Why is Moldova your Next IT Outsourcing Destination in 2025?

In recent years, IT outsourcing from an option - a strategy to make business processes more efficient and reduce costs, has finally become an almost mandatory condition, being indispensable for expansionist companies that pursue outstanding performance indicators.

IT Outsourcing is segmented into four distinct markets: Administrative Outsourcing, including hardware management, cybersecurity and IT support; Application Outsourcing, applied for software development and implementation; Web hosting, essential for the company’s online presence; Additional IT services, including infrastructure and network outsourcing.

Globally, the IT outsourcing market is on an upward trend, with revenues estimated to reach $591.20 billion by 2025 and a compound annual growth rate (CAGR) of 8.28% between 2025 and 2029, reaching $812.70 billion. This expansion reflects the significant investments that companies are willing to make for optimization and efficiency, with average spending per employee estimated at $164.60 in 2025. According to Statista the United States remains the leader in outsourcing, generating the highest revenues of $213.60 billion, while India continues to attract clients through its skilled workforce and solidifying its status as a provider of efficient IT solutions, strengthening its efficient IT industry.

In this blog, we will find out what the latest global outsourcing trends are and how Moldova can become the next IT Outsourcing destination in 2025.

What can Moldova offer to the IT Outsourcing market?

The IT sector in the Republic of Moldova is developing rapidly, becoming an emerging IT Outsourcing destination, with an 8.3% contribution to GDP in 2023 and a record growth in IT services exports, surpassing countries such as Ukraine, Romania, Estonia, Latvia and Lithuania. Supported by government initiatives such as the Moldova Innovation Technology Park (MITP) and an attractive tax regime of 7% on turnover, valid until 2035, the IT sector has attracted investments from 33 countries, including the USA, Germany and the UK. With over 1,600 IT companies established within the MITP, of which 95% are SMEs, Moldova is becoming increasingly competitive in the global technology market ( invest.gov.md).

Moldova, compared to competing countries with common features, such as Romania, Ukraine, Poland, and the Czech Republic, can offer at least a practical combination of competitive prices and high-quality services. The country has a well-developed infrastructure in IT, a progressive educational system in the field of technology, good professionalism, and talent. Another aspect that would facilitate collaboration with international partners and would greatly facilitate the process of integration and understanding the needs of requesting companies is, of course, the knowledge of several languages of international circulation ( English, French, German, Spanish, Italian, Russian, etc.), the culture similar and adaptable to many countries, the almost non-existent racist discrimination and one hundred percent religious tolerance.

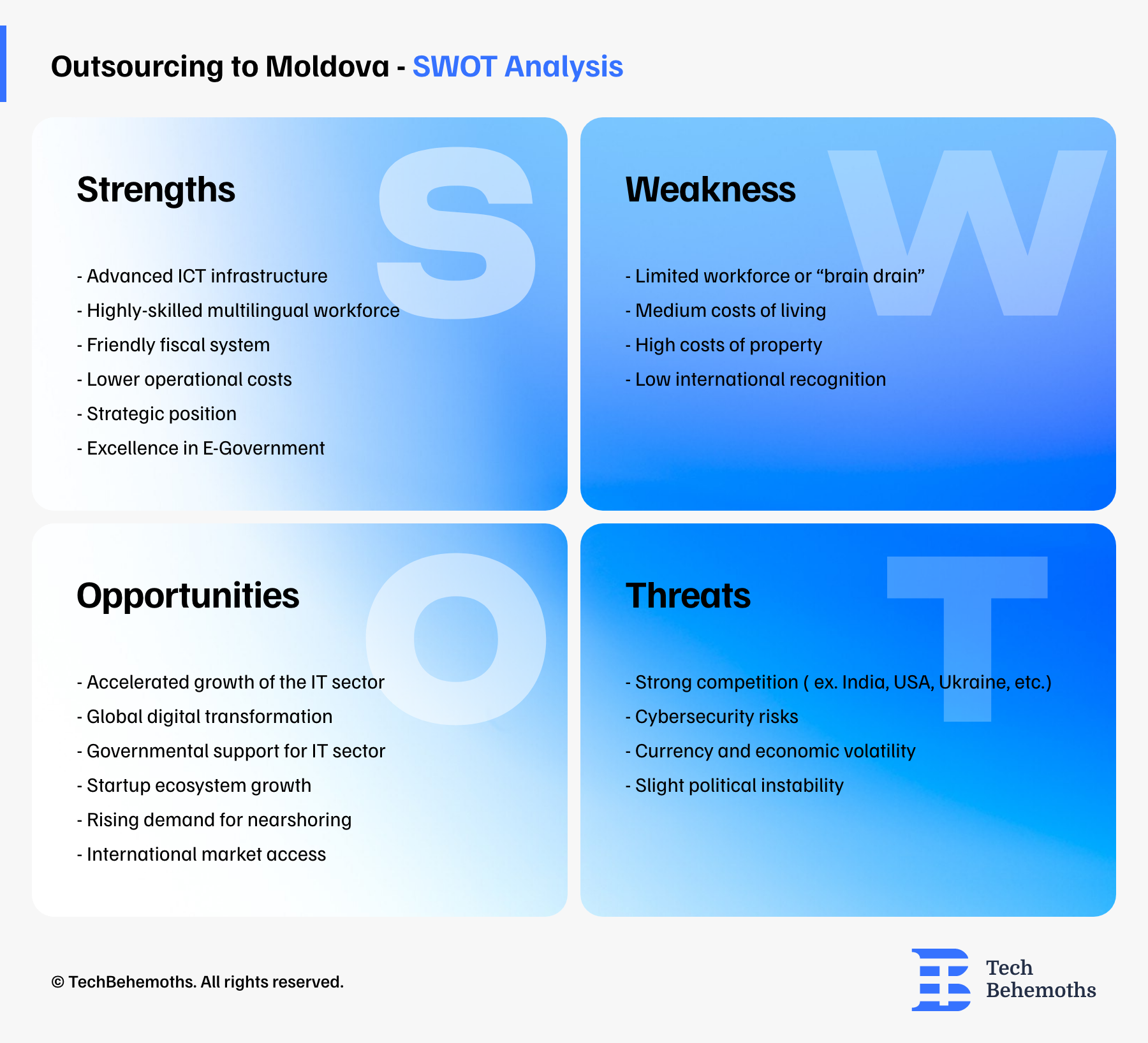

Outsourcing to Moldova presents numerous benefits, such as affordable services, a talented and multilingual labor force, and a supportive business climate fostered by initiatives like Moldova IT Park, which features an easy tax system with a 7% flat tax for IT firms. The nation features a robust talent base of more than 15,000 IT experts, skilled in software engineering, quality control, and new areas like AI and blockchain, and its strategic position in Eastern Europe guarantees slight time zone variations with Western customers, promoting instant collaboration. Nevertheless, possible obstacles encompass political and economic instability, which, while getting better, might still generate uncertainties for long-term investments, along with infrastructure constraints beyond major cities, potentially affecting scalability. Furthermore, although Moldova possesses a developing IT ecosystem, it is still less significant than well-known outsourcing centers such as the Czech Republic, Poland, or Ukraine, which may result in a tighter talent pool for specialized projects. Despite these obstacles, Moldova keeps enhancing its status as a viable outsourcing location with competitive benefits for companies seeking high-quality, cost-effective IT solutions.

Data Visualization

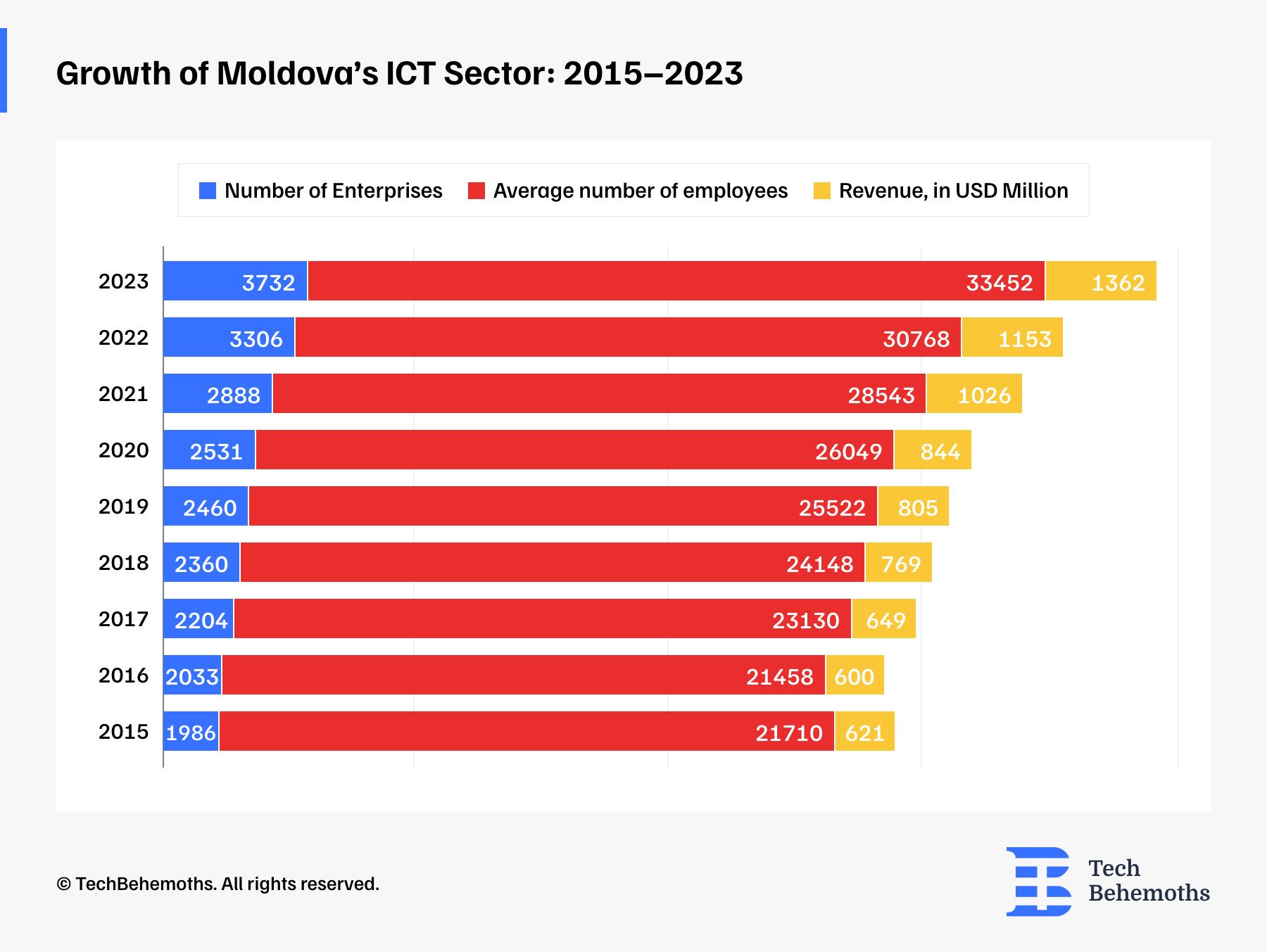

In the chart presented above, in the research of the Information & Communication Sector for the period from 2015 to 2023, there is an increase in the Number of companies, from 1986 to 3732 companies. Also, with the increase in the number of companies, the Average number of employees increased, which is logical to happen, these two indicators are interdependent. As for the indicator of annual Revenue in millions of dollars, it also registered a constant increase during the years 2015 - 2023, fluctuating from 621,09 million dollars in 2015 to 1362,64 million dollars.

This graph demonstrates both the desire to develop the Information and Communication Technologies sector, as well as a defined potential of the Republic of Moldova in the expansion and progress of the IT Outsourcing sector.

The graphic representation was made based on public data provided on the statbank.statistica.md and the average annual exchange rate to convert from MDL to USD for each year researched on the official website of the National Bank of Moldova.

Case studies: Orange, Endava & Pentalog

Orange Moldova is an excellent example of nearshoring. Orange Moldova International Operational Team provides nearshoring services to external customers – including EE & Community Fibre London in the UK, Sunrise Communications in Switzerland, IPM Media Holding in Belgium – and to other Orange countries (Romania, Poland, Slovakia, Belgium & Luxembourg). The wide portfolio of services, more or less complex, ranging from Finance to HR, Customer Service, and IT. Their nearshoring activity is a real success, satisfying millions of customers across Europe.

Through the Digital Evolution, Agile Transformation and Automation solutions, Endava is helping clients be more engaging, responsive and efficient. The company employs over 4,600 professionals worldwide, located in offices in North America and Western Europe and delivery centres in Romania, Moldova, Bulgaria, Serbia, Macedonia, Argentina, Uruguay, Venezuela, and Colombia. In Chisinau, Endava employs over 1,000 people.

Pentalog is a global full-stack IT service platform designed to support digital and tech businesses throughout their product lifecycle: design, development, marketing, and funding. They rely on 25 years of worldwide experience in software engineering, a global team of 1,000+ IT engineers, 50+ consultants, and a talent pool of 400,000+ profiles to set up your team and launch your project within 4 weeks.

Conclusion

-

Companies using IT Outsourcing services benefit from professional, high-quality IT management offered by service vendors. In the upcoming years, enterprises will depend more on service providers, which keep them up to date with evolving new technologies.

-

Moldova can be a good competitor for companies that offer IT Outsourcing services, taking into consideration the internal and exogenous factors it has. ( see SWOT Analysis)

-

Moldova has all the chances and resources to become your next IT Outsourcing destination in 2025, pleasantly surprising you with its professionalism, responsiveness, competence in attitude, and quality, diversity in services, offering you a complex portfolio of IT services and a convenient collaboration.