How does Microsoft make its billions? Microsoft revenue breakdown 2025

Summary

Microsoft started in the 1990s with Windows OS. It has since expanded into cloud services, gaming, professional networking, and productivity tools.

Major Revenue Sources (2024-2025):

- Microsoft earns $138 billion from its cloud services, growing at 21%. It is the second-largest cloud provider in the world after AWS.

- Windows (Commercial and OEM) generates $29.1 billion, making up 11.35% of total revenue. Windows 11 is adopted by 38.7% of users.

- Microsoft Teams has over 320 million users and brings in $13.5 billion, thanks to enterprise adoption and its connection with Microsoft 365.

- Gaming revenue is increasing. The Xbox Series X|S has sold more than 30 million units. Minecraft has sold 300 million copies and has 180 million active users.

- LinkedIn earns $16 billion through talent sourcing, marketing, and premium subscriptions. It has over 1 billion members.

- The Office Suite has over 400 million paid commercial seats. The AI-powered Copilot feature helps increase premium revenue.

Microsoft invests $11 billion in OpenAI and uses AI in its products, including Copilot, Azure, and Bing.

As of July 2025, Microsoft has a market value of $3.35 trillion, ranking it among the top two companies in the world.

Back in the 90s, Microsoft was only about Windows - the first OS that went on a global scale of usage, and it was the only usable option for a long time. But over time, when new operating systems and devices became available, Microsoft had to review their financial and technological policy and start selling in other fields.

Now, in 2025, the question about how Microsoft makes money is still trending, and in this article, we will try to figure out together all the income sources of Gates’ tech giant.

First things first, and just before we dive into the financial story, we should identify the major sources of revenue Microsoft has:

-

Cloud computing - The entire business suite of Microsoft is focused on cloud services. Microsoft Azure, for example, is the leading direction in the company’s cloud services. But things are more complicated

-

Windows OS - from Windows 95 till 10th version is only 15 years. And in May 2021 with the 21H1 update rumors are saying that the next thing that will happen in Autumn 2021 is the release of Windows 11. It was and continues to be one of the largest sources of revenue for Microsoft.

-

Microsoft Teams - An alternative to Slack, some would say, but Microsoft is putting more than just a comfortable chat for users. It is designed to become a digital environment for companies and employees of any company in the world.

-

Xbox - the gaming industry is growing, and Microsoft couldn’t stay apart from this topic. Sony needed competition and Xbox is the best possible alternative to it at the moment

-

LinkedIn - Since 2016 when Microsoft acquired LinkedIn, the professional social network continued to grow and became a unique and indispensable tool for HR professionals all over the world.

-

Minecraft - as if Xbox was not enough, Microsoft dives into the gaming industry even more with Minecraft.

So, there is a good portfolio for Microsoft which in its turn provides a series of exclusive services, or competitive at least. Some of them were invented by them, others were acquired in time and transformed into digital masterpieces, Microsoft proved that it doesn’t really matter where your products and services come from if you handle them well.

Now, for the anxious ones, here is a quick preview to understand the large picture of Microsoft revenues:

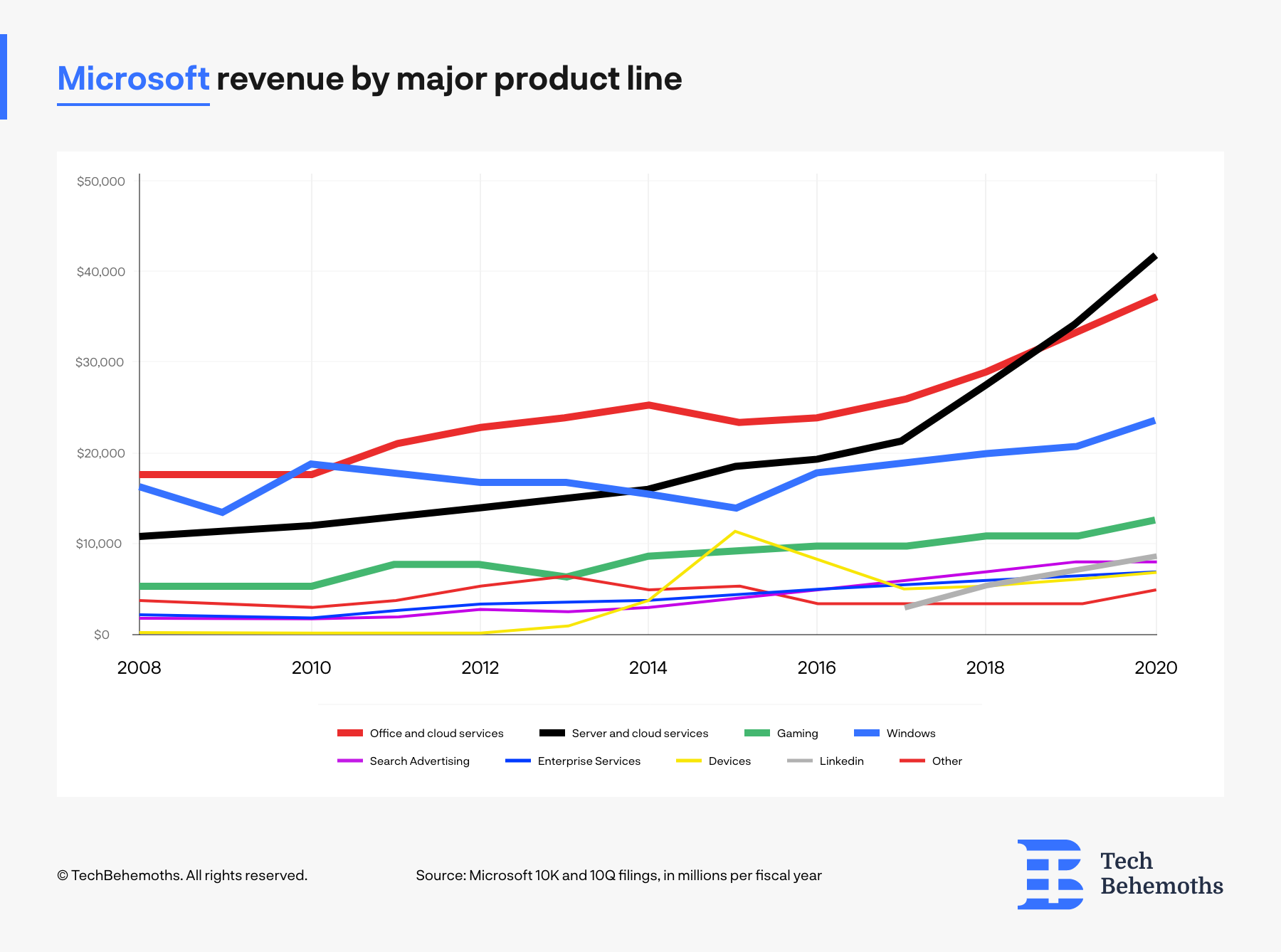

Considering Microsoft's major product lines, for the 2024 fiscal year, the tech behemoth registered solid growth both in net income and in revenue, which allowed it to invest in other projects, such as artificial intelligence and empowering its search engine. Microsoft's latest financial statement reveals that the revenue for 2024 was $256.4B, which is $19.8B higher compared to 2023. At the same time, the company's net income for 2024 was $93.6B, which is $12.7B higher compared to 2023.

The revenue and income growth is explained by continuous product updates and AI integration, including Copilot integration across Office, Teams, Windows, GitHub, and Azure. Microsoft also expanded Azure’s AI service portfolio and Bing’s AI capabilities, contributing significantly to its growth.

As such, Microsoft integrated Artificial Intelligence with its Azure, Viva Sales, GitHub Copilot, and Teams among others. Needless to mention the promising investment of $1B in OpenAI from 2019, followed by another round of $10B more in Q1 2023. All these put together generated solid growth in 2023 and 2024. And the investment turned out to be profitable, as the latest figures show that OpenAI makes $3.4B yearly from subscriptions and API, according to Sam Altman, who returned as CEO in 2024 after the temporary leadership shift in late 2023.

But Microsoft didn't limit itself to investing in OpenAI, but also hired the co-founders of OpenAI after they had been fired by the OpenAI board on November 18, 2023. In this way, Sam Altman and Greg Brockman will join Microsoft to empower the tech giant's AI capabilities according to Satya Nadella's announcement on Twitter/X.

We remain committed to our partnership with OpenAI and have confidence in our product roadmap, our ability to continue to innovate with everything we announced at Microsoft Ignite, and in continuing to support our customers and partners. We look forward to getting to know Emmett…

— Satya Nadella (@satyanadella) November 20, 2023

How Microsoft Makes Money From Cloud (Azure)

The cloud business from Microsoft has a story behind starting in October 2008. It was named Microsoft Azure, and it is referred to as Azure. The codename for Azure is “Project Red Dog” and it was formally released in 2010 when Windows Azure transformed into Microsoft Azure.

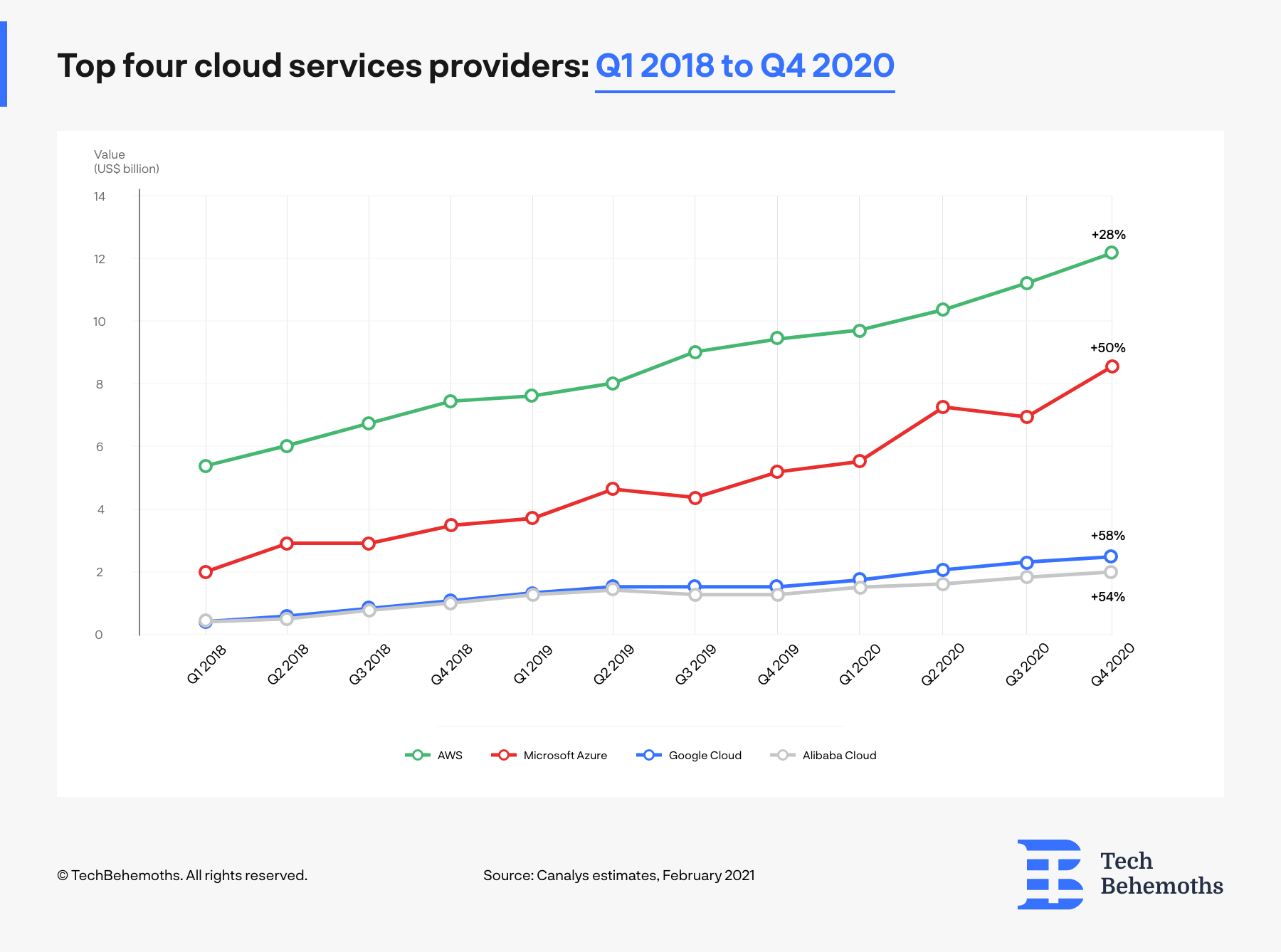

Since then, and until 2021 Microsoft Azure is a top cloud service provider competing with Google Cloud and AWS from Amazon.

Microsoft Azure is a cloud computing service that is meant for tasks such as testing, deployment, and managing applications and services through Microsoft-managed data centers. Azure provides SaaS (Software as a Service), a platform for PaaS (Platform as a Service), and IaaS (Infrastructure as a Service). In one sentence, full business kit for businesses that need digital services.

In 2020 Microsoft’s Azure growth rate accelerated once again, up by 50% to boost its market share in the global cloud services market to 20%. Microsoft has focused on driving Azure consumption across all customer segments through annuity sales programs and customer success investments, as well as targeted incentives for its global partner channel. It has also benefited from continued high demand for Teams, Windows Virtual Desktop, and other Microsoft services running on Azure as lockdowns tightened.

Now, Azure is not the top 1 leading cloud computing provider, as Amazon’s AWS is on top, but it is the second-largest on the market. On top of that, there are hundreds of companies providing Microsoft Bi & Data solutions that expands company's culture and selling efforts even more

But Microsoft’s cloud computing service is not only about Azure, but also includes services like Windows Servers, GitHub, OneDrive, and other services as well. So, overall, to have a precise picture of how much Microsoft makes from cloud computing, we refer to the official data that states that “Revenue in Intelligent Cloud was $14.6 billion and increased 23% (up 22% in constant currency), with the following business highlights: Server products and cloud services revenue increased 26% (up 24% in constant currency) driven by Azure revenue growth of 50% (up 48% in constant currency)”

As for the 2024 fiscal year, Microsoft states that all its cloud products and services brought more money to the company compared to the previous year. Following rebranding, merging, and dividing some of its cloud services, the growth revenue breakdown for 2024 is as follows:

-

Microsoft Cloud increased by 21% in 2024, reaching $138B

-

Office Commercial products and cloud services revenue increased by 12% driven by Microsoft 365 Copilot adoption.

-

Office Consumer products and cloud services revenue increased by 8% and Microsoft 365 Consumer subscribers grew to 71.3 million.

-

Dynamics products and cloud services revenue increased by 16% driven by Dynamics 365 and Power Platform.

-

Server products and cloud services revenue increased by 19% driven by Azure and other cloud services growth of 22%.

-

Windows Commercial products and cloud services revenue increased by 7%.

In terms of market share, Azure's position is still in second place with 24% following AWS, which keeps its leading position with a 31% market share. According to Statista, Google Cloud holds the third position with a 12% market share while other vendors such as Alibaba Cloud, IBM, and Salesforce have 5% and below market share each.

How Does Microsoft Make Money From Windows

The Windows direction from Microsoft is split into 2, as well as the revenue, financial reports, and other official data. So, the two components that form together Windows revenue for Microsoft are:

-

Windows Commercial

-

Windows OEM

Technically, you get the same Windows in both cases, and for end-users, there is no difference. However, OEM stands for Original Equipment Manufacturer. This means that Microsoft draws sales from selling Windows as a product for the masses, and also, in the case of OEM, Microsoft gets revenue from Windows pre-installed devices, such as laptops and PCs. The only difference you might get as a user is that the OEM is created, installed, and dedicated to one specific device, while Commercial Windows can be installed on different devices.

Now that we’ve made this thing clear, let’s take a look at how much money Microsoft has earned from Windows. According to Microsoft data, Windows revenue increased $1.9 billion or 9%, driven by growth in Windows Commercial and Windows OEM. Windows Commercial products and cloud services revenue increased 18%, driven by increased demand for Microsoft 365. Windows OEM revenue increased 9%, ahead of PC market growth.

On the other hand, Windows OEM Pro revenue grew 11%, driven by Windows 7 end of support and healthy Windows 10 demand, offset in part by weakness in small and medium businesses. Windows OEM non-Pro revenue grew 5%, driven by consumer demand from remote work and learning scenarios.

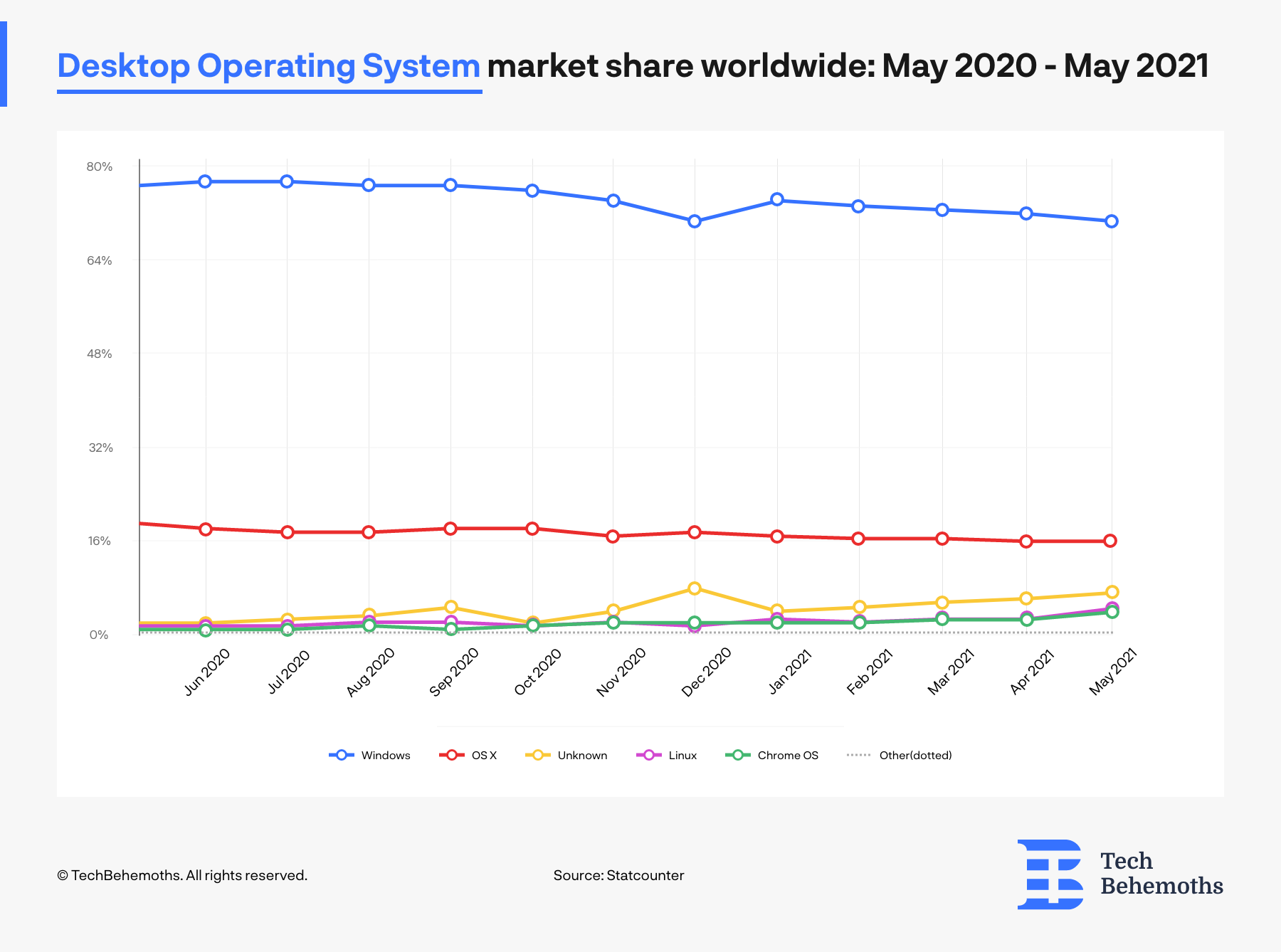

Now, according to StatCounter, Windows is by far the most popular OS for desktop devices with 73.54% of all devices, while in second place comes Mac OS in a distant 15.87%.

In October 2021, Microsoft launched its new Windows version, also known as Windows 11. Even though at the beginning the product had some technical limitations and could be installed on specific devices, later Microsoft launched several updates that aimed to broaden its audience and lift the technical restrictions previously mentioned. At the end of 2022, Microsoft stated that Windows, both OEM and Commercial, brought 11% revenue growth each compared to 2021. At first sight, it looks like a success; however, it is important to mention that Microsoft didn't launch any other Windows products in 2021, and the sales in the previous year came from Windows 10, launched back in 2015.

Either pushing the sales limits or improving its operating system, Microsoft launched 2 major updates for Windows 11. Both 21H2 and 22H2 confirm that the product was not fully ready for launch in late 2021. In June 2022, AdDuplex shared that only 23.9% of PCs are making use of Windows 11 (both stable and insider versions), while 2/3 of users still run various releases of Windows 10. Here it is important to mention that Windows 7, which was also a popular choice among PC users, reached its EOL (end of life) on January 14, 2020

As of 2023, Windows 11 is available in two versions: Home and Pro, each with a different price. The Windows 11 Home version is priced at $139, while the Windows 11 Pro version costs $199. These prices are the same as those for Windows 10 before the release of the latest version.

By early 2025, Windows 11 continues to receive support and new features through regular updates. Microsoft has also announced that "Windows 12" is in development, with an expected release in late 2025, featuring enhanced AI-native capabilities.

As of March 2025, Windows 11 adoption has reached 38.7%, while Windows 10 remains the leader with 56.4% of desktop installations. In 2024, the Windows operating system generated $29.1 billion in revenue, accounting for 11.35% of Microsoft’s total revenue.

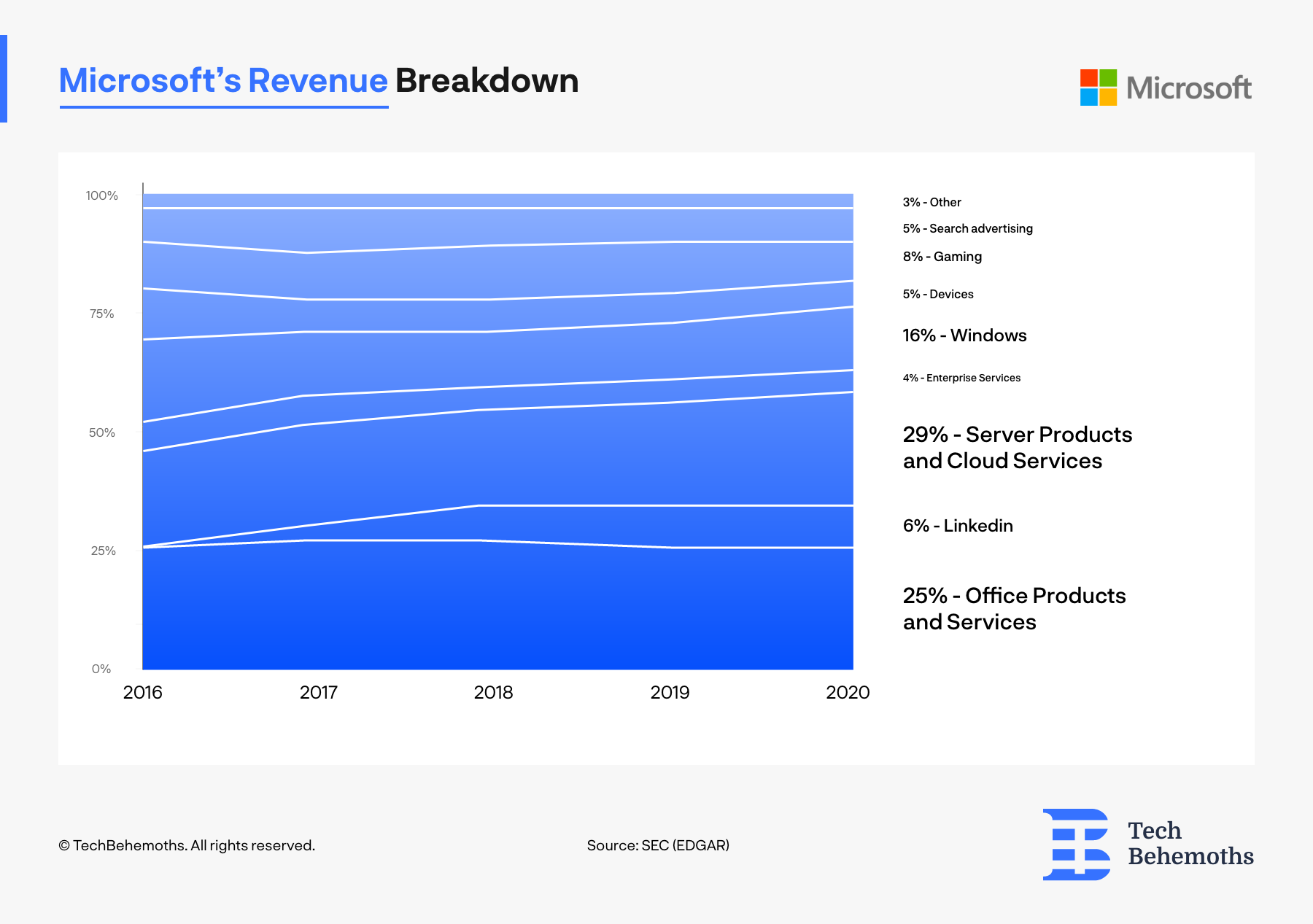

With all this, Microsoft had only 16% of its income from Windows as of 2020, which related to a replanned technology focus on other industries, but at the same time, keeping the OS alive, with new updates and news.

However, in 2024, Microsoft revenue from Windows (both OEM and Commercial) continued to decrease as a percentage of total revenue. In the company's annual financial report, it is stated that Windows generated $29.1B in revenue, which is 11.35% of the total revenue.

Yet, considering the total revenue grew by $19.8B in 2024, mainly due to Azure, Microsoft 365 Copilot, and AI services, Windows still represents a relevant and stable part of Microsoft's income.

How Microsoft Makes Money from Teams

Microsoft Teams was announced in November 2016, and it was a surprise to the market, which was mainly controlled by Slack. However, rumors say that Gates offered to buy Slack for $8 billion, but it was told to use Skype as a competing tool for Slack.

Instead of using Skype as the new Slack, Gates’ Microsoft created Teams, which has one large advantage on the market - it comes pre-built with the Office suite and Microsoft 365. However, the number of apps that Teams can be integrated with is lower than in the case of Slack, which spent years on all kinds of optimizations for third-party applications.

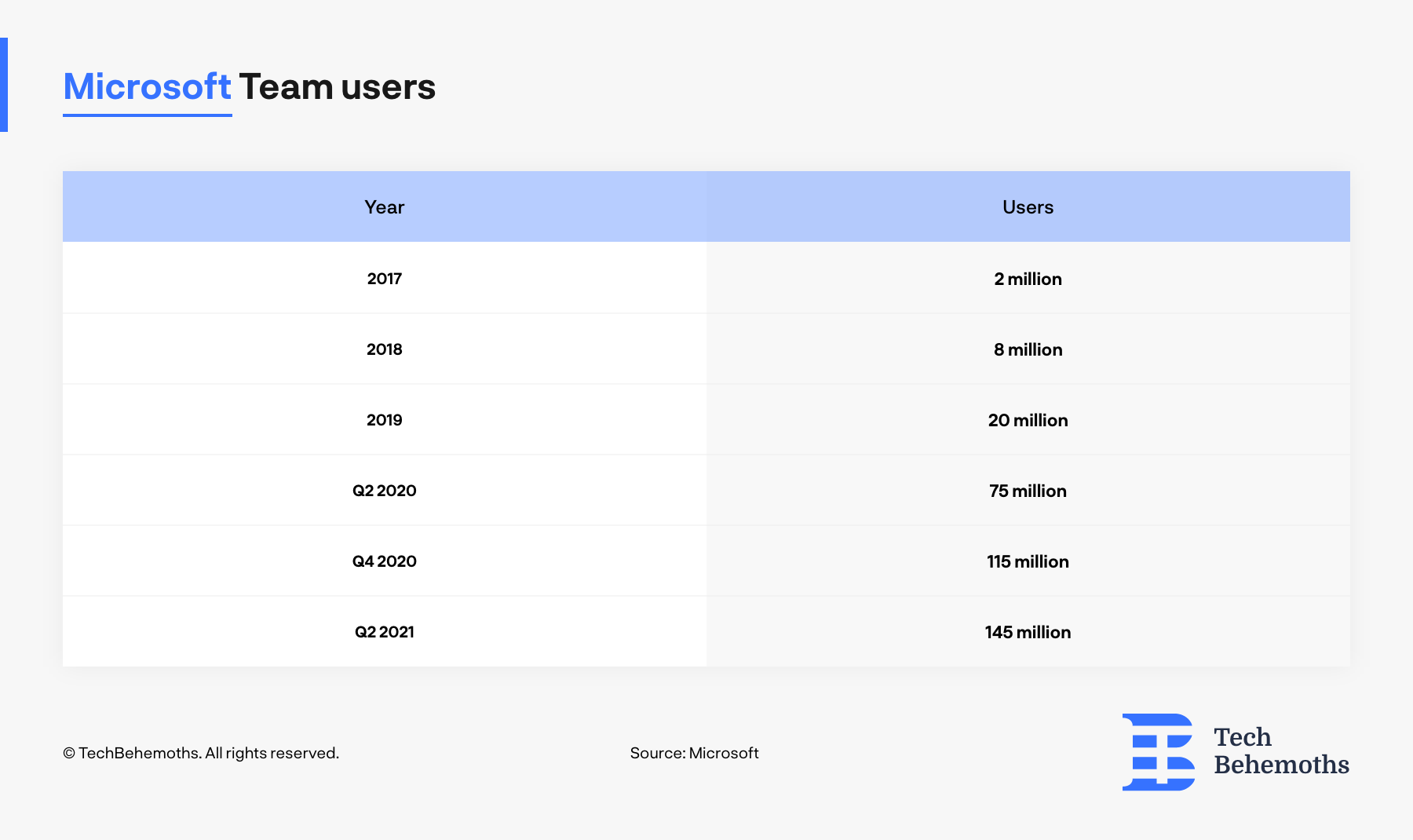

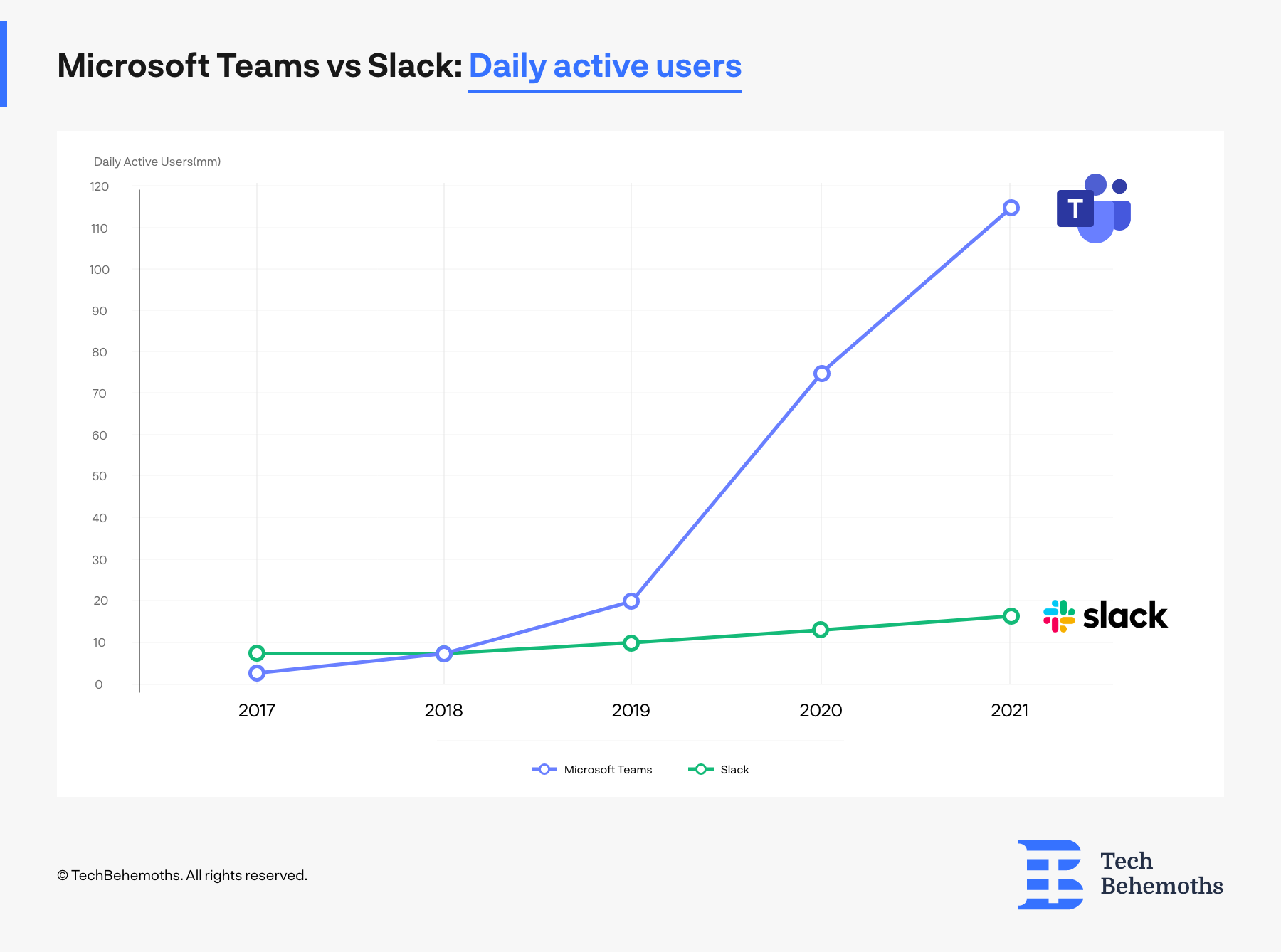

But the pandemic changed things about Teams, which starting in early 2020 focused on video calls and entered Zoom’s territory, and in direct competition. Nonetheless, Teams registered a huge growth between November 2019 - April 2020: started with 20 million users, in March reached 44 million users, and by April went to 75 million users. This means that in the given timeframe, Microsoft Teams grew by 320% when it comes to users.

In 2022, Microsoft Teams didn't stop growing and reached over 270 million users, which is almost double compared to the previous year. Most of Microsoft Teams users come from the US, with a demographic share of 17.6%, followed by UK users and those from India with 6.4% and 5.7% share respectively. In 2024, Microsoft Teams surpassed 320 million monthly active users, continuing its dominance in the business communication sector.

As per age groups, 60% of Microsoft Team users are between 34-54 years old. At the same time, youngsters under 24 are only 4% of Teams users, while people above 55 years old are 20% of the communication software users.

In an Industry breakdown report, Microsoft Teams is used most by companies from the Information and Technology sector, having 29% of the total user share. Computer and Software development companies make 11% of Teams users, while higher education institutions across the world make 10.6% of Teams users.

Other professionals that use Microsoft Teams are actively involved in Education Management, Healthcare, Finance services, and Governmental Institutions.

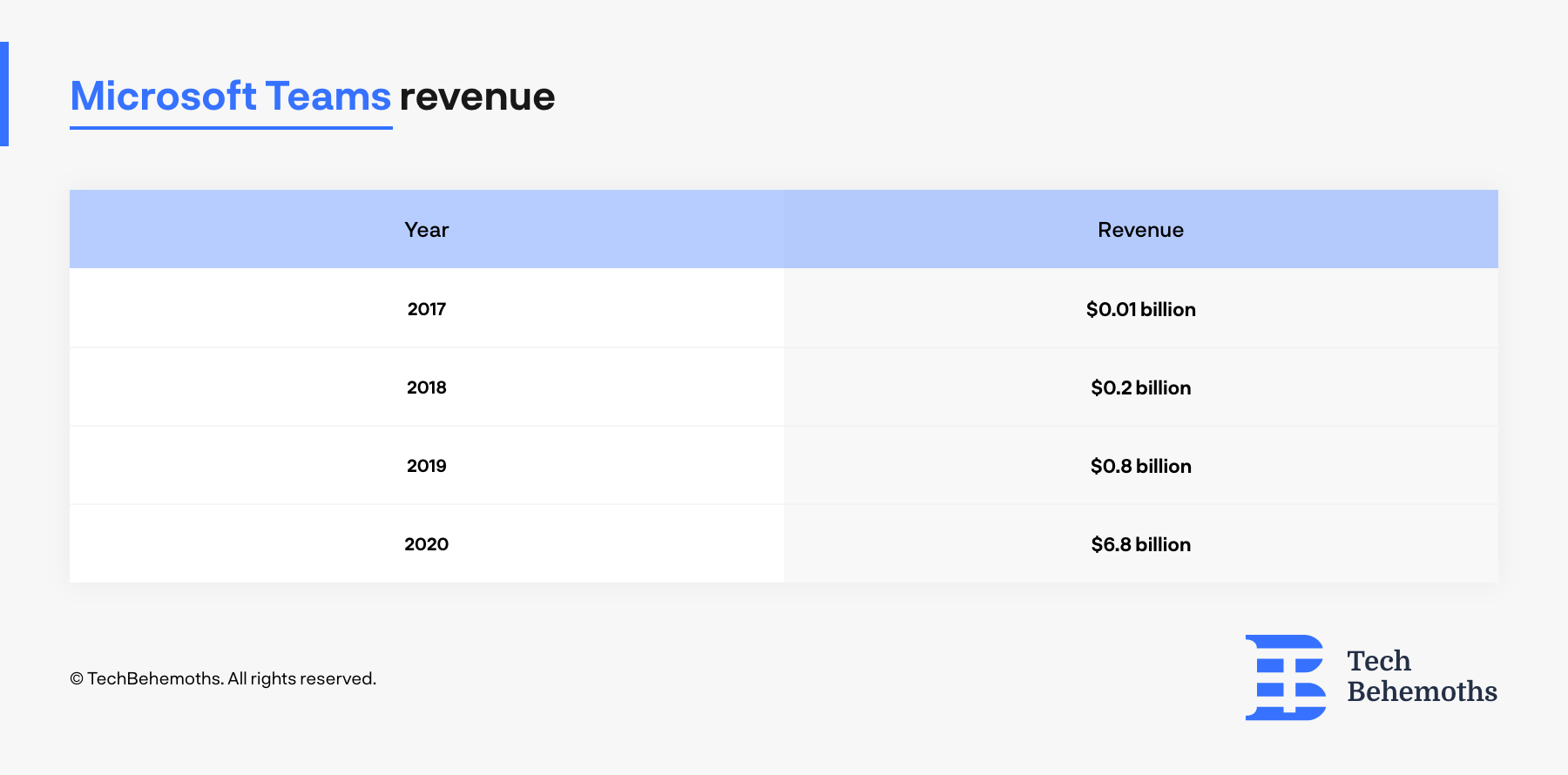

But the numbers grew not only in users but also in millions of dollars. Back in 2017 when it started, it had $0.01 billion revenue, and in 2020 reached $6.8 billion in revenue. By the end of 2024, Microsoft Teams generated an estimated $13.5 billion in revenue, driven by its enterprise adoption, premium features, and integration with Microsoft 365 Copilot.

Microsoft Teams is now available in 190 countries and 51 languages with more than 220,000 educational institutions using it as a primary communication tool.

How Does Microsoft Make Money From Xbox

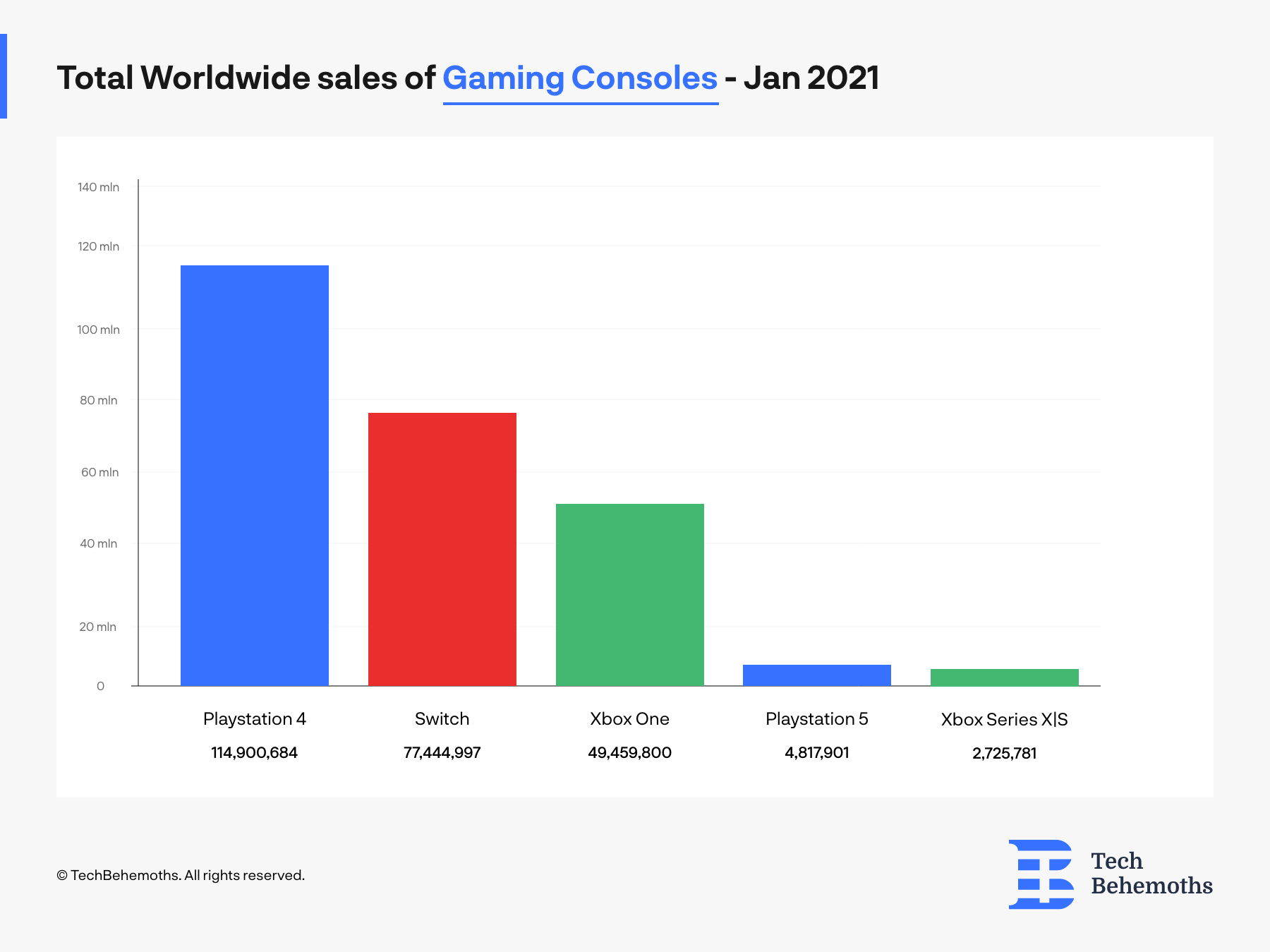

In November 2001, Microsoft announced and introduced the Xbox to the general public. A thing that put them in direct competition with Sony and Nintendo at that moment. Over time, Xbox didn’t get enough popularity among users, but still managed to keep its third position in place with more than 49 million devices sold by January 2021.

However, these numbers are not enough for close competition with PlayStation and Nintendo, but things are going to change.

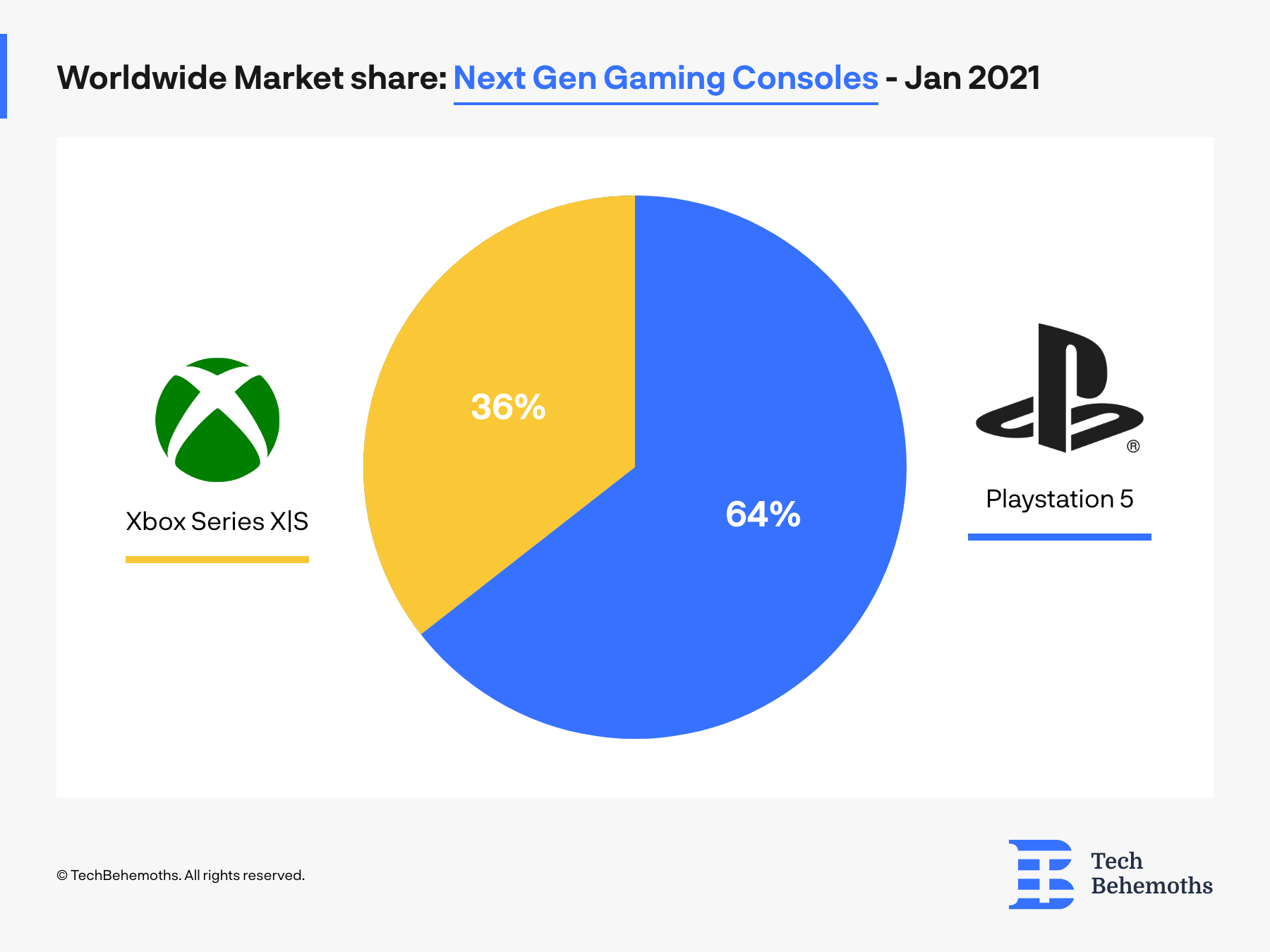

With the new technology and generations of gaming consoles, in the battle so far there are only two players, Nintendo being either kicked out or resigned by themselves focusing more on portable consoles.

In the iconic battle of Next Generation Gaming Consoles, Microsoft’s Xbox has a larger share and provides more competitiveness to PlayStation. And all together with the cross-platform games being released, it seems that the battle will go between affordability and customer loyalty rather than innovation and comfort.

When it comes to revenue, Microsoft doesn’t state exactly how much it earns from Xbox sales, but it mentions it as a catalyst for an increase in the gaming industry revenue, along with their brand new laptop series - Microsoft Surface, and Minecraft.

“Gaming revenue increased $189 million or 2%, driven by an increase in Xbox content and services, offset in part by a decrease in Xbox hardware. Xbox content and services revenue increased $943 million or 11% on a strong prior year comparable, driven by growth in Minecraft, third-party titles, and subscriptions, accelerated by higher engagement during stay-at-home guidelines. Xbox hardware revenue declined 31%, primarily due to a decrease in volume and price of consoles sold. Surface revenue increased $457 million or 8%, driven by increased demand from remote work and learn scenarios” - FY20 Q4 Microsoft Official Statement

Either way, Xbox continues to position itself as a serious competitor to PlayStation’s dominant market presence. According to Microsoft’s 2024 financial report, revenue from game consoles grew by 4% compared to 2023, helping the Xbox Series X|S surpass 30 million units sold globally.

However, PlayStation still leads the console market: as of June 2025, it holds an estimated 67.55% of the market, with Xbox trailing at 32.45%, according to StatCounter. While supply chain recovery has slightly improved Xbox’s shipment volumes, PlayStation maintains a clear lead in both sales and overall performance.

How Does Microsoft Make Money From LinkedIn

LinkedIn is just another successful deal that made Microsoft enter a new market, and thus, in a new competition. This time, with Facebook and at that specific time with Google+. Yet, LinkedIn is a social network for professionals, and a great tool for HR professionals, and also for freelancers, job finders, and for all other types of employees.

LinkedIn was acquired in 2016 by Microsoft, and it sparked several data breach scandals before and after it was acquired. But this never stopped Microsoft from making it the one and only network of its kind on a global scale.

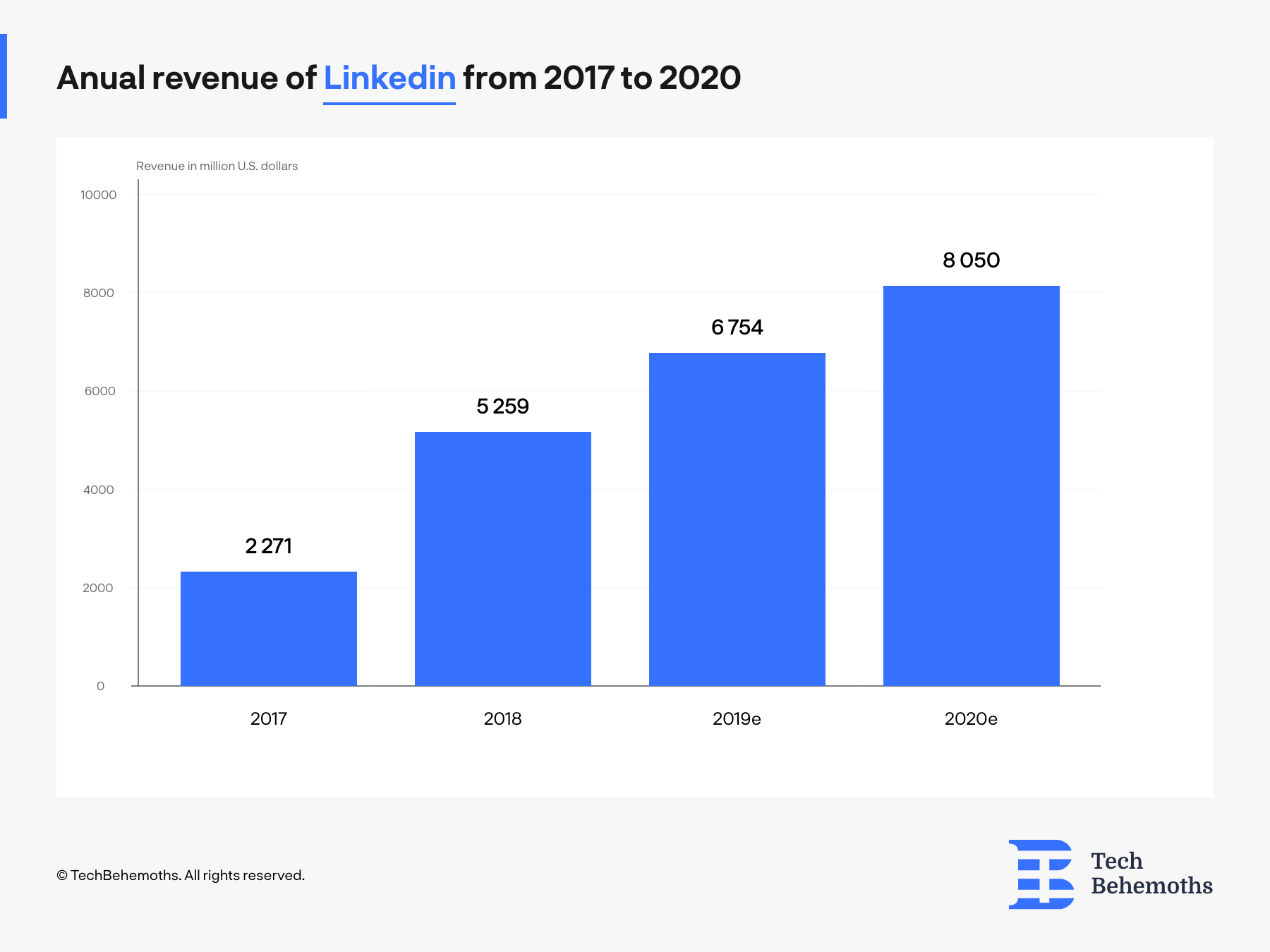

According to Statista, LinkedIn revenue only increased since it was acquired, a thing that speaks of investments and good management, or at least better management than it was before.

In 2017, the professional network brought to Microsoft a bit more than $2 billion, and in 2018 the numbers grew more than 120%, and it reached $5.25 billion. In 2019 the growth curve flattened and brought almost $7 billion, and in 2020 the revenue was $8 billion.

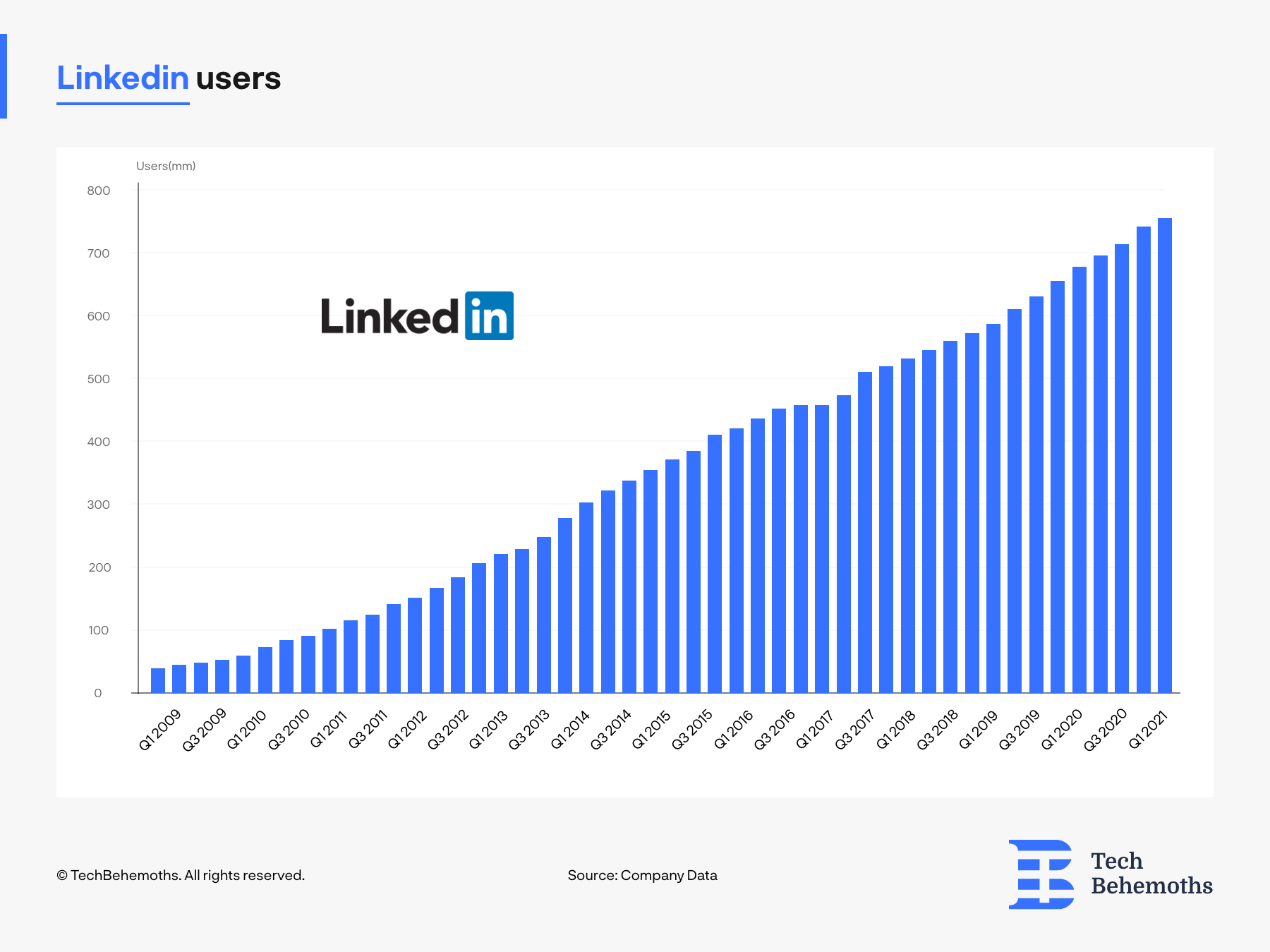

The revenue didn’t grow by itself, and there is more than one reason behind it. First of all, users - from 433 million users back in 2016 when it was acquired, up to 740 million users in 2021. The user growth brought new tools of revenue growth - LinkedIn ads, and premium accounts. So generally we can speak about the domino effect in the case of LinkedIn.

In 2022, LinkedIn revenue was stable but lower compared to the trend between 2009-2021. At the end of Q4 2024, LinkedIn revenue increased by 9% year-over-year. Microsoft stated that “LinkedIn has surpassed 1 billion members globally, and that all four revenue streams (Talent, Marketing, Sales, and Premium Subscriptions) continue to grow double digits annually.

At the same time, LinkedIn's revenue model has expanded and added several new streams, which in total make 4 now:

- LinkedIn Talent Solutions

- LinkedIn Marketing Solutions

- LinkedIn Premium Subscriptions

- LinkedIn Sales Solutions

2024 Financial Breakdown:

- Talent Solutions brought in around $7 billion

- Marketing Solutions (ads) generated approximately $5 billion

- Sales Solutions, primarily via Sales Navigator, contributed roughly $1 billion

- Premium Subscriptions accounted for about $6.44 billion

Total LinkedIn revenue reached about $16 billion in 2024.

In this way, Microsoft diversified the sources from subscription only, by targeting 3 major goals that users follow by using LinkedIn.

LinkedIn Talent Solutions works as a platform that matches jobs with people using automated processes. It is aimed both for professionals and recruiters as it can be used from both ends. LinkedIn Talent Solutions has 3 plans:

- LinkedIn Jobs - which is free

- LinkedIn Recruiter Lite - starts from $99.95/mo

- LinkedIn Recruiter + Job Solts - starts from $825/mo

LinkedIn marketing solutions are basically a social media targeting tool. In this way, companies and their professionals can use it to match their sponsored content with the right audience. To provide a wider range of tools, Marketing Solutions has 4 categories

- Ad

- B2B Lead Generation

- Lead Generation

- Ad Targeting

For each of these service lines, the prices vary based on audience and products.

LinkedIn premium subscriptions are the premium feature sets that are also divided into 5 different plans:

- LinkedIn Premium Career - starting from $39,99/mo

- LinkedIn Premium Business - $59,99/mo

- LinkedIn Sales Navigator Professional - $99,99/mo

- LinkedIn Sales Navigator Team - $149,99/mo

- Recruiter Lite - $170/month

These tiers offer advanced features like InMail credits, search filters, analytics, and AI-driven insights.

In 2024, Microsoft also integrated more generative AI into LinkedIn Premium and recruiter tools, allowing automatic candidate matching, resume suggestions, and enhanced ad targeting based on behavioral data.

How Does Microsoft Make Money From Minecraft

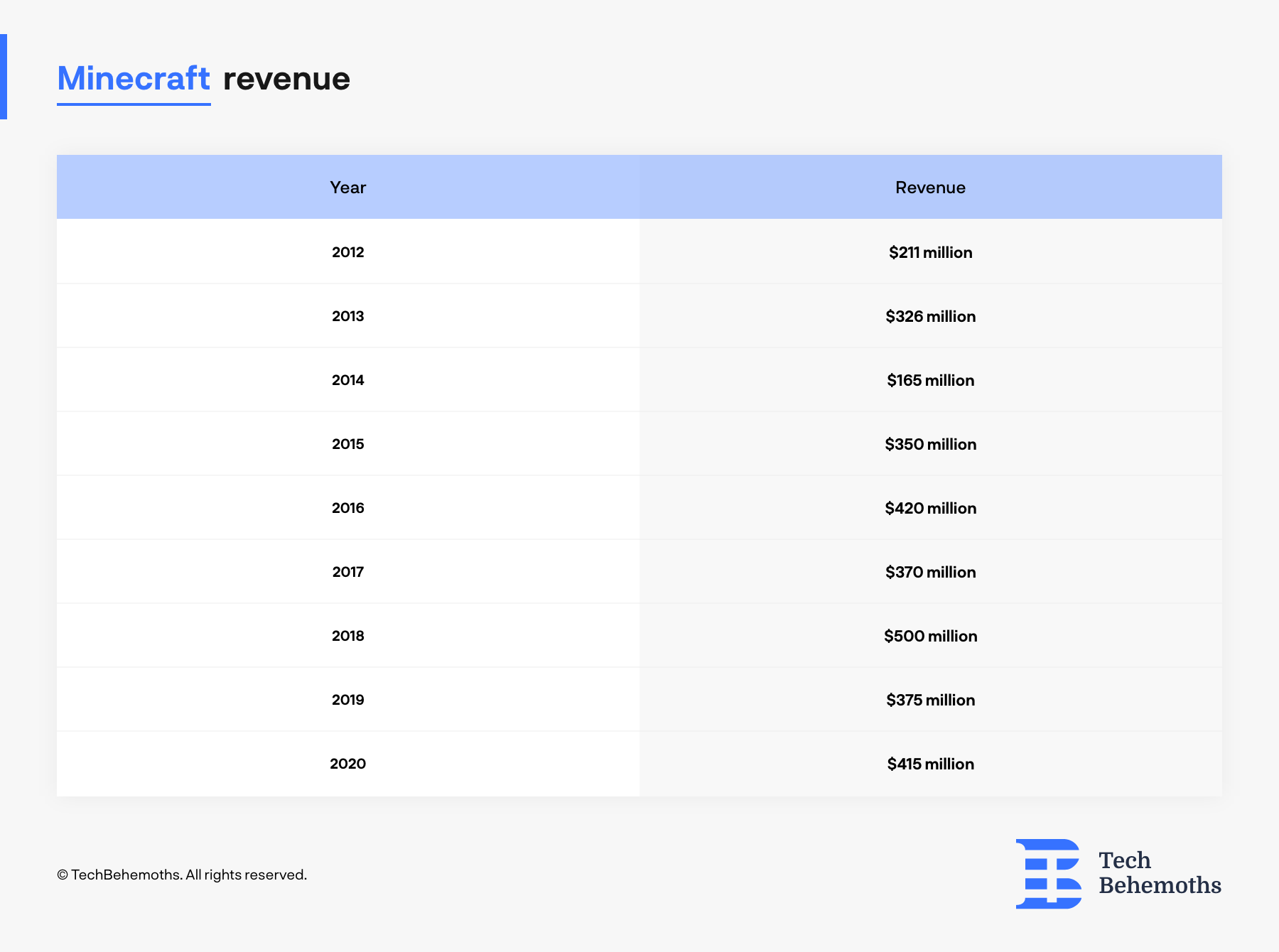

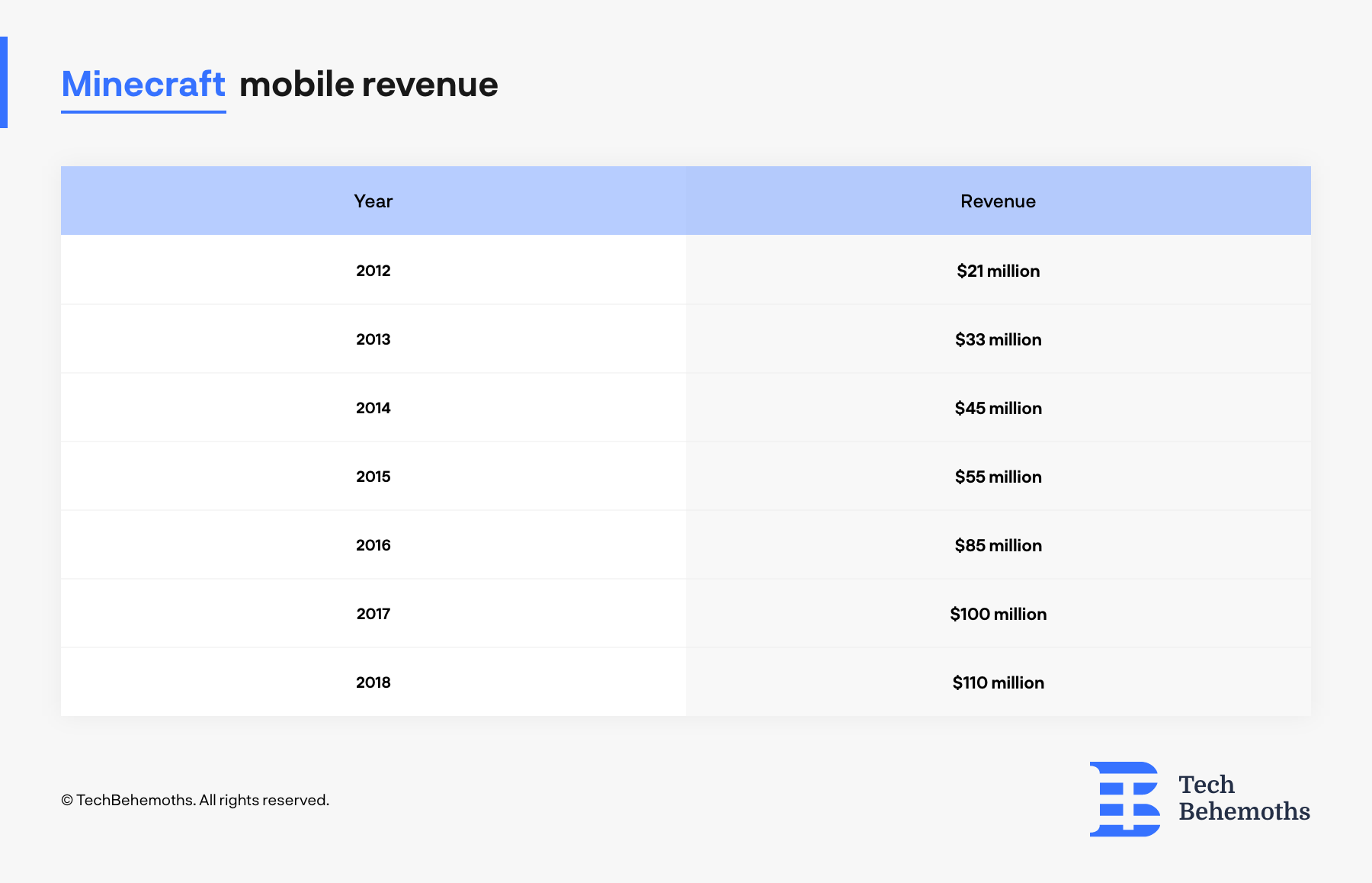

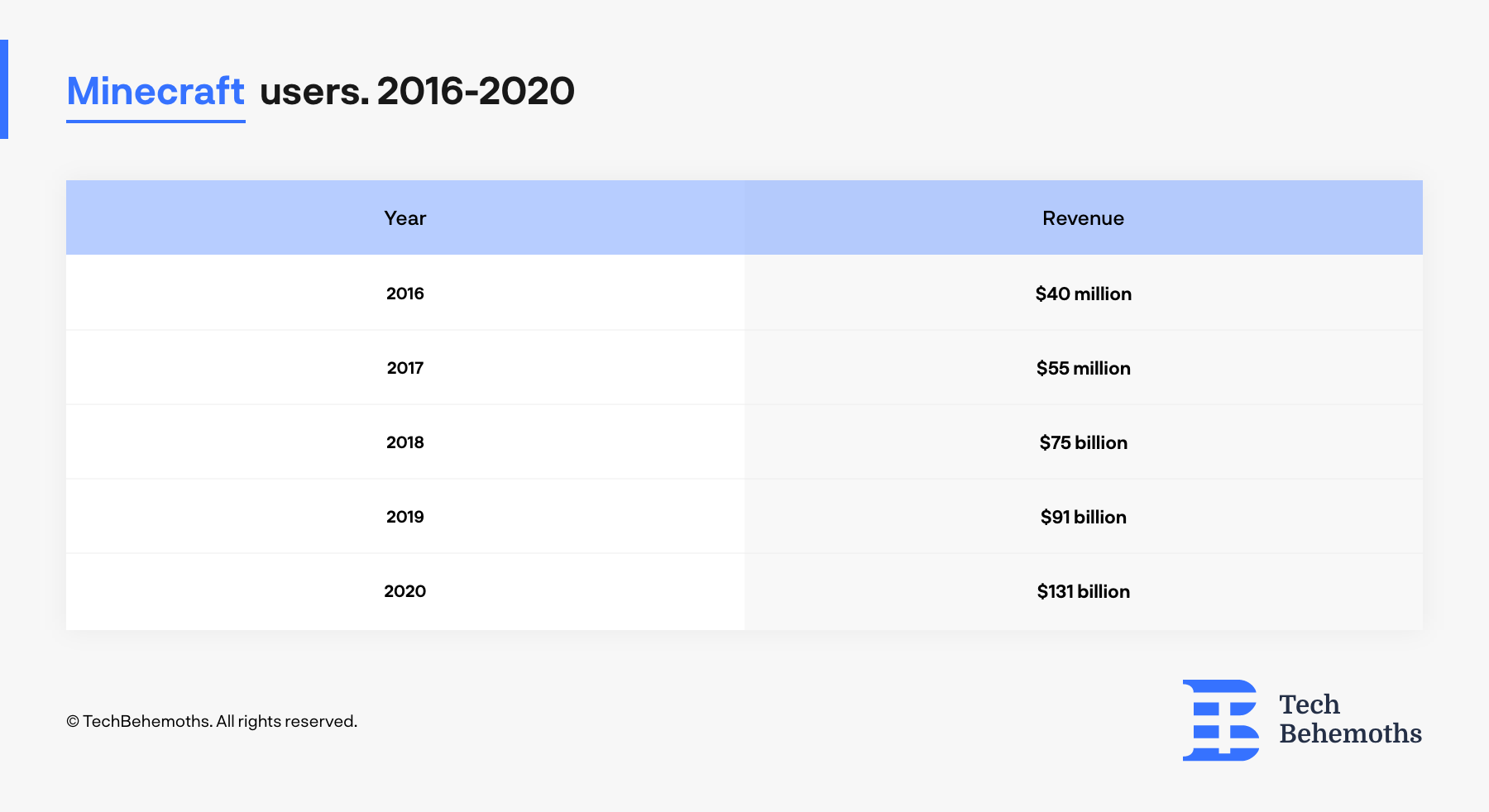

In addition to Xbox, Minecraft is the second part of how Microsoft makes money in the gaming industry. In 2014, there were rumors that Microsoft would acquire Mojang for $2.5 billion. At that time, Microsoft was not even close in the league of game production, so it was obvious from the very beginning that Microsoft was actually interested in the game, more than the studio itself. So it was - under Microsoft management, Mojang continued to develop the Minecraft universe.

The Minecraft universe expanded two times for big. In 2017, TellTale launched Minecraft: Story Mode, which brought the experience beyond the sandbox, and in 2020, Mojang came up with Minecraft Dungeons. The efforts were not in vain, since both revenue and the number of players grew year to year.

The most recent update shared by Microsoft in 2024 shows that Minecraft has surpassed 300 million copies sold globally, and active monthly users reached 180 million. It remains one of the top-earning titles in Microsoft’s game portfolio.

How Does Microsoft Make Money From Office Suite

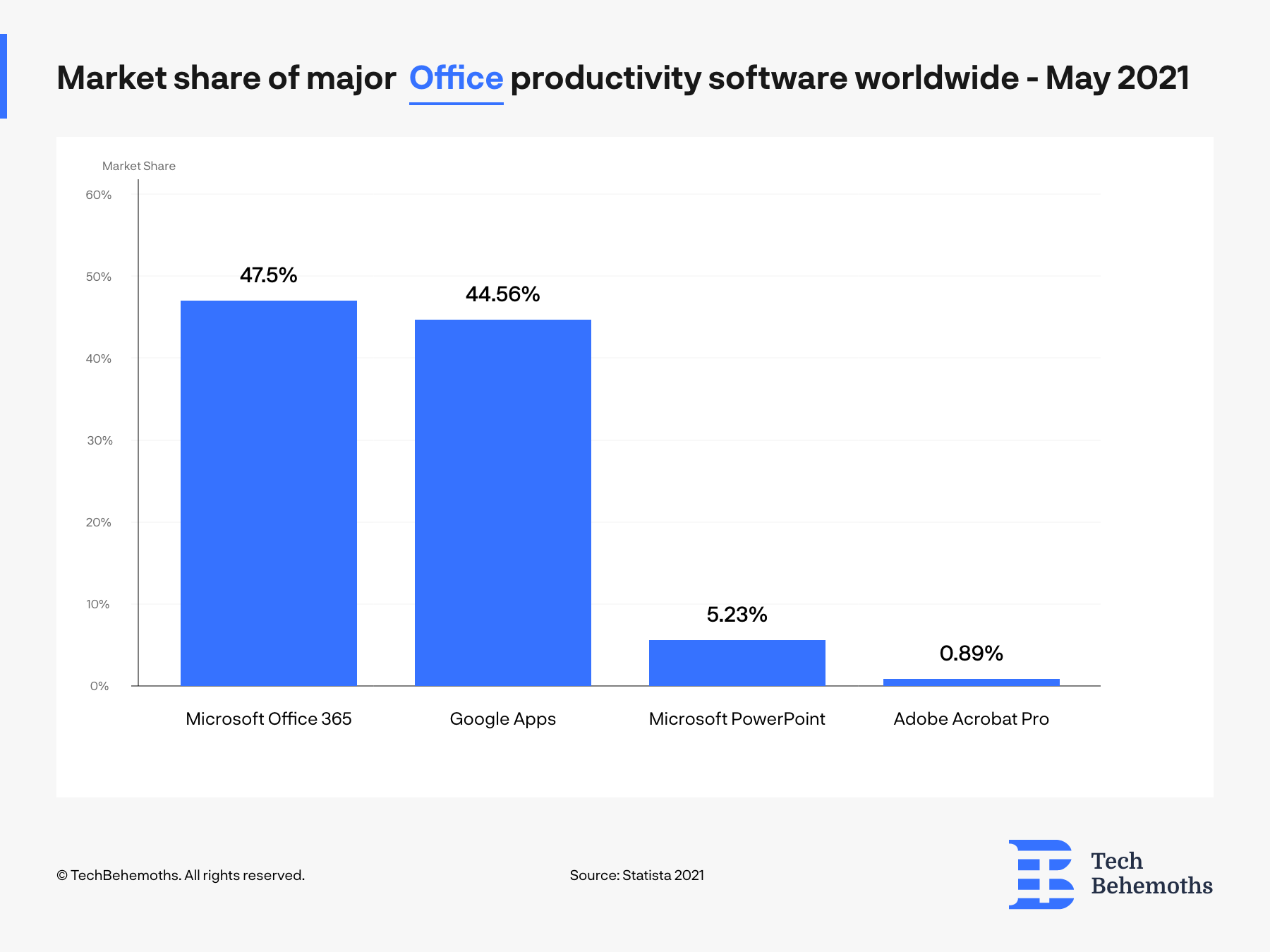

The one thing that Microsoft keeps in the shadows more than others is how does the Office Suite performs. With no much official data to share, we could only suspect that Office is one of the most profitable products Microsoft has at this moment. This fact is confirmed by the latest statistics that place Microsoft Office 365 as the leading productivity software, in tight competition with Google Apps.

The aggressive market strategy Microsoft has for their products increases the value and usage rate, but also the revenue and number of users. Office, Azure, and Xbox are the ones to mention when it comes to aggressive market positioning.

The Office Suite remained one of the strongest product lines, with Microsoft 365 surpassing 400 million commercial paid seats as of late 2024, and Copilot AI tools driving additional revenue via premium subscriptions.

How Microsoft will make money from Activision in 2022

Microsoft started 2022 with the largest acquisitions in the gaming industry in history. Activision Blizzard was acquired by Microsoft for $68.7 Bn in January 2022 and announces a hot year for Tech. The merge is not yet completed but the FTC is already watching closely the entire process, and there are voices that say the Activision acquisition by Microsoft may be the subject of an anticompetitive deal. Everything happens on the following financial background - Microsoft reported revenues of $15.4 Bn in 2021, while Activision Blizzard shared info of $8.7Bn revenue in the same timeframe.

Right after the deal is closed, it's expected that Activision CEO - Bobby Kotick will retire and be replaced by Chris Spencer - the head of the Game Division at Microsoft. But Bobby will take with him around $375 million, or equal to 0.53% of Activision shares that he holds. It seems that it's a double win for Bobby, as he was previously accused to know about harassment inside Activision, he now gets away with clean hands and full pockets.

On the other hand, for Microsoft, this acquisition is a long-term investment in cloud gaming and will hopefully significantly increase the company's revenue in 5 years. An Omida research shows that Cloud Gaming is expected to grow from $3.7Bn in 2021 up to $12 Bn by 2026. In this very industry, Microsoft already holds a 60% market share. The first step to this would be adding all other Activision-owned games to the Microsoft Game Pass. A collection of AAA games to it would attract even more users, that by the way reached 25 million in 2021 after a 39% growth from 2020. Microsoft assures that Activison acquisition will bring fair prices for gamers and games, and will lower the price range.

As of 2025, the deal was officially finalized in October 2023 after regulatory approval. Starting in Q1 2024, Microsoft integrated Activision’s flagship titles — such as Call of Duty, Diablo, and Overwatch — into Xbox Game Pass. This move helped boost Game Pass subscriptions to 36 million by mid-2024. Bobby Kotick stepped down as CEO in December 2023, and Matt Booty, previously head of Xbox Game Studios, now oversees the newly merged gaming division. Microsoft also strengthened its dominance in the cloud gaming sector, now holding over 65% market share. Omida’s updated projections show the industry is expected to reach $15.3Bn by 2026.

How Much Money Does Microsoft Have

According to NASDAQ, Microsoft's market cap is at $1.99T, and a declared revenue in 2021 is equal to $168Bn. Based on this data, but also considering expenses, revenue and profit, GoBanking Rates estimates that Microsoft values ~$456Bn. Taking into account Microsoft acquisitions in the past years, and as well its product development focus, there might be a change in its marketcap, value and price/share. However, it all depends on how the company will manage the existing products, and the way it will develop further.

As of July 2025, Microsoft’s market cap is $3.35 trillion, placing it among the top two most valuable companies globally. According to GoBankingRates and financial analysts, Microsoft’s estimated value is ~$740B excluding market cap, based on tangible and intangible assets, acquisitions, and investment strategies.

Related Questions & Answers

Does Microsoft make more mone than Apple?

How did Microsoft become so rich?

How much of Microsoft does Bill Gates own?

Will AI continue to be a major source of revenue for Microsoft?

What is Google's biggest revenue stream?

What's next for Microsoft's growth?