How Salesforce Makes Money: Revenue & Profit Breakdown

With the digitalization process going on all over the world, there are tons of companies of all sizes that use CRM software for better customer management. While companies use CRMs, they fuel other businesses that make, support, and advertise these products.

Salesforce is by far the most popular and well-known brand that takes care that customer management goes smoothly, as their main product is, as expected, a CRM as well.

In this article, we’ll talk more about Salesforce and less about CRM as a whole. And more precisely, about how Salesforce makes money, and how much money did the company earn in the past few years.

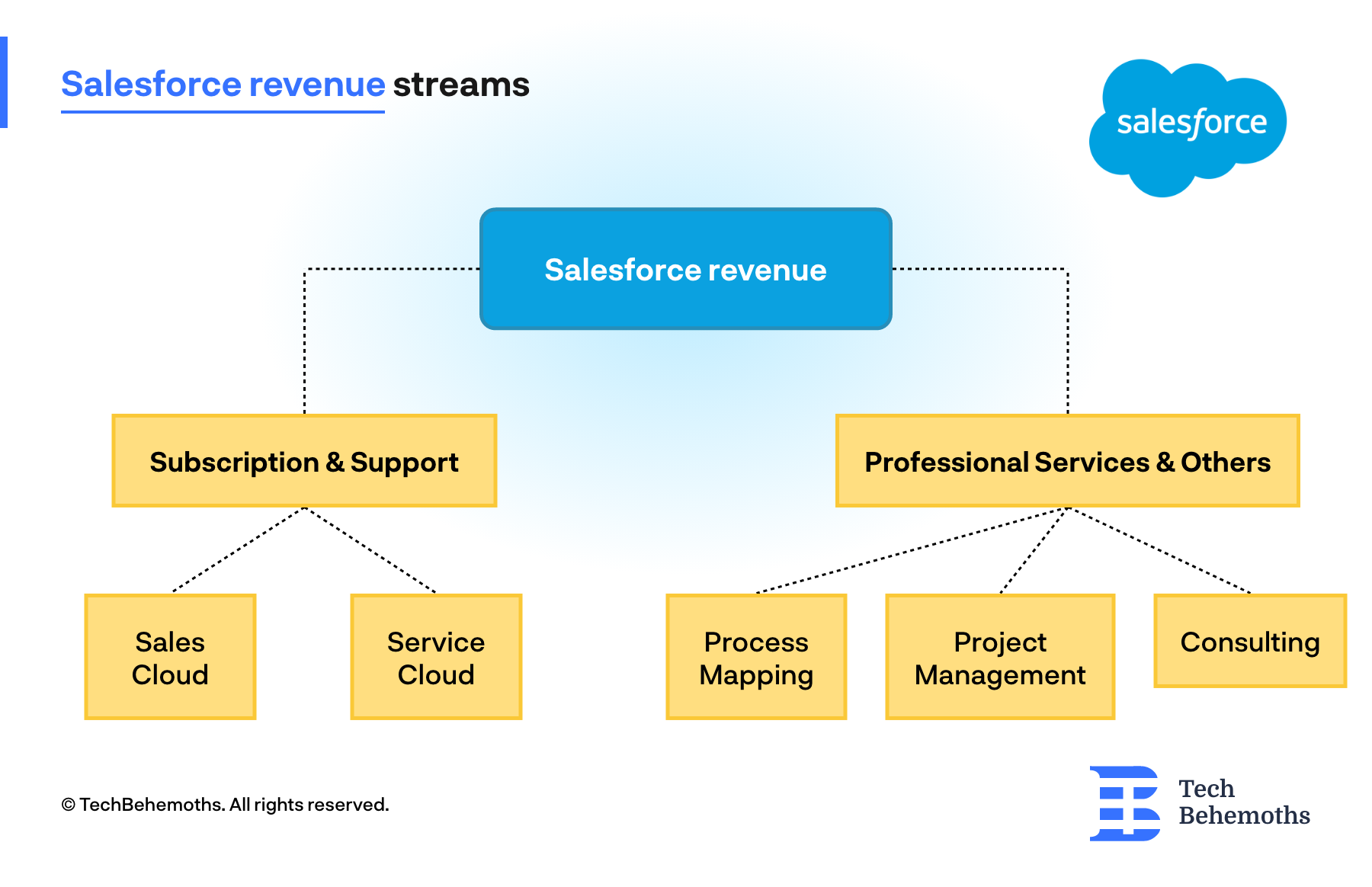

Analyzing Salesforce Revenue Streams:

Just like any other tech behemoth, Salesforce splits its revenue stream into several business segments, in this case, 2:

- Subscription and Support

- Professional services and others.

Salesforce's subscription and support segment include cashflow from all their subscription-based products such as Customer 360 - the all-in-one CRM solution from Salesforce

Professional services from Salesforce representing consulting services provided by Acumen - a Salesforce company specializing in IT services and IT consulting.

Both revenue streams brought revenue of $26,492B in 2022 according to Salesforce financial reports. This is $5B more compared to the 2021 fiscal year.

Despite its simple service segmentation, Salesforce services are rather complex as their CRM and Consulting services must suit every type of business regardless of the industry.

Having this said, we can analyze how Salesforce makes money from each segment.

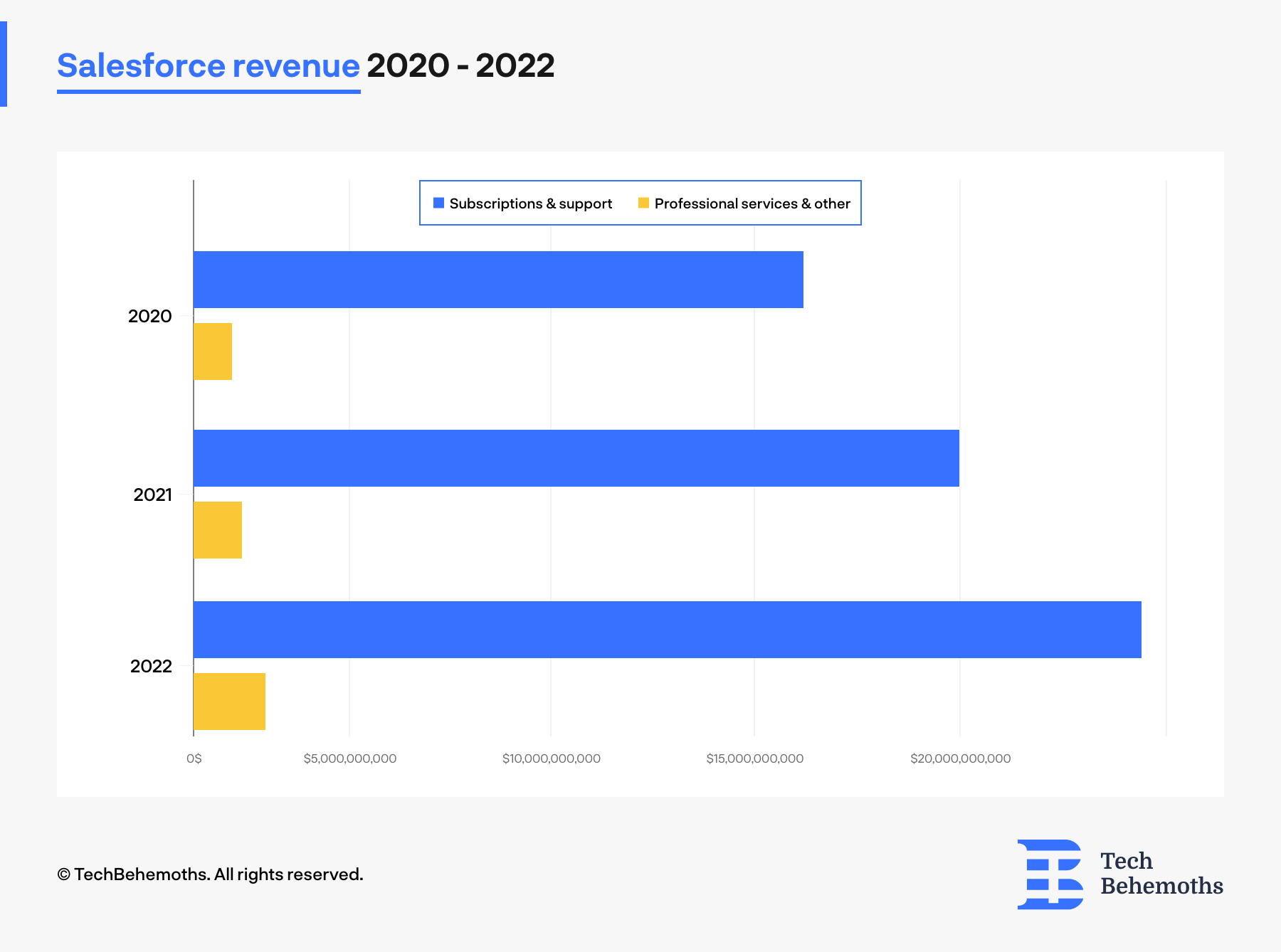

Salesforce revenue by segment (2020-2022)

The subscription and support business segment was the most successful one for Salesforce between 2020-2022. A total of over $60B was generated between 2020-2022 from sales from the Subscription and Support Segment, represented by Customer 360 service and all derived products: Sales Cloud and Service Cloud.

The Sales Cloud from Salesforce is an all-in-one CRM sales tool that includes the sale funnel, customer support, and marketing strategies for both B2B and B2C models. One of its main features is that brings together all spreadsheets and data on one platform and makes it easy to manage and operate.

The Service Cloud on the other hand is focused on case management and 1 to 1 customer relationships. Despite a lot of similarities with Sales Cloud, the Service Cloud comes with fundamentally different features, and thus, targets businesses that do more customer support.

Sometimes, businesses can migrate from one option to another, or, by case choose both options - depending on their business model, and development stage.

The second business segment, Salesforce professional services business segment generated revenue equivalent to $4.04B between 2020-2022, with an average growth rate of 30% year over year. As products, Salesforce’s “Professional Services and Others” is divided into

- Project management services

- Process mapping

- Product Implementation

- Cloud Consulting

One very interesting aspect of Salesforce’s professional services is the 30 days free trial period. While it is a well-known and widely practiced onboarding method, it may be that this is the reason why the Professional Services and Others drive such low results, or, less than 10% of the company’s total revenue.

All in all, Salesforce managed to pull a total of $64B in revenue between 2020-2022 with more than 20% growth in their YoY financial statement.

In a more detailed breakdown of Salesforce revenue by year and segment here are the numbers, followed by the graphical representation of how Salesforce makes money from its two largest revenue streams:

Salesforce revenue from Subscription & Support Business Segment:

- For Q1-Q4 of 2020 - $16.04B

- For Q1-Q4 of 2021 - $19,97B

- For Q1-Q3 of 2022 - $24B

Salesforce revenue from Professional Services and Others Business Segment:

- For Q1-Q4 of 2020 - $1,05B

- For Q1-Q4 of 2021 - $1,27B

- For Q1-Q3 of 2022 - $1,83B

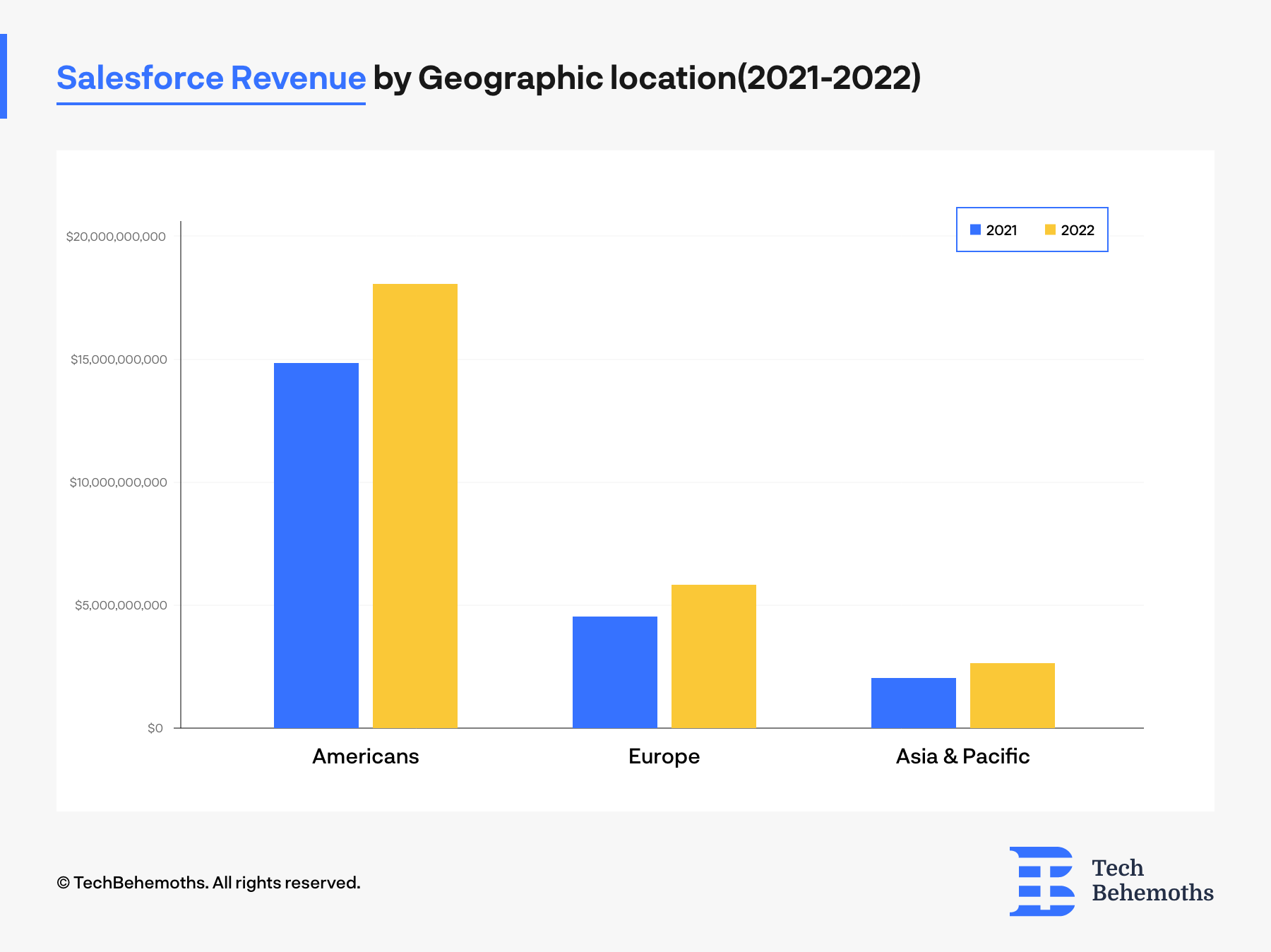

Salesforce Revenue: Geographical Distribution

To identify where most Salesforce subscribers come from, we need to look at the company’s revenue from a geographical perspective. This time, the numbers are available for the last two years 2021-2022.

The company divides its business segments into three geographic regions:

- Americas

- Europe

- Asia Pacific

According to Salesforce’s financial sheet, most of the customers, and the largest share of revenue comes from the Americas - which accounts for both North and South America. In the 2021 fiscal year, Salesforce gained more than $14B from sales in this region, and, in the 2022 fiscal year, the company says that the revenue grew up to $17,93B.

Europe is the second-largest geographic region by revenue. Salesforce says that in the 2021 fiscal year European clients generated $4.5B, and in the 2022 fiscal year the revenue grew up to $6.01B.

The Asia Pacific region generated the lowest revenue for Salesforce in the 2021 and 2022 fiscal years, with a total of $4.5B

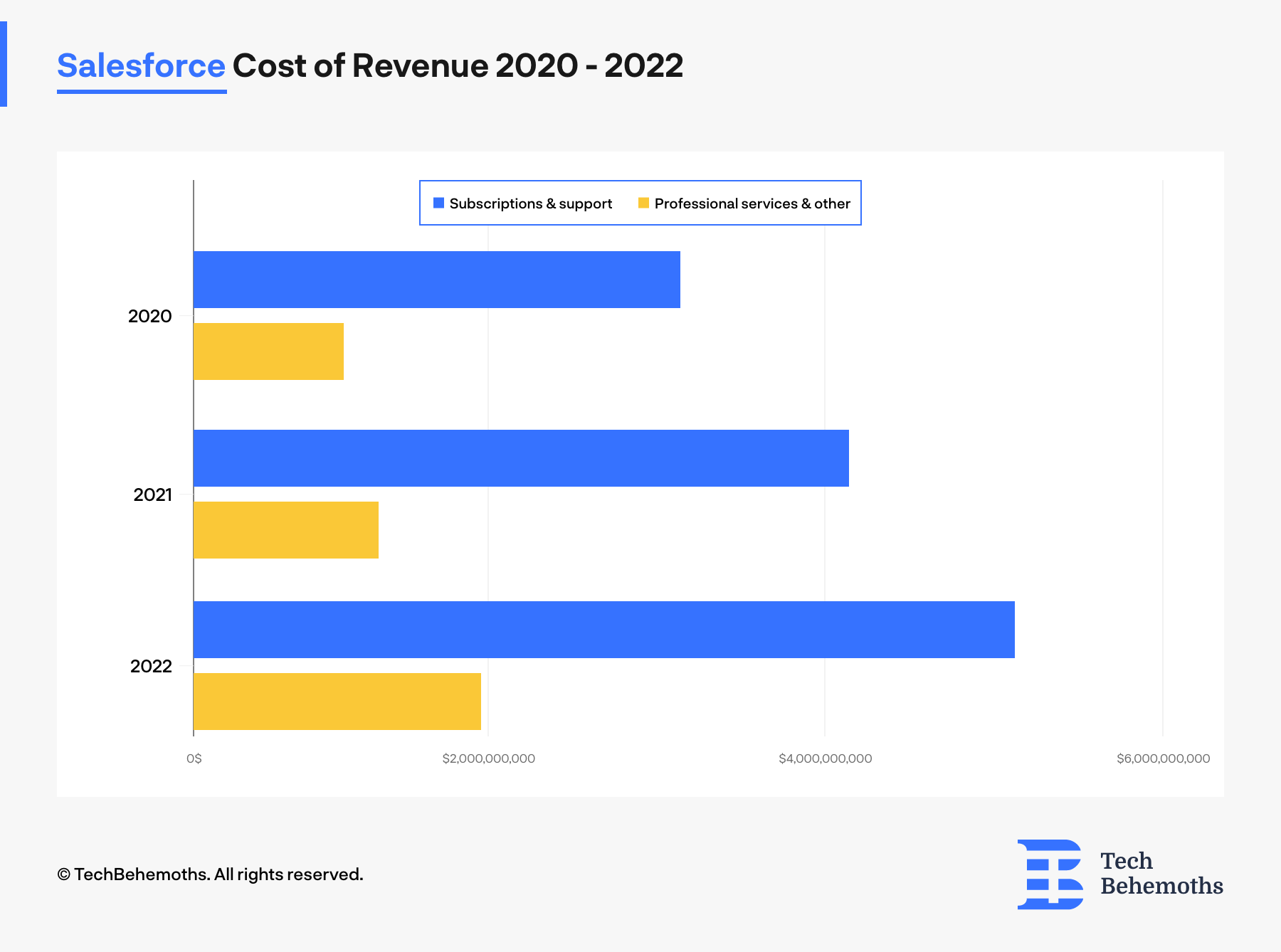

Salesforce Cost of Revenue (2020 - 2022)

At the same time, Salesforce's cost of revenue was proportional to the revenue itself, which in the end resulted in particularly low profit between 2020-2022. In this way, the “Professional Services” business segment didn’t turn out to be profitable in 2021 and brought small profits in 2020 and 2022.

On the other hand, the Subscription and Support business segment proved itself to be top-performing for Salesforce in all three years multiplying the company’s profitability by at least 4 times in 2020, 2021, and 2022.

In other words, Salesforce's cost of revenue for the Subscription and Support business segment was 4 times lower than the revenue itself.

If we’re talking about figures, Salesforce's cost of revenue for the Subscription and Support segment was $3.19B in 2020 and $4.15B in 2021. As for 2022, Salesforce invested $5.09B in the Subscription and Support segment.

The numbers for the Professional Services segment's costs of revenue were lower, but so was the revenue for all three years:

- 2020 Cost of revenue - $1.03B (vs $1.05B revenue)

- 2021 Cost of revenue - $1.28B (vs $1.27B revenue)

- 2022 Cost of revenue - $1.96B (vs $1.83B revenue)

Overall, Salesforce invested more than it gained in the “Professional Services & Other” business segment but multiplied its profit from the “Subscription and Support” business segment.

In What Salesforce Invests Most

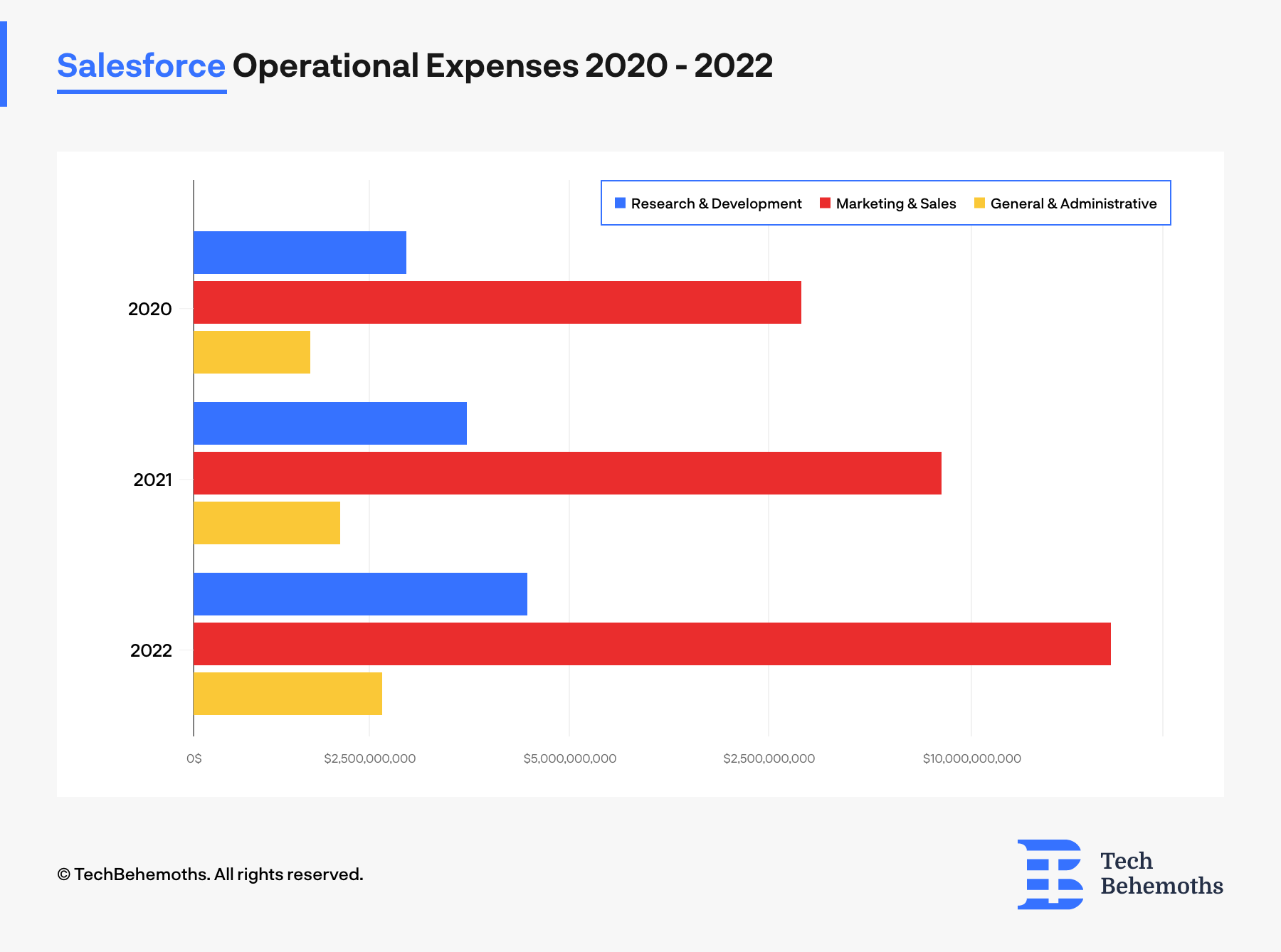

Following Salesforce’s cost of revenue, it is curious about what the company invests most, and where the money goes. According to the company’s financial sheet, its operational expenses followed three directions:

- Research & Development

- Marketing & Sales

- General and Administrative.

Between 2020-2022 Salesforce spent over 10.8 billion dollars in Research and development with an average growth spending of 5% year over year. Most of Salesforce's operational spending between 2020-2022 was in Marketing and Sales which drove off the budget by almost $30B.

At the same time, the General & Administrative expenses were pretty high but maintained at the same level each year. $2.5B Salesforce spent in the past two years on it. The overall operational expenses between 2020-2022 raised up to $43.3B.

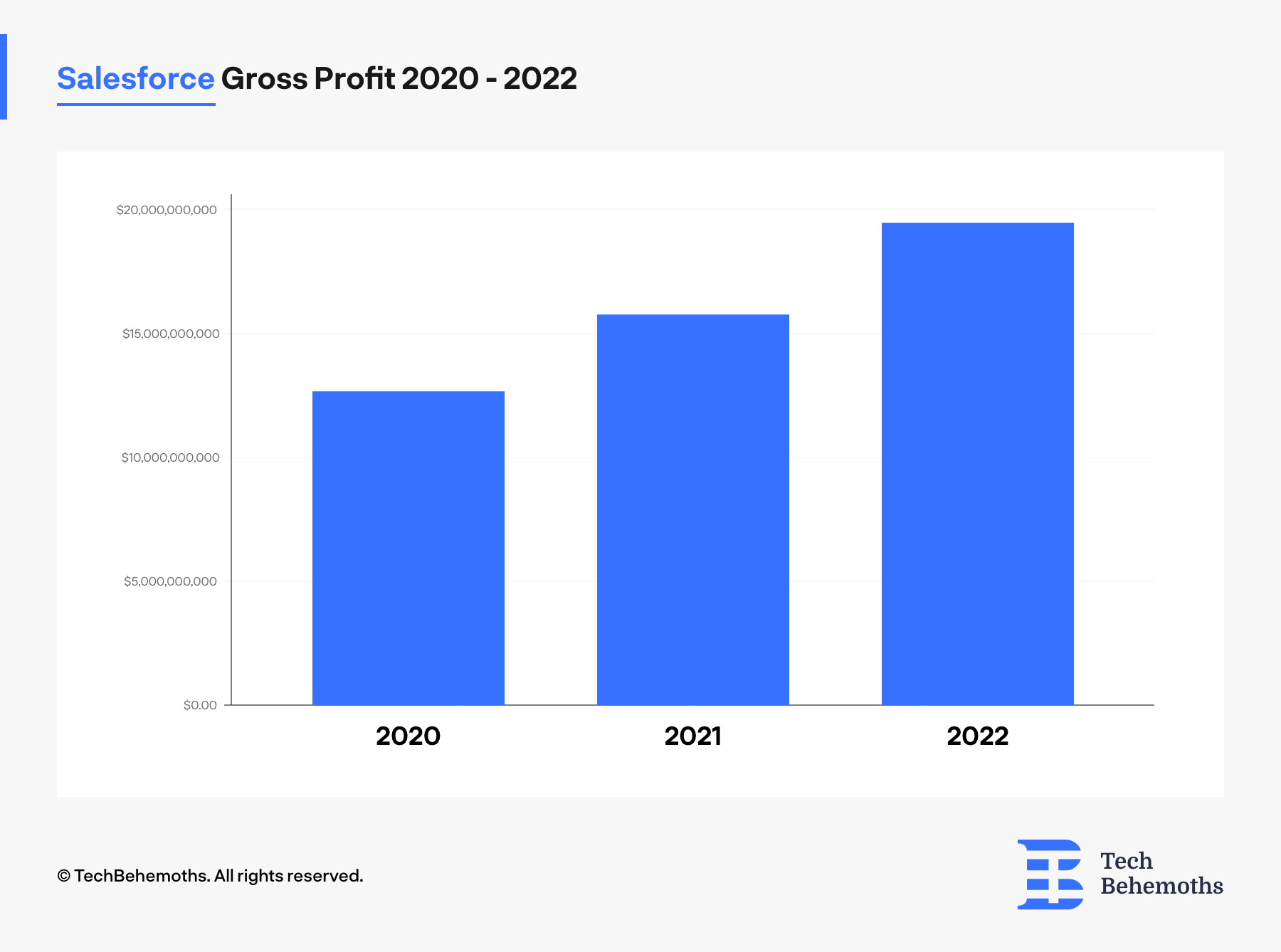

What Profit Does Salesforce Have?

Now that we analyzed the revenue and expenses, it’s time to draw the lines and talk about profitability. More specifically about the company’s gross profit, which means before taxes.

Salesforce’s financial statement says that between 2020-2022, the gross profit was between $12-19B. The total gross profit within the mentioned timeframe was over $46B, with the highest profit earned in the 2022 fiscal year - $19,46B.

As it was expected, Salesforce's main profit source was the Subscription and Support segment that brought over 90% of the profit, while Professional Services and Others is still growing, with more investments needed to consolidate its position in the company’s financial statements.

Wrapping things up

It is certain that businesses will continue to use Customer Relationship Management tools even more in the following years. The reason behind this is the digitalization processes in the emerging markets and economies that learned from the impact of the COVID-19 pandemic.

The question that still remains unanswered is how will Salesforce manage to absorb the market, especially with more competing and innovative products from smaller companies. I guess that this is still something we will live to see