Crunchbase vs Pitchbook: Which One Should You Use, and Why

When it comes to investment research and market intelligence, the two platforms that come to mind are Crunchbase and PitchBook. These industry-leading platforms offer data, insights, and tools to help investors, analysts, and entrepreneurs make informed decisions. In this article, we will compare Crunchbase and PitchBook, exploring their features, data coverage, user experience, and pricing.

Crunchbase

Crunchbase is a popular investment research platform that provides a vast database of companies, investors, and industry trends. It offers a user-friendly interface and allows users to access information on funding rounds, acquisitions, key personnel, and more. Crunchbase's strength lies in its extensive coverage of startup and early-stage companies, making it a valuable resource for venture capitalists and angel investors. The platform also offers customizable alerts and advanced search functionalities, enabling users to track specific industries, geographies, or investment trends. This has been like this from the start, in 2007, when Crunchbase was founded as a database to keep track of startups that were featured in articles on TechCrunch.

PitchBook

PitchBook, on the other hand, is a financial data and research platform designed for private equity, venture capital, and investment banking professionals. It provides insights into companies, investments, and market trends. PitchBook's strength lies in its financial analysis capabilities, with detailed financials and valuation metrics. It also offers a wide range of tools for portfolio management, deal sourcing, and benchmarking. PitchBook's target audience consists mostly of professionals involved in deal-making, due diligence, and investment strategy.

Like Crunchbase, the company was founded in 2007. However, instead of startups, PitchBook started as a database for private equity-focused intelligence, which hasn’t changed since then.

Data Coverage and Accuracy

Both Crunchbase and PitchBook have extensive data coverage. Crunchbase focuses on private companies, startups, and emerging trends, providing a database of funding rounds, investors, and industry analysis. The platform's data is sourced from multiple channels, including user contributions, public sources, and partnerships with data providers. While Crunchbase's data coverage is impressive, it is important to note that the accuracy of the information can vary. This is due to the fact that user contributions are used on the website.

PitchBook, on the other hand, dives deeper into the financial data and analysis. The platform's data is gained from multiple sources, including regulatory filings, company announcements, and research. PitchBook has a dedicated team of data analysts who validate and update the information regularly, ensuring a high level of accuracy in the process. This focus on financial data makes PitchBook an excellent choice for investors and professionals who require in-depth financial analysis and valuation metrics to create a well-thought investing strategy.

User Experience and Interface

Crunchbase offers a clean user interface that is easy to navigate. The platform provides multiple handy search filters and allows users to save searches and set up custom notifications. Crunchbase's interface is designed to provide quick access to relevant information, with interactive charts, funding details, and company profiles presented in a visually appealing manner. However, as mentioned before, the platform's reliance on user-generated content can sometimes lead to inconsistencies in data and presentation.

PitchBook's user interface is more complex. Likely to meet the needs of professional investors. The platform offers advanced search capabilities, allowing users to filter way deeper into specific investment criteria. PitchBook's interface provides loads of financial information, including detailed tables, financial statements, and valuations. Since the platform offers so much data and features, it may be harder to use for new users due to its complexity.

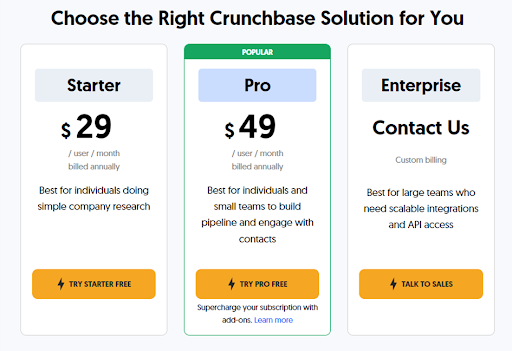

Pricing and Subscription Models

Crunchbase offers a free model, allowing users to access basic company information and limited search functionality for free. To unlock advanced features such as advanced search filters, saved searches, and custom alerts, users can go for Crunchbase Pro, which is available on a monthly or annual subscription basis. The pricing for Crunchbase Pro varies depending on the level of access and additional features required.

PitchBook, on the other hand, is not so transparent in its pricing. There is a free trial available upon request. After the free trial, a subscription is available for close to 12k per user annually.

Deep Dive into Data Analysis and Visualization

One of the key aspects of investment research platforms is their ability to provide robust data analysis and visualization tools. In this regard, both Crunchbase and PitchBook offer powerful features to help users make sense of complex datasets and identify valuable insights.

Crunchbase provides users with interactive charts, graphs, and visualizations to explore and analyze data. Users can customize and filter data based on multiple criteria such as location, industry, funding rounds, and more. The platform also offers tools for trend analysis, allowing users to track changes in funding activity, market trends, and company performance over time. These visualization capabilities help users to gain a deeper understanding and identify investment opportunities easier than just based on raw data.

PitchBook, on the other hand, is renowned for its robust financial analysis tools. The platform allows users to conduct in-depth financial modeling and valuation analysis. Users can access detailed financial statements, capitalization tables, and transaction data to evaluate the financial health and growth potential of companies. PitchBook's advanced analytics capabilities enable users to compare and benchmark companies, assess market multiples, and perform scenario analysis for investment decision-making. As mentioned earlier, PitchBook is more complex and targets clients who have more knowledge regarding the market. Hence why their tools are more complex as well.

Additionally, both platforms offer data export functionality, allowing users to extract data in various formats such as Excel or CSV. This feature is particularly useful for users who prefer to do their own analysis or need the data to be imported into their own existing workflows.

Overall, both Crunchbase and PitchBook provide powerful data analysis and visualization tools that give users the ability to uncover insights and make informed investment decisions. Whether users are interested in exploring trends, assessing financial performance, or conducting detailed modeling, these platforms offer a wide array of features to support sophisticated data analysis.

Summing up

In conclusion, Crunchbase and PitchBook both offer powerful data analysis and visualization tools and integration capabilities to support users in conducting comprehensive investment research. These features give users the opportunity to explore and analyze data, customize their workflows, and use investment data seamlessly. When either the users require in-depth financial analysis or flexible integration options, both platforms provide multiple highly valuable tools to meet the needs of all kinds of investors, analysts, and entrepreneurs. With their capabilities and user-friendly interfaces, Crunchbase and PitchBook continue to be industry leaders in the realm of investment research and data analysis.