Digital Payments in 2025: Survey Insights from IT Companies

Summary

In 2025, digital payments are a regular part of IT projects. Most companies use platforms like Stripe and PayPal, and support common payment methods such as credit cards, bank transfers, and digital wallets. Fixed pricing is still the most used model, but freemium options are becoming more popular because they offer flexibility. Even with this progress, many companies face problems like technical limits from payment providers, trouble with failed payments, and keeping up with rules for privacy and security. Handling different currencies and connecting billing tools with other systems are also common issues. To keep up with client needs, companies are focusing on simple, flexible, and global-ready payment solutions.

Digital payments have become part of everyday life, with consumers quickly adapting to a wide range of digital channels. With more services now offered on a subscription basis, companies need reliable systems for pricing, billing, and managing payments. Tap-to-pay is now the norm, financial institutions are experimenting with blockchain, and generative AI is beginning to support stronger fraud detection.

To better understand these dynamics, TechBehemoths conducted a global survey of 1,050 IT companies across 48 countries between May 30 and June 6. The survey focused on the internal structure of digital payment systems: how they are set up, what billing models are preferred, what technologies power them, and which pain points companies are still trying to resolve.

This survey offers a focused snapshot of the state of digital payments in 2025, grounded in first-hand industry data to help decision-makers evaluate their systems against global benchmarks.

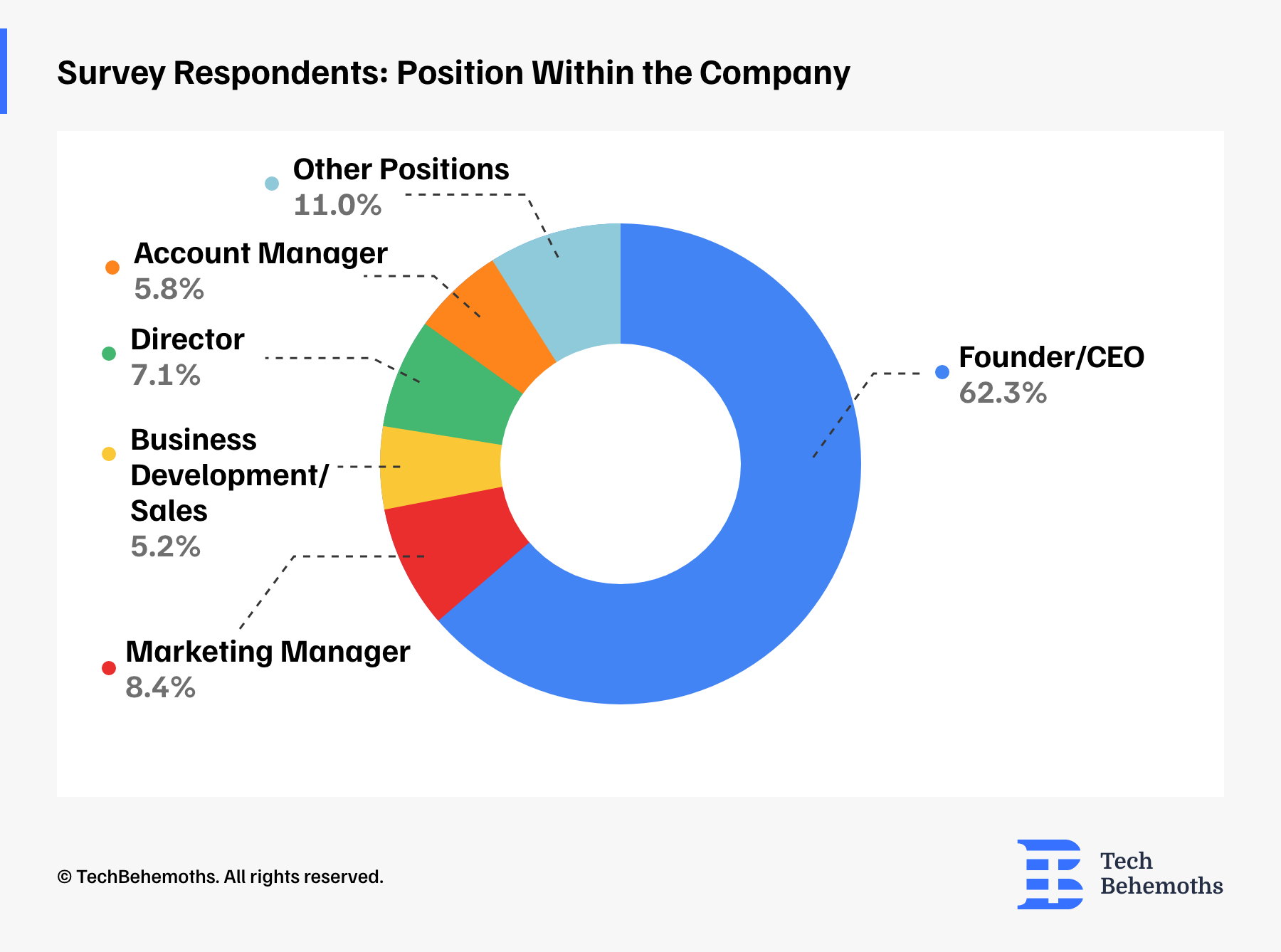

Survey Respondents: Position Within the Company

TechBehemoths states that 62.3% of respondents in the survey are Founders or CEOs, placing the insights directly in the hands of those who lead and decide. Marketing Managers follow with 8.4%, while Directors make up 7.1%. Account Managers represent 5.8%, and Business Development or Sales roles cover 5.2%. Another 11% fall into other positions across the organization.

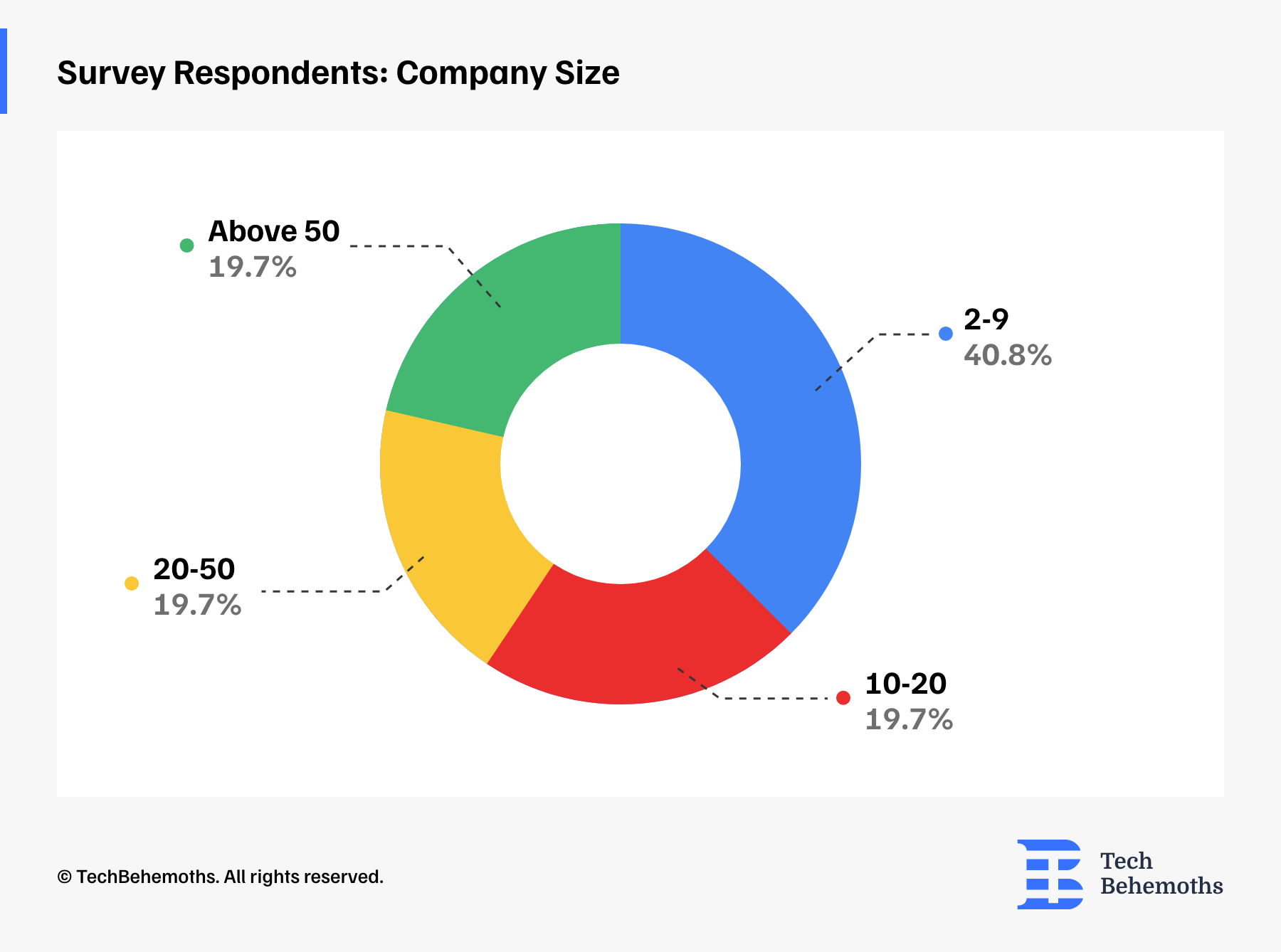

How many employees do digital payment services providers on Techbehemoths have?

According to TechBehemoths, most digital payment service providers in the survey operate in small teams. 40.8% work in companies with 2-9 employees - the largest segment by far. The rest are evenly split: 19.7% have 10-20 employees, 19.7% fall in the 20-50 range, and another 19.7% work in companies with more than 50 employees.

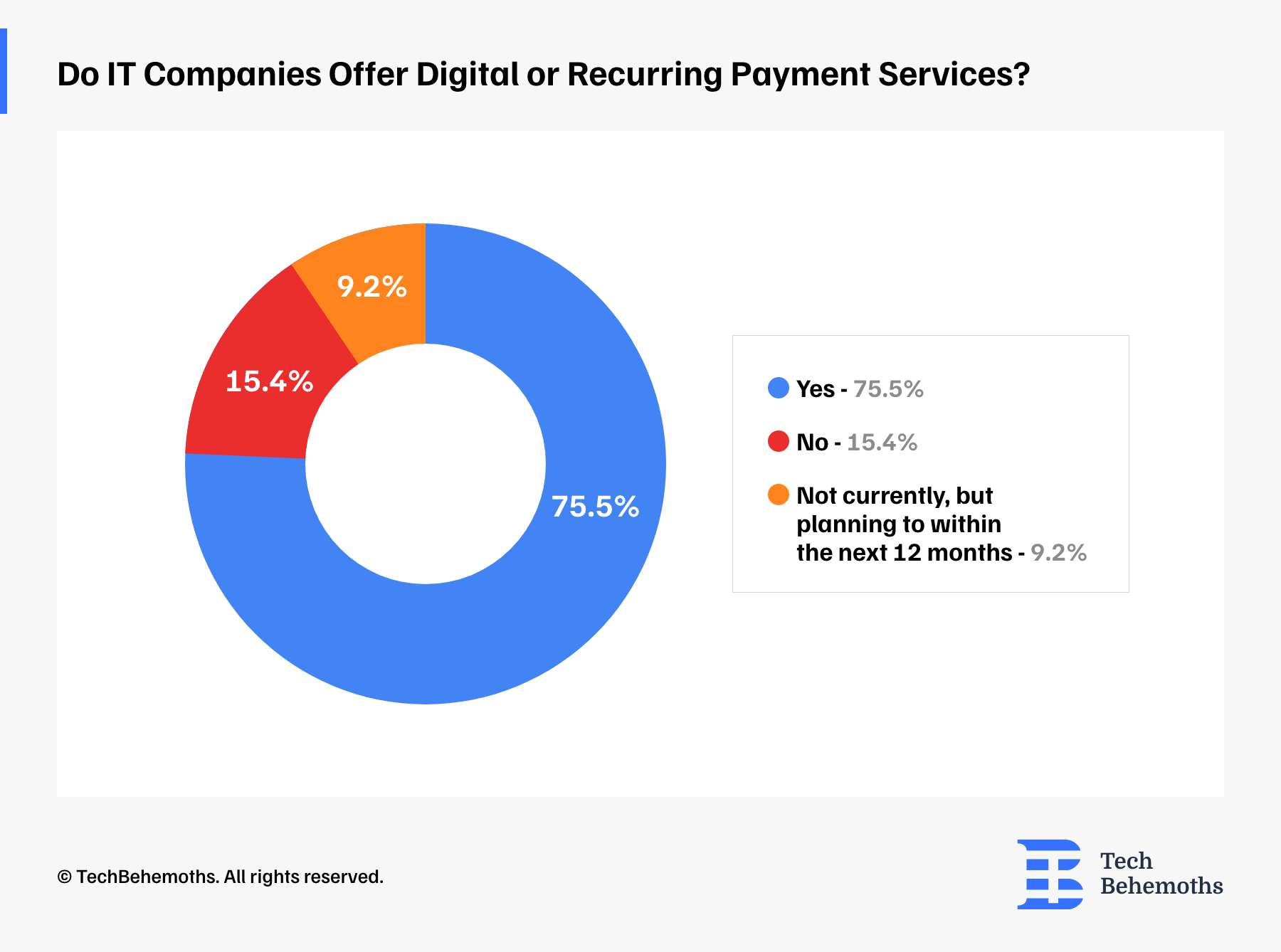

Do IT Companies Offer Digital or Recurring Payment Services?

Yes - according to TechBehemoths, 75.5% of IT companies already offer services related to digital or recurring payments. 15.4% do not provide such services at all, while 9.2% say they are not offering them yet but plan to do so within the next 12 months. Recurring payments are no longer a niche feature – they are becoming a standard expectation in IT service delivery. As more companies move toward automation, subscriptions, and global clients, the ability to support digital billing models is turning into a key capability.

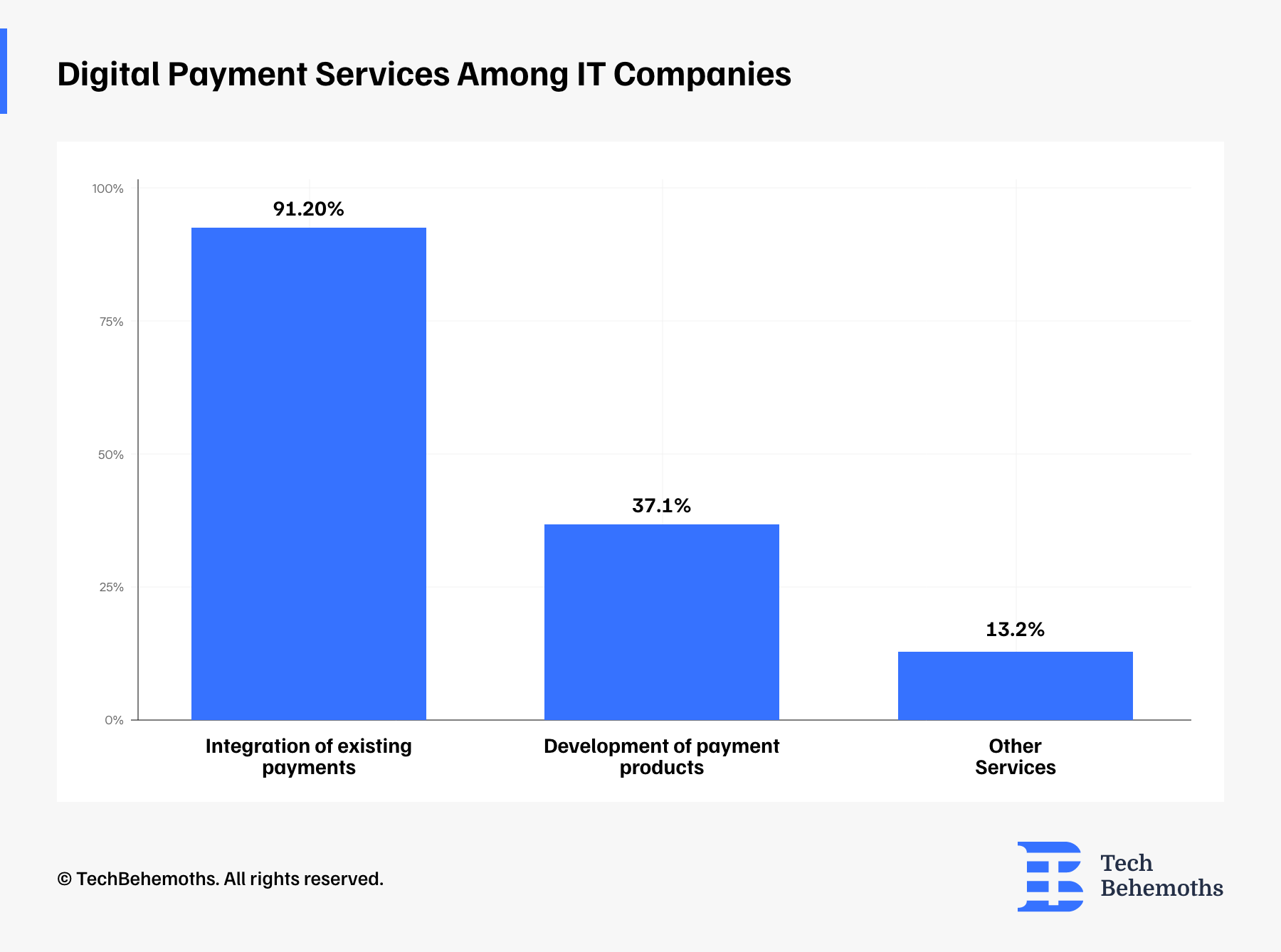

Which of the following digital payment services do IT companies currently offer?

91.2% of IT companies that offer digital payment services focus on the integration of existing payment systems. This reflects a clear industry preference for solutions that work with platforms like Stripe, PayPal, or regional gateways. Meanwhile, 37.1% of companies are involved in the development of custom payment products, such as proprietary billing tools or digital wallets. A smaller segment - 13.2% offers other related services, such as integration and product development, rather than peripheral support.

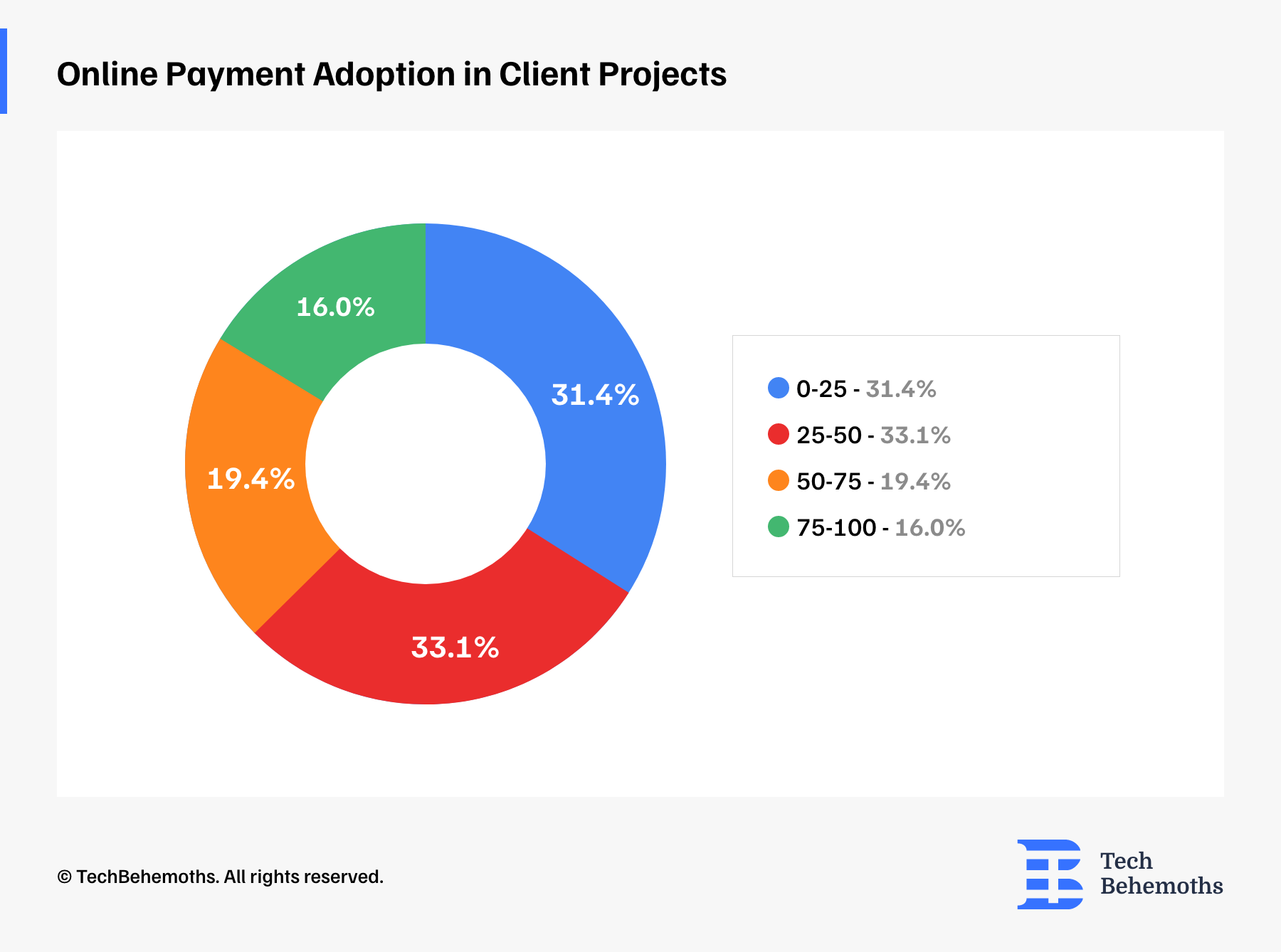

How many of the IT Companies’ projects involve online payments?

The survey conducted by TechBehemoths reveals how frequently IT companies implement online payment features in their client projects. According to the findings, 33.1% of companies reported that between 25-50% of their projects include online payment integration, while 31.4% indicated a lower range of 0-25%. On the other end, 19.4% said that 50-75% of their projects involve such features, and only 16.0% confirmed online payments are part of 75-100% of their work. While many companies offer digital payment services, their use across projects varies widely depending on client needs and business models.

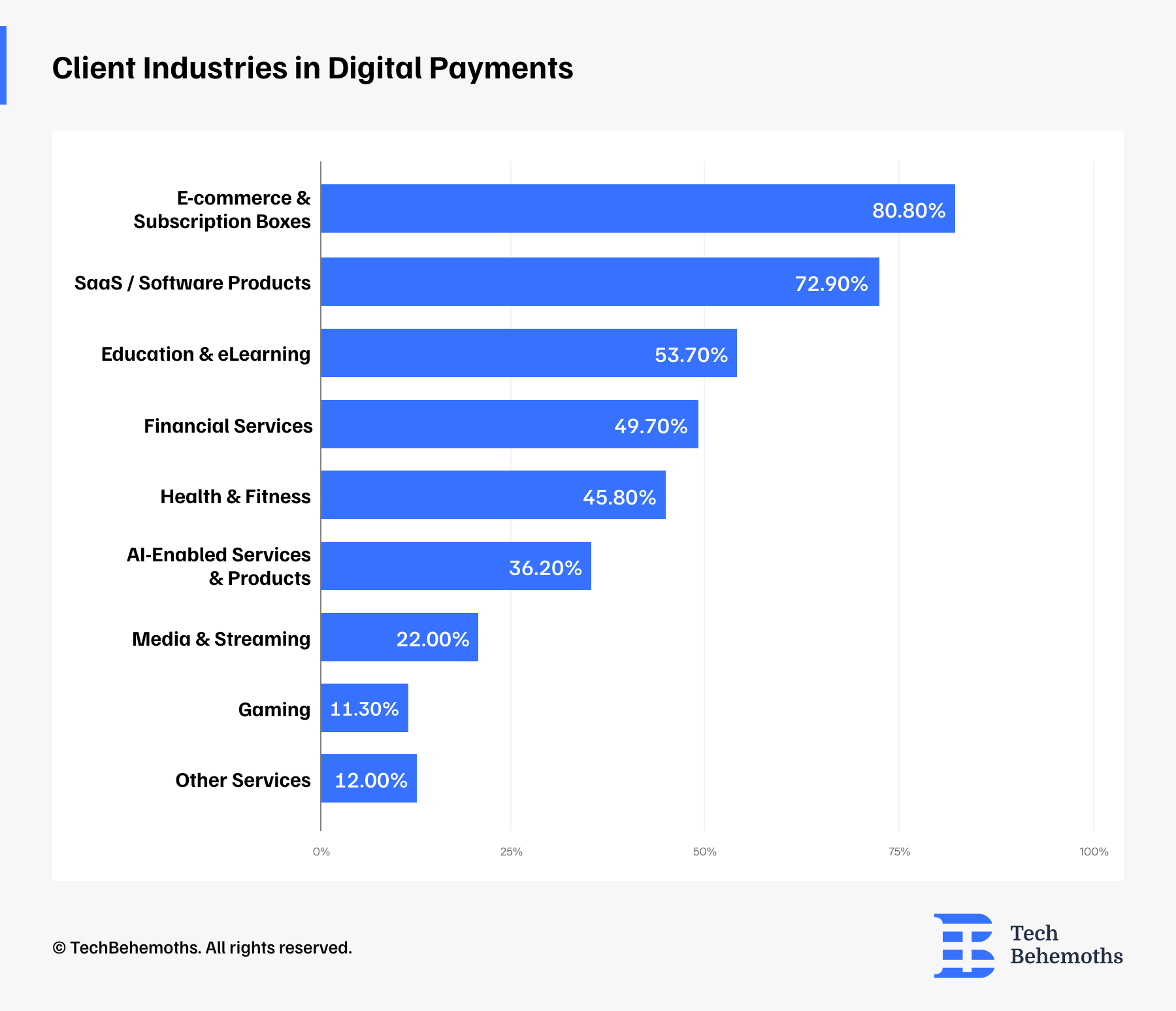

Which industries do IT companies’ clients typically serve in digital payments?

The TechBehemoths survey shows that most IT companies work with clients in E-commerce & Subscription Boxes (80.8%) and SaaS/Software Products (72.9%), industries that rely heavily on recurring or digital payments. Education & eLearning (53.7%), Financial Services (49.7%), and Health & Fitness (45.8%) also rank high.

AI-Enabled Products & Services are involved in 36.2% of cases, covering tools like chatbots, automation platforms, and recommendation systems, many now integrating payment systems. Less frequent clients come from Media & Streaming (22.0%), Gaming (11.3%), and Other Services (12.0%).

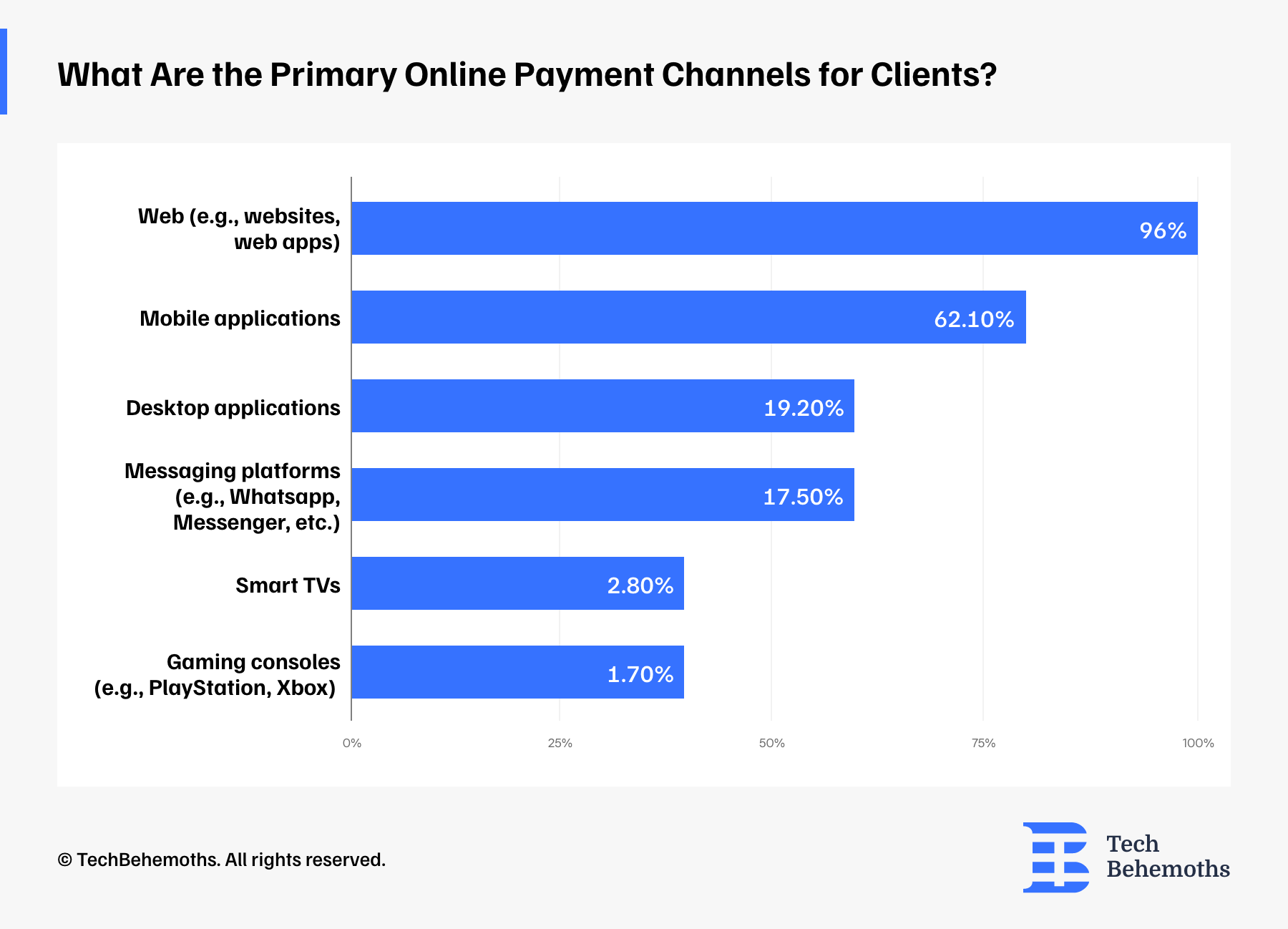

What Are the Primary Online Payment Channels for Clients?

The TechBehemoths survey shows that most IT companies work with clients in E-commerce & Subscription Boxes (80.8%) and SaaS/Software Products (72.9%), industries that rely heavily on recurring or digital payments. Education & e-learning (53.7%), Financial Services (49.7%), and Health & Fitness (45.8%) also rank high.

AI-Enabled Products & Services are involved in 36.2% of cases, covering tools like chatbots, automation platforms, and recommendation systems, many now integrating payment systems. Less frequent clients come from Media & Streaming (22.0%), Gaming (11.3%), and Other Services (12.0%).

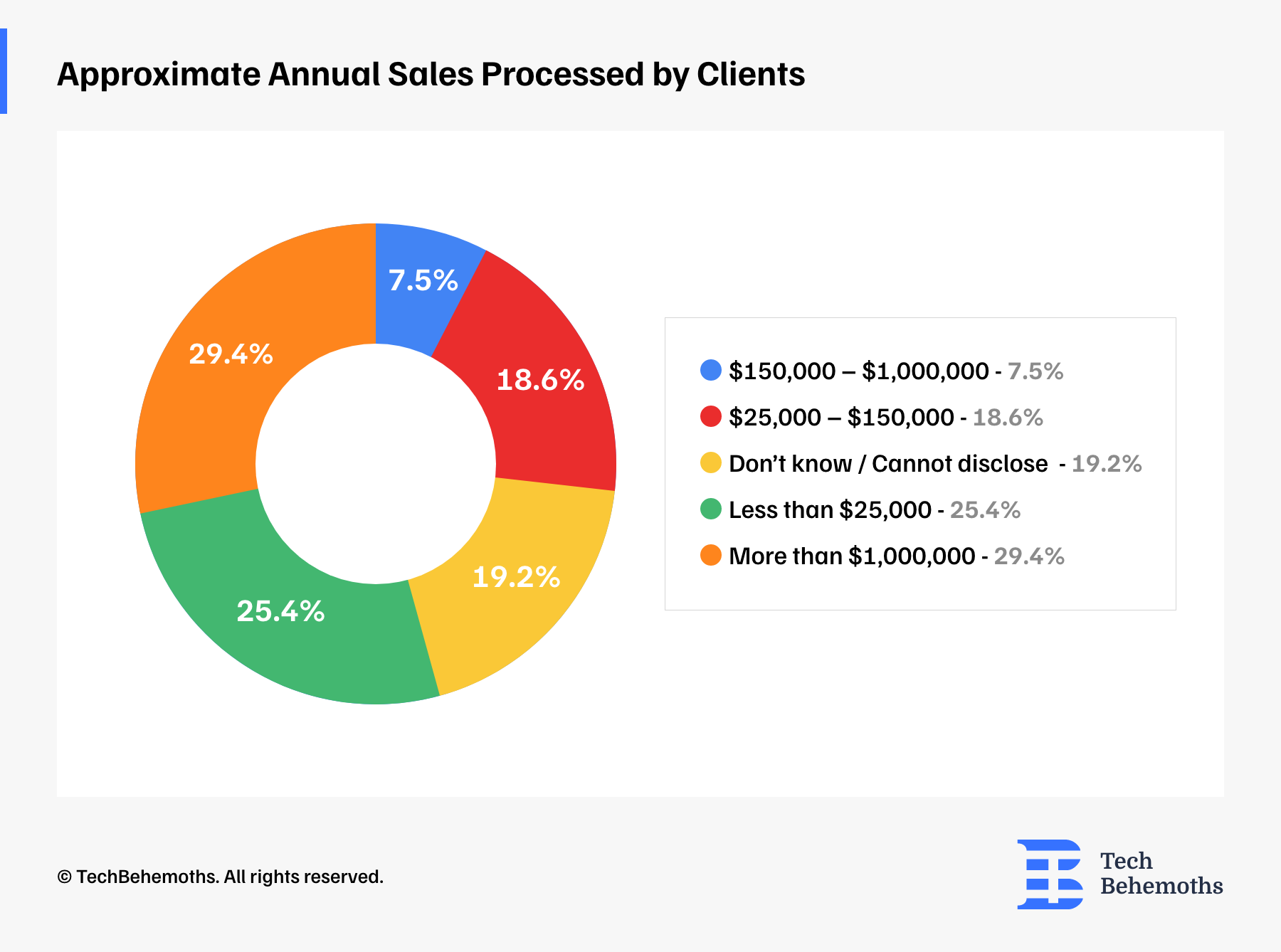

Approximate Annual Sales Processed by Clients

The survey shows that IT companies serve a broad mix of clients when it comes to annual sales through digital payments. The largest group, 29.4%, processes over $1 million, likely mature businesses in sectors like e-commerce or SaaS. On the other end, 25.4% handle less than $25,000, often smaller firms or early-stage startups.

Only 7.5% fall into the $150K–$1M range, suggesting many clients either grow quickly or remain smaller. 18.6% process $25K–$150K, reflecting steady, mid-sized activity. Lastly, 19.2% didn’t disclose sales volumes.

Payment Models

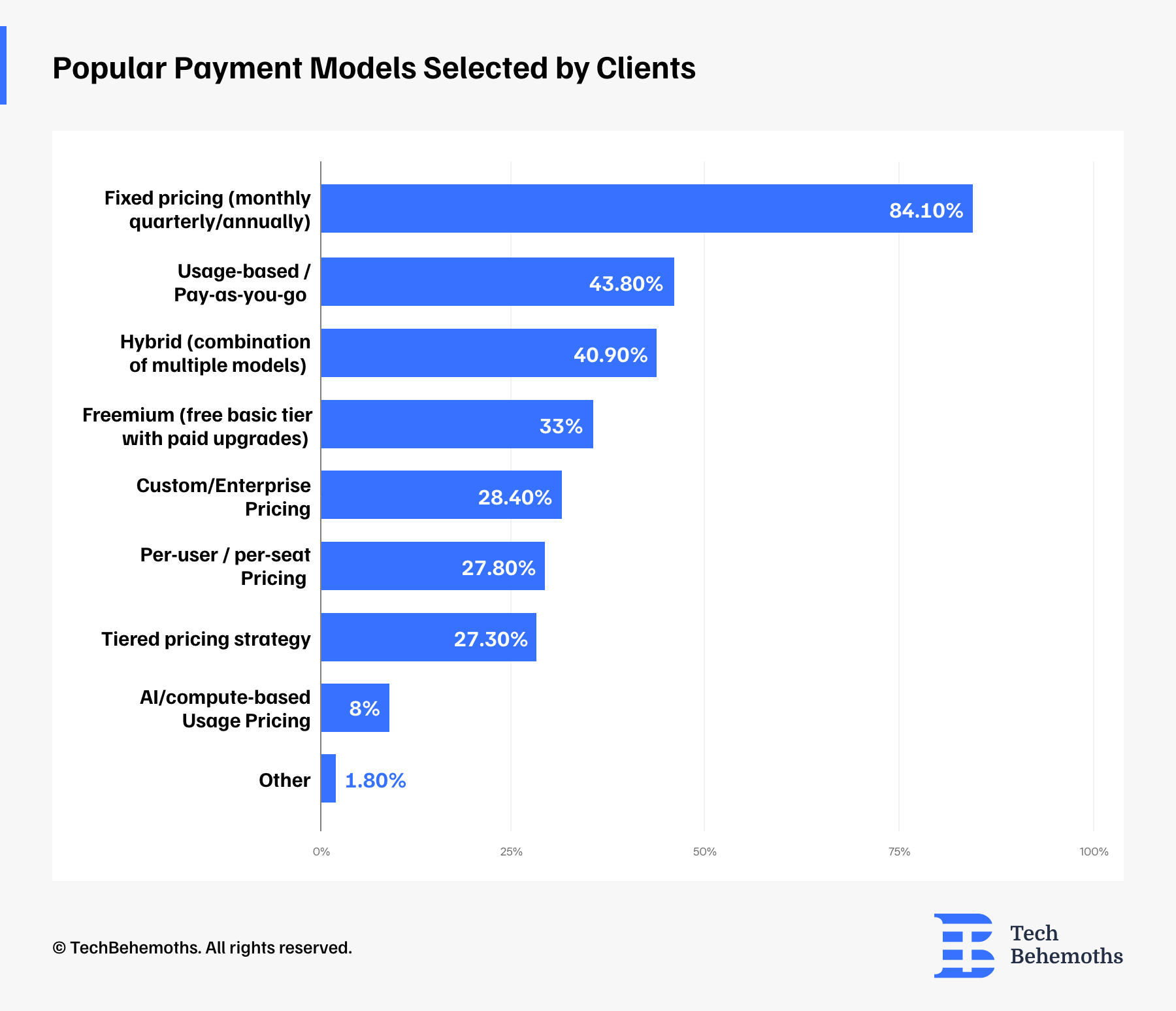

Which payment models are most commonly used by IT companies' clients?

Fixed pricing models (monthly, quarterly, or annually) are by far the most common, selected by 84.1% of clients. This shows a strong preference for predictable, recurring payments.

Usage-based or pay-as-you-go models come next at 43.8%, followed closely by hybrid models (a mix of pricing strategies) at 40.9%. These options appeal to clients looking for flexibility or scalability.

Freemium models - offering a free base tier with paid upgrades are used by 33%, often for SaaS products. Meanwhile, custom/enterprise pricing is chosen by 28.4%, and per-user/per-seat pricing by 27.8%, both common in B2B software.

Tiered pricing strategies follow closely at 27.3%, while AI or compute-based usage pricing remains niche at 8%. Only 1.8% use other models, showing that most clients stick to proven pricing structures.

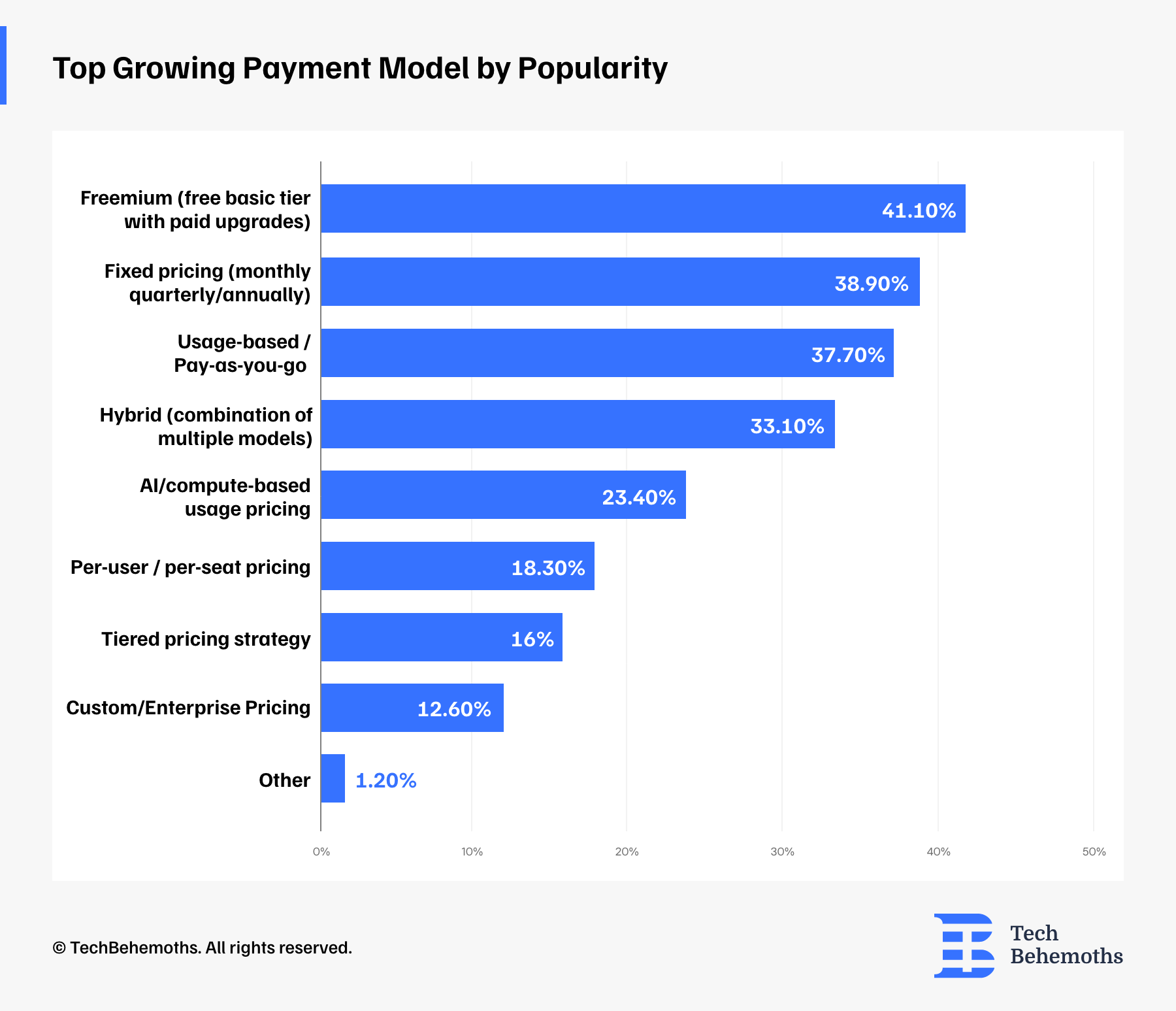

Top Growing Payment Model by Popularity

The fastest-growing payment model, according to the TechBehemoths survey, is freemium, used by 41.1% of IT companies’ clients. This model offers a free basic tier with paid upgrades and is especially popular among SaaS and digital product providers.

Close behind is fixed pricing (monthly, quarterly, or annually) at 38.9%, followed by usage-based/pay-as-you-go at 37.7%, both still appealing for their clarity and scalability.

More businesses are using hybrid pricing models, which combine different pricing strategies to meet various user needs. This method is becoming more popular, with 33.1% adoption. AI-based usage pricing is also growing quickly, now at 23.4%, showing that more people are using AI tools and platforms. In comparison, traditional models like per-user or per-seat pricing (18.3%), tiered pricing (16%), and custom or enterprise pricing (12.6%) are growing more slowly.

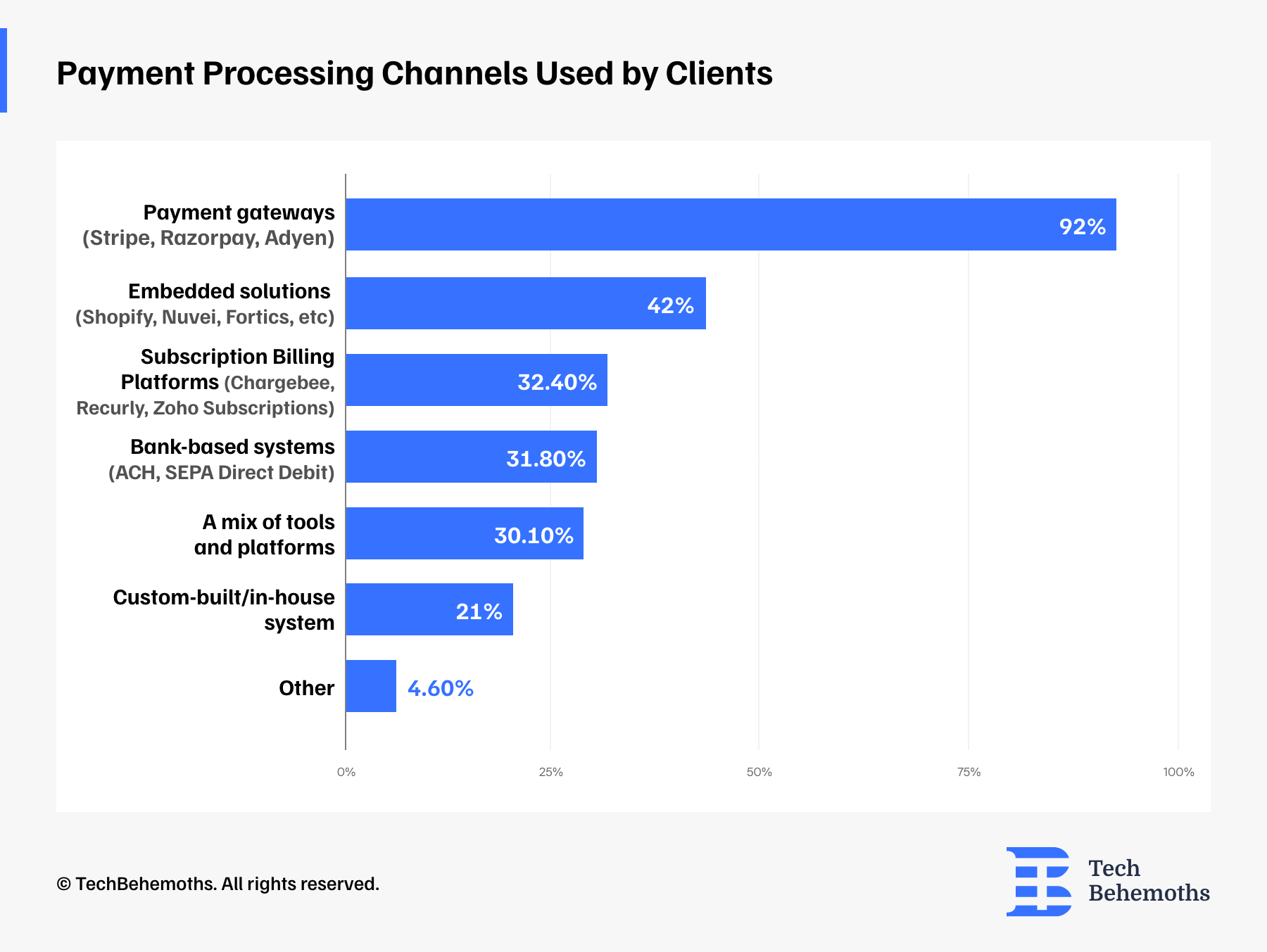

How do IT companies' clients typically handle payment processing?

The survey reveals that most IT companies’ clients prefer using payment gateways like Stripe, Razorpay, or Adyen, chosen by a dominant 92%. These platforms are widely trusted for their simplicity, security, and global coverage.

42% of clients use embedded solutions such as Shopify or Nuvei, especially popular among businesses that need integrated e-commerce capabilities. Tools like Chargebee or Zoho Subscriptions, grouped under subscription billing platforms, are used by 32.4%, followed closely by bank-based systems (31.8%) like ACH and SEPA for direct debit processing.

Around 30.1% combine multiple tools to manage payments, reflecting more complex or multi-regional setups. Meanwhile, 21% of clients opt for custom-built or in-house systems, often to meet specific technical or compliance requirements. Only 4.6% fall into the “other” category, showing most clients rely on well-established payment infrastructure.

Payment Processing Methods

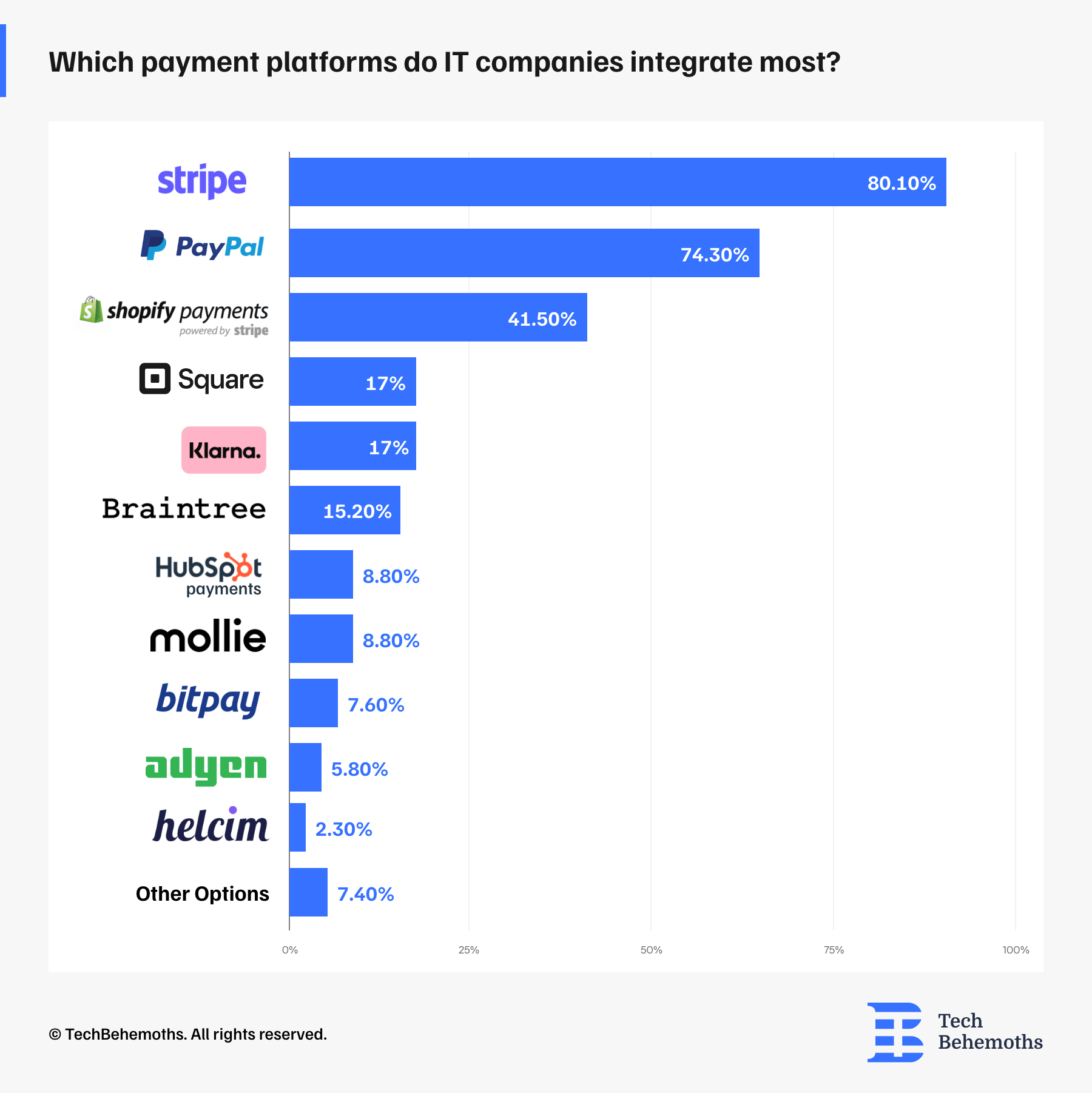

Which payment platforms or gateways do IT companies most frequently integrate with?

The data shows that when it comes to integrating payment platforms, Stripe leads the way, used by 80.1% of IT companies. PayPal follows closely at 74.3%, remaining a widely trusted and recognizable option for global transactions.

Shopify Payments, which runs on Stripe infrastructure, comes next at 41.5%, showing its popularity among e-commerce-focused clients. Square and Klarna are each used by 17% of companies, while Braintree appears in 15.2% of integrations.

Less commonly, IT companies also work with HubSpot Payments and Mollie (both at 8.8%), BitPay (7.6%), Adyen (5.8%), and Helcim (2.3%). Another 7.4% of companies reported using various other platforms. Overall, Stripe and PayPal dominate, but a wide range of other tools is also being adopted based on client needs and regional focus.

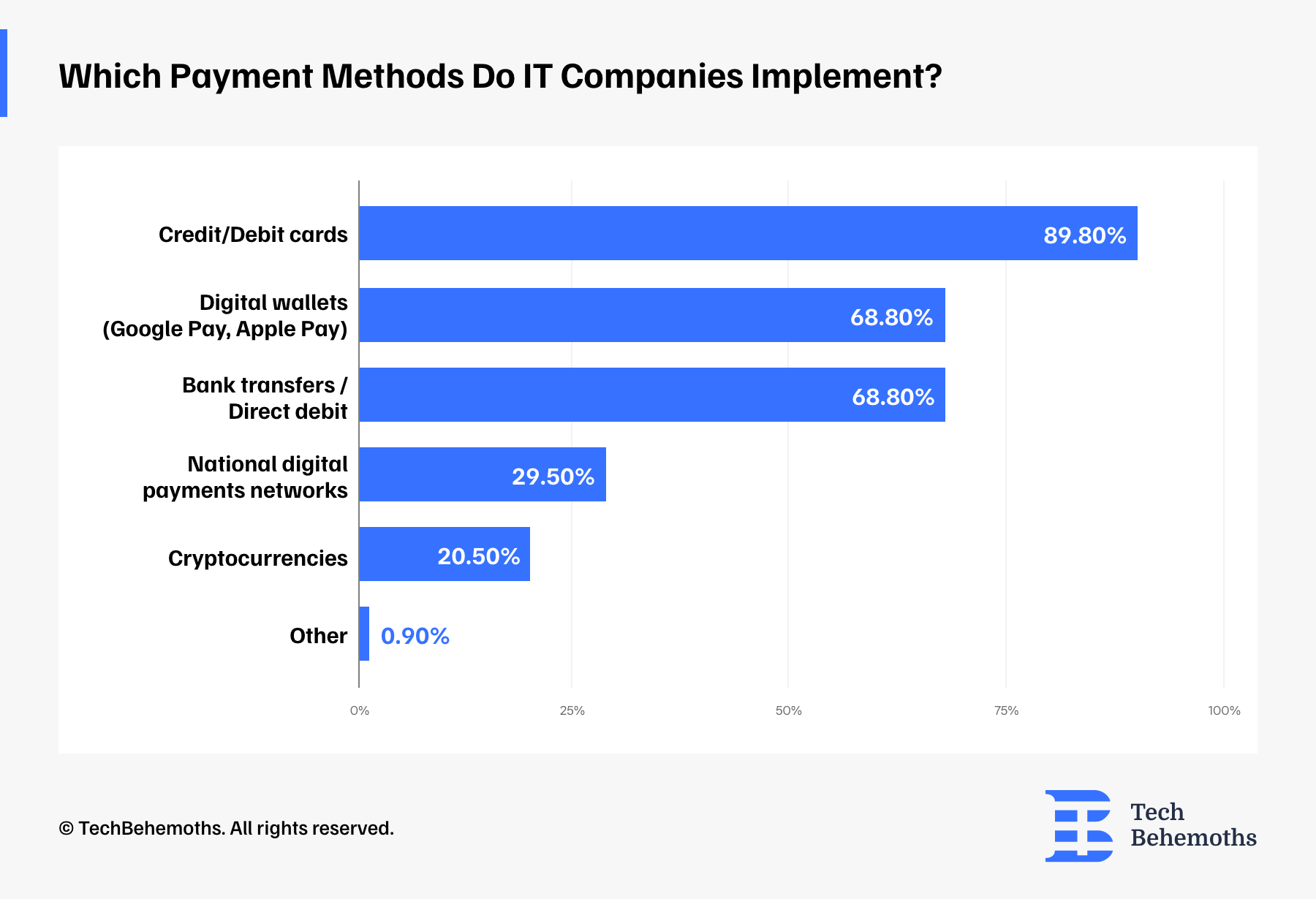

Which payment methods do IT companies use in their projects?

When it comes to payment methods implemented in client projects, IT companies most frequently use credit and debit cards, with 89.8% integrating this option due to its global acceptance and user familiarity. Digital wallets like Google Pay and Apple Pay, along with bank transfers/direct debit, are also widely used, each included in 68.8% of projects. These offer convenient and secure alternatives for both mobile-first and traditional users.

National digital payment networks (such as UPI in India or iDEAL in the Netherlands) are gaining ground, used in 29.5% of cases. Cryptocurrencies are supported by 20.5% of IT companies, showing some traction in niche or forward-looking sectors. Just 0.9% of respondents mentioned using other, less common methods, indicating that most implementations stick to mainstream, widely supported payment solutions.

Payment Methods & PSP Limitations

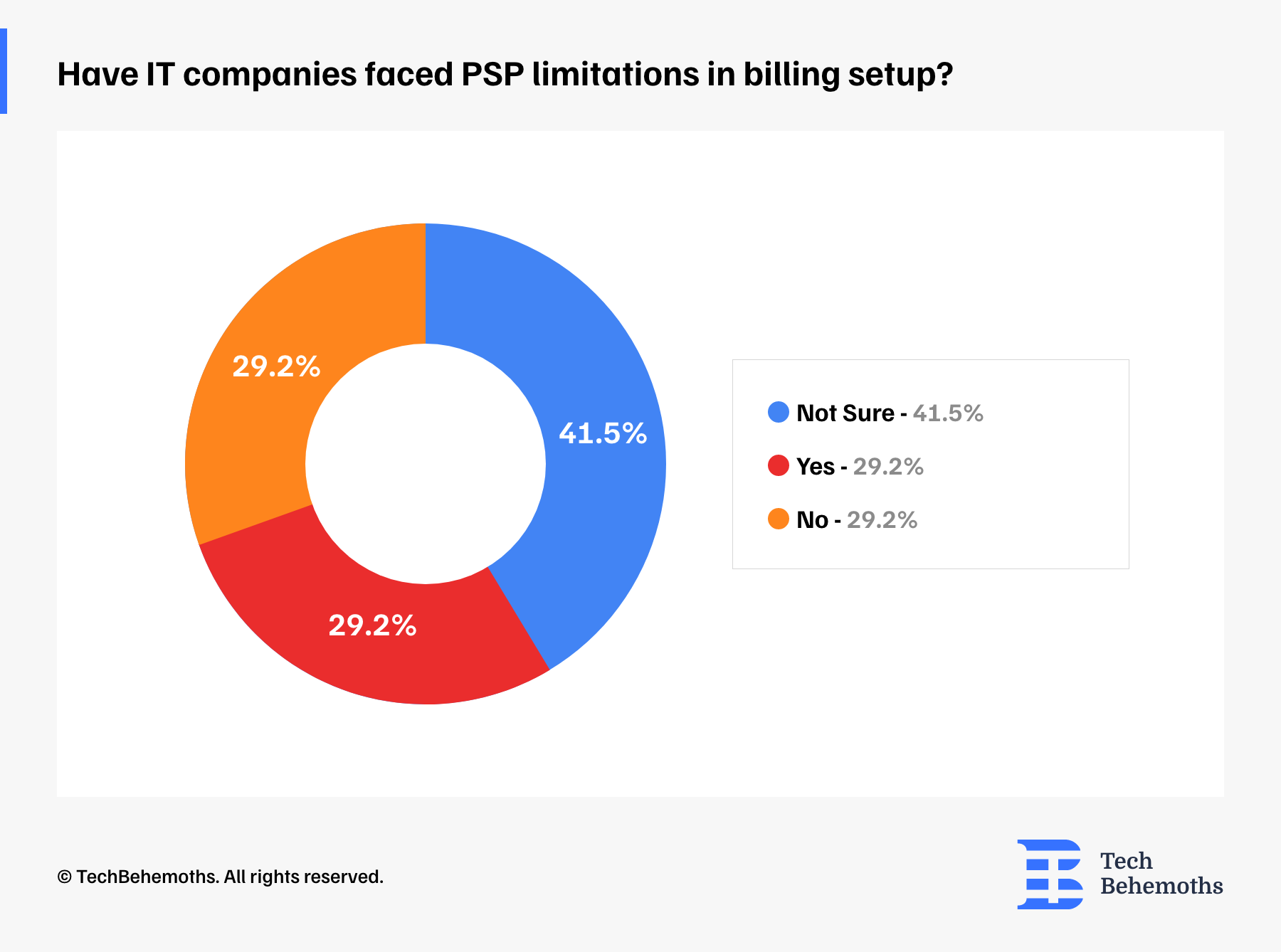

Have IT companies encountered limitations with PSPs when setting up billing processes?

The responses are quite evenly split. 29.2% of companies said they have encountered limitations with payment service providers when setting up billing. Another 29.2% reported no issues at all. The largest group, 41.5%, responded that they are not sure, which may indicate that the billing setup is either outsourced or not visible to all teams involved. This shows a possible gap in awareness or communication around PSP-related challenges during implementation.

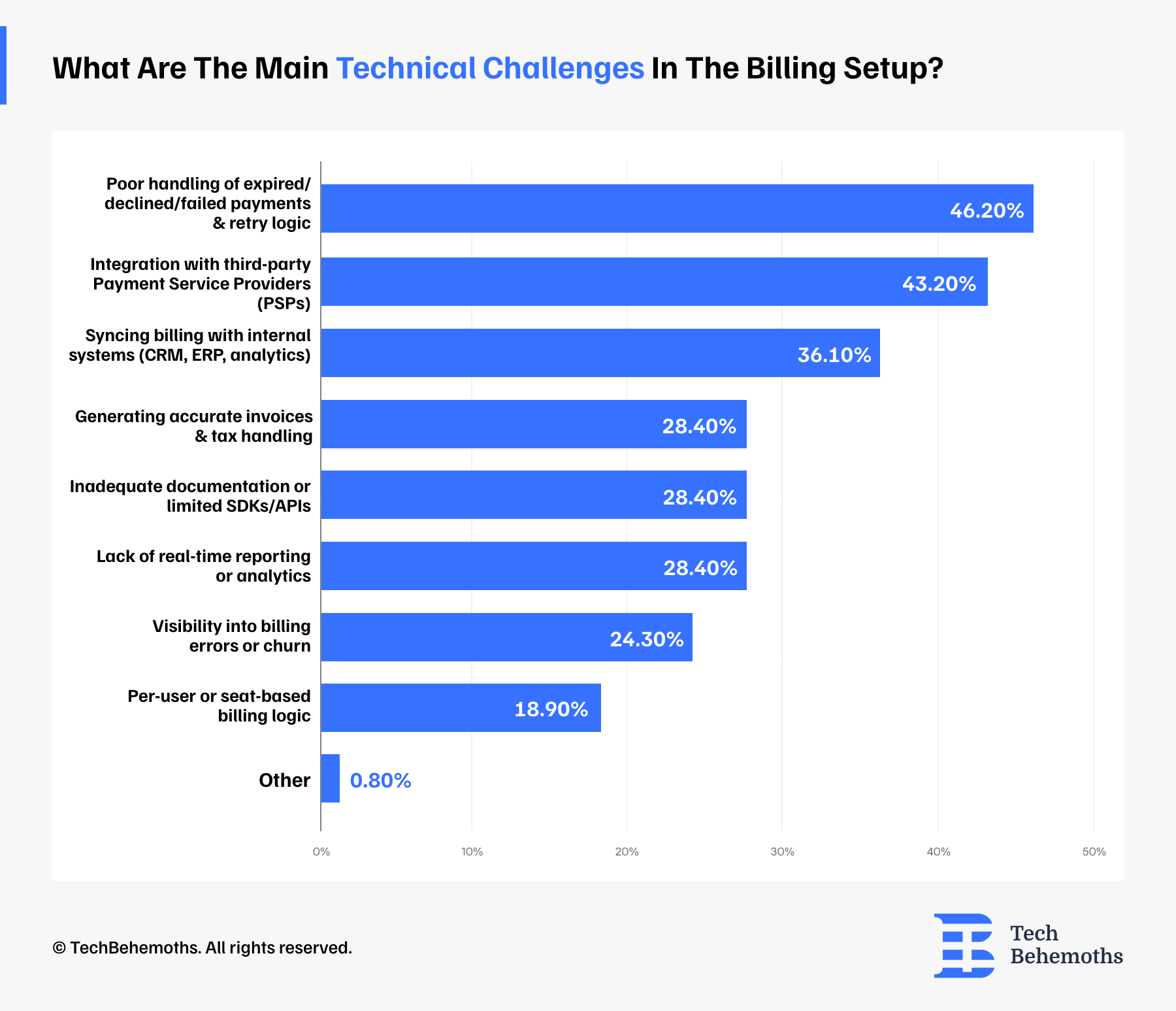

What Are the Main Operational Challenges in Billing Setup?

The most common issue is poor handling of failed or declined payments, including retry logic, reported by 46.2% of companies. Another 43.2% face difficulties integrating with third-party payment service providers.

Syncing billing systems with internal tools like CRMs or analytics platforms is also a key concern for 36.1% of respondents. Generating accurate invoices, dealing with taxes, limited API support, and poor documentation all follow closely at 28.4%.

Lack of real-time reporting and limited visibility into billing errors or customer churn affect a significant portion as well, while 18.9% struggle with per-user or seat-based billing logic. Only 0.8% mentioned other challenges, showing that most issues fall within a clear set of recurring pain points.

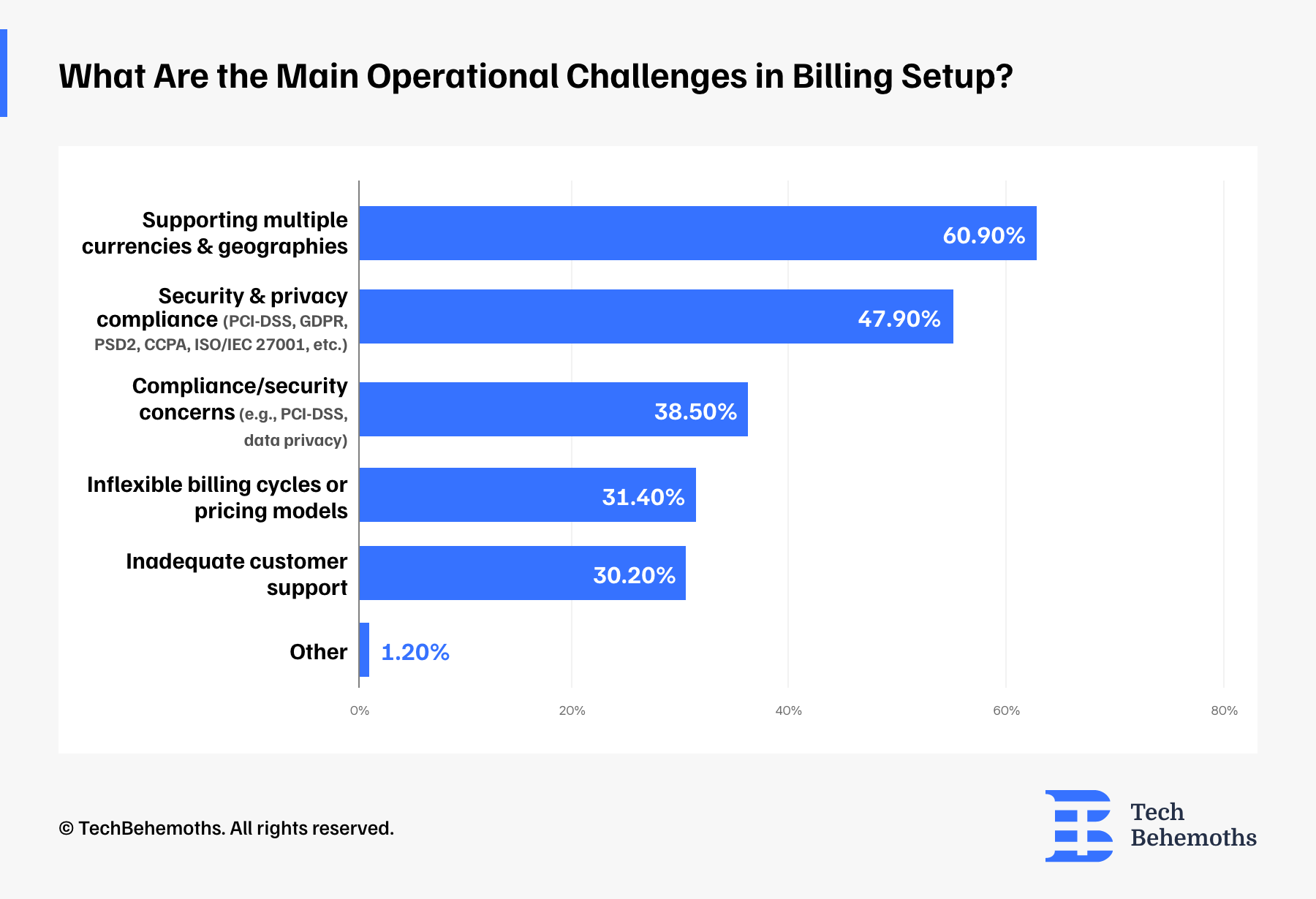

What are the biggest operational challenges/limitations in setting up billing systems?

The top concern for IT companies is handling multiple currencies and geographies, selected by 60.9% of respondents. This reflects the complexity of billing in a global market where clients operate across regions.

Security and privacy compliance is another major challenge at 47.9%, covering frameworks like PCI-DSS, GDPR, and CCPA. An additional 38.5% also cited general compliance and data protection concerns.

Billing flexibility is also a pain point. 31.4% struggle with rigid billing cycles or pricing models, while 30.2% pointed to inadequate customer support from payment or billing platforms.

Only 1.2% of respondents reported other issues, suggesting most operational challenges fall into these key categories.

Wrapping Things Up

In 2025, digital payments are no longer just a feature — they are a core part of how IT companies build and deliver value to their clients. The growing diversity in payment models, the demand for seamless global transactions, and the increasing reliance on third-party platforms highlight a clear shift toward more flexible, integrated, and scalable billing ecosystems. While technical and operational challenges still exist, especially around compliance, billing logic, and PSP limitations, the trend is unmistakable: companies that invest in adaptable and user-friendly payment solutions will be better positioned to meet evolving client needs in a fast-changing digital economy.

Partner Companies

The survey was not limited to any geographical region or country and its main target was the global community of IT companies and web agencies. As such, survey respondents come from 1,050 IT companies across 48 countries. On this occasion, TechBehemoths is proudly announcing and crediting the list of partner companies that helped spread the word and gather answers for this survey.

- 2N Consulting Group, US

- 5w155 SA, Switzerland

- Absolute Websites, Cyprus

- Abstract Infosys, Nepal

- Adverge, US

- Aetherius Solutions d.o.o., Serbia

- AFIVE Digital Agency, UK

- AgileTech Vietnam, Vietnam

- Altlier, UK

- Analaize, Nigeria

- Angelsmith, Inc., US

- App Gurus, Australia

- aPurple, India

- Aroasis Softech, India

- Astoe Company, India

- Atta Systems, Romania

- Awecode Solutions Pvt. Ltd., Nepal

- axiusSoftware, India

- B1 Studio, Romania

- Bartoňová, Czechia

- BeeWeb, Armenia

- Bespoke Web Dev, Australia

- Prachin Global School, India

- Brave New Agency, Poland

- Breidan Web Agency, Lebanon

- BRND WGN, Malta

- BroadWeb Digital, Australia

- Brupace Digital Limited, Kenya

- Bulcode 2016 Ltd., Bulgaria

- BUSINESS CONFIG, Portugal

- Buzzvel, Portugal

- Byteout Software, Serbia

- Bytevault Infotech, India

- Calcey, SriLanka

- Spark Solutions 360, Pakistan

- Chill Byte, Serbia

- Coderfy, Ukraine

- Codezela Technologies, SriLanka

- Codezela Technologies Ltd, UK

- Commerce Pundit, US

- CredibleSoft, India

- Cyber Nest, US

- Decipher Zone, India

- Design-makers, Russia

- Devmont Digital, Pakistan

- DigiTrends Global Inc., US

- Double Coconut, US

- DPL, Pakistan

- Ekantik Technologies, India

- Element Media, Palestine

- Elinext, Poland

- Elite Dev Squad, Armenia

- Elites, Lebanon

- Empat, Ukraine

- Epahubb Consult, Ghana

- Epigra, Turkey

- Exceed IT, SouthAfrica

- Exodus Ethiopia Trading PLC, Ethiopia

- FGM Technologies, Morocco

- Fidex Developers (pvt) Ltd, SriLanka

- Folio Manager, Australia

- Foxcode, Oman

- Fuse Web, Netherlands

- Futurex Tech, Nepal

- H16M Agency, France

- HaulMar LLC, Kyrgyzstan

- Hukumsa, India

- hulo.dev, Ukraine

- Hypreom Research Pty Ltd, SouthAfrica

- I Concept Digital, Malaysia

- Ideaware, Colombia

- ILB Metrics, Mexico

- Imagio Creations, Nepal

- iMiMDesign™ Co., India

- Information Technology, UAE

- Infosprint Technologies, Canada

- Infotyke, India

- INSAIM DESIGN, Portugal

- InStandart, UK

- Instinctools, Germany

- Integrated MLM Software, India

- Isle Geeks, SouthAfrica

- IT Brick, Uzbekistan

- Vision Infotech, India

- Zero Two Solutions, India

- IZMHS, Pakistan

- JAM-Forte Technologies, Nigeria

- Kevych Solutions, Ukraine

- KLH Technology Solutions, US

- KNOWN DESIGN, SouthAfrica

- Kuri Graphics, Ethiopia

- kV Marketing, Colombia

- Lasting Dynamics, Spain

- launchOptions, Cyprus

- Lemon Dev OU, Estonia

- LimaRank | Agencia de Marketing Digital, Peru

- Linkage IT Private Limited, India

- Macovin Web Co., Philippines

- Mahé Technologies, Mauritius

- Ramam Tech, US

- Markimist, Bangladesh

- Maxcoreteam, Nigeria

- Ministry of Programming, Sweden

- Mobiteam GmbH, Germany

- molfar.io, Cyprus

- MOON LINES, Lebanon

- morphsites, UK

- Navus, Germany

- NBW Internet Wizards, Greece

- Nevexo, Romania

- OBI Services LLC, Philippines

- Of2On Software Solutions, India

- One9 cummune, Pakistan

- Parasol Leads, US

- Phaedra Solutions, UAE

- Pixel Zambia LTD, Zambia

- Pixelweb, Morocco

- PixoLabo AI, Japan

- Qualia Solutions, Cyprus

- Real Wisconsin Website Design, US

- Reconnaissance Technologies, Nigeria

- Revo Agency, UK

- Route4design, Germany

- Sadeed Tech, Bahrain

- SAFCO, Tanzania

- Sailing Byte, Poland

- Seasia Infotech, US

- Seedium, Estonia

- ShotCoder Tech, Nepal

- Sigli, Belgium

- SinzerAD, Andorra

- SOFTMAART, India

- Solar Digital, UK

- Soyculto, Argentina

- spektralsoft, Cameroon

- Square63, Pakistan

- Strategic Results Marketing, US

- Tech We Aah, South Africa

- TechDoodles, India

- Technostacks, India

- Teqrox Solutions LLP, India

- Thanka Digital Pvt. Ltd., Nepal

- The Ave studio, Serbia

- The Genoese Studio, Italy

- The Logo Magic, Saudi Arabia

- Theorem Team, Nigeria

- TheTechies Limited, Nigeria

- Thinkogic, India

- Timspark, UK

- Titan Blue Australia, Australia

- TMZ Software, Romania

- Transparent Data, Poland

- Trizone Communications Pvt Ltd, India

- TRVL CODE, Tunisia

- Upracoreteam, Nigeria

- Vaikunth Technologies, India

- VATask, Bangladesh

- Vivo Group, Australia

- Voidweb, Bulgaria

- VOLO LLC, Armenia

- Web Development Service Provide, India

- Webamboos, Romania

- webinew, Iran

- Webmozaika, Ukraine

- WebOrigo Magyarország Zrt., Hungary

- Webspot, Lebanon

- Weetech Solution PVT LTD, India

- Williams Web Solutions, US

- Wind Song Enterprises, India

- Wireless Computer Service, Nigeria

- XY DIGITAL SRL, Moldova

- YetiStudio, Nepal

- ZAPTA Technologies, Pakistan

- Zentech Softech India, India

- Zexsoft, Romania

- ZnetGuru, Portugal