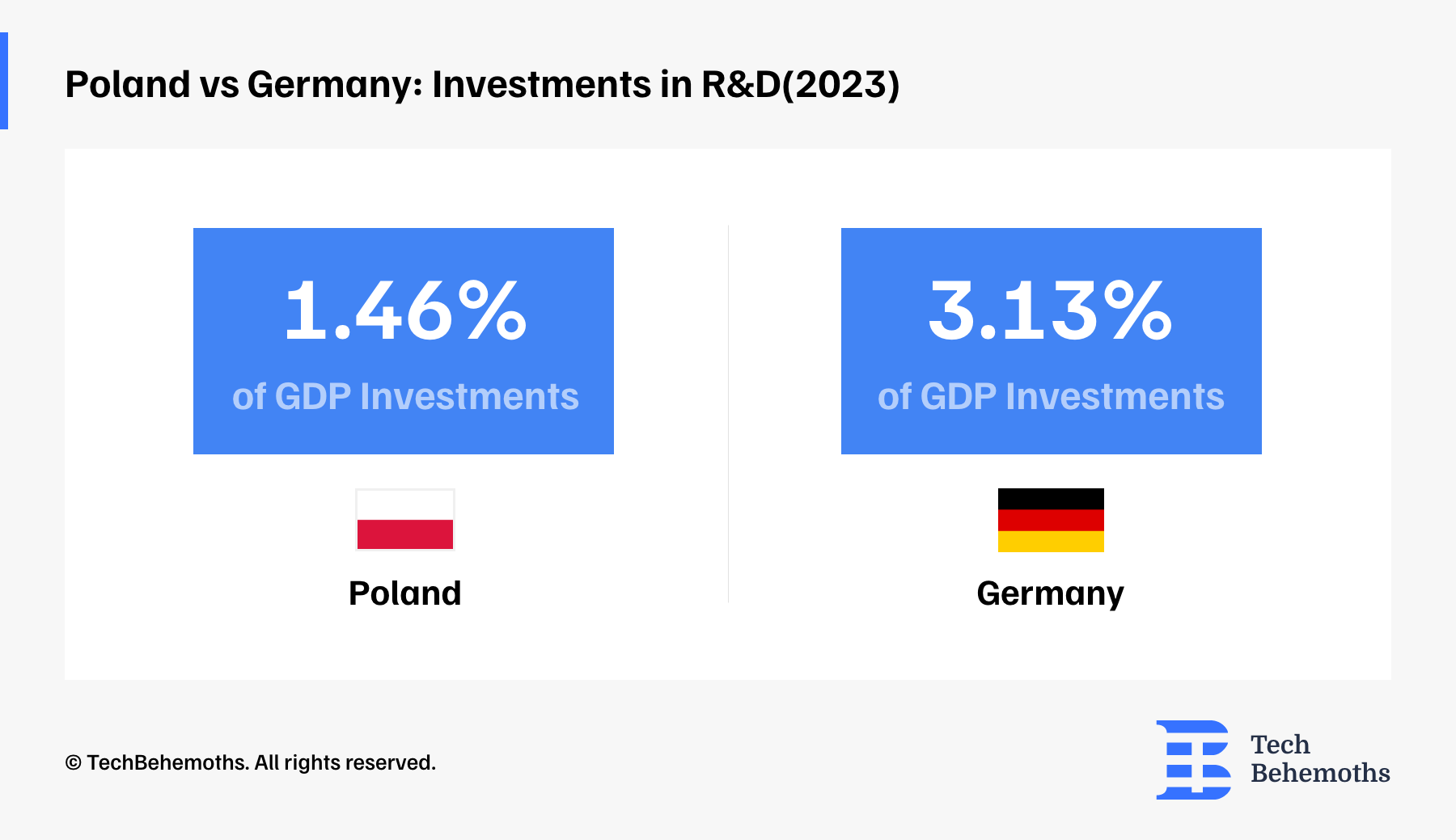

Both Poland and Germany invest in R&D, but Germany has a longer tradition of innovation and typically spends more on R&D as a percentage of GDP. Therefore, Germany invests 3.13% of its GDP in research and development projects. At the same time, Poland invests in R&D 1.46% of its GDP

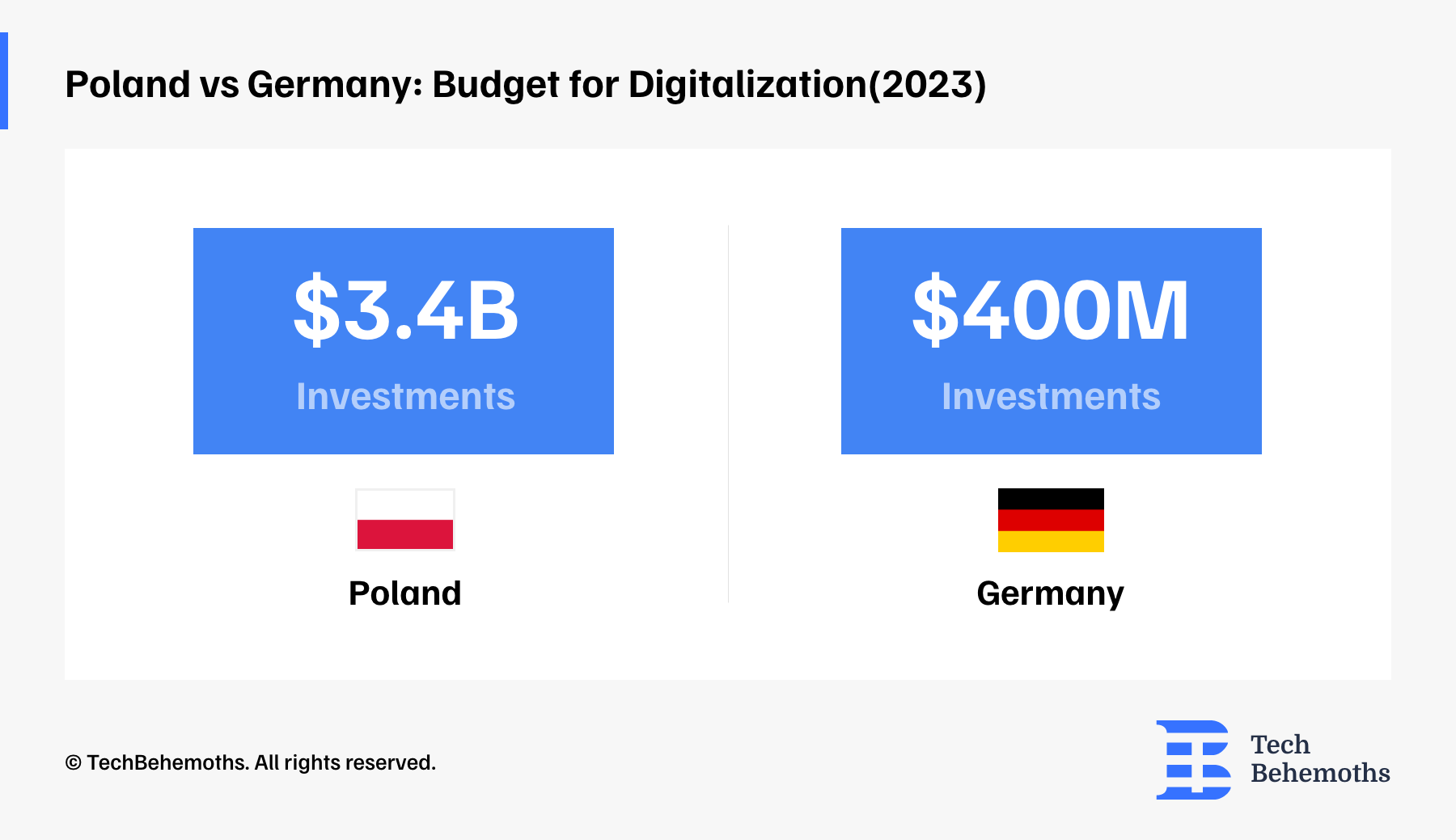

Poland's National Recovery Plan anticipates $3.4 billion for digital development projects. Germany has various initiatives to support the tech industry, including funding for startups and innovation clusters. Therefore, Poland’s budget for digital development is estimated at $3.4B while Germany’s Digitalization budget is expected to be only at EUR377M, after a cut of EUR3M announced by the internal affairs minister.

Trends and Predictions for Poland & Germany’s ICT

Poland's tech industry is expected to continue its growth trajectory, with a strong focus on software and IT services. The country is well-positioned as a key IT hub in Central and Eastern Europe, with a robust startup scene and a powerful gaming industry. The Polish ICT market has been steadily growing, reaching PLN 212 billion in net sales in 2021, and the IT sector accounted for 8% of the country's GDP in 2022

The tech industry in Germany is projected to experience significant growth in 2024, with IT spending expected to increase by 9.3%, totaling $1.1 trillion. Cloud computing and cybersecurity are anticipated to be key areas of increased spending, with investment in cloud services expected to grow by 27%. Security and risk management spending in Europe, including Germany, is forecasted to reach $56 billion in 2024, a 16% increase from 2023.

Nonetheless, both Poland and Germany have unique strengths in the tech industry, presenting opportunities for collaboration and growth.

With both countries investing heavily in cloud services, there are opportunities for collaboration in developing cloud infrastructure and services that cater to the needs of the region. As cybersecurity becomes a priority for both countries, collaboration on security solutions and best practices could enhance the security posture of both nations. Poland's vibrant startup scene and Germany's strong tradition of innovation provide a fertile ground for collaboration in nurturing and scaling innovative tech startups. Both countries are focused on digital transformation. Sharing experiences and strategies in this area could accelerate progress. With Poland's powerful gaming industry, there are opportunities for collaboration with Germany's tech industry in developing gaming technologies and platforms. As both countries invest in AI and automation, collaboration on research and development in these areas could lead to breakthroughs and advancements.